- Home

- »

- Animal Health

- »

-

Veterinary DNA Testing Market Size, Industry Report, 2030GVR Report cover

![Veterinary DNA Testing Market Size, Share & Trends Report]()

Veterinary DNA Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Dogs, Cats), By Sample (Blood, Saliva), By Test (Breed Profile, Genetic Diseases), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary DNA Testing Market Size & Trends

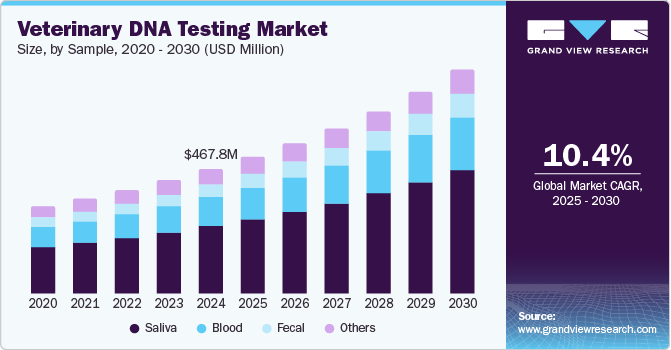

The global veterinary DNA testing market size was estimated at USD 467.81 million in 2024 and is projected to grow at a CAGR of 10.36% from 2025 to 2030. Factors driving market growth include the increasing popularity of DNA testing, efforts to spread awareness and education, the emergence of novel research projects, and increasing exploratory studies in multiple species. The market has steadily progressed with lucrative growth in the last decade owing to growing large scale genomic research projects.

Multiple veterinary entities such as research institutions, animal welfare organizations, veterinary education & clinical settings, independent researchers, etc., are increasingly engaging in comprehensive research projects spanning multiple species such as dogs, cats, horses, turtles, livestock, etc. These projects are focused on acquiring and storing crucial DNA and genetic information to facilitate the field. Some of the key projects in this sector are The Dog Genome Project, The Equine Genome Project, and The Canine DNA Recovery Project (CDnaRP).

The Dog Genome Project, conducted by the National Human Genome Research Institute (NHGRI) of the National Institute of Health (NIH), focuses on genetics associated with canine health and body structure. In this project, pet owners and veterinarians voluntarily submit DNA samples from domestic dogs. This project aims to understand the genetic correlations of traits like size, coat color, and behavior, which differ vastly across dog breeds. The project focuses on finding DNA variations in more than 350 identified inherited diseases among dogs. Since many diseases in dogs mirror human disorders, findings have the potential to offer dual insights into dog health as well as human health. This project's researchers are encouraging voluntary DNA sample submissions from any dog owner to facilitate ongoing studies. The researchers are actively sharing valuable research updates and opportunities for interaction and participation across multiple platforms.

Furthermore, since 1995, multiple scientists from over 20 laboratories across the globe, funded by organizations like the Havemeyer Foundation and the NIH, have initiated the "Horse Genome Project." This project, helmed by Antczak Laboratory of Germany, has mapped and sequenced the horse genome to study gene function in horses worldwide. Researchers have successfully identified the mutation behind Lavender Foal Syndrome in Arabian horses and created a diagnostic test. The researchers also released genetic testing standards for promoting rigorous diagnostic validation in routine clinical practice owing to growing concerns about commercially available tests. These guidelines ensure that owners and veterinarians exercise caution and utilize tests backed by sound scientific data. Experts emphasize making veterinarians understand the importance of responsible testing to ensure that their patients receive accurate guidance. The project also underscores the necessity of transparency and patient education regarding test results. The project's researchers also present the possibility of these genetic tests helping determine the best animal diet and exercise plan. These guidelines highlight the importance of reproducibility, ethical research practices, industry education, clear distinctions between scientific developments and commercial interests, and the integration of genetic information with traditional breeding approaches.

Industry experts are also engaging in pioneering research initiatives to develop innovative testing practices in the sector. For instance, in September 2024, Liverpool John Moores University initiated a novel research project called the Canine DNA Recovery Project (CDnaRP). This IVC Evidensia-supported project has developed “Early Evidence Kits” to collect canine DNA from livestock animals to help identify dogs responsible for livestock attacks. Currently, these kits are available in around 10 regions across the UK to help gather samples for this project.

Such projects will lead to a more precise and comprehensive collection of genomic data on animals and aid in accurate and timely disease detection, personalized treatment plans, and better-informed breeding practices. Such advancements will allow for a more proactive and preventative approach to veterinary health management.

Key Benefits of DNA Testing in Pets

Category

Description

Benefits/Insights

Ancestry Unveiling

Determines the specific breeds present in a mixed-breed dog's genetic makeup.

Provides clarity on inherited physical and behavioral traits. Demystifies breed-specific characteristics (e.g., herding instincts, ear shape).

Behavioral Insights

Explores the genetic component of behavior.

Helps anticipate and manage behaviors like territoriality, playfulness, and excitability. Allows for tailoring training methods to a pet’s genetic predispositions.

Health & Growth Predictions

Offers predictions about an adult dog's size and potential health risks.

Enables proactive planning for diet, exercise, and veterinary care, which is especially valuable for pet owners.

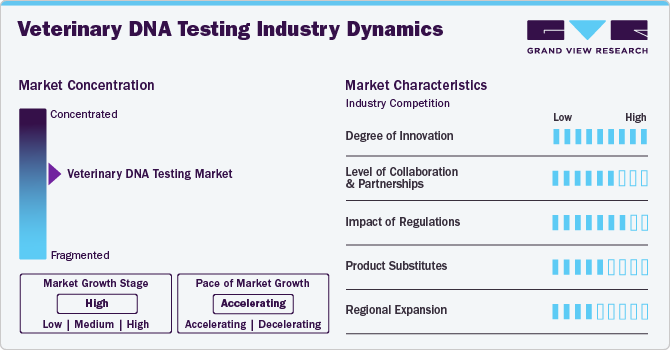

Market Concentration & Characteristics

The industry is experiencing and is expected to experience an increasing degree of innovation. This is mainly owing to extensive research projects being conducted worldwide. These projects include pets like dogs and cats and involve other species like cattle, horses, sheep, turtles, and many more. The initiatives are increasing the innovative variety of products/ services available in the industry.

The level of collaboration in this market is expected to be moderate to high. This is because various industry participants, such as laboratories, research institutions, veterinary hospitals and clinics, manufacturers, etc., are constantly collaborating to enhance access to such tests by creating novel solutions and supporting centralized databases focusing on veterinary genomic data gathering.

Regulations such as the Kennel Club's Health Standard and International Federation for Equestrian Sports (FEI) Veterinary Regulations emphasize accuracy and ethical data handling. The Kennel Club guidelines categorize these DNA tests as "Good Practice" or "Best Practice" to ensure breeders utilize only approved labs for disease prediction. FEI regulations mandate DNA profiling for equine identification and anti-doping compliance, with strict lab standards. These regulations promote consumer trust and ensure the ethical use of genetic information. Therefore, the overall impact of regulation is estimated to be slightly higher than moderate.

The industry is experiencing a low impact of product substitutes. However, this picture will change due to the many active research and development initiatives across the sector. With researchers and companies actively developing novel products for many animal species, the impact of product substitutes is expected to rise shortly.

Despite the current moderate level of regional expansion efforts, a trend of spreading business across countries, either by opening a branch or acquiring domestic companies, has been observed in recent years. Such trends are set to fuel regional expansion across the industry. For instance, emerging companies from developing regions like Asia Pacific are entering developed and lucrative markets like Europe.

Animal Insights

The dog segment is expected to dominate in 2024, with a market share of more than 67%. This can be attributed to factors such as high dog adoption and healthcare expenditure, well-penetrated adoption of DNA tests in these animals, and a continuous cycle of innovative research and product development. For instance, in October 2024, Ancestry, a leading genealogy company, launched a novel canine DNA test called Know Your Pet DNA Breeds & Health Kit. This kit offers insights into over 200 canine genetic health conditions and 30+ behavioral [ traits across 400+ dog breeds. Under a partnership, the customers of this test receive a free one-month consultation from veterinary telemedicine service provider Dutch.

Other animal segments, including cattle, horses, birds, turtles, etc., are anticipated to grow at the highest growth rate of 11.6% over the forecast period. This can be attributed to increasing efforts by industry participants to launch DNA tests for previously less explored species like cattle, sheep, turtles, etc., as well as the establishment of large-scale DNA testing projects for animals like horses. For instance, researchers from Iowa State University's College of Agriculture and Life Sciences in September 2024 successfully initiated the cataloging of genetic regulatory regions in the DNA of livestock animals. This will assist in improving animal breeding for efficiency and health by identifying variation in the DNA. These regions of the DNA influence multiple traits in these animals by creating heritable genetic or epigenetic variation. The current focus of this project is on cattle, pigs, and sheep, with the ultimate goal being to develop an open-source database to assign functions to specific DNA sequences supported by an online resource and training programs.

Sample Insights

Based on sample, the saliva segment held the largest share of 54.36% in 2024. The saliva sample is preferred and adopted more commonly over others because of its ability to provide significantly higher DNA yields. Some studies show that saliva samples contain DNA roughly ninefold more than blood samples. In addition, collecting this sample is the most non-invasive and convenient method for pet owners and veterinarians. This can also be seen in the commercially available test kits, wherein the majority offer a simple saliva sample collection feature.

Conversely, the fecal segment is expected to grow at the fastest CAGR during the forecast period. Compared to other samples such as blood, semen, hair, tissue, teeth, bone, vomit, organ, and urine, the fecal sample collection is the second best after the saliva sample. It is non-invasive, barring the issue of animal compliance, and the collector can easily take this sample after an animal defecates. This sample has received regulatory validation in some regions of the world, with governments making it mandatory to conduct canine DNA tests through feces.

Test Insights

Based on test, the breed profile segment held the largest share of 41.4% in 2024. This can be owed to their accuracy in identifying an animal’s genetic makeup, which assists in determining its ancestry and potential health risks associated with specific breeds. This information is crucial for animal owners and breeders to make informed decisions about breeding pairs to reduce the likelihood of transferring genetic diseases to the offspring. This test also helps owners design diets, exercise plans, and health monitoring based on the needs of a breed. Breed profiling through DNA testing enhances dogs' health and well-being and supports responsible breeding practices.

The genetic disease segment is set to lead the growth rate of this segment over the forecast period. DNA tests are crucial in identifying risk related to inherited disease. Complete genetic profile assessment helps in the early detection of predispositions in animals, which can prove fatal to themselves or their offspring. In breeding programs, mandatory DNA profiling lessens the risk of harmful mutations, reducing disease transmission to offspring. Furthermore, a trend of increasing research initiatives for the timely detection of various animal genetic diseases can be noticed in this sector. For instance, in February 2025, researchers from Utrecht University, Netherlands, developed a novel DNA test to detect polymyositis, a hereditary muscle disease common in the local dog breed, Kooikerhondjes. The test can identify a crucial piece of DNA linked to the dog’s immune system function, which causes muscle inflammation. This research study was published in Plos Genetics and was conducted with the support of The Society for the Dutch Kooikerhondje (VHNK).

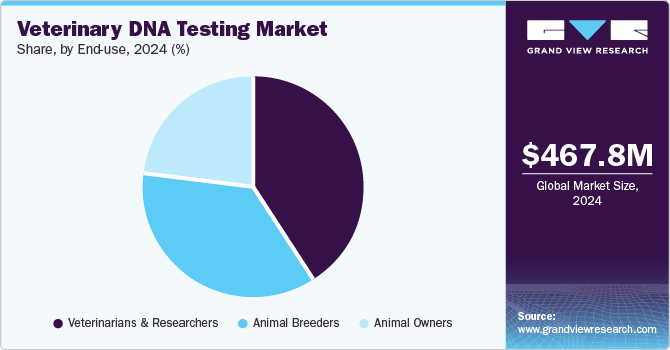

End Use Insights

Based on end use, the veterinarians & researchers segment held the largest share of 40.86% in 2024. These individuals are key users of these DNA tests, primarily for diagnosing and managing animal genetic diseases. Researchers use DNA tests to explore the genetic basis of veterinary diseases, intending to develop novel diagnostic tools and treatments. On the other hand, veterinarians rely on these tests for accurate genetic disease diagnoses and base their advice to pet owners on health management strategies. The information from DNA tests is crucial for maintaining breed health and diversity. In addition, genetic data supports the development of precision medicine approaches tailored to individual animals. By integrating genetic testing into veterinary practice, veterinarians and researchers contribute to improving animal health outcomes.

The animal owners segment is expected to grow at the fastest CAGR of 11.47% during the forecast period. Pet owners increasingly use DNA tests to uncover their pets' ancestral history, breed makeup, and potential physical traits. These tests provide valuable insights into genetic diseases, behavioral changes, and drug sensitivity, allowing for early intervention. This information helps owners prepare for potential health issues and tailor care to their pet's needs. In addition, ancestry tests verify breed authenticity when purchasing from breeders.

Furthermore, DNA tests are also on the rise among owners of animals such as horses, cattle, sheep, goats, and other species. These tests help them verify parentage, identify genetic diseases, and assess breed ancestry, which is crucial for informed breeding decisions and health management. For horses, DNA tests are particularly valuable for parentage verification and identifying genetic traits related to health and equestrian performance.

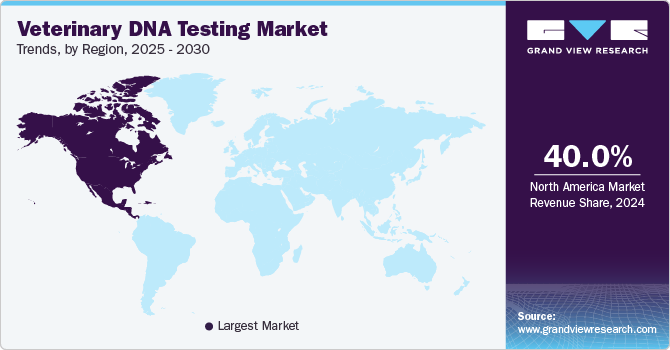

Regional Insights

North America veterinary DNA testing industry dominated globally with a share of more than 40% in 2024. This can be attributed to growing financial investments by academic & research institutions across countries like the U.S., Canada, and Mexico into building advanced DNA-based technologies to boost various industries from veterinary health to meat production. For instance, the University of Alberta's Faculty of Agricultural, Life & Environmental Sciences, Canada, in July 2024, invested about CAD 2.2 million (USD 1.5 million) into developing advanced DNA technology. The startup from the institution, Livestock Gentec, over the next four years is testing the DNA of 40,000 cattle, providing reports on traits like fertility, feed efficiency, and carcass quality. This will enable producers to breed cattle that have low food intake, produce less methane, and maximize profits. The project aims to improve genomic tools and support the beef industry's long-term sustainability and food security.

U.S. Veterinary DNA Testing Market Trends

The U.S. veterinary DNA testing industry leads in revenue in the global market due to researchers and veterinarians from the country constantly developing innovative solutions to tackling challenges in the veterinary industry. For instance, in April 2024, scientists from Nebraska-Lincoln University cataloged two genetic mutations in cattle breeds. These mutations are delayed blindness in Herefords cattle, bovine familial convulsions, and ataxia in Angus cattle. These discoveries enable beef producers to make informed breeding decisions to avoid producing affected cattle. Identifying these mutations was done in collaboration with breed associations and producers across the country, reporting complications and highlighting the importance of communication in addressing genetic problems. Genetic tests have been developed commercially to allow producers to manage these mutations within their herds.

Europe Veterinary DNA Testing Market Trends

The veterinary DNA testing industry in Europe is anticipated to grow fastest over the forecast period due to factors like advancing regulations, large-scale research projects, efforts to spread education and awareness about DNA testing, expanding applications of DNA tests, product launches, and many more. These initiatives are not limited to a specific country but span across regions across countries such as the UK, Germany, Italy, and Netherlands. For instance, in July 2024, Generatio GmbH, a German company, launched a new DNA test that detects deafness in cats with a Dominant Blue Eye color (DBE). A mutation in the PAX3 gene causes this deafness. The test identifies the DBE-RE allele, which leads to deafness and is associated with blue eyes and white fur patches, allowing breeders to avoid breeding affected cats.

The UK veterinary DNA testing industry is the most lucrative in Europe, with the largest market share in 2024, and is projected to have the fastest growth rate over 2025 - 2030. In recent years, the UK has been very active in various initiatives like novel product launches, cross-species research projects, exploring applications of DNA tests in different animals, attracting international players to the domestic market, and many more. For instance, a new DNA test that identifies mud snails infected with liver fluke by detecting their DNA in water samples has been developed by a joint project by Farming Connect and IBERS at Aberystwyth University, UK. This test helps farmers to identify high-risk habitats, which enables targeted livestock management decisions. Farms receive detailed maps assessing fluke infection risks and supporting strategies like fencing and drainage to minimize livestock exposure. The DNA test also detects liver fluke and rumen fluke DNA, offering a comprehensive assessment of fluke infection risks in fields.

The veterinary DNA testing industry in Italy is witnessing lucrative growth that can be attributed to advancing veterinary DNA testing regulations in the country. For instance, in January 2024, the Italian province of Bolzano made it mandatory to conduct DNA tests for all dogs in the province to combat the problem of dog waste on city streets. Pet owners must register their dogs' genetic profiles in a centralized database. Abandoned dog droppings will be DNA-matched to the database, and the owners will be fined.

Asia Pacific Veterinary DNA Testing Market Trends

The Asia Pacific veterinary DNA testing industry is set to experience lucrative CAGR owing to companies from the region expanding their business presence into leading regions of the market. For instance, in September 2024, Orivet, an Australian veterinary company, acquired Animal DNA Diagnostics, a company from the UK, to expand its operations in the country’s DNA testing market.

The veterinary DNA testing industry in India is growing steadily due to the use of advanced genetic technologies to enhance the health management of the country's dominant animal species, cattle. India is home to the largest cattle population in the world and also leads in milk production. This dominance requires efficient efforts to maintain proper breeding practices and health management. One such effort was taken by multiple institutional genetic analyses published in Nature Journal in April 2024. Owing to the 2022 lumpy skin disease virus outbreak in India, the researchers analyzed and identified over 1,800 mutations in the LSDV virus' DNA genome. Such studies prompt appropriate treatment and disease eradication responses in the affected regions.

Latin America Veterinary DNA Testing Market Trends

The adoption of veterinary DNA testing in Latin America is increasing due to rising pet ownership, growing awareness of animal health, and advancements in genetic testing technologies. Countries like Brazil and Argentina are leading this trend, supported by regulatory developments and research initiatives enhancing consumer confidence in DNA testing. For instance, in January 2025, scientists from Argentina created the first genetically edited horses using CRISPR-Cas9, enhancing their muscle growth and speed. This breakthrough positions Argentina as a leader in genetic testing and editing, offering potential benefits for equine performance and raising ethical concerns about genetic modifications and fair competition. Regulatory bodies are addressing these ethical implications to ensure compliance with existing regulations.

The veterinary DNA testing industry in Brazil is driven by increasing awareness among pet owners about responsible breeding and animal welfare. DNA testing is crucial in verifying pet lineage and genetic health, helping prevent deceptive practices by breeders. The growing demand for transparency in pet ownership further supports the expansion of the pet DNA testing market in Brazil.

Middle East & Africa Veterinary DNA Testing Market Trends

The veterinary DNA testing industry across the MEA is witnessing growth due to emerging trends in pet humanization and a growing awareness of pet health. There is a gradual shift towards sophisticated pet care practices, which include genetic testing for better health management. However, the market's growth is also influenced by the availability of veterinary services and awareness campaigns about the benefits of DNA testing.

The veterinary DNA testing industry in South Africa is set to exhibit lucrative CAGR owing to veterinarians exploring the use of DNA testing in exotic animal species. For instance, in May 2024, a DNA testing study from South Africa revealed that a large genetic diversity was documented in leopards from the country. Researchers compiled a comprehensive mitochondrial DNA dataset to study leopard genetics, showing that this high genetic diversity enhances the leopards' resilience to environmental changes and diseases, underscoring the need for conservation efforts to protect this population.

Key Veterinary DNA Testing Company Insights

The veterinary DNA testing industry is experiencing high growth, driven by rapid advancements in diagnostics and increased R&D investments by key players. The market is primarily consolidated but expected to move towards fragmentation, with significant and upcoming minor players focusing on new product development and collaborations with research institutions. These partnerships enhance market presence and expand the availability of DNA testing solutions. Key players are also expanding globally to tap emerging markets and capitalize on growing awareness of veterinary diagnostics. Overall, the market's growth is influenced by technological advancements and strategic collaborations.

Key Veterinary DNA Testing Companies:

The following are the leading companies in the veterinary DNA testing market. These companies collectively hold the largest market share and dictate industry trends.

- EasyDNA

- Wisdom Panel (Mars Inc.)

- Macrogen, Inc.

- Embark Veterinary, Inc.

- The Royal Kennel Club Ltd.

- Zoetis Services LLC

- Orivet

- Neogen Corporation

- LIC

- Animal Genetics, Inc.

- VHLGenetics

- AffinityDNA

Recent Developments

-

In February 2025, The Royal Kennel Club approved new DNA testing schemes for gangliosidosis, a progressive neurological disease, in Japanese Shiba Inus. These tests can identify dogs as Clear, Carrier, or Affected, helping breeders make informed decisions to reduce the disease risk in future generations.

-

In January 2025, scientists from the U.S. successfully developed one of the first portable eDNA tests capable of detecting the critically endangered Swinhoe's softshell turtle in large bodies of water. This innovative tool, which uses qPCR technology, allows for real-time, on-site testing, bypassing the need for specialized labs and speeding up the process of locating the remaining individuals of this species. The test is currently being deployed in Vietnam to search for more turtles and aid in conservation efforts.

-

In May 2024, Everfur launched the Fur-Forward Diagnostics Kit, which utilizes a fur sample to provide insights into pet health areas like fur quality, brain health, digestion, and immunity.

Veterinary DNA Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 511.89 million

Revenue Forecast in 2030

USD 838.01 million

Growth Rate

CAGR of 10.36% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal, sample, test, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

EasyDNA; Wisdom Panel (Mars Inc.); Macrogen, Inc.; Embark Veterinary, Inc.; The Royal Kennel Club Ltd.; Zoetis Services LLC; Orivet; Neogen Corporation, LIC; Animal Genetics, Inc.; VHLGenetics, and AffinityDNA

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary DNA Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary DNA testing market report based on animal, sample, test, end use, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Saliva

-

Fecal

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Breed Profile

-

Genetic Diseases

-

Health and Wellness

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinarians & Researchers

-

Animal Breeders

-

Animal Owners

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary DNA testing market size was estimated at USD 467.81 million in 2024 and is expected to reach USD 511.89 million in 2025.

b. The global veterinary DNA testing market is expected to grow at a compound annual growth rate of 10.36% from 2025 to 2030 to reach USD 838.01 million by 2030.

b. The UK market is the most lucrative in Europe, with the highest market share in 2024 and the highest growth rate over 2025 – 2030. In recent years, the UK has been very active in various initiatives like novel product launches, cross-species research projects, exploring applications of DNA tests in different animals, attracting international players to the domestic market, and many more.

b. Some key players operating in the telemedicine market include EasyDNA, Wisdom Panel (Mars Inc.), Macrogen, Inc., Embark Veterinary, Inc., The Royal Kennel Club Ltd., Zoetis Services LLC, Orivet, Neogen Corporation, LIC, Animal Genetics, Inc., VHLGenetics, and AffinityDNA.

b. Key factors that are driving the market growth include increasing popularity of DNA testing, efforts to spread awareness and education, the emergence of novel research projects, and increasing exploratory studies in multiple species.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.