- Home

- »

- Medical Devices

- »

-

Vascular Access Devices Market Size & Share Report, 2030GVR Report cover

![Vascular Access Devices Market Size, Share & Trends Report]()

Vascular Access Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Short PIVCs, Huber Needles, Midline Catheters, PICCs, CVCs, Dialysis Catheters, Implantable Ports), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-023-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vascular Access Devices Market Summary

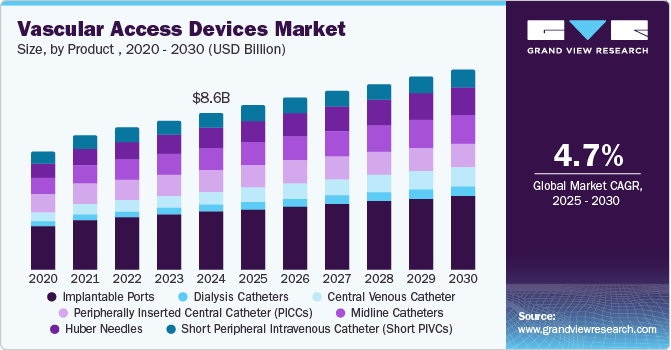

The global vascular access devices market size was estimated at USD 8.64 billion in 2024 and is projected to reach USD 11.49 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Patient demographics are expected to significantly impact the growth of the market over the forecast period.

Key Market Trends & Insights

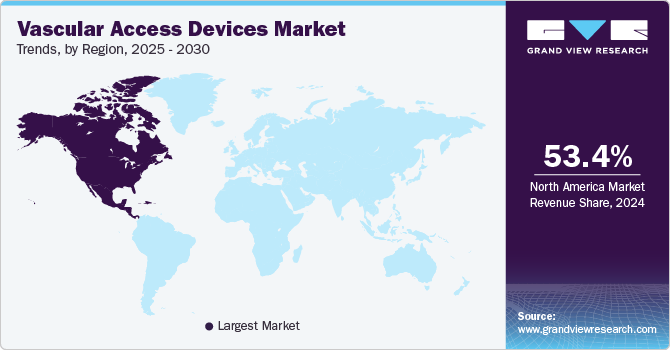

- The North America vascular access devices market held a substantial share of 53.35% in 2024.

- Increased cancer cases and chemotherapy demand drive growth in the U.S. vascular access devices market.

- Based on product, the short peripheral intravenous catheter held a dominating revenue share of more than 44.0% in 2024.

- Based on the end use, the hospital-based segment dominated the market with a more than 50.2% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.64 billion

- 2030 Projected Market Size: USD 11.49 billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

The growing geriatric population across the globe and the rising prevalence of cancer & other chronic, cardiovascular, respiratory, and metabolic disorders are expected to increase the number of patients requiring a vascular access device during treatment. As a result, the market is expected to grow moderately in tandem with the expanding patient pool.

The global COVID-19 pandemic negatively impacted the vascular access device market. Furthermore, despite a significant decline in vascular access device sales overall in 2020, the industry's revenues increased in the following years as a result of rising PICC, CVC, and dialysis catheter adoption due to an uptick in demand for vascular access devices used in the treatment and management of COVID-19 and related patients.

Furthermore, the market is supported by the awareness of the expenses associated with catheter-related complications in healthcare institutions. This leads to the rising need for solutions that can lower problem rates. Clinical investigations have shown that improper usage and upkeep of vascular access devices could cause significant problems. Manufacturers could distinguish their products from those of their competitors for the end user and foster brand loyalty by offering online or in-person training programs. The Teleflex Academy program from Teleflex Medical and the Clinical Training programs from BD are a few examples of such successful programs.

The rising global prevalence of vascular diseases, driven by factors like sedentary lifestyles, poor diets, and aging populations, has led to an increased need for advanced medical management. These conditions often require frequent intravenous therapies, leading to growing demand for vascular access devices such as central venous catheters (CVCs) and PICC lines. These devices are essential for administering treatments, managing chronic conditions, and improving patient outcomes in the face of rising vascular disease cases. For instance, as per a report published in May 2023 by the World Heart Federation, the global incidence of CVD mortality increased from 12.1 million in 1990 to 20.5 million in 2021. CVD emerged as the predominant cause of global mortality, with a notable prevalence in low- and middle-income countries, accounting for 80% of CVD-related fatalities.

Recent technological advancements in vascular access devices (VADs) have significantly improved patient outcomes and procedural efficiency. According to the NCBI article published in June 2023, notable advancements in the arteriovenous graft (AVG) technology have led to the developing of heparin-bonded expanded PTFE grafts, such as the Acuseal graft by W. L. Gore & Associates. These innovative grafts enable early cannulation, often within 24 hours of placement, while achieving impressive primary patency rates of 76.2%, 60.4%, and 33.8% to 43.6% at 3, 6, and 12 months, respectively. In comparison, the primary patency rate for arteriovenous fistulas (AVFs) at one year is 64%.

Product Insights

Based on the product , the market is segmented into Short Peripheral Intravenous Catheters (Short PIVCs), Huber Needles, Midline Catheters, Peripherally Inserted Central Catheters (PICCs), Central Venous Catheters (CVCs), Dialysis Catheters, and Implantable Ports. In 2024, the short peripheral intravenous catheter held a dominating revenue share of more than 44.0%. In addition, the market for short PIVCs will have a disproportionately large portion of the revenue during the forecast period, primarily due to consumers preferring more expensive safety short PIVCs than standard devices.

The (Short PIVCs) segment is expected to grow over the forecast period. The growth is primarily driven by the high frequency of their use in clinical settings as the most common invasive procedure healthcare professionals perform. According to the NCBI article published in August 2023, short PIVCs is the primary solution for patients needing fluid infusion and multiple blood draws.

Moreover, altering usage patterns in recent years, particularly in nations such as the U.S., due to the Michigan Appropriateness Guide to Intravenous Catheters (MAGIC) recommendations, have pushed vascular access specialists away from a historical access system, dramatically limiting the uptake of PICCs.

On the other hand, the CVC market is anticipated to hold the second leading position. However, the usage of CVC is limited to some extent by intense pressure from competing devices such as PICCs and implantable ports.

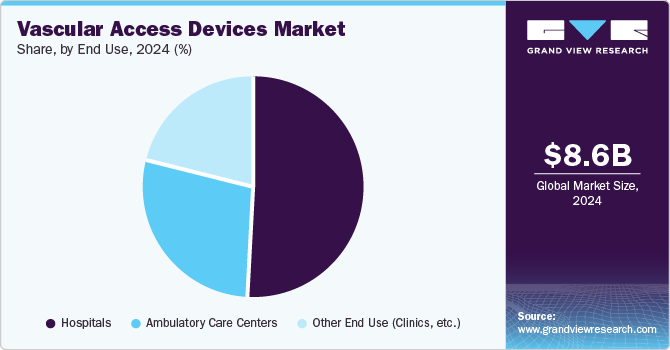

End Use Insights

Based on the end use, the market is segmented into hospitals, ambulatory care centers, and other end use (clinics, etc.). The hospital-based segment dominated the market with a more than 50.2% revenue share in 2024. The substantial availability of highly skilled and experienced healthcare staff at hospitals will likely allow the industry to continue its dominance over the coming years. In healthcare facilities like dialysis clinics and hospitals, the presence of qualified and experienced staff offers the best possible care and improved vascular access outcomes. The category is expected to be driven by several reasons, including the increasing emphasis of companies on developing independent vascular access facilities.

The ambulatory care/surgical centers (ASCs) segment of the vascular access devices (VADs) market is experiencing substantial growth due to the increasing preference for outpatient procedures among patients and healthcare providers. The demand for efficient vascular access solutions has surged as ASCs become more prominent in the healthcare landscape. The rising number of minimally invasive surgeries performed in ASCs contributes to this trend, as these procedures often require reliable vascular access for administering medications and fluids.

Regional Insights

The North America vascular access devices market held a substantial share of 53.35% in 2024. Key factors propelling the market in North America are the shift toward value-based care in the U.S., which supports the use of established vascular access devices with demonstrated benefits. Devices such as Short Peripheral Intravenous Catheters (Short PIVCs), Huber Needles, and Midline Catheters have been shown to improve patient outcomes & practitioner safety. They can reduce long-term costs associated with complications & readmissions. Vascular access devices are relatively low cost and have a solid value-to-cost proposition, which has led to their widespread adoption in the U.S.

U.S. Vascular Access Devices Market Trends

In the U.S. vascular access devices market, increased cancer cases and chemotherapy demand drive growth. According to the National Cancer Institute, in 2024, it is projected that approximately 2,001,140 new cancer cases will be diagnosed in the United States, with an estimated 611,720 individuals expected to die from the disease.

Canada vascular access devices market is growing due to factors such as increasing incidence of CVD and cancer, rising government initiatives, and technological advancements. According to the Canadian Cancer Statistics in 2023, with an estimated 2 in 5 Canadians expected to develop cancer during their lifetime and approximately 1 in 4 likely to die from it, the demand for advanced medical solutions continues to grow.

Europe Vascular Access Devices Market Trends

The vascular access devices market in Europe is witnessing robust growth, driven by a rising prevalence of chronic diseases such as cancer and cardiovascular conditions that necessitate long-term medical treatment. Vascular access devices, including central venous catheters, peripheral intravenous catheters, and implantable ports, are crucial for delivering medications, fluids, and nutrients to patients requiring ongoing care.

UK Vascular Access Devices Market Trends

The UK vascular access devices market held the second-largest market share in 2024. The rising number of CVD-related deaths highlights the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. According to a Guardian News & Media Limited article published in January 2024, the premature death rate due to CVD in the UK rose to 80 per 100,000 individuals in 2022.

Germany Vascular Access Devices Market Trends

The rising number of cardiac surgery patients fuels the Germany vascular access devices market’s growth. Effective monitoring is crucial for ensuring patient safety, optimizing surgical outcomes, and managing postoperative recovery. As the number of surgeries increases, healthcare systems face challenges in enhancing surveillance, integrating advanced technologies, and managing extensive data.

Asia Pacific Vascular Access Devices Market Trends

The Asia Pacific vascular access devices market is expected to grow fastest during the forecast period. The increase in R&D investments by international bodies such as the China Cardiovascular Association and the American College of Cardiology collaborating to advance cardiac care technologies is one of the reasons behind this.

Japan Vascular Access Devices Market Trends

The rising incidence of cancer cases drives the growth of Japanvascular access devices market. According to Cancer Statistics In JAPAN 2022 article, Japan reported around 1,009,800 new cancer diagnoses in 2021, with 577,900 cases occurring in men and 431,900 in women. Among these, prostate cancer emerged as the most prevalent type for males, accounting for 17% of cases, while breast cancer represented a significant 22% of cases in females.

Australia Vascular Access Devices Market Trends

Growing CVD incidence drives the Australiavascular access devices market. According to the Heart Foundation article published in March 2024,In Australia, one in six individuals self-report as living with CVDs, amounting to over 4.5 million people. This significant figure represents nearly 18% of the total Australian population.

Latin America Vascular Access Devices Market Trends

The Latin America vascular access devices market is growing due to the rising incidence of CVD disorders, increasing incidence of cancer, and technological advancements. A study published in the NCBI in August 2022 provided insights into the incidence and mortality rates of CVD across various countries in Latin America. The study revealed variations in the incidence and mortality rates, with countries experiencing different levels of CVD burden.

Middle East & Africa Vascular Access Devices Market Trends

The Middle East and Africa (MEA) vascular access devices market is witnessing significant growth due to the increasing prevalence of cancer and cardiovascular diseases (CVDs). With an aging population and lifestyle factors such as poor dietary choices and sedentary habits, this rise in disease incidence has heightened the demand for effective treatment options. Vascular access devices are essential for the administration of medications, fluids, and nutritional support, particularly for patients undergoing chemotherapy and those with complex CVD conditions.

Key Vascular Access Devices Company Insights

The key market players focus on launching innovative products, strategic acquisitions, and technological advancement that will allow companies to add complementary devices to their existing product lines. Competition among market players can be attributed to the growing demand for technologically advanced vascular access devices. Some key players in this market are BD, B Braun; Teleflex, Terumo; Medcomp/Medical Components, Inc.; and Vygon SA. BD is a leading player in the market, notably supported by its acquisition of C. R. Bard's extensive portfolio of market-leading products covering almost all segments.

The rising number of product approvals, participants, and effective distribution agreements are all factors that have led to the increased industry rivalry. As a result, it is anticipated that industry competition will be intense throughout the forecast period.

Key Vascular Access Devices Companies:

The following are the leading companies in the vascular access devices Market. These companies collectively hold the largest market share and dictate industry trends.

- Teleflex Medical

- BD

- B. Braun

- Smith’s Medical (ICU Medical, Inc)

- Cook Medical

- AngioDynamics

- Medtronic

- Medical Components, Inc.

- Cook Medical

- Terumo Medical Corporation

- Access Vascular, Inc.

Recent Developments

-

In November 2023, BD unveiled the PIVO Pro, a revolutionary needle-free device for blood collection. The device stands out by being the first to work seamlessly with both integrated and long-term peripheral IV catheters, such as the Nexiva system, which now includes NearPort IV Access, following its approval by the FDA.

-

In October 2023, B. Braun Medical Inc. introduced the Introcan Safety 2 IV Catheter, featuring Multi-Access Blood Control, as the latest advancement in their series of catheters designed for passive needlestick prevention. This development also aimed to minimize clinicians' exposure to blood, thereby reducing the risk of bloodborne pathogen transmission during IV procedures.

Vascular Access Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.1 billion

Revenue Forecast in 2030

USD 11.49 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

The base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, end use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; France; Italy; Spain; Germany; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Teleflex Medical; B. Braun; AngioDynamics; Smith’s Medical (ICU Medical, Inc); Medtronic; Medical Components, Inc.; Cook Medical; Terumo Medical Corporation; Access Vascular, Inc.

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Customized purchase options are available to meet your exact research needs. Explore purchase options

Global Vascular Access Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and analyzes the industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global vascular access devices market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Short Peripheral Intravenous Catheter (Short PIVCs) *

-

Safety

-

Standard/ Conventional

-

-

Huber Needles *

-

Safety

-

Standard/ Conventional

-

-

Midline Catheters *

-

Standard

-

Power-Injectable

-

-

Peripherally Inserted Central Catheter (PICCs) *

-

Standard

-

Power-Injectable

-

-

Central Venous Catheter (CVCs) *

-

Acute

-

Tunneled

-

-

Dialysis Catheters *

-

Acute

-

Tunneled

-

-

Implantable Ports *

-

Single-Lumen

-

Dual-Lumen

-

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Ambulatory care centers

-

Other end use (Clinics, etc.)

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vascular access devices market size was estimated at USD 8.64 billion in 2024 and is expected to reach USD 9.1 billion in 2025.

b. The global vascular access devices market is expected to grow at a compound annual growth rate of 54.7% from 2025 to 2030 to reach USD 11.49 billion by 2030.

b. North America dominated the vascular access devices market with a share of over 53.7% in 2024. This is attributed to the presence of advanced healthcare infrastructure and the rising prevalence of chronic diseases in the region.

b. Some key players operating in the vascular access devices market include BD, Teleflex Medical, B. Braun, AngioDynamics, Smiths Medical (ICU Medical, Inc), Medtronic, Medical Components, Inc., Cook Medical, Terumo Medical Corporation, and Access Vascular, Inc.

b. Key factors driving the market growth include increasing demand for minimally invasive procedures, growing prevalence of chronic diseases, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.