- Home

- »

- Animal Health

- »

-

Veterinary Chemistry Analyzer Market Size Report, 2030GVR Report cover

![Veterinary Chemistry Analyzer Market Size, Share & Trends Report]()

Veterinary Chemistry Analyzer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Benchtop, Portable), By Product (Consumables, Instruments), By Species (Cattle, Canine), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-503-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Chemistry Analyzer Market Summary

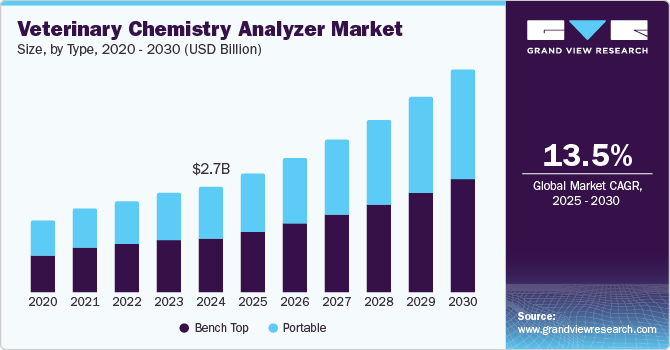

The global veterinary chemistry analyzer market size was valued at USD 2.66 billion in 2024 and is projected to reach USD 5.63 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The market is anticipated to develop due to the humanization of pets worldwide, increased investment in the animal health sector, novel technologies and developments in bringing testing to the point of care (POC), increased hospital pet visits, and increased POC diagnostics usage.

Key Market Trends & Insights

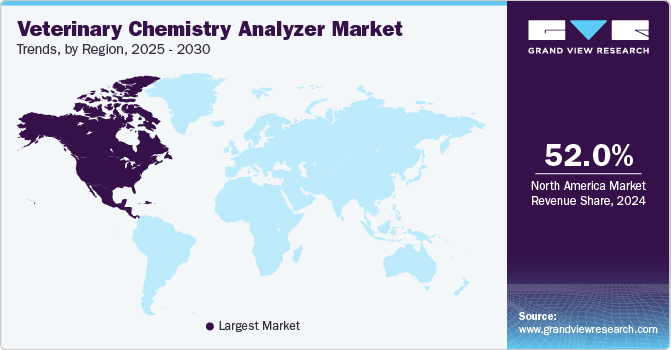

- North America veterinary chemistry analyzer market held over 52% of the overall revenue in 2024.

- The veterinary chemistry analyzer market in the U.S. held the dominant share of the regional market in 2024.

- By species, the canine segment dominated the market with a revenue share of over 36.2% in 2024.

- By type, benchtop veterinary chemistry analyzers segment held the largest market share in 2024.

- By product, the consumables segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.66 Billion

- 2030 Projected Market Size: USD 5.63 Billion

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to a study published by the American Veterinary Medical Association in October 2024, in the 2024 survey, 80% of pet owners indicated they had visited the veterinarian at least once in the past six months, with almost two-thirds making one to three visits-a rise of four percentage points compared to 2022. This surge in demand for veterinary services is leading to greater utilization of diagnostic tools, including chemistry analyzers, to facilitate faster and more accurate health assessments in clinics. As a result, the market for these analyzers is experiencing robust growth to meet the rising need for efficient veterinary diagnostics.Additionally, the market for veterinary chemistry analyzers is predicted to grow due to the increased demand for pet insurance and increased pet adoption globally. The demand for pet insurance has grown due to rising veterinary expenses. Pet diagnostic tests can be expensive, and the high cost of such diagnostics deters many pet owners from choosing treatment options. For eligible accidents and diseases, the majority of pet insurance policies will pay for diagnostics and treatments. For instance, if the "Preventative and Wellness" package is added to a Lemonade pet health insurance policy, annual wellness checkups, pet diagnostics such as x-rays, cytology, bloodwork, lab work, urinalysis, a heartworm test, and more will be covered.

However, an unprecedented rise in the adoption of companion animals to alleviate psychological stress imposed by the coronavirus pandemic may promote industry recovery in the coming years. Dog-owning households surged from 31.3 million in 1996 to 59.8 million in 2024, while cat-owning households increased from 27 million to 42.1 million. As of 2024, dog-owning households represent nearly 45.5% of all U.S. households, up from 31.6% in 1996. Cat-owning households now account for 32.1%, compared to 27.3% in 1996. Furthermore, the growing prevalence of animal-to-human infections and the increasing demand for animal protein may promote the market for veterinary chemistry analyzers.

Clinical diagnostics are now accessible, affordable, quick, and simple to use since the development of point-of-care testing. The importance of this platform resides in its ability to enable patients to monitor their health status more often in the comfort of their homes, allowing for the earliest possible diagnosis of diseases. For instance, veterinary glucometers are attributed to their ease of use in clinical settings, the workplace, and at home. An easy-to-use veterinary blood glucose monitoring system, AlphaTRAK from Zoetis is available for cats and dogs. Additionally, a rise in the prevalence of diabetes in animals is another factor that increases the demand for analyzers.

In veterinary medicine, the overuse and misuse of antimicrobials are, in large part, accountable for the development of antibiotic resistance. Antimicrobial resistance is currently regarded as one of the significant concerns to public health globally. Chemistry analyzer tests could enable veterinarians to identify if a patient's sickness is caused by bacteria earlier in the course of treatment, resulting in the prescription of fewer antibiotics when they are not necessary. As a result, this significantly contributes to reducing the overuse of antibiotics and promoting good antimicrobial stewardship, which in turn encourages overall market expansion.

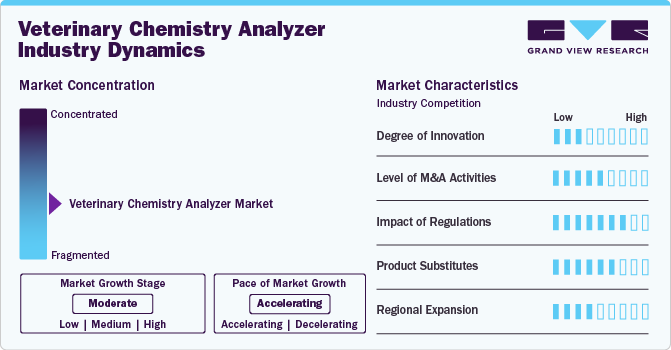

Market Concentration & Characteristics

The market is characterized by moderate industry concentration, with a mix of established companies and emerging players. Key players include IDEXX Laboratories, Abaxis, and Zoetis, which dominate the market through innovative product offerings and extensive distribution networks. However, the presence of smaller companies and startups contributes to competitive dynamics, driving innovation and potentially enhancing service offerings.

The market demonstrates a high degree of innovation, driven by advancements in automation, AI integration, and point-of-care (POC) technology. Modern analyzers are now equipped with capabilities like automated sample handling, cloud-based data storage, and streamlined interfaces for enhanced usability, allowing veterinarians to obtain accurate results quickly and efficiently. The market has seen significant growth in analyzers with AI-powered diagnostics, which offer rapid, lab-quality accuracy at the POC, reducing turnaround time for critical decisions. For instance, in January 2024, IDEXX Laboratories introduced IDEXX inVue Dx Cellular Analyzer, a slide-free, AI-powered tool that delivers rapid, reference-quality cytology and blood morphology results in just 10 minutes. Offering 3D cellular imaging and real-time diagnostics enhances diagnostic accuracy and integrates with IDEXX's ecosystem for seamless veterinary workflows.

The market has seen steady M&A activity as companies aim to strengthen diagnostic offerings, expand geographic reach, and integrate advanced technologies. Key players have been acquiring specialized diagnostics and analytics firms, targeting companies that provide innovative testing solutions, such as rapid biochemical analysis and point-of-care diagnostics. This M&A trend is driven by a growing need for enhanced diagnostic capabilities in response to increasing pet ownership, livestock health demands, and evolving veterinary care standards. For instance, in February 2024, Herdwatch acquired ComTag in Ireland and Lilac Technology in the UK, expanding its reach in the veterinary sector with software solutions for TB and blood testing. These acquisitions aim to integrate over 1,000 veterinary professionals onto the Herdwatch platform, enhancing veterinary practice management and strengthening Herdwatch’s position as a leading livestock management software provider in the UK and Ireland.

Regulations in the market significantly impact product development, compliance costs, and market entry timelines. Stricter standards, particularly in regions with advanced animal healthcare policies like the EU and the U.S., mandate rigorous testing, calibration, and quality control to ensure analyzer accuracy and safety. Compliance with these regulatory frameworks, such as the EU's In Vitro Diagnostic Regulation (IVDR) and the U.S. FDA's guidelines, raises operational costs but improves market credibility and product reliability. These regulations drive innovation as manufacturers develop analyzers that meet precise diagnostic needs while adhering to regulatory standards, ultimately enhancing diagnostic outcomes in veterinary practices.

The product substitutes include handheld diagnostic devices, rapid test kits, and point-of-care (POC) analyzers. Handheld devices and test kits offer quick, on-site testing capabilities that are convenient and cost-effective, often preferred for preliminary diagnostics in smaller practices. POC analyzers, while similar in function, are generally more compact and integrated with practice management systems, providing results rapidly with lower maintenance needs. These substitutes, though often less comprehensive than full-scale chemistry analyzers, appeal to veterinarians seeking efficiency and affordability in routine diagnostics, especially in rural or mobile veterinary settings.

The market is experiencing regional expansion driven by increasing pet ownership and the demand for advanced diagnostic tools, particularly in North America and Europe. Emerging markets in Asia-Pacific and Latin America are also seeing growth due to rising veterinary care standards and the integration of technology in animal healthcare, leading to a greater adoption of automated and efficient diagnostic solutions. This trend reflects a global push toward enhancing veterinary practices and improving animal health outcomes.

Type Insights

Benchtop veterinary chemistry analyzers held the largest market share in 2024. Advantages associated with benchtop analyzers, such as automation of tasks, reduced manual errors, high accuracy, and precision, support their demand globally. These analyzers are efficient in diagnosing certain diseases in companion animals, which is one of the major factors contributing to the most significant share held by this segment. EasyRA benchtop analyzer is a completely automated chemistry analyzer with veterinary practices' low-cost, high-speed requirements. EasyRA is quickly operational, ready to run samples, and able to analyze samples in less than 8 minutes.

Portable analyzers are anticipated to witness lucrative growth over the forecast period. Portable analyzers enable bedside monitoring and are mobile. Ease of use, facility to monitor pets at home, portability, on-the-spot results, and less training requirement are some of the factors responsible for segment growth. Soaring demand for point-of-care analyzers is further spurring the growth of the segment. For instance, in January 2023, EKF Diagnostics launched the Lactate Scout Vet, a handheld lactate analyzer tailored for veterinary use. This device allows species selection for dogs, horses, pigs, and cattle, making it suitable for small and large animal practices. The Lactate Scout Vet is designed to provide quick and cost-effective lactate testing, aiding in the prognosis and diagnosis of various clinical conditions while enhancing triage and risk stratification for veterinarians. Therefore, the global market expansion of products is anticipated to fuel market growth.

Product Insights

The consumables segment held the largest market share in 2024 and is anticipated to register the fastest growth of 13.7% over the forecast period. Consumables can be further divided into reagents, panels, and strips. Reagents accounted for approximately half of the consumables segment in 2024. Continuous requirement of consumables is likely to augment the overall market. Also, recurring purchase requirements for consumables, easy-to-use reagents, and availability of most reagents in liquid form, which requires no preparation, are factors responsible for the segment's growth.

The instruments segment is projected to progress at a significant CAGR during the forecast period due to technological product advancements. The segment has been further categorized into chemistry analyzers, blood gas & electrolyte analyzers, urine analyzers, and glucometers. The introduction of automated benchtop and portable analyzers, such as Element POC (Heska Corporation), Catalyst One (IDEXX), RX Series (Randox Laboratories Ltd.), and others, is poised to propel the growth of the market. For instance, in August 2023, Seamaty launched four innovative veterinary analyzers designed for pet hospitals, enhancing point-of-care diagnostics. These analyzers include the VG2 Blood Gas Electrolyte Immunoassay Analyzer, VG1 Blood Gas & Electrolyte Analyzer, Vi1 Fluorescence Immunoassay Analyzer, and VBC30 and VBC50 Hematology Analyzers.

Species Insights

The canine segment dominated the market with a revenue share of over 36.2% in 2024 due to the significant disease prevalence and rising adoption rates of dogs. The increasing incidence of obesity, diabetes, cancer, and other significant diseases is one of the major drivers for the market. According to the Morris Animal Foundation study published in August 2023, approximately 56% of dogs and 60% of cats in the U.S. are classified as overweight or obese. Additionally, around 30% of horses are also considered obese. As these health issues become more prevalent among companion animals, the demand for diagnostic tools that enable quick and accurate assessments of pet health is increasing. Veterinary chemistry analyzers play a crucial role in the early detection and management of these conditions, allowing veterinarians to provide timely interventions and improve patient outcomes.

The feline segment is anticipated to register the fastest CAGR during the forecast period owing to the increasing cat adoption rates in households of both developing and developed economies. Prevalent conditions in cats, such as endocrine diseases, chronic kidney diseases, and diabetes, have further raised the demand for point-of-care diagnostics, presenting the segment with lucrative growth opportunities. Furthermore, the companies are constantly investing in R&D to develop innovative diagnostics tests for cats and dogs to gain market share. For example, in June 2023, IDEXX Laboratories launched the IDEXX Cystatin B Test, the first veterinary diagnostic test for detecting kidney injury in cats and dogs, enabling earlier intervention and improved patient outcomes. This test complements existing renal health assessments, such as IDEXX SDMA and creatinine tests, by identifying kidney injury even before changes in kidney function occur.

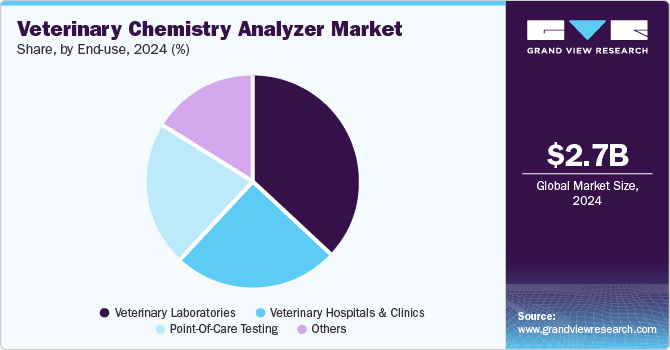

End-use Insights

Based on end-use, the veterinary laboratories segment held the largest market share and is poised to continue its dominance over the forecast period. The rising incidence of diseases such as diabetes, renal disease, cancer, and abnormalities resulting from long-term medications in animals are some of the major factors estimated to contribute to the growth of the segment. The major role of veterinary laboratories is diagnostic services and pathology. The veterinary laboratories widely work on pathology which covers investigating veterinary diseases. The growing number of advanced laboratories with better infrastructure is another factor propelling the segment's growth.

Over the forecast period, the Point-Of-Care Testing segment is anticipated to develop more quickly than other market segments. The segment growth is estimated to be driven by the growing adoption of rapid diagnostic tools. Furthermore, increasing awareness regarding animal health is projected to fuel the segment's growth. Specific advantages of point-of-care instruments, like cost-effectiveness and simplicity of use, are further anticipated to drive market growth.

Application Insights

The blood chemistry analysis segment dominated the veterinary chemistry analyzer market in terms of revenue in 2024, owing to the increasing incidence of zoonotic diseases and the rising number of veterinary practitioners. According to the WHO, it is estimated that zoonoses cause about a billion cases of disease and millions of fatalities each year globally. Zoonoses account for over 60% of new infectious illnesses that are reported globally.

On the other hand, the blood gas & electrolyte analysis segment is expected to register lucrative growth during the forecast period. The introduction of point-of-care analyzers is leading to an upswing in the demand for blood gas and electrolyte analysis. A growing need for analysis that facilitates test results for electrolyte and blood count in a given sample of serum, plasma, or urine is anticipated to boost the segment's growth.

Idexx offers a Catalyst One Chemistry Analyzer that can run any of 34 parameters for electrolyte, chemistry, and immunoassay profiles in a single run of whole blood. This analyzer is the perfect fit for clinics of any size and provides testing flexibility.

Regional Insights

North America veterinary chemistry analyzer market held over 52% of the overall revenue in 2024. North America has numerous animal health and diagnostics companies. There has been a significant rise in veterinary healthcare expenditure in the region, which is expected to accelerate the growth of the market. Moreover, well-developed infrastructure and high R&D spending in the region are factors anticipated to boost the market in the North America region.

U.S. Veterinary Chemistry Analyzer Market Trends

The veterinary chemistry analyzer market in the U.S. held the dominant share of the regional market in 2024. This can be attributed to the presence of significant players in the country, such as Zoetis and IDEXX, who are involved in the development and introduction of analyzers required to diagnose various diseases in animals. Furthermore, advancements in technology and a growing focus on improving pet healthcare drive regional markets. Manufacturers are continuously developing new devices with enhanced features such as improved accuracy, ease of use, and real-time data tracking capabilities. For example, in February 2023, Zoetis launched the AlphaTrak 3 blood glucose monitoring system for diabetic cats and dogs in the U.S., featuring a new mobile app for data collection and sharing between pet owners and veterinarians.

Europe Veterinary Chemistry Analyzer Market Trends

The veterinary chemistry analyzer market in Europe is driven by several key factors, including the rising prevalence of animal diseases, increasing pet ownership, and advancements in diagnostic technology. For example, the launch of IDEXX's Cystatin B Test allows for early detection of kidney injury in pets, addressing the growing need for precise veterinary diagnostics. Additionally, the integration of AI-powered analyzers, like Zoetis' Vetscan OptiCell, enhances diagnostic efficiency and accuracy, further propelling the market growth.

The UK veterinary chemistry analyzer market held the largest share of the European industry in 2024. The UK market is experiencing significant growth owing to an increase in product launches. Manufacturers are continuously innovating and expanding their product lines to meet the rising demand for advanced diagnostic solutions in veterinary practices. For example, according to data published by Zoetis in September 2024, Zoetis will introduce the Vetscan OptiCell, the first AI-powered cartridge-based hematology analyzer, at the London Vet Show on November 14-15, 2024. This innovative device offers Complete Blood Count analysis with laboratory-quality accuracy at the point of care, improving clinic efficiency while minimizing costs and maintenance.

Asia Pacific Veterinary Chemistry Analyzer Market Trends

The veterinary chemistry analyzer market in Asia Pacific is projected to be the fastest-growing market with a CAGR of 16.3% over the forecast period due to the growing animal population, rising awareness about animal health, and increasing adoption of pets. Pet adoption in Asia has surged over the past decade, with 60% of residents now owning a pet. Notably, 32% of the population considers their cats and dogs to be their closest companions. Countries such as China and India are expected to witness rapid market growth owing to an increase in the number of manufacturing facilities in the region. Growing R&D investment by market players for the development of value-added devices is anticipated to drive market growth in the region.

India veterinary chemistry analyzer market is witnessing notable growth owing to rising pet ownership rates, increased awareness of animal health, and the growing demand for rapid and accurate diagnostic solutions in veterinary practices. For example, as more households adopt pets, there is a corresponding need for advanced veterinary diagnostics, leading to greater investments in veterinary chemistry analyzers to ensure timely and effective healthcare for animals.

Latin America Veterinary Chemistry Analyzer Market Trends

The veterinary chemistry analyzer market in Latin America is primarily driven by increasing pet ownership, a growing emphasis on animal healthcare, and advancements in veterinary diagnostics technology. For instance, as more families adopt pets in countries like Brazil and Argentina, the demand for comprehensive veterinary services rises, leading to increased investment in veterinary chemistry analyzers for accurate and timely diagnosis. Additionally, the expansion of veterinary clinics and animal hospitals in urban areas further propels the market, facilitating access to advanced diagnostic tools for better animal health management.

Brazil veterinary chemistry analyzer market is driven by rising pet ownership, increasing awareness of animal health, and technological advancements in veterinary diagnostics. The growing trend of pet adoption, particularly among urban families, increased the demand for regular veterinary checkups and diagnostics, including blood chemistry analysis. For example, cities like São Paulo are seeing a surge in veterinary clinics equipped with advanced chemistry analyzers to provide timely and accurate diagnostics, enhancing overall animal healthcare.

Middle East & Africa Veterinary Chemistry Analyzer Market Trends

The veterinary chemistry analyzers market in the Middle East and Africa is driven by the increasing prevalence of diabetes in pets, advancements in pet healthcare technology, growing pet population, rising awareness about pet health, and availability of innovative glucose monitoring devices. These factors collectively contribute to the expansion of the market for veterinary chemistry analyzers in the Middle East and Africa region. Additionally, increased spending on animal health care and wellness, supported by a growing middle class and awareness of pet health, is propelling the market.

Saudi Arabia veterinary chemistry analyzer market is driven by several factors, including increasing pet ownership, rising awareness of animal health, and government initiatives aimed at improving veterinary services. The growing trend of pet adoption, particularly among urban populations, has led to a higher demand for regular veterinary care and diagnostics. For example, the establishment of specialized veterinary clinics in major cities like Riyadh and Jeddah reflects this trend, as these clinics are increasingly equipped with advanced veterinary chemistry analyzers to provide accurate and timely health assessments. Additionally, the Saudi government is promoting veterinary practices through regulations and initiatives to enhance animal welfare, further stimulating market growth.

Key Veterinary Chemistry Analyzer Company Insights

Competition in the overall markets is intense. The veterinary chemistry analyzers market is a well-established field in which there are a number of competitors that have substantially greater financial resources and larger, more established marketing, sales, and service organizations. Market players are focusing on the development of new products and are entering into distribution and supply agreements with other players to achieve a higher market share.

Key Veterinary Chemistry Analyzer Companies:

The following are the leading companies in the veterinary chemistry analyzer market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Zoetis

- Mars Inc. (Heska Corporation)

- HORIBA Medical

- URIT Medical Electronic Co. Ltd.

- Randox Laboratories Ltd.

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Chengdu Seamaty Technology Co., Ltd.

- SKYLA CORPORATION

- Bioevopeak Co., Ltd.

Recent Developments

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

-

In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability, featuring a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

Veterinary Chemistry Analyzer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.99 billion

Revenue Forecast in 2030

USD 5.63 billion

Growth Rate

CAGR of 13.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, species, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

IDEXX Laboratories, Inc.; Zoetis; Mars Inc. (Heska Corporation); HORIBA Medical; URIT Medical Electronic Co. Ltd.; Randox Laboratories Ltd.; Shenzhen Mindray Animal Medical Technology Co., LTD.; Chengdu Seamaty Technology Co., Ltd.; SKYLA CORPORATION; Bioevopeak Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Chemistry Analyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary chemistry analyzer market report based on type, product, species, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bench Top

-

Portable

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents

-

Panels

-

Strips

-

-

Instruments

-

Blood Chemistry Analyzers

-

Urine analyzer

-

Blood Gas & Electrolyte Analyzer

-

Glucometers

-

-

-

Species Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Canine

-

Feline

-

Caprine

-

Equine

-

Ovine

-

Porcine

-

Avian

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Chemistry Analysis

-

Urinalysis

-

Blood Gas & Electrolyte Analysis

-

Glucose Monitoring

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Laboratories

-

Veterinary Hospitals and Clinics

-

Point-Of-Care Testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of the Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary chemistry analyzer market size was estimated at USD 2.66 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The global veterinary chemistry analyzer market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 5.63 billion by 2030.

b. North America spearheaded the market in 2024 by contributing over 52% to the overall revenue. North America has numerous animal health and diagnostics companies. There has been a significant rise in veterinary healthcare expenditure in the region, which is expected to accelerate the growth of the market.

b. Some key players operating in the veterinary chemistry analyzer market include IDEXX Laboratories, Inc., Zoetis, Mars Inc. (Heska Corporation), HORIBA Medical, URIT Medical Electronic Co. Ltd., Randox Laboratories Ltd., Shenzhen Mindray Animal Medical Technology Co., LTD., Chengdu Seamaty Technology Co., Ltd., SKYLA CORPORATION, Bioevopeak Co., Ltd.

b. Key factors driving the veterinary chemistry analyzer market growth include the humanization of pets worldwide, increased investment in the animal health sector, novel technologies and developments in bringing testing to the point of care (POC), increased hospital pet visits, and increased POC diagnostics usage

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.