- Home

- »

- Animal Health

- »

-

Veterinary Pain Management Market, Industry Report, 2030GVR Report cover

![Veterinary Pain Management Market Size, Share & Trends Report]()

Veterinary Pain Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (Osteoarthritis, Postoperative Pain, Others), By Product, By Route of Administration, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-060-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Pain Management Market Trends

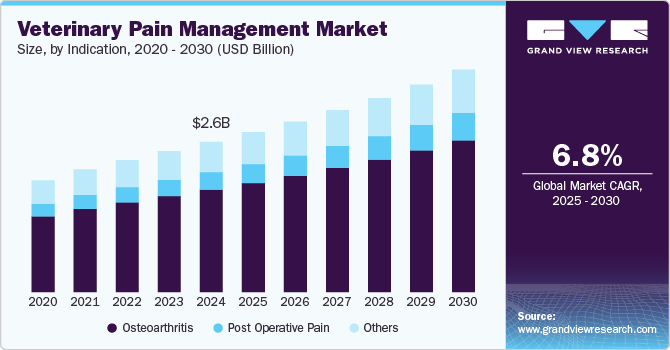

The global veterinary pain management market size was estimated at USD 2.58 billion in 2024 and is projected to grow at a CAGR of 6.80% from 2025 to 2030. Some of the key drivers of the market include evolving treatment methodologies, rising awareness initiatives, increasing R&D initiatives, and rising prevalence of associated health conditions. In recent years, pain management treatment in the veterinary sector has significantly evolved. Experts from across the globe are utilizing innovative strategies to tackle the pain in animals. Effective management is essential for animal health as it facilitates faster recovery from health complications such as osteoarthritis and muscular & cancer-related pain and also helps reduce postoperative pain. The importance of appropriate administration of pain relief medicine is highlighted by research showcasing the correlation between the presence of pain and the slow recovery of animals.

Experts have formulated a multimodal treatment strategy that combines different classes of drugs and relief techniques to enhance management. This approach targets various steps in the pathway and maximizes relief while minimizing adverse effects associated with individual medications. It combines a variety of drugs with different mechanisms of action, aiming to provide optimal relief. This method allows lower doses of each medication, ultimately reducing the risk of adverse effects. Both neuropathic and nociceptive pain are effectively addressed, promoting improved recovery. This method further suggests inculcation of physical therapy, which assists in healing the affected area.

Researchers worldwide are involved in discovering novel methodologies to treat pain in animals effectively. For example, according to a February 2023 publication, researchers at Utrecht University (Netherlands) developed a novel treatment for dogs with osteoarthritis: injecting stem cells into the affected joint to promote cartilage regeneration and reduce pain. In addition, according to an article published in July 2023, researchers from the University of Southern California started a biopharmaceutical startup aimed at slowing down aging & arthritis in dogs and focusing on developing relief treatments. It is led by a professor of orthopedic surgery, stem cell research, and regenerative medicine, Denis Evseenko, and they are currently focused on developing non-opioid relief and joint preservation drugs for dogs, with a focus on breeds like Labradors and Golden Retrievers, which are comparatively more prone to arthritis due to their genetic predisposition. Initial results have shown promising results in alleviating pain and inflammation in dogs with osteoarthritis. Such breakthroughs can significantly improve management in animals, enhance their quality of life, and open up new avenues for research & development.

Another crucial market driver is the increase in research & developmental activities undertaken by industry participants to introduce novel & improved products to manage pain in animals such as dogs, cats, and livestock. For instance, in June 2024, two companies, Can-Fite Biopharma Ltd. and Vetbiolix, announced positive results from the initial clinical trial for their canine osteoarthritis drug Piclidenoson (A3 adenosine receptor agonist). Osteoarthritic dogs were administered with varying doses of this drug for 90 days, along with questionnaires and assessment scales. Significant canine mobility and reduction was observed, particularly at higher doses. Both companies are considering entering an entire licensing agreement for the commercialization rights of the product upon regulatory approval.

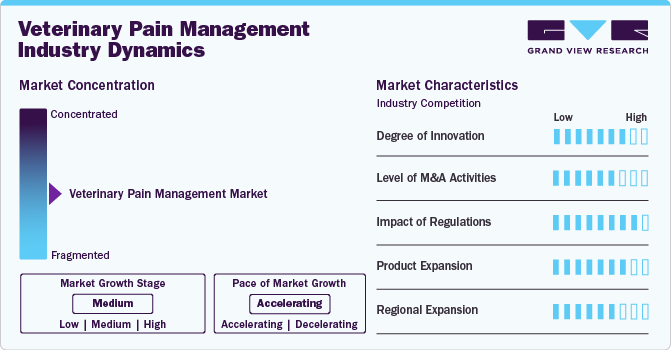

Market Concentration & Characteristics

The veterinary pain management industry is moderately concentrated. It is expanding faster and is currently in a medium growth stage. The growing number of pet owners is a primary driver of market growth. As more individuals acquire pets as friends, the number of pets worldwide is growing. The rise in pet ownership increases the need for veterinary services, particularly the requirement for NSAIDs and anesthetics. The demand for specialized medical care, such as orthopedic treatments, is rising as more people bring dogs into their homes.

The veterinary pain management industry exhibits a moderate to high level of innovation, as demonstrated by the constant collaboration and joint ventures among industry participants, the introduction of new products, and supportive initiatives. For instance, in May 2023, Elanco announced a breakthrough treatment for canine parvovirus. This treatment is the only approved therapeutic solution to treat the highly contagious and deadly disease affecting dogs successfully. The therapy can reduce the virus's mortality rate to 91% without supportive care.

The rising trend of pet ownership, especially in developed regions, boosts the demand for pet surgeries and instruments. Pet owners are increasingly willing to invest in advanced medical treatments for their animals. The growth of specialized veterinary clinics and hospitals equipped with advanced diagnostic and surgical facilities also positively impacts the demand for veterinary surgical instruments. These facilities are better equipped to manage complex veterinary operating procedures.

Market players in this sector have recently been subject to regulatory scrutiny due to their non-compliant business activities. Some leading companies, like Zoetis, have recently come under the European Commission (EC) scanner for their anticompetitive conduct in the medicines space for canines.

Product Insights

The NSAIDs segment led the market with the largest revenue share of 85% in 2024. and is anticipated to grow at a lucrative CAGR over the forecast period. These are the most widely prescribed drugs for osteoarthritis-related pain and inflammation.NSAIDs (Non-Steroidal Anti-Inflammatory Drugs) have several benefits over other relief products, making them a popular choice for managing various conditions in animals, particularly in pets. Many alternative relief products, such as opioids or certain sedative medications, can cause drowsiness or sedation in animals. NSAIDs, on the other hand, generally do not sedate animals, allowing them to maintain normal activity levels while still managing pain. Companies are striving to develop new NSAIDs with fewer adverse side effects and reactions.

The anesthetics segment is expected to grow at the fastest CAGR over the forecast period. Anesthetics are used to prevent animals from experiencing discomfort during surgeries, dental work, or other invasive medical procedures. By rendering the animal unconscious or insensate, anesthetics ensure that methods can be performed without causing distress or harm. Furthermore, for many medical interventions, such as fracture repairs, wound treatments, or tumor removals, anesthesia is critical. It allows veterinarians to perform complex procedures safely, minimizing stress and physical trauma to the animal. Local anesthetics and systemic anesthesia contribute to effective postoperative relief. This enhances the animal's comfort and promotes faster recovery, as animals in pain tend to move less, eat poorly, and have delayed healing.

Indication Insights

Based on indication, the osteoarthritis (OA) segment led the market with the largest revenue share of 68.11%in 2024. This is owing to the high prevalence of arthritis and joint pain, especially in canine animals. As animals age, osteoarthritis increases, leading to greater demand for relief solutions such as nonsteroidal anti-inflammatory drugs (NSAIDs), joint supplements, and regenerative therapies like stem cell treatments. Moreover, some breeds are more likely to develop osteoarthritis due to genetic causes. Large dog breeds, such as German Shepherds and Labrador Retrievers, are prone to hip dysplasia and arthritis. For mild to moderate OA pain, nutraceuticals are preferred over NSAIDs, whereas Coxibs are used for moderate to severe pain. Among the medications prescribed for the illness are Metacam, Meloxicam, Rimadyl, and Galliprant.

The postoperative pain segment is estimated to grow at the fastest CAGR during the forecast period. Rising surgical procedures due to the incidence of diseases and the demand for better pet care are instrumental in adopting these pharmaceuticals in developed and developing economies. Postoperative ache is a major cause of death in many animals due to the lack of analgesics. Hence, companies focus on developing analgesics that can address postoperative complications, as the use of opioids is strictly monitored.

Animal Insights

Based on animal, the production animals segment led the market with the largest with the largest revenue share of 64% in 2024, owing to increasing incidence of chronic diseases, awareness amongst animal healthcare organizations, high animal healthcare spending in developing countries, and growing demand for relief solutions in production animals such as cattle, swine, poultry, sheep, etc. Livestock often require medical procedures such as dehorning, castration, or cesarean sections, which create demand for effective solutions. Veterinarians are turning to analgesics, NSAIDs, and other methods to ensure a quick recovery and minimize pain during these interventions.

The companion animals segment is anticipated to grow at the fastest CAGR over the forecast period, owing to increased ownership, awareness, and demand for efficient animal care. Moreover, the increasing prevalence of obesity and other chronic illnesses, such as osteoarthritis and cancer, is fueling the market growth. For instance, an Animal Care Foundation research states that around six million additional cases of cancer are reported in dogs and a similar number in cats each year in the United States. In the near future, this factor is expected to boost market growth.

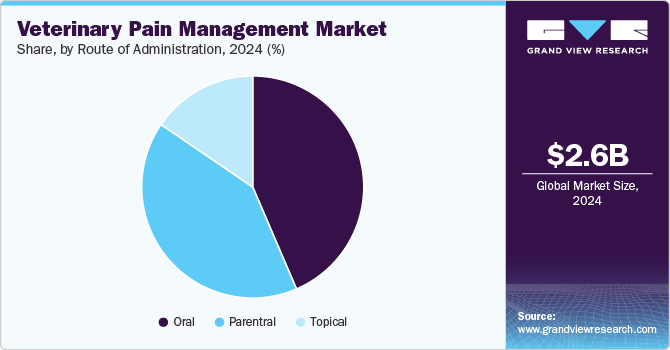

Route of Administration Insights

Based on route of administration, the oral segment led the market with the largest revenue share of 43.55% in 2024. Oral tablets are easier to administer than other medication forms like injections. This ease of use encourages pet owners to adhere to prescribed plans, ensuring that animals receive regular and effective medication. Oral tablet form is available for a wide range of pain management pharmaceuticals, such as opioids, non-steroidal anti-inflammatory drugs (NSAIDs), and supplementary relievers. This variety enables veterinarians to tailor treatment procedures to specific illnesses and pain levels.

The topical segment is anticipated to grow at the fastest CAGR over the forecast period. Applying topical drugs is frequently less complicated than administering oral or injectable ones, particularly for challenging-to-manage animals. Both pet owners and their pets will experience less stress when owners apply these therapies without the requirement of expert training. Topical preparations enable application directly to the area of inflammation or pain. For some ailments, including arthritis or localized injuries, this targeted treatment may be more beneficial, offering quick relief with potentially fewer systemic side effects.

Mode of Purchase Insights

Based on mode of purchase, the prescription segment led the market with the largest revenue share of 84.05% in 2024. One of the benefits of medication prescribed for pain is that they are under professional supervision. Veterinarians are qualified to oversee the administration of these medications, modify dosages as needed, and monitor for any difficulties or adverse effects. For analgesics to be used safely and effectively, this oversight is essential. Animals with chronic pain may need long-term care regimens that involve routine veterinary visits and medication changes. Prescription drugs make this continual management easier and guarantee reliable and efficient pain relief.

Moreover, prescription drugs also cover a broad spectrum of advanced pharmacological choices, including opioids, non-steroidal anti-inflammatory drugs (NSAIDs), and innovative therapies like monoclonal antibodies. Because of their strength and requirement for medical supervision, these options are frequently unavailable over the counter. Prescription medications are typically more potent than OTC drugs. Conditions like postoperative pain, chronic arthritis, or cancer-related discomfort in animals often require medications with greater strength to effectively manage severe pain, which OTC drugs may not adequately address.

End Use Insights

Based on end use, the hospitals & clinics segment led the market with the largest revenue share of 82.49% in 2024. This is due to an increase in the number of patients seeking treatment for various animal ailments at these facilities. As a result, this segment is projected to grow significantly over the forecast period. Moreover, veterinary hospitals and clinics often handle a wide range of surgeries and treatments where pain management is critical, such as postoperative care, chronic conditions like arthritis, and cancer-related pain. As more pets receive medical interventions in these settings, the demand for effective pain management solutions rises.

The other segment which include pharmacies, drug stores, and pet shops. This segment is expected to witness at a lucrative CAGR over the forecast period. Veterinary pharmacies offer specialized pain management prescriptions for pets, including medications for arthritis, postoperative care, and chronic pain conditions. Their access to advanced pharmaceuticals and ability to dispense prescription and non-prescription medications make them pivotal for pain management in pets. Pet stores also contribute by selling non-prescription pain management products, such as supplements, herbal remedies, and devices like orthopedic beds and braces. They also offer easier access to pain relief products, helping increase market reach, particularly for mild pain management solutions.

Regional Insights

North America dominated the veterinary pain management market with the largest revenue share of 39.56% in 2024, driven by the region's growing pet population, rising costs for pet care, an increase in the frequency of chronic illnesses, and a surge in orthopedic procedures. In addition, a strong healthcare infrastructure and the existence of significant market players will continue to propel the market in the upcoming years. For example, Vegas Valley Pet Hospital announced in November 2023 that it would be opening a veterinary clinic in Las Vegas. The facility will provide orthopedic and soft tissue pet surgery as part of its specialized care. These factors positively influence market growth.

U.S. Veterinary Pain Management Market Trends

The veterinary pain management market in the U.S. accounted for the largest revenue share in North America in 2024, owing to the significant number of prominent animal medicine organizations having a local presence. The U.S. market is propelled by the growing number of veterinarians and pet procedures performed nationwide, as well as the ever-increasing incidence of obesity, chronic illnesses, injuries, and osteoarthritis in the pet population. In addition, increasing pet spending significantly drives the veterinary pain management market due to pet owners' growing prioritization of animal health and well-being. As pets are increasingly considered family members, owners are more willing to invest in veterinary care, especially in managing pain related to aging, arthritis, surgery, or chronic conditions like osteoarthritis and cancer. This higher spending allows for the development and adoption of advanced pain management solutions, including medications, therapies, and technologies, which enhances the overall market growth.

Europe Veterinary Pain Management Market Trends

The veterinary pain management market in Europe is expected to grow at a significant CAGR over the forecast period, due to increased pet population and pet care expenditure. For instance, according to a FEDIAF report, the number of households owing at least one dog or cat is approximately 25% and 27% in Europe in 2022. As more households adopt pets, there is a growing demand for veterinary care, including pain management solutions. Owners are becoming more aware of the importance of treating pain due to chronic conditions like arthritis, surgery recovery, or other ailments. This surge in pet ownership, coupled with the increasing humanization of pets, leads to higher veterinary visits and spending on health treatments, including advanced pain management therapies and pet medications.

The UK veterinary pain management market is expected to grow at a significant CAGR during the forecast period, primarily due to the country's high pet population, rising pet ownership rates, and rising incidence of joint problems in pets. 53% of adult UK citizens own a pet, of which 29% own a dog, 24% own a cat, and 2% own a rabbit, in 2023, according to the PDSA. According to the VetCompass, the top 10 diseases in the UK for dogs include obesity, limb lameness, and arthritis. Moreover, according to the same source, joint problems and cancer accounted for the majority of Labrador Retriever deaths. Large breeds with the highest risk of elbow disorders were also identified, including English Springer Spaniel, German Shepherd, Rottweiler, and Labrador Retriever.

The veterinary pain management market in France is anticipated to grow at a substantial CAGR during the forecast period. The presence of many companies offering pain relief medications significantly drives the market growth in France by ensuring the availability and accessibility of effective treatments for various animal conditions. These companies invest in research, development, and distribution, ensuring a wide range of medications, such as NSAIDs, opioids, and other analgesics, are available for veterinarians. Their presence supports advancements in pain management solutions, enhances the quality of care provided to animals, and fosters competition, which can lead to innovations and improvements in the treatment landscape. This, in turn, increases the potential for market growth.

Asia Pacific Veterinary Pain Management Market Trends

The veterinary pain management market in Asia Pacific has been rapidly growing and is expected to expand further over the forecast period. The growth of middle-class families, the increasing adoption of companion animals, rising pet expenses, the humanization of pets, the strong presence of market players, and supportive government efforts are expected to drive the regional market. Furthermore, as regional facilities rise, countries like China and India are expected to have significant growth potential. In addition, increased consumer awareness about pet treatments and procedures is expected to boost the market in the future.

The India veterinary pain management market is home to a vast array of livestock and poultry, which contribute significantly to improving the socioeconomic conditions of rural populations. According to the 20th Livestock Census, the country has about 303.76 million bovines (Mithun, cattle, buffalo, and yak), 148.88 million goats, 9.06 million pigs, 74.26 million sheep, and about 851.81 million poultry. Currently, India is the world's largest producer of milk, the second largest producer of eggs, and the fifth largest producer of meat overall. The livestock sector grew at a compound annual growth rate of 7.38% between 2014-2015 and 2022-2023. As livestock farming increases, there is a greater possibility of the incidence of pain-related illnesses that require veterinary intervention, further raising the market for pain management solutions, including drugs, specialist therapies, and veterinary services.

Latin America Veterinary Pain Management Market Trends

The veterinary pain management market in Latin America is driven by establishing specialized veterinary clinics and hospitals in countries like Kuwait to enhance access to comprehensive veterinary care, including pain management services. These facilities often employ trained professionals who can offer a range of treatments. For instance, in May 2023, the International Horse Care Centre (IHCC) in Kuwait announced that they are offering Arthramid Vet as part of its comprehensive equine services, including the first private equine hospital in the country. Arthramid Vet is expanding its presence in the Middle East significantly.

The Brazil veterinary pain management market is anticipated to grow at a substantial CAGR during the forecast period. According to recent USDA data, Brazil has the largest livestock population in Latin America and ranks as the third-largest cattle producer globally, following China and India. The cattle production forecast indicates a 1% increase in 2023, reaching approximately 48.5 million head. However, a 4% decrease is anticipated in 2024, resulting in about 46.5 million head. The overall livestock population, including pigs and poultry, is also rising, leading to increased demand for veterinary care and pain management services.

MEA Veterinary Pain Management Market Insights

The veterinary pain management market in MEA is anticipated to grow at the fastest CAGR during the forecast period. The increase in the launch of innovative products for pet pain management is significantly driving growth in the MEA. New treatments, such as advanced non-opioid options like CBD-based therapies and improved drug delivery systems, are offering enhanced efficacy and longer-lasting relief. For instance, in October 2024, Innocan Pharma, an Israel-based company, announced promising results from a multi-year compassionate therapy using liposomal-CBD (LPT-CBD) injections for dogs with osteoarthritis.

The South Africa veterinary pain management market accounted for the largest revenue share of 24.49% in MEA in 2024. The market for veterinary pain management medicines in South Africa is driven by the rising prevalence of arthritis, growing animal health concerns, developed infrastructure, and growing requirements for veterinary care. For instance, in an interview conducted in February 2024, Zoetis, South Africa, reported that 37% of dogs in the country have arthritis, a chronic degenerative condition. If untreated, the pain may worsen over time. Osteoarthritis (OA) typically affects the hips, elbows, and knees. The market is expected to witness growth due to a diverse population, the presence of well-established infrastructure, and the availability of veterinarians

Key Veterinary Pain Management Company Insights

The veterinary pain management industry is fairly competitive due to the existence of key market participants. Moreover, the market is slightly fragmented due to the presence of multiple small and large companies. Thus, small players face intense competition to maintain their market position. Moreover, companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansions, and the launch of products, to expand their market shares. For instance, in March 2022, Elanco expanded its shared value footprint across Sub-Saharan Africa to create sustainable development solutions for those dependent on livestock for livelihoods.

Key Veterinary Pain Management Companies:

The following are the leading companies in the veterinary pain management market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim

- Vetoquinol

- Ceva Animal Health, Llc

- Chanelle Pharma (Exponent)

- Elanco

- Dechra Pharmaceuticals Plc (Eqt)

- Zoetis

- Merck & Co., Inc.

- Norbrook

- Assisi (Wind Point Partners)

Recent Developments

-

In September 2024, Boehringer Ingelheim acquired Saiba Animal Health AG, an organization specializing in discovering innovative therapeutic medications for dogs' chronic diseases.

-

In July 2024, Merck Animal Health acquired Elanco Animal Health Incorporated's aqua division.

-

In March 2024, Zoetis expanded its investment in Australia by purchasing a 21-acre manufacturing facility in Melbourne. This will allow the company to significantly grow its current operations at the site and increase its future capacity to develop and manufacture vaccines for sheep, cattle, dogs, cats, and horses.

-

In February 2024, EQT, a Swedish investment firm, acquired Dechra Pharmaceuticals, a manufacturer of veterinary drugs.

Veterinary Pain Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.75 billion

Revenue forecast for 2030

USD 3.82 billion

Growth rate

CAGR of 6.80% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, animal, route of administration, mode of purchase, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country cope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim; Vetoquinol; Ceva Animal Health, Llc; Chanelle Pharma (Exponent); Elanco Dechra Pharmaceuticals Plc (EQT); Zoetis; Merck & Co., Inc.; Norbrook; Assisi (Wind Point Partners)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Pain Management Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary pain management market report based on product, indication, animal, route of administration, mode of purchase, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

NSAIDs

-

Anesthetics

-

Opioids

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoarthritis

-

Postoperative Pain

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Companion Animals

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

Topical

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

OTC

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary pain management market size was estimated at USD 2.58 billion in 2024 and is expected to reach USD 2.75 billion in 2025.

b. The global veterinary pain management market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 3.82 billion by 2030.

b. In 2024, the North America veterinary pain management market accounted for the largest share of the global market, driven by the region's growing pet population, rising costs for pet care, an increase in the frequency of chronic illnesses, and a surge in orthopedic procedures.

b. Some key players operating in the veterinary pain management market include Boehringer Ingelheim, Vetoquinol, Ceva Animal Health, Llc, Chanelle Pharma (Exponent), Elanco, Dechra Pharmaceuticals Plc (EQT), Zoetis, Merck & Co., Inc., Norbrook, and Assisi (Wind Point Partners)

b. Some of the key drivers of the market include evolving treatment methodologies, rising awareness initiatives, increasing R&D initiatives, and rising prevalence of associated health conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.