- Home

- »

- Automotive & Transportation

- »

-

U.S. Warehouse Management System Market, Industry Report, 2030GVR Report cover

![U.S. Warehouse Management System Market Size, Share & Trends Report]()

U.S. Warehouse Management System Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Services, Software), By Deployment (Cloud, On-premise), By Function, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-230-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

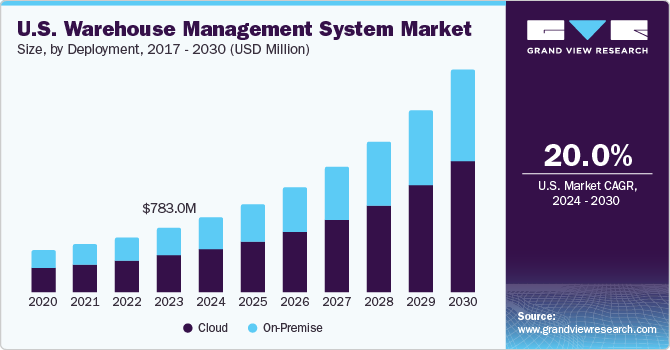

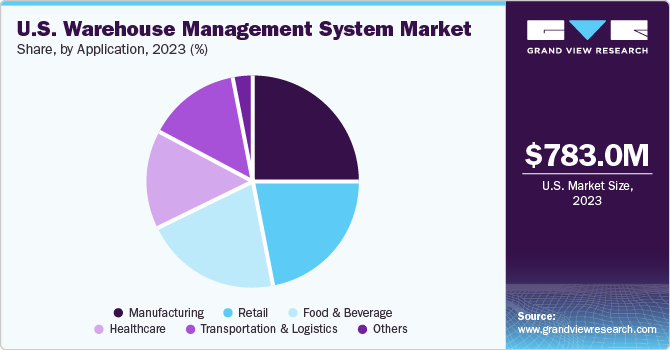

The U.S. warehouse management system market size was valued at USD 783.0 million in 2023 and is projected to grow at a CAGR of 20.0% from 2024 to 2030. To meet the rising consumer demand, logistics companies in the U.S. are striving to enhance their operations owing to challenges posed by fluctuating markets and shipping schedules. The U.S. markets are expected to experience a surge in the demand for warehouse management systems (WMS) as manufacturers adapt their supply chain models to accommodate changing market dynamics. One key trend driving the market growth is the need for manufacturers to automate warehouse management processes and reduce costs.

The escalating demand for WMS is fueled by its capacity to expedite product shipping and ensure the fastest delivery times through optimal shipping routes. In 2023, the U.S. market accounted for approximately 19.85% share of the global warehouse management system market.

The integration of automation and AI-driven decision-making through WMS is revolutionizing the supply chain and logistics sector by enabling improvements in efficiency and reducing order processing errors. Supply chains become more flexible and responsive owing to the use of these technologies, resulting in unprecedented speeds in order processing, better demand forecasting, and inventory management. Deliveries are made faster and with more reliability owing to the use of cutting-edge technologies such as route optimization and real-time tracking. This ultimately increases customer satisfaction and loyalty, resulting in fueling the market growth for WMS.

Cloud-based WMS systems provide a dynamic and adaptable platform for businesses that require agility, scalability, and real-time insights into their operations. These systems offer seamless integration, making real-time data access across the supply chain, from order fulfillment to inventory management, possible. By reducing the requirement for substantial on-premise infrastructure, the cloud-based method lowers expenses while improving accessibility. It also makes remote administration and communication possible, which is essential in dispersed work environments. Cloud-based WMS systems are expected to become increasingly popular owing to the growing demand for efficiency, cost-effectiveness, and adaptability. These advantages of cloud-based WMS systems are anticipated to propel growth of the U.S. WMS market.

The growing digitization of supply chain operations has led to the handling and storing of large volumes of sensitive data on WMS platforms, which has made them potential weak points. Data leakage, data corruption, and internal and external threats are common security risks associated with warehouses. These reasons may act as market restraints for the U.S. WMS market. In addition, privacy issues with warehouses using cloud-based solutions include data residency and sovereignty, which relate to the physical location and legal jurisdiction of data.

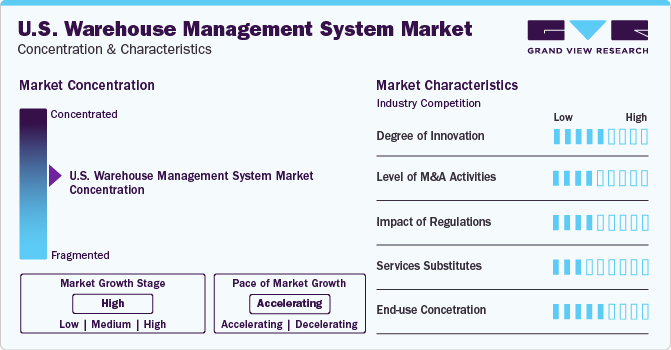

Market Concentration & Characteristics

The stage of growth of market in the U.S. is high and the pace of growth is accelerating. The U.S. WMS market is characterized by the presence of established companies holding strong brand recognition and experiencing economies of scale. New technologies such as automation, artificial intelligence, and blockchain are driving the growth of advanced warehouse management solutions. Therefore, the degree of innovation is moderate to high in the U.S. WMS industry.

In the U.S., the WMS market is extremely competitive characterized by the presence of many well-established companies striving to offer customizable WMS solutions with innovative functionalities supported by service excellence. Notably, larger businesses are strengthening their market position by acquiring smaller ones, a trend known as market consolidation. Mergers and acquisitions continue to be the key tactic used by larger companies to bolster their market position by acquiring smaller rivals.

Regulatory trends in the U.S. market focus on data security, compliance, and environmental sustainability. In the context of data protection, especially in warehouses dealing with healthcare products, strict adherence to the Health Insurance Portability and Accountability Act (HIPAA) is imperative to safeguard sensitive health information stored within the WMS. To adapt to evolving regulatory landscapes, WMS solutions are aligning with industry standards and legal requirements. The data security concern is vital for protecting sensitive information within warehouse management systems.

Given the crucial role of WMS in optimizing warehouse operations and the ability of WMS to integrate with other supply chain solutions, there are hardly any direct substitutes for WMS. The need for effective warehouse management and streamlining supply chain operations reinforces the low viability of substitutes.

Component Insights

In terms of component, the services segment dominated the market with the largest revenue share of 80.91% in 2023. The services segment includes consulting, system integration, operation, and maintenance services. The services segment in the U.S. WMS industry is witnessing significant growth owing to the increasing demand for implementation, training, and support services. Implementation services are crucial in the U.S. market, where businesses are adopting WMS solutions to handle complex supply chain needs. WMS providers offer expertise in configuring and deploying WMS software tailored to the specific requirements of diverse industries. The growth of the services segment can be attributed to the increasing adoption of WMS in various industries and the focus of WMS providers on offering comprehensive solutions that cater to the evolving needs of businesses in the U.S.

The software segment is anticipated to witness the fastest CAGR of 22.2% from 2024 to 2030. The growth can be attributed majorly to the surge in e-commerce activities. Companies such as Amazon.com, Inc. and Walmart in the U.S. are significantly investing in advanced WMS software to optimize inventory management and expedite order fulfillment. Cloud-based WMS solutions are gaining popularity in the U.S. owing to their scalability, flexibility, and cost-effectiveness. Real-time visibility and data-driven decision-making are crucial aspects that fuel the growth of the software segment, providing businesses insights into inventory status, order processing, and overall warehouse performance.

Deployment Insights

In terms of deployment, the cloud segment dominated the market with the largest revenue share of 56.54% in 2023 and is anticipated to register the fastest- CAGR of 20.7% from 2024 to 2030. The growth of the cloud segment can be attributed to the flexibility offered by the cloud deployment mode, allowing businesses to adapt quickly to the changing market dynamics. The U.S. market is witnessing a surge in demand for Software as a Service (SaaS) WMS solutions, where businesses subscribe to cloud-based platforms to access WMS functionalities. Cloud-based WMS also enables seamless integration with other business applications, enhancing overall operational efficiency. The U.S. is witnessing a shift toward cloud-native architectures, where WMS providers are optimizing their solutions for cloud environments. This ensures that businesses can harness the full potential of cloud-based WMS, including rapid deployment, automatic updates, and improved disaster recovery capabilities.

The on-premise deployment segment is anticipated to exhibit a significant CAGR over the forecast period. The growth of the on-premise segment in the U.S. market is accelerated by the unique business requirements of various industries. For instance, companies operating in pharmaceuticals, automotive, and electronics are leveraging on-premise solutions to comply with industry-specific regulations and ensure data compliance. The on-premise approach offers companies greater control over their data and system customization. For instance, a large manufacturing facility in the U.S. may opt for an on-premise warehouse management system to ensure seamless integration with existing legacy systems and maintain data security.

Function Insights

The systems integration & maintenance segment dominated the U.S. market in 2023 with the largest revenue share of 31.39%. The systems integration & maintenance segment plays a key role in ensuring seamless functionality and sustained performance. In the U.S., the demand for robust WMS integration and maintenance solutions is escalating, driven by the need for cohesive supply chain operations. In addition, the emphasis on proactive maintenance services ensures that the WMS functions optimally, reducing downtime and supporting the continuous flow of operations. This growing trend in the U.S. underscores the strategic importance of systems integration & maintenance in the evolving WMS market, which is propelling the segment growth.

The analytics & optimization segment is anticipated to witness the fastest CAGR of 22.3% from 2024 to 2030. In the U.S., this segment is witnessing substantial growth as companies increasingly recognize the value of data-driven decision-making in managing their supply chains. For instance, major e-commerce players in the U.S., such as Amazon.com, Inc., are investing heavily in analytics and optimization tools within their WMS to gain insights into inventory patterns, improve order fulfillment processes, and minimize operational costs. The integration of technologies such as artificial intelligence and machine learning further augments the capabilities of these systems, enabling predictive analytics and intelligent decision support.

Application Insights

The manufacturing segment held the largest revenue share of 25.32% in 2023. In the U.S., manufacturing companies are increasingly adopting advanced WMS solutions to optimize their supply chain operations. In the U.S., major manufacturers leverage WMS to enhance inventory control, streamline production processes, and improve overall operational efficiency. WMS technology tailored for the manufacturing sector offers features such as demand forecasting, production scheduling, and integration with Enterprise Resource Planning (ERP) systems. The integration of technologies such as RFID and automation into WMS further enhances the accuracy and speed of material handling and distribution processes. The above-mentioned factors are propelling the growth of the segment.

The healthcare segment is anticipated to witness the fastest CAGR of 21.1% from 2024 to 2030. The healthcare sector is critical and rapidly evolving in the U.S. WMS industry. In the U.S., healthcare organizations are increasingly adopting advanced WMS solutions to enhance the efficiency of their supply chain processes. Major healthcare providers leverage WMS to streamline the management of medical supplies, ensure accurate inventory control, and meet stringent regulatory compliance standards. Overall, the adoption of WMS in the healthcare sector is to focus on improving operational workflows, reducing errors, and ensuring timely access to crucial medical resources.

Key U.S. Warehouse Management System Copmany Insights

Some of the prominent players in the market include Made4net, Epicor, Infor, and Blue Yonder among other major players.

-

Blue Yonder Group, Inc., formerly known as JDA Software, is a global software company specializing in supply chain management and retail solutions. The company offers a comprehensive suite of cloud-based solutions, including supply chain planning, transportation management, warehouse management, retail planning, and workforce management. These solutions leverage advanced technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and data analytics, to provide businesses with actionable insights and predictive capabilities for better decision-making.

-

Infor, Inc. offers enterprise software solutions with industry-specific functionalities. The company’s solutions are designed to enable customers to plan and execute their supply chain strategies effectively and more profitably. The company has been operating as a standalone subsidiary of Koch Industries Inc. since February 2020, when it was acquired by the latter. Koch Industries Inc., an investor in Infor, Inc. since 2017, acquired the entire equity stake in Infor, Inc. from Golden Gate Capital.

Logiwa and DecisionPoint are some of the emerging companies in the U.S. market for warehouse management system.

-

Logiwa is a cloud-based system for multichannel order fulfillment and warehouse management. It is tailored for small and medium-sized e-commerce and retail enterprises. This software streamlines warehouse and inventory management. With features for managing backorders, cross-docking, and intelligent picking, it synchronizes multi-channel order fulfillment efficiently. It is engineered to enhance processes like warehouse and inventory management, billing, and ensuring customer satisfaction, it offers visibility and control throughout the order fulfillment journey.

-

DecisionPoint provides workforce management solutions catering to diverse industries including warehouse management, retail management, and field service. Its suite encompasses features such as dispatching, work order management, invoicing, inventory management, mobile inventory, and price management. Additionally, it offers functionalities like merchandising, CRM, ordering, pricing and promotions, asset tracking, delivery returns, invoicing and payments, integrated GPS, data forms, web portal technology, and real-time communication.

Key U.S. Warehouse Management System Companies:

- EPICOR

- Infor

- Made4net

- Manhattan Associates

- Oracle

- Blue Yonder Group

- SAP

- Softeon

- Synergy Logistics Ltd

- Körber AG (HighJump)

Recent Developments

-

In November 2023, Blue Yonder, a leading supply chain solutions provider, announced the acquisition of Doddle, a leading technology business focused on making the first and last mile more seamless, sustainable, and profitable. With this acquisition, Blue Yonder offers a more comprehensive logistics suite designed to build more sustainable and profitable end-to-end supply chains.

-

In November 2023, Epicor, a global leader in industry-specific enterprise software designed to promote business growth, announced the acquisition of Elite EXTRA, a leading provider of cloud-based last-mile delivery solutions. The acquisition expands Epicor's ability to help its customers across the make, move, and sell industries simplify last-mile logistics and compete in a hyper-competitive market more effectively. Financial terms were not disclosed.

U.S. Warehouse Management System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 914.7 million

Revenue forecast in 2030

USD 2720.0 million

Growth rate

CAGR of 20.0% from 2024 to 2030

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, function, application

Country scope

U.S.

Key companies profiled

EPICOR; Infor; Made4net; Manhattan Associates; Oracle; Blue Yonder Group; SAP; Softeon; Synergy Logistics Ltd; Körber AG (HighJump)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Warehouse Management System Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis on the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. warehouse management system market report based on component, deployment, function, and application:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

- Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Labor Management System

-

Analytics & Optimization

-

Billing & Yard Management

-

Systems Integration & Maintenance

-

Consulting Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation & Logistics

-

Retail

-

Healthcare

-

Manufacturing

-

Food & Beverage

- Others

-

Frequently Asked Questions About This Report

b. The U.S. warehouse management systems market was estimated at USD 783 million in 2023 and is expected to reach USD 914.7 million in 2024.

b. The U.S. warehouse management systems market is expected to progress at a compound annual growth rate of 20% from 2024 to 2030 to reach USD 2,727 million in 2030.

b. The services segment accounted for the largest revenue share of more than 80% in 2023 in the U.S. warehouse management systems market. It will maintain its dominance over the forecast period owing to the increasing demand for implementation, training, and support services.

b. The key players operating in the U.S. warehouse management systems market include Made4net, Epicor, Infor, and Blue Yonder among other major players.

b. Key factors driving the U.S. warehouse management systems market include the need for manufacturers to automate warehouse management processes and reduce costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.