- Home

- »

- Animal Health

- »

-

Animal Vaccines Market Size, Share & Trends Report, 2030GVR Report cover

![Animal Vaccines Market Size, Share & Trends Report]()

Animal Vaccines Market Size, Share & Trends Analysis Report By Animal Type (Livestock, Companion), By Product (Attenuated Live Vaccines, Recombinant Vaccines), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-053-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Animal Vaccines Market Size & Trends

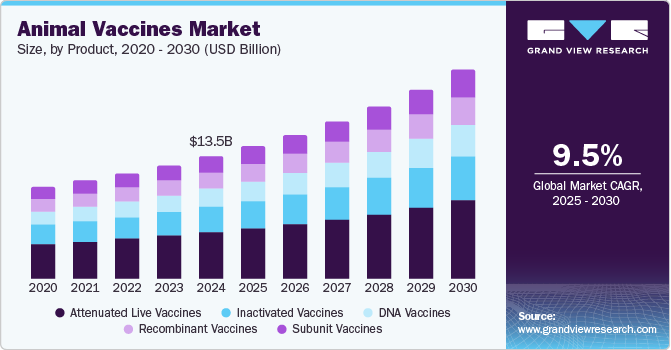

The global animal vaccines market size was valued at USD 13.67 billion in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030. The increasing outbreaks of cattle disease and the ever-expanding livestock population are the key factors for the wide acceptance of ruminants, especially cattle vaccines, globally. Animals serve as a vital source of meat, protein, food, milk, and other commercial products such as wool and leather. Most used animal vaccines comprise rabies vaccines, equine influenza virus vaccines, and foot and mouth diseases vaccines, which prevent the transmission of infectious agents by mimicking naturally acquired immunity.

The market growth was moderate in 2020. The COVID-19 pandemic has impacted all industries, including animal vaccines. During the initial time of the pandemic, OIE confirmed that no animals can spread this virus. However, human-to-animal transmission has been reported in a few countries. IDEXX Laboratories and other companies have tested many dogs and cats for the virus, with test results being negative. In the initial months of the pandemic, there was speculation that it may spread through birds, which negatively impacted the livestock industry. In the U.S., several pig and poultry processing plants shut down after the major outbreak.

Rising concerns over food security and increasing animal husbandry are boosting the demand for animal vaccines for the livestock population. Increasing demand for animal products has led to growth in livestock production globally. Furthermore, various factors such as variations in food preferences due to changing lifestyles and population growth are increasing the demand for livestock products. These factors are aiding in the market growth. Furthermore, the perpetual introduction of technologically advanced vaccines and the outbreak of livestock diseases have contributed to the shifting market dynamics.

The increasing prevalence of zoonotic diseases can negatively impact human lives, which is likely to boost the demand for animal vaccines. Emerging and exotic animal diseases are a growing threat to human and animal health and jeopardize food security. The rise in the population of both humans and animals, along with environmental degradation and globalized trade and travel, improves opportunities for the transmission of pathogens within and between species. The resulting ailments pose massive challenges currently and in the future. In most of the countries, improved demand for animal protein has resulted in increased commercial food animal production. Emerging zoonotic diseases of both companion and livestock animals are a major threat to public health. In the future decades, the entire world will undoubtedly witness more new disease outbreaks. Consequently, animal vaccinations may be extremely important for controlling the spread of new diseases.

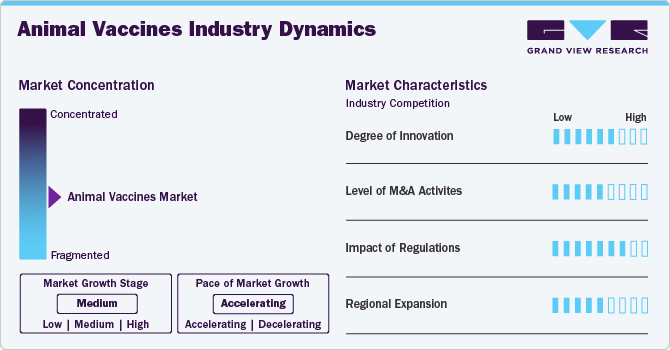

Market Concentration & Characteristics

The market exhibits a moderate concentration, and the pace of the market growth is accelerating. One of the key factors fueling the market growth is the increasing demand for animal protein. The growing global population is expected to boost the demand for protein, including meat, dairy, and eggs. According to OECD predictions, the consumption of pork meat is anticipated to grow from 112.58 megatons in 2022 to 127.27 megatons by 2029 around the world. Similarly, the OECD's 2020 to 2029 estimates state that cow milk accounts for approximately 80% of the world's milk production, with India & Pakistan expected to contribute over 30% to global milk production by 2029.

The market demonstrates a high degree of innovation. Innovations in animal vaccines have become increasingly significant in veterinary medicine, driven by advances in biotechnology, changing disease landscapes, and growing awareness of animal welfare. Key trends and innovations include recombinant DNA vaccines, as these vaccines use genetic engineering to produce antigens that stimulate the immune response. They are safer than traditional vaccines because they don't require live pathogens. Recombinant vaccines are effective for diseases like rabies, feline leukemia, and foot-and-mouth disease.

Within the market, there exists a moderate to high level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic acquisition and partnerships among industry players. For instance, in January 2024, Ceva acquired Scout Bio, a leading biotechnology firm specializing in advanced therapies for pets. This acquisition marks a substantial advancement for Ceva, granting access to groundbreaking treatments such as monoclonal antibodies and gene therapy aimed to tackle chronic pet diseases

The market experiences a high impact of regulations. Vaccines must undergo a rigorous approval process before they are marketed. This involves laboratory research, clinical trials, and reviews of safety, efficacy, and quality. In the U.S., the Center for Veterinary Biologics (CVB), under the U.S. Department of Agriculture (USDA), regulates veterinary vaccines. Moreover, manufacturers must adhere to Good Manufacturing Practices (GMP) to ensure the quality and consistency of vaccines. GMP compliance is regularly monitored through inspections.

Moderate levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For instance, in October 2023, Bimeda, Inc. inaugurated a cutting-edge facility worth USD 4.30 million, which includes the AgTechUCD Innovation Center and the UCD Bimeda Herd Health Hub, situated at UCD Lyons Farm in Ireland.

Product Insight

The attenuated live vaccines segment led the market with the largest revenue share of 37.64% in 2023. The most traditional immunization technique in use in the veterinary industry is live attenuation. This method is also under trial for the development of additional applications. Some of these alternatives include the development of protein subunit vaccines for swine, which are given intramuscularly. These products aid in reducing the mortality rate and improve the life span of disease-affected swine.

The recombinant vaccine segment is anticipated to grow at the fastest CAGR over the forecast period. These vaccines help reduce the risk of pathogenicity in animals after vaccination. Recombinant vaccines are also expected to help achieve vaccination against multiple virus strains as recombinants can carry multiple gene inserts. These vaccine formulations can avoid the need for adjuvants, increase the viability of the vaccine, and improve stability. In veterinary medicine, recombinant vaccinations are offered against canine distemper, avian influenza, Newcastle disease, pseudorabies, and Lyme disease.

Animal Type Insights

Based on animal type, the livestock segment led the market with the largest revenue share of 71.85% in 2023. This can be attributed to the factors such as the rising livestock population, supportive government initiatives, and the outbreak of diseases among cattle and sheep. Vaccinations that are developed for preventing E. coli include Aviguard and Nobilis E. coli inac by Merck & Co., Inc. According to Zoetis, the prevalence rate of E. Coli in various cattle groups (cattle at slaughter, cattle on irrigated pasture, feedlot cattle, and cattle grazing rangeland forages) ranges between 0.2% to 27.8%.

The companion segment is expected to grow at the fastest CAGR during the forecast period. Canine distemper virus is carried by house pets as well as ferrets and requires strictly preventive vaccination as no post-infection treatment is available. The Morbillivirus affects dogs, foxes, raccoons, and wolves to cause distemper and is transmitted through the air as well as other modes of contact between infected and healthy animals. Immunization of dogs is essential as canine distemper destroys the respiratory, urogenital, and gastrointestinal tract. Dogs suffering from bacterial infections of the gastrointestinal tract and newborn pups are more susceptible to this disease. Several canine distemper vaccines are available in the market, including Megavac 6 and 7, DHPPi/L Vaccine, DHP, and Vanguard.

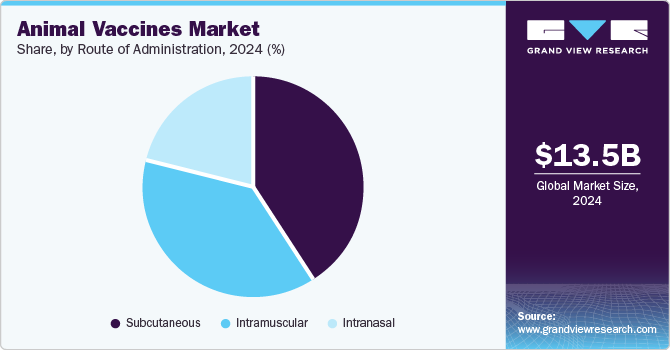

Route Of Administration Insights

Based on route of administration, the subcutaneous segment led the market with the largest revenue share of 41.18% in 2023. In most animals, the subcutaneous injection sites are located behind the shoulder blades and neck. Ease of administration of drugs subcutaneously as they can be absorbed slowly into the body is anticipated to boost the market growth. The subcutaneous route of administration is also quicker and less painful for animals. Furthermore, it is easier to train veterinary professionals to administer subcutaneous injections. Intramuscular and subcutaneous are the common routes of administration in animals currently. These factors promote market growth.

The intranasal segment is expected to grow at the fastest CAGR of 10.0% during the forecast period. Intranasal vaccines are mostly limited to a single dose. The growing prevalence of respiratory diseases in animals and rising research activities by market players to develop better vaccines are expected to fuel market growth.

Distribution Channel Insight

Based on distribution channel, the hospital/clinic pharmacy segment led the market with the largest revenue share of 19.91% in 2023. Hospital/clinic pharmacies are often at the forefront of adopting new technologies. Moreover, these facilities are often the first point of contact for pet owners and farmers seeking medical care for their animals. They serve as trusted sources for recommending and administering vaccines. Hospitals and clinics often collaborate with vaccine manufacturers, gaining access to the latest products and technologies. These partnerships can drive the adoption of new vaccines in the market.

The E-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. E-commerce platforms provide broader geographic reach, making it easier for veterinarians, farmers, and pet owners to access vaccines, especially in remote areas where physical stores may be scarce. Online retailers often offer competitive pricing compared to traditional brick-and-mortar stores, which can drive sales. Discounts, bulk purchasing, and subscription models further incentivize customers to buy online.

Regional Insights

North America dominated the animal vaccines market with the largest revenue share of 29.24% in 2023. The region is expected to remain dominant throughout the forecast period. This large share can be attributed to the high prevalence of livestock and zoonotic diseases leading to large-scale animal deaths. In addition, the market is anticipated to grow more quickly due to the high number of well-established pharmaceutical companies that are constantly working to expand their global reach and commercialize their vaccines. In addition, the growing number of pets in the United States and the rising occurrence of canine diseases, which is driving up vaccine adoption for the same, are some of the key factors contributing to the expansion of the regional market.

U.S. Animal Vaccines Market Trends

The animal vaccines market in the U.S. is anticipated to grow at the fastest CAGR over the forecast period. The market growth is attributed to a wide range of definitive measures adopted by the government animal care organizations consistently striving for overall improvement. For instance, the presence of Animal Health Emergency Management (AHEM) is aimed at ensuring food security and concentrates on aspects associated with animal products such as quality, safety, and affordability. In addition, these organizations also focus on the prevention of pathogenic agents, management of sudden disease outbreaks are involved in formulating strategies for efficient eradication and control of the disease.

Europe Animal Vaccines Market Trends

The animal vaccines market in Europe is expected to grow at a consistent CAGR over the forecast period, because of the high production and companion animal population across this region. For instance, according to the FEDIAF 2022 report, 90 million households in the EU own a pet (46%), with around 110 million cats, 90 million dogs, and other pets. Furthermore, the European Medicines Agency (EMA) and its regulatory network partners identify action plans to improve and increase the availability of animal vaccines in Europe.

The Germany animal vaccines market is anticipated to grow at a constant CAGR during the forecast period, due to the rising number of R&D activities and the influx of new animal products, rising animal adoption & cattle population, increasing adoption of preventive care for animals, and growing awareness about the significance of the health of farm & companion animals in the country. For instance, according to the German Livestock, the country has the largest dairy cattle herd & the second-largest cattle population in the EU. Furthermore, according to the International Committee for Animal Recording (ICAR), 50% of German farms specialize in livestock, which is anticipated to drive the market.

Asia Pacific Animal Vaccines Market Trends

The animal vaccines market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The anticipated rise in the livestock population and government initiatives, especially in developing economies, are some of the major factors expected to boost market growth in the region. Moreover, large cattle population in the country calls for vaccine demand. The market is driven by high R&D expenditure by many major players, combined with rising attempts for the commercialization of veterinary vaccines and inoculations at tolerably low prices.

The Japan animal vaccines market is anticipated to drive market growth. In addition, growing pet healthcare expenditure and pet adoption in Japan are expected to drive the market. For instance, Japan is the only other country in the world where pets outnumber children. According to the Japan Pet Food Association, there are over 20 million cats and dogs in the country and 17 million children under the age of 16 years. Government support and regulation for the welfare of animal health are anticipated to fuel the market growth in Japan.

Latin America Animal Vaccines Market Trends

The animal vaccines market in Latin America is expected to grow at a significant CAGR over the forecast period, owing to increasing reforms in the healthcare industry in this region. Rising incidence of chronic livestock diseases is a factor driving market growth. Furthermore, rise in supportive government funding in countries such as Brazil is another contributing factor. Presence of untapped opportunities, economic development, and rising awareness levels are some of the factors that can be accounted for the rapid growth of this region.

The Brazil animal vaccines market is anticipated to grow at a substantial CAGR over the forecast period.Growing mandates for vaccination to curb livestock disease outbreaks and increasing demand for livestock-related food products are primary factors expected to drive the market. The market growth in Brazil can be attributed to a large cattle population. For instance, according to Agro Concept Management Ltd, Brazil had the second-largest cattle herd, accounting for 232 million heads. Moreover, the country is also the world’s largest exporter of beef. This has resulted in greater awareness of animal health and, subsequently, boosted the demand for veterinary medicines in the country.

Middle East & Africa Animal Vaccines Market Trends

The animal vaccines market in Middle East & Africa is expected to grow at a significant CAGR over the forecast period. South Africa, Saudi Arabia, UAE, and Kuwait constitute the Middle East & Africa (MEA). The market in this region is anticipated to show growth due to the high incidence of diseases like animal influenza and viral diseases, such as foot-and-mouth disease, coupled with rising awareness. These factors led to an increase in the need for effective management of the aforementioned chronic diseases in regions such as South Africa. The rising urgency can be attributed to inadequate treatment alternatives present in this region. The growing consumer preference for a healthy lifestyle is also fueling the market growth.

The South Africa animal vaccines market is anticipated to grow at a lucrative CAGR during the forecast period. This is believed to be a consequence of certain government programs focused on overall animal health care improvement in the country. Livestock production accounts for up to 25% of national income. South Africa produces chicken at the 6th lowest price per kilo in the world, hence, it is competitive in the global poultry industry. Increasing government initiatives for advancing the poultry sector are key factors driving the market growth in the country.

Key Animal Vaccines Company Insights

The market is highly competitive and marked by the presence of various small and large animal vaccine manufacturers. The key parameters affecting competition include the rapid adoption of veterinary preventive injections, coupled with government-aided bulk purchase of veterinary vaccines. In addition, in an attempt to retain share and diversify the product portfolio, major players are frequently opting for various strategies such as mergers and acquisitions, partnerships, and new product launches. For instance, in February 2021, Ceva partnered with the French National Research Institute for Agriculture, Food, and Environment (INRAE) for R&D in the prevention of infectious diseases from animal origin and the improvement of animal health.

Key Animal Vaccines Companies:

The following are the leading companies in the animal vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Merck & Co., Inc.

- Boehringer Ingelheim Animal Health

- Elanco

- Virbac

- Phibro Animal Health Corporation

- Calier

- Ceva

- Bimeda Biologicals

- Neogen Corporation

View a comprehensive list of companies in the Animal Vaccines Market

Recent Developments

-

In August 2022, Zoetis expanded the poultry product portfolio with the Poulvac Procerta HVT-IBD vaccine for the protection of poultry against Infectious Bursal Disease (IBD). This added to the company’s line of recombinant vector vaccines

-

In January 2022, Boehringer Ingelheim collaborated with MabGenesis, a biopharmaceutical company, to discover novel monoclonal antibodies in canines

-

In November 2021, Ceva created a new cryogenic storage facility in Monor by investing in its European vaccine production capacity to meet the rapidly growing demand for vaccines

Animal Vaccines Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.6 billion

Revenue forecast in 2030

USD 25.1 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; Merck & Co., Inc.; Boehringer Ingelheim Animal Health; Elanco; Virbac; Phibro Animal Health Corporation; Calier; Ceva; Bimeda Biologicals; Neogen Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Vaccines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal vaccines market report based on animal type, product, route of administration, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous

-

Intramuscular

-

Intranasal

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock

-

Poultry

-

Aqua

-

Ruminants

-

Swine

-

-

Companion

-

Canine

-

Feline

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal vaccines market size was estimated at USD 13.67 billion in 2023 and is expected to reach USD 14.6 billion in 2024.

b. Some key players operating in the animal vaccines market include Zoetis, Merck & Co., Inc., Boehringer Ingelheim Animal Health, Elanco, Virbac, Phibro Animal Health Corporation, Calier, Ceva, Bimeda Biologicals, Neogen Corporation

b. The global animal vaccines market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 25.1 billion by 2030.

b. North America dominated the animal vaccines market and accounted for the largest revenue share of over 29% in 2023.

b. Key factors that are driving the animal vaccines market growth include growing livestock population, growing demand for animal derived food products, rising disease outbreak, and increasing R&D and manufacturing advancements

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."