- Home

- »

- Medical Devices

- »

-

U.S. X-ray Systems Market Size, Industry Report, 2030GVR Report cover

![U.S. X-ray Systems Market Size, Share & Trends Report]()

U.S. X-ray Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Radiography, Fluoroscopy), By Technology (Digital Radiography, Computed Radiography), By Mobility, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-537-7

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. X-ray Systems Market Size & Trends

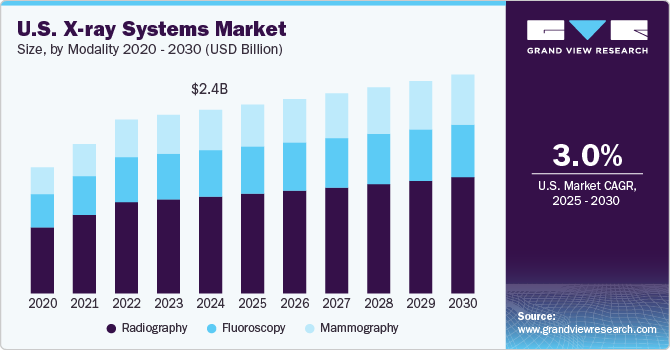

The U.S. X-ray systems market size was estimated at USD 2.4 billion in 2024 and is expected to grow at a CAGR of 3.0% from 2025 to 2030. The market is growing due to technological advancements, rising chronic disease prevalence, an aging population, and favorable reimbursement policies. Digital radiography and AI-powered imaging improve diagnostic accuracy and efficiency. However, high equipment costs, radiation exposure concerns, and stringent FDA regulations pose challenges. Increasing demand for portable and mobile X-ray systems further drives market expansion, particularly in emergency and outpatient settings.

The market is witnessing increased mergers and acquisitions, with companies strengthening their presence. For instance, in April 2024, Shimadzu Medical Systems USA acquired California X-ray Imaging Services to expand its North American healthcare business.

Regulatory approvals are shaping the market, ensuring safety and innovation. In February 2025, the FDA granted Lumitron's HyperVIEW X-ray system Breakthrough Device designation for breast cancer imaging. HyperVIEW utilizes K-Edge subtraction and laser-Compton X-rays, offering 100 times higher resolution and a potential 3000% improvement in tumor detection over traditional systems.

Portable X-ray systems are also driving market growth. In January 2025, Oxos Medical secured FDA clearance for its MC2 ultraportable X-ray system, featuring cordless operation, dynamic digital radiography, and low radiation output, reducing infrastructure needs. This follows Oxos’ successful Micro C launch in 2021.

Despite strong growth, challenges include high equipment costs, radiation exposure concerns, and stringent FDA regulations. However, the increasing adoption of AI-enhanced imaging and digital radiography is improving diagnostic efficiency and accessibility. With continued technological advancements and regulatory support, the market is poised for further expansion, offering enhanced diagnostic capabilities and improved patient outcomes.

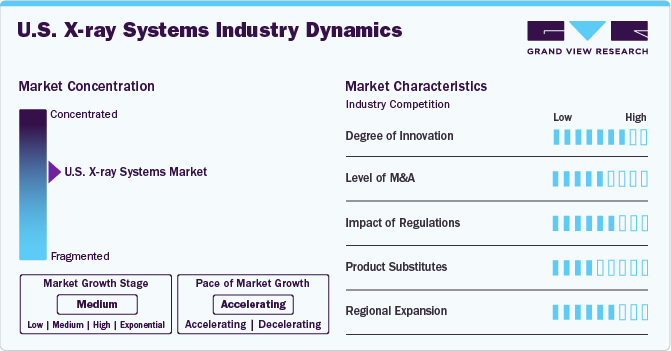

Market Concentration & Characteristics

The U.S. X-ray systems market is highly concentrated, dominated by major players like GE Healthcare, Siemens Healthineers, and Philips. Industry characteristics include strong regulatory oversight, high R&D investment, and rapid technological advancements, such as AI integration and portable X-ray solutions. In addition, the rising demand for early and accurate disease detection and the need for efficient and cost-effective imaging solutions contribute to industry expansion. Major players in the industry are continuously working to improve their product offerings to expand their customer base and gain a larger industry share. This involves expanding their products, gaining approvals, exploring acquisitions, obtaining government approvals, and engaging in important cooperation activities.

The U.S. X-ray systems industry is advancing with AI, VR, and 3D radiography innovations, enhancing diagnostic precision and imaging capabilities. AI-powered X-ray machines improve accuracy, while VR assists radiologists in visualization. Published in July 2022, CERN’s sensor chip technology provides detailed soft tissue imaging, improving diagnostics in orthopedics, cancer, and vascular diseases. These advancements address key challenges like low-dose exposure and high-resolution imaging. Regulatory approvals, such as the FDA’s designation of Lumitron’s HyperVIEW system, further highlight the industry's commitment to improving safety, efficiency, and diagnostic precision in medical imaging.

Mergers and acquisitions in the U.S. X-ray systems industry are accelerating. In November 2024, Radon Medical Imaging announced its acquisition of Alpha Imaging, expanding into seven new states. The deal enhances Radon’s product portfolio, service capabilities, and workforce. Alpha Imaging CEO Michael Perrico joins Radon’s leadership team, strengthening customer access and industry reach. Established in 1986, Alpha Imaging is a key distributor for major vendors like Shimadzu and Konica Minolta. This marks Radon’s third acquisition since partnering with 5th Century Partners. The deal closed in October 2024, reinforcing Radon’s position as a leader in medical imaging services.

Regulations significantly influence the U.S. X-ray systems industry by ensuring safety, quality, and compliance. The FDA’s stringent oversight under the Radiation Control for Health and Safety Act mandates performance standards to minimize radiation exposure. State-level regulations further govern equipment installation, use, and maintenance. Compliance with guidelines from the American College of Radiology (ACR) and the Joint Commission enhances imaging accuracy and patient safety. Evolving policies, such as stricter dose monitoring and AI integration standards, drive innovation while increasing costs for manufacturers. Regulatory updates continue to shape market dynamics, influencing technology adoption, reimbursement policies, and overall industry growth.

The U.S. X-ray systems industry faces competition from advanced imaging technologies such as MRI, CT, and ultrasound, which serve as substitutes in various diagnostic applications. MRI and CT provide superior soft-tissue contrast and 3D imaging, while ultrasound offers radiation-free imaging, making them preferable in certain cases. Additionally, emerging technologies like photon-counting CT and portable MRI systems are gaining traction. However, X-ray remains the primary choice for cost-effective, rapid diagnostics in trauma, dental, and orthopedic imaging. The balance between affordability, accessibility, and technological advancements determines the adoption of these substitutes in the evolving medical imaging landscape.

The U.S. X-ray systems industry is expanding with Harrison.ai’s entry, announced in February 2025. Backed by USD 112 million in Series C funding, the AI-driven company aims to enhance radiology and pathology diagnostics. Its technology analyzes X-rays, CT scans, and pathology slides, aiding early disease detection and improving clinician efficiency. This expansion addresses the growing demand for diagnostic solutions amid a global shortage of 1.5 million clinicians. The move strengthens Harrison.ai’s presence in the U.S., complementing its growth in the UK, EMEA, and APAC regions while advancing AI-powered medical imaging for improved patient outcomes.

Modality Insights

The radiography segment dominated the market and accounted for the largest revenue share of 52.7% in 2024. Its dominance is driven by increasing demand for digital radiography, advancements in detector technology, and rising applications in disease diagnosis. Hospitals and diagnostic centers increasingly adopt digital X-ray systems due to their efficiency, lower radiation exposure, and high image quality. The growing prevalence of chronic conditions like osteoporosis and lung diseases further fuels market expansion. Additionally, government initiatives promoting early disease detection and technological advancements in AI-powered imaging solutions contribute to the segment’s growth, solidifying its leadership in the U.S. X-ray systems market.

The mammography segment is expected to exhibit the fastest growth during the forecast period due to increasing breast cancer cases, rising awareness about early detection, and technological advancements like digital breast tomosynthesis (DBT). Government initiatives, such as expanded screening programs and reimbursement policies, further drive adoption. AI-powered mammography solutions enhance diagnostic accuracy, improving early disease detection rates. Additionally, the shift from analog to digital mammography systems, coupled with investments in research and development, supports market expansion.

Technology Insights

The digital radiography segment dominated the market and accounted for the largest revenue share of 70.7% in 2024 and is expected to exhibit the fastest growth during the forecast period. This dominance is driven by its superior image quality, faster processing times, and lower radiation exposure compared to traditional methods. Increasing adoption in hospitals, diagnostic centers, and outpatient facilities, along with advancements in AI integration and portable DR systems, further fuel market expansion.

The computed radiography (CR) segment in the U.S. X-ray systems market is expected to grow steadily due to its cost-effectiveness, ease of integration with existing X-ray infrastructure, and gradual transition from analog to digital imaging. CR systems offer improved image quality, lower radiation exposure, and enhanced workflow efficiency compared to traditional film-based systems. Rising demand for advanced imaging solutions in smaller healthcare facilities, veterinary clinics, and outpatient centers further supports the growth.

Mobility Insights

The stationary segment dominated the market and accounted for the largest revenue share of 62.5% in 2024 and is expected to exhibit the fastest growth during the forecast period. This segment is anticipated to experience the fastest growth during the forecast period, driven by increasing demand for high-quality imaging in hospitals and diagnostic centers. The adoption of advanced stationary X-ray systems, offering enhanced imaging capabilities and workflow efficiency, is further fueling market expansion. Additionally, technological advancements, including AI integration and digital radiography, are improving diagnostic accuracy and efficiency. The continued preference for stationary X-ray systems in large healthcare facilities is expected to sustain its dominance and drive significant market growth in the coming years.

The mobile X-ray segment is projected to grow at the fastest rate in the U.S. X-ray systems market during the forecast period. This growth is driven by rising demand for portable imaging solutions in emergency care, ICUs, and home healthcare settings. Technological advancements like AI and wireless connectivity help to enhance diagnostic accuracy and operational efficiency. Moreover, market players' emphasis on developing innovative and enhanced mobile X-ray units drives increased adoption. For instance, in November 2022, Canon Medical Systems Corporation introduced the Mobirex i9 mobile system to the U.S. market.

End Use Insights

The hospitals segment dominated the market and accounted for the largest revenue share of 43.4% in 2024. This dominance was driven by the increasing adoption of advanced imaging technologies, rising patient volumes, and growing demand for diagnostic accuracy. Hospitals invest heavily in state-of-the-art X-ray systems to enhance patient care, support complex procedures, and improve workflow efficiency. Additionally, government initiatives and funding for healthcare infrastructure further fueled market expansion. The segment’s growth is also attributed to the higher preference for hospital-based imaging over standalone diagnostic centers due to comprehensive care availability and integration with other medical services.

The diagnostic imaging centers segment is expected to grow at the fastest rate in the U.S. X-ray systems market during the forecast period. This growth is driven by increasing demand for cost-effective, outpatient imaging services, and advancements in portable and digital X-ray technologies. Rising awareness of early disease detection and the convenience of standalone imaging centers contribute to market expansion. Additionally, lower operational costs compared to hospitals, faster turnaround times, and growing investments in diagnostic infrastructure further accelerate growth.

Key U.S. X-ray Systems Company Insights

Leading market players include Koninklijke Philips N.V. and Siemens Healthineers AG, both innovators in X-ray technology. These companies have utilized their technological expertise to secure a strong presence in this growing market. Their strategies emphasize affordability, user-friendly designs, and improved accessibility, ensuring widespread adoption of their advanced imaging solutions.

Key U.S. X-Ray Systems Companies:

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Mindray Medical International Limited

- Hologic, Inc

- AGFA

Recent Developments

-

In August 2024, DocGo partnered with MinXray to launch a mobile X-ray program in New York City, aiming to provide rapid chest X-rays for vulnerable populations and identify active tuberculosis (TB) cases. The program utilizes MinXray's portable, battery-powered X-ray systems and artificial intelligence to promptly analyze images, ensuring immediate care for those affected.

-

In December 2024,Konica Minolta Healthcare Americas partnered with Gleamer to integrate AI-powered BoneView into its X-ray systems. The FDA-cleared solution enhances musculoskeletal imaging by identifying fractures, improving diagnostic accuracy, and optimizing workflows. Available across Konica Minolta’s DR portfolio, it streamlines radiology processes and enhances patient care efficiency.

U.S. X-ray Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.5 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 3.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, technology. mobility, end use

Regional scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; Siemens Healthineers AG; GE Healthcare; Canon Medical Systems; Shimadzu Corporation; FUJIFILM SonoSite, Inc.; Carestream; Mindray Medical International Limited; Hologic, Inc; AGFA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. X-ray Systems Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. X-ray systems market report based on modality, technology, mobility, and end use.

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Radiography

-

Computed Radiography

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Mobile

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic imaging centers

-

Other end users

-

Frequently Asked Questions About This Report

b. The U.S. X-ray systems market size was estimated at USD 2.4 billion in 2024 and is expected to reach USD 2.5 billion in 2025.

b. The U.S. X-ray systems market is expected to grow at a compound annual growth rate of 3.0% from 2025 to 2030 to reach USD 2.9 billion by 2030.

b. The radiography modality dominated the U.S. X-ray systems market, with a share of 52.7% in 2024. This dominance is due to its being less expensive and less time-consuming than other systems.

b. Some key players operating in the U.S. X-ray systems market include Koninklijke Philips N.V.; Siemens Healthineers AG; GE Healthcare; Canon Medical Systems; Shimadzu Corporation and among others.

b. Key factors driving the U.S. X-ray systems market growth include the presence of major market players in this country and the growing prevalence of chronic disorders necessitating medical imaging examinations such as X-rays.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.