- Home

- »

- Medical Devices

- »

-

Vessel Sealing Devices Market Size Analysis Report, 2030GVR Report cover

![Vessel Sealing Devices Market Size, Share & Trends Report]()

Vessel Sealing Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (General Surgery, Laparoscopic Surgery), By End-Use (Hospitals & Specialty Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-476-6

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vessel Sealing Devices Market Summary

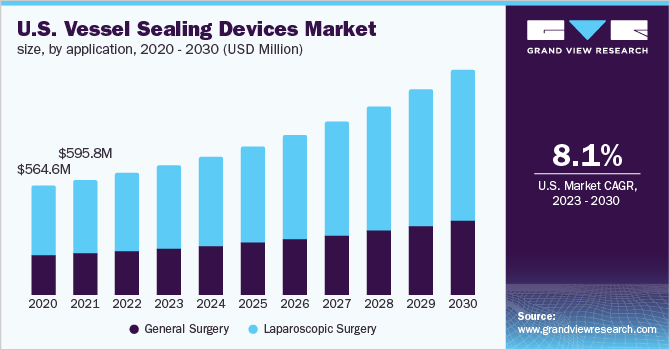

The global vessel sealing devices market size was estimated at USD 1,510.0 million in 2022 and is projected to reach USD 2,967.0 million by 2030, growing at a CAGR of 9.04% from 2023 to 2030. Growing product developments, surgical procedures, and preference for minimally invasive surgeries are some of the key drivers of this market.

Key Market Trends & Insights

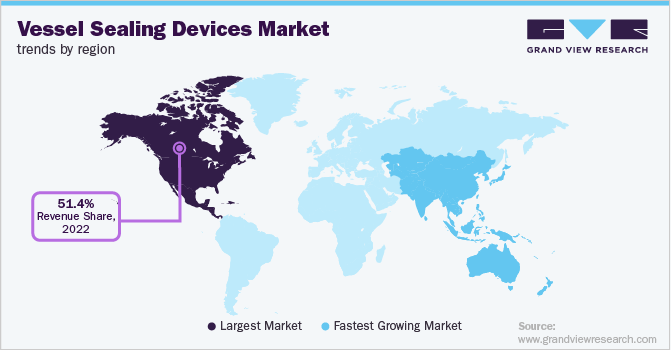

- North America dominated the market and accounted for the largest revenue share of 51.35% in 2022.

- In Asia Pacific, the is estimated to witness the fastest CAGR of 11.2% over the next few years.

- By application, the laparoscopic surgery segment accounted for the largest revenue share of 62.73% in 2022.

- By end-use, the hospitals and specialty clinics segment held the largest revenue share of 55.28% in 2022.

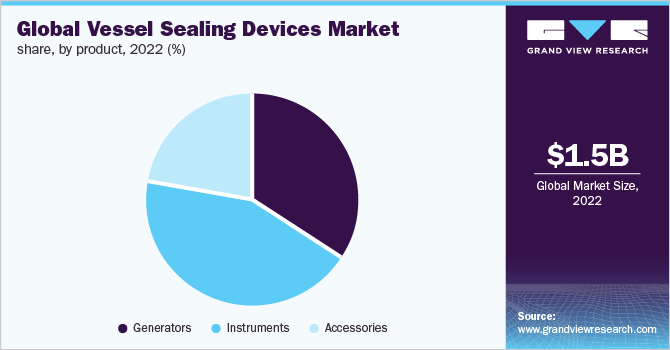

- By product, the instruments segment accounted for the largest revenue share of 43.48% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1,510.0 Million

- 2030 Projected Market Size: USD 2,967.0 Million

- CAGR (2023-2030): 9.04%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Medtronic, a market leader in vessel sealing devices, for example, registered record sales of USD 5.4 million in its surgical innovations portfolio comprising advanced energy, stapling, and visualization devices. This was owing to a strong portfolio with continuous product enhancements. One of the main drivers boosting the market is the rising geriatric population, which is more prone to chronic ailments. Axillary dissection, chronic hepatitis, colorectal cancer, and other conditions are among the many conditions that are often treated with vessel sealing devices. Additionally, the broad use of the product in laparoscopic procedures, which are less invasive and result in less postoperative pain, is boosting market expansion. In addition, the development of bipolar devices, which help in stronger and more uniform compression, and ultrasound technology, which monitors the distribution of heat and energy, are giving the industry a boost.Additionally, the growing need for safe and efficient surgical instruments to lower infection rates and blood loss is driving up overall sales of vessel sealing devices, which is benefiting the market's expansion. The market is predicted to grow as a result of a number of additional variables, such as the development of cutting-edge, high-quality vessel sealing devices, an increase in gynecological, urological, cardiovascular, and orthopedic operations, and a sizable expansion of the medical sector.

The COVID-19 pandemic adversely impacted the market for vessel sealing devices with low demand and sales. This resulted from supply chain challenges, deferred or canceled elective procedures, reduced sales and marketing activities, and movement restrictions due to lockdowns. Medtronic for instance reported a negative impact of COVID-19 on its fourth-quarter financial results ending April 24, 2020. The company was also impacted by the postponed elective and semi-elective procedures that use Medtronic’s products. The reluctance of people for undergoing non-COVID-19 emergency procedures affected the company’s emergent product lines.

In its 2020 annual report, Intuitive Surgical reported a 3.0% decrease in revenue compared to 2019, owing to constraints in staff and ICU capacity in hospitals and deferred surgical procedures. The company reported a 19.0% year-on-year decline in procedures during Q2 2020 with a gradual recovery in Q3 and Q4. Intuitive Surgical estimated that about 1.25 million surgeries were performed during the year. The company, however, reported growth in its surgical energy portfolio, with its E-100 generator, SynchroSeal system, and vessel sealers lineup gaining customer acceptance. The company planned to expand its regional presence outside the U.S., advance its product launches, and extend economic, clinical, and hospital-by-hospital validation in key countries and procedures, as part of its 2021 strategy.

Rising product improvement is a key driver contributing to the growth of the market for vessel sealing devices. This is due to the growing demand for vessel sealing devices that offer better consistency, utility, reliability, efficiency, and safety. According to an article published in the International Journal of Scientific Research, an ideal vessel sealing device is effective on vessels having a diameter less than or equal to 7mm, produces minimal thermal spread, works quickly, is reusable, and produces consistent results. Market players are also involved in integrating these devices into robotic surgical systems. For example, Intuitive Surgical’s SynchroSeal is compatible with the da Vinci surgical system and enables the user to quickly seal and cut vessels up to 5 mm in diameter.

COVID-19 Vessel Sealing Devices market impact: over 5.93% decline in demand

Pandemic Impact

Post COVID Outlook

The earlier projections depicting approximately 6.5% YoY growth was countered by the pandemic resulting in a decline of 0.2% in the year-on-year growth rate from 2019 to 2020.

The market is expected to regain its previous growth and demonstrate a year-on-year growth rate of 6.4% from 2020 to 2021 and 6.7% from 2021 to 2022.

Intuitive Surgical announced a 3% decrease in its annual revenue from 2019 to 2020 due to issues in ICU capacity in hospitals and deferred surgical procedures.

In its strategy for 2021, Intuitive Surgical plans to expand its market presence outside the U.S. and advance its product portfolio.

Patients were reluctant to go through non-essential COVID-19 procedures, which further impacted the market.

Elective surgeries are anticipated to return to pre-COVID numbers as the underlying causes remain unchanged. The American Society of Anesthesiologists (ASA) has released several guidelines for resuming elective surgery. The American College of Surgeons has also released a roadmap for resuming elective surgeries in collaboration with the ASA, Association of Perioperative Registered Nurses, and the American Hospital Association. There is also a growing preference for minimally invasive surgeries due to associated benefits such as smaller incisions, reduced pain and scarring, and faster recovery times. These factors are estimated to contribute to the growth of the market for vessel sealing devices during the forecast period.

Application Insights

The laparoscopic surgery segment dominated the market for vessel sealing devices and accounted for the largest revenue share of 62.73% in 2022. The segment is also estimated to witness a CAGR of 9.7% in the coming years. The key factor contributing to this growth includes a growing preference for and rising number of minimally invasive surgeries and awareness of the benefits of laparoscopic surgeries over open surgeries. Furthermore, a favorable reimbursement scenario for laparoscopic surgeries in the U.S. is expected to boost the market.

Awareness about these surgeries is also increasing owing to their advantages, further aiding the market growth. According to a 2020 retrospective study performed by the Department of Surgery, Cleveland Medical Center, in the U.S. the number of open procedures performed by general surgery residents has been on the decline since 2000 with a growing preference for minimally invasive surgery. This trend is expected to continue fueling the demand for vessel sealing devices.

The general surgery segment is expected to grow at a favorable rate as it is the preferred option in some types of surgeries, such as appendectomies and sigmoidectomies. This preference can be attributed to the high success rate of these surgeries as compared to laparoscopy. The low market share of general surgeries is because of their high cost and longer post-surgical hospital stay. Furthermore, Olympus Corporation offers Thunderbeat and Sonicbeat instrument lineups for endoscopic and open surgery. The devices use ultrasonic energy for fast and precise dissection and advanced bipolar energy for sealing vessels and for secure hemostasis. The seal and cut mode enables spot coagulation and pre-sealing of vessels through fewer steps to ensure optimal outcomes during open surgical procedures.

End-Use Insights

The hospitals and specialty clinics segment dominated the market for vessel sealing devices and held the largest revenue share of 55.28% in 2022. This is attributable to a higher volume of surgeries performed in hospital settings. Vessel sealing devices in particular reusable devices, also offer better efficacy and cost savings for the end-users. According to a study published in the Journal of Surgical Oncology, reusable vessel sealing devices used in modified total neck dissection procedures significantly reduced medical costs and provided similar clinical efficacy compared to disposable devices.

The ambulatory surgical center (ASC) segment is anticipated to register the fastest CAGR of 10.90% over the forecast period due to the increasing number of ambulatory centers and related cost-effectiveness. According to the March 2021 data provided by the Centers for Medicare and Medicaid Services (CMS), there are about 187 Medicare-certified ASCs in Washington state, 817 in California, 442 in Texas, 457 in Florida, and 368 in Georgia. These numbers are expected to increase over the coming years.

Product Insights

The instruments segment dominated the market for vessel sealing devices and accounted for the largest revenue share of 43.48% in 2022. The segment is also expected to witness the fastest CAGR of 9.56% over the forecast period. The key factors contributing to this share include the rising demand for reliable, affordable, and safe vessel sealing instruments, product developments, and the rising number of surgical procedures. There is also growing demand for reprocessed or reusable vessel sealing instruments due to their cost-efficacy and associated environmental benefits such as significant reduction in medical waste. KLS Martin Group, based in Germany, offers reusable vessel sealing instruments under the brand name- marSeal.

The generators segment is anticipated to register notable growth owing to technological advancements such as integrated devices and multiple applications. The VIO 3 Generator marketed by the German Erbe Elektromedizin company, for instance, supports the use of up to 6 instruments for various procedures and the user programs can be upgraded through the Erbe support app. FMX Generator by OmniGuide Holdings offers a touchscreen display and comes with patented software that monitors and adjusts the delivery of energy continuously, facilitating the delivery of an optimal amount of heat to the tissues.

Regional Insights

North America dominated the vessel sealing devices market and accounted for the largest revenue share of 51.35% in 2022. The large share of the region is due to the presence of key players and technologically equipped hospitals in the U.S. and Canada. Europe held the second-largest revenue share of the market in 2022 due to an aging population and the prevalence of chronic conditions resulting in the increasing number of surgeries. As per the Federal Statistical Office, 17. 2 million surgeries were performed in Germany in 2019. Out of these intestinal, spinal, endoscopic surgeries, and hip implant surgeries were some of the most common. This is estimated to contribute to the region's share.

In Asia Pacific, the market for vessel sealing devices is estimated to witness the fastest CAGR of 11.2% over the next few years. This is owing to investments by companies to expand their regional presence and develop healthcare infrastructure. For example, the All India Institute of Medical Sciences (AIIMS) in Bhubaneswar India, procured Medtronic accessories and consumables for a cautery machine with vessel sealing in January 2020 through the company’s authorized representative in the country- Sushruta Surgicals Pvt. Ltd. The products were intended to equip the institute’s Department of Surgical Oncology.

Key Companies & Market Share Insights

The market is competitive in nature. Market players implement strategic initiatives, such as product development and launches, expansion of distribution network, and global footprint through subsidiaries and partnerships. Key players are also involved in portfolio diversification and mergers and acquisitions. For instance, in June 2021, Medical Devices Business Services, Inc. (Johnson & Johnson) announced the launch of the ENSEAL X1 Curved Jaw Tissue Sealer, which is a new advanced bipolar energy device that increases procedural efficiency, provided stronger sealing, and better access to more tissues. Adding to that, in January 2021, Bolder Surgical launched CoolSeal Vessel Sealing Platform thus adding to its line of vessel sealing products.

Furthermore, in November 2019, Intuitive Surgical’s SynchroSeal vessel sealer and E-100 Generator for da Vinci X/Xi surgical platforms received FDA clearance. According to June 2021 Goldman Sachs Global Healthcare Conference report, Medtronic dominated the advanced energy market (with around 60% share) and is a leader in the RF segment due to its robust offerings such as the LigaSure Vessel Sealing Instruments. Going forward, the company plans to increase its share of the ultrasonic market. Some of the prominent players in the global vessel sealing devices market include:

-

Medtronic

-

Olympus Corporation

-

B. Braun Melsungen AG

-

Medical Devices Business Services, Inc. (Johnson & Johnson)

-

Erbe Elektromedizin GmbH

-

Bowa Medical

-

OmniGuide Holdings, Inc.

-

Intuitive Surgical

-

Bolder Surgical, LLC

-

KLS Martin Group

Vessel Sealing Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,619.0 million

Revenue forecast in 2030

USD 2,967.0 million

Growth rate

CAGR of 9.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Olympus Corporation; B. Braun Melsungen AG; Medical Devices Business Services, Inc. (Johnson & Johnson); Erbe Elektromedizin GmbH; Bowa Medical; OmniGuide Holdings, Inc.; Intuitive Surgical; Bolder Surgical LLC; KLS Martin Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vessel Sealing Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vessel sealing devices market report based on application, product, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Laparoscopic Surgery

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Generators

-

Instruments

-

Accessories

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Specialty Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vessel sealing devices market size was estimated at USD 1,510.0 million in 2022 and is expected to reach USD 1,619.0 million in 2023.

b. The global vessel sealing devices market is expected to grow at a compound annual growth rate of 9.04% from 2023 to 2030 to reach USD 2,967.0 billion by 2030.

b. North America dominated the vessel sealing devices market with a share of 51.35% in 2022. This is attributable to the presence of key players and technologically equipped hospitals in the U.S. and Canada.

b. Some key players operating in the vessel sealing devices market include Medtronic, Olympus Corporation, B. Braun Melsungen AG, Medical Devices Business Services, Inc. (Johnson & Johnson), Erbe Elektromedizin GmbH, Bowa Medical, OmniGuide Holdings, Inc., Intuitive Surgical, Bolder Surgical, LLC, and KLS Martin Group, among others.

b. Key factors that are driving the vessel sealing devices market growth include growing product developments, surgical procedures, and preference for minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.