- Home

- »

- Animal Health

- »

-

Veterinary Dermatology Drugs Market Size Report, 2030GVR Report cover

![Veterinary Dermatology Drugs Market Size, Share & Trends Report]()

Veterinary Dermatology Drugs Market Size, Share & Trends Analysis Report By Indication, By Type, By Animal Type, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-552-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

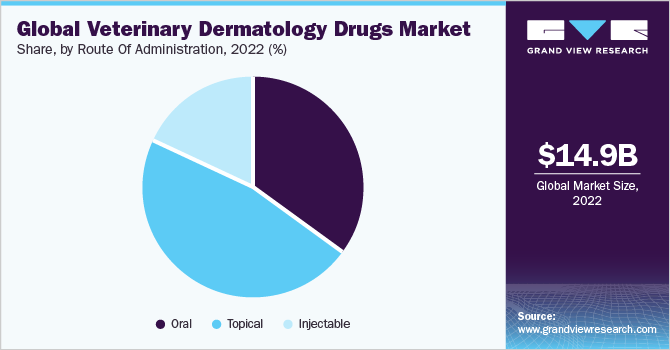

The global veterinary dermatology drugs market size was valued at USD 14.89 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 8.89% from 2023 to 2030. Increasing pet ownership, growing number of dermatology drugs clinical trials and approval, a rising incidence rate of parasitic as well as other skin diseases in animals, and investments by market players are key drivers driving the market growth. In addition, environmental changes, such as climate variations, pollution, and allergens, have led to an increase in skin-related problems in pets, further driving the demand for veterinary dermatology drugs.

The COVID-19 pandemic has affected the global supply chain for various industries, including the veterinary industry. Restrictions on international trade, lockdowns, and travel disruptions could have led to challenges in sourcing raw materials and finished products, potentially causing supply shortages for veterinary dermatology drugs. During the height of the pandemic, many pet owners postponed non-urgent veterinary visits to comply with social distancing measures and stay-at-home orders. This decline in regular veterinary visits has affected the diagnosis and treatment of skin-related issues in pets, which impacted the demand for dermatology drugs. However, post-pandemic the market bounced back with a Y-o-Y growth of over 13.0% and is anticipated to grow at a significant rate over the forecast period.

Skin diseases are common in animals, affecting both domestic pets and livestock. Various factors can contribute to these conditions, including parasites, allergies, infections, environmental factors, and genetic predisposition. Some common skin diseases in animals include flea allergy dermatitis, atopic dermatitis, ringworm, bacterial and fungal infections, and others. For instance, since May 2022, various Indian states have been affected by an ongoing outbreak of Lumpy skin disease (LSD). Lumpy skin disease is not a zoonotic illness but rather an epizootic. The Capri pox virus causes the infection, which is genetically close to the viruses that cause goat and sheep pox. Approximately 2.4 million animals were suffered as of October 21st, 2022, with over 110,000 deaths.

The pet population has grown considerably in different regions over the years. The most popular pets, including dogs and cats, are valued for offering better company to people. Due to their many advantages, including psychological comfort, lowering stress and sadness in adults, and assisting those with anxiety, pets have become an integral part of every home. In many countries, these factors contributed to pet ownership and pet humanization. For instance, according to a May 2021 report in Frontiers Media S.A., the UK had a spike in pet adoption rates, which caused shelters to be completely emptied during the COVID-19 pandemic.

The market is being boosted by key companies investing in the launch of new products. For instance, Elanco introduced its first oral flea and tick treatment for cats in May 2021. The drug, also known as Credelio CAT (lotilaner), expands Elanco's product line and gives it a competitive edge in the market.

Indication Insights

The parasitic infections segment dominated the market and held the largest revenue share of more than 40.0% in 2022. As reported by WebMD, a study carried out by Colorado State University in May 2021 identified Lyme disease-carrying ticks in abundance near beaches in Northern California, the United States. Therefore, it is anticipated that the prevalence of these parasitic conditions will promote market growth. Additionally, heartworm, lyme disease, and other parasitic illnesses of pets continue to spread in the United States, according to an AVMA study in 2022.

The allergic infections segment is expected to witness the fastest CAGR of over 9.2% during the forecast period. The rising incidence of ailments such as atopic dermatitis and other itch disorders, particularly in companion animals, is anticipated to support market growth. In addition, more pet owners making pet care decisions, which is projected to drive market growth. Furthermore, allergic dermatitis is the most prevalent form of skin condition in dogs, according to 2023 Frontiers Media S.A., twenty to thirty percent of dogs have an allergic dermatitis of some kind. One of the most significant symptoms of allergic dermatitis is pruritus, which is also frequently the most difficult to take care of.

Type Insights

The prescription segment dominated the veterinary dermatology drugs market in 2022. The vast majority of dermatologist-prescribed skin drugs are taken orally, generally in the form of a delicious, chewable tablet. Veterinarians believe that some regions are experiencing an increase in the resistance of fleas and ticks to ingredients in over-the-counter preventatives. Different compounds that may be more effective are utilized in prescription skin disease treatments. They are only available with the guidance of a veterinarian since they have a reduced margin of error when it comes to safe, effective use.

The OTC segment is anticipated to grow at the fastest CAGR of about 9.1% from 2023 to 2030. Customers can purchase over-the-counter (OTC) dermatology products online and in shops and pharmacies. Over-the-counter medications are applied topically to a pet's skin to treat fleas and ticks, either as spot-on drops or as a collar that delivers the medication over time. A prescription is not necessary for the majority of topical flea and tick medications, including spot-on treatments, a Seresto collar, and flea and tick shampoo.

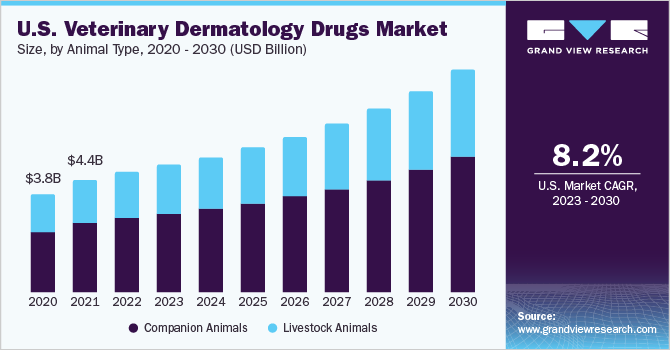

Animal Type Insights

Companion animals dominated the market in 2022, due to the rise in pet ownership, public awareness, and demand for high-quality animal care. The segment includes pet animals such as dogs, cats, horses, rabbits, and other animals. As pet ownership and adoption rates increase globally, people are more willing to make greater financial and time commitments to the well-being of their cherished pets. According to the American Kennel Club (AKC), the proportion of homes in the United States with dogs increased from 50% in 2017 to 54% in 2021, totaling 69 million. Similar to this, the FEDIAF European Pet Food Industry projects that in 2021, 90 million European families (or 46% of all households) will have at least one pet.

The livestock animals segment is expected to witness lucrative CAGR during the forecast period, The cost of animal healthcare is increasing, especially in industrialized economies, as a result of the greater adoption of farm animals, which promotes market growth. The National Agricultural Statistics Service reported in July 2022 that the total amount spent on American farms in 2021 was USD 392.9 billion, up from USD 366.2 billion in 2020. The livestock animals segment is further subdivided into cattle and others. The market for veterinary dermatology drugs is anticipated to be driven by two factors: the incidence of parasitic infections in livestock animals and the rising demand for animal protein.

Route Of Administration Insights

The topical segment dominated the market in 2022 and is expected to witness a lucrative CAGR during the forecast period. Topical drugs allow for direct application to the affected area, ensuring that the medication is delivered precisely where it is needed. This targeted approach reduces the risk of systemic side effects that might occur with oral medications. When medications are applied topically, they are absorbed locally through the skin. This limited absorption into the bloodstream helps minimize the risk of systemic toxicity and interactions with other medications the animal may be taking. Moreover, many animals may resist taking oral medications, making it challenging to ensure they receive the full course of treatment. Topical drugs can be easier to apply, leading to better compliance and treatment success. Also, topical medications can often provide quicker relief to localized skin problems compared to systemic medications that take time to circulate throughout the body.

Distribution Channel Insights

By distribution channel, hospital pharmacies dominated the market with a revenue share of 62.0% in 2022, because more pet owners are taking their animals to hospitals for treatment. Additionally, their desire to spend money on their pets and the rise in skin disorders in these animals are boosting the market growth. Patient footfall to veterinary hospitals is rising significantly as the majority of medication brands require obligatory veterinary monitoring prior to use.

The E-commerce segment is expected to witness a lucrative CAGR during the forecast period. Pet owners' quick transition to online shopping and the existence of major shops like Amazon, Walmart, Chewy.com, and PetCo are the primary factors contributing to the market growth for veterinary dermatology Products. These online merchants make it simple to choose and buy products with a quicker delivery method, which is fueling market growth. Moreover, online stores are accessible 24 hours a day, seven days a week, providing customers the flexibility to shop at their convenience, regardless of time zones or business hours.

Regional Insights

North America held the highest revenue share of over 38.0% of the market in 2022. The growing number of pet owners in North America has led to higher demand for veterinary services, including dermatological treatments for skin conditions in animals. As pet owners become more invested in the health and well-being of their pets, they are willing to spend more on veterinary services, including dermatology drugs, to ensure the best possible care. Moreover, pharmaceutical companies continue to invest in research and development of new veterinary dermatology drugs, which drives the availability of more effective treatment options.

Asia Pacific is anticipated to witness a lucrative CAGR during the forecast period. The market is growing in the region as a result of rising demand for veterinary dermatology medications and gradually rising consumer knowledge of these products available in emerging economies like China and India. Additionally, many significant market participants, like Elanco, have production operations in the Asia Pacific, which contributes to the region's continual growth.

Key Companies & Market Share Insights

The market is fragmented owing to numerous companies offering veterinary dermatology drugs. These organizations carry out a number of strategies to increase their market presence and share. Some of these initiatives include mergers & acquisitions, partnerships & collaborations, product launches, R&D, regional expansion, and more. In September 2022, for example, Zoetis completed the acquisition of Jurox, which provides Zoetis with a portfolio of important products with the potential for broader international expansion and a valuable animal health portfolio. Some of the prominent players in the global veterinary dermatology drugs market include:

-

Elanco

-

Ceva

-

Vetoquinol

-

Merck & Co., Inc.

-

Zoetis

-

Virbac

-

Bimeda, Inc

-

Vivaldis

-

Bioiberica S.A.U.

-

Boehringer Ingelheim International GmbH

Veterinary Dermatology Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.80 billion

Revenue forecast in 2030

USD 28.69 billion

Growth rate

CAGR of 8.89% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, type, animal type, route of administration, distribution channel, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Elanco; Boehringer Ingelheim International GmbH; Ceva; Vetoquinol; Merck & Co., Inc.; Zoetis; Virbac; Bimeda, Inc; Bioiberica S.A.U.; Vivaldis

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Dermatology Drugs Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary dermatology drugs market based on indication, type, animal type, route of administration, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Parasitic Infections

-

Allergic Infections

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

OTC

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animals

-

Cattle

-

Others

-

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary dermatology drugs market size was estimated at USD 14.89 billion in 2022 and is expected to reach USD 15.80 billion in 2023.

b. The global veterinary dermatology drugs market is expected to grow at a compound annual growth rate of 8.89% from 2023 to 2030 to reach USD 28.69 billion by 2030.

b. North America dominated the veterinary dermatology drugs market with a share of 38.73% in 2022. The growing number of pet owners in North America has led to higher demand for veterinary services, including dermatological treatments for skin conditions in animals.

b. Some key players operating in the veterinary dermatology drugs market include Elanco, Boehringer Ingelheim International GmbH, Ceva, Vetoquinol, Merck & Co., Inc., Zoetis, Virbac, Bimeda, Inc, Bioiberica S.A.U., Vivaldis.

b. Key factors that are driving the veterinary dermatology drugs market growth include a growing number of clinical trials related to veterinary dermatology drugs, the rising prevalence of skin diseases in animals as well as high investments by market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."