- Home

- »

- Medical Devices

- »

-

U.S. Wound Wash Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Wound Wash Market Size, Share & Trends Report]()

U.S. Wound Wash Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Antiseptic, Saline Solution), By Product Form (Solutions, Sprays, Wipes), By Application (Acute Wounds, Chronic Wounds), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-524-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wound Wash Market Size & Trends

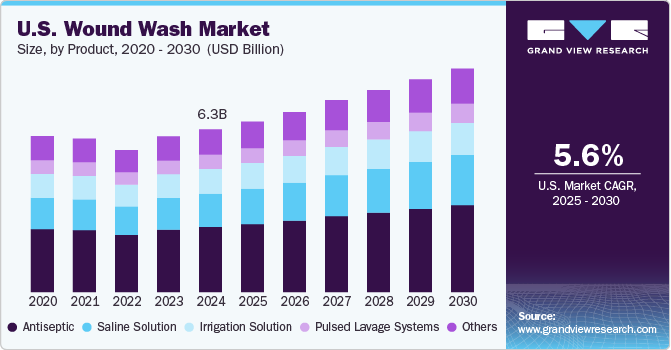

The U.S. wound wash market size was estimated at USD 6.33 billion in 2024 and is projected to grow at a CAGR of 5.56% from 2025 to 2030. The market growth is driven by the increasing number of surgical procedures performed across the country. The growing aging population and advancements in surgical techniques contribute to a higher demand for effective wound care solutions, including wound wash products. Moreover, the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is anticipated to propel the market growth in the coming years. For instance, according to data published by Healogics, LLC, in August 2024, an estimated 7 million Americans live with chronic or non-healing wounds.

The U.S. wound wash market is experiencing significant growth, driven by the increasing number of surgical procedures performed across the country. The growing aging population and advancements in surgical techniques contribute to a higher demand for effective wound care solutions, including wound wash products. The increasing number of general, orthopedic, cardiovascular, and plastic surgeries has led to a surge in post-operative wound management needs. Surgical wounds require proper cleaning to prevent infections, promote faster healing, and reduce complications. Wound wash solutions, which help irrigate and cleanse wounds without causing tissue damage, have become essential in post-surgical care. According to the American Society of Plastic Surgeons (ASPS), 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the U.S. in 2022.

The rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is anticipated to propel the market growth in the coming years. According to a study published by the American Medical Association in November 2023, around 34% of individuals with diabetes develop a foot ulcer during their lifetime. Diabetic foot ulcers impact about 1.6 million individuals in the U.S. each year. Moreover, a study published by the National Library of Medicine in January 2024 highlighted that approximately 2.5 million hospitalizations in the U.S. can be attributed to pressure ulcers.

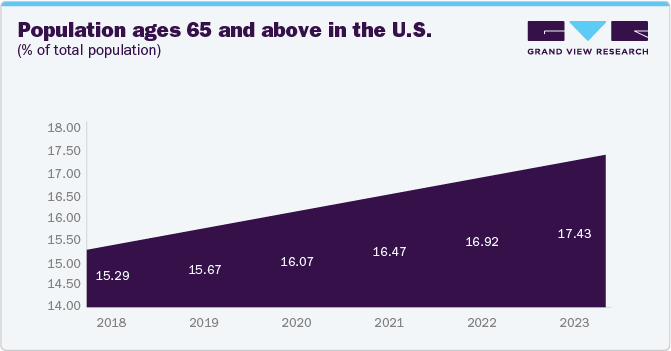

As the older population in the U.S. continues to grow, the incidence of chronic wounds is expected to rise. Data from the Population Reference Bureau, published in January 2024, projects that the number of individuals aged 65 and over in the U.S. will increase from 58 million in 2022 to 82 million by 2050-a 47% rise. Moreover, the share of this age group within the total population is expected to grow from 17% to 23%. These expanding elderly demographic is anticipated to drive a substantial increase in the prevalence of chronic wounds, further boosting the demand for wound wash products.

Advancements in wound and surgical washes are a significant driver of the U.S. wound wash market. Traditional wound cleansing methods have evolved with advancements in antimicrobial agents, biofilm-disrupting solutions, and automated irrigation systems, making wound care more effective and efficient. The shift toward advanced antimicrobial solutions is one of the most essential factors driving the wound wash market. Traditionally, wound care involved basic saline or sterile water irrigation, but research has led to antiseptic solutions that actively prevent infections and promote healing. Silver has long been known for its antimicrobial properties. Modern wound wash solutions incorporate silver nanoparticles or sulfadiazine to provide broad-spectrum antimicrobial activity. As per the National Library of Medicine, silver-based solutions benefit burns, chronic wounds, and post-surgical care by reducing bacterial colonization and biofilm formation. They provide a sustained antimicrobial effect without harming healthy tissue.

Furthermore, the rising concerns about healthcare-associated infections, drives the demand for effective antiseptics like Chlorhexidine.

U.S. States With The Most Hospital-acquired Infections In 2023

Rank

State

Total HAIs

1

CA

8,024

2

NY

5,491

3

TX

5,177

4

FL

4,503

5

PA

4,058

6

OH

3,391

7

IL

2,970

8

NC

2,807

9

GA

2,759

10

MI

2,495

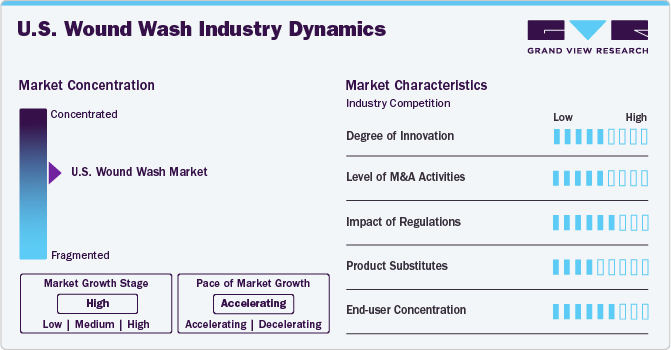

Market Concentration & Characteristics

The U.S. wound wash market is moderately innovative. Companies are increasingly focused on improving the effectiveness of wound cleansing products by combining advanced ingredients that promote faster healing, reduce infection, and enhance patient comfort. In addition, there has been a rise in eco-friendly packaging and sustainable production processes to meet consumer demand for more environmentally responsible options.

Regulatory bodies such as the FDA significantly influence the market. The U.S. Food and Drug Administration (FDA) oversees the approval process for wound care products, including wound washes, to guarantee they meet strict standards before reaching the market. Compliance with these regulations requires manufacturers to conduct thorough testing and submit detailed documentation, which can lead to increased product costs and longer development timelines.

Mergers and acquisitions (M&A) activity in the U.S. wound wash market has been steadily increasing as companies seek to expand their product offerings, strengthen market positions, and enhance their research and development capabilities. Larger firms are acquiring smaller, innovative companies that specialize in new wound care technologies or have niche market strengths, allowing them to diversify their portfolios and stay competitive. This consolidation not only provides financial growth opportunities but also helps in broadening distribution networks and improving access to advanced products.

The U.S. wound wash market benefits from limited direct competition from substitute products. While there are other ways to clean a wound, such as plain soap and water or saline solution, wound washes are often preferred by healthcare professionals because they are specifically designed for this purpose and may contain ingredients that promote healing or fight infection.

The U.S. wound wash market exhibits a diversified end-user base, with hospitals and clinics are big buyers because they use wound washes for many different things, from treating cuts and scrapes to cleaning wounds after surgery. Doctors' offices also use a lot of wound wash products. Other important customers include places like urgent care centers, nursing homes, and home healthcare providers.

Product Insights

The antiseptics segment dominated the market in 2024 owing to the rising demand for antiseptics with improved antibacterial and antimicrobial efficacy. For instance, in April 2023, 3M Health Care launched its FDA-approved 3M SoluPrep S Sterile Antiseptic Solution for preoperative patient skin preparation. This solution contains 2% chlorhexidine gluconate and 70% isopropyl alcohol. Studies have demonstrated that it offers rapid, broad-spectrum antimicrobial action (in vitro; clinical significance is not yet established) and provides persistent antimicrobial activity for at least 96 hours after application in healthy volunteers. Such novel product launches by key market players are expected to boost the segment growth over the forecast period.

The saline solution segment is expected to witness the fastest growth in the U.S. wound wash market. Saline solution is gaining popularity as a wound wash due to its safety, simplicity, and affordability. Its similarity to bodily fluids makes it gentle on sensitive skin and new wounds, and its ready availability and lower cost compared to specialized washes further drive demand. The increasing preference for gentler, more natural cleaning methods also contributes to its growth.

Product Form Insights

The solutions segment dominated the market in 2024 owing to its versatility, ease of use, and broad application across different types of wounds. Saline and antiseptic solutions are preferred by both consumers and healthcare professionals for their ability to effectively cleanse wounds while reducing the risk of infection. These solutions are available in a range of formulations, including sterile, preservative-free options, making them suitable for various patient needs, from minor cuts to more serious injuries.

The wipes segment is expected to witness the fastest growth in the U.S. wound wash market due to wipes offer a convenient and easy-to-use solution for wound care in both clinical and home settings. These pre-moistened wipes effectively cleanse wounds by removing dirt, debris, and bacteria, providing a hygienic approach to wound management. Their portability has led to increased popularity, especially for individuals with limited mobility or those needing frequent wound care.

Application Insights

The acute wounds segment dominated the market in 2024 owing to the increasing incidence of acute injuries and surgical procedures. Increasing awareness of the importance of proper wound cleansing in preventing infections and complications like sepsis or delayed healing is driving this growth. Furthermore, innovative wound wash products with gentle, non-irritating formulas and convenient formats such as pre-moistened wipes and sprays are making acute wound care more accessible for both healthcare providers and patients.

The chronic wounds segment is expected to witness the fastest growth in the U.S. wound wash market due to the increasing prevalence of chronic wounds, including pressure ulcers, venous leg ulcers, and diabetic foot ulcers. The rising prevalence of diabetic foot ulcers is anticipated to increase due to the rise in the prevalence of diabetes. According to a report by CDC, in May 2024, in the U.S., an estimated 38.4 million people (11.6% of the population) live with diabetes. Of these, 29.7 million are diagnosed, including 29.4 million adults, while 8.7 million (22.8% of diabetic adults) remain undiagnosed. Effective wound care is crucial for these patients, as these wounds are often difficult to heal, prone to infection, and can significantly impact quality of life. This growing burden of chronic wounds fuels the demand for specialized wound wash products and advanced wound care solutions.

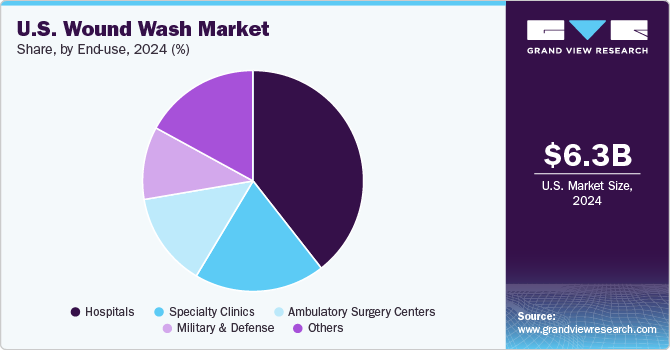

End-use Insights

The hospitals segment dominated the market in 2024. Hospitals serve as the primary centers for diagnosing, managing, and treating various types of wound injuries. Hospitals are crucial in the healthcare sector due to their advanced technologies, specialist medical knowledge, and extensive infrastructure for managing this condition. Moreover, hospitals focus on delivering brief medical interventions for severe injuries or illnesses, urgent medical needs, or postsurgical recovery. They provide various services, including emergency care, surgical procedures, intensive care, and specialized medical treatments.

The military and defense segment is expected to grow at the fastest CAGR in the U.S. wound wash market due to an increased focus on the health and safety of personnel. Rising instances of injuries in combat situations and the demand for effective wound care solutions to address battlefield injuries are driving this growth. Moreover, advancements in wound care technology and growing government investments in military healthcare initiatives contribute to the expansion of this segment. As the defense sector prioritizes better treatment options, wound wash products are increasingly being incorporated into medical kits for military personnel. This trend drives a significant opportunity for innovation and growth in the U.S. wound wash market.

Key U.S. Wound Wash Company Insights

Key market players are adopting various strategies such as product launches, approvals and others to increase their market presence and get competitive advantage over other market players. These advancements in U.S. wound wash market are anticipated to boost market growth over the forecast period.

Key U.S. Wound Wash Companies:

- Atlantis Consumer Healthcare Inc.

- Medline Industries, LP

- B. Braun SE

- Johnson & Johnson Consumer Inc. (Johnson & Johnson)

- Zimmer Biomet

- Urgo Medical North America (URGO Group)

- Coloplast Corp (Coloplast Group)

- Mölnlycke Health Care AB

- Cardinal Health

- Armis Biopharma

- Bravida Medical

- Irrimax Corporation

- BD

- Sanara MedTech Inc.

- Pure&Clean

- Innovacyn, Inc.

Recent Developments

-

In August 2024, ARCHIMED announced the acquisition of Irrimax, the providers of anti-microbial wound irrigation solutions. The collaboration between the two companies will enable Irrimax to broaden its product lineup, penetrate new markets, and enhance its global presence.

-

In August 2024, Irrimax announced an expansion of its product portfolio, featuring a series of enhancements and new offerings through a two-phase innovation pipeline, with plans to introduce five new products over the next two years. In phase one, the focus was on the flagship IRRISEPT Antimicrobial Wound Lavage product, exploring its features and applications for use across various care settings, from pre-hospital to acute and post-acute environments. Now, with the launch of phase two, Irrimax has introduced two new kits: the 'IRRISEPT Accessory Kit' and the 'IRRISEPT Wound Solution Kit.' These kits are specifically designed to complement the original IRRISEPT Antimicrobial Wound Lavage product.

-

In May 2023, Armis Biopharma announced that the U.S. Food and Drug Administration (FDA) granted 510(k) clearance for its VeriCyn Wound Wash medical device. VeriCyn Wound Wash offers skin-friendly wound care with a unique formulation that is free from chlorine and surfactants. When used with a lavage system, it facilitates mechanical movement at the wound surface. This device is indicated for cleansing and removing foreign materials, including microorganisms and debris, from various types of wounds, such as stage I-IV pressure ulcers, diabetic foot ulcers, post-surgical wounds, first-degree burns, partial thickness burns, as well as grafted and donor sites

U.S. Wound Wash Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.64 billion

Revenue forecast in 2030

USD 8.90 billion

Growth rate

CAGR of 5.56% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Product, product form, application, end-use

Country scope

U.S.

Key companies profiled

Atlantis Consumer Healthcare Inc.; Medline Industries, LP.; Johnson & Johnson Consumer Inc.; B. Braun SE; Zimmer Biomet; Urgo Medical North America; Coloplast Corp; Mölnlycke Health Care AB; Cardinal Health; Armis Biopharma; Bravida Medical; Irrimax Corporation; BD; Sanara MedTech.; pure&clean; Innovacyn, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Wash Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. wound wash market report on the basis of product, product form, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Antiseptic

-

Povidone Iodine

-

Chlorhexidine

-

Polyhexanide (PHMB)

-

Others

-

-

Saline Solution

-

Irrigation Solution

-

Pulsed Lavage Systems

-

Disposable

-

Reusable

-

Semi Disposable

-

-

Others

-

-

Product Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Sprays

-

Wipes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns & Lacerations

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Military & Defense

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wound wash market size was estimated at USD 6.33 billion in 2024 and is expected to reach USD 6.64 billion in 2025.

b. The U.S. wound wash market is expected to witness a compound annual growth rate of 5.56% from 2025 to 2030 to reach USD 8.90 billion by 2030.

b. Antiseptic segment dominated the U.S. wound wash market with a share of 40.00% in 2024. This is attributable to their effectiveness in preventing infection, a primary concern in wound care.

b. Some key players operating in the U.S. wound wash market include Atlantis Consumer Healthcare Inc.; Medline Industries, LP.; Johnson & Johnson Consumer Inc.; B. Braun SE; Zimmer Biomet; Urgo Medical North America; Coloplast Corp; Mölnlycke Health Care AB; Cardinal Health; Armis Biopharma; Bravida Medical; Irrimax Corporation; BD; Sanara MedTech.; pure&clean; and Innovacyn, Inc.

b. Key factors that are driving the market growth include the increasing number of surgical procedures, trauma cases, and the rising prevalence of chronic wounds such as diabetic ulcers and pressure sores.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.