- Home

- »

- Animal Health

- »

-

Veterinary Prosthetics And Orthotics Market Size Report, 2030GVR Report cover

![Veterinary Prosthetics And Orthotics Market Size, Share & Trends Report]()

Veterinary Prosthetics And Orthotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Prosthetics, Orthotics), By Animal Type (Canine, Feline), By Technique (Molding, 3D Printing), By Modality, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-947-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Prosthetics And Orthotics Market Summary

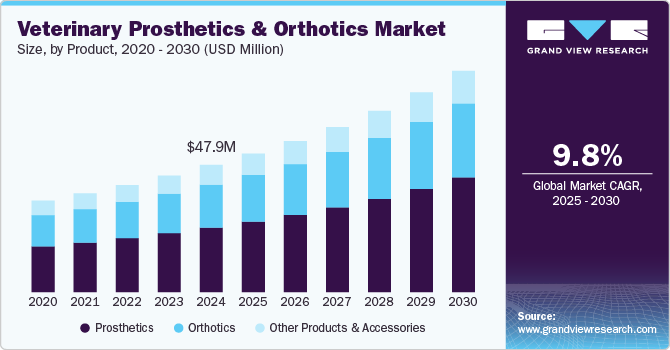

The global veterinary prosthetics & orthotics market size was estimated at USD 46.9 million in 2024 and is projected to reach USD 80.4 million by 2030, growing at a CAGR of 9.84% from 2025 to 2030. Key factors driving the industry include expanding applications of veterinary prosthetics & orthotics, rising penetration into lower & middle-income countries (LMIC), strategic support initiatives, and growing penetration of advanced technologies.

Key Market Trends & Insights

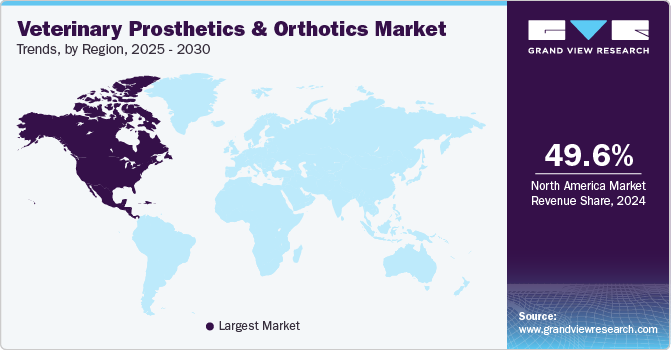

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Denmark is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, prosthetics accounted for a revenue of USD 25.3 million in 2024.

- Prosthetics is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 46.9 Million

- 2030 Projected Market Size: USD 80.4 Million

- CAGR (2025-2030): 9.84%

- North America: Largest market in 2024

These prosthetic & orthotic products have been commonly used for canine & feline orthopedic complications. However, in recent years, these products have been increasingly explored and applied to other animals like horses, cattle, camels, turtles, goats, donkeys, etc. In recent years, various veterinary professionals across the globe in multiple countries, like the U.S., UK, and Pakistan, have successfully installed prosthetics on these animals.

For instance, in July 2024, a 10-year-old tortoise named Cookie, suffering from left front limb lameness due to necrosis, received a prosthetic fitting. Veterinary specialists from DoveLewis Veterinary Emergency & Specialty Hospital, Portland, Oregon, U.S., collaborated to create a custom prosthesis enhancing mobility and quality of life. Veterinarians explained that they applied a surgical implant putty to the underside of the shell, allowing a piece with multiple attachments to click into place easily.

Furthermore, in February 2024, a goat named Gourd from Split Creek Farm in South Carolina was implanted with a prosthetic leg. The goat, suffering from arthritis, was fitted with the new leg by veterinary prosthetic & orthotic expert Derrick Campana. Such innovative initiatives highlight the dynamic nature of this market, acting as a driving factor.

Another crucial driving factor for this industry is the growing integration of advanced technologies to address the demand for orthotics & prosthetics in animals. 3D printing has been emerging as a cost-effective and highly customizable method for manufacturing accurate prosthetics for animals in need. Some of the other advanced technologies being used and explored for veterinary applications include microprocessor-controlled joints & osseointegration.

Microprocessor-controlled joints enhance the joint's stability and mimic natural movement comparatively closely to the natural joint. In addition, prosthetics tailored for specific activities are being adopted increasingly, optimizing comfort and performance for various scenarios. Technologies like osseointegration offer a lucrative approach by creating a direct connection between living bones and implants, potentially improving mobility, though it raises concerns about implant longevity and infection rates. These innovations signal a significant evolution in the veterinary orthotics & prosthetics market.

The importance of these advanced technologies is further highlighted by industry leaders investing heavily in integrating these advanced technologies to enhance their portfolios. For instance, in October 2024, WIMBA, a Polish company, opened a new in-house 3D printing facility in Kraków to improve the speed of manufacturing and delivering veterinary prosthetic & orthotic devices worldwide.

Product Type Insights

The prosthetics segment held the largest revenue share of 50.71% in 2024 and is expected to grow at 10.25% over the forecast period. This segment is further divided into partial prosthetics & full prosthetics. These devices offer advantages over other products and are a viable alternative for surgical treatments and post-surgery recovery support. Animal prostheses are medical devices that help animals with partially or entirely lost or severed limbs. The key factors driving market expansion are technological advancements in prostheses and increased adoption rates. Furthermore, technological developments and the low-cost 3D-printed prosthetics will likely enhance market growth.

Furthermore, the growing awareness of prosthetics across numerous organizations contributes to market growth. Bionic Pets, for example, is a company founded by a Penn State alum that makes prosthetics and braces for various animals. It distributes casting molds worldwide before manufacturing prosthetic legs or braces in Sterling, Virginia. As a result of the factors mentioned above, the prosthetics market is predicted to increase significantly over the forecast period.

Animal Type Insights

The canine segment held the largest revenue share of more than 60% in 2024 and is expected to grow at a lucrative rate over the forecast period. The dominance of this species can be attributed to their high ownership combined with high health expenditure compared to other animals. Furthermore, professionals across the globe have performed comprehensive research and development to enhance these products for dogs. In addition, dogs' adaptability to these products is higher than other animals, and they are highly adopted in various countries worldwide. For instance, in March 2024, a 9-month-old dog from Bangkok, Thailand, was fitted with two prosthetic legs, which were lost during a fatal accident.

The other animal segment is estimated to grow at the fastest CAGR of over 11.03% over the forecast period. This segment includes animal species like horses, cattle, camels, turtles, and donkeys. The high growth rate of this segment can be attributed to the increasing adoption of prosthetic & orthotic products in this variety of animals. Recently, reports of prosthetic implantation in animals like goats, turtles, camels, donkeys, cattle, etc., have been increasing. Many experts are exploring novel avenues to expand the use of these products in more variety of animals. For instance, in July 2024, a donkey named Dale received a new custom prosthetic front leg. The donkey lost this leg in an accident on a farm in Iowa, U.S.

Technique Insights

The 3D printing segment held the dominant revenue share in 2024 due to increased technological advancement. These prosthetics can be light, inexpensive, and completely personalized. For instance, Bionic Pets & DiveDesign is one of the pioneers in developing veterinary prosthetics. They, in collaboration, create prosthetics to transform animal rehabilitation and pain management. DiveDesign has developed a digital tool using 3D scanning and printing technology to speed up the production of a full-limb prosthesis.

Furthermore, many more companies worldwide are actively investing capital in developing their 3D-printing capabilities. For instance, WIMBA, a Polish startup company, utilizes HP's Multi Jet Fusion 3D printing technology to manufacture custom orthotics for dogs and companion animals. This technology allows for producing lightweight and comfortable orthotic devices for various types of animals.

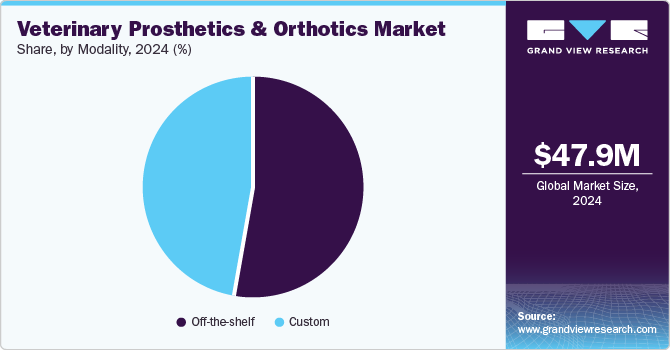

Modality Insights

The off-the-shelf segment held the largest revenue share in 2024. This segment encompasses products like prosthetic limbs, orthotic braces, cranial helmets, socks, straps, splints, lifting supports, drag bags, protective boots, wagons/carts/ wheelchairs, etc. These products are manufactured per standard measurements for various species and can be used without custom measurements. They are widely used as they are readily available and sometimes act as a primary support until a custom animal-specific prosthetic or orthotic is designed & manufactured. Furthermore, in markets where custom options are unavailable or not easily accessible, these off-the-shelf products efficiently address the demand.

The custom segment is estimated to grow at the fastest CAGR from 2025 to 2030 due to increasing demand for specially designed prosthetics & orthotics in animals. One of the complications with off-the-shelf products is that, in some cases, these pre-made products may only fit some animals properly, which may cause limping, pain, and low adaptability. Therefore, pet owners and veterinarians are increasingly shifting towards custom-made prosthetics and orthotics explicitly designed for animals by taking necessary measurements.

Furthermore, in complex cases like amputation or loss of limbs due to accident or illness, a generic off-the-shelf product may only sometimes be beneficial for fitting and adaptability. Therefore, a custom device needs to be manufactured by taking the measurements of that animal’s affected part to minimize the discomfort and maximize the adaptability.

End-use Insights

The veterinary hospitals/clinics segment held the largest revenue share in 2024. The dominance can be attributed to implanting prosthetics and complex orthotics requiring specialized equipment and professionals to perform the procedure. In some cases, like spinal/cervical complications and limb prostheses, the animal may need to be admitted into the hospital/clinics and require constant medical surveillance. For these reasons, this segment is expected to continue its dominance over the forecast period.

The other end use segment, which consists of animal rescue centers, rehabilitation centers, ambulatory centers, academic & research institutions, etc., is expected to grow at the fastest CAGR over 2025 to 2030. This growth can be attributed to increasing awareness of animal welfare and rehabilitation needs, leading to the adoption of these products in specialized facilities catering to injured or disabled animals. Demand for these products in animal rescue and rehabilitation centers is also set to increase because of rising cases of debilitating injuries in the animals at these centers due to accidents or illnesses. Furthermore, demand for these products in academic & research institutions is increasing rapidly due to rising indulgence in complex research activities to improve the existing technologies and innovate novel technologies to address the market demand better.

Regional Insights

North America veterinary prosthetics & orthotics market held over 49.62% of the global market in 2024 and is expected to grow at the highest rate over the forecast period. Higher availability of animal therapeutic choices, greater awareness of prosthetics & orthotics, key market participants, and rising animal health expenditure all contribute to this region's dominance and growth.

U.S. Veterinary Prosthetics And Orthotics Market Trends

The veterinary prosthetics & orthotics market in the U.S. dominated the market in 2024 in terms of revenue share. This dominance is owed mainly to continuous research & developmental activities that are going on in the country. These activities encourage developing and deploying innovative prosthetic and orthotic solutions for many animals, from dogs to livestock animals like cattle, goats, donkeys, etc.

Europe Veterinary Prosthetics And Orthotics Market Trends

The European veterinary prosthetics & orthotics market holds the second-largest share of this industry. The primary driver for this market is the innovative spirit of the researchers in the region, leading to the development of novel startups to conduct research and develop advanced products for addressing the prosthetic & orthotic requirements of animals. One such example is WIMBA, a Polish startup company. This company manufactures custom veterinary prosthetic and orthotic devices using advanced technologies like 3D printing. Within just 2 years since its inception in 2022, the company has amassed over 700 customers across more than 25 countries.

The veterinary prosthetics & orthotics market in the UK dominates the European market in 2024 in terms of revenue share. This dominance is primarily owed to efforts taken by veterinarians and research scientists to diversify the penetration of prosthetics & orthotics to species of animals other than dogs. For instance, in January 2024, a young Nubian goat named Thistle received a 3D-printed prosthetic foot from the Royal Veterinary College (RVC). The goat was diagnosed with chronic non-articular fractures in her right foot and was initially suggested to be euthanized due to this. Still, due to the efforts taken by the owner, she was given a prosthesis.

The Germany veterinary prosthetics & orthotics market is set to show a lucrative growth mainly due to researchers and organizations in the country increasing their focus on exotic animal prostheses. For instance, in June 2023, e-NABLE Germany, an animal welfare organization, created a custom 3D-printed prosthetic leg for secretary bird of prey at the Weltvogelpark Walsrode sanctuary. This innovative solution significantly improved mobility after a severe leg injury.

Asia Pacific Veterinary Prosthetics And Orthotics Market Trends

The veterinary prosthetics & orthotics market in the Asia Pacific is one of the emerging regions for veterinary prosthetics & orthotics products. This can be attributed to the increasing penetration of advanced veterinary prosthetics & orthotics to LMICs of the region. For example, the government of Sindh (Pakistan) assisted in covering the charges for fitting a prosthetic leg to a camel from the Comprehensive Disaster Response Services (CDRS) animal shelter in Karachi. This displays the increasing penetration of this market into the niche markets in the world.

India veterinary prosthetics & orthotics market is set to grow at a lucrative pace due to veterinary professionals making considerable strides in complex prosthetic surgeries of livestock animals. For instance, in September 2024, doctors at The Sakerbai Dinshaw Petite for Animals (Bull Hospital) conducted a successful & country's first artificial leg transplant surgery on a bull.

Latin America Veterinary Prosthetics And Orthotics Market Trends

The veterinary orthotics and prosthetics market in Latin America is driven by increasing pet ownership and a growing awareness of animal welfare, leading to higher demand for advanced veterinary care. Additionally, the rise in disposable income allows pet owners to invest more in their animals' health, including prosthetic solutions.

Brazil veterinary orthotics and prosthetics market is set to grow at a lucrative pace due to more owners seeking advanced medical solutions for their pets. In addition, the large livestock animal population increases the risk of injuries, increasing the demand for investment in veterinary prosthetic devices. Technological advancements, particularly in 3D printing, are enabling the creation of customized prosthetics that improve the quality of life for injured or disabled animals, further fueling market growth.

Middle East & Africa Veterinary Prosthetics And OrthoticsMarket Trends

The veterinary prosthetics & orthotics market in the Middle East & Africa (MEA) driven by the factors such as expanding veterinary services and clinics and rising pet adoptions. The region's growing interest in animal rehabilitation and the introduction of innovative veterinary technologies further support market growth in this area.

South Africa veterinary prosthetics & orthotics market is driven by therising animal health concerns, developed infrastructure, and growing requirements for veterinary care. The market is expected to witness growth due to a diverse population, the presence of well-established infrastructure, and the availability of veterinarians. In addition, rising cases of pet injuries, obesity, and orthopedic surgeries have led to the increasing adoption of orthopedics products such as orthotics & prosthetics.

Key Veterinary Prosthetics And Orthotics Company Insights

The veterinary prosthetics & orthotics industry is competitive. The main focus of industry players and veterinary service providers is to expand the application of orthotics & prosthetics to the increased variety of animals. Hence, the industry is experiencing a high degree of innovation as well as business activities like partnerships and collaborations, fundraising, expansion, mergers & acquisitions, technology launches, etc.,

Key Veterinary Prosthetics And Orthotics Companies:

The following are the leading companies in the veterinary prosthetics and orthotics market. These companies collectively hold the largest market share and dictate industry trends.

- Bionic Pets

- Animal Ortho Care (AOC)

- K-9 Orthotics & Prosthetics Inc.

- WIMBA

- Dassiet Vet, Inc (OrthoPets)

- Paw Prosper

- OrthoDesign

- Specialized Pet Solutions

- OrthoVet LLC

- Petsthetics

Recent Developments

-

In November 2024, Paw Prosper expanded their global presence by acquiring K9 Mobility, a UK-based company.

-

In September 2024, a partially blind cow with mobility issues due to infection in her adolescence received a new prosthetic leg. A non-profit organization, Sammamish Animal Sanctuary, funded this procedure.

-

In May 2024, WIMBA partnered with Intrauma to enhance veterinary orthotic products by conducting joint research & innovations in 3D printing.

-

In May 2024, Nupsala & WIMBA forged a collaboration to leverage the former’s expertise in pet mobility and well-being product sales and the latter's innovative veterinary prosthetic & orthotics solutions.

-

In March 2024, Leap Venture Studio & Academy conducted a cohort to accelerate innovations & a collaborative approach towards research & development. The startups participating in the cohort were GekkoVet, Omni, Scooch, WIMBA, Innovative Pet Lab, VetVerifi, and BestBnB.

-

In March 2023, Paw Prosper acquired multiple companies like Help 'Em Up, FitPaws, Muffin's Halo, and Respond Systems in the domain of pet mobility.

Veterinary Prosthetics And Orthotics Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 52.06 million

The revenue forecast in 2030

USD 83.24 million

Growth rate

CAGR of 9.84% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million & CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product type, technique, animal type, modality, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bionic Pets; Animal Ortho Care (AOC); K-9 Orthotics & Prosthetics Inc.; WIMBA; Dassiet Vet, Inc (OrthoPets); Paw Prosper; OrthoDesign; Specialized Pet Solutions; OrthoVet LLC; Petsthetics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Prosthetics And Orthotics Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary prosthetics and orthotics market report based on the product type, animal type, technique, modality, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthotics

-

Limb Orthotics

-

Spinal & Cervical Orthotics

-

Other Orthotics

-

-

Prosthetics

-

Partial Prosthetics

-

Full Prosthetics

-

-

Other Products & Accessories

-

-

Animal Type (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Other Animals

-

-

Technique (Revenue, USD Million, 2018 - 2030)

-

Molding

-

3D Printing

-

-

Modality (Revenue, USD Million, 2018 - 2030)

-

Custom

-

Off-the-shelf

-

-

End-use (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Other end-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary prosthetics and orthotics market size was estimated at USD 47.86 million in 2024 and is expected to reach USD 52.06 million in 2025.

b. The global veterinary prosthetics and orthotics market is expected to grow at a compound annual growth rate of 9.84% from 2025 to 2030 to reach USD 83.24 million by 2030.

b. By Product, the prosthetics segment held the largest market share of 50.71% in 2024 and is expected to grow at 10.25% over the forecast period. This segment is further divided into partial prosthetics & full prosthetics. These devices offer advantages over other products and are a viable alternative for surgical treatments and post-surgery recovery support.

b. Some key players operating in the veterinary prosthetics and orthotics market include Bionic Pets, Animal Ortho Care (AOC), K-9 Orthotics & Prosthetics Inc., WIMBA, Dassiet Vet, Inc (OrthoPets), Paw Prosper, OrthoDesign, Specialized Pet Solutions, OrthoVet LLC, and Petsthetics, among others.

b. Key factors that are driving the veterinary prosthetics and orthotics market growth include expanding applications of veterinary prosthetics & orthotics, rising penetration into lower & middle-income countries(LMIC), strategic support initiatives, and growing penetration of advanced technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.