- Home

- »

- Medical Devices

- »

-

U.S. Weight Management Market Size, Industry Report 2030GVR Report cover

![U.S. Weight Management Market Size, Share & Trends Report]()

U.S. Weight Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Function (Diet (Meals, Beverages, Supplements), Fitness Equipment (Cardiovascular Training Equipment), Surgical Equipment, Services), And Segment Forecasts

- Report ID: GVR-4-68040-245-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Weight Management Market Trends

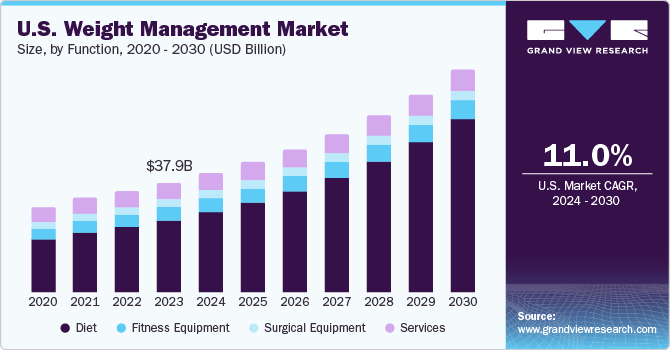

The U.S. weight management market size was estimated at USD 37.86 billion in 2023 and is expected to grow at a CAGR of 11.01% from 2024 to 2030. This growth can be attributed to the growing prevalence of chronic diseases, rising obesity rates, chronic diseases, awareness about nutrition, and increasing disposable income. According to the National Institute of Health, Americans spend approximately $2.1 billion each year on weight loss dietary supplements, while a significant amount of data suggests that 30% of cancer cases are associated with unhealthy dietary practices.

The U.S. weight management market accounted for 24% of the global weight management market in 2023. The growing adoption of sedentary lifestyles and increased consumption of unhealthy diets have significantly raised the risk of various diseases and conditions, including diabetes, cardiovascular diseases, obesity, and cancer. This contributes to the development of chronic conditions like diabetes, heart disease, and certain types of cancer.

Moreover, consumers are seeking products that aid in weight management and overall well-being, leading to a focus on balanced nutrition and preventive health practices. Major companies offering these products include Kellogg Company, Herbalife International, IncNutrisystem, Inc., Atkins, and Nutritionals Inc. These trends are boosting market growth.

Obesity is a major factor increasing the healthcare burden in the U.S. According to data published by Trust for America’s Health in 2020, the obesity rate among U.S. adults was 42.4%. The economic burden of obesity-related disorders is substantial, representing nearly 21% of healthcare expenditure in the U.S. This significant cost underscores the importance of preventive measures against obesity. As a result, there is an expected rise in demand for bariatric surgeries. Thus, a rise in bariatric and endoscopic surgeries to control obesity cases is anticipated to grow market revenue.

Moreover, manufacturers are driving the market through initiatives like launching new products and innovating existing ones. For instance, in March 2024, Labcorp introduced a Weight Loss Management portfolio to provide individuals and physicians with accessible and convenient testing options to guide weight loss management decisions and treatments. It equips individuals and healthcare providers with essential information to inform treatment options, such as lifestyle modifications, Glucagon-like peptide-1 (GLP-1) medications, or bariatric surgery.

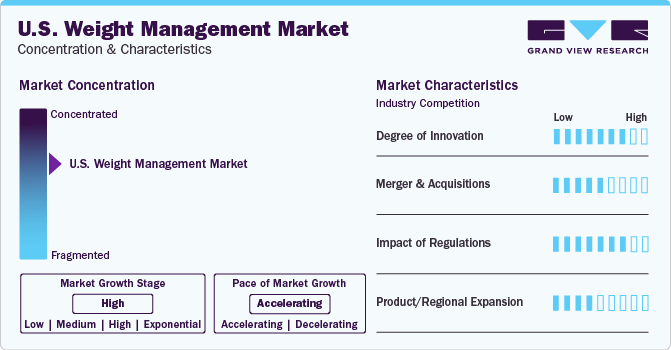

Market Concentration & Characteristics

The U.S. weight management products market is concentrated characterized by intense competition among key companies. These companies are strategically engaging in mergers & acquisitions and product innovations to maintain and strengthen their industry positions. As a result, the competition in the weight management products market is anticipated to remain high throughout the forecast period.

Institutions are engaging in more research and development activities to introduce innovative weight management products. This helps new entrants to focus on these products and fulfill industry needs while strengthening their presence. For instance, in December 2023, researchers from MIT developed a vibrating, ingestible capsule to treat obesity. The innovative device mentioned vibrates within the stomach, activating stretch receptors that sense stomach distension. This mechanism can help individuals reduce their food intake, potentially aiding in weight management and obesity treatment.

Numerous market industries are actively involved in acquiring smaller companies to expand their market positions. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in June 2023, Wellful, Inc. acquired the Jenny Craig brand to expand its portfolio of health and wellness brands. This acquisition marks a strategic move by Wellful to bring back Jenny Craig as a direct-to-consumer brand, offering convenient delivery of food and personalized coaching services.

The U.S. Food and Drug Administration (FDA) oversees the regulation of medical devices and provides guidance for the development of drugs and therapeutic biologics for weight management. For instance, in November 2023, The U.S. FDA approved Eli Lilly and Company's Zepbound (tripeptide) injection which helps in chronic weight management in adults with overweight or obesity and at least one weight-related medical problem.

The approach of regional expansion in the weight management products market enables companies to strengthen their presence in various regions, adapt to local industry needs, and enhance their market share by targeting diverse customer segments. For instance, in November 2022, Usana Health Sciences acquired Rice Bar, a protein bar manufacturer, and another MLM supplement sales platform. This strategic move aligns with Usana's plans and aims to enhance its product offerings in the nutrition and wellness industry.

Function Insights

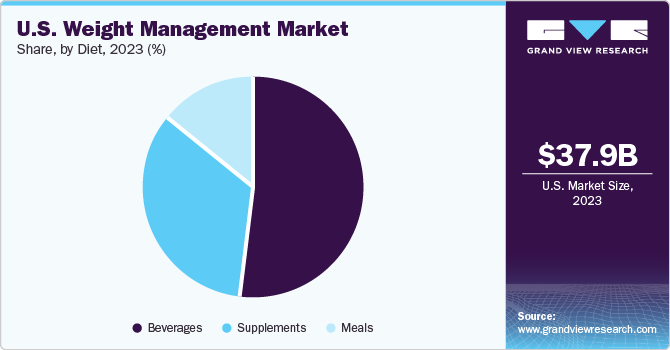

Based on function, the diet segment dominated the market with a share of 66% in 2023 and is projected to grow at the fastest CAGR over the forecast period. This segment is fragmented into meals, beverages, and supplements. The growth of this segment can be attributed to the increasing popularity of weight-loss beverages, meal replacement therapies, and dietary supplements. The availability of various dietary products such as protein bars, green tea, protein shakes, weight loss enhancers, and increasing disposable income is driving market growth. Moreover, customized diet plans and weight loss supplements are fueling market growth.

The fitness equipment segment is expected to show a significant CAGR from 2024 to 2030. This segment is driven by the increasing prevalence of chronic diseases and the rise in overall health consciousness within the population. Fitness equipment includes cardiovascular training equipment, treadmills, elliptical trainers, stationary cycles, rowing machines, and more. These types of equipment enable various exercises contributing to weight management, physical well-being, and core strength. Such features of this segment will enhance market growth in the coming years.

Key U.S. Weight Management Company Insights

The major companies operating in the U.S. weight management market include Herbalife, Kellogg's, Nutrisystem, and Eli Lilly among others. There is intense competition due to the consistent effort of prominent companies to develop innovative weight management products in the form of therapeutic drugs, protein bars, weight loss enhancers, and more. Furthermore, companies offer a diverse portfolio of products, including sports, active nutrition & supplements, herbs, minerals & vitamins, and distribute these products through various online and retail stores, leading market expansion.

Key U.S. Weight Management Companies:

- Herbalife International, Inc.

- Nutrisystem, Inc.

- Atkins Nutritionals Inc.

- WW International, Inc.

- Life Extension

- Brunswick Corporation

- Kellogg Co.

- Gold’s Gym International

- GNC Holdings

- Cargill, Inc.

- Now Health Group Inc.

- Amway Corp

- Jenny Craig

- Nu Skin Enterprise, Inc.

- Apollo Endosurgery, Inc.

- Covidien Plc.

- Medical Device Business Services, Inc.

Recent Developments

-

In February 2024, Novo Holdings announced acquisition of Catalent for USD 16.5 billion aims to secure production demand for the weight-loss drug Wegovy. This strategic move would enhance the production capacity for Wegovy, a popular weight-loss medication.

-

In July 2023, Eli Lilly acquired Versanis to expand its weight loss pipeline with a USD 1.9 billion deal. This strategic move aligns with Lilly's commitment to developing innovative solutions for weight management.

U.S. Weight Management Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 76.9 billion

Growth rate

CAGR of 11.01% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function

Country scope

U.S.

Key companies profiled

Herbalife International, Inc; Nutrisystem, Inc; Atkins Nutritionals Inc; WW International, Inc; Life Extension; Brunswick Corporation; Kellogg Co.; Gold’s Gym International; GNC Holdings; Cargill, Inc; Now Health Group Inc.; Amway Corp; Jenny Craig; Nu Skin Enterprise, Inc; Apollo Endosurgery, Inc; Covidien Plc.; Medical Device Business Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Weight Management Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. weight management market report based on function:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Diet

-

Meals

-

Beverages

-

Supplements

-

Proteins

-

Fibers

-

Green Tea Extract

-

Conjugate Linoleic Acid

-

Green Coffee

-

L-carnitine

-

-

-

Fitness Equipment

-

Cardiovascular Training Equipment

-

Strength Training Equipment

-

Others

-

-

Surgical Equipment

-

Minimally Invasive Surgical Equipment

-

Noninvasive Surgical Equipment

-

-

Services

-

Fitness Centers

-

Slimming Centers

-

Consultation Services

-

Online Weight Loss Service

-

-

Frequently Asked Questions About This Report

b. The U.S. weight management market size was estimated at USD 37.86 billion in 2023.

b. The U.S. weight management market is expected to witness growth at a compound annual growth rate (CAGR) of 11.01% from 2024 to 2030 to reach USD 76.9 billion by 2030.

b. Based on function, the diet segment dominated the market with a share of 66% in 2023 and is projected to grow at the fastest CAGR over the forecast period.

b. The major companies operating in the U.S. weight management market include Herbalife, Kellogg's, Nutrisystem, and Eli Lilly among others.

b. Growth can be attributed to the growing prevalence of chronic diseases, rising obesity rates, chronic diseases, awareness about nutrition, and increasing disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.