- Home

- »

- Animal Health

- »

-

Veterinary Intravenous Solutions Market Size Report, 2030GVR Report cover

![Veterinary Intravenous Solutions Market Size, Share & Trends Report]()

Veterinary Intravenous Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Animal Type (Companion Animals, Production Animals), By Indication, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-099-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Intravenous Solutions Market Summary

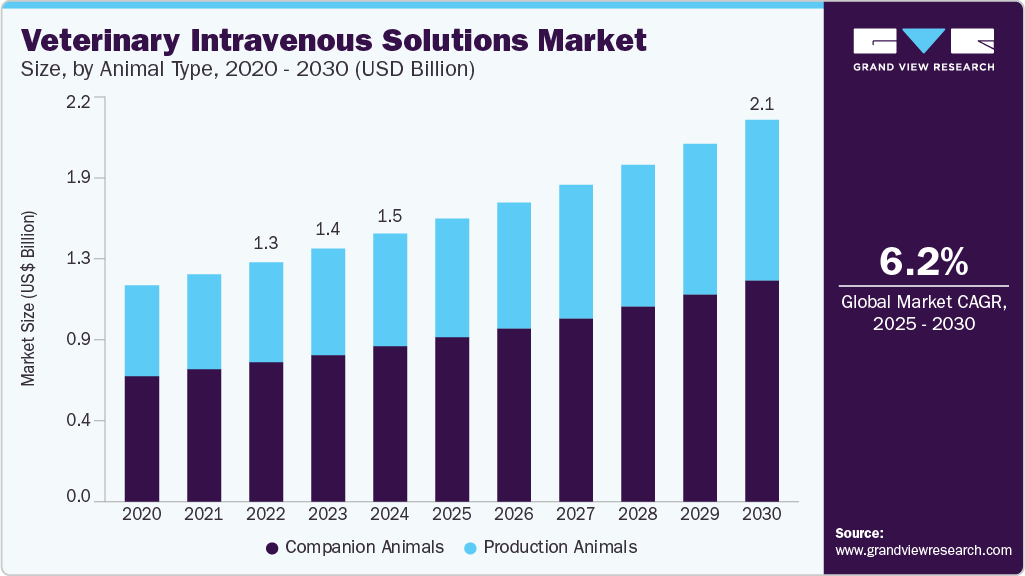

The global veterinary intravenous solutions market size was estimated at USD 1.45 billion in 2024 and is projected to reach USD 2.07 billion by 2030, growing at a CAGR of 6.21% from 2025 to 2030. For instance, according to an article published by International Cat Care, in February 2025, chronic kidney disease (CKD) can affect cats at any age but is most frequently diagnosed in middle-aged to senior cats, particularly those over 7 years old.

Key Market Trends & Insights

- North America dominated the market and accounted for a revenue share of over 38.09% in 2024.

- The U.S. market is experiencing steady growth, driven by the rising incidence of chronic diseases in companion animals.

- By product, the isotonic crystalloids segment dominated the market and accounted for a revenue share of over 42.00% in 2024.

- By animal type, the companion animal segment dominated the market with a revenue share of over 58.0% in 2024.

- By indication, the diabetic ketoacidosis segment dominated the market for veterinary intravenous (IV) solutions with a revenue share of over 28.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.45 Billion

- 2030 Projected Market Size: USD 2.07 Billion

- CAGR (2025-2030): 6.21%

- North America: Largest market in 2024

It is estimated that approximately 20% to 50% of cats aged 15 and older exhibit some level of CKD. The growing adoption of pet insurance worldwide is playing a pivotal role in driving demand for veterinary intravenous (IV) solutions. With rising veterinary costs, pet insurance helps owners manage expenses and opt for higher-quality treatments, especially in critical care situations where IV therapy is essential. IV therapy is a cornerstone in the treatment of a variety of pet health conditions such as dehydration, infections, post-surgical recovery, renal disorders, and toxin exposure, which are frequently covered under pet insurance policies. This access to reimbursement encourages pet owners to choose intensive care options that include IV administration, rather than delaying or avoiding treatment due to cost concerns.

For example, according to an article published by the North American Pet Health Insurance Association, Inc. (NAPHIA) in April 2025, approximately 7.03 million pets were insured in North America by the end of 2024, marking a 12.2% increase from the 6.25 million insured pets in 2023. Additionally, a 2024 article by PetMD highlights that horse insurance can range from USD 300 to USD 3,000, with basic plans typically covering diagnostic tests, treatments, and surgeries, including those related to chronic diseases. With pet owners increasingly prioritizing the health of their horses and dogs, these trends are expected to significantly drive growth in the veterinary intravenous (IV) solutions industry.

Pricing Analysis

Type of Product

Price Range in USD

Size

Isotonic Crystalloids

Lactated Ringer’s Solution (LRS)

$8.00 - $15.00

1 x 1000 ml

0.9% Sodium Chloride (Normal Saline)

$7.00 - $11.00

1 x 1000 ml

Plasma-Lyte

$10.00 - $460.00

1 x 1000 ml

Normosol-R

$5.00 - $11.00

1 x 1000 ml

Synthetic Colloids

Hetastarch

$30 - $60

1 x 1000 ml

Tetrastarch

$40 - $70

1 x 1000 ml

Gelatins

$25 - $50

1 x 1000 ml

Dextrans

$30 - $60

1 x 1000 ml

Blood Products

Whole Blood

$100 - $200

1 x 500 ml

Packed Red Blood Cells (pRBCs)

$80 - $150

1 x 250 ml

Fresh Frozen Plasma (FFP)

$60 - $120

1 x 250 ml

Frozen Plasma (FP)

$50 - $100

1 x 250 ml

Cryoprecipitate

$100 - $200

1 x 50 ml

Platelet-rich plasma

$150 - $300

1 x 50 ml

Dextrose Solutions

5% Dextrose in Water (D5W)

$1 - $2

1 x 1000 ml

2.5% or 5% Dextrose in LRS or 0.45% NaCl

$2 - $3

1 x 1000 ml

50% Dextrose (concentrated)

$4 - $9

1 x 500 ml

Parenteral Nutrition

Amino acids

$25 - $50

1 x 1000 ml

Lipids

$30 - $60

1 x 1000 ml

Electrolytes

$10 - $20

1 x 1000 ml

Vitamins & trace elements

$20 - $40

1 x 1000 ml

Moreover, dehydration is a common and potentially life-threatening condition in both companion animals and livestock. For instance, according to an article published by Hindustan Times, in February 2025, in January 2025, a total of 177 dehydrated animals, including 158 birds and 19 mammals, were admitted to the Transit Treatment Centre (TTC) in Bavdhan, marking a notable increase in such cases. According to data from the RESQ Charitable Trust, a non-governmental organization working in partnership with the Maharashtra Forest Department, these admissions were primarily due to weather-related health issues, with dehydration being a leading concern. These conditions often necessitate immediate rehydration, electrolyte balance, and medication delivery, all of which are effectively managed through IV therapy.

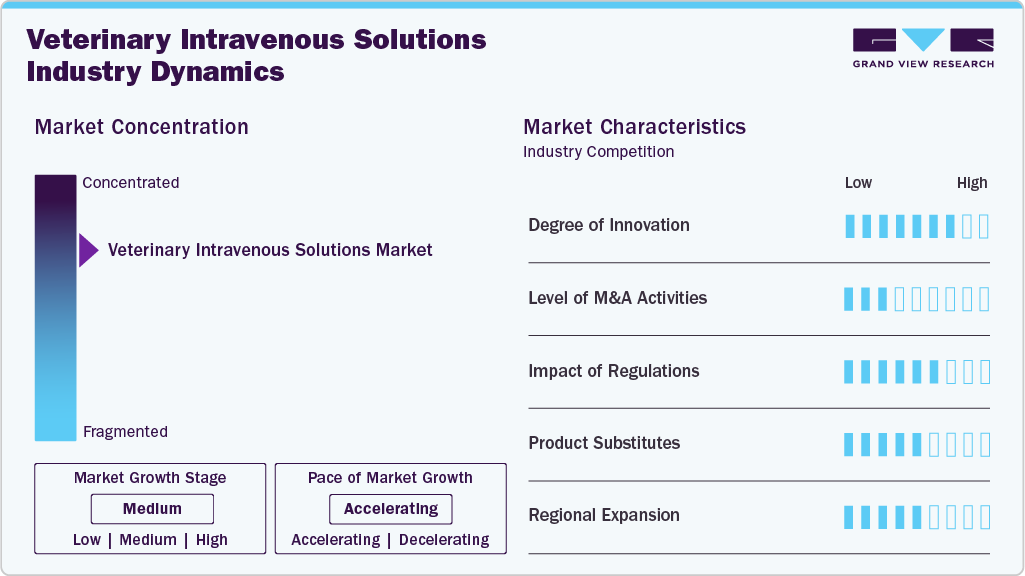

Market Concentration & Characteristics

The IV solutions market exhibits a moderate market concentration, and the market growth is accelerating. One of the key factors fueling the market growth is the increasing number of surgical procedures in animals. With an increasing number of pets and livestock undergoing surgeries ranging from routine procedures like spaying to complex operations such as tumor removals and orthopedic interventions, the demand for supportive therapies like IV fluids has surged. For instance, according to an article published by Dr. Kelly's Surgical Unit, in February 2024, approximately 80% of dogs have been spayed or neutered. Intravenous solutions play a crucial role during and after surgery, helping maintain hydration, stabilize electrolyte balance, deliver medications, and support overall recovery.

The market demonstrates a moderate to high level of innovations, due to technological advancements and the launch of new products. For instance, in March 2025, Laboratories Alfa SRL introduced a solution combining 5.5% dextrose with 0.9% sodium chloride. This intravenous solution is designed for fluid and electrolyte replenishment, offering a balanced composition for veterinary use. These solutions are sterile, non-pyrogenic, and intended for single-dose use. They contain no antimicrobial agents and should be discarded if not used immediately after opening. The solutions are available in various concentrations and packaging sizes to meet clinical needs.

Within the market, there exists a low level of mergers and acquisitions activity. As companies consolidate, they can pool resources for research and development, leading to the introduction of more advanced and cost-effective solutions. M&A also enhances market reach, enabling better distribution networks and access to a larger customer base, including veterinary clinics and hospitals.

Regulatory frameworks play a critical role in shaping the market by directly influencing product development, approval timelines, quality standards, and market accessibility. Agencies such as the FDA’s Center for Veterinary Medicine (CVM) in the U.S. and the European Medicines Agency (EMA) in the EU mandate strict compliance with Good Manufacturing Practices (GMP) and pharmacovigilance requirements to ensure the safety and efficacy of intravenous (IV) solutions administered to animals.

The product substitutes in the market exert a moderate to significant impact by influencing treatment choices, pricing, and innovation. Alternatives such as oral rehydration solutions, subcutaneous fluid therapy, and advanced drug delivery systems (e.g., transdermal patches or injectables) offer less invasive, more convenient, and sometimes cost-effective options, particularly in non-critical or outpatient settings. This can reduce demand for traditional IV solutions in routine veterinary care.

Expanding into new regions allows for better accessibility of IV solutions to a wider array of veterinary clinics, animal hospitals, and healthcare providers. This expansion fosters market penetration in emerging economies with growing pet populations and livestock industries, leading to increased demand for veterinary care.

Product Insights

The isotonic crystalloids segment dominated the market and accounted for a revenue share of over 42.00% in 2024. Isotonic crystalloids are commonly used in veterinary medicine to manage various diseases and conditions by restoring fluid and electrolyte balance. They have the same osmolality as blood plasma, ensuring they do not cause significant fluid shifts between compartments. These solutions have an osmolality similar to that of blood plasma, making them effective for treating dehydration, shock, and acid-base imbalances. Isotonic fluids contain the same osmolality as extracellular fluids. As a result, they are great solutions for rehydration and maintenance needs, particularly because they can be provided intravenously, intraosseously, subcutaneously, and intraperitoneally. Lactated Ringer's, 0.9 percent (physiologic or normal) saline, Ringer's, acetated Ringer's, and 2.5% dextrose in 0.45% saline and Plasma-Lyte A are examples of commonly used isotonic solutions.

The dextrose solutions segment is anticipated to grow at the fastest CAGR of about 7.26% from 2025 to 2030. Dextrose, also known as glucose, is a type of sugar that can be administered intravenously to supply a readily available source of energy to the animal's body. Veterinary dextrose solutions can also provide hydration support. By administering dextrose solutions intravenously, water is delivered along with the glucose, helping to maintain proper hydration levels in animals that may be dehydrated or unable to drink water adequately. The most commonly used concentration is 5% dextrose, which is considered isotonic and is often administered alone or in combination with other electrolytes like sodium chloride or lactate. For instance, combinations such as 5% dextrose with 0.33% sodium chloride or with lactated Ringer’s solution are formulated to address both fluid and electrolyte deficits. These combinations help in correcting dehydration while providing essential nutrients.

Animal Type Insights

The companion animal segment dominated the market with a revenue share of over 58.0% in 2024. Companion animals, particularly dogs and cats, are commonly kept as pets in many households. The high rate of pet ownership contributes to the significant demand for veterinary IV fluids, as these animals often require intravenous therapy for various health conditions, surgeries, or critical care situations. According to 2024 data from the American Pet Products Association (APPA), the U.S. is home to over 65.1 million dogs, making it the country with the highest number of owned pets. Apart from the U.S., over 32% of households in Asia own a dog, according to a 2021 survey by Rakuten Insights.

The production animal segment is expected to exhibit the fastest growth rate during the forecast period. Veterinary intravenous (IV) therapy is a critical component in managing the health of production animals such as cattle, sheep, goats, and pigs. These animals are susceptible to dehydration and metabolic imbalances due to factors like gastrointestinal diseases, heat stress, and nutritional deficiencies. Intravenous solutions enable rapid and controlled fluid and electrolyte replacement, which is essential for stabilizing these animals. As the prevalence of mouth disease in farm animals is increasing. For example, animals with cloven hooves, such as cattle, pigs, sheep, and goats, are most commonly affected by the extremely contagious viral disease known as foot-and-mouth disease. While it mainly causes lesions on the feet and mouth, the disease can spread rapidly and have a significant economic impact due to restrictions on animal movement and trade.

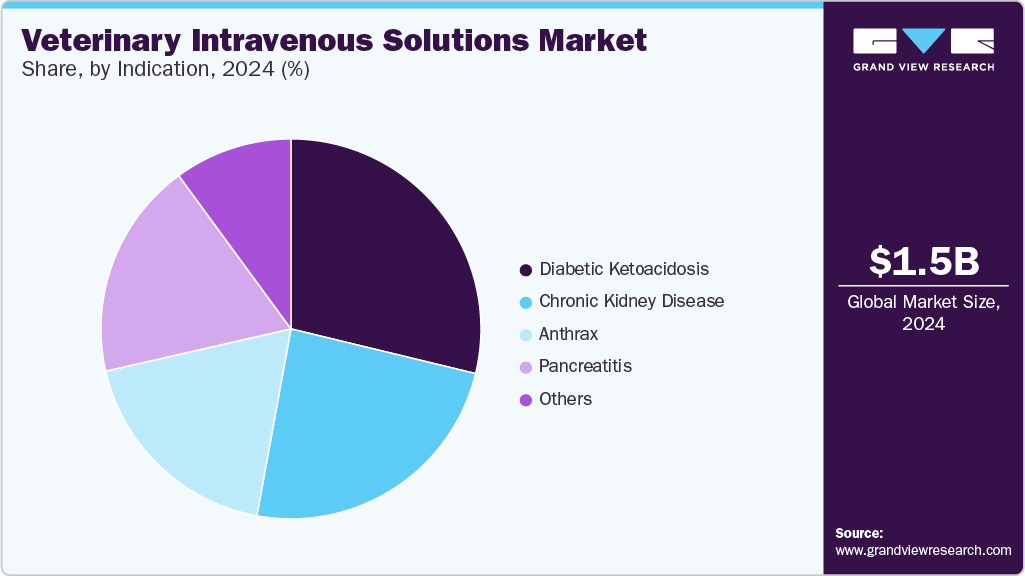

Indication Insights

The diabetic ketoacidosis segment dominated the market for veterinary intravenous (IV) solutions with a revenue share of over 28.0% in 2024. The prevalence of DKA in animals is directly linked to the prevalence of diabetes mellitus in the animal population. Diabetes mellitus, which can be either type 1 or type 2, is relatively common in companion animals, particularly dogs and cats. The incidence of diabetes in animals has been increasing in recent years, potentially leading to a higher prevalence of DKA cases. Intravenous fluid treatment is an essential component of managing diabetic ketoacidosis (DKA) in animals. DKA is a dangerous and sometimes fatal side effect of diabetes mellitus that is typified by metabolic acidosis, hyperglycemia, and ketosis. The intravenous fluid treatment for DKA in animals aims to correct dehydration, restore electrolyte balance, and provide glucose and insulin therapy.

The others segment is expected to exhibit the fastest growth rate of over 6.49% over the forecast period. The others segment includes vomiting, diarrhea, and dehydration. Diarrhea is a frequent presenting condition in companion animal practice. Young dog puppies are considerably more likely to experience both diarrhea and vomiting, and the risk of developing diarrhea falls from 16% in 7- to 12-week-old puppies to 5.4% in 12- to 18-month-old dogs. Veterinary intravenous (IV) solutions are crucial in managing dehydration and electrolyte imbalances associated with diarrhea in animals. Isotonic crystalloids like Lactated Ringer’s and 0.9% Normal Saline are commonly used to restore fluid balance and address acidosis.

End Use Insight

In 2024, the veterinary hospital segment accounted for the highest share in the market because more pet owners are taking their animals to hospitals for treatment. Veterinary hospitals often utilize IV fluid therapy as a fundamental component of patient care. Veterinary hospitals are equipped to handle emergencies and provide immediate and intensive care for animals in critical conditions. IV solutions are frequently used in emergencies to stabilize patients, address shock, and ensure prompt delivery of necessary medications and fluids. They play a pivotal role in administering intravenous (IV) solutions, which are essential for managing a wide array of medical conditions in animals. These solutions are utilized to address issues such as dehydration, shock, electrolyte imbalances, and to facilitate the delivery of medications and nutrients.

The others segment is anticipated to grow at the fastest CAGR over the forecast period. Veterinary home care settings involve providing medical care and treatment for animals in the comfort of their own homes rather than in a traditional veterinary clinic or hospital setting. In such settings, veterinary professionals visit the pet owner's home to provide various healthcare services, including the administration of veterinary IV solutions. Veterinary home care offers convenience and comfort to both the animals and their owners. It eliminates the stress and anxiety associated with transporting animals to a clinic and allows them to receive care in a familiar environment.

Regional Insights

North America dominated the market and accounted for a revenue share of over 38.09% in 2024. The market is primarily driven by the rising prevalence of chronic and acute diseases in companion animals. Conditions such as chronic kidney disease (CKD), gastrointestinal illnesses, trauma, and infectious diseases necessitate supportive fluid therapy, making IV solutions an essential component of treatment. For example, CKD affects up to 80% of cats over 15 years old in the U.S., and IV fluids are critical in managing hydration and toxin clearance. Similarly, parvovirus in puppies often requires aggressive fluid therapy to address severe dehydration and electrolyte imbalance. These medical demands are contributing to steady market growth across veterinary practices and emergency clinics.

U.S. Veterinary Intravenous Solutions Market Trends

The U.S. market is experiencing steady growth, driven by the rising incidence of chronic diseases in companion animals, such as chronic kidney disease (CKD), gastrointestinal disorders, and severe dehydration. With over 70 million pet dogs and 60 million pet cats in the U.S., and a growing number of aging pets, the demand for IV fluid therapy is escalating. Additionally, emergency and surgical care in veterinary practices routinely rely on IV solutions for anesthesia support, electrolyte balance, and shock management.

Europe Veterinary Intravenous Solutions Market Trends

The European IV solutions market is expected to grow rapidly due to growing emphasis on animal welfare, the expansion of advanced veterinary care, and the high prevalence of chronic and infectious diseases in livestock and companion animals. According to the European Pet Food Industry Federation (FEDIAF), there were approximately 352 million companion animals in Europe as of 2024, with a notable rise in veterinary visits per pet due to improved awareness and spending on animal health. Veterinary clinics across countries like Germany, France, and the UK are increasingly adopting IV fluid therapy in treatments for dehydration, renal disease, and post-surgical care, particularly in aging pet populations, boosting demand for diverse IV solution formulations such as electrolytes, saline, and glucose.

The UK IV solutions market is primarily driven by the increasing pet ownership rates and heightened awareness of veterinary healthcare. According to the Pet Food Manufacturers' Association (PFMA), approximately 59% of UK households owned pets, with dogs and cats being the most common. This growing pet population has directly increased demand for advanced veterinary treatments, including those requiring IV solutions for critical care, surgery, and management of chronic conditions. Veterinary practices are increasingly equipped with facilities for fluid therapy administration, particularly in response to the rising prevalence of kidney disease and diabetes in aging pet populations.

Asia Pacific Veterinary Intravenous Solutions Market Trends

The Asia Pacific veterinary intravenous (IV) solutions market is witnessing significant growth, primarily driven by the region’s expanding livestock population, increasing companion animal ownership, and rising incidence of infectious diseases in animals. Countries like India, China, Australia, and South Korea are seeing increased demand for veterinary healthcare services, particularly in treating dehydration, electrolyte imbalances, and infections in both livestock and pets. For instance, India and China, two of the world's leading producers of cattle and pigs, have seen frequent outbreaks of gastrointestinal infections such as calf diarrhea, swine dysentery, and avian enteritis, which have emphasized the necessity of IV fluid therapy to support animal recovery and reduce mortality rates.

The India veterinary intravenous solutions market is witnessing significant growth, driven by a sharp increase in chronic and acute illnesses among companion animals, particularly renal failure in dogs. According to an article published in February 2025 in the Times of India, Guru Angad Dev Veterinary and Animal Sciences University (GADVASU) in Ludhiana reports 6-7 new canine renal failure cases daily, with many requiring fluid therapy or dialysis. The root causes range from poor diet (junk food, grapes, chocolates), lack of exercise, and the overuse of human painkillers to infectious diseases like babesiosis and tick fever. In these cases, intravenous fluid therapy is essential to restore hydration, support kidney function, and flush out toxins from the body.

Latin America Veterinary Intravenous Solutions Market Trends

Latin America's livestock sector plays a pivotal role in the demand for veterinary IV solutions. Brazil, for instance, stands as a global leader in meat production, with cattle slaughter reaching 34.06 million head in 2023, marking a 13.7% increase from the previous year. Additionally, poultry and swine sectors set records with 6.28 billion chickens and 57.17 million pigs processed, respectively. Such large-scale operations necessitate advanced veterinary care, including IV therapies, to manage animal health effectively and ensure productivity.

The Brazil IV solutions market is experiencing sustained growth, driven by the widespread prevalence of infectious diseases such as neonatal calf diarrhea, alongside the country’s expansive cattle industry. Diarrheal diseases, particularly those caused by rotavirus A (RVA) and bovine viral diarrhea virus (BVDV), significantly threaten young calves and contribute to economic losses through reduced growth rates, increased mortality, and higher veterinary costs. A study covering Brazil’s Midwest, South, and Southeast regions found RVA in 27.4% of diarrheic fecal samples from calves, with beef calves showing a notably higher infection rate (31.9%) compared to dairy calves (17.4%), and the Midwest region alone showing 39.4% RVA-positive cases. These findings illustrate the urgent demand for supportive treatments such as IV fluid therapy to manage dehydration and stabilize infected animals.

Middle East & Africa Veterinary Intravenous Solutions Market Trends

The veterinary intravenous (IV) solutions market in the Middle East and Africa (MEA) region is growing steadily, driven by the expanding livestock sector, rising pet ownership, and increasing government investment in animal health infrastructure. Countries like Saudi Arabia, UAE, Kuwait, and South Africa have large livestock populations—Saudi Arabia alone has over 30 million livestock heads—necessitating IV treatments for dehydration, heat stress, and disease management, especially in arid climates.

The market in South Africa is experiencing notable growth. One of the primary drivers is the increasing prevalence of animal diseases such as infectious diseases, dehydration, and chronic conditions like kidney disease, which frequently require IV fluid therapy as part of treatment protocols. In both emergency and routine veterinary care, IV solutions are essential for managing dehydration, delivering medications, and supporting animals during surgical procedures or periods of critical illness. For example, outbreaks of diseases such as avian influenza in poultry and rising cases of chronic kidney disease in aging pets have increased the demand for supportive therapies like IV fluids to stabilize and treat affected animals.

Key Veterinary Intravenous Solutions Company Insights

The market is competitive and marked by the presence of key players. The key parameters affecting competition include a technological advancement. Additionally, to maintain market share and expand their product portfolios, leading companies are adopting strategies such as mergers and acquisitions, strategic partnerships, and the launch of innovative products.

Key Veterinary Intravenous Solutions Companies:

The following are the leading companies in the veterinary intravenous solutions. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc (Animal Health

- Dechra

- Animalcare Limited

- B. Braun Vet Care (B Braun SE)

- Elanco Animal Health Incorporated (Animal Health

- Zoetis Inc.

Recent Developments

- In June 2018, Sypharma Pty Ltd, an Australian pharmaceutical manufacturer, achieved a significant milestone with FDA approval for the distribution of its Hartmann’s IV solution in the United States. Marketed under its veterinary brand Sykes IV Lyte Injection (Electrolytes), this approval marks a strategic expansion of Sypharma’s global footprint in the animal health sector.

Veterinary Intravenous Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.53 billion

Revenue forecast in 2030

USD 2.07 billion

Growth Rate

CAGR of 6.21% from 2025 to 2030

Historical Period

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck & Co., Inc (Animal Health; Dechra; Animalcare Limited; B. Braun Vet Care (B Braun SE); Elanco Animal Health Incorporated (Animal Health; Zoetis Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Intravenous Solutions Market Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the veterinary intravenous solutions market report based on animal type, product, indication, end use, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Isotonic crystalloids

-

Synthetic colloids

-

Blood products

-

Dextrose solutions

-

Parenteral nutrition

-

-

Indication Outlook (Revenue, USD Million; 2018 - 2030)

-

Diabetic Ketoacidosis

-

Pancreatitis

-

Anthrax

-

Chronic Kidney Disease

-

Others

-

-

Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Companion Animals

-

Production Animals

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

- Rest of MEA

-

Frequently Asked Questions About This Report

b. The global veterinary intravenous (IV) solutions market size was estimated at USD 1.48 billion in 2022 and is expected to reach USD 1.58 billion in 2023.

b. The global veterinary intravenous (IV) solutions market is expected to grow at a compound annual growth rate of 8.37% from 2023 to 2030 to reach USD 2.67 billion by 2030.

b. North America dominated the veterinary intravenous solutions market with a share of 38.24% in 2022. North America has a significant pet ownership rate, with a large number of households owning companion animals such as dogs, cats, and small mammals. The high demand for veterinary care for these pets contributes to the demand for veterinary IV solutions.

b. Some key players operating in the Veterinary Intravenous Solutions market include Merck & Co., Inc.; Dechra Veterinary Products; Sypharma; Animalcare; B. Braun SE; Woods Consulting, LLC; Baxter; Fresenius Kabi.

b. Key factors that are driving the veterinary intravenous solutions market growth include increasing pet ownership, increasing the prevalence of diseases such as anthrax, pancreatitis, and oral disease, and raising awareness of animal welfare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.