- Home

- »

- Next Generation Technologies

- »

-

Version Control Systems Market Size & Share Report, 2030GVR Report cover

![Version Control Systems Market Size, Share & Trends Report]()

Version Control Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Deployment (On-premise, Cloud) By Enterprise Size, By End-use (BFSI, IT & Telecom, Retail & CPG), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-009-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Version Control Systems Market Summary

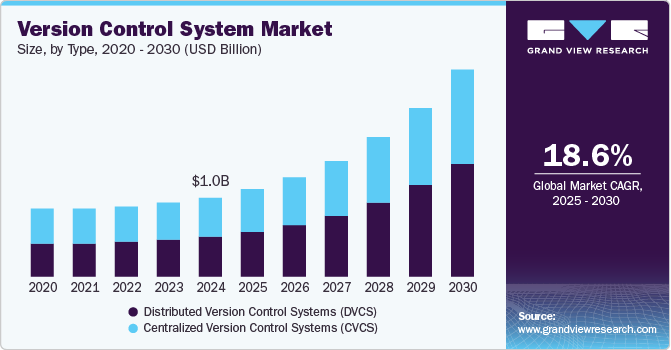

The global version control systems market size was valued at USD 1.03 billion in 2024 and is projected to reach USD 2.66 billion by 2030, growing at a CAGR of 18.6% from 2025 to 2030, owing to the rapid digitization across various industries. As businesses continue to embrace digital transformation, the need for robust version control systems has become paramount.

Key Market Trends & Insights

- North America's version control systems market led the market with a 35.0% share in 2024.

- The China version control systems market dominated the APAC market in 2024.

- By type, distributed version control systems dominated the market with a 51.4% share in 2024.

- By deployment, on-premise deployment is expected to grow at a CAGR of 11.2% over the forecast period.

- By enterprise size, large enterprises accounted for over 66.5% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 2.66 Billion

- CAGR (2025-2030): 18.6%

- North America: Largest market in 2024

Version control systems enable teams to manage and track changes in software code efficiently, facilitating collaboration and ensuring that projects are completed on time and within budget. Another contributing factor is the rise of remote work and distributed teams. The pandemic accelerated the adoption of remote working models, and this trend has persisted. Version control systems are essential for remote teams, allowing developers to work on the same codebase from different locations without conflicts. This capability is crucial for maintaining productivity and optimized functionality.Furthermore, technological advancements, including the integration of version control systems with cloud-based solutions, have made VCS tools more accessible and scalable. Cloud-based VCS offers several advantages: enhanced security, easier collaboration, and reduced infrastructure costs. Organizations have increasingly shifted towards cloud-based version control systems to leverage these benefits.

Additionally, the increasing complexity of IT infrastructure in organizations has significantly driven the market. With software applications increasingly becoming more sophisticated, the need for effective version control has become more critical. Version control systems help manage this complexity by providing a structured way to track changes, resolve conflicts, and maintain a history of modifications. This capability is particularly important for large enterprises that manage extensive codebases and multiple development teams.

Type Insights

Distributed version control systems dominated the market with a 51.4% share in 2024, owing to the increasing need for enhanced collaboration among development teams. DVCS, such as Git, allows developers to have a complete copy of the code repository, enabling them to work independently and merge changes. This decentralized approach facilitates better collaboration, especially for large and geographically dispersed teams. Moreover, the rise of open-source projects and the broader adoption of open-source software have stimulated the market forward. DVCS are particularly well-suited for open-source development in which remote contributors can work on the same project without needing constant access to a central server.

Centralized version control systems are expected to grow over the forecast period. CVCS is cost-effective, allowing developers to keep a log of changes in the source code, which helps developers minimize complexities in software development. Distributed Version Control Systems (DVCS) have gained popularity among individual programmers as they offer better performance and make the development of new code branches quicker and simpler. DVCS also allows users to work when not connected to the network. Moreover, it enables developers to use various development models, such as the commander model and development branches, to develop user-friendly software. These factors are further expected to drive the growth of the DVCS segment.

Deployment Insights

Cloud deployment held a dominant market share in 2024 and is projected to grow exponentially in the coming years, owing to the rising demand for scalability and flexibility. Cloud-based VCS solutions allow organizations to scale their infrastructure up or down based on their needs without the need for significant upfront investments in hardware. This scalability benefits startups and small to medium-sized enterprises (SMEs) that experience fluctuating workloads. Moreover, these systems offer enhanced collaboration capabilities. With teams increasingly working remotely or in distributed environments, cloud deployment ensures that all team members have real-time access to the latest codebase, regardless of their location.

On-premise deployment is expected to grow at a CAGR of 11.2% over the forecast period, with the need for enhanced security and control over data. Organizations dealing with sensitive information, such as financial institutions, healthcare providers, and government agencies, prefer on-premise solutions to ensure that their data remains within their infrastructure. This control helps mitigate risks associated with data breaches and compliance with stringent regulatory requirements. Furthermore, businesses with complex IT environments and specific requirements benefit from on-premise solutions allowing deeper integration with existing tools and workflows.

Enterprise Size Insights

Large enterprises accounted for over 66.5% share in 2024. The market growth can be credited to the increasing need for enhanced collaboration and efficiency in managing extensive and complex codebases. Large enterprises often have multiple development teams working on various projects simultaneously, necessitating robust VCS tools to streamline workflows, track changes, and ensure seamless code integration. Large enterprises handle vast amounts of sensitive data and must adhere to stringent regulatory requirements. VCS tools provide detailed audit trails and access controls, enabling organizations to monitor changes, manage permissions, and ensure compliance with industry standards.

Small and medium enterprises (SMEs) are expected to emerge over the forecast period. SMEs often operate with limited resources and smaller teams, which makes it essential to have tools that streamline workflows and enhance productivity. Version control systems enable these businesses to manage code changes effectively, track progress, and ensure that all team members are aligned. Additionally, these enterprises have increasingly invested in digital tools and technologies to stay competitive in the market. VCS plays a vital role in this transformation by providing a structured way to manage software development processes, reduce errors, and improve the overall quality of the software.

End-use Insights

The IT and telecom sectors dominated the market in 2024. The growing development in mobile applications, frequent release of updated software versions, and rising demand for detecting and resolving software errors will likely drive the demand for version control systems in the IT and telecom segment. The version control system supports multiple platforms and allows software developers to offer updated software versions. The systems also help IT and telecom organizations secure their work on the latest release and source code of the newly released software version.

The healthcare & life sciences sector is expected to grow at the fastest CAGR of 22.1% over the forecast period owing to the increasing complexity of healthcare IT infrastructure and the growing need for efficient data management and compliance. As healthcare organizations adopt more sophisticated software solutions to manage patient records, research data, and regulatory compliance, the demand for robust version control systems has significantly surged. These systems ensure data integrity, facilitate collaboration among research teams, and streamline software development processes, which are critical in maintaining the accuracy and security of sensitive health information.

Regional Insights

North America's version control systems market led the market with a 35.0% share in 2024, owing to the region’s strong emphasis on technological innovation and digital transformation. North America is home to numerous tech giants and startups that continuously push the boundaries of software development. This environment fosters a high demand for advanced VCS tools to manage complex codebases, facilitate collaboration, and ensure efficient version control.

U.S. Version Control Systems Market Trends

The U.S. version control systems market is expected to be driven by the widespread adoption of DevOps practices across various industries over the forecast period. DevOps emphasizes continuous integration and deployment (CI/CD), which require robust VCS tools to manage code changes and automate deployment processes. Integrating VCS with CI/CD pipelines helps organizations accelerate software delivery, improve quality, and respond more quickly to market demands.

Europe Version Control Systems Market Trends

Europe's version control systems market held a 26.2% share in 2024 owing to the increased digital transformation efforts across various industries, coupled with the adoption of cloud computing. Businesses have increasingly migrated to cloud-based VCS solutions for easier collaboration and remote access, especially in the post-pandemic era of remote and hybrid work. European companies have increasingly invested in agile development, which requires robust VCS to manage code changes efficiently.

Asia Pacific Version Control Systems Market Trends

The Asia Pacific (APAC) version control systems market held 23.0% of the global revenue share in 2024 and is expected to grow over the forecast period. Businesses in the region have undergone significant digital transformation. The push to modernize IT infrastructure, especially in fast-growing economies including China, India, and Southeast Asia, has created a surge in demand for VCS to support modern software development processes.

The China version control systems market dominated the APAC market in 2024 due to the rapid expansion of the software development industry, which emphasizes maintaining high code quality and fostering collaboration among developers. The rise of open-source projects and the need for efficient project management tools have also contributed to the market’s expansion.

Key Version Control Systems Company Insights

The global version control system market is intensely competitive, featuring key participants such as Amazon Web Services, Inc., Atlassian, GitHub, Inc., and others. These companies have increasingly invested in extensive research and development activities to drive innovation in version control systems. These innovations include better integration with other development tools, enhanced security features, and improved user interfaces.

-

Atlassian is an Australian software company renowned for its product suite designed to help software developers, project managers, and content management teams collaborate more effectively. Atlassian’s flagship products include Jira, a powerful issue and project tracking tool, and Confluence, a team collaboration platform.

Key Version Control Systems Companies:

The following are the leading companies in the version control systems market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Atlassian

- GitHub, Inc.

- GitLab B.V.

- Mercurial

- Open Text Corporation

- Microsoft

- Perforce Software, Inc.

- PTC

- Unity Technologies

Version Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.13 billion

Revenue forecast in 2030

USD 2.66 billion

Growth rate

CAGR of 18.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Amazon Web Services, Inc.; Atlassian; GitHub, Inc.; GitLab B.V.; Mercurial; Open Text Corporation; Microsoft; Perforce Software, Inc.; PTC; Unity Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Version Control Systems Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global version control systems market report based on type, deployment, enterprise size, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Centralized Version Control Systems (CVCS)

-

Distributed Version Control Systems (DVCS)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Education

-

Healthcare & Life Sciences

-

IT & Telecom

-

Retail & CPG

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.