- Home

- »

- Communication Services

- »

-

Usage-based Insurance For Automotive Market Report, 2030GVR Report cover

![Usage-based Insurance For Automotive Market Size, Share & Trends Report]()

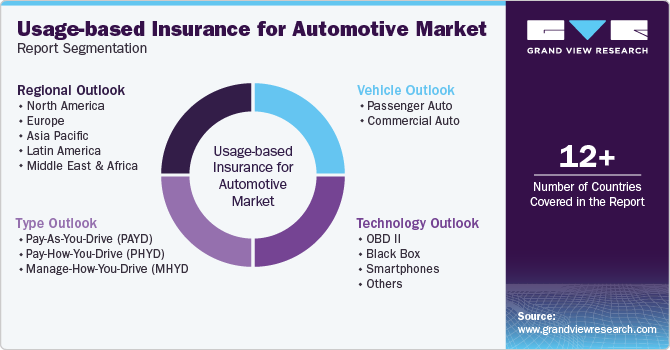

Usage-based Insurance For Automotive Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (PAYD, PHYD, MHYD), By Technology (Black Box, Smartphones), By Vehicle, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-940-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Usage-based Insurance For Automotive Market Summary

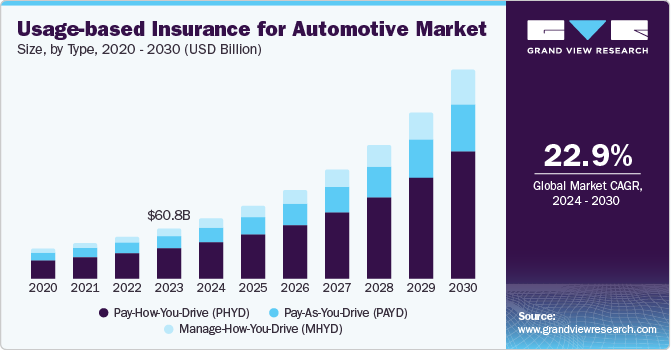

The global Usage-based Insurance For Automotive market was estimated at USD 60.82 billion in 2023 and is projected to reach USD 250.97 billion by 2030, growing at a CAGR of 22.9% from 2024 to 2030. The steadily rising presence of passenger and commercial vehicles on roads has increased the risk of accidents caused due to reckless or distracted driving, forcing insurance companies to launch solutions that can enforce ideal driving behavior by tracking parameters such as distance driven, time of day, and phone or media usage while driving.

Key Market Trends & Insights

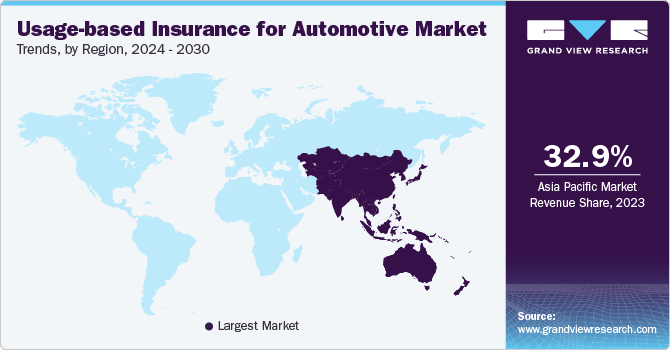

- Asia Pacific led the global market with a revenue share of 32.9% in 2023.

- The U.S. accounted for the largest share of the North America market in 2023.

- By vehicle, the commercial auto segment is anticipated to account for a sizeable contribution to the market in the coming years.

- By type, Pay-How-You-Drive (PHYD) led the market with a revenue share of 60.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 60.82 Billion

- 2030 Projected Market Size: USD 250.97 Billion

- CAGR (2024-2030): 22.9%

- Asia Pacific: Largest market in 2023

Usage-based insurance (UBI) programs offer a range of benefits, including lower insurance premiums when compared to standard policies and the ability to utilize smartphones to monitor driver activity and receive feedback in real-time. Furthermore, a constant increase in sales of telematics-equipped vehicles, along with introduction of government regulations geared toward improvements in vehicle safety, are expected to aid market expansion.

Increasing awareness regarding the advantages of UBI policies has created significant interest among consumers. For instance, according to Trackm8, an insurance telematics solution provider, a national driver survey found that around 70% of drivers in the UK expected to drive more miles in 2023 than the previous year. Moreover, around 58% stated that they would prefer to have a telematics insurance policy so that costs associated with increased mileage and car usage could be reduced. This is expected to encourage organizations to offer comprehensive solutions to customers and offer personalized programs based on their requirements and habits. UBI helps customers to pay a premium depending on the number of miles driven and their driving pattern. Companies receive substantial benefits from usage-based insurance features such as pricing accuracy, fraud detection, automated claims management, stolen vehicle recovery, and reduction or elimination of towing charges. The collected information helps provide value-added services to policyholders while lowering operating expenses and reducing claims leakage.

The emergence of several new companies offering technologically advanced solutions has increased the competitiveness in the market, forcing well-established organizations to invest in technologies such as AI and machine learning. In September 2022, Otonomo Technologies, an Israeli autotech company, announced that its subsidiary, The Floow, had launched the ‘FloowFusion’ technology to allow insurance providers to leverage existing smartphone data with connected vehicle data to benefit from connected insurance policies. Other companies have undertaken strategies such as partnerships and acquisitions to bring more optimized solutions for vehicle owners. For instance, in March 2023, Powerfleet announced that it had acquired Movingdots, a Germany-based provider of sustainable mobility and advanced insurance telematics solutions. Through this deal, Powerfleet would be able to leverage the customization features and insurance risk insights of the Coloride telematics app solution by Movingdots.

Type Insights

In terms of insurance type, Pay-How-You-Drive (PHYD) led the market with a revenue share of 60.6% in 2023. The growing popularity of determining insurance premiums based on the driving pattern of the vehicle, coupled with increasing efforts by drivers to follow regulations and laws and drive responsibly, is projected to boost sales of UBI products. Certain insurance providers also offer enrollment discounts based on the program that the driver signs up for. Companies are encouraging customers to try these programs voluntarily as they can offer drivers critical insights regarding their behavior in vehicles that can help prevent collisions.

The Manage-How-You-Drive (MHYD) segment is anticipated to advance at the fastest CAGR during the forecast period. The demand for MHYD products has increased substantially, as drivers are increasingly aiming to understand their driving style and make the required changes based on the feedback received. This helps in the continuous improvement of their driving behavior and situational awareness, leading to a lower risk of accidents and higher chances of safety. Additionally, companies are also offering MHYD package integration with different connected services, including vehicle wellness reports and theft insurance programs, which is expected to significantly enhance the appeal of this policy type among insurers and customers in the coming years.

Technology Insights

OBD II technology accounted for the largest revenue share in the usage-based insurance for automotive market in 2023. OBD II is the next generation of on-board diagnostics (OBD) that has become an integral part of the fleet management and telematics ecosystem, aiding its usage in vehicles. Through this technology, fleets can determine wear trends of vehicles, proactively diagnose and address issues, and measure driving behavior, idling time, distance covered, and speed. The increasing usage of telematics technologies in vehicles and preference of consumers to calculate premiums in real-time instead of using generalized data and historical statistics is expected to steadily drive segment growth. Globe Cascadeo, an AWS partner, leverages GV500 MAP OBD2 devices to send event-related and periodic messages that enable insurance companies to acknowledge good driving behavior with rewards or credits.

On the other hand, smartphones are expected to emerge as the fastest-growing segment from 2024 to 2030. The high rate of smartphone adoption globally, portability of these devices, and the extensive range of features provided have led to the reduced usage of external telematics devices in recent years. Both customers and insurers prefer smartphones to monitor and understand their driving behavior and related insurance benefits. Smartphone-centric telematics programs can offer major insights regarding distracted driving that may not be possible with hardware devices. For instance, Zendrive, a mobility risk insurance provider, offers products that can efficiently measure phone usage, detect stop sign violations, and provide automated driver coaching. The ease of deployment and cost-efficiency of smartphone-based UBI solutions can greatly improve the success rate of UBI programs by adding more customers. These advantages are expected to ensure substantial segment growth in the forecast period.

Vehicle Insights

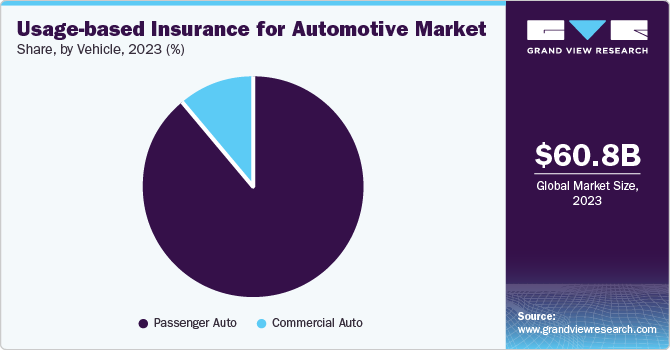

The passenger auto segment accounted for a dominant revenue share of the global market in 2023. Increasing sales of passenger vehicles worldwide have compelled automakers to install telematics devices in their models. These devices enable the monitoring and availability of real-time information regarding vehicle condition, driving style and habits, and the mileage covered. Drivers of passenger vehicles are increasingly utilizing these telematics features to improve driving habits, leading to a substantial reduction in insurance premiums and improved discounts on safe driving insurance. Additionally, continued efforts by government bodies and private organizations to improve road safety and minimize the risk of accidents have created better awareness among consumers regarding responsible driving, with UBI providers offering further incentives through their products to encourage and promote such practices.

The commercial auto segment is anticipated to account for a sizeable contribution to the market in the coming years. The growing presence of commercial vehicles such as trucks, buses, and vans has driven the demand for UBI products to encourage safe and distraction-free driving, which can greatly reduce the risk of human life and property losses. Companies that deploy their own vehicles to transport goods or people are increasingly turning to these insurance products so that drivers constantly remain alert regarding oncoming vehicles and traffic while the management can monitor the vehicle’s position and distance covered continuously. Moreover, the lower cost of insurance premiums has led commercial fleet owners to leverage benefits of usage-based insurance programs.

Regional Insights

Asia Pacific led the global market with a revenue share of 32.9% in 2023. The rapid proliferation of mobile connectivity and smartphone technologies in the region is expected to boost the adoption of usage-based insurance services. Additionally, there has been a sharp growth in the sales of passenger cars and commercial vehicles in economies such as China and India, owing to higher disposable incomes and improved standards of living, which has highlighted the need for launching solutions that can encourage safe driving practices, leading to regional market expansion. Government policies and regulatory approvals are further anticipated to play an important role in the introduction of innovative solutions in this market.

India is anticipated to emerge as a substantial contributor to the regional market in the coming years. Increasing presence of vehicles on roads in the country, coupled with the growing prevalence of collisions and accidents, has compelled vehicle owners to enroll in policies that can encourage safe driving. In July 2019, the Insurance Regulatory and Development Authority of India (IRDAI) launched a regulatory sandbox, with the body receiving more than 350 applications from insurtechs and insurers, of which eight were for Pay-As-You-Drive (PAYD) programs. In July 2022, the IRDAI announced the official enforcement of usage-based insurance products in the country, including Pay-How-You-Drive (PHYD) and Pay-As-You-Drive solutions (PAYD). Such developments are expected to aid market growth in India.

North America Usage-based Insurance for Automotive Market Trends

North America held a substantial share of the global market in 2023. Countries such as the U.S. and Canada have witnessed a steady increase in the number of passenger cars on roads, leading to a growing demand for better driver awareness, which has encouraged insurance companies to launch UBI programs. The presence of companies such as Allstate, State Farm, Liberty Mutual, and Metromile in the region is expected to drive industry competitiveness and lead to the introduction of more advanced and user-friendly products in the regional market. Additionally, increasing pace of telematics adoption and growing smartphone usage have helped create a strong ecosystem for UBI products.

U.S. Usage-based Insurance for Automotive Market Trends

The U.S. accounted for the largest share of the regional market in 2023. The presence of several major multinational insurance companies in the country, along with high rate of technological developments, have aided industry expansion. Additionally, the growing financial burden of road accidents has played an important role in enabling the launch of usage-based insurance products for the automotive sector. For instance, according to the National Highway Traffic Safety Administration’s report “The Economic and Societal Impact of Motor Vehicle Crashes, 2019,” published in January 2023, traffic crashes resulted in the damage of around 23 million vehicles in the country, translating to USD 340 billion in costs. As a result, insurance organizations have been encouraged to expand their portfolio and launch extensive options for vehicle owners.

Europe Usage-based Insurance for Automotive Market Trends

Europe is anticipated to witness substantial growth in the global usage-based insurance market for the automotive sector from 2024 to 2030. The presence of a well-established telematics infrastructure in the region, along with the extensive integration of digital technologies in vehicles, has created several growth avenues for the regional market. The European Commission published a report in 2023 stating that investments of approximately USD 189 billion had been made in technologies containing AI, robotics, and innovative materials, with 28 such projects being selected in March 2023. This has led UBI companies to integrate advanced technologies to gather information regarding driver behavior and accordingly set insurance prices.

The UK is anticipated to contribute significantly to the regional market in the coming years. The presence of several major automotive manufacturers in the economy, coupled with the steady launch of government initiatives to raise awareness regarding safe driving practices, has enabled the growth of the usage-based insurance market. As per a report by PTOLEMUS Consulting Group published in October 2022, the UK, along with Italy, is a major market for UBI products, with 1.3 million policies being active in the country in 2022. The report further estimated that there were more than 25 usage-based insurance programs in effect during this period, mainly targeting young consumers in the economy. This has helped positively shape the market’s growth.

Key Usage-based Insurance For Automotive Company Insights

Some key companies involved in the usage-based insurance for automotive market include Allstate Insurance Company, AXA, and State Farm Mutual Automobile Insurance Company, among others.

-

Allstate Insurance Company offers auto, casualty, property, and other insurance products to customers across the U.S. and Canada. It operates through five segments, including Protection Services, Allstate Protection, Run-off Property-Liability, Allstate Health and Benefits, and Corporate & Other Segments. The company’s ‘Drivewise’ mobile application offers personalized auto insurance rates based on the vehicle owner’s safe driving skills. On the other hand, its ‘Milewise’ solution is a pay-per-mile offering that makes use of a device to record the miles driven and an application to ensure transparency regarding the user’s driving and costs.

-

State Farm Mutual Automobile Insurance Company is based in Illinois, the U.S., and provides casualty, property, and auto insurance solutions across the country. In the vehicle segment, the company offers insurance for auto, motorcycle, boat, RV, ATVs, off-road vehicles, and travel and camping trailers. State Farm Insurance offers the ‘Drive Safe & Save’ usage-based insurance program, which monitors mileage and driving behavior to determine insurance premiums. Driving behavior includes acceleration, speed, hard cornering and braking, time of day, miles driven, and phone usage while driving.

Key Usage-based Insurance for Automotive Companies:

The following are the leading companies in the usage-based insurance for automotive market. These companies collectively hold the largest market share and dictate industry trends.

- Allstate Insurance Company

- Allianz

- American International Group, Inc.

- AXA

- Assicurazioni Generali S.p.A.

- insurethebox

- Liberty Mutual Insurance

- MAPFRE

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

Recent Developments

-

In April 2024, Allstate announced results from research conducted in partnership with Arity, a mobile data and analytics company, highlighting the benefits of using its Drivewise application for vehicles. These findings are part of the 16th ‘Allstate America's Best Drivers Report’ and stated that customers using Drivewise reduce the likelihood of them having a severe collision by 25% when compared to those who do not use this feature. The user-based insurance solution offers feedback regarding safe driving to users after every trip, enabling savings on their policy.

-

In February 2022, Ford announced the launch of the ‘Drive Safe & Save’ product, in partnership with State Farm Insurance, for Lincoln and Ford vehicle owners with eligible connected vehicles in the U.S. The feature was first introduced in the states of Idaho, Oregon, Montana, and Alaska and was made available for vehicle models launched from 2020 onwards. The Drive Safe & Save program makes use of a Bluetooth signal made available to the policyholder after signing up, to automatically record trips by keeping track of their location.

Usage-based Insurance For Automotive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.94 billion

Revenue Forecast in 2030

USD 250.97 billion

Growth Rate

CAGR of 22.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, technology, vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Allstate Insurance Company; Allianz; American International Group, Inc.; AXA; Assicurazioni Generali S.p.A.; insurethebox; Liberty Mutual Insurance; MAPFRE; Progressive Casualty Insurance Company; State Farm Mutual Automobile Insurance Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Usage-based Insurance For Automotive Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global usage-based insurance for automotive market report based on type, technology, vehicle, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pay-As-You-Drive (PAYD)

-

Pay-How-You-Drive (PHYD)

-

Manage-How-You-Drive (MHYD)

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

OBD II

-

Black Box

-

Smartphones

-

Others

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Auto

-

Commercial Auto

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.