- Home

- »

- Animal Health

- »

-

Veterinary Orthopedic Medicine Market Size Report, 2030GVR Report cover

![Veterinary Orthopedic Medicine Market Size, Share & Trends Report]()

Veterinary Orthopedic Medicine Market Size, Share & Trends Analysis Report By Product Type (Biologics, Pharmaceuticals, Viscosupplements), By Animal Type (Canine, Feline), By Application, By Route of Administration, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-167-6

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Veterinary Orthopedic Medicine Market Trends

The global veterinary orthopedic medicine market size was estimated at USD 3.62 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2030. Rising prevalence of osteoarthritis among animals and the adoption of biologics for veterinary orthopedic complications treatment are key factors driving market growth. Stem cell therapy has recently gained popularity and attracted great interest in research and clinical settings. In veterinary medicine, stem cell therapy has been studied as a potential treatment option for various health complications, such as dermatological, orthopedic, dental, etc. The use of stem cells in these diseases is still in its infancy, but the potential for stem cell therapy in veterinary medicine is extensive. Another such booming treatment is platelet-rich plasma (PRP) therapy, used in humans and equines and is now gaining popularity in companion animal applications.

The emergence of these therapies is providing a significant boost to market growth. Industry leaders like Zoetis, Inc.; Boehringer Ingelheim, Elanco Animal Health, American Regent, Inc.; Merck Animal Health (Merck & Co. Inc), and Vetoquinol S.A. are investing significantly in research and development of novel medicines for musculoskeletal complications gripping various animals. Companies like Ardent Animal Health, LLC, VetStem, Inc.; MEDREGO LLC, etc. are specializing in developing specialized biologics like Stem Cells, Platelet-Rich Plasma (PRP), and Monoclonal Antibodies to combat orthopedic conditions in animals effectively. An essential fact accelerating the industry growth is the rising prevalence of osteoarthritis (OA) and other degenerative joint disease (DJD) among animals like dogs, cats, horses, etc. According to estimates by a 2022 study in Frontiers of Veterinary Sciences, OA is the most common musculoskeletal disorder in dogs where, about, 1 in 4 dogs suffer from it.

Another research study from the Veterinary Ireland Journal (2021) stated that approximately 40% of all cats suffer from OA. Estimates provided by the American Animal Hospital Association or AAHA in 2021 point towards the fact that 40-92% of all cats experience joint pain due to OA or other DJD. These studies also suggest possible underdiagnosis of these conditions in these animals. Figures provided by Zoetis in May 2023 indicate that out of the total diagnosed cases of canine osteoarthritis in the US, only 33% are treated by veterinarians. Furthermore, June 2022 University of Illinois data suggests that athletic horses are at a high risk of developing OA. Osteoarthritis causes lameness in these horses, and it is estimated that the disease prevalence in horses aged 15 years & above is greater than 50%; in horses aged over 30 years, it is more than 80-90%. Osteoarthritis affects the performance and well-being of athletic horses. It is crucial to understand causal and developmental pathways, tailor education, and prescribe correct treatment for early diagnosis.

Market Concentration & Characteristics

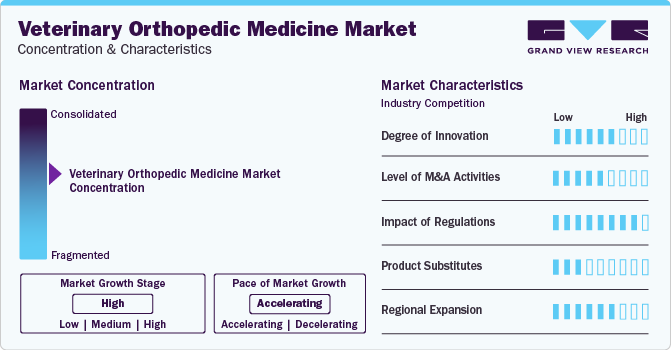

Market growth stage is high, and the pace of market growth is accelerating. Market is characterized by a high degree of innovation owing to advancements, such as the emergence of regenerative medicine in veterinary medicine and increasing adoption of viscosupplementation products in the treatment of musculoskeletal disorders in animals like cats, horses, and dogs.

Market is characterized by a high level of M&A activities by the leading players and emergence of specialist companies. These specialist companies concentrate on developing dynamic products for market using a specific type of material or substance. For instance, Hyalogic is a US-based company that specializes in producing various products using hyaluronic acid. It has products for humans and animals like dogs, cats, and horses.

The market is also subject to increasing regulatory scrutiny. Stem cell-based products (SCPs) are gaining popularity in the field of veterinary medicine. As SCPs are used for regeneration, repair, or replacement of damaged areas and sometimes can be fatal for the animal, these are subject to intense regulatory scrutiny. Leading regulatory authorities worldwide, such as the U.S. FDA and European Medicines Agency, ensure these products are safe for use in veterinary medicine.

These regulatory bodies provide manufacturers of SCPs or other Animal Cells, Tissues, and Cell- and Tissue-Based Products (ACTPs) with recommendations on manufacturing unique ACTPs and how to meet CGMP requirements. They also help developers, veterinarians, and others who determine donor eligibility for ACTPs. Selecting an appropriate donor is critical to ensure the quality of an ACTP and prevent the spread of diseases from donor to animal recipient and to humans who handle the product.

Adoption of products by end-users is variable based on type of product. Orthopedic Pharmaceuticals (NSAIDS, Steroids, etc.) show a very high adoption in end-user settings like home settings where animal owners can directly procure required pharmaceuticals. However, orthopedic biologics and viscosupplementation, being specialized products and requiring trained personnel for administration, have a higher adoption in veterinary hospitals and clinics.

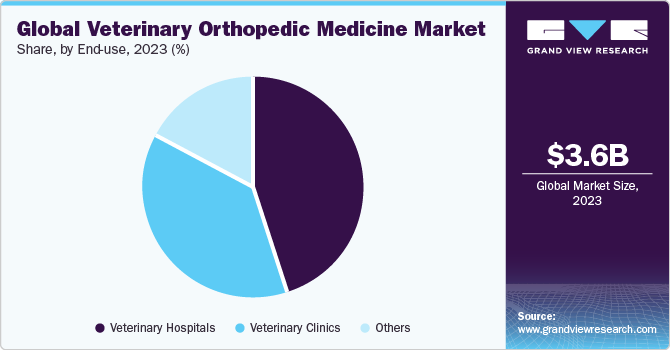

End-use Insights

The veterinary hospitals segment led the market in 2023. It is attributed to growing patient footfall in hospitals for treatment of these diseases in animals. Products like biologics and viscosupplements require specialized instruments and trained professionals to carry out procedures. Also, as per individual treatment plans, pharmaceuticals are prescribed by veterinarians, and they are available in hospitals to make it convenient for pet owners to procure them.

The veterinary clinics segment is also anticipated to witness a substantial rise in this market owing to higher accessibility for animal owners. Large-scale veterinary hospitals are only present at a specific location that is central to all. However, for individuals, traveling to a local veterinary clinic might be more beneficial for basic requirements like procurement of medications, routine check-up of animals, etc.

Regional Insights

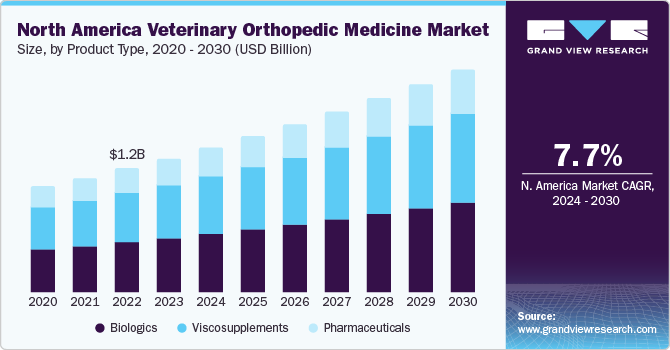

North America dominated the highest revenue share of 37.1% share in 2023. This high share is attributed to developed veterinary care infrastructure, high pet adoption, and the presence of major market players like Zoetis and Elanco Animal Health in the U.S. According to Humane Society International data from 2023, the U.S. alone accounts for around 85 million pet owner families, of which 85 million is pet dog population and 65 million is pet cat population. Also, Humane Canada stated that in 2021, around 20,974 dogs and 60,677 cats were taken into shelters, of which 44% of dogs and 62% of cats have been adopted back into homes. Also, this region is seeing a rise in health insurance for pets and other animals, which is driving market growth in this region.

Asia Pacific is anticipated to witness significant growth from 2024 to 2030. Population in this region is dependent on agriculture and livestock animals for their livelihood. Small farms with few animals, like cattle, sheep, etc., are said to produce 80% of the food consumed in the Asia Pacific region. These small farms are present globally in all countries but are majorly concentrated in Asia. It is crucial to ensure that livestock animals on farms stay healthy. Therefore, public and private entities are ensuring that a good standard of care is provided and proper medications reach these farms promptly. Furthermore, the Elanco Animal Health survey for 2022 states that pet ownership in China is estimated to jump from 19% of households in 2020 to 40% of households by 2030.

Product Type Insights

Pharmaceuticals led the market and held a revenue share of 51.8% in 2023. This high percentage can be attributed to the fact that pharmaceuticals are the first line of treatment for any musculoskeletal disorder in animals. They come in various dosage forms like tablets, chewable tablets, powders, liquids, creams/ointments, etc., and therefore can be used as per convenience on different species. Furthermore, NSAIDS segments under the Pharmaceuticals account for the highest revenue share as they have labeled claims of efficacy in pain management, specific regulatory approvals, and can be prescribed by veterinarians. The viscosupplements segment is estimated to have a high growth rate of 9.3% from 2024 to 2030 as these products have proven effective in replenishing synovial fluid (fluid present in joints) affected by musculoskeletal disorders in animals.

Animal Type Insights

Canine accounted for the largest revenue share in 2023 due to the growing dog adoption globally. As per data published by HealthforAnimals in September 2022, dogs are the most commonly adopted pet in the world, and it is estimated that 1 in 3 households across the globe owns a dog. Brazil marks as one of the countries with the highest pet dog population (54.2 million) after the U.S. Families from the U.S., China & Europe contribute to approximately half a billion total dogs & cats. Furthermore, a research article published in the Journal of Small Animal Practice (JSAP) in 2023 suggested that musculoskeletal disorders like osteoarthritis and degenerative joint disease alone affect approximately 200,000 dogs annually.

The equine segment is expected to register a high CAGR from 2024 to 2030. The popularity of equestrian sports is on the rise globally. These equestrian sports activities put a strain on the joints as well as an overall musculoskeletal system of horses. A Journal of Equine Veterinary Science study from 2020 revealed that the training & exercise time of an athletic horse is a direct correlation with the development of OA in them. The U.S. Department of Agriculture reported that of all lameness observed in horses, 60% is due to OA. In addition, manufacturers are increasingly producing specialized products to combat this issue. All these factors combined present a promising growth prospect for this segment.

Application Insights

Osteoarthritis accounted for the largest revenue share in 2023. It is attributable to fact that OA is the most common type of musculoskeletal disorder in animals. This disease is very debilitating and causes inflammation of joints surrounding the joints. It is often painful and leads to lameness and postural & behavioral changes in animals like dogs, cats, horses, cattle, etc. A 2018 study examining dairy farms across England & Wales stated that the prevalence of lameness in cattle is at around 36.8%.

Arthritis and joint pain are the leading causes of this lameness. The joint inflammation/pain segment is estimated to have a high growth rate from 2024 to 2030. It is because any musculoskeletal complication has joint pain as the first and vital symptom. Furthermore, apart from traditional oral and topical medications, newer therapies like stem cell and PRP, have been emerging in the treatment of these complications.

Route of Administration Insights

The parenteral route segment accounted for the largest revenue share in 2023 due to a large number of products administered through this route of administration. This method is most convenient as medications administered this way have a higher absorption rate and faster onset of action inside the animal’s body. Another reason is that animals are sedated before any procedure or medication administration, so in that sedation state, this route of administration is considered most convenient by veterinarians and the animal may not always comply with an oral route easily.

Key Companies & Market Share Insights

Some of the key players operating in the market include Zoetis Inc.; Boehringer Ingelheim, Elanco Animal Health, Inc.; and Merck Animal Health (Merck & Co. Inc.).

-

Zoetis is one of the major veterinary product companies in the world. It discovers, develops, manufactures, and commercializes vaccines, medicines, diagnostics, and other technologies for the treatment of various diseases in companion animals and livestock animals. It has widespread network in over 45 countries

-

Elanco Animal Health has been operational in veterinary industry for more than 65 years. It is a subsidiary of Pharmaceutical products giant Elli Lilly & Company. The company is among the top 4 veterinary product manufacturers, with over 200 brands and a presence in over 90 countries

-

Hyalogic, Bioiberica S.A.U, and Contipro A.S. are some of emerging market participants in the market

-

Hyalogic is a company that specializes and focuses on manufacturing products made from High Molecular Weight Hyaluronic Acid. This substance is known to have hydrating as well as lubricating properties. It has a product portfolio ranging from Skin Care, Personal Care, Joint Care, etc., in humans and specialized Joint Care products in Animal Care

-

Contipro A.S. is a Czech Republic-based company specializing in producing Hyaluronic Acid based products for humans and animals. The company has innovative flagship products for veterinary in joint care, dental care, etc.

Key Veterinary Orthopedic Medicine Companies:

- Zoetis, Inc.

- Boehringer Ingelheim

- Elanco Animal Health

- American Regent, Inc.

- Merck Animal Health (Merck & Co. Inc.)

- Vetoquinol S.A.

- Ceva Sante Animale

- Virbac

- Biogenesis Bago

- Ardent Animal Health, LLC

- Bioiberica S.A.U

- PetVivo Holdings, Inc. (Spryng)

- Contipro A.S.

- VetStem, Inc.

- Enso Discoveries

- Contura Vet US

- T-Cyte Therepeutics

- MEDREGO LLC

- Bimeda U.S.

- Hyalogic

- Hester Biosciences

Recent Developments

-

In October 2023, VetStem, Inc. entered into a partnership agreement and expanded its production by acquiring 3 GMP manufacturing facilities in the San Diego BioPharma Corridor.

-

In October 2022, Zoetis Inc. announced the acquisition of Jurox, an Australia-based company that develops, manufactures, and markets a wide range of veterinary medicines for treating livestock and companion animals.

-

On 21 April 2022, Boehringer Ingelheim received approval in Europe for RenuTend™, a product to improve healing of tendon and suspensory ligament injuries in horses. Complements equine stem cell product Arti-Cell FORTE treats recurrent lameness associated with non-septic joint inflammation in horses.

Veterinary Orthopedic Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.94 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, animal type, application, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

US; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis, Inc.; Boehringer Ingelheim; Elanco Animal Health; American Regent, Inc.; Merck Animal Health (Merck & Co. Inc); Vetoquinol S.A.; Ceva Sante Animale; Virbac; Biogenesis Bago; Ardent Animal Health, LLC; Bioiberica S.A.U; PetVivo Holdings, Inc. (Spryng); Contipro A.S.; VetStem, Inc.; Enso Discoveries; Contura Vet US; T-Cyte Therepeutics, ;EDREGO LLC; Bimeda U.S.; Hyalogic and Hester Biosciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Orthopedic Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented veterinary orthopedic medicine market report based on product type, animal type, application, route of administration, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Stem Cells

-

Platelet-Rich Plasma (PRP)

-

Monoclonal Antibody

-

-

Viscosupplements

-

Pharmaceuticals

-

Steroids

-

NSAIDS

-

Others

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

Cattle

-

Swine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoarthritis

-

Degenerative Joint Disease

-

Joint Inflammation/Pain

-

Other Applications

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Intra-muscular

-

Intra-articular

-

Others

-

-

Topical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

Frequently Asked Questions About This Report

b. The global veterinary orthopedic medicine market size was estimated at USD 3.62 billion in 2023 and is expected to reach USD 3.94 billion in 2024.

b. The global veterinary orthopedic medicine market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 6.37 billion by 2030.

b. North America dominated the veterinary orthopedic medicine market with a share of 37.1% in 2023. This is attributable to rising pet healthcare awareness and increasing pet adoption in the region.

b. The veterinary orthopedic medicine market in the U.S is estimated to be USD 1.34 billion in 2023

b. The key factors driving the market are emergence of regenerative medicine in veterinary medicine and, increasing adoption of viscosupplementation products in treatment of musculoskeletal disorders in animals like cats, horses, and dogs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."