- Home

- »

- Paints, Coatings & Printing Inks

- »

-

UV-curable Coatings Market Size, Industry Report, 2033GVR Report cover

![UV-curable Coatings Market Size, Share & Trends Report]()

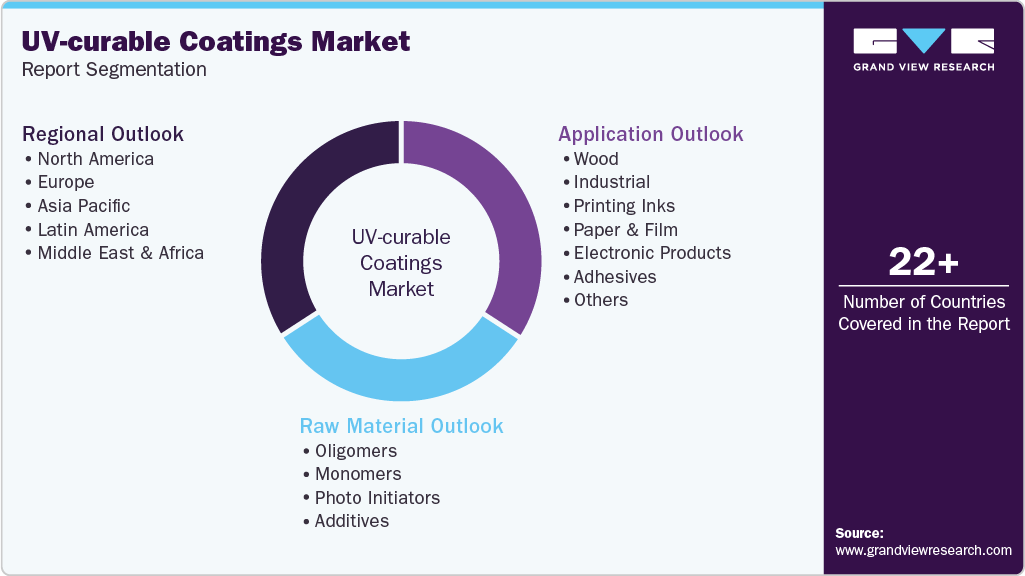

UV-curable Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Raw Material (Oligomers, Monomers, Photo Initiators), By Application (Wood, Industrial, Printing Inks), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-779-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2035

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UV-curable Coatings Market Summary

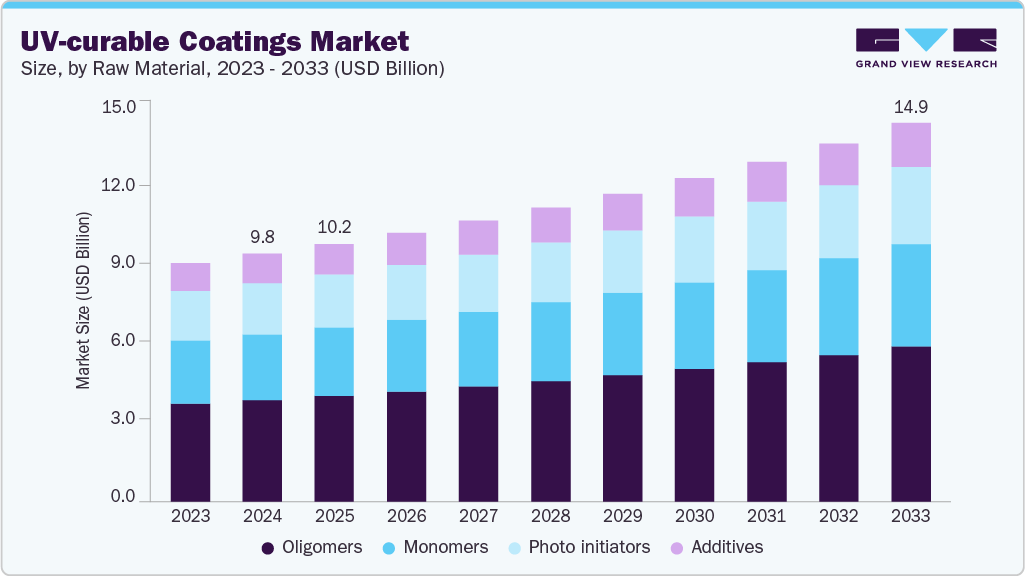

The global UV-curable coatings market size was estimated at USD 9,810.7 million in 2024 and is projected to reach USD 14,982.0 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The market is primarily driven by increasing demand for high-performance, fast-curing coatings across industrial, wood, electronics, and packaging applications.

Key Market Trends & Insights

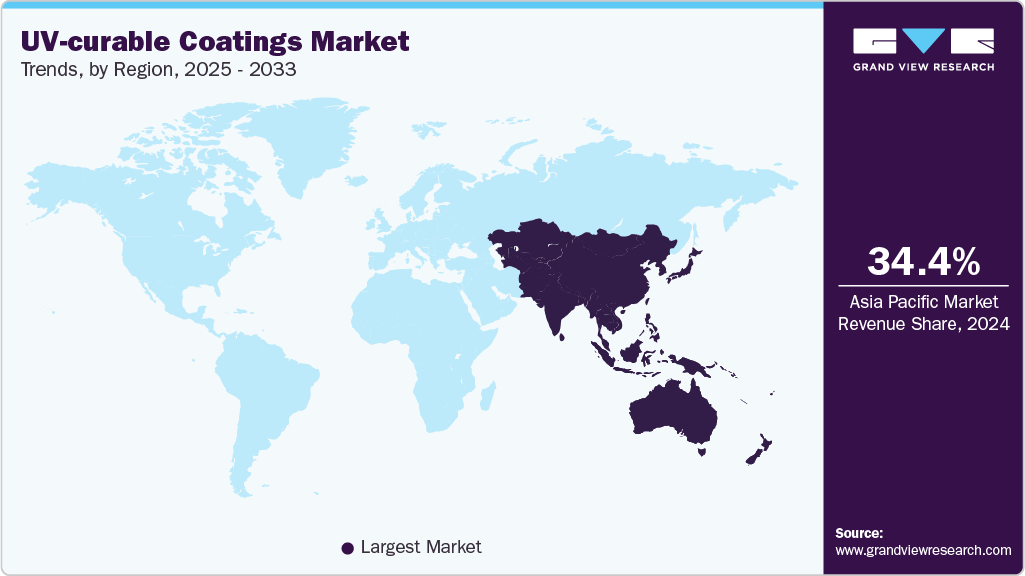

- Asia Pacific dominated the patchouli alcohol market with the largest revenue share of 34.3% in 2024.

- The market in China is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033.

- By raw material, the monomers segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By raw material, the oligomers segment held the largest revenue share of 41.1% in 2024 in terms of fastest-growing value.

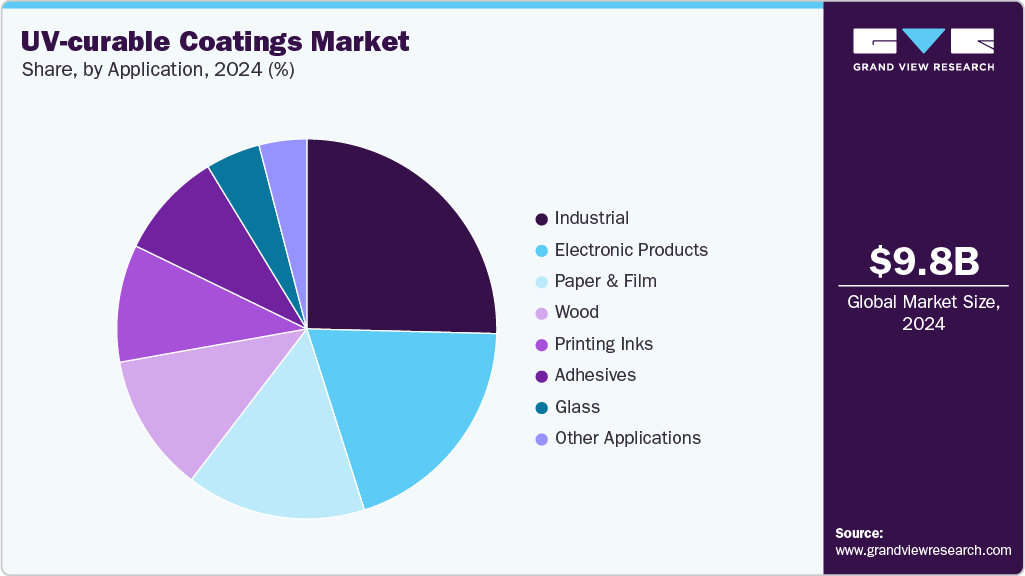

- By application, the industrial segment held the largest revenue share of 25.4% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 9,810.7 Million

- 2033 Projected Market Size: USD 14,982.0 Million

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2024

Regulatory mandates targeting low-VOC and environmentally sustainable coatings have further accelerated adoption, while industrial automation and shorter production cycles in manufacturing are fostering the need for instant-curing solutions. The rising utilization of UV-curable coatings in printing inks, paper & film, and specialty electronics supports market growth, making these coatings essential in modern manufacturing processes.The market presents significant opportunities in the rapidly growing UV-LED technology segment, which offers energy efficiency, longer lamp life, and reduced environmental footprint. Expansion in emerging economies, particularly in Asia-Pacific, driven by industrial growth, rising electronics manufacturing, and packaging demand, opens avenues for market penetration. Moreover, developing waterborne UV and hybrid formulations to comply with stringent environmental regulations and innovation in specialty coatings for high-value applications such as automotive, aerospace, and optical surfaces provides ample opportunities for differentiation and premium product offerings.

Despite robust growth, the market faces challenges, including high initial capital expenditure for UV and UV-LED curing equipment, which can be a barrier for small-scale manufacturers. Formulation complexity and the need for technical expertise in achieving optimal cure performance limit widespread adoption, particularly in cost-sensitive markets. In addition, compatibility issues with diverse substrates and potential limitations in penetration depth for thick coatings pose technical hurdles, while competition from conventional coatings and emerging alternatives can exert pricing pressure on manufacturers.

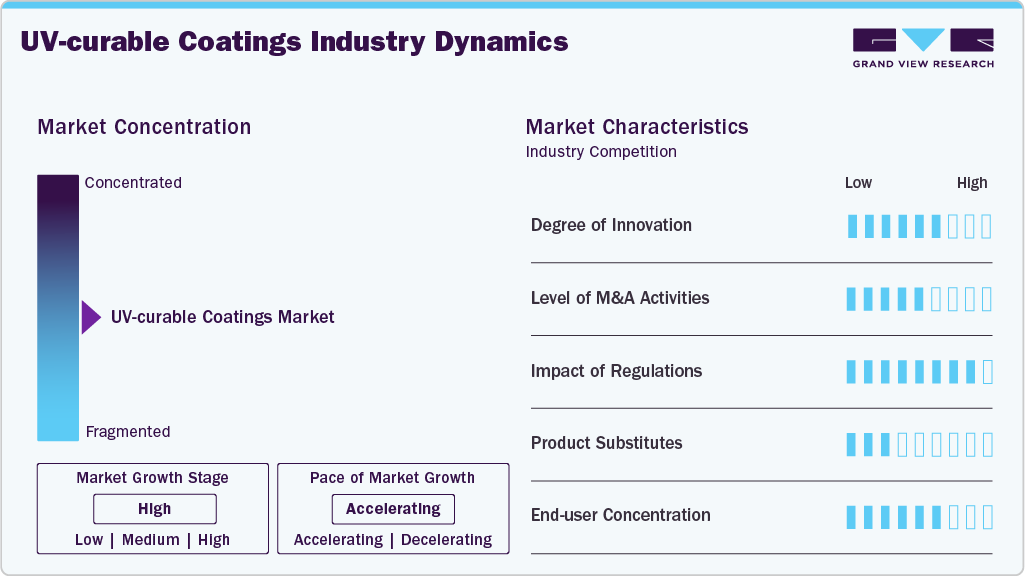

Market Concentration & Characteristics

The global UV-curable coatings industry is highly competitive and dominated by multinational chemical and coatings manufacturers with strong R&D capabilities, extensive product portfolios, and global distribution networks. Key players such as AkzoNobel, PPG Industries, BASF, Nippon Paint, and Sokan New Materials focus on innovation, sustainability, and high-performance formulations to maintain leadership. Companies are investing heavily in UV-LED curing technology, waterborne UV systems, and specialty oligomers, monomers, and photo initiators to meet increasing industrial and regulatory demands. Strategic partnerships, acquisitions, and collaborations with equipment manufacturers are common to strengthen technological capabilities and expand market reach.

Market competition is further intensified by regional and niche players offering specialized coatings for electronics, packaging, and automotive applications. While established players leverage economies of scale, brand reputation, and global customer networks, smaller firms differentiate themselves through innovative formulations, fast response to market trends, and tailored solutions for high-value applications. The competitive dynamics are influenced by continuous R&D investments, regulatory compliance, and sustainability initiatives, which collectively shape market positioning, pricing strategies, and adoption of emerging technologies like UV-LED curing systems and environmentally friendly, low-VOC coatings.

Raw Material Insights

Oligomers held the largest revenue share of 41.1% in 2024, driven by their critical role as the backbone of UV-curable coatings, providing essential mechanical strength, chemical resistance, and flexibility. Their high functionality and ability to form durable polymer networks make them indispensable across industrial, wood, electronics, and packaging applications. The widespread adoption of epoxy, urethane, and polyester oligomers and the rising demand for high-performance and low-VOC coatings further cemented their market dominance. Oligomers are often formulated to work seamlessly with advanced curing technologies such as UV-LED systems, enabling faster production cycles and enhanced coating efficiency, which supports both industrial and high-value applications.

Monomers, photo initiators, and additives accounted for the remaining market share, providing complementary functions critical to UV-curable formulations. Monomers, acting as reactive diluents, help optimize viscosity, cure speed, and film properties, capturing a significant portion of the market. Photo initiators are essential for initiating polymerization under UV light and are in high demand due to increasing industrial automation and the need for instant curing solutions. Though smaller by volume, additives enhance surface properties, adhesion, and stability, and are increasingly formulated to meet regulatory and environmental requirements. The combined growth of these raw materials is driven by innovation in specialty formulations and the expanding adoption of UV-curable coatings across diverse end-use industries worldwide.

Application Insights

The industrial segment dominated the market with the largest revenue share of 25.4% in 2024, driven by the growing demand for high-performance coatings in metal, plastic, machinery, and automotive components. Industrial applications require coatings that offer superior chemical resistance, abrasion resistance, and durability, making UV-curable solutions ideal due to their rapid curing times and long-lasting performance. The shift towards automation and faster production cycles in manufacturing has further accelerated the adoption of UV-curable coatings in this segment, as these solutions reduce production downtime and increase operational efficiency. Developing UV-LED and waterborne UV systems has enhanced performance while minimizing environmental impact, supporting global industrial adoption.

Wood captured a significant share driven by demand for furniture, flooring, and cabinetry with premium finishes that combine aesthetics and durability. Printing inks and paper & film applications benefited from the growing packaging industry, which increasingly relies on fast-curing UV inks for labels, flexible packaging, and laminates. Electronics, adhesives, and glass segments are also witnessing rising adoption due to the precision coating and high-performance requirements in displays, circuit boards, and specialty optical applications. The other applications category, including plastics, textiles, and niche specialty coatings, is gradually expanding, reflecting the versatility and performance advantages of UV-curable solutions across multiple end-use industries worldwide.

Regional Insights

Asia-Pacific held the largest share of the global UV-curable coatings market in 2024, accounting for 34.4% of revenues, driven by rapid industrialization, urbanization, and growing demand across electronics, packaging, automotive, and wood industries. Strong manufacturing hubs in China, Japan, South Korea, and India fuel the consumption of high-performance, fast-curing coatings. Adopting UV-LED and waterborne UV technologies and supportive government regulations promoting low-VOC and energy-efficient solutions have further accelerated market growth in the region, making it the key revenue contributor globally.

China UV-curable Coatings Market Trends

The UV-curable coatings market in China is the dominant market within Asia-Pacific, holding 35.7% of the regional UV-curable coatings revenue. Owing to its massive electronics, packaging, and automotive manufacturing sectors, China’s large-scale industrial base demands rapid-curing, high-performance coatings to enhance productivity and meet stringent environmental regulations. Moreover, government initiatives encouraging green manufacturing and energy-efficient solutions have driven the adoption of UV-curable coatings in traditional industrial applications and emerging high-tech sectors such as electronics, optical films, and specialty adhesives.

Europe UV-curable Coatings Market Trends

The UV-curable coatings market in Europe accounted for 19.2% of the global market in 2024, with Germany, France, and the UK emerging as key contributors. The market is driven by stringent environmental regulations, particularly targeting VOC emissions, which has increased the adoption of UV-curable and waterborne coating technologies. Strong industrial sectors, including automotive, packaging, electronics, and wood finishing, focusing on sustainability and advanced curing technologies such as UV-LED, support steady market growth across the region.

Germany UV-curable coatings market is one of the largest in Europe, owing to its robust automotive, machinery, and electronics industries. The country's emphasis on technological innovation and strict environmental regulations reinforces the demand for high-quality, fast-curing, and environmentally compliant coatings. German manufacturers increasingly adopt UV-LED systems and waterborne formulations to improve efficiency, reduce production time, and maintain sustainability standards, positioning the country as a key growth driver within the European UV coatings landscape.

North America UV-curable Coatings Market Trends

The UV-curable coatings market in North America accounted for 11.1% of the global market in 2024, driven by industrial, wood, and packaging demand. The region’s adoption is supported by advanced manufacturing practices, regulatory frameworks promoting low-VOC coatings, and the presence of leading UV-curable coating manufacturers like PPG Industries, Sherwin-Williams, and AkzoNobel. Continuous innovation in UV-LED curing technology and growing demand for high-performance industrial coatings have contributed to steady market expansion in the region.

The U.S. UV-curable coatings market is the largest market within North America for UV-curable coatings, fueled by the electronics, automotive, and packaging industries. Rising demand for energy-efficient, fast-curing, and environmentally sustainable coatings drives adoption across multiple industrial applications. Moreover, strong R&D infrastructure, favorable regulatory support for low-VOC and solvent-free coatings, and increasing application in printing inks, adhesives, and specialty coatings contribute to the country’s leadership position in the regional market.

Middle East & Africa UV-curable Coatings Market Trends

The UV-curable coatings market in the Middle East & Africa remains niche but is gradually expanding, driven by infrastructure development, automotive growth, and industrial modernization in countries such as the UAE, Saudi Arabia, and South Africa. Adoption of UV-curable coatings is primarily focused on industrial applications, wood finishing, and specialty coatings where rapid curing and durability are critical. Investments in advanced manufacturing technologies, sustainable solutions, and rising awareness of environmental regulations are expected to drive steady growth in the MEA region over the coming years.

Latin America UV-curable Coatings Market Trends

The UV-curable coatings market in Latin America is emerging steadily, driven by industrial, automotive, and wood application growth in countries like Brazil and Mexico. While market penetration is moderate compared to Asia-Pacific and Europe, the demand for fast-curing, durable, and environmentally compliant UV-curable coatings is rising as manufacturers modernize production processes. Growth is supported by urbanization, expanding packaging sectors, and increasing awareness of sustainable and low-VOC coating solutions.

Key UV-curable Coatings Company Insights

Key players dominate the market, such as AkzoNobel N.V., PPG Industries Inc., BASF SE, Axalta Coating Systems, Sherwin-Williams, and Hempel A/S.

-

AkzoNobel N.V. is a leading global paints and coatings company headquartered in the Netherlands, recognized for its high-performance, innovative, and sustainable coating solutions across industrial, decorative, and specialty applications. The company has a strong presence in the UV-curable coatings market, offering advanced products such as Optidur 8002 High Flex UV Sealer, Aerodur Clearcoat UVR, and 100% UV RUBBOL wood coatings, catering to industrial, wood, and specialty applications. AkzoNobel’s market leadership is reinforced by extensive R&D capabilities, strategic collaborations, and a global distribution network, enabling it to provide rapid-curing, low-VOC, and environmentally compliant solutions. The company’s focus on sustainability, technological innovation, and tailored customer solutions positions it as a key player driving growth in the global UV-curable coatings market.

Key UV-curable Coatings Companies:

The following are the leading companies in the UV-curable coatings market. These companies collectively hold the largest market share and dictate industry trends.

- AkzoNobel N.V.

- PPG Industries Inc.

- BASF SE

- Axalta Coating Systems

- Sherwin-Williams

- Hempel A/S

- Nippon Paint Holdings

- DSM Coatings

- Axion Specialty Coatings

- Sokan New Materials

Global UV-curable Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,205.1 million

Revenue forecast in 2033

USD 14,982.0 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

AkzoNobel N.V.; PPG Industries Inc.; BASF SE; Axalta Coating Systems; Sherwin-Williams; Hempel A/S; Nippon Paint Holdings; DSM Coatings; Axion Specialty Coatings; Sokan New Materials

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global UV-curable Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global UV-curable coatings market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Oligomers

-

Monomers

-

Photo Initiators

-

Additives

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Wood

-

Industrial

-

Printing Inks

-

Paper & Film

-

Electronic Products

-

Adhesives

-

Glass

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global UV-curable coatings market size was estimated at USD 9,810.7 million in 2024 and is expected to reach USD 10,205.1 million in 2025.

b. The UV-curable coatings market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 14,982.0 million by 2033.

b. The oligomers segment held the largest revenue share of 41.1% in 2024 due to their critical role as the backbone of UV-curable coatings, providing essential mechanical strength, chemical resistance, and durability. Their ability to form high-performance polymer networks makes them indispensable across industrial, wood, electronics, and packaging applications. The growing adoption of UV-LED and waterborne UV technologies has further reinforced oligomers’ dominance by enabling faster curing and enhanced coating efficiency.

b. Some of the key players operating in the UV-curable coatings market include AkzoNobel N.V., PPG Industries Inc., BASF SE, Axalta Coating Systems, Sherwin-Williams, Hempel A/S, Nippon Paint Holdings, DSM Coatings, Axion Specialty Coatings, and Sokan New Materials.

b. The global UV-curable coatings market is driven by increasing demand for high-performance, fast-curing coatings across industrial, wood, electronics, and packaging applications. Regulatory mandates for low-VOC and environmentally sustainable solutions, coupled with the push for automation and faster production cycles, have further accelerated adoption. The growing utilization of UV-curable coatings in printing inks, paper & film, and specialty electronics is supporting robust market growth worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.