- Home

- »

- Consumer F&B

- »

-

Vegan Cheese Market Size & Share, Industry Report, 2033GVR Report cover

![Vegan Cheese Market Size, Share & Trends Report]()

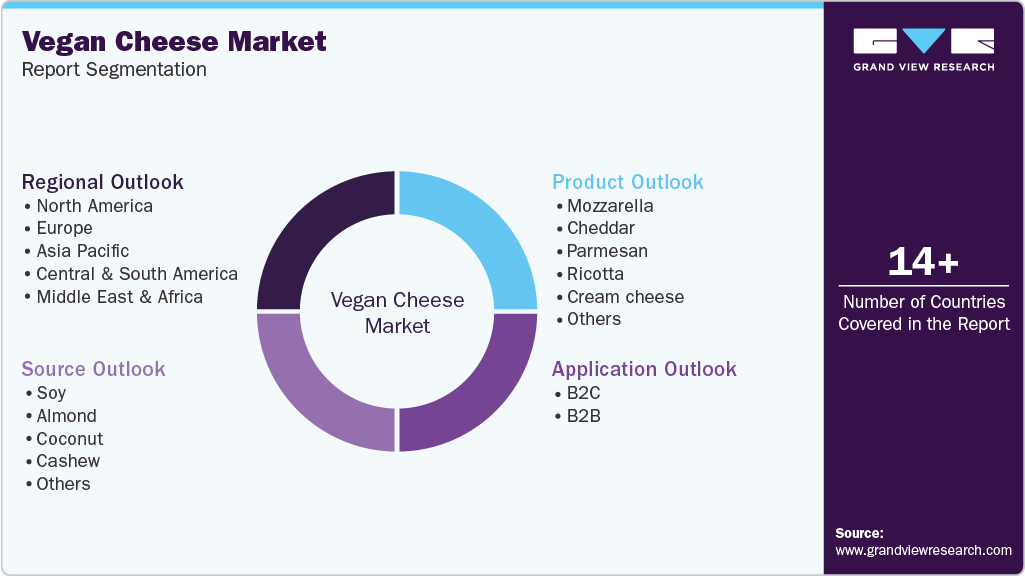

Vegan Cheese Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mozzarella, Ricotta, Cheddar, Parmesan, Cream Cheese), By Source (Cashew, Soy, Almond, Coconut), By Application (B2C, B2B), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-024-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Cheese Market Summary

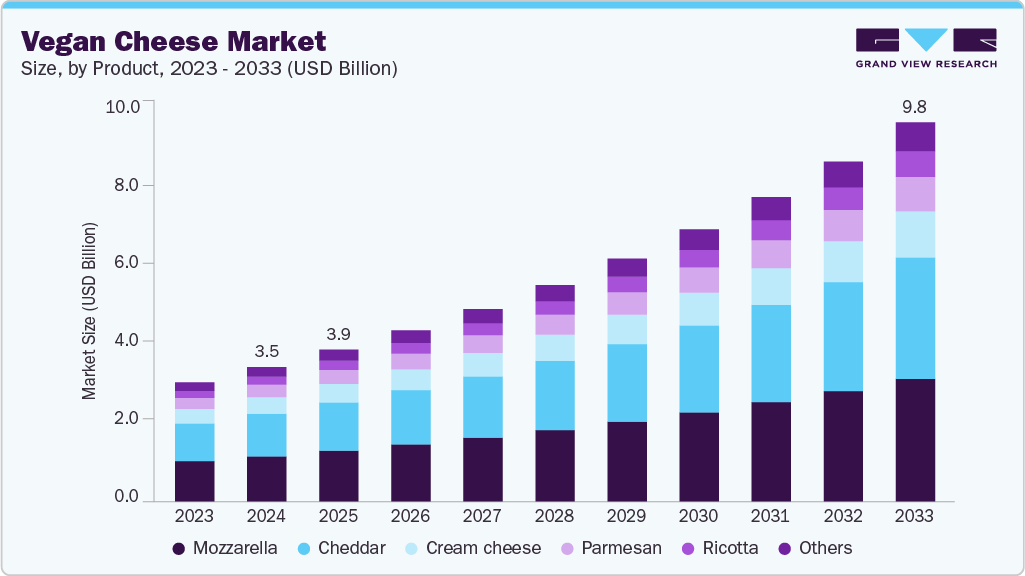

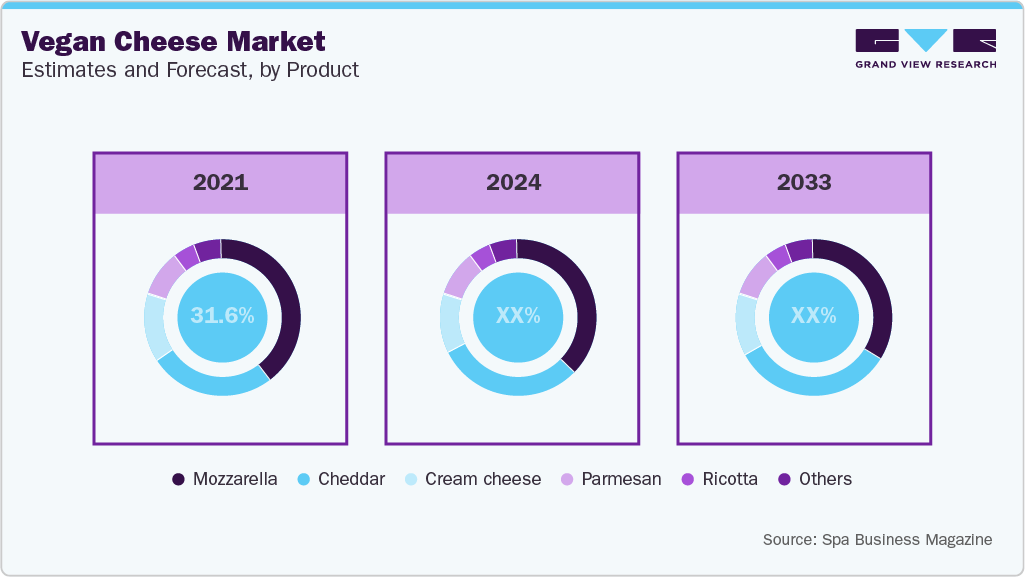

The global vegan cheese market size was valued at USD 3,510.1 million in 2024 and is projected to reach USD 9,897.4 million by 2033, growing at a CAGR of 12.1% from 2025 to 2033. Rising demand for plant-based diets, product innovation and improved taste & texture, expanding retail availability and e-commerce growth, increasing lactose intolerance and dairy allergies, and sustainability and ethical consumption trends are some of the factors leading to the growth of the industry.

Key Market Trends & Insights

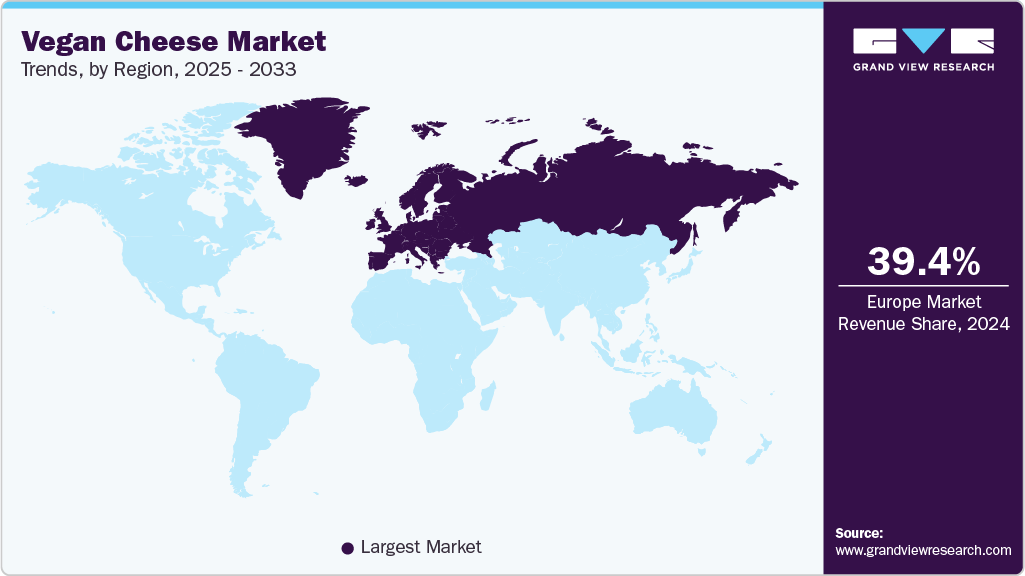

- Europe vegan cheese market dominated the global industry and accounted for the largest revenue share of 39.4% in 2024.

- The vegan cheese market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period.

- By product, the mozzarella segment dominated the market and accounted for a revenue share of 33.6% in 2024.

- By source, the cashew-based cheese segment dominated the market and accounted for the largest revenue share of 37.8% in 2024.

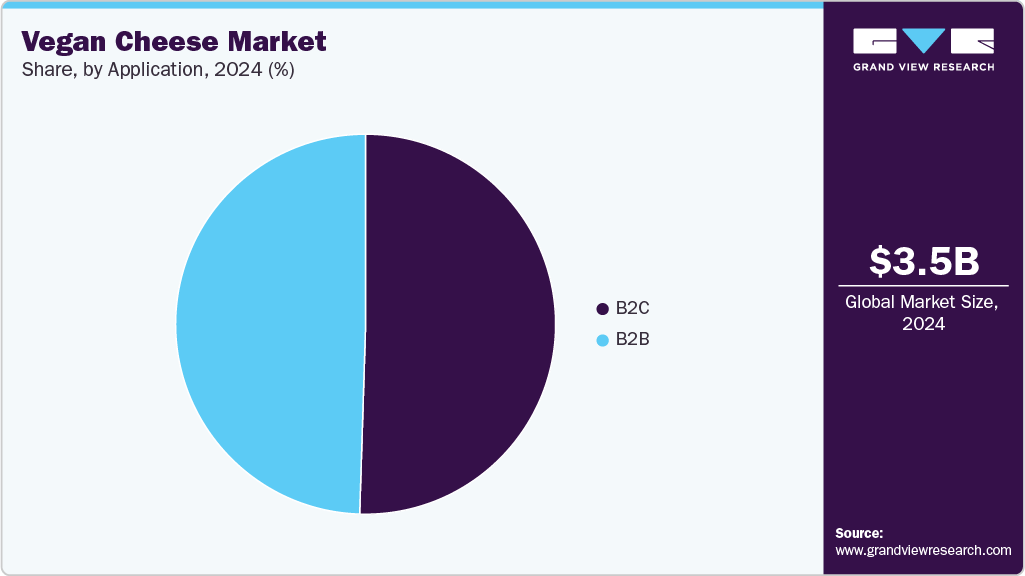

- By application, the B2C segment accounted for the largest revenue share of 50.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,510.1 Million

- 2033 Projected Market Size: USD 9,897.4 Million

- CAGR (2025-2033): 12.1%

- Europe: Largest market in 2024

The global shift toward plant-based eating is becoming one of the strongest growth catalysts for the industry. As consumers are increasingly prioritizing health, sustainability, and ethical food choices, vegan cheese is moving beyond niche shelves and entering mainstream diets. This trend is further amplified by the rise of flexitarian lifestyles, where individuals actively reduce their dairy intake without fully committing to a vegan lifestyle. Social media, food influencers, and plant-based culinary innovation have further accelerated awareness and acceptance of dairy alternatives. As a result, vegan cheese is no longer viewed as a compromise but as a modern, responsible choice aligned with evolving consumer preferences, driving consistent demand across retail and foodservice channels.

Rapid advancements in formulation techniques and ingredient innovation are transforming vegan cheese into a competitive alternative to dairy cheese. Producers are leveraging fermentation technology, microbial cultures, and premium plant bases such as cashews, almonds, oats, and coconut to achieve realistic meltability, stretch, and flavor depth. This evolution has reshaped consumer perception, attracting even those who were previously dissatisfied with the quality of plant-based cheese. Unique innovations such as precision fermentation, clean-label formulations, and artisanal-style aging are unlocking new product possibilities, enabling brands to replicate specialty cheeses once exclusive to dairy. These improvements not only broaden the consumer base but also strengthen brand loyalty by offering a more authentic cheese experience.

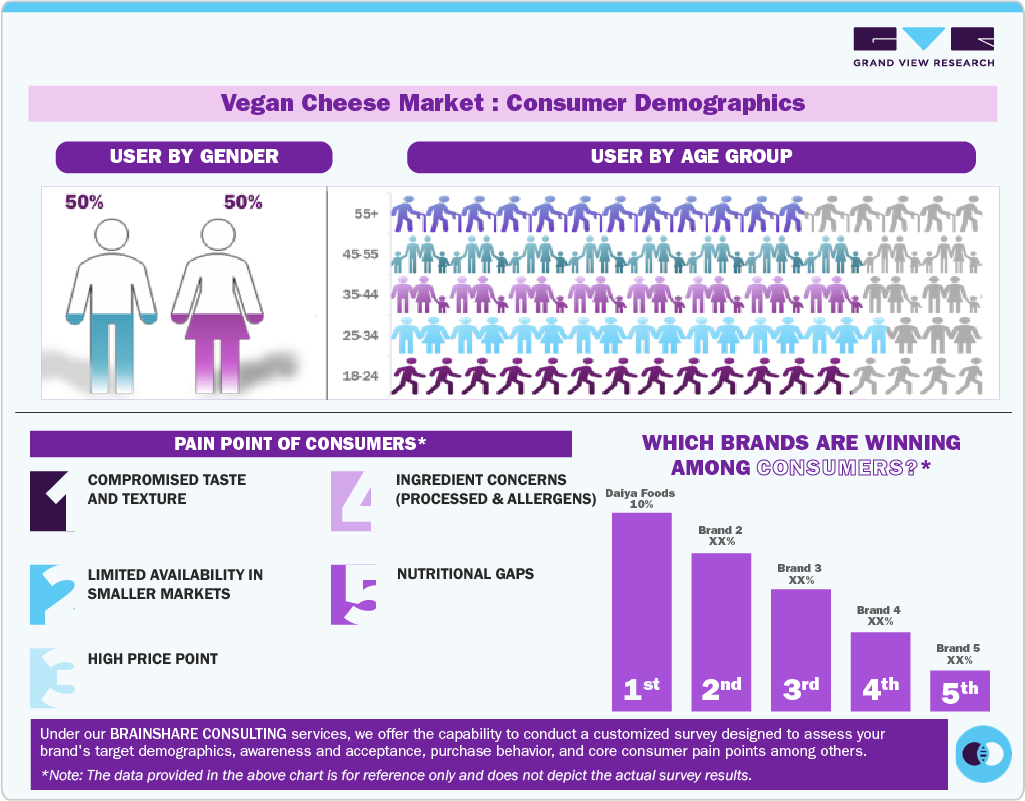

Consumer Insights for Vegan Cheese

Consumer preferences in the industry are evolving rapidly, driven by a combination of health awareness, culinary curiosity, and improved product availability. Modern buyers, especially millennials and Gen Z, are actively seeking dairy-free options that replicate traditional cheese without compromising on taste or nutritional value. Many consumers now prioritize clean-label ingredients, minimal processing, and allergen-friendly formulas, prompting manufacturers to innovate using more sustainable plant bases and advanced fermentation techniques. In addition, social media plays a significant role, with recipe creators showcasing vegan cheese in pizzas, pasta, and charcuterie boards, reinforcing its mainstream appeal. As awareness grows, consumers increasingly view vegan cheese as a sustainable, ethical, and flavorful alternative.

Another key insight is the growing influence of lifestyle segmentation, where motivations vary across groups but collectively drive market expansion. Flexitarians drive volume growth as they diversify their diets with plant-forward choices, while vegans and lactose-intolerant consumers sustain consistent demand. Premium buyers seek artisanal, fermented, or aged vegan cheeses, whereas value-focused consumers prefer convenient slices and shreds. The increasing focus on gut health is also shaping preferences, with probiotic-infused and minimally processed vegan cheeses gaining attention. Convenience remains crucial; ready-to-eat, ready-to-melt, and meal-specific formats attract busy urban consumers. Overall, shifting attitudes toward sustainability and wellness continue to strengthen long-term adoption.

Product Insights

The mozzarella cheese dominated the market and accounted for a revenue share of 33.6% in 2024, due to its universal culinary relevance and superior meltability. Consumers consistently choose mozzarella for pizzas, lasagnas, and everyday cooking, making it a staple in both B2C and foodservice channels. Brands have invested heavily in enhancing stretch, browning, and dairy-like texture using advanced starch blends and fermentation processes, enabling mozzarella to outperform other varieties. Its clean, neutral flavor profile also appeals to first-time buyers exploring plant-based cheese. With rising demand for vegan pizzas and convenience foods globally, mozzarella remains the category’s anchor, driving repeat purchases and high retail turnover.

The ricotta cheese segment is anticipated to register the fastest CAGR of 13.4% during the forecast period, 2025 to 2033. This growth is fueled by growing interest in specialty and gourmet plant-based products. Ricotta’s smooth, creamy texture makes it ideal for both sweet and savory applications, expanding its relevance across bakery, pasta, and dessert categories. Consumers are increasingly seeking dairy-free alternatives for traditional dishes like ravioli, cannoli, and stuffed shells, pushing foodservice operators to adopt vegan ricotta. Manufacturers are innovating with almond, cashew, and oat bases to replicate authentic creaminess while maintaining clean-label attributes. As culinary experimentation rises globally, vegan ricotta is poised to transition from a niche to a mainstream product faster than other segments.

Source Insights

The cashew-based cheese segment dominated the market and accounted for the largest revenue share of 37.8% in 2024. The dominance is driven by its naturally creamy texture, mild flavor, and superior compatibility with fermentation. Consumers perceive cashew cheese as a premium, minimally processed option, aligning with the rising clean-label and artisanal trends. Brands leverage cashews to produce soft, aged, and spreadable cheeses with enhanced flavor complexity, attracting health-conscious and gourmet buyers. The ingredient’s versatility supports innovation across various formats, including blocks, sauces, and dips. In addition, cashew cheese benefits from strong acceptance in Western markets where consumers associate tree-nut-based alternatives with higher quality. As transparency and authenticity become key purchase drivers, cashew cheese continues to gain dominance.

The soy-based cheese segment is expected to register the fastest CAGR of 12.5% during the forecast period 2025 to 2033. The growing need for soy-based cheese is driven by its affordability, protein density, and widespread availability. Soy remains one of the earliest plant-based cheese bases, and modern processing techniques have significantly improved its flavor and texture, making it more competitive with nut-based varieties. Its cost-effectiveness appeals to budget-conscious consumers and large-scale foodservice buyers. In addition, soy’s strong nutritional profile, particularly its protein content, makes it attractive for consumers seeking functional benefits. Emerging markets in Asia also favor soy-based cheeses due to cultural familiarity with soy foods. As price sensitivity increases globally, soy-based cheese is positioned for rapid adoption.

Application Insights

B2C sales of vegan cheese accounted for a market share of 50.5% in 2024, driven by increasing household adoption and enhanced retail visibility. Supermarkets, online grocery platforms, and specialty vegan stores have expanded their offerings, making vegan cheese accessible across a range of price points. Consumers are increasingly using vegan cheese in their daily meals, sandwiches, snacks, and homemade pizzas, driving consistent retail demand. E-commerce growth has further enabled trial purchases, subscription models, and brand discovery. Attractive packaging, flavor innovation, and targeted marketing strategies, such as influencer campaigns, have strengthened consumer trust. As home cooking and plant-forward lifestyles continue to gain popularity, B2C channels remain the dominant force in overall market consumption.

The B2B segment is expected to register the fastest CAGR of 12.4% during the forecast period from 2025 to 2033. The rising adoption and usage of vegan cheese across restaurants, quick-service chains, bakeries, and meal-kit providers is driving this segment. Food service operators are increasingly integrating vegan cheese into their menus to appeal to flexitarian and lactose-intolerant customers, making it a strategic offering rather than a niche request. The expansion of vegan pizzas, burgers, and pasta dishes has created sustained demand for high-melt, cost-effective vegan cheese solutions. In addition, institutional buyers, such as airlines, hotels, and corporate cafeterias, are incorporating plant-based options to expand and enhance menu diversity. As vegan offerings become standard in the global foodservice industry, B2B demand is expected to surge rapidly.

Regional Insights

North America vegan cheese market accounted for a revenue share of 23.8% in 2024. The growth of the region is supported by strong consumer awareness, a mature plant-based ecosystem, and high purchasing power. The region has seen a surge in flexitarian lifestyles, with consumers actively reducing their dairy consumption for both health and environmental reasons. Major retailers, including Whole Foods, Walmart, and Costco, have expanded their vegan cheese portfolios, enhancing accessibility across the region. Ingredient innovation, particularly in cashew, oat, and potato starch-based products, has improved product quality, resulting in increased repeat purchases. In addition, the influence of food influencers, celebrity endorsements, and sustainability-focused campaigns continues to shape consumer behavior, positioning North America as a global leader in the adoption of vegan cheese.

U.S. Vegan Cheese Market Trends

The vegan cheese market in the U.S. dominated the region with a revenue share of 77.9% in 2024. The U.S. vegan cheese market benefits from a strong consumer emphasis on clean labels, allergen-free foods, and sustainable eating practices. American consumers are increasingly experimenting with dairy alternatives due to lactose intolerance, concerns about gut health, and growing environmental awareness. The country’s vibrant foodservice sector, comprising vegan restaurants, pizza chains, and gourmet eateries, actively incorporates plant-based cheeses, expanding exposure. The U.S. also leads in technological innovation, particularly in precision fermentation, which is enhancing the taste and meltability of products. Retailers prioritize shelf space for premium and functional vegan cheeses, supporting market penetration. With strong media influence and growing cultural acceptance of plant-forward diets, the U.S. remains one of the fastest-evolving vegan cheese landscapes globally.

Europe Vegan Cheese Market Trends

The vegan cheese market in Europe dominated the industry with a revenue share of 39.4% in 2024. The dominance of the region is attributed to stringent sustainability standards, dairy reduction movements, and rising ethical consumption. European consumers prioritize transparency, favoring products with minimal additives and organic ingredients. Countries such as Germany, France, and the Netherlands are experiencing a strong shift toward flexitarian diets, further boosting demand. The region’s established cheese culture has encouraged manufacturers to innovate with artisanal, aged, and specialty vegan cheeses that appeal to traditional cheese lovers. In addition, government-backed sustainability initiatives and emissions-reduction policies are driving the adoption of plant-based products. Europe’s robust retail infrastructure and high environmental consciousness collectively position it as a powerhouse in global vegan cheese growth.

The UK vegan cheese market is expected to grow rapidly in the coming years, as consumers increasingly seek healthier, ethical, and climate-friendly alternatives to dairy. Strong vegan and flexitarian movements, reinforced by campaigns like Veganuary, have normalized plant-based consumption. British retailers such as Tesco, Sainsbury’s, and Marks & Spencer have diversified their vegan cheese offerings, often developing private-label ranges to meet demand. The country’s high rate of lactose intolerance and rising awareness of animal welfare also contribute to adoption. Moreover, the U.K.'s thriving takeaway and delivery ecosystem supports demand for vegan mozzarella and cheddar, which are used in pizzas and sandwiches. Continued innovation in flavor and affordability is propelling market momentum.

Asia Pacific Vegan Cheese Market Trends

The vegan cheese market in Asia Pacific is expected to grow at the fastest CAGR of 13.5% over the forecast period from 2025 to 2033. The rapid growth is driven by rising urbanization, Western food influence, and increasing health consciousness. Younger consumers, particularly in metropolitan areas, are adopting flexitarian and dairy-free lifestyles due to digestive concerns and increasing environmental awareness. International restaurant chains expanding across the APAC region are now including vegan cheese options, which boosts their visibility. Countries like Australia, Japan, and India are emerging as hotspots for premium plant-based foods, while Southeast Asia is seeing momentum in affordable soy- and coconut-based cheeses. E-commerce penetration further enables the discovery of niche brands. As cultural openness to global cuisines increases, the APAC region is transforming into a high-growth opportunity for vegan cheese.

China vegan cheese market is growing significantly and gaining traction as consumer diets shift toward plant-based foods, driven by the prevalence of lactose intolerance, affecting nearly 90% of the population, and increasing interest in Western cuisine. Urban millennials experiment with dairy alternatives for perceived digestive and wellness benefits. The rapid expansion of cafés, bakery chains, and pizza outlets has significantly increased demand for vegan mozzarella and cream cheese. Domestic brands are emerging with soy, oat, and rice-based formulations tailored to local tastes. E-commerce giants like Alibaba and JD.com amplify product access, creating strong online demand. As sustainability awareness grows, the adoption of vegan cheese is expected to accelerate across major Chinese cities.

Central & South America Vegan Cheese Market Trends

The vegan cheese market in Central & South America is growing significantly due to rising health consciousness, growing vegan communities, and increased exposure to global food trends. Countries such as Mexico, Argentina, and Chile are witnessing a higher acceptance of plant-based diets among younger populations. Retailers have begun allocating more shelf space to dairy alternatives, while local artisanal producers experiment with coconut and cashew bases suited to regional flavors. Economic affordability remains important, pushing brands to develop cost-effective vegan cheese options. Social media activism around animal welfare and climate change further influences purchasing decisions. As foodservice outlets incorporate vegan pizzas and sandwiches, demand across the region continues to strengthen.

The Brazil vegan cheese market is fueled by heightened interest in wellness, increasing cases of lactose intolerance, and strong environmental activism. Brazilian consumers are becoming increasingly aware of the ecological impact of dairy, prompting a shift toward plant-based alternatives. Local brands are innovating with cashew and coconut bases, ingredients readily available in the region, creating flavorful, locally inspired vegan cheeses. Food delivery apps and restaurant chains are integrating vegan options, further normalizing the consumption of vegan products. Retail expansion, especially in São Paulo and Rio de Janeiro, has improved accessibility. As sustainability movements and plant-forward diets deepen among urban consumers, Brazil is emerging as a major growth market in Latin America.

Middle East & Africa Vegan Cheese Market Trends

The vegan cheese industry in the Middle East and Africa region is growing, supported by rising health awareness, increasing dairy sensitivities, and the growing presence of Western restaurant chains. Urban consumers in regions such as the GCC are increasingly embracing plant-based foods for wellness and lifestyle reasons. Import-driven retail shelves now offer a wider selection of vegan cheese, while local manufacturers experiment with affordable soy and coconut formulations. Environmental concerns and water scarcity issues also encourage reduced dependence on dairy production. In Africa, expanding middle-class incomes and modern retail infrastructure support early-stage adoption. As awareness spreads, MEA is shaping into a promising frontier for vegan cheese expansion.

The UAE vegan cheese market is driven by its multicultural population, strong tourism sector, and premium food retail landscape. Health-conscious consumers, particularly expatriates, actively seek dairy-free options, while foodservice outlets in Dubai and Abu Dhabi have rapidly integrated vegan pizzas, burgers, and pastries. The government’s sustainability initiatives and carbon-emission reduction goals further encourage the adoption of plant-based consumption. High disposable incomes support demand for premium cashew, almond, and artisanal vegan cheeses. Retailers such as Carrefour and Spinneys now offer a diverse range of vegan cheese brands, making these products widely accessible. With wellness trends accelerating, the UAE is positioned for sustained growth in the vegan cheese segment.

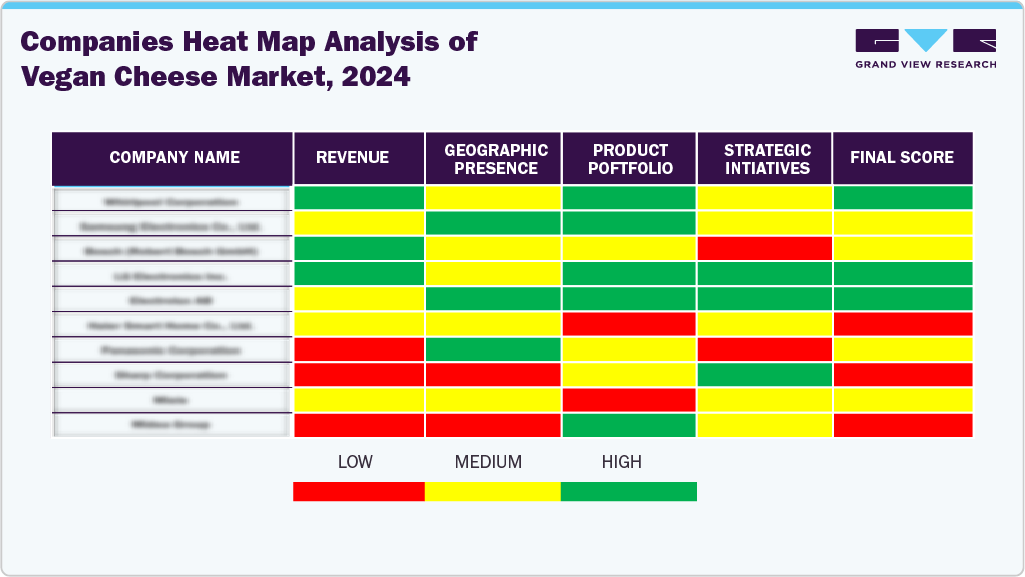

Key Vegan Cheese Company Insights

Key players operating in the vegan cheese market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Vegan Cheese Companies:

The following are the leading companies in the vegan cheese market. These companies collectively hold the largest market share and dictate industry trends.

- Daiya Foods.

- Miyoko's Creamery

- Flora Food Group (Violife)

- Kite Hill

- Follow Your Heart

- Treeline Cheese

- Tofutti Brands, Inc.

- Parmela Creamery

- Nush Foods.

- GOOD PLANeT Foods.

Recent Developments

-

In October 2025, Italian plant-based cheesemaker Dreamfarm launched its nut-based mozzarella (and other vegan cheeses) in around 70 Monoprix stores in Paris, France.

-

In September 2025, the French vegan cheese producer Jay&Joy launched its organic cashew- and soy-based camembert alternative, “Albert”, in the UK.

-

In January 2025, a Brooklyn-based company RIND launched ALPINE SVVISS, a cashew-based vegan cheese, in the United States. The artisan cheese was unveiled at the Specialty Food Association Winter Fancy Food Show in Las Vegas.

-

In March 2023, Indian company PlantWise launched plant-based cheese spreads, shreds, and “cheesy” nuggets across India. Their products, made via natural fermentation, were designed to taste, melt, and spread just like dairy cheese, while remaining clean-label and preservative-free.

Vegan Cheese Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,963.2 million

Revenue Forecast in 2033

USD 9,897.4 million

Growth rate

CAGR of 12.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Daiya Foods.; Miyoko's Creamery; Flora Food Group (Violife); Kite Hill; Follow Your Heart; Treeline Cheese; Tofutti Brands, Inc.; Parmela Creamery; Nush Foods.; GOOD PLANeT Foods.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Cheese Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global vegan cheese market report on the basis of product, source, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mozzarella

-

Cheddar

-

Parmesan

-

Ricotta

-

Cream cheese

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Soy

-

Almond

-

Coconut

-

Cashew

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

B2C

-

B2B

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The mozzarella cheese dominated the market and accounted for a market revenue share of 33.6% in 2024, due to its universal culinary relevance and superior meltability.

b. Some key players operating in the vegan cheese market include Daiya Foods., Miyoko's Creamery, Flora Food Group (Violife), Kite Hill, Follow Your Heart, Treeline Cheese, Tofutti Brands, Inc., Parmela Creamery, Nush Foods., and GOOD PLANeT Foods.

b. The global vegan cheese market size was estimated at USD 3,510.1 million in 2024 and is expected to reach USD 3,963.2 million in 2025.

b. The global vegan cheese market is expected to grow at a compounded growth rate of 12.1% from 2025 to 2033 to reach USD 9,897.4 million by 2033.

b. The global shift toward plant-based eating is becoming one of the strongest growth catalysts for the vegan cheese market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.