- Home

- »

- Animal Health

- »

-

Veterinary Oncology Market Size, Industry Report, 2030GVR Report cover

![Veterinary Oncology Market Size, Share & Trends Report]()

Veterinary Oncology Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Canine, Feline), By Therapy (Radiotherapy, Surgery), By Cancer Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-182-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Oncology Market Summary

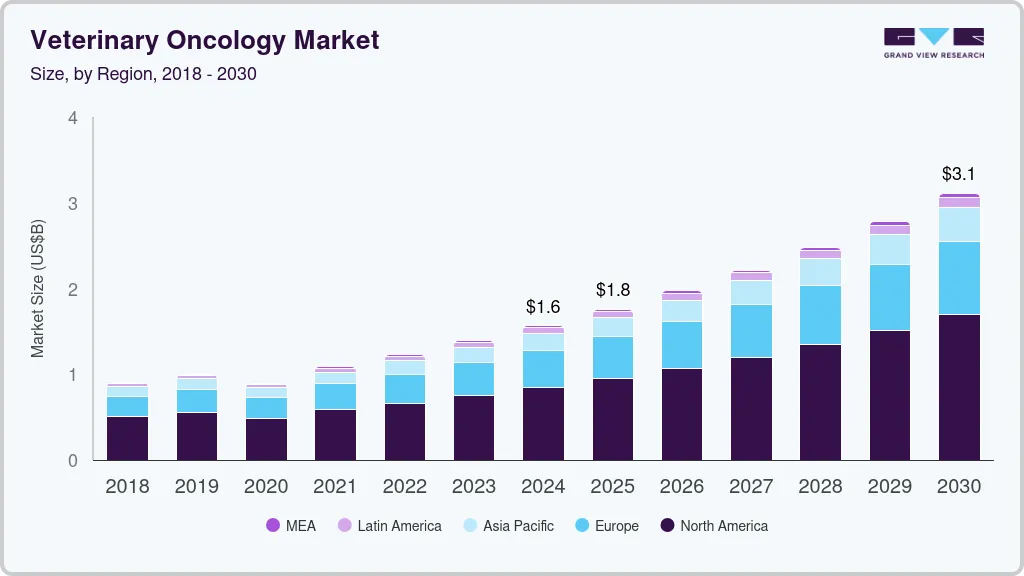

The global veterinary oncology market size was estimated at USD 1.57 billion in 2024 and is projected to reach USD 3.11 billion by 2030, growing at a CAGR of 12.08% from 2025 to 2030. Key growth drivers include increasing the prevalence of cancer in pets, increasing R&D in pet cancer therapy, and growing focus on animal safety.

Key Market Trends & Insights

- The North America veterinary oncology market accounted for the largest revenue share of over 53.9% in 2024.

- The U.S. is set to exhibit a lucrative rise due to clinical trials and ongoing research in the veterinary oncology industry.

- Based on animal type, the canine segment held over 86.09% revenue share in 2024 and is set to grow fastest at 12.56% during 2025–2030.

- Based on therapy, the surgery segment dominated the market with the largest revenue share in 2024.

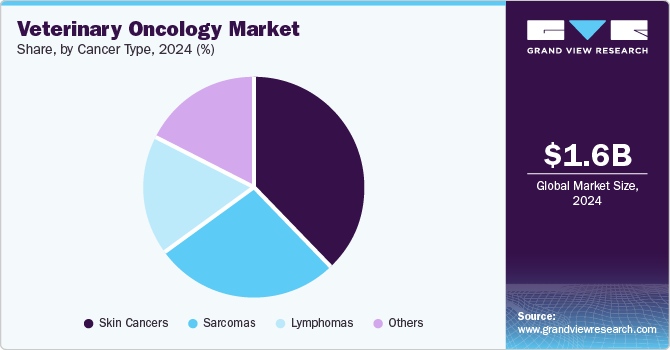

- Based on cancer type, the skin cancer type segment held the largest revenue share in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.57 Billion

- 2030 Projected Market Size: USD 3.11 Billion

- CAGR (2025-2030): 12.08%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As per The Veterinary Cancer Society, cancer is the top reason of death in 47% of canines, particularly those over 10 years old, and in 32% of felines. In addition, around 1 in 4 dogs will experience abnormal tissue growth or neoplasia during their lifetime.

With nearly 100 types of cancer affecting pets, a diagnosis can be overwhelming, yet advances in veterinary care have improved treatment success rates for both dogs and cats.

According to the American Animal Hospital Association, the most common cancers that have a higher prevalence in dogs include lymphoma, osteosarcoma, melanoma, and hemangiosarcoma. The article states that early detection of cancer is a critical part of a pet’s treatment and survival. Cancer is one of the most dreadful diseases that can occur in pets. Hence, there is an increased requirement for cancer treatment in pets, as the therapy leads to pets living longer, pain-free lives. For instance, according to the Merck Manual of Diagnosis and Therapy, cancer can completely and permanently be eradicated in the pet with the help of treatment. In addition, the growing awareness of cancer treatments for pets and the increasing availability of diagnostic tools and therapies are contributing to market growth. With more veterinary clinics offering oncology services and advancements in cancer research, the veterinary oncology industry is expected to continue its upward trajectory, driven by the rising incidence of cancer in pets.

The increasing research and development in veterinary oncology is expected to drive market growth by providing better pet cancer treatments. Investments in cancer therapies for companion animals are also contributing to this growth. For example, in May 2024, the AKC Canine Health Foundation (CHF) announced a $3.6 million investment in canine cancer research, funding studies on oral melanoma and osteosarcoma, which could also benefit human cancer treatments. Similarly, in September 2024, CureLab Veterinary Inc. raised $15 million to support its gene therapy, ElenaVet, which boosts the immune response to cancer and reduces chronic inflammation in pets. The company is focused on improving pet health and longevity through innovative cancer treatments.

Veterinary research organizations are also advancing the fight against pet cancer. In January 2024, the Morris Animal Foundation announced funding for eight new research grants to study various canine cancers, including lymphoma, bone cancer, and soft-tissue sarcomas. These studies aim to improve understanding, diagnosis, and treatment options for pet cancer, potentially benefiting both pets and humans. These ongoing R&D initiatives and investments by industry stakeholders are expected to drive significant growth in the veterinary oncology industry in the coming years.

Animal Type Insights

The canine segment held the largest revenue share of over 86.09% in 2024 and is also expected to grow at the highest growth rate of 12.56% during 2025-2030. This growth is due to the rising prevalence of cancer and growing awareness of treatment options. In addition, the increasing pet dog population also contributes to the segment's growth. Cancer is the leading cause of morbidity and mortality in dogs. In addition, the rising number of clinical trials to develop treatments against canine tumors contributes to market growth further. For instance, according to the AVMA Veterinary Clinical Trials Registry, 57 clinical trial studies are actively recruiting canine candidates for treatments and therapies against cancer.

The feline segment is anticipated to witness significant growth throughout the forecast period. This growth is primarily attributed to the rising population of cats in the world and the apparent rise in the number of diseases associated with them. According to the International Fund for Animal Welfare (IFAW), there are over 220 million pet cats worldwide. Similarly, according to the American Veterinary Medical Association (AVMA), the pet cat population in the U.S. is estimated to be 73.8 million in 2024. Furthermore, establishing research institutes and organizations dedicated to veterinary research helps researchers to access data for understanding cancer patterns in pets. One such initiative is the Australian Companion Animal Registry of Cancers (ACARCinom). Founded in November 2023, ACARCinom aims to create a comprehensive national database for cancer occurrences in companion animals, specifically dogs and cats. Such initiatives are expected to drive the segment's growth in the coming years.

Therapy Insights

The surgery segment dominated the market with the largest revenue share in 2024 as it is the most effective treatment for tumors that can be completely removed without exposing critical structures, especially when cancer has not yet spread to other parts of the body. For malignant cancer, surgical intervention is frequently the first step. If the tumor is low-grade and there are no signs of local or distant metastasis, surgery can help in achieving remission. If the procedure is successful, there may be no need for additional therapies, and the cancer might not recur. Owing to these advantages of surgery over other treatments, the segment is anticipated to surge and contribute to market growth.

The immunotherapy segment is anticipated to witness exponential growth of over 14.16% throughout the forecast period. Immunotherapy is one of the recent developments in tumor treatment. Multiple organizations engaged in animal health research sponsor studies to bring new treatment options to the market. For instance, in January 2023, the Morris Animal Foundation funded a clinical trial initiated by the University of Minnesota to develop novel immunotherapeutics for big-breed dogs suffering from osteosarcoma. Similarly, the University of Tokyo is advancing research in canine cancer treatment through innovative immunotherapy techniques. Furthermore, in August 2024, Purdue University and Akston Biosciences partnered to co-develop an anti-cPD-L1 monoclonal antibody (mAb) immunotherapy aimed at treating cancer in dogs. Thus, the companies working on immunotherapeutic R&D for veterinary cancer also contribute to the market's expansion.

Cancer Type Insights

The skin cancer type segment held the largest revenue share in the market in 2024. This growth can be attributed to the prevalence of squamous cell carcinoma in cats & dogs, and skin tumors are the most typical form of cancer in older dogs. For instance, according to research published in the PubMed Central Journal in April 2023, 56% of the total malignant tumors in dogs were found in the skin. Similarly, 69% of benign tumors were skin cancers. In cats, squamous cell carcinoma (SCC) commonly occurs in facial areas. However, it can occur anywhere, including the toes. For instance, the SCC of the toes comprises around 25% of all cat digital tumors. Mast cell tumors (MCTs) are the third most common type of tumor found in dogs, accounting for 11% of skin cancer cases. Thus, the rising prevalence of skin cancers in canine, feline, and equine demand for early diagnosis and advanced therapeutics, which are fueling market growth.

The others segment is expected to grow the most over the forecast period, with a CAGR of 13.49% during the forecast period. The others segment comprises adenocarcinomas (e.g., anal sac adenocarcinoma), mammary cancers, brain tumors, nasal tumors, oral tumors, and other cancers. The rising prevalence of various cancers in animals boosts the demand for oncology therapies and surgeries. For instance, according to the article by MDPI in July 2024, the incidence of pulmonary carcinoma (PPC) is the most in primary lung cancer among dogs. Under pulmonary carcinoma, the most common histological subtype is pulmonary adenocarcinoma, which accounts for 60-80% of incidences.

Regional Insights

North America veterinary oncology market accounted for the largest revenue share of over 53.9% in 2024. The region's need for oncology care is being increased by the expanding strategic initiatives by major companies to increase access to precision medicine treatments for pet cancer in North America. For instance, in July 2023, Ardent and FidoCure formed an innovative partnership to provide consumers with oncology innovation in the animal health industry. By using each company's unique strengths, this partnership advances knowledge, expands access to the most advanced precision treatment for animals, and fosters innovation in the veterinary oncology sector.

U.S. Veterinary Oncology Market Trends

The veterinary oncology market in the U.S. is set to exhibit a lucrative rise due to clinical trials and ongoing research in the veterinary oncology industry, as they lead to advancements in treatment options and improve outcomes for animals diagnosed with cancer. For instance, in March 2024, a Yale researcher produced a vaccine that can prevent or slow down several dog tumors. Over 300 canines have received the vaccination thus far in a series of clinical trials that are presently going on at ten locations across the United States and Canada. The vaccine raises the 12-month survival chances of dogs with specific tumors from roughly 35% to 60%, the research team reports. The therapy also reduces tumor size in many dogs.

Europe Veterinary Oncology Market Trends

The European veterinary oncology market is set to witness a lucrative rise due to the growing pet population, owners' increasing willingness to spend money on their pets, increasing concerns about pet health, and growing demand for veterinary cancer treatment. In 2023, for instance, there were approximately 352 million pets in Europe, according to FEDIAF, the trade association for the pet food sector. Approximately 129 million of these were cats, 106 million were dogs, and the remaining number included aquatic pets, small mammals, and pet birds. In 2023, around 166 million homes in Europe had pets. Also, the pet population in 2023 is significantly higher than the 300 million pet population anticipated in Europe in 2018. A sizable pet population indicates a growing population of possible cancer sufferers, which is anticipated to fuel market growth.

The UK veterinary oncology market is set to witness lucrative growth due to the highest pet populations as well as the highest pet-related spending rates. In addition, a high rate of medicalization, increasing pet humanization, enhanced diagnostics, and an increasing number of veterinary clinics providing oncology care all contribute to the substantial market across the country. For example, the UK's Willow Veterinary Centre offers a variety of medicinal and surgical oncology therapies to pets there. These include intracavitary chemotherapy, electrochemotherapy, therapeutic melanoma vaccination, chemotherapy, surgery, and metronomic (low-dose) chemotherapy. Moreover, market growth is anticipated to be supported by a number of measures taken by industry participants to increase diagnostic rates. For example, in November 2023, Veterinary Pathology Group and VolitionRx Limited collaborated to introduce the Nu. Q Vet Cancer Test, which uses vaccination, electrochemotherapy, and intracavitary chemotherapy to identify and track cancer in dogs in the UK and Ireland.

The German veterinary oncology market growth is primarily driven by the rising incidence of animal cancer. A National Library of Medicine report from October 2022 states that 109,616 German dog tissue samples' pathological datasets were processed and statistically analyzed. 70,966 samples (64.7%) had neoplasms diagnosed, whereas 38,650 samples (35.3%) had non-neoplastic diseases. The most common neoplasms were odontogenic tumors (4.7%), melanocytic tumors (5.2%), mast cell tumors (9.7%), soft tissue sarcomas (5.8%), lipomas (5.8%), benign skin tumors (15.4%), histiocytomas (7.0%), and breast cancers (21.9%). As cancer rates in pets increase, pet owners are seeking specialized oncology treatments, including surgery, chemotherapy, radiation therapy, and targeted therapies, to improve their pets' quality of life. This demand has led to advancements in veterinary oncology, with new diagnostic tools and treatment options becoming more accessible.

Asia Pacific Veterinary Oncology Market Trends

The veterinary oncology market in Asia Pacific is expanding quickly and is expected to grow even faster over the forecast period. The primary drivers expected to drive the regional market are the rise in middle-class households, the number of adopted companion animals, the rising expense of pet care, the humanization of pets, the strong presence of industry players, and supportive government policies. In addition, it is projected that growing consumer awareness of animal practices and treatments will fuel market growth.

The veterinary oncology market in India is estimated to exhibit a significant increase over the forecast period. This can be attributed to the increasing prevalence of veterinary cancers in the region and growing initiatives by the government to combat its spread. According to an article published by Ray Pallab in the International Journal of Biological and Environmental Investigations, in 2024, India experienced a sharp increase in the number of domestic animal cancer cases, particularly in dogs and cats. This market is further fueled by pet owners' increasing awareness of various treatment options, such as immunotherapy, radiation therapy, and chemotherapy, as they look for specialized treatment to manage and treat their pets' diseases.

Latin America Veterinary Oncology Market Trends

The Latin America veterinary oncology market is estimated to witness a lucrative rise over the forecast period. The region has seen an increase in pet cancer cases, especially in dogs and cats, which has increased the demand for veterinary oncology services. Additionally, pet owners are becoming more aware of early detection and treatment possibilities, which motivates them to seek veterinary oncology treatments. Pet owners are finding oncology care more affordable because of the increased popularity of pet insurance, which helps pay for costly cancer treatments.

This Brazil veterinary oncology market is subject to a lucrative increase during the forecast period. The region's market is being driven by rising awareness of pet health and increasing pet ownership. According to Bennett, Coleman & Co. Ltd, Brazil has the world’s fourth largest pet market. Increased awareness of pet health and advancements in veterinary medicine have led to a greater recognition of cancer in animals. This has fueled demand for veterinary oncologists and cancer treatments.

MEA Veterinary Oncology Market Trends

The veterinary oncology market in MEA is estimated to witness lucrative growth over the forecast period. The market is growing as a result of the expanding availability of specialist veterinary cancer services, such as radiation therapy, chemotherapy, and surgical options. These treatments are becoming more widely available because of the existence of specialty veterinary cancer clinics in urban areas. Furthermore, an increase in veterinarian consultations and treatments has resulted from growing awareness campaigns about pet health, particularly cancer prevention and early detection. Veterinary specialists in the region are becoming more knowledgeable about oncology, increasing the provision of high-quality care. The availability of high-quality diagnostic tools and equipment such as imaging technologies such as CT scans, MRIs and radiation therapy machines in the MEA region is enhancing the accuracy and success rates of cancer treatment in animals.

This veterinary oncology market in South Africa is subject to lucrative growth in the coming years. The presence of pet insurance providers, as well as the increased use of pet insurance, are key drivers of the country's veterinary oncology industry. Additionally, the presence of pet insurance providers, as well as the increased use of pet insurance, are key drivers of the country's veterinary oncology industry. For instance, the top pet insurance broker in South Africa, MediPet, provides thorough, authentic, and transparent coverage. The Ultimate 360 Plan, which costs R72,000 (USD 4,084.95) annually, is one of the several plans the company offers. Surgery is a part of one of the most thorough plans. Surgery, chemotherapy, and radiation therapy are among the expensive veterinary oncology procedures that pet insurance helps pay for. This increases demand for veterinary oncology services by motivating pet owners to pursue cutting-edge therapies for their animals.

Key Veterinary Oncology Company Insights

Major players operating in the market are involved in various strategies such as distribution agreements, mergers & acquisitions, and expansions. Most crucially, they exhibit a very high degree of innovation in product research & development to improve their market penetration. For instance, in September 2024, Boehringer Ingelheim International GmbH acquired Saiba Animal Health AG to strengthen its animal therapeutics portfolio. The company's innovative vaccine development platform is expected to enhance the veterinary oncology sector.

Key Veterinary Oncology Companies:

The following are the leading companies in the veterinary oncology market. These companies collectively hold the largest market share and dictate industry trends.

- Elanco

- Boehringer Ingelheim International GmbH

- Zoetis

- Elekta AB

- PetCure Oncology

- Accuray Incorporated

- Varian Medical Systems, Inc. (parent company: Siemens Healthineers)

- Virbac

- Merck & Co., Inc.

- Dechra Pharmaceuticals PLC

- NovaVive Inc.

- Ardent Animal Health, LLC (A BreakthrU Company)

Recent Developments

-

In September 2024, Boehringer Ingelheim International GmbH acquired Saiba Animal Health AG to strengthen its animal therapeutics portfolio. The company's innovative vaccine development platform is expected to enhance the veterinary oncology sector.

-

In July 2024, Dechra Pharmaceuticals PLC acquired Invetx to bolster the company's existing pipeline.

-

In March 2024, Merck & Co., Inc. completed the acquisition of Harpoon Therapeutics, Inc. to diversify its oncology pipeline.

Veterinary Oncology MarketReport Scope

Report Attribute

Details

Market size value in 2025

USD 1.76 billion

Revenue forecast in 2030

USD 3.11 billion

Growth Rate

CAGR of 12.08% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, therapy, cancer type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Virbac; Elanco; Idexx Laboratories; Dechra Pharmaceuticals; Heska Corporation; Indian Immunologicals Ltd; Hester Biosciences Pvt. Ltd; Biogénesis Bagó

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Oncology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary oncology market report based on animal type, therapy, cancer type, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiotherapy

-

Stereotactic Radiation Therapy

-

LINAC

-

Other Types

-

-

Conventional Radiation Therapy

-

Surgery

-

Chemotherapy

-

Immunotherapy

-

Other Therapies

-

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancers

-

Lymphomas

-

Sarcomas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary oncology market size was estimated at USD 1.57 billion in 2024 and is expected to reach USD 1.76 billion in 2025.

b. The global veterinary oncology market is expected to grow at a compound annual growth rate of 12.08% from 2025 to 2030 to reach USD 3.11 billion by 2030.

b. North America accounted for the largest revenue share of over 53.9% in 2024. The region's need for oncology care is being increased by the expanding strategic initiatives by major companies to expand access to precision medicine treatments for pet cancer in North America.

b. Some key players operating in the veterinary oncology market include Elanco; Boehringer Ingelheim International GmbH; Zoetis; Elekta AB; PetCure Oncology; Accuray Incorporated; Varian Medical Systems, Inc. (parent company: Siemens Healthineers); Virbac; Merck & Co., Inc.; Dechra Pharmaceuticals PLC; NovaVive Inc.; Ardent Animal Health, LLC (A BreakthrU Company)

b. Key factors that are driving the veterinary oncology market growth include the growing prevalence of cancer in companion animals, increasing R&D in veterinary oncology, a growing number of pet ownership, technological advancements in pet cancer treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.