- Home

- »

- Animal Health

- »

-

U.S. Veterinary Oncology Market Size, Industry Report, 2035GVR Report cover

![U.S. Veterinary Oncology Market Size, Share & Trends Report]()

U.S. Veterinary Oncology Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Canine, Feline, Equine), By Therapy (Radiotherapy, Surgery, Chemotherapy, Immunotherapy), By Cancer Type, And Segment Forecasts

- Report ID: GVR-4-68039-370-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary Oncology Market Trends

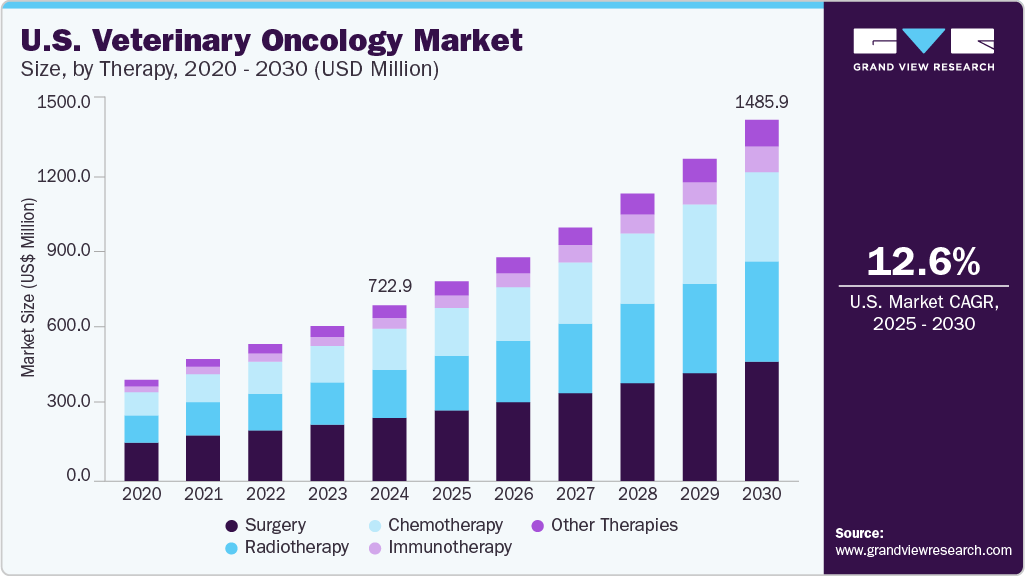

The U.S. veterinary oncology market size was estimated at USD 722.86 million in 2024 and is expected to grow at a CAGR of 12.58% from 2025 to 2030. The industry is driven by advancements in cancer treatment technologies like stereotactic radiation therapy, increasing pet ownership and expenditure on advanced care, and the growing prevalence of cancer in pets. For instance, according to the Cancer Letter Inc. article published in May 2024, approximately 6 million dogs are diagnosed with cancer each year in the U.S., making cancer a leading cause of death, particularly in older dogs..

The industry is driven by a surge in clinical trials and regulatory approvals for advanced cancer therapies, reflecting a broader shift toward precision and translational medicine. For instance, in March 2025, ELIAS Animal Health received full USDA approval for its ELIAS Cancer Immunotherapy (ECI), the first adoptive cell therapy approved for treating canine osteosarcoma. ECI uses a patient's immune system by deploying activated killer T cells to target cancer cells and is now available at 100 authorized treatment centers across the U.S. This marks a significant advancement in canine oncology, especially for large breed dogs at high risk of bone cancer.

Additionally, in February 2024, Cornell University’s clinical trial of trametinib for oral squamous cell carcinoma (OSCC) demonstrates the repurposing of human cancer drugs for veterinary use, showing early success in tumor reduction without toxicity. These innovations highlight increasing investment in genomics-driven, minimally invasive treatments, fueling growth and transformation in the U.S. veterinary oncology landscape.

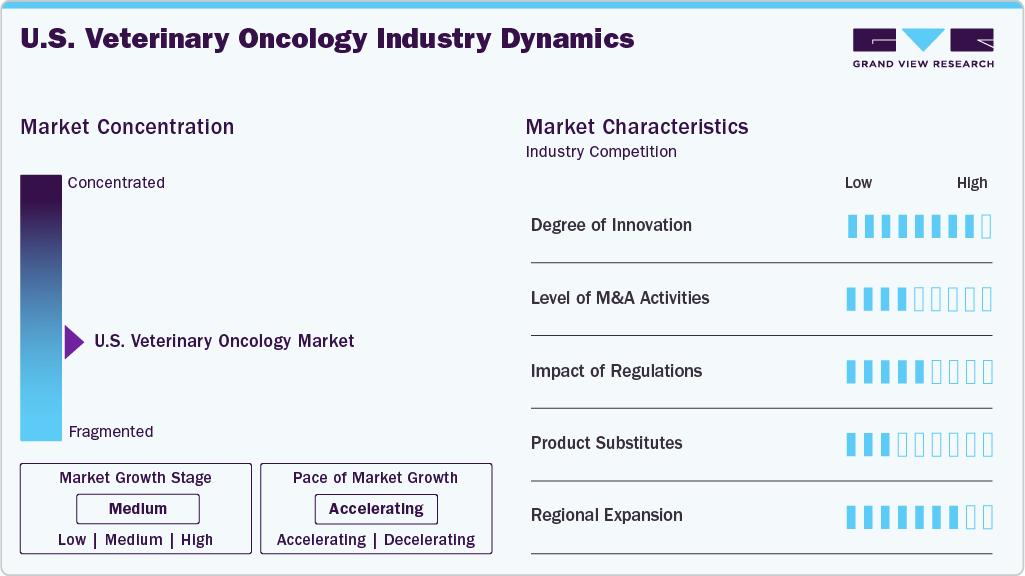

Market Concentration & Characteristics

The industry is moderately concentrated, with key players including Zoetis, Merck Animal Health, and Elanco. The market is characterized by increasing adoption of advanced therapies, a growing prevalence of pet cancer, and a rising focus on personalized treatment options.

The industry is experiencing a high degree of innovation, driven by advancements in precision medicine, immunotherapy, and targeted drug delivery. Novel therapies such as adoptive T-cell immunotherapy (e.g., ELIAS Cancer Immunotherapy), listeria-based cancer vaccines (OS Therapies), and intratumoral sustained-release injectables (BeneVet Oncology) are transforming treatment paradigms. These breakthroughs reflect the rapid translation of human oncology innovations into veterinary applications, expanding non-invasive and personalized care options for companion animals.

The industry has seen a significant increase in M&A activities, with numerous acquisitions to expand capabilities and market reach. Key deals include Mars' acquisition of VCA Inc. and JAB Holdings' acquisition of Compassion-First Pet Hospitals, highlighting the consolidation trend in the sector. For instance, in September 2023, Zoetis acquired the Munich-based biotech Adivo, known for its innovative therapeutic antibodies for companion animals. This acquisition enhances Zoetis' capabilities in veterinary oncology, potentially accelerating the development of new treatments for canine cancers and inflammatory diseases.

Regulations play a pivotal role in shaping the industry by ensuring the safety, efficacy, and quality of cancer therapies for companion animals. Approval pathways from agencies like the U.S. Department of Agriculture (USDA) for biologics and the FDA Center for Veterinary Medicine (CVM) for pharmaceuticals enable faster entry of advanced therapies. Streamlined regulatory frameworks for autologous cell therapies and repurposed human cancer drugs have accelerated clinical translation, as seen in Cornell's trametinib trial for canine OSCC. While regulations uphold clinical standards, they also encourage innovation and investor confidence, fueling the growth of precision oncology solutions in the market.

In the U.S. veterinary oncology industry, the rise of product substitutes is reshaping treatment dynamics, offering alternatives to traditional therapies like surgery, chemotherapy, and external beam radiation. Innovations such as ELIAS Cancer Immunotherapy (ECI), an adoptive cell therapy for canine osteosarcoma, and IsoPet Precision Radionuclide Therapy (PRnT), a non-invasive Y-90-based radiation treatment, are gaining traction due to their targeted mechanisms, fewer side effects, and outpatient convenience. Additionally, ongoing clinical trials repurposing human cancer drugs (e.g., trametinib for canine oral squamous cell carcinoma) are introducing novel options. These substitutes improve patient outcomes and quality of life and diversify veterinary oncologists' toolkits, intensifying competition and accelerating market innovation.

The industry is experiencing significant regional expansion, driven by the growing demand for advanced cancer treatments for pets, equines, and exotic animals. Key players in the market, such as Vivos Inc. with its IsoPet therapy, are expanding their reach by establishing new certified treatment centers across the country. In 2025, Vivos added new clinics in states like Texas, Washington, and Tennessee, contributing to broader access for pet owners. This regional growth is facilitated by an increasing number of veterinary professionals trained in specialized treatments and greater awareness of non-invasive, cost-effective therapies.

The evolution of veterinary cancer therapy in the U.S.:

Time Period

Therapy/Approach

Key Example

Impact on Veterinary Oncology

Pre-2000s

Traditional Surgery & Chemotherapy

Common treatments like surgery for tumors and chemotherapy for various cancers

Limited options; focus on invasive treatments with high side effects.

Early 2000s

Targeted Radiation Therapy

Stereotactic radiation therapy (SRT) for localized tumors (e.g., in brain or spinal tumors)

Less invasive, offering precision, but still with significant risks.

Mid 2000s

Immunotherapy Research & Trials

Development of vaccines like the Oncept melanoma vaccine (2010) for dogs.

Early-stage exploration of immunotherapy provides new hope for cancer treatments.

2010s

Monoclonal Antibodies & Gene Therapy

Introduction of Palladia (toceranib phosphate), a tyrosine kinase inhibitor for mast cell tumors (2010).

Expansion of targeted therapies, focusing on blocking specific tumor pathways.

2020-Present

Adoptive Cell Therapy & Immunotherapy

ELIAS Cancer Immunotherapy (ECI) for canine osteosarcoma (2025) and Trametinib trial for OSCC (2024).

Significant leap toward precision medicine, utilizing the body’s immune system to fight cancer.

Future Trends

Oncolytic Virotherapy & Personalized Therapies

Ongoing trials of oncolytic virus therapies and other personalized immunotherapies

Further diversification of cancer treatment options with minimal side effects.

Animal Insights

Based on animal, the market is segmented into canine, feline, and equine. The canine segment dominated the market in 2024 with a share of 86.28% and is expected to be the fastest-growing segment with a CAGR of 13.22% over the forecast period. Dogs are more prone to various cancers than other pets, leading to a greater demand for oncology services. Additionally, the availability of specialized treatments, including surgery, radiation, and chemotherapy, designed for dogs, drives market growth. For instance, in November 2023, a study published by the University of Colorado Cancer Center stated that a new clinical trial at Colorado State University explores CAR T-cell therapy for dogs with metastatic osteosarcoma, reflecting the growing demand for advanced cancer treatments in canine oncology. This innovative approach aims to address the limitations of existing therapies. It features the growing specialized dog cancer care market, driven by increasing prevalence and the need for cutting-edge treatments.

The feline segment holds a significant market share due to the increasing incidence of cancer in cats, advancements in diagnostic and treatment technologies, and a growing awareness among pet owners about feline cancer care. Enhanced veterinary services and specialized cat treatment options also contribute to this anticipated growth.

Therapy Insights

Based on therapy, surgery held the largest share of 36.02% in 2024 due to its effectiveness in removing tumors and managing localized cancer. Advances in surgical techniques and technologies, with high success rates and improved outcomes, have driven the increasing preference for surgical interventions in veterinary oncology. Furthermore, innovations such as minimally invasive procedures and improved imaging technologies enhance the precision and success rates of surgical treatments.

The immunotherapy segment is estimated to grow at the fastest CAGR of 14.65% over the forecast period due to its promising potential to treat a wide range of cancers with fewer side effects than traditional therapies. Treatments like ELIAS Cancer Immunotherapy (ECI) for canine osteosarcoma and the development of listeria-based immunotherapies by OS Therapies showcase the shift towards harnessing the immune system to target cancer cells more precisely. Immunotherapies' ability to provide personalized, targeted treatments for pets with various cancers, including lymphoma and melanoma, drives their increasing adoption and rapid market growth.

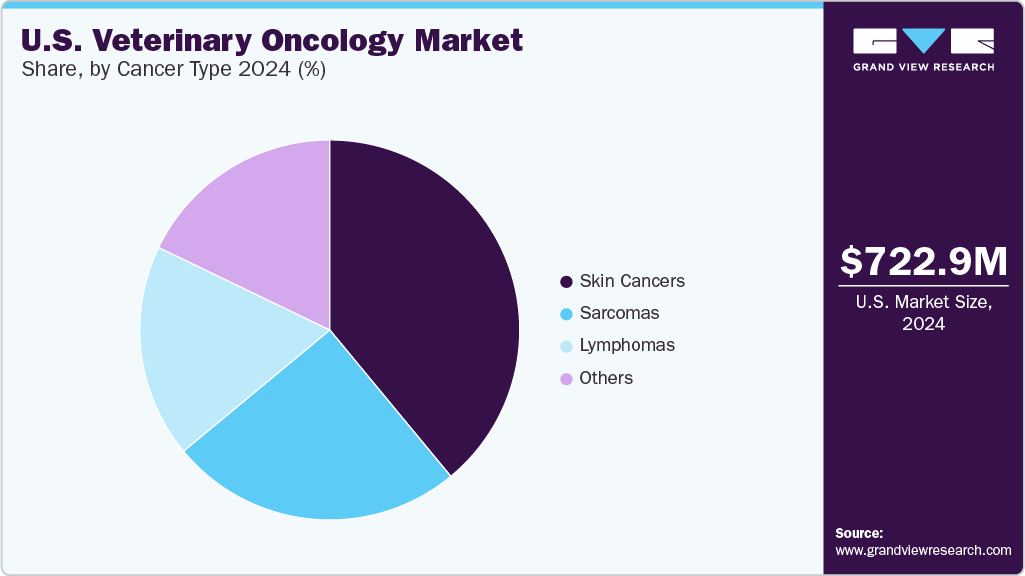

Cancer Type Insights

Based on cancer type, the skin cancers segment held the highest share of 39.0% in 2024. According to the article published by Morris Animal Foundation in June 2024, skin cancer emerged as the most prevalent form of cancer in companion animals, particularly dogs and cats. In canines, skin tumors accounted for approximately 34.6% of all diagnosed tumors, with mast cell tumors representing 16% to 21% of these cases. In felines, cutaneous squamous cell carcinoma (FC-SCC) was identified as the most common skin cancer, typically developing on sun-exposed areas such as the ears, nose, eyelids, and lips. This high prevalence underscores the critical need for early detection and effective treatment strategies in veterinary oncology.

The other segment is expected to grow at the fastest CAGR of 14.05% over the forecast period. This segment includes adenocarcinomas (e.g. anal sac adenocarcinoma), mammary cancers, brain tumors, nasal tumors, and oral tumors. Growing advancement in canine cancer treatment for a wide range of cancer types is expected to boost segment growth over the forecast period. For instance, in May 2024, the UC Davis veterinary hospital successfully treated Hunter, a cocker spaniel diagnosed with apocrine gland anal sac adenocarcinoma (AGASACA), a rare cancer in dogs. With advanced oncology services, UC Davis offers specialized care through a collaborative team of experts. This case highlights the growing importance of specialized veterinary oncology services in the U.S., indicating the market's emphasis on advanced cancer treatments for pets.

Country Insights

The U.S. veterinary oncology market is expected to grow significantly over the forecast period, driven by advancements in veterinary oncology therapy, increasing demand for early disease detection and personalized treatment options in pets, and many key players in the region. Additionally, growing investments from nonprofit organizations, veterinary institutions, and industry leaders, such as Petco Love and Blue Buffalo, for funding cancer research and treatment advancements, are expected to contribute to market growth. For instance, in May 2024, Petco Love and Blue Buffalo renewed their 14-year partnership to combat pet cancer with an additional $1 million investment, bringing their total commitment to $20 million. This funding supports 12 university veterinary oncology programs in the U.S., enhances research, and provides treatment grants, addressing the leading disease-related cause of death for dogs and cats in the country.

Key U.S. Veterinary Oncology Companies Insights:

Key players operating in the U.S. veterinary oncology market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Veterinary Oncology Companies:

- Elanco

- Boehringer Ingelheim International GmbH

- Zoetis

- Elekta AB

- PetCure Oncology

- Accuray Incorporated

- Varian Medical Systems, Inc. (parent company: Siemens Healthineers)

- Virbac

- Merck & Co., Inc.

- Dechra Pharmaceuticals PLC

- NovaVive Inc.

- Ardent Animal Health, LLC (A BreakthrU Company)

- Karyopharm Therapeutics, Inc.

Recent Developments

-

In March 2025, Privo Technologies launched BeneVet Oncology, a new subsidiary that enhanced cancer treatment for companion animals by adapting its advanced human drug delivery platforms. BeneVet will initially focus on intratumoral and topical therapies for cutaneous and subcutaneous solid tumors in dogs and cats, emphasizing safety, efficacy, and ease of use. The company plans to collaborate with veterinary professionals and pet owners to ensure practical clinical application.

-

In March 2025, the USDA approved ELIAS Cancer Immunotherapy (ECI), the first autologous adoptive cell therapy for treating canine osteosarcoma. Developed by ELIAS Animal Health, ECI harnesses a dog's immune cells to target cancer and is now available at over 100 authorized treatment centers across the U.S.

-

In April 2023, Torigen Pharmaceuticals partnered with Veterinary Management Groups (VMG) to provide over 2,000 VMG member clinics with access to Torigen's experimental autologous cancer immunotherapies. This collaboration aims to enhance the availability of advanced cancer treatments for companion animals by integrating Torigen's innovative solutions with VMG's extensive network, thus expanding treatment options for pet owners across the U.S.

U.S. Veterinary Oncology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 821.61 million

Revenue Forecast in 2030

USD 1.48 billion

Growth rate

CAGR of 12.58% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, therapy, cancer type

Key companies profiled

Elanco; Boehringer Ingelheim International GmbH; Zoetis; Elekta AB; PetCure Oncology; Accuray Incorporated; Varian Medical Systems, Inc. (parent company: Siemens Healthineers); Virbac; Karyopharm Therapeutics, Inc.; Merck & Co., Inc.; Dechra Pharmaceuticals PLC; NovaVive Inc.; Ardent Animal Health, LLC (A BreakthrU Company)

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Customized purchase options are available to meet your exact research needs. Explore purchase options

U.S. Veterinary Oncology Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each subsegment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary oncology market report based on animal, therapy, and cancer type.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiotherapy

-

Stereotactic Radiation Therapy

-

LINAC

-

Other Types

-

-

Conventional Radiation Therapy

-

-

Surgery

-

Chemotherapy

-

Immunotherapy

-

Other Therapies

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancers

-

Lymphomas

-

Sarcomas

-

Others

-

Frequently Asked Questions About This Report

b. The Surgery segment dominated the U.S. veterinary oncology market and accounted for the largest revenue share of more than 36% in 2023.

b. The U.S. veterinary oncology size was estimated at USD 495.94 million in 2023 and is expected to reach USD 585.56 million in 2024.

b. The U.S. veterinary oncology market is expected to grow at a compound annual growth rate of 10.76% from 2024 to 2030 to reach USD 1.08 billion by 2030.

b. The canine segment dominated the U.S. veterinary oncology market and accounted for the largest revenue share of around 86% in 2023.

b. Some key players operating in the U.S. veterinary oncology market include Boehringer Ingelheim International GmbH, Elanco, Zoetis, PetCure Oncology, Accuray Incorporated, Varian Medical System, Inc., Morphogenesis, Inc., Karyopharm Therapeutics, Inc., Regeneus Ltd., One Health., and OHC

b. Key factors that are driving the U.S. veterinary oncology market growth include the increasing adoption of different cancer therapeutics to curb cancer cases in pets, a growing pet population with the rising number of companion pet ownership, and willingness to spend on pets by pet proprietors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.