- Home

- »

- Next Generation Technologies

- »

-

User Generated Content Platform Market Size Report, 2030GVR Report cover

![User Generated Content Platform Market Size, Share & Trends Report]()

User Generated Content Platform Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Blogs, Websites), By End-user (Enterprises, Individual), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-470-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

User Generated Content Platform Market Summary

The global user generated content platform market size was valued at USD 4.4 billion in 2022 and is projected to reach USD 32.6 billion by 2030, growing at a CAGR of 29.4% from 2023 to 2030. User Generated Content (UGC)/ User Created Content Platform enables brands to accumulate company mentions or visual product references including short videos, from social media and other sources to repurpose them to enable sales, advertising, and marketing efforts.

Key Market Trends & Insights

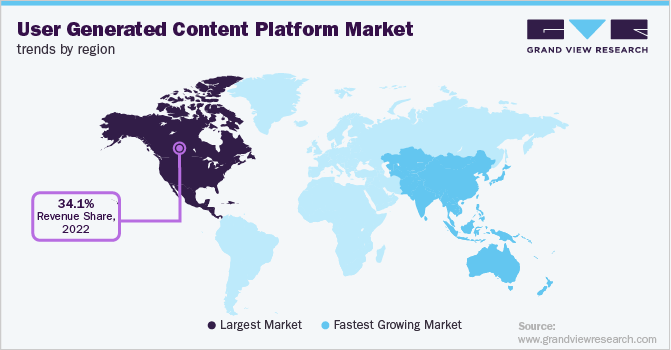

- North America dominated the global user generated content platforms market with a market share of 34.1% in 2022.

- Asia Pacific is projected to demonstrate the highest CAGR over the forecast period.

- Based on product type, the audio and video segment holds the maximum revenue share of 33.7% in 2022.

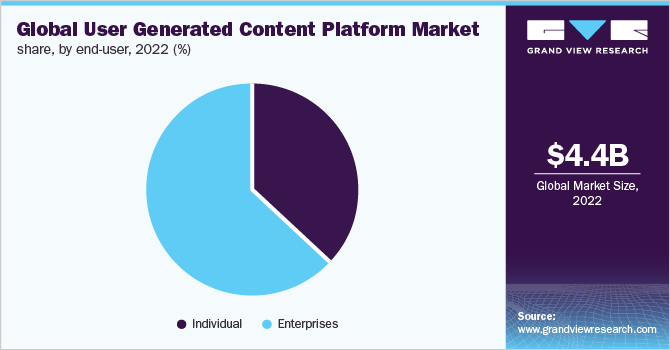

- By end-user, the enterprise segment dominates the market, with a revenue share of 63.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.4 Billion

- 2030 Projected Market Size: USD 32.6 Billion

- CAGR (2023-2030): 29.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The application of user-generated content (UGC) for brand advertising and marketing purposes has grown explosively in recent years, the emergence of online shopping and the growing consumer aversion to intrusive marketing techniques, many advertisers and brands have turned to user-generated content to engage and connect with their customers. User-generated content shared via social media may have more power and influence than other sources because it is transmitted by a reliable information source embedded in a consumer's network. Social media allows consumers to share their opinions and exert individual and collective influence on other consumers and brands which propels the application of user generated content.

The music industry and social media networks are highly interdependent. The UGC marketing incorporated into the music industry has proven to be a significant contributor to the overall growth of the music industry in recent years. This growth is attributable to the halo effect of driving audio streams on music platforms, such as Apple Music, Spotify, YouTube Music, and Amazon Music. The music industry and artists have leveraged the extended reach of social media networking to generate a constant flow of content to keep their followers engaged and reach new audiences. It has been more crucial than ever during the COVID-19 crisis. UGC and social media platforms had given music followers a window into creative pursuits and artists’ lives when more structured content, such as official promo videos, live shows, and finished albums, were not available

Some popular streams of user-generated content include collaboration between a user and a brand. Many brands repurpose UGC for their benefits and marketing, sharing brand-inspired customer testimonials and fan art across different social network platforms. For instance, GoPro, Inc. utilizes fan-generated content and promotes unique customer-created video content on its YouTube channel. For another instance, Amazon.com, Inc. utilizes customer reviews to get repositioned on the website. It helps the brands improve their ranking as approximately 70% actively seek online reviews before purchasing.

User-generated content platforms help to promote creative designers and performers. It also encourages innovation and creativity by bringing together all types of talent on a single platform. Instagram has emerged as the most popular social platform for user-generated content, with thousands of businesses adopting the trend of posting user generated content to build brand loyalty and extend their reach. One of the effective ways to get consumer content is by hosting contests on social media platforms, creating unique hashtags, and getting brands’ followers to contribute to that unique hashtag. With a UGC hashtag contest, brands encourage followers to share images/ videos on social media and use a particular hashtag. A user-generated content strategy can be remarkably effective, as demonstrated by Adobe and their Instagram campaign #Adobe Perspective, which enabled designers to freely publish their original works and Adobe planned to interact with members of various other groups.

Product Type Insights

The audio and video product type segment dominates the market, with a revenue share of 33.7% in 2022. User-generated product videos have exponentially become more popular as compared to official videos released on YouTube. The video content offers enormous potential for shareability as approximately 92% of users are likely to share the watched videos on social media platforms. Moreover, it draws the attention of viewers as it provides complete insight into the product. User generated content platforms with the use of audio and video are a game-changer for any brand in case of increasing sales and boosting any campaigns. For instance, in January 2023, Sting, PepsiCo Inc.'s energy drink brand partnered with Moj, an Indian short video app to generate user-generated content around the company's campaign to promote the brand. This innovation aimed to boost user-generated content and, the campaign’s promotion.

Video content posted across social media platforms get nearly 12 times more engagement than any other form of user-generated content. For instance, in December 2020, Comscore, Inc., an American media measurement and analytics company, reported that the paid content combined with UGC boosted the conversion rate by 28%. The social media segment is expected to be the second largest during the forecast period. Social media platforms can be useful for discovering creative artists and talent, and user-generated content for brands which is responsible for the rising demand for the social media user generated content platform segment.

End-user Insights

The enterprise segment dominates the market, with a revenue share of 63.1% in 2022. The increasing use of user generated content for promoting products and services by businesses to strengthen their brand identity is responsible for the growth of the enterprise segment. The increasing adoption of social media and texting platforms, where people can easily become content creators on their mobile devices propels the expansion of the enterprise segment. Corporations can share user generated content on their websites, social media platforms, and other marketing channels as the explosion of social media, Instagram and Facebook have become platforms for User generated content platforms. Every December, Starbucks Coffee Company, an American chain of coffeehouses and roastery reserves, launches a hashtag contest, namely #RedCupContest, asking followers to submit pictures of their coffee cups to win a Starbucks gift card. This campaign has garnered more than 30,000 images of coffee cups and still counting.

Besides, the individual segment projected the highest growth over the forecast period. The exponential increase in the number of smartphone users and the rising popularity of social media platforms have made UGC easily accessible. User generated content is helping people to show their talent. Every individual has now become the chief content creator. For instance, every day 350 million photos are uploaded to Facebook, 95 million photos and videos are shared on Instagram, and over 500 million tweets are posted on Twitter.

Further, the enterprise segment is bifurcated into sub-segments, including government or public sector, retail & e-commerce, IT & telecommunication, and others. The retail & e-commerce sub-segment accounted for the highest market share in 2022. E-commerce retailers are completely optimizing UGC as more consumers are becoming regular social media users.

Region Insights

North America dominated the global user generated content platforms market with a market share of 34.1% in 2022. This can be attributed to the presence of well-established ICT solution providers and a large customer base. The region is characterized by a massive pool of content platform providers, such as Taggbox.com; Pixlee Inc.; and Pancake Laboratories, Inc. Increased technological advancements, and widespread adoption in the IT & telecommunications are attributed to the growth of user generated content market in North America region. Rising demand for the Internet of Things (IoT) and connected devices along with the growing deployment of broadband network platforms also drives user generated positive growth in this region.

On the other hand, Asia Pacific is projected to demonstrate the highest CAGR over the forecast period. This growth is attributed to the increasing use of mobiles and tablets, rapid technological advancements, and the popularity of social networking sites in emerging economies, such as China and India. The overall UGC market appears as a fast-evolving industry in the Asia Pacific market, driven by increased tech-savvy consumers on the demand side and an increase in audio and video platform offerings on the supply side. For instance, in May 2020, Reuters an international news organization announced the expansion of its user-generated content (UGC) offering to Reuters News Agency customers in EMEA, Latin America, and Asia Pacific through a partnership with Storyful, which is a social media intelligence agency. Through this initiative, Reuters customers can access user-generated content across the globe.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaboration among the key players. For instance, in November 2022, Jio Platforms, an Indian Multinational Technology company, partnered with CreativeAndroid Asia, a creative services company, and Rolling Stone’s Indian edition launched a new app called Platform. Platform app aims to target celebrity entertainers with an ecosystem designed which empowers creators to advance through ranks and reputation. For instance, in February 2020, Bazaarvoice a provider of product reviews and user-generated content (UGC) solutions announced a partnership with Yotpo, a prominent e-commerce marketing platform. This partnership was aimed at expanding the syndication of user-generated content between brands and retailers. Vendors in the market are focusing on raising funds for product launches and geographical expansion. Some of the prominent players in the global user generated content market include:

-

Bazaarvoice

-

CrowdRiff

-

Curalate, Inc.

-

Monotype Imaging Inc.

-

Olapic Inc.

-

Pancake Laboratories, Inc.

-

Pixlee TurnTo

-

Stackla Pty Ltd.

-

TINT

-

Yotpo Ltd

User Generated Content Platform Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.36 billion

Revenue forecast in 2030

USD 32.6 billion

Growth rate

CAGR 29.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Market revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-user, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; China; India; Japan; and Brazil.

Key companies profiled

Bazaarvoice; CrowdRiff; Curalate, Inc.; Monotype Imaging Inc.; Olapic Inc.; Pancake Laboratories; Inc.; Pixlee TurnTo; Stackla Pty Ltd.; TINT; Yotpo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

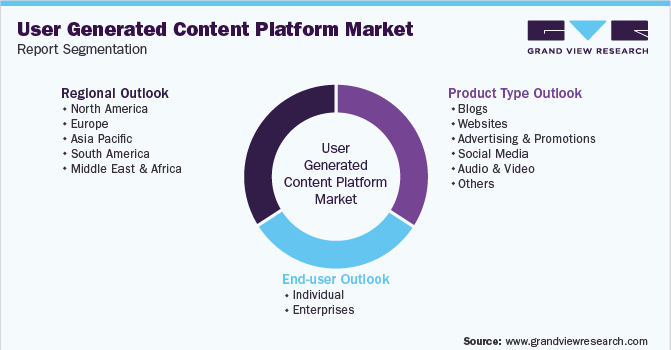

Global User Generated Content Platform Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global user generated content platform market report based on product type, end-user, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Blogs

-

Websites

-

Advertising and Promotions

-

Social Media

-

Audio and Video

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Individual

-

Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Thailand

-

Vietnam

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

Israel

-

Kuwait

-

United Arab Emirates

-

-

Frequently Asked Questions About This Report

b. The global user generated content platform market size was estimated at USD 4.4 billion in 2022 and is expected to reach USD 5.36 billion in 2023.

b. The global user generated content platform market is expected to grow at a compound annual growth rate of 29.4% from 2023 to 2030 to reach USD 32.6 billion by 2030.

b. North America dominated the global UGC Platform market in 2022 with a revenue share of 34.1%. This can be attributed to the presence of well-established ICT solution providers and a large customer base

b. Some key players operating in the user generated content platform market include CrowdRiff; Curalate; Monotype Imaging Inc.; Olapic Inc.; Pancake Laboratories, Inc.; Pixlee; Stackla Pty Ltd.; TINT; TurnTo; Yotpo; and Yuema Inc.

b. Key factors that are driving the market growth include growth in digital music industry, explosive growth in live streaming, and growing demand for high-speed internet connectivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.