- Home

- »

- Next Generation Technologies

- »

-

U.S. Virtual Production Market Size, Industry Report, 2030GVR Report cover

![U.S. Virtual Production Market Size, Share & Trends Report]()

U.S. Virtual Production Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Pre-production, Production), By End-User, And Segment Forecasts

- Report ID: GVR-4-68040-214-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Virtual Production Market Size & Trends

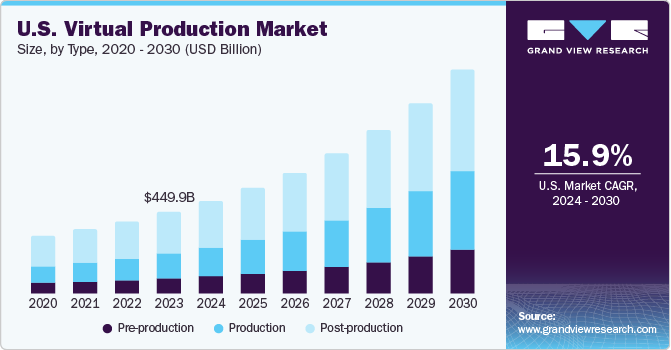

The U.S. virtual production market size was valued at USD 449.9 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.9% between 2024 and 2030. The uptake of virtual production in film studios, such as Walt Disney Studios, Viacom CBS, Warner Media, and NBC Universal, has redefined the regional landscape. Media, entertainment, and advertising industries have sought digital tools and state-of-the-art technologies to bring virtual effects to physical sets, making production cost-effective and flexible.

The trend for reducing production times and streaming video services embracing digitization have fared well for market growth. For instance, a film that previously would have cost USD 125 million can now cost (using virtual tools) USD 50 million. Besides, sustainability-focused companies are likely to inject funds into the next big thing to reduce material use, thereby minimizing carbon footprint.

Lately, computer-generated imagery (CGI) and visual effects (VFX) have reshaped cinematic storytelling with the integration of augmented reality, game engines, LED volumes, and AI. Heightened demand for action and adventure movies has spurred the footfall of CGI to transport actors into other worlds. Hollywood and content creators expect virtual production to underpin shooting efficiency and foster production planning.

VFX artists, VFX producers, and Hollywood directors have witnessed increased applications of AI in content production for 3D texturing, action simulation, and post-processing motion-capturing data. In addition, creative leaders can combine 3D graphic elements with the live shooting video for the creation of final visual effects using virtual cameras or simul-cams to capture live-action scenes on-set. Lately, virtual sets and LED volumes have gained prominence in shooting commercials and reusing VFX assets for subsequent seasons, sequels, and other media.

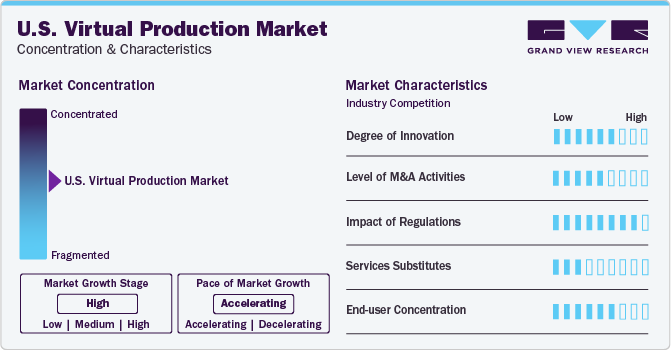

Market Concentration & Characteristics

Innovations have brought a notable shift in the U.S. virtual production market against the backdrop of robust adoption of AR, IoT and AI. Bespoke solutions have become an enabler of metaverse as the entertainment industry becomes more interactive and social. In essence, the gaming industry has witnessed an increased penetration of mixed reality (MR) and VR. Market leaders are expected to inject funds into the landscape. For instance, in January 2023, HTC VIVE announced the rollout of VIVE XR Elite, which combines the capabilities of MR and VR into one powerful, lightweight, compact, and versatile device for gaming and productivity, among others.

Dynamics, such as mergers & acquisitions, have brought a paradigm shift in the U.S. market. The M&A strategy has enabled companies to shift their focus from financial gains to access to new technology and market expansion. Strategic buyers are likely to seek M&A for cost synergies and technology-fueled activities. Additionally, these strategies will leverage companies to enhance their market penetration in the U.S. market.

Regulatory compliance requirements and legal considerations may have a notable impact on the industry forecast. Regulatory scenarios have become pronounced in light of the emergence of deep fakes and audio fakes that have become new weapons on the online battlefield. As content producers adopt deep fakes, regulatory issues are expected to emerge. For instance, various YouTubers swapped actors in major roles, such as Jim Carrey for Jack Nicholson in the Shining. While deep fake can save time and costs for production, it can pose an existential threat to creative professions.

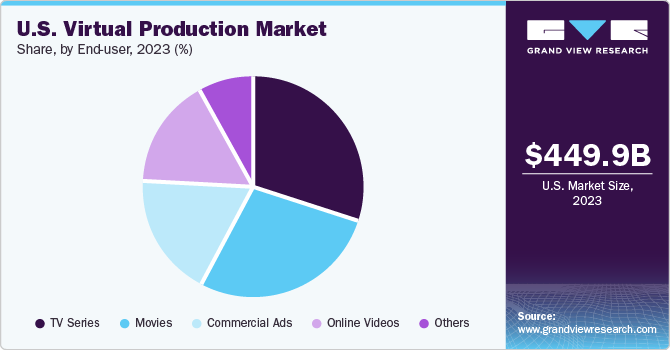

Virtual production will be highly sought-after across end-use applications, including television, commercials, movies, online videos and others. The expanding footprint of online videos across the U.S. has encouraged VFX artists and content creators to invest in advanced virtual production technologies. Besides, the growing footprint of movies and televisions will also propel the penetration of state-of-the-art technologies in the landscape.

End-user Insights

The movie segment spearheaded the market, accounting for the largest revenue share in 2023. A notable uptick in film production and the trend for VFX has reinforced the position of movies. In essence, the shifting consumer trend toward OTT platforms has prompted movie-makers to invest in virtual production technologies. With VFX becoming a game-changer in filmmaking, directors and visual effect artists are banking on LED walls to bring visual effects onto the set. LED walls have gained ground to build new virtual sets, disrupting the movie landscape.

The television segment will observe notable growth on the back of the soaring trend of OTT platforms. A Gracenote Global Video Data revealed that 84% of the video titles (studio-produced) available to U.S. audiences were available on streaming platforms. Nielsen noted that TV audiences watched over 15.6 billion hours of the top 10 most-streamed original programs, movies and acquired programs available to them during the week of November 6, 2023. With connectivity redefining content access, the changing TV landscape will encourage advertisers, publishers, and agencies to count on the next-generation technologies.

Component Insights

The software component segment led the U.S. virtual production market, accounting for 41.8% revenue share in 2023. The growth is partly attributed to the surging demand for software in the cinematography of video content. The 3D design for pre-visualization and the penetration of computer-generated graphics have spurred the footfall of software components. Bullish demand for VFX, AR, VR and deep learning in movies, commercials and online videos will bode well for market forecast.

The hardware component is expected to witness notable growth in the wake of the trend for real-time special effects tool-creating visualizations. Lately, virtual camera systems, motion capture workstations, real-time special effects tools (RTFX) and SimulCam have received traction across the North American country. Soaring demand for high-performance hardware will encourage industry leaders to inject funds into the portfolio.

Type Insights

The post-production segment contributed the largest revenue share in 2023, and it is likely to exhibit considerable uptake on the back of technological advancements in audio files, rigs, facial captures and editing, and VFX to create the final video footage. Lately, post-production has observed considerable demand for CGI and visual effects. Innovations in color correction and grading and promoting video content will underscore brand awareness. Moreover, an uptick in video production projects has fostered the dynamics of post-production stage.

Industry leaders have furthered investments in the production stage to redefine photogrammetry, motion control, tech visualization, and performance capture. Robust use of advanced technology on front-loading projects, evaluation and editing will augur well for industry growth. Furthermore, demand for virtual production technology in movies and commercials has prompted incumbent players to infuse funds into the landscape.

Key U.S. Virtual Production Company Insights

Some leading companies redefining the market include Adobe Inc., Autodesk Inc., BORIS FX, INC, and Epic Games, Inc. Industry dynamics redefining the U.S. market are highlighted below:

-

In September 2022, Adobe reportedly revealed the world’s first cloud-based collaboration for shooting content on virtual sets. The American giant joined forces with Mo-Sys to bring “instant collaboration and the speed of virtual production” to more filmmakers.

-

In March 2022, Autodesk announced the acquisition of The Wild, an extended reality (XR) solution provider, to keep up with the soaring demand for AR and VR technology advancements in the architecture, engineering and construction (AEC) industry.

-

In August 2023, Boris FX acquired SynthEyes, a 3D camera tracking VFX Software Company, to offer tremendous plugins and applications in the broadcast post-production, film and streaming portfolio.

Some emerging companies, such as 360Rize and Vū Technologies, have augmented their strategies to gain a competitive edge in the industry.

- In March 2022, Vū Technologies announced it closed a USD 17 million seed investment to augment virtual production studio network. The company asserts its fully immersive and photorealistic virtual environments and the investments will redefine the filmmaking landscape.

Key U.S. Virtual Production Companies:

- Adobe

- Autodesk Inc.

- BORIS FX, INC

- Epic Games, Inc.

- NVIDIA Corporation.

- Pixar (The Walt Disney Company)

- Vū Technologies

- HTC Corporation (VivePort)

- 80Six

- Venture Visuals

- Technicolor

- Side Effects Software Inc (SideFX)

Recent Developments

-

In March 2022, NVIDIA rolled out new NVIDIA Omniverse features that will help developers to sort asset libraries, share assets, collaborate and deploy AI to animate facial expressions of characters.

-

In April 2022, Epic Games received USD 2 billion (Sony Group and KIRKBI investing USD 1 billion each) to spur metaverse development and build the future of digital entertainment.

U.S. Virtual Production Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 509.5 million

Revenue Forecast in 2030

USD 1.2 billion

Growth Rate

CAGR of 15.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component; type; end-user

Key Companies Profiled

Adobe, Autodesk Inc., BORIS FX, INC, Epic Games, Inc., NVIDIA Corporation, Pixar (The Walt Disney Company), Vū Technologies, HTC Corporation (VivePort), 80Six, Venture Visuals, Technicolor, Side Effects Software Inc (SideFX)

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Virtual Production Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. virtual production market report based on component, type and end-user.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Pre-production

-

Production

-

Post-production

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Movies

-

TV Series

-

Commercial Ads

-

Online Videos

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. virtual production market size was estimated at USD 449.9 million in 2023 and is expected to reach USD 509.5 million in 2024.

b. The U.S. virtual production market is expected to grow at a compound annual growth rate of 15.9% from 2024 to 2030 to reach USD 1.2 billion by 2030.

b. Post-production dominated the U.S. virtual production market with a share of 50.2% in 2023. The segment is likely to exhibit considerable uptake on the back of technological advancements in audio files, rigs, facial captures, and editing, and VFX to create the final video footage.

b. Some key players operating in the U.S. virtual production market include Adobe, Autodesk Inc., BORIS FX, INC, Epic Games, Inc., NVIDIA Corporation, Pixar (The Walt Disney Company), Vū Technologies, HTC Corporation (VivePort), 80Six, Venture Visuals, Technicolor, Side Effects Software Inc (SideFX).

b. Key factors that are driving the market growth include increased adoption of LED video wall technology, and rising popularity of web series.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.