- Home

- »

- Animal Health

- »

-

Veterinary Microchips Market Size, Industry Report, 2030GVR Report cover

![Veterinary Microchips Market Size, Share & Trends Report]()

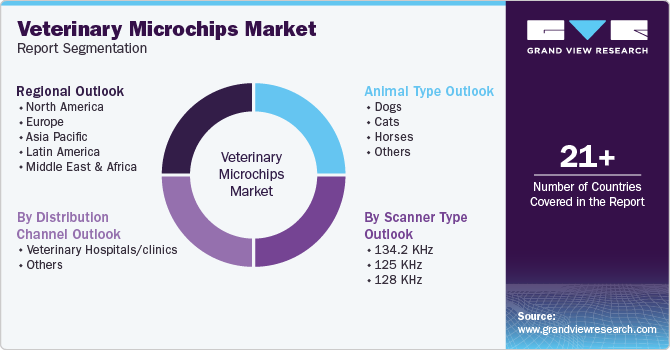

Veterinary Microchips Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type, Scanner Type (134.2 kHz, 125 kHz, 128 kHz), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-445-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Microchips Market Summary

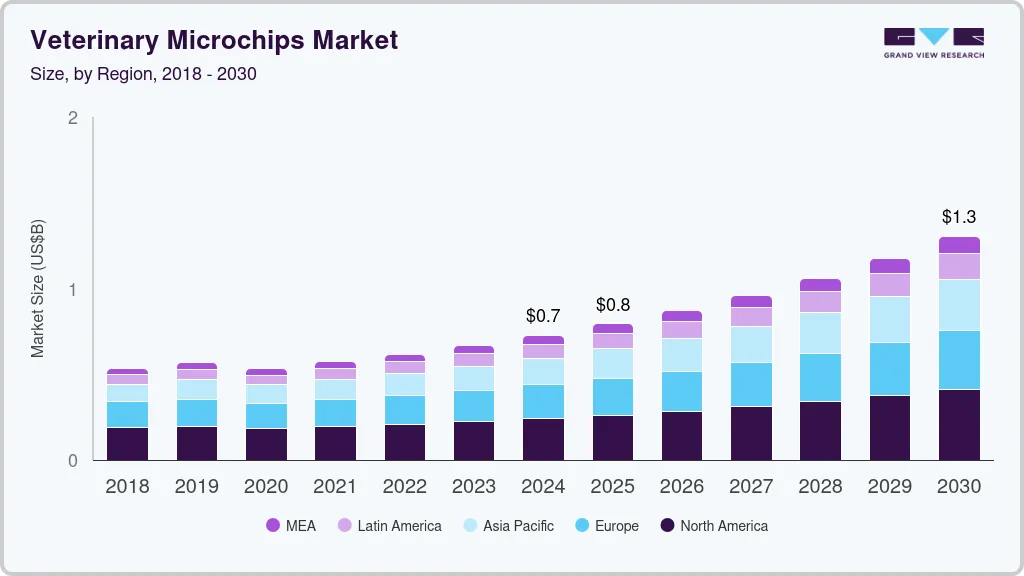

The global veterinary microchips market size was estimated at USD 727.0 million in 2024 and is projected to reach USD 1.31 billion by 2030, growing at a CAGR of 10.44% from 2025 to 2030. The growing popularity of companion animals, the development of animal microchip technology, rising animal health costs, and the growing use of microchips are the main drivers anticipated to propel the market.

Key Market Trends & Insights

- In 2024, North America accounted for the largest share of over 33% in the veterinary microchips market.

- The U.S. market is anticipated to grow significantly due to the strict government rules pertaining to dog microchipping.

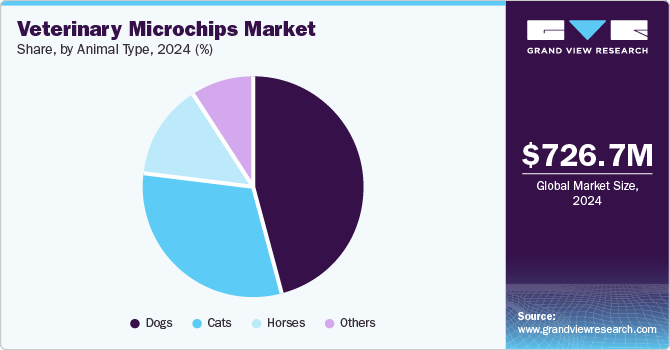

- By animal type, dogs held the dominant share of the Veterinary Microchips Market in 2024.

- By scanner type, 134.2 KHz scanner type dominated the Veterinary Microchips Market in 2024.

- By distribution channel, veterinary hospitals/clinics held the dominant share of the veterinary microchips market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 727.0 Million

- 2030 Projected Market Size: USD 1.31 Billion

- CAGR (2025-2030): 10.44%

- North America: Largest market in 2024

For example, according to AVMA, as of 2023, there are an estimated 92 million dogs maintained as pets in the United States, a 39% rise in dog ownership over the previous ten years. As a result, the market for veterinary microchips is expanding due in large part to the growing popularity of companion animals. The safety, identification, and traceability of pets are becoming increasingly important as more people bring pets into their homes. In order to reunite lost animals with their owners and guarantee appropriate pet care, microchipping offers a trustworthy and long-lasting way to identify pets.The COVID-19 pandemic had a major effect on industries and sectors in every field, as well as the world's population. Additionally, the market for animal health suffered greatly. Among the main detrimental effects of COVID-19 on the animal health industry are supply chain disruption, decreased sales, low demand, and operational difficulties brought on by shifting regulations and policies. The COVID-19 pandemic had an impact on the veterinary microchip business. Local authorities microchipped 77% fewer dogs during the shutdown. During the COVID-19 epidemic, veterinarians nationwide stopped providing non-emergency care.

Moreover, microchips have various advantages, including cost-effectiveness, lifetime protection, and reduced pet theft. Microchipping is a cost-effective method of pet identification. Depending on the veterinary practice and area, microchipping usually has a low initial cost of $25 to $50. When one considers the potential costs associated with missing dogs, including the cost of publishing flyers, offering rewards, and conducting searches, microchipping appears to be a financially sensible option. Additionally, many animal shelters and rescue organizations offer low-cost microchipping services on special occasions or as part of adoption packages.

Market Concentration & Characteristics

The market for veterinary microchips is growing at a faster rate and shows a modest level of market concentration. The rising cost of animal health care is one of the main drivers of market expansion. Pet owners are eager to spend money on cutting-edge veterinary services, such as microchipping, as their concerns about their animals' health grow. The benefits of microchipping for identification, growing rules requiring microchip implants for pets, and growing awareness of pet safety are the main drivers of this development. Furthermore, the need for microchipping as a deterrent against lost or stolen pets is anticipated to increase as veterinary treatment becomes more advanced and widely available, further driving market expansion.

There has been a lot of innovation in the market. Technological developments and the growing need for more complex solutions for animal identification and health monitoring have spurred innovation in the veterinary microchip market. For instance, VetChip has produced a new generation of enhanced pet identity microchips. Technology gives doctors and pet owners a previously unheard-of capacity to keep an eye on the health of their animals almost anywhere in the world. The "chip" tracks biological data in real time via a smartphone app, giving owners a unique view on their pet's health.

There is a moderate to high level of merger and acquisition activity in the market, which is a sign of continued industry player consolidation, strategic acquisitions, and alliances. For example, Datamars purchased the animal handling equipment maker Prattley Industries Ltd. in September 2022. By combining Prattley's industry-leading handling equipment with Datamars' own livestock traceability and productivity technologies, the company provides a comprehensive package for livestock farmers worldwide.

Regulations have a moderate to high impact on the market. Governments in many countries have passed laws requiring mandatory microchipping of pets, particularly dogs and cats, which increases demand for microchips and standardizes the market. For instance, the UK has requirements for all dogs to be microchipped, and the European Union has similar rules for pets traveling across borders.

Initiatives by significant competitors in the market are the reason for the market's moderate to high levels of regional growth operations. Due to strict microchipping laws and high pet ownership rates, businesses in this region, such as Pethealth and HomeAgain, are growing into nearby regions like Latin America. Businesses are expanding the range of products they sell in order to meet various geographical demands. For example, to satisfy the unique needs of various regions, Virbac provides a variety of microchip sizes and types.

Animal Type Insight

Dogs held the dominant share of the Veterinary Microchips Market in 2024. Dogs are widely adopted as pets, and pet owners are becoming more aware of the value of microchipping for identification and recovery in the event of a loss. This dominance is also a result of regulations in different regions that require dogs to be microchipped. The need for microchipping to protect dogs is further fueled by the close emotional connection that exists between owners and their pets. Additionally, rising veterinary healthcare expenses and the significance of pet health are anticipated to support additional market expansion. With 90 million pet dogs in 2024, the United States has the most, according to the World Population Review.

The other segment is anticipated to grow at the fastest CAGR over the forecast period. Pigs, cattle, small mammals, and other livestock animals are included in this segment. Microchips are crucial for livestock tracking and identification. They assist in keeping track of animals' whereabouts, monitoring their records, and making sure they are returned in the event that they are stolen or lost. By giving farmers information on animal movements, breeding, and health, microchips help them run their farms more effectively by enabling them to make better decisions and maximize productivity. Additionally, microchipping aids in fulfilling export regulations and guaranteeing the health and traceability of animals across borders as the global commerce in cattle and livestock products expands.

By Scanner Type Insights

134.2 KHz scanner type dominated the Veterinary Microchips Market in 2024. The most widely used frequency for veterinary microchips is 134.2 kHz, which is standardized for pet identification in many regions, including North America and Europe. The 134.2 kHz frequency is a component of ISO standards, which help ensure that microchips and microchip readers are compatible and interoperable across various systems and countries. This standardization is essential for successful pet identification and recovery, making it the market leader for veterinary microchips.

The majority of contemporary pet scanners are made to read microchips that operate at 134.2 kHz. Because of this broad compatibility, pets can be identified no matter where they are, or which scanner is used. Additionally, the technology used for 134.2 kHz microchips is made to last, guaranteeing that the data stored will be accurate and available for many years, which is essential for long-term pet identification.

Distribution Channel Insight

Veterinary hospitals/clinics held the dominant share of the Veterinary Microchips Market in 2024. Nowadays, microchipping services are frequently provided by veterinary clinics as part of their care plans, particularly during regular examinations or spay/neutering operations. Additionally, veterinarians frequently educate pet owners about the benefits of microchipping, such as permanent identification and improved chances of reuniting lost pets with their owners. Veterinary clinics and hospitals are frequently at the forefront of adopting new technologies, including advanced microchip systems with enhanced features.

The other segment is anticipated to grow at the significant rate over the forecast period. Online retailers, pharmacies, and other businesses are included in the other segments. Numerous pharmacies work with veterinarian clinics to provide microchipping services. This may entail giving veterinarians training, equipment, and microchips. Pet owners can obtain microchipping services more easily thanks to these collaborations. Veterinary personnel can buy and use microchip items and related supplies more easily since veterinary pharmacy stores may carry them. This accessibility may promote broader adoption. In general, the acceptance of microchipping is fueled by veterinary pharmaceutical stores' critical role in raising its exposure and accessibility.

Regional Insights

In 2024, North America accounted for the largest share of over 33% in the Veterinary Microchips Market and is expected to grow at a significant CAGR over the forecast period. The existence of well-established competitors and the rising need for microchips are the market's main drivers. Additionally, the industry is expanding due to increase per capita income and veterinary treatment costs. The North American Pet Health Insurance Association (NAPHIA) is in charge of overseeing the pet insurance industry in this area. 66% of American families, or 86.9 million homes, owned a pet in 2023, according to the American Pet Products Association's National Pet Owners Surveys.

U.S. Veterinary Microchips Market Trends

The U.S. market is anticipated to grow significantly due to the strict government rules pertaining to dog microchipping. According to a May 2024 article by Adriana Gentil, Mike Stobbe, and The Associated Press, all dogs coming into the United States from other nations must be microchipped and at least six months old in order to stop the spread of rabies. Therefore, laws requiring canines to be microchipped have the potential to greatly propel the veterinary microchip market's expansion. The demand for microchips and related services typically rises when a nation or region implements mandatory microchipping.

Europe Veterinary Microchips Market Trends

The Europe Veterinary Microchips Market is expected to grow at a significant pace due to favorable government regulations. The two major factors propelling market growth are the increase in the number of companion animals and high per capita income. In Europe, cats are the most common pet in Europe, making up 127 million households, or 26% of all households; dogs came in second at 1%, with 25% of European homes owning a pet dog, according to a September 2023 article by the Pet Food Industry.

UK Veterinary Microchips Market Trends

UK veterinary microchips market is expected to grow at a significant rate over the forecast period. In Wales and England, it is legally mandatory for every dog older than eight weeks to have a microchip, according to an RSPCA article. If a pet is microchipped and not previously registered on an approved database, owners may receive a notification instructing them to do so. If owners don't comply within the following 21 days, they risk criminal charges and a £500 (USD 658.46) punishment. Laws mandating that pets be microchipped can therefore significantly boost adoption rates, which in turn drives market expansion.

Asia Pacific Veterinary Microchips Market Trends

The Asia Pacific market is expected to exhibit lucrative growth over the forecast period. This is a result of the growing pet adoption trend and the growth of the local economy. Other factors propelling market growth include improved veterinary healthcare infrastructure and heightened awareness of veterinary health. The IMF estimates that by 2024, Asia Pacific's per capita income will have increased from USD 7.35 thousand to USD 10.18 thousand.

India Veterinary Microchips Market Trends

The Veterinary Microchips Market in India is expected to grow at a significant rate over the forecast period. A country's microchip databases and registrations might have a significant impact on the veterinary microchip business. For instance, the first and only pet microchip registration and repair service in India is called Whizzles. By microchipping their pet, owners can make sure it has a unique identification number. In the event that the pet is lost or stolen, this number will mostly be utilized for tracking and retrieval. To do this, a pet's disappearance is first reported to Whizzles Network centers, veterinarians, and the appropriate pet authorities. The pet's unique ID number is then entered into a global databank.

Latin America Veterinary Microchips Market Trends

The Latin American veterinary microchips market is anticipated to rise during the projected period because to factors such as rising per capita income, increased penetration of veterinary healthcare, and growing awareness of the many advantages of microchips. One major factor is the rising number of pet owners in the area; dogs are the most common pet, followed by cats and birds. Latin America's pet ownership rates have been changing. An article released by Pet Food Industry in June 2023 states that the demand for cats and small dogs is increasing as more people migrate into cities.

Brazil Veterinary Microchips Market Trends

Growing pet ownership and pet humanization are two elements propelling the Brazilian veterinary microchip market. The demand for microchipping is driven by Brazil's rising pet ownership rate, as owners want to make sure their animals are safe and can be found if they become lost. Additionally, as pets become more humanized, more money is spent on pet safety and health precautions like microchipping.

Middle East & Africa Veterinary Microchips Market Trends

South Africa, Saudi Arabia, and the UAE constitute the Middle East & Africa (MEA) Veterinary Microchip Market. In the MEA, developing nations like Saudi Arabia and South Africa are becoming more conscious of animal health issues. The high level of disposable income in the area suggests that people have more money to spend on animal healthcare and are therefore more inclined to purchase wellness and preventive measures for their pets, such microchipping, which can improve pet safety and aid in recovery in the event that they go lost. The need for veterinary microchips is probably going to increase as a result of this trend.

South Africa Veterinary Microchips Market Trends

Since many farmers care for their animals to provide meat and milk for the nation and the world, livestock is the foundation of the economy. Microchips are used by farmers and ranchers to monitor and control cattle, a task that becomes even more crucial as herd sizes increase. This aids in breeding, localization, and health monitoring. Improved biosecurity and disease tracking are made possible by microchips. Microchips can offer useful data, and controlling and preventing diseases becomes essential with bigger cattle populations.

Key Veterinary Microchips Company Insights

The market is relatively competitive due to the large number of small-scale to major market participants. Businesses are increasingly using a variety of tactics to expand in the market, including new launches, geographic expansion, and mergers and acquisitions. For example, Merck Animal Health opened a new production site dedicated to Animal Health Intelligence in October 2022. This cutting-edge facility will create innovative solutions for animal tracking and identification using the newest technologies, such as RFID and data analytics. The establishment of this plant confirms Merck's position as a significant industry leader and shows its commitment to enhancing animal health.

Key Veterinary Microchips Companies:

The following are the leading companies in the veterinary microchips market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.,

- Peeva Inc

- Virbac

- ID Tech (Eruditus Executive Education)

- Dipole RFID

- Trovan Ltd.

- Wuxi Fofia Technology Co., Ltd

- Avid Identification Systems, Inc

- Datamars

- Pethealth Inc

Recent Developments

-

In May 2023, Datamars acquired Kippy S.r.l., the popular GPS tracker and activity monitoring system for dogs, an appropriate expansion of its current service for pet owners worldwide.

Veterinary Microchips Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 794.8 million

Revenue forecast in 2030

USD 1.31 billion

Growth rate

CAGR of 10.44% from 2025 to 2030

Actual data

2024

Historical Year

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, scanner type, distribution channel

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Merck & Co., Inc., Peeva Inc, Virbac, ID Tech (Eruditus Executive Education), Dipole RFID, Trovan Ltd., Wuxi Fofia Technology Co., Ltd, Avid Identification Systems, Inc, Datamars, Pethealth Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Microchips Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Veterinary Microchips Market report based on animal type, scanner type, distribution channel, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

By Scanner type Outlook (Revenue, USD Million, 2018 - 2030)

-

134.2 KHz

-

125 KHz

-

128 KHz

-

-

By Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary microchips market size was estimated at USD 726.7 million in 2024 and is expected to reach USD 794.8 million in 2025.

b. The global veterinary microchips market is expected to grow at a compound annual growth rate of 10.44% from 2025 to 2030 to reach USD 1.31 billion by 2030.

b. North America dominated the veterinary microchips market with a share of over 33% in 2024. This is attributable to the presence of established players and increasing demand for microchips. Moreover, the market is growing because of rising veterinary healthcare expenditures and per capita income.

b. Some key players operating in the veterinary microchips market include Merck & Co., Inc., Peeva Inc, Virbac, ID Tech (Eruditus Executive Education), Dipole RFID, Trovan Ltd., Wuxi Fofia Technology Co., Ltd, Avid Identification Systems, Inc, Datamars, Pethealth Inc

b. Key factors that are driving the market growth include the increasing adoption of companion animals, technological advancement in animal microchips, growing animal health expenditure, and increasing adoption of microchips

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.