- Home

- »

- Animal Health

- »

-

Veterinary Lasers Market Size, Share, Industry Report, 2030GVR Report cover

![Veterinary Lasers Market Size, Share & Trends Report]()

Veterinary Lasers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Therapeutic Lasers, Surgical Lasers), By Animal (Dogs, Cats), By Application (Pain & Inflammation Management), By Class (Class 2, Class 3), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-951-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Lasers Market Summary

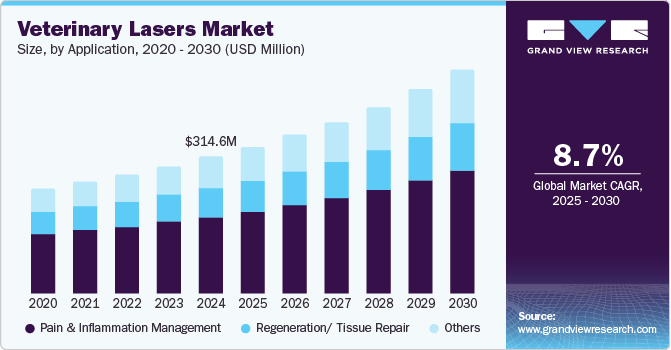

The global veterinary lasers market size was estimated at USD 314.64 million in 2024 and is projected to reach USD 512.67 million by 2030, growing at a CAGR of 8.70% from 2025 to 2030. Some of the key drivers fueling market growth are increased demand for therapeutic lasers, a growing popularity of pet insurance, advancements in technology, strategic activities by key businesses, and rising usage of laser systems by veterinary care providers.

Key Market Trends & Insights

- North America veterinary lasers market held the largest revenue share of more than 35.0% in 2024.

- By product, the therapeutic lasers segment held the largest revenue share of over 54.0% in 2024.

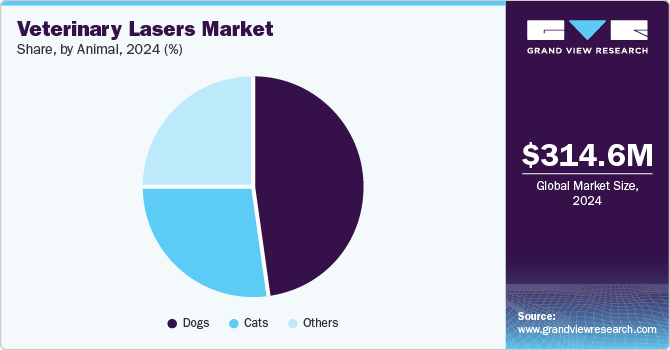

- By animal, the dogs segment held the largest revenue share of over 47.0% in 2024.

- By application, the pain and inflammation management segment led with the largest revenue share of over 56.0% in 2024.

- By class, the class 3 lasers segment held the largest revenue share of over 46.0% in 2024.

- By end use, the veterinary hospitals and clinics held the largest revenue share of over 88.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 314.64 Million

- 2030 Projected Market Size: USD 512.67 Million

- CAGR (2025-2030): 8.70%

- North America: Largest market in 2024

Additionally, the market is growing due to a rise in the number of veterinarians and establishments. For example, the AVMA states that there were 127,131 veterinary practitioners in the United States, among which 82,704 employed in clinical practice and 14,488 public or corporate employees in 2023. Hence, with more veterinarians entering the field and more clinics and hospitals opening, there’s a higher demand for advanced, effective treatment options, such as laser therapy.

The COVID-19 pandemic negatively impacted the market. During lockdowns, many non-essential veterinary visits were postponed or canceled. This led to fewer opportunities for laser treatments, especially for elective and non-emergency cases that could utilize lasers for pain management, wound healing, and rehabilitation. COVID-19 disrupted global supply chains, causing delays in the production and delivery of veterinary laser equipment. Manufacturers faced challenges sourcing components, leading to equipment shortages and higher costs.

The growing adoption of pets, combined with the expansion of pet insurance coverage, is positively impacting the veterinary laser therapy market. As pet ownership rises, so does the demand for advanced veterinary treatments, including laser therapy, which is widely used for pain management, wound healing, inflammation reduction, and surgical procedures. Pet insurance coverage for these treatments makes laser therapy more accessible and affordable, encouraging pet owners to seek higher-quality care for their animals. For instance, MetLife Pet Insurance offer compensation for alternative or holistic therapies which include laser therapy, as long as it is conducted by a licensed veterinarian and is approved and covered by the policy.

Advantages of lasers over surgeries is one of the factors that contributes to the market growth. Laser therapy is one of the most versatile tools in a veterinarian’s toolbox. These include “a reduction in pain and inflammation, increased circulation to promote the healing process after injuries or surgery, and improved mobility for more functional strengthening to get animals back on their feet faster post-surgery. Laser therapy is used in a variety of procedures, including soft tissue surgeries, dental extractions, spays and neuters, wound healing, and the management of chronic pain and inflammatory conditions.

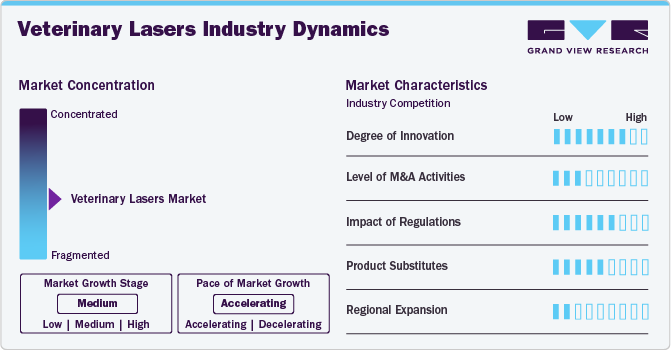

Market Concentration & Characteristics

The market is considered to be at a medium level in terms of growth stage, with significant market growth. The market is growing owing to technological advancement in laser treatment. The use of Low-Level Laser Therapy (LLLT) in veterinary medicine has increased significantly in recent years. Photobiomodulation therapy, another name for this non-invasive therapeutic method, uses low-power laser light to stimulate cellular activity and aid in the healing process. LLLT was first created for human medicine, but it has since gained popularity and been successful in the veterinary field.

The market demonstrates a moderate to high degree of innovation. For example, A new 40-Watt CO2 Surgical Laser System has been introduced by Cutting Edge Laser Technologies, a market leader that has been offering the veterinary industry high-end surgical and therapeutic laser technology for almost 20 years. Building on the success of earlier models, the 40-Watt CO2 Laser offers more efficient CO2 canisters, an enhanced user interface, and an astounding 25 watts of power in Super Pulse mode. These important developments reduce the total cost of ownership, enhance therapeutic results, and make operating simpler and more convenient.

The market sees a low degree of merger and acquisition activity, indicating consolidation and strategic collaboration among industry leaders. These transactions are typically driven by the need to reach a larger demographic, obtain access to new technology or information, and achieve economies of scale.

The veterinary lasers market is shaped by various regulatory frameworks aimed at ensuring the safety and efficacy of these devices for animal treatment. In some countries, veterinary boards or councils establish additional guidelines around the use of lasers, including practitioner certification and training requirements. These guidelines help ensure that veterinary professionals using lasers have adequate knowledge to operate them safely and effectively for therapeutic or surgical procedures.

Substitutes for veterinary lasers include alternative surgical and therapeutic devices that offer similar benefits but may differ in functionality, cost, or specific use cases. Electrosurgical units are often used for tissue cutting and coag/Servicelation, similar to lasers, and can be a more cost-effective option. They work by using high-frequency electric currents to cut or coagulate tissue, although they may cause more thermal damage than lasers, affecting the precision and recovery time in certain procedures.

For example, the Italian company Eltech K-Laser s.r.l. opened an office in Miami, USA, in May 2022 to increase its footprint in the Americas. The company offers a variety of veterinary lasers, such as the Speciale brand of laser systems and the Cube line of High Power Lasers (HPL).

Product Insights

Therapeutic lasers accounted for the largest revenue share of over 54% in 2024 and is anticipated to grow at a fastest CAGR over the forecast period. This is due to the advantages of therapeutic lasers and the increasing use of these devices in veterinary clinics. The use of light energy to promote healing in specific body parts is recognized as therapeutic laser therapy. Photobiomodulation is the term for this interaction between light and tissue.

The most typical applications for therapeutic lasers are muscular sprains and strains and the pain they cause, osteoarthritis, post-operative use around wounds and incisions (to promote and speed healing), and any situation wherein the pet experiences musculoskeletal discomfort. Additional uses include helping to heal tendon injuries, lick granulomas, bone fractures, and as a component of acupuncture treatments.

Moreover, according to Small Animal Specialist Hospital, A clinical experiment found that in addition to reducing lameness and pain in laser-treated dogs, there was a significant decrease in the dogs' reliance on NSAIDs. After six weeks, around 80% of patients were able to reduce their NSAID dosage in half.

Animal Insights

Dogs accounted for the largest revenue share of over 47% in 2024 due to the rising prevalence of chronic diseases, bone and joint problems, and obesity. The longer lifespan of dogs and the particularly high number of pet dogs are major factors in this increasing incidence. For example, according to a 2022 survey, 40% to 45% of dogs between the ages of 5 and 11 are overweight, and over 50% of North American canines are obese. Lack of exercise and overfeeding are the main causes of this.

Hence, increasing obesity in dogs is a significant factor leading to conditions such as joint pain, arthritis, and reduced mobility. These issues often require treatment and pain relief, which has driven the demand for therapeutic interventions like laser therapy. By targeting affected areas with light energy, laser therapy helps improve blood circulation and accelerate recovery, making it a popular choice for managing the pain associated with obesity-related conditions in dogs.

The others segment is anticipated to grow at the fastest CAGR over the forecast period. It includes pets such as horses and birds. The increasing popularity of horse racing and other competitive sports has raised awareness of equine health. Increasing company operations and the availability of equine healthcare products are some of the key factors propelling the market.

Application Insights

Pain and inflammation management held the largest revenue share of over 56% in 2024. Pain manifests in a variety of ways, making it common in companion animals. Trauma and long-term conditions such as arthritis can cause inflammation and discomfort, which must be addressed with multiple therapy sessions and other combination treatments. Moreover, Osteoarthritis is a painful and degenerative illness that causes cartilage degradation, joint inflammation, and eventually alterations in bone, according to Zoetis. It is expected to affect more than one in five dogs and is the most prevalent cause of lameness in dogs, with heavier breeds being more affected.

Regeneration/tissue repair is expected to exhibit the fastest CAGR over the forecast period. Laser treatment for nerve regeneration is gaining popularity in human health and is anticipated to have an effect on the animal health sector as well. For example, horses can have ligament and tendon lesions repaired and remodelled using Regenerative Laser Therapy (RLT) lasers, which also encourage collagen synthesis and cell proliferation in equine speices.

Class Insights

Class 3 lasers dominated the market with the largest revenue share of over 46% in 2024 as veterinary care providers have widely adopted these products. In fact, class 3 lasers are the most widely utilized therapeutic lasers, according to the American Animal Hospital Association. Often utilized for therapeutic rather than surgical purposes, they offer mild, non-invasive treatment for a variety of animal ailments. The low heat output of class 3 lasers lowers the possibility of burns or tissue damage to the animal.

Class 4 lasers is anticipated to grow at the fastest CGR over the forecast period. According to Summus Medical Laser, A Class IV therapy laser is a technology that can be used to treat animals in pain or with injuries. It has been demonstrated to help treat mild aches and pains, shorten the recovery period following surgery, and lower the quantity of medication required for chronic diseases. Class IV therapy lasers are powerful instruments that produce photochemical effects in both superficial and deep tissues using light pulses. As a result, patients often heal sooner and, more crucially, better. All animal species can use it for both acute and chronic diseases.

End Use Insights

Veterinary hospitals and clinics dominated the market with the largest revenue share of over 88% in 2024, due to the fact that these hospitals provide laser therapy as the primary treatment option. The U.S. Census Bureau estimates that in 2024, there will be more than 35,203 veterinarian facilities in the country. With the expansion of clinical applications, the use of therapeutic and surgical lasers in veterinary practice is rapidly increasing, which is anticipated to accelerate the segment growth in the near future.

Hospitals are using highly advanced technology to treat animal patients more effectively. These tools aid in speedier and more effective therapy delivery in addition to streamlining the therapeutic processes. Additionally, expanding research projects by veterinary companies and university organizations are driving improvements in laser technology for veterinary applications.

Regional Insights

By region, North America veterinary lasers market accounted for the largest revenue share of more than 35% of the global market in 2024, due to the presence of significant players, growing pet expenses, and a suitable veterinary healthcare infrastructure. For example, the U.S.-based IRIDEX Corporation provides veterinary lasers to treat retinal disorders, glaucoma, and cataracts in animals. For transscleral glaucoma and retinal treatments, the company's Cyclo G6 Glaucoma Laser and DioVet System offer benefits over cryotherapy, including increased accuracy and less postoperative pain.

U.S. Veterinary Lasers Market Trends

Growing pet expenditures in the United States is a major factor propelling the market growth. Many pet owners are treating their pets as family members, leading to higher spending on health and wellness, including preventive and specialized care. Technological improvements in veterinary diagnostics and treatment, such as minimally invasive surgeries, advanced imaging, and specialized therapies, have made higher-cost procedures more accessible and in demand. For instance, according to the American Pet Products Association, pet owners in the US spent USD 147.0 billion on their companion animals in 2023, with USD 38.3 billion going toward veterinary treatment and product sales.

Europe Veterinary Lasers Market Trends

One of the factors propelling the veterinary lasers market in the region is growing awareness of non-invasive procedures. Because laser treatments are less intrusive and frequently result in faster recovery times than standard surgical methods, both pet owners and veterinarians are becoming more and more aware of their advantages. The expansion of veterinary laser applications in clinics and hospitals is aided by this trend. Additionally, the demand for veterinary care, including non-invasive treatment alternatives like laser therapy, has increased due to the expanding pet population in Europe.

The presence of key players such as Apollo Vet Laser, Omega Laser Systems Ltd, VBS Direct Limited, and others in the UK significantly drives market growth. For instance, The UK's largest low-level laser producer, Omega Laser Systems, is heavily involved in the early research in this field. For almost 25 years, medical practitioners all over the world have been using Omega's equipment. The company offers class 3 and class 4 lasers.

Asia Pacific Veterinary Lasers Market Trends

Asia Pacific veterinary lasers market is anticipated to grow at the fastest CAGR of 10.19% over the forecast period. This is due to the growth of veterinary laser companies in emerging nations, as well as the existence of local businesses in the region. For instance, the Chinese company Wuhan Dimed Laser Technology Co., Ltd. sells the Berylas, Harlas, and Cherylas product lines under the Veterinary Lasers brand. These are utilized in treating illnesses such as arthritis, back pain, trauma, wounds, surgery, nasal difficulties, and inflammatory conditions.

There has been increasing evidence that obesity is a problem for dogs and cats in developing nations, particularly China. According to research, 21% of dogs are overweight by the time they are six months old, indicating that an increasing percentage of young animals are becoming obese. To investigate the causes of the increase in pet obesity, the Waltham Petcare Science Institute performed a multiple countries survey in China, Brazil, Russia, the UK, and the US. Up to 59% of the dogs and 52% of the cats in the study were obese.

Latin America Veterinary Lasers Market Trends

Rising prevalence of chronic conditions in pets and advancements in lasers technology are factors contributing to the market growth. Technological advancements have led to the development of more efficient, portable, and versatile veterinary laser devices, making them easier to incorporate into standard veterinary practices. Innovations such as cold lasers, low-level lasers, and higher-powered Class 4 lasers are expanding the therapeutic uses in veterinary medicine.

Brazil has the highest pet population in Latin America. Veterinarians might find great opportunities in this dynamic and distinctive sector. The increased humanization of pets, the need for high-quality care, and rising pet expenses are the main drivers of the market growth. Additionally, the growing number of clinics has resulted in higher veterinary surgery sales, which has led the industry to grow significantly in recent years.

Middle East & Africa Veterinary Lasers Market Trends

South Africa, Saudi Arabia, the UAE, and Kuwait are the key countries in the MEA market. Due to increased pet health problems, a number of organizations in the region are offering veterinary lasers to vet institutions. The number of veterinary treatments performed on animals has increased as a result of the growing prevalence of obesity and injuries. As a result, laser devices are increasingly being used to treat a variety of acute and chronic illnesses, including pain, arthritis, etc. These factors are anticipated to propel market growth.

One of the primary drivers of market growth is the availability of veterinary hospitals and clinics that offer laser treatment. For example, in an attempt to offer better patient care, Animal Zone Veterinary Hospital implemented MLS Laser Therapy in 2020. Complete animal health care is provided by Animal Zone Veterinary Hospital. Additionally, the facility was the first in South Africa to employ non-invasive MLS laser therapy and Qs Vet Magnetotherapy.

Key Veterinary Lasers Company Insights

The existence of numerous small, medium, and large businesses characterizes the competitive and fragmented market. To increase their market share, the market participants implement strategic initiatives such product enhancements, regional growth, distribution alliances, partnerships, and mergers and acquisitions.

Key Veterinary Lasers Companies:

The following are the leading companies in the veterinary lasers market. These companies collectively hold the largest market share and dictate industry trends.

- SpectraVET

- VBS Direct Limited

- Omega Laser Systems Ltd

- Excel Lasers Limited

- SOUND

- Multi Radiance Medical

- ASALaser

- BIOLASE, Inc.

- Cutting Edge Laser Technologies

- Summus Medical Laser, LLC

Recent Developments

-

In March 2024, Cutting Edge Laser Technologies and the Veterinary Academy of Higher Learning (VAHL) expanded their collaboration. As a result of this collaboration, VAHL's RACE-approved Certified Dog Rehabilitation Practitioner and Certified Equine Rehabilitation Practitioner programs at the University of Tennessee now primarily rely on Cutting Edge for laser therapy equipment.

-

In October 2024, Cutting Edge Laser Technologies recently revealed the launch of the new Robotic M7 MLS Therapy Laser, which marks a step forward in photobiomodulation therapy.

Veterinary Lasers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 337.76 million

Revenue forecast in 2030

USD 512.67 million

Growth Rate

CAGR of 8.70% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, application, class, product, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

SpectraVET; VBS Direct Limited; Omega Laser Systems Ltd; Excel Lasers Limited; SOUND; Multi Radiance Medical; ASALaser; BIOLASE, Inc.; Cutting Edge Laser Technologies; Summus Medical Laser, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Lasers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary lasers market report based on animal, application, class, product, end use, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain & Inflammation Management

-

Regeneration/ tissue repair

-

Others

-

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Class 2

-

Class 3

-

Class 4

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Lasers

-

Surgical Lasers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary lasers market size was estimated at USD 314.64 million in 2024 and is expected to reach USD 337.76 million in 2025.

b. The global veterinary lasers market is expected to grow at a compound annual growth rate of 8.70% from 2025 to 2030 to reach USD 512.67 million by 2030.

b. North America dominated the veterinary lasers market with a share of over 35% in 2024. This is attributable to favorable veterinary healthcare infrastructure, rising pet expenditure, and the presence of key players.

b. Some key players operating in the veterinary lasers market include SpectraVET, VBS Direct Limited, Omega Laser Systems Ltd, Excel Lasers Limited, SOUND, Multi Radiance Medical, ASALaser, BIOLASE, Inc., Cutting Edge Laser Technologies, Summus Medical Laser, LLC

b. Key factors that are driving the veterinary lasers market growth include increased demand for therapeutic lasers, a growing popularity of pet insurance, advancements in technology, strategic activities by key businesses, and rising usage of laser systems by veterinary care providers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.