- Home

- »

- Healthcare IT

- »

-

U.S. Workplace Stress Management Market Size Report, 2030GVR Report cover

![U.S. Workplace Stress Management Market Size, Share & Trends Report]()

U.S. Workplace Stress Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Stress Assessment, Yoga & Meditation), By Delivery Mode, By End-use, By Activity, And Segment Forecasts

- Report ID: GVR-4-68039-972-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

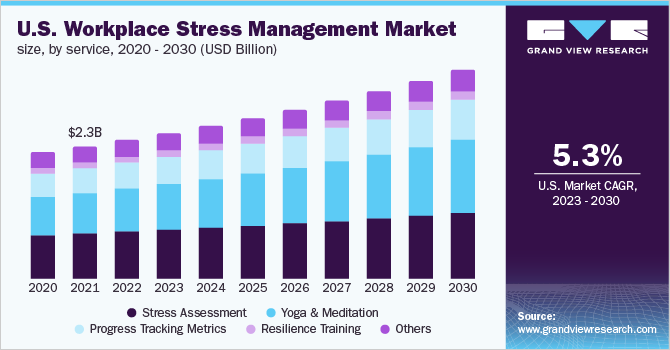

The U.S. workplace stress management market size was valued at USD 2.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.33% from 2023 to 2030. Major factors driving the growth are the high prevalence of stress among employees and the increasing investment of employers in wellness services to maintain and promote employee health. Workplace wellness programs focus on boosting employee health and assist organizations in increasing productivity. Although these services incur a certain cost to the employers, the reduction in absenteeism and increased productivity help avoid financial losses to the company.

According to the 2021 Work and Well-being Survey of 1,501 U.S. workers conducted by the American Psychological Association, 79% of employees had encountered work-related stress in the month preceding the survey. Furthermore, nearly three-fifths of employees reported negative effects of work-related stress, such as lack of interest, motivation, or energy (26%), and lack of effort at work (19 %).

Similarly, according to a survey conducted by the American Institute of Stress in February 2022, 65% of 1,000 adults in the United States reported being more stressed due to the COVID-19 pandemic. Thus, the rising prevalence of stress among the population is fueling market growth.

As per a study led by Aetna Behavioral Health, mental health expenditures increased by more than 10% yearly over five years, whereas other medical expenditures increased by 5% annually. The expense of treating depression alone is USD 110 billion per year, of which 50% is incurred by employers.

The Kaiser Family Foundation stated in 2016 that businesses spent nearly USD 2.6 billion on opioids, an increase of eightfold since 2004. Some workplaces are putting the treatment of mental health a major priority, on par with cancer, diabetes, and other chronic diseases. According to a 2018 survey of 687 businesses conducted by Willis Towers Watson. 57 % of companies questioned intend to focus on mental and behavioral health to a considerable or "very great" extent.

In addition, there is a growing awareness of the benefits of corporate wellness programs in combating various mental and physical disorders. High return on investment, significant cost savings, improvement in overall work culture, and employee satisfaction are some of the advantages of corporate wellness. This has led to an increase in employer adoption. According to a study published in the American Journal of Health Promotion, nearly half of all U.S. workplaces offered health promotion programs in 2017.

COVID-19 U.S. workplace stress management market impact: 5.3% decrease from 2019 to 2021

Pandemic Impact

Post COVID Outlook

The market contracted by 5.3% in 2021, compared to 2019. However, employee wellness programs in the COVID-19 adjusted their emphasis to include more mental health activities to assist employees in these unique circumstances. Even while mental health initiatives have been a part of workplace wellness in the past, the pandemic has exposed the need to step it up a notch.

The pandemic has increased interest in establishing stress-relieving office cultures that boost mental health and productivity. By offering digital technology that enables real-time access to healthcare resources, businesses can empower their employees to manage their health. In up to 85% of cases, SilverCloud Health users report an improvement in depression and anxiety symptoms, resulting in increased job satisfaction.

Wellness service providers have adopted virtual techniques for scheduling appointments with health coaches and psychologists in response to the increasing prevalence of depression and feelings of isolation. During the pandemic, numerous companies, including Salesforce, 3M, and SAP, have placed a premium on virtual wellness programs and activities.

As a result of the pandemic, incorporating wellness programs into the place of work has become a greater priority, especially as a means of keeping employees more engaged while working remotely from home. Several of these business concepts involve the use of Zoom for social gatherings and group workouts. This will likely stimulate market growth.

Workplace wellness services are regulated by certain U.S. laws. Americans with Disabilities Act (ADA), Health Insurance Portability and Accountability Act (HIPAA), and the Internal Revenue Code’s taxation of employers regulate the wellness services provided by an employer.

For instance, HIPPA prohibits an employer to charge higher premiums to sick employees in turn avoiding financial tension for the employees. Moreover, the data collected during wellness activities such as biometric data, health history, and other medical test results are protected by wellness providers by adhering to HIPPA standards.

Service Insights

The stress assessment segment held the largest revenue share of 34.3% in 2022 due to the high prevalence of depression among the working population in the country. Stress assessment is conducted using a questionnaire that evaluates lifestyle factors and other health risks of employees. The service focuses on increasing self-awareness in employees and provides health education feedback and recommendations for making positive lifestyle changes.

The yoga & meditation segment is projected to witness a maximum CAGR of 6.9% during the forecast period. due to increasing awareness regarding its effectiveness in attaining mental peace. A survey conducted by the Yoga Alliance and Yoga Journal found that the number of Americans doing yoga rose from 20.4 million to 36 million between 2012 and 2016. The increasing adoption of yoga due to its proven benefits in relaxing the mind and mental peace is boosting segment growth.

Resilience training is an important service that focuses on the spiritual, physical, cognitive, mental, and emotional well-being of employees. The training is a preventive method adopted to reduce depression among employees. For instance, an employee survey on resilience training conducted by Harris Poll, in May 2020, revealed that around 76% of employees thought of resilience training as valuable and around 73% of training participants reported positive outcomes saying it improved their health.

Delivery Mode Insights

In 2022, the personal fitness trainers segment held the largest revenue share of 43.7% due to the benefits of physical workouts in maintaining mental health. According to the Bureau of Labor Statistics (BLS), in 2020, there were 309,800 jobs for fitness trainers and instructors and the number is expected to reach around 431,500 in 2030, registering an increase of approximately 39%. Apart from improving fitness, saving time of commute from the workplace to the gym is an important factor contributing to the demand for personal fitness trainers by corporate wellness service providers.

Counseling is an important part of an employee assistance program (EAP) and helps employees to identify the cause of stress and understand the role their thoughts play in increasing the stress level. The benefits of counseling in overcoming anxiety and depression are increasing the demand for counseling services and in turn the care providers. Communication is an established strategy for conquering stress, anxiety, and sadness. Cognitive Behavioral Therapy (CBT) provides employees with an outlet for negative ideas and emotions, thereby promoting mental wellness.

The meditation specialists segment is anticipated to register a CAGR of 6.6% during the forecast period. According to a poll conducted by the National Business Group on Health in 2018, 52% of firms provided mindfulness classes or training to their employees. This represents a significant rise, from 36% in 2017.

In addition, firms that taught meditation to their staff report a reduction in work absenteeism of 85% and an increase in revenues of 520%. Moreover, the increase in mental illness among employees during the COVID-19 pandemic, especially due to financial instability, job insecurity, and pay cuts, is expected to further contribute to the demand for meditation services by employers.

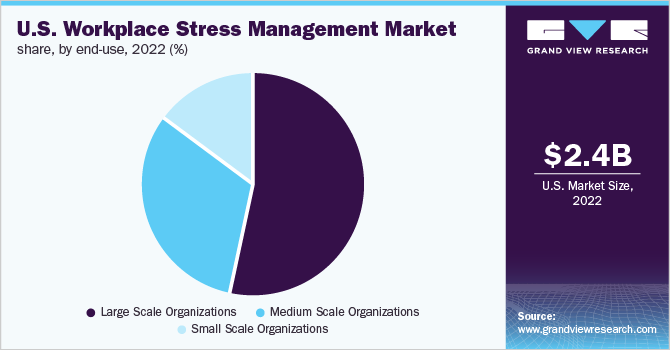

End-use Insights

In 2022, the large-scale organizations segment accounted for the major portion of the market. This can be attributed to the availability of capital for investing in wellness services. Struggling to achieve financial well-being is a common contributor to mental illness, however, hiring financial professionals comes at a significant cost making it difficult for medium & small-scale organizations to afford them.

Medium-scale organizations segment is expected to register the fastest growth over the forecast period mainly due to increasing investment in employee wellness services. According to Wellable, medium-scale organizations were found to invest more in various wellness aspects especially in financial wellness, meditation, and sleep management during 2020 as compared to 2019.

Small-scale organizations are the highest in number, however, since the number of employees they hire is less it limits the type of wellness services they provide. Rising awareness about employee health programs and increased absenteeism and attrition are anticipated to boost the growth of the small-scale organization's segment. According to Wellable, 76% of start-up companies with 0-5 years of experience are making a high investment in corporate mental health programs. This is likely to bode well with the segment growth.

Activity Insights

Based on activity, The medium scale organizations segment held a maximum revenue share of 32.1% in 2022. owing to the gathering and travel restrictions imposed during the COVID-19 pandemic. Indoor activities generally include meditation sessions, education lectures, and team-building activities that promote interaction among employees positively affecting productivity. The wellness providers generally include stress assessment in their indoor activities since it enables employers to assess the wellness needs of their employees.

The outdoor segment is projected to witness a maximum CAGR of 5.9% during the forecast period. The growth can be attributed to initiatives undertaken by employers such as providing gym membership to promote employee fitness and organizing team outings. Employers are promoting these activities as a preventive measure to promote employee relaxation & health, avoiding business losses due to factors such as absenteeism.

The type of services offered by employers majorly depends on the financial stature of the organization. Outdoor activities incur significant costs and hence are majorly executed by large-scale organizations, whereas small and medium-scale organizations prefer indoor activities such as yoga & meditation sessions. Although the pandemic restricted office visits, indoor activities were offered virtually through online sessions considering the increased need for wellness services.

Key Companies & Market Share Insights

The market is fragmented due to the presence of multiple small & medium and a few large-scale corporate wellness service providers in the country. Various initiatives such as partnerships, mergers, and acquisitions are undertaken by key players to strengthen their market position. In November 2021, the provider of financial wellness programs, My Secure Advantage, Inc (MSA) partnered with a digital provider of employee wellbeing, Whil. The partnership enables Whil to provide wellness services targeted to reduce financial stress among employees and increase productivity. Some prominent players in the U.S. workplace stress management market include:

-

ActiveHealth Management, Inc.

-

Asset Health

-

ComPsych Corporation

-

CuraLinc Healthcare

-

Marino Wellness

-

Virgin Pulse

-

TotalWellness

-

Aduro

-

Beacon Health Options

-

FitBit

U.S. Workplace Stress Management Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.6 billion

Growth rate

CAGR of 5.33 % from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, delivery mode, end-use, activity

Country scope

U.S.

Key companies profiled

ActiveHealth Management, Inc.; Asset Health; ComPsych Corporation; CuraLinc Healthcare; Marino Wellness; Virgin Pulse; TotalWellness; Aduro; Beacon Health Options; FitBit

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Workplace Stress Management Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the U.S. workplace stress management market report based on service, delivery mode, end-use, and activity:

-

Service Outlook (Revenue, USD Million, 2016 - 2030)

-

Stress Assessment

-

Resilience Training

-

Yoga & Meditation

-

Progress Tracking Metrics

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2016 - 2030)

-

Personal Fitness Trainers

-

Individual Counselors

-

Meditation Specialists

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Activity Outlook (Revenue, USD Million, 2016 - 2030)

-

Indoor

-

Outdoor

-

Frequently Asked Questions About This Report

b. Stress assessment segment dominated the U.S. workplace stress management market in 2021. This is attributable the high prevalence of depression among the working population in the country.

b. The U.S. workplace stress management market size was estimated at USD 2.4 billion in 2022 and is expected to reach USD 2.5 billion in 2023.

b. The U.S. workplace stress management market is expected to grow at a compound annual growth rate of 5.33% from 2023 to 2030 to reach USD 3.6 billion by 2030.

Which delivery mode segment accounted for the largest U.S. workplace stress management market share?b. Personal fitness trainers segment dominated the U.S. workplace stress management market with a share of 44.1% in 2021. This is attributable to the benefits of physical workouts in maintaining mental health. Apart from improving fitness, saving time of commute from the workplace to the gym is an important factor contributing to the demand for personal fitness trainers by corporate wellness service providers.

b. Some key players operating in the U.S. workplace stress management market include ActiveHealth Management, Inc.; Asset Health; ComPsych Corporation; CuraLinc Healthcare; Marino Wellness; Virgin Pulse; TotalWellness; Aduro; Beacon Health Options; and FitBit

b. Key factors that are driving the U.S. workplace stress management market growth include the high prevalence of stress among employees and the increasing investment of employers in wellness services to maintain and promote employee health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.