- Home

- »

- Animal Health

- »

-

Veterinary Anti-infectives Market Size, Industry Report, 2033GVR Report cover

![Veterinary Anti-infectives Market Size, Share & Trends Report]()

Veterinary Anti-infectives Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal Type, By Product (Antimicrobials, Antifungals, Antivirals), By Route Of Administration, By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-917-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Anti-infectives Market Summary

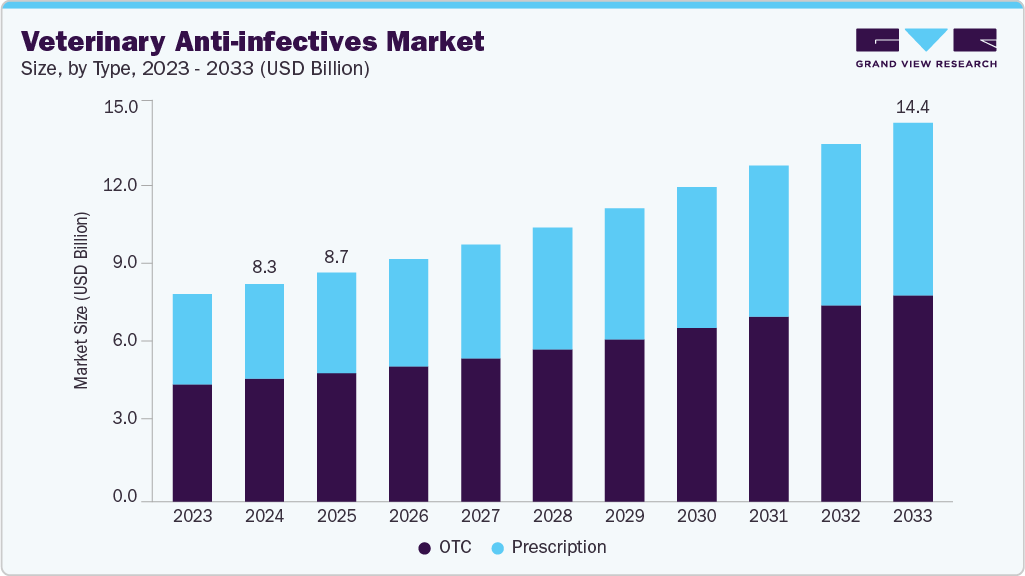

The global veterinary anti-infectives market was estimated at USD 8.26 billion in 2024 and is projected to reach USD 14.37 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. Key factors expected to drive the market include the rise in animal infectious diseases, developing research initiatives, a boost to prudent antibiotic use, increasing regulatory approvals, and growing applications of Artificial Intelligence (AI).

Key Market Trends & Insights

- North America's veterinary anti-infectives market held 35.69% of the global market in 2024.

- The U.S. took the highest share in the global market. The country market has benefited from the existence of significant industry players, including Kindred Biosciences, Elanco, Dechra, and Zoetis.

- By animal type, the livestock segment held the highest market share of 63.57% in 2024.

- Based on product, the antimicrobials segment held the highest market share of around 51% in 2024.

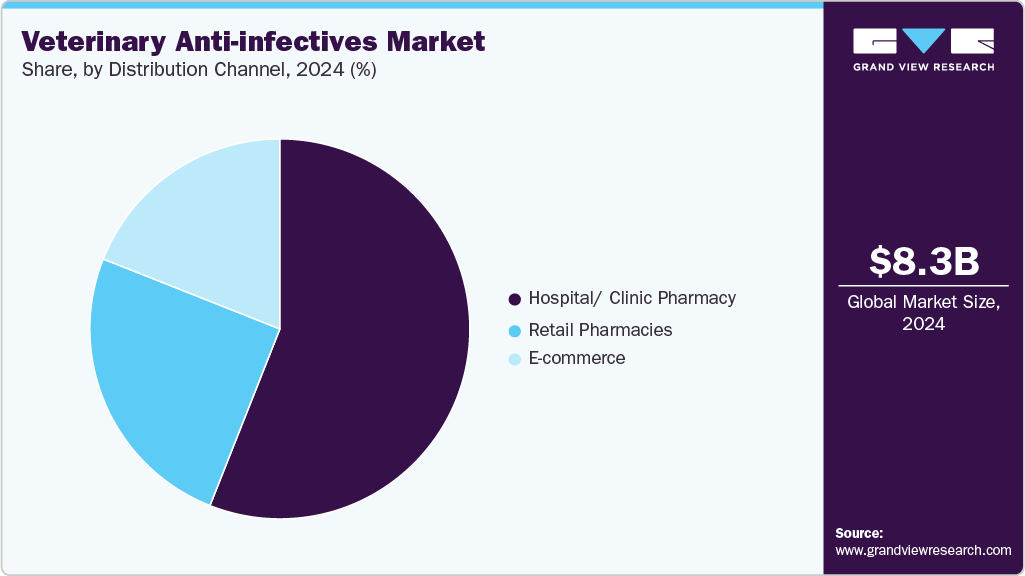

- Based on distribution channel, the retail pharmacies segment dominated the veterinary anti-infectives market in terms of share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.26 Billion

- 2033 Projected Market Size: USD 14.37 Billion

- CAGR (2025-2033): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the foremost drivers is the growing integration of artificial intelligence (AI) in veterinary practices. Educational institutions, animal welfare bodies, and commercial players are adopting AI to streamline clinical decision-making, assist in early disease detection, identify treatment gaps, and even accelerate veterinary drug discovery. AI also offers potential for predictive modeling in outbreak surveillance, helping to rationalize anti-infective use amid rising concerns of antimicrobial resistance (AMR).Another critical factor is the increasing global prevalence of infectious diseases in companion and livestock animals. For example, India-a leading dairy-producing country-witnessed a severe outbreak of Lumpy Skin Disease in 2023, which infected nearly 2.95 million cattle and resulted in over 155,000 deaths across 15 states. Similarly, in the U.S., one of the world's top beef producers, a recent outbreak of highly pathogenic avian influenza (HPAI) among cattle saw over 250 beef samples from 38 states testing positive as of May 2024. South Africa also faced a 30% drop in egg production and had to cull over a million poultry in 2023 due to HPAI. These disease outbreaks are directly escalating the demand for effective anti-infective therapies.

Rising antimicrobial resistance (AMR) is also shaping the market, prompting stricter regulatory surveillance. In June 2025, India's Central Drugs Standard Control Organisation (CDSCO) launched a nationwide initiative to monitor antibiotic use in livestock. It established inter-agency collaborations and mandated AMU (antimicrobial use) data reporting to combat misuse and overuse of antibiotics, which can drive the development and adoption of newer, more targeted anti-infectives.

Intensive R&D and industry collaborations support these regulatory developments. In March 2024, Zoetis partnered with Blacksmith Medicines to develop novel antibiotics to circumvent bacterial resistance by selectively targeting drug-resistant strains. Likewise, discoveries such as bird flu's zoonotic shift to cattle-uncovered by a veterinarian in Texas-open new avenues for therapeutic innovation in livestock disease management.

Additionally, the growth of generic and value-added veterinary medicines is expanding market accessibility. The 2024 European Market Study by Access VetMed revealed that generics account for around 50% of all veterinary product authorizations, with significant traction in anti-infectives and antiparasitics. Despite regulatory burdens like EU Regulation 2019/6, especially for SMEs, the sector remains growing, particularly for companion animal products and alternative administration routes.

Overall, the rise in infectious disease outbreaks, regulatory tightening on antimicrobial use, technological innovations like AI, and increased investment in R&D and generics significantly propel the veterinary anti-infectives market. These forces are expected to meet current treatment demands and ensure veterinary antimicrobial therapy's long-term sustainability and efficacy.

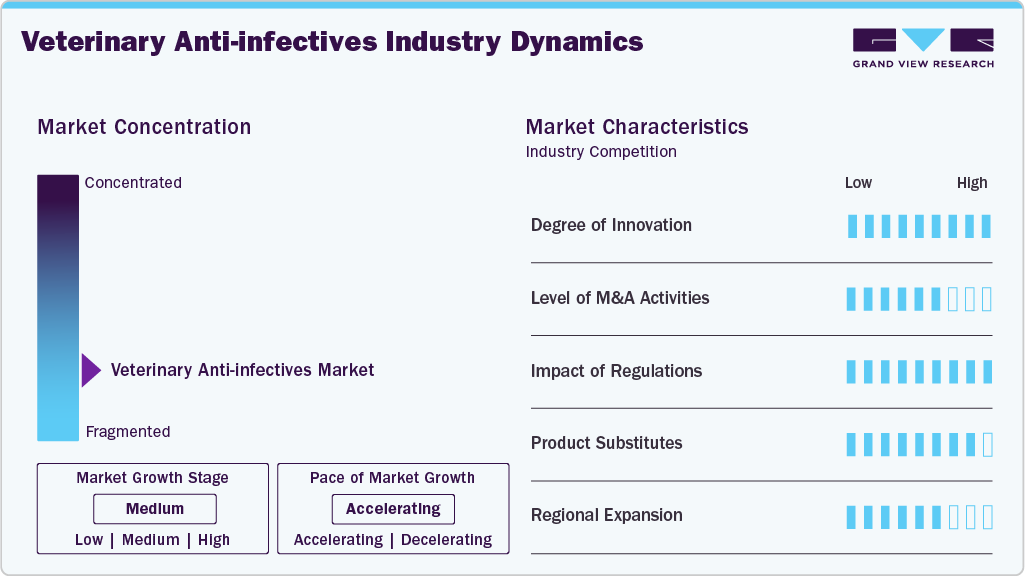

Market Concentration & Characteristics

This industry is highly innovative, with researchers worldwide launching novel products and developing creative business activities to address growing infectious diseases in animals. For example, in March 2025, Agrovet Market launched a new line of intramammary suspension antibiotics tailored for lactating and dry cows to treat and prevent mastitis. The products include multi‑antibiotic + anti‑inflammatory combinations for lactation (e.g., Pen Tetra Strep LC, Kanacef LC, Cefquinox LC, Clox‑A‑Lac LC) and long‑acting dry‑cow formulations (Clox‑A‑Dry, Cefquinox DC) designed to improve udder health and boost dairy productivity.

The market has a moderate level of mergers and acquisitions. Industry participants are attempting to consolidate the distribution channels for veterinary medicines by acquiring other platforms. For instance, in May 2024, Pharmacy2U acquired PharmPet Co. to enhance its online pharmacy services.

Regulations have a very high impact on this market. This can be attributed to regulatory restrictions on the use of antibiotics in animals amidst the rise in drug resistance. These restrictions have restricted the drugs from being used selectively and are subject to heavy regulatory scrutiny before approvals, as well as monitoring post-approval. These steps taken by organizations like the USFDA and EU aim to address concerns over antibiotic resistance and promote responsible antibiotic use.

A few players, such as Zoetis, Boehringer Ingelheim, Dechra Pharmaceuticals plc, and Merck & Co. Inc. lead the market. However, the adoption of regional products is very high due to factors like cost concerns and alternative therapies. Due to a shift in regulatory dynamics, many emerging startups aim to develop selective anti-infective drugs to bypass drug resistance.

The market is experiencing moderate regional expansion. Manufacturers are expanding their production capacity to boost revenues and introduce novel therapies in different countries to grow their regional presence. For instance, in February 2025, Zoetis expanded its cattle anti‑infective lineup by acquiring marketing rights to Loncor 300 (florfenicol) from Elanco. This adds a fourth class of antibiotics to their portfolio, providing a broad‑spectrum treatment for bovine respiratory disease (BRD) and foot rot.

Animal Type Insights

The livestock segment accounted for the largest revenue share, 63.57%, in 2024. Fish, poultry, swine, cattle, sheep, and goats are among the subcategories of the livestock segment. These animals' high disease burden and routine anti-infective use drive this dominance. Rising global demand for animal protein, especially meat, further intensifies the need for preventive and therapeutic anti-infectives. For instance, according to an April 2025 article by FnBnews, India’s meat industry has witnessed steady expansion, with production reaching 10.25 million metric tons (MMT) in 2023-24, up 4.95% from the previous year. Poultry leads with over 5 MMT, followed by buffalo meat at 4.57 MMT. India now ranks as the fifth-largest global meat producer, contributing 7% of worldwide output. Additionally, increasing focus on food safety, productivity, and sustainable livestock farming bolsters the use.

The companion animal segment is projected to grow at the fastest CAGR in the veterinary anti-infectives market due to rising pet ownership and increased awareness of the health benefits of having pets, such as reduced stress, anxiety, and improved cardiovascular health. This trend is further supported by a shift toward preventive veterinary care and the availability of specialized anti-infective products tailored for pets. Additionally, higher spending on pet healthcare and emotional bonding with companion animals drive demand for advanced therapeutic solutions, contributing to the segment's rapid expansion.

Product Insights

The antimicrobials segment dominated the veterinary anti-infectives market with a market share of around 51% in 2024, driven by the high prevalence of bacterial infections in livestock and companion animals. Widely used classes such as cephalosporins, tetracyclines, penicillins, and macrolides are essential for treating respiratory, gastrointestinal, and systemic infections. Increasing global concerns over zoonotic diseases, food safety, and antimicrobial resistance have prompted greater regulation and responsible usage. Initiatives by organizations like the WHO to combat antibiotic resistance and improve animal health systems further support the segment's dominance by ensuring sustained demand and accountable innovation in antimicrobial therapies.

The antiviral segment in veterinary anti-infectives is poised for the fastest growth due to a surge in viral disease incidence across livestock and companion animals. Recent research underscores the significant economic threats posed by endemic and emerging viral infections in cattle, swine, and other species-such as bovine respiratory syncytial virus (BRSV), foot‑and‑mouth disease, and lumpy skin disease-which result in significant production losses and heightened demand for targeted antiviral therapies. Concurrently, advancements in antiviral drug development and vaccine technologies-highlighted in MDPI’s April 2025 article-fuel innovation in veterinary virology. Coupled with growing awareness of viral threats, One Health initiatives, and the imperative for food security, these factors drive rapid investment and expansion in the antiviral veterinary segment.

Route Of Administration Insights

The oral segment dominated the veterinary anti-infectives market with a 71.04% share in 2024, primarily due to the ease and convenience of administering livestock and companion animals. Oral dosage forms-such as tablets, chewables, and liquids-enable mass medication through feed or water, reducing the need for veterinary supervision and clinic visits. This cost-effective method improves treatment compliance and is suitable for large-scale preventive and therapeutic use. Additionally, commonly used antimicrobials like tetracyclines, macrolides, and sulphonamides are well-suited for oral delivery, further reinforcing their widespread adoption.

The "Others" segment, encompassing topical, rectal, and intrauterine routes, is projected to grow at the fastest CAGR from 2025 to 2033 in the veterinary anti-infectives market. This growth is driven by veterinarians' increasing adoption of alternative drug delivery methods, particularly for cases where oral or injectable routes show poor compliance or limited efficacy. These methods are often preferred for localized infections or disease-specific needs, such as intrauterine therapy for reproductive infections or topical treatment for skin conditions. Additionally, topical routes offer enhanced bioavailability for surface infections, further boosting the segment's demand.

Type Insights

The OTC or over-the-counter segment dominated the market in 2024 by type. Animal owners prefer these products because they are affordable, suitable for mild diseases, convenient, and accessible without a prescription from a veterinarian. The popularity of over-the-counter (OTC) options indicates that animal owners prefer readily available, reasonably priced, and reliable solutions for their animals' everyday medical requirements, even while prescription treatments are necessary for severe health conditions.

The prescription segment is estimated to grow at the highest CAGR over the forecast period. This can be attributed to the recent regulatory changes that restrict veterinary drug use to prescriptive use, lowering the consumption of OTC anti-infectives and leading to increased adoption of prescription anti-infective drugs.

Distribution Channel

The retail pharmacies segment dominated the veterinary anti-infectives market in terms of share in 2024. This is explained by the accessibility and ease of delivery of immunizations and medications via retail pharmacies. Their extensive distribution networks guarantee product availability, and their well-established standing and adherence to regulations cultivate consumer confidence. Furthermore, it is projected that the digitization of retail pharmacies will spur the expansion of this market in the upcoming years by lowering the possibility of prescription errors.

The e-commerce segment is estimated to grow at the highest rate over the forecast period. This segment will be driven by the ease of ordering from home and being accessible around the clock. Online retailers improve consumer happiness by providing many products at competitive prices and home delivery options. Further driving growth has been the move to online purchasing brought about by the pandemic, increased internet use, and increased digital literacy. These factors indicate a significant shift in consumer behavior toward online purchases.

Regional Insights

In 2024, North America accounted for the largest market share of 35.69%. The existence of well-established competitors and rising treatment costs among veterinary clinics are the primary drivers of the industry. Zoonoses and Public Health (2016) states that zoonotic illnesses represent a significant burden on the North American continent. Given that animals frequently spread zoonotic illnesses, they pose an even greater risk to public health. The market is growing in part because zoonotic infections are so common. According to 2024 reports by the CDC, six out of ten infectious diseases known to spread to people can be spread by animals. Moreover, animals are the source of three of every four newly discovered or developing contagious human diseases.

U.S. Veterinary Anti-infectives Market Trends

The U.S. took the highest share in the global market. The country market has benefited from the existence of significant industry players, including Kindred Biosciences, Elanco, Dechra, and Zoetis. These businesses make substantial R&D investments to meet consumer demand and develop innovative veterinary medications. For example, in March 2025, Dechra launched DuOtic, the first FDA-approved antibiotic-free otic gel for treating yeast-driven otitis externa (primarily Malassezia pachydermatis) in dogs. This innovation combines antifungal terbinafine with anti-inflammatory betamethasone, providing up to 45 days of relief with a pre-measured, clinic-administered dose. By eliminating unnecessary antibiotic use, such products support antimicrobial stewardship and address the growing concern over resistance in veterinary health.

Europe Veterinary Anti-infectives Market Trends

Advantageous government laws like the EU Veterinary Medicines Regulation, which restricts antibiotics to specific situations and prohibits routine administration due to rising drug resistance among animals, are expected to grow the European market considerably. Furthermore, trade organizations like EFTA, the increasing pet population, rising pet insurance penetration, and better animal husbandry methodologies bolster market growth potential in the region.

Germany veterinary anti-infectives market will likely expand due to the growing pet adoption rate and the growing importance of animal husbandry. German livestock data indicates that the nation has the second-biggest cow population in the EU and the largest dairy cattle herd. The International Committee for Animal Recording (ICAR) also reports that almost half of German farms are livestock-focused, which is expected to foster favorable conditions for the veterinary anti-infectives industry.

Asia Pacific Veterinary Anti-infectives Market Trends

The Asia Pacific market is growing fastest due to the rising incidence of animal diseases, the growing concern for animal health, the increasing number of livestock, and the growing adoption of pets. A significant number of cattle and growing healthcare spending on veterinary care and animal health are additional vital factors anticipated to drive market expansion. For instance, according to April 2025 data by USDA, more than 40% of all cattle worldwide are found in China and India. The expanding population of livestock has boosted the demand for the production of meat and dairy products, which is predicted to fuel the demand for veterinary antibiotics for livestock animals.

The India veterinary anti-infectives market is expected to grow at a CAGR of more than 8% over 2025-2033. This is owed to the developing dairy industry, growing veterinary healthcare institutions, and expanded livestock production. This large cattle population, i.e., about 30% of the global population, is set to boost the demand for anti-infective drugs to ensure that infectious outbreaks do not affect livestock production in the country. Furthermore, another crucial driving factor is the recent rise in the adoption of pets like dogs and cats among Indian households and spending on preventive and therapeutic care for various infectious diseases.

Latin America Veterinary Anti-infectives Market Trends

The growing incidence of pet injuries and increased product sales drive the Latin American industry. Additionally, throughout the forecast period, the market is anticipated to be driven by the growing number of livestock and the existence of animal pharmaceutical firms. The Food & Agriculture Organization of the United Nations estimates that, with a cattle herd nearing 360 million heads, Latin America accounts for roughly 24 percent of global cattle production. Furthermore, it exports over 22% of the world's beef, accounting for 23% of worldwide beef production.

The Brazil veterinary anti-infectives market is projected to grow due to growing vaccination laws aimed at preventing the spread of animal diseases and rising consumer demand for food items related to livestock. Brazil's increasing veterinary anti-infectives market results from the country's large cattle population. At around 186 million cattle, Brazil has the second-largest herd of cattle, according to USDA data from April 2025. Additionally, it is the biggest exporter of beef in the world. Because of this, there has recently been a higher awareness of the importance of animal health, which has increased the demand for veterinary medications like antibiotics, antifungals, and antivirals, among others.

Middle East & Africa Veterinary Anti-infectives Market Trends

The Middle East & Africa (MEA) market is formed by South Africa, Saudi Arabia, Kuwait, and the United Arab Emirates. The MEA's growing need for veterinary medicine is expected to fuel the market's growth throughout the forecast period. The region's increasing prevalence of infectious diseases in animals is also likely to boost demand for veterinary treatments and medications. A further factor driving demand for veterinary medicines, including veterinary antibiotics, is the spread of animal pathogens due to increased international trade. Finally, the MEA's rising livestock and poultry adoption is anticipated to spur regional market growth.

The South Africa veterinary anti-infectives market is driven by large farmer population in the country. Many farmers maintain their animals to supply milk and meat to consumers worldwide; livestock is an essential component of the country's economic system. However, since livestock are susceptible to an array of infectious diseases, there's a growing requirement for veterinary medicines to treat pets and livestock and stop the disease from spreading to other animals. Two major influenza outbreaks since 2003 were caused by avian influenza (H5N1) and swine flu (H1N1). Therefore, it is anticipated that the rising incidence of such infectious disorders would fuel the need for veterinary medications such as anti-infectives.

Key Veterinary Anti-infectives Company Insights

The veterinary anti-infectives market is highly regulated, with strict oversight by authorities like the USFDA, the EU, and the recent addition of CDSCO to curb antibiotic misuse and resistance. While major players such as Zoetis and Boehringer Ingelheim dominate, regional and cost-effective alternatives remain popular, and new startups are emerging with selective, resistance-bypassing therapies. The market is moderately expanding geographically, as seen with Zoetis’ acquisition of Anchor 300 to strengthen its cattle portfolio. Innovation remains a key driver, highlighted by Agrovet Market’s launch of specialized intramammary antibiotics. Mergers and acquisitions are also shaping the landscape, with efforts like Pharmacy2U’s acquisition of PharmPet Co. aimed at streamlining distribution and expanding digital access.

Key Veterinary Anti-infectives Companies:

The following are the leading companies in the veterinary anti-infectives market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Dechra Pharmaceuticals Plc.

- Elanco Animal Health

- Ceva Sante Animale

- Virbac

- Biogénesis Bagó

- Vetoquinol

- Calier

- Norbrook Laboratories

Recent Developments

-

In January 2025, the Federation of Veterinarians of Europe launched Alternatives to Veterinary Antibiotics (AVANT). This ongoing project aims to reduce antimicrobial reliance in livestock by developing and promoting effective non-antibiotic solutions. It focuses on improving animal health and welfare while supporting sustainable farming practices.

-

In May 2024, Virbac acquired Sasaeah to strengthen its position in the veterinary antibiotics market, especially in the cattle segment. The company plans to offer manufacturing and R&D facilities in Japan and Vietnam through this acquisition.

-

In March 2024, Zoetis purchased a 21-acre manufacturing site in Melbourne to expand vaccine production for livestock and companion animals, increasing its footprint in Australia.

-

For instance, in April 2024, Norbrook Laboratories, a leading veterinary drugs manufacturer, doubled the production capacity at its existing facility in the U.S.

Veterinary Anti-infectives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.69 billion

Revenue forecast in 2033

USD 14.37 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Historical period

2021 - 2023

Base year for estimation

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, route of administration, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Dechra Pharmaceuticals Plc.; Elanco Animal Health; Ceva Sante Animale; Virbac; Biogénesis Bagó; Vetoquinol; Calier; Norbrook Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Anti-infectives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary anti-infectives market report based on animal type, product, route of administration, type, distribution channel & region.

-

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Livestock Animal

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

Others

-

-

Companion Animal

-

Dogs

-

Cats

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Antimicrobial

-

Tetracyclines

-

Penicillin

-

Cephalosporins

-

Macrolides

-

Quinolones

-

Others

-

-

Antifungals

-

Antivirals

-

Antiparasitic

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Topical

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

OTC

-

Prescription

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital/ Clinic Pharmacy

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary anti-infectives market size was estimated at USD 8.26 billion in 2024 and is expected to reach USD 8.69 billion in 2025.

b. The global veterinary anti-infectives market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 14.37 billion by 2033.

b. North America dominated the veterinary anti-infectives market with a share of 35.69% in 2024. This is attributable to the presence of advanced animal healthcare programs coupled with awareness regarding animal health.

b. Some key players operating in the veterinary anti-infectives market include Zoetis, Boehringer Ingelheim, Merck & Co. Inc., Dechra Pharmaceuticals Plc., Elanco Animal Health, Ceva Sante Animale, Virbac, Biogénesis Bagó, Vetoquinol, Calier and Norbrook Laboratories

b. Key factors that are driving the market growth include rise in infectious diseases among animals, growing research initiatives, a boost to prudent antibiotic use, increasing regulatory approvals, and growing applications of Artificial Intelligence (AI).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.