- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Vegetable Flakes & Granules Market Size & Share ReportGVR Report cover

![Vegetable Flakes & Granules Market Size, Share & Trends Report]()

Vegetable Flakes & Granules Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Onion, Tomato, Potato, Carrot, Bell Peppers And Herbs, Others), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-070-7

- Number of Report Pages: 240

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

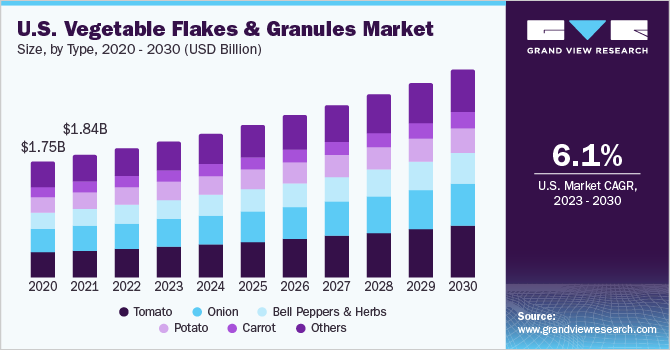

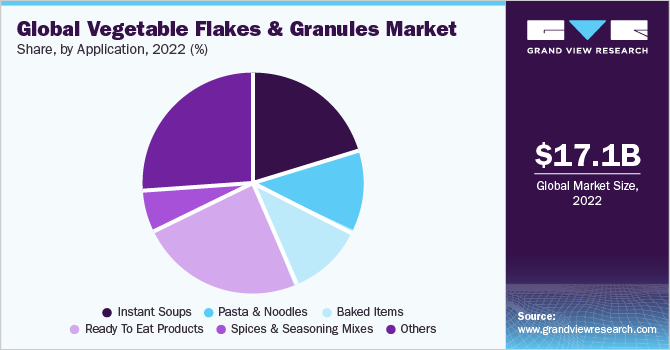

The global vegetable flakes & granules market size was valued at USD 17.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. The primary growth factors include growing demand for ready-to-eat meals and processed food, increased shelf-life of dried vegetable flakes, and changing dietary patterns influenced by hectic consumer lifestyles. However, the high cost of raw materials and processing is one of the market-limiting factors.

Vegetable flakes and granules can be used as an additive or to enhance the flavor of instant soups, dips & dressings, sauces, and convenience foods. Shifting consumer preferences have led to a growing demand for dehydrated vegetable counterparts such as flakes and granules. These are dried to enhance the shelf-life of the product and obtain long-term storage. These factors, coupled with the growing demand for processed food and ready-to-eat meals are projected to drive market growth.

The growth in technological advancements has led to innovation in dehydration technologies. The adoption of innovative dehydration technologies for vegetables is increasing owing to the growing demand for seasonal vegetables and to enhance the shelf life of vegetables. For instance, vegetable flakes and granules are produced using technologies such as air drying, vacuum drying, drum drying, infrared drying, freeze-drying, and spray drying. These technologies help preserve vegetables in dry form so that they can be stored and consumed for a longer time. There is a growing demand for dehydration technologies to produce vegetable flakes to retain the nutritional qualities, taste, and texture of vegetables for application in instant soups, ready to eat products, and snacks.

Type Insights

Based on type, the tomato segment dominated the global market, accounting for a revenue share of 22.36% in 2022 owing to the growing demand for tomato flakes in instant soups and sauces. The hectic lifestyle of consumers, especially in developing regions, has led to the demand for instant and convenience products. This is driving demand for tomato flakes.

Furthermore, tomatoes are highly perishable and have a 93% water content. This led to a demand for appropriate technologies to preserve and enhance them. Tomato flakes are processed and come with a longer shelf life. There is a growing demand for tomato flakes in fast food chains for the preparation of soups, dips, and sauces, fast food items, and pasta. Consumers are preferring a dried form of tomatoes, such as flakes and granules as its flavor gets more intense after it is dried. Fast food chains prefer dried tomato flakes for pasta sauces owing to its rich flavor. Additionally, tomato flakes are high in dietary fibers which will drive its preference in food products owing to its nutritional value. Therefore, tomatoes are also projected to record the fastest growth of 7.0% in revenue during the forecast period.

Onion flakes are projected to witness a significant revenue CAGR of 5.4% during the forecast period. The growing technological support from agricultural scientists to enable long-term storage of dried onion is likely to drive innovation in production technologies. In 2020, agricultural scientists at the Punjab Agricultural University (India) attempted with technology to prepare dehydrated onion flakes with a shelf-life of 12 months thereby preserving their natural and fresh-like flavor. This can be used by food manufacturers for the production of onion-based snacks and by food service outlets for curried preparations.

End-User Insights

Based on end-user, the food manufacturing industry dominated the market with more than 75% of the revenue share in 2022. The food manufacturing industry is projected to witness the fastest CAGR of 5.6% in terms of revenue growth during the forecast period. Food manufacturing industry is preferring the use of dried flakes to avoid the fluctuating raw material prices and to save the seasonal vegetables for a longer period to be used in a variety of different food products such as instant soups, snacks, processed food, ready mixes, and seasoning premixes.

The food service & retail industry is projected to expand at a revenue CAGR of 4.9% during the forecast period. There is a growing preference for vegetable flakes among the fast-food chains and food service outlets owing to the increasing demand for shelf-stable products. Food service outlets are also using vegetable flakes such as herbs to enhance the taste and appearance of the food items. Food service outlets are also moving towards the adoption of vegetable flakes, such as onion flakes to restrict the kitchen work and time involved in preparation of the food product. With fluctuating raw material prices, food service outlets are stocking up on vegetable flakes for the preparation of vegetarian and non-vegetarian dishes.

Application Insights

Based on application, ready to eat products dominated the market with more than a 20% revenue share in 2022. The growing technological advancements in vegetable dehydration technologies have led to the use of a variety of vegetable flakes in ready mixes and processed meals. The growth in hectic lifestyles across geographies has led to consumers shifting to convenience food products such as ready mixes. This has led to a favorable impact on the demand for vegetable flakes for manufacturing ready to eat products.

Instant soups recorded the fastest CAGR of 6.2% in terms of revenue during the forecast period. The changing consumer lifestyle has led to an increasing demand for instant food products. This, coupled with rising disposable income across developing economies has led to a growing demand for instant soups. Dried tomato and mushroom flakes are gaining popularity in instant soup applications. The addition of different vegetable flakes in instant soups for a variety of flavors to appeal to a larger consumer base is likely to drive the demand for instant soups between 2023-2030.

Regional Insights

In terms of revenue, Asia Pacific dominated the market, accounting for a revenue share of 37.10% in 2022, owing to growing population which has led to a large consumer base and established food manufacturing industry. Additionally, the increasing demand for RTE food products and convenience snacks in the region has further fueled the growth of the market. The macroeconomic factors in the region such as increasing disposable income, shifting consumer lifestyles towards convenience, and rapid rate of urbanization has positively impacted the vegetable flakes & granules market in the region, especially in countries such as China and India. Furthermore, growing per capita income is likely to support the demand for vegetable flakes in retail outlets in the region. For instance, according to the OECD, the annual average growth rate of GDP per capita across Asia Pacific between 2015-2020 was 1.4%, which is comparatively higher than 0.9% between 2012-2017.

North America is expected to register a significant revenue CAGR of 5.8% from 2022 to 2030 owing to the technological advancements enabling efficient production of vegetable flakes in countries such as the U.S.

Key Companies & Market Share Insights

The global vegetable flakes and granules market is moderately fragmented. The industry is expected to witness moderate competition among the market participants owing to the presence of numerous players with diversified product portfolios across the industry. Manufacturers are motivated to expand their portfolio of dehydrated vegetable flakes owing to the changing consumer trends towards convenience food products. ITC Limited and Sensient Technologies are characterized as market leaders owing to strong financial strength and wide geographic presence.

The key market participants have adopted new product launches, collaborations and partnerships, and investments & expansions as primary growth strategies. For instance, in January 2021, one of the Indian food processing start-ups, Anuha Food Products Pvt. Ltd., launched dehydrated onion flakes and garlic cloves under its dehydrated gluten-free F&B brand, ‘Zilli’s’. The company expanded its portfolio of processed flakes, aiming to cater to the growing demand for ready-to-cook healthy mixes across the U.S. and India. The product has a shelf-life of 12-18 months and follow the necessary guidelines from the FSSAI. It can be used by food manufacturers to produce ready mixes. Furthermore, it can also be adopted by food service outlets to make cooking easier, thereby reducing cooking time. Some prominent players in the global vegetable flakes & granules market include:

-

ITC Limited

-

California Sun Dry Foods

-

Mercer Foods, LLC

-

Sensient Technologies

-

Bella Sun Luci

-

Van Drunen Farms

-

European Freeze Dry

-

BCFoods

-

Harmony House Foods, Inc.

-

Mevive International

Vegetable Flakes & Granules Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.88 billion

Revenue forecast in 2030

USD 26.05 billion

Growth Rate (Revenue)

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in metric tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

ITC Limited; California Sun Dry Foods; Mercer Foods, LLC; Sensient Technologies, Bella Sun Luci; Van Drunen Farms; European Freeze Dry; BCFoods; Harmony House Foods, Inc.; Mevive International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

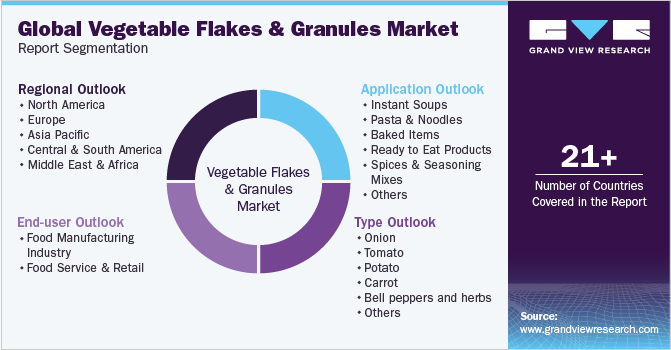

Global Vegetable Flakes & Granules Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vegetable flakes & granules market report based on type, application, end-user, and region:

-

Type Outlook (Volume, Metric Tons, Revenue, USD Million, 2017 - 2030)

-

Onion

-

Tomato

-

Potato

-

Carrot

-

Bell peppers and herbs

-

Others

-

-

Application Outlook (Volume, Metric Tons, Revenue, USD Million, 2017 - 2030)

-

Instant soups

-

Pasta & noodles

-

Baked items

-

Ready to eat products

-

Spices & seasoning mixes

-

Others

-

-

End-User Outlook (Volume, Metric Tons, Revenue, USD Million, 2017 - 2030)

-

Food manufacturing industry

-

Food service & retail

-

-

Regional Outlook (Volume, Metric Tons, Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vegetable flakes & granules market size was estimated at USD 17.05 billion in 2022 and is expected to reach USD 17.88 billion in 2023.

b. The global vegetable flakes & granules market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 26.05 billion by 2030.

b. Asia Pacific dominated the vegetable flakes & granules market with a share of 37.1% in 2022. This is attributable to the increasing demand for RTE food products and convenience snacks in the region.

b. Some key players operating in the vegetable flakes & granules market include ITC Limited, California Sun Dry Foods, Mercer Foods, LLC, Sensient Technologies, Bella Sun Luci, Van Drunen Farms, European Freeze Dry, BCFoods, Harmony House Foods, Inc., and Mevive International.

b. Key factors that are driving the vegetable flakes & granules market growth include growing demand for ready-to-eat meals and processed food, increased shelf-life of dried vegetable flakes, and changing dietary patterns influenced by hectic consumer lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.