- Home

- »

- Animal Health

- »

-

Veterinary Research Equipment Market Size Report, 2033GVR Report cover

![Veterinary Research Equipment Market Size, Share & Trends Report]()

Veterinary Research Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (In Vivo Research Equipment, Molecular Biology & Genomics Equipment), By Animal, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-834-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Research Equipment Market Summary

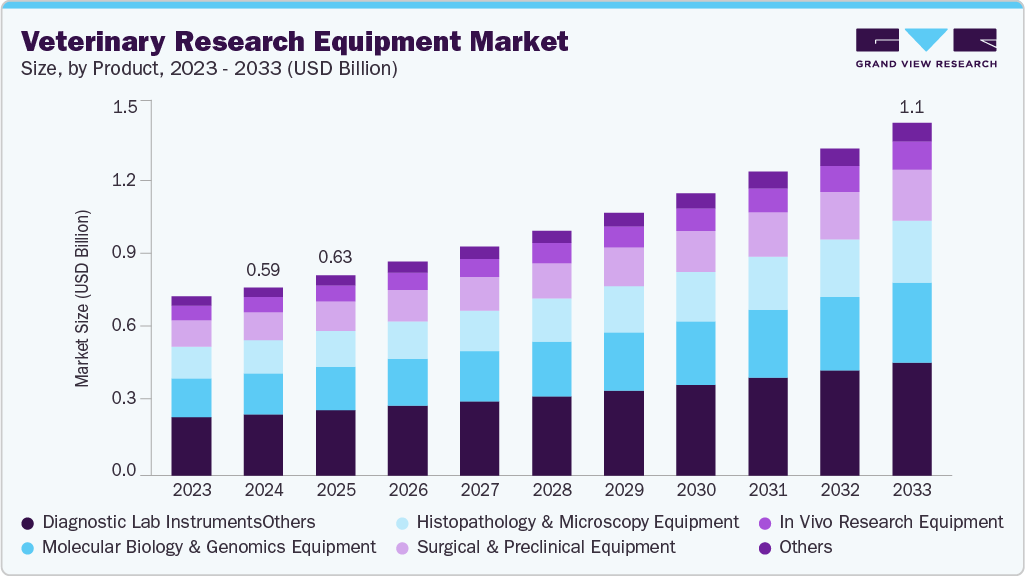

The global veterinary research equipment market size was estimated at USD 0.59 billion in 2024 and is projected to reach USD 1.11 billion by 2033, growing at a CAGR of 7.34% from 2025 to 2033. The market is advancing due to the rising prevalence of animal diseases, increasing investment in animal health and diagnostics, and growing demand for advanced research tools to support companion animal care and livestock productivity.

Key Market Trends & Insights

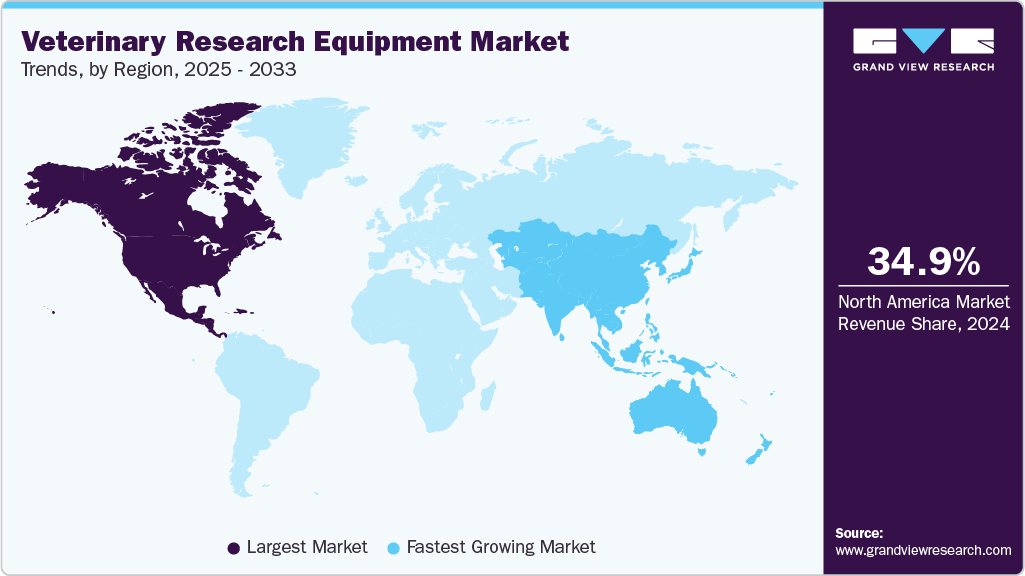

- The North America veterinary research equipment market held the largest revenue share of 34.87% in 2024.

- The U.S. dominated the North America region with the largest revenue share in 2024.

- By product, the diagnostic lab instruments segment held the largest share of 32.77% of the market in 2024.

- By animal, the small animal segment held the largest share in 2024.

- Based on application, the disease research segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.59 Billion

- 2033 Projected Market Size: USD 1.11 Billion

- CAGR (2025-2033): 7.34%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

Additionally, technological advancements in imaging, molecular diagnostics, and lab automation are accelerating adoption across research institutions and veterinary clinics. The veterinary research equipment market is also boosted by the increasing utilization of advanced tools for veterinary research, drug development, biological agent production, and the development of treatments for various animal diseases and infections. The rising demand for precise diagnostics, molecular research, and controlled laboratory environments is fueling investments in instruments such as PCR systems, ELISA kits, imaging technologies, and automated laboratory equipment.

For example, data from Understanding Animal Research (UAR) in September 2024 reported that ten major organizations in Great Britain conducted 54% of all animal research in 2023, amounting to over 1.4 million procedures out of a total of 2.68 million. The majority of these studies (99%) involved mice, fish, and rats, highlighting the critical role of veterinary research equipment in supporting large-scale, high-throughput animal studies for scientific, pharmaceutical, and disease-prevention purposes.

Furthermore, partnerships with international research institutions can lead to knowledge transfer and technological advancements. For instance, the establishment of advanced veterinary research facilities aligns with Vision 2030, supporting innovation and sustainability in the animal healthcare sector.

Most widely used veterinary research equipment and its applications

Equipment

Applications

PCR (Polymerase Chain Reaction) System

Detection and identification of pathogens, genetic research, and disease surveillance

ELISA (Enzyme-Linked Immunosorbent Assay) Kit

Antibody/antigen detection, immune response monitoring, vaccine efficacy studies

Hematology Analyzer

Blood analysis, detection of anemia, infections, and hematological disorders

Biochemistry Analyzer

Assessment of organ function, metabolic profiling, and disease diagnostics

Flow Cytometer

Immunology research, cell counting, and biomarker analysis

High-Throughput Sequencing (NGS)

Genomic research, pathogen genomics, and precision veterinary medicine

Incubators & Biosafety Cabinets

Cell culture, microbial studies, and safe handling of infectious agents

Automated Animal Housing Systems

Controlled environment for behavioral, physiological, and welfare studies

Microscopes (Light, Fluorescence, Electron)

Cellular and tissue analysis, pathogen identification, and histopathology

Automated Bioreactors & Lab Robots

Sample processing, drug testing, and molecular research automation

Environmental Monitoring Equipment

Monitoring of lab conditions, pathogen contamination, and biosecurity compliance

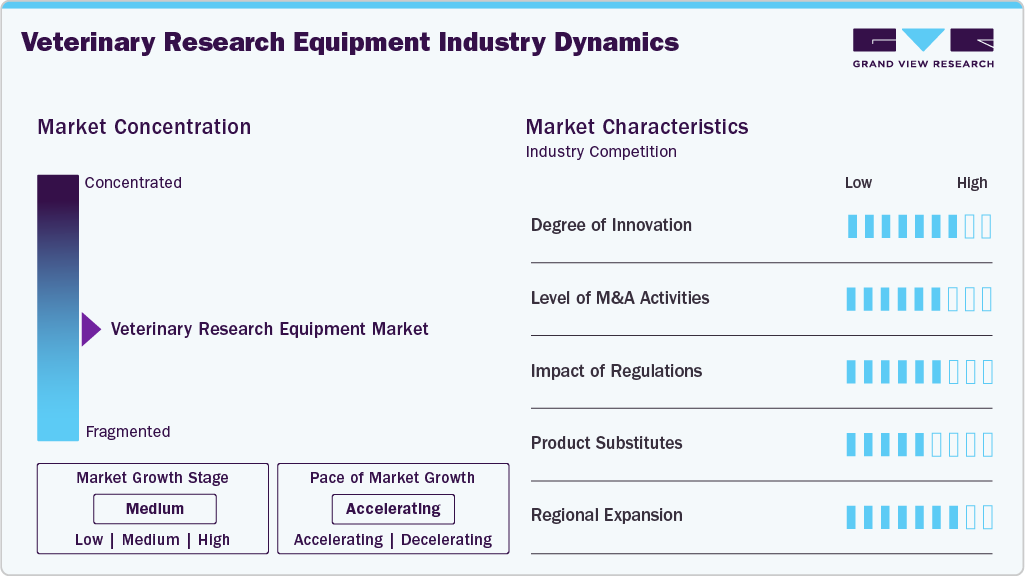

Market Concentration & Characteristics

The veterinary research equipment industry is moderately concentrated, with a mix of established global manufacturers and specialized niche players. Leading companies dominate through broad product portfolios, strong distribution networks, and continuous technological innovation in diagnostics, imaging, and laboratory automation. However, the market also includes smaller firms that focus on specialized instruments or emerging technologies, contributing to competitive diversity. Consolidation through partnerships and acquisitions is increasing as major players seek to expand capabilities and address growing demand for advanced veterinary research solutions.

The market exhibits a high degree of innovation, driven by advances in molecular diagnostics, imaging technologies, and lab automation. Innovations such as portable ultrasound systems, next-generation sequencing (NGS) platforms for pathogen detection, and automated hematology analyzers are enhancing diagnostic accuracy and research efficiency. AI-powered imaging tools and digital pathology systems are also gaining traction, enabling faster and more precise interpretation of animal health data. These advancements are significantly improving disease surveillance, treatment planning, and overall research outcomes.

M&A activity is moderately high, driven by the need to expand product portfolios, strengthen technological capabilities, and enter new geographic markets. Key players frequently acquire companies specializing in diagnostics, imaging, and lab automation. For example, IDEXX’s acquisitions to enhance its diagnostic platform and Zoetis’s acquisition of Abaxis to expand its veterinary point-of-care testing capabilities. Such deals are accelerating innovation and allowing major firms to offer more integrated research and diagnostic solutions.

Regulations have a significant impact on the market for veterinary research equipment, shaping product development, quality standards, and commercialization timelines. Compliance with guidelines from bodies such as the FDA, USDA, and EMA ensures the safety and reliability of diagnostic devices, imaging systems, and laboratory instruments. For example, strict validation requirements for molecular diagnostic tools or biosafety standards for animal research labs influence equipment design and certification. These regulatory frameworks ultimately drive higher product quality but can increase development costs and time-to-market.

Product substitutes remain limited but are growing with technological advancements. Non-invasive digital tools, such as wearable animal health monitors, can sometimes serve as substitutes for traditional diagnostic equipment. Similarly, telemedicine platforms and AI-based imaging software may reduce reliance on certain in-clinic instruments. In some research settings, advanced simulation models or in-silico testing can partially replace the need for physical laboratory equipment, though they cannot fully replicate traditional tools.

Regional expansion is accelerating as companies target high-growth regions with rising animal health investments. North America and Europe remain core markets, but manufacturers are increasingly expanding into Asia-Pacific and Latin America, where demand for advanced diagnostics and livestock productivity tools is growing. For example, firms are establishing distribution partnerships in India and China to support veterinary research labs, while global players are scaling operations in Brazil to serve the expanding livestock sector. This geographic diversification is enhancing market reach and competitiveness.

Product Insights

On the basis of product, the diagnostic lab instruments segment dominated the market with the largest revenue share of 32.77% in 2024. This is attributed to the rising prevalence of infectious and chronic animal diseases, which drives demand for accurate and rapid laboratory testing. These instruments, such as hematology analyzers, PCR systems, and biochemical analyzers, are essential for routine diagnostics, disease surveillance, and research applications. Additionally, advancements in molecular and immunodiagnostic technologies have strengthened their adoption across veterinary clinics, research institutions, and livestock facilities, further consolidating this segment’s lead.

The “others” segment is the fastest-growing category, driven by an increasing emphasis on biosecurity, welfare compliance, and controlled research environments. The segment includes environmental monitoring equipment, containment systems (BSL rooms, isolators), and advanced animal housing systems. Rising research on zoonotic diseases and high-containment pathogen studies is boosting demand for BSL infrastructure and isolators, while stricter standards for animal well-being are driving investment in modern housing systems. These specialized solutions are becoming essential for ensuring data integrity, regulatory compliance, and safe operation in veterinary research facilities.

Animal Insights

On the basis of animal, the small animal segment dominated with the largest revenue share in 2024. This segment comprises dogs, cats, horses, and other companion animals. This is driven by rising pet ownership, urbanization, and higher spending on preventive and advanced veterinary care, with U.S. veterinary care and product sales reaching USD 39.8 billion. The segment is further supported by growing awareness of pet health, improved veterinary infrastructure, and technological advancements in diagnostic and treatment equipment. In addition, the extensive use of small animals in research reinforces this trend; for instance, in 2023, AstraZeneca used 182,458 animals, over 97% being rodents or fish. Besides, a 2024 Harvard Medical School study reported that about 95% of warm-blooded research animals are rats and mice.

The large animal segment is estimated to be the fastest-growing segment over the forecast period. The market is witnessing an increasing demand for livestock productivity, disease surveillance, and food safety. Rising investments in advanced diagnostic tools, imaging systems, and monitoring equipment for cattle, horses, and other livestock are accelerating market growth. Furthermore, the expansion of commercial farming operations and heightened focus on managing zoonotic diseases are boosting the adoption of sophisticated research and veterinary care technologies in this segment.

Application Insights

On the basis of application, the disease research segment held the largest revenue share in 2024 due to the high prevalence of infectious, zoonotic, and chronic conditions affecting both companion animals and livestock. The growing need for advanced diagnostic tools, molecular testing systems, and controlled research environments has driven significant investment in this area. Additionally, increased focus on early detection, vaccine development, and antimicrobial resistance management further strengthened the demand for specialized veterinary research equipment, solidifying the segment’s leading position.

The genomics & molecular research represents the fastest-growing segment over the forecast period, driven by rapid advances in genetic sequencing, molecular diagnostics, and biomarker discovery for animal health. Rising focus on understanding pathogen genomics, improving disease resistance in livestock, and developing targeted therapies is accelerating the adoption of PCR systems, NGS platforms, and other molecular tools. Increasing applications in precision veterinary medicine and breed improvement programs further fuel this segment’s rapid growth.

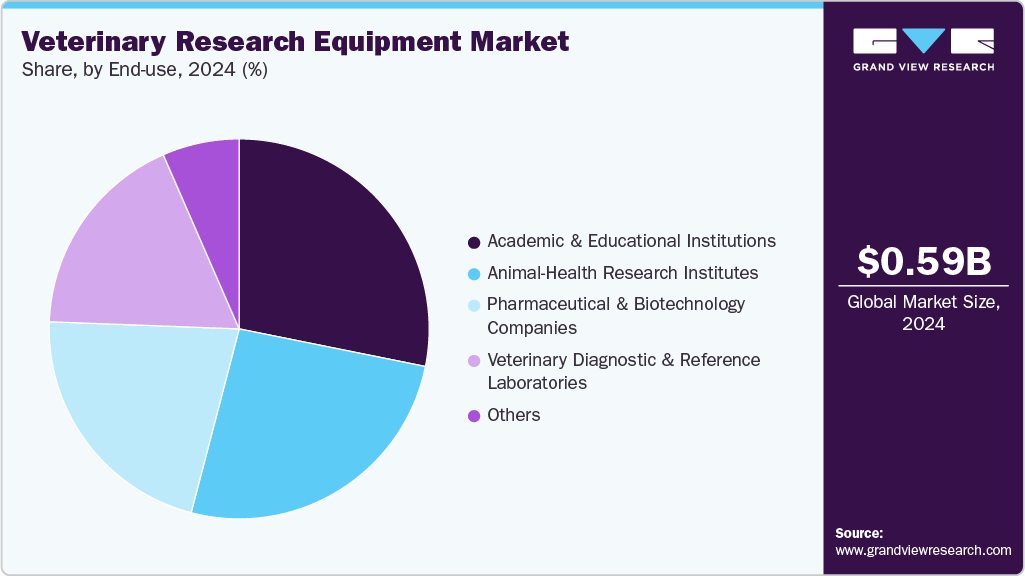

End Use Insights

On the basis of end use, academic & educational institutions constituted the largest revenue share in 2024, driven by expanding research programs, curriculum development, and investment in state-of-the-art laboratory infrastructure. The growing emphasis on animal health studies, disease surveillance, and training in advanced diagnostic and molecular techniques has increased demand for laboratory instruments, imaging systems, and molecular research tools in universities and veterinary colleges. This sustained focus on education and research continues to support the segment’s market dominance.

The animal-health research institutes segment is poised to exhibit the fastest CAGR over the forecast period, driven by increasing investment in veterinary R&D, disease surveillance, and vaccine development. Rising focus on emerging zoonotic diseases, livestock productivity, and precision animal health solutions is boosting demand for advanced diagnostic, molecular, and laboratory research equipment. Expansion of dedicated research facilities and government-supported animal health programs further accelerates the adoption of sophisticated veterinary research tools in this segment.

Regional Insights

The veterinary research equipment industry in North America dominated the market with the largest revenue share of 34.87% in 2024. The market is driven by high pet ownership, advanced veterinary infrastructure, and significant R&D investment in animal health. The region is witnessing growing adoption of molecular diagnostics, imaging systems, and automated laboratory instruments. For example, IDEXX Laboratories is expanding its diagnostic and research platforms to meet the rising demand for companion animal and livestock health solutions. Additionally, increasing government funding for zoonotic disease research and preventive veterinary care supports market growth in the region.

U.S. Veterinary Research Equipment Market Trends

TheU.S. veterinary research equipment industry accounted for the largest market share in the North America market, owing to technological innovation and demand for precision animal healthcare. Growth is fueled by the adoption of AI-enabled imaging, digital pathology, and high-throughput molecular research platforms in veterinary laboratories. Companies are also focusing on integrated solutions for disease surveillance and vaccine development, reflecting a trend toward more comprehensive research capabilities. Furthermore, collaborations between academic institutions and private firms are accelerating product development and market penetration.

The veterinary research equipment industry in Canada is expected to grow at a significant CAGR during the forecast period,propelled by increasing investments in animal health research and rising demand for advanced diagnostic and laboratory instruments. The adoption of molecular diagnostics, imaging systems, and automated lab equipment is expanding across veterinary clinics and research institutes. For example, Canadian universities and research centers are leveraging PCR platforms and high-resolution imaging tools for livestock disease surveillance and companion animal health studies. Government support for zoonotic disease monitoring and biosecurity initiatives further strengthens market growth.

Europe Veterinary Research Equipment Market Trends

The veterinary research equipment industry in Europe is expanding due to government and EU initiatives, increased awareness of zoonotic diseases, and growth in livestock production. According to the European Centre for Disease Prevention and Control, campylobacteriosis and salmonellosis were the most reported zoonotic diseases in 2023, highlighting the need for advanced diagnostic and surveillance tools. Programs promoting animal welfare, antimicrobial stewardship, and traceability are driving the adoption of high-quality laboratory instruments and consumables. Companies like IDEXX and Thermo Fisher are supplying molecular diagnostics and imaging systems to support research and disease monitoring across Europe.

The UK veterinary research equipment industry is growing steadily, driven by rising investment in animal health research, increased pet ownership, and a focus on livestock productivity. Advanced diagnostic tools, molecular testing platforms, and imaging systems are widely used in research institutes and veterinary clinics. For example, in 2023, the UK conducted 2.68 million procedures involving living animals, with mice, fish, birds, and rats accounting for 95% of the total, highlighting the reliance on animal-based studies in biomedical research and drug development. Additionally, regulatory changes, including the Animal Welfare (Sentencing and Recognition of Sentience) Bill and updated guidance from the Animals in Science Regulation Unit (ASRU), are enhancing ethical standards and driving the adoption of specialized veterinary research equipment.

The veterinary research equipment industry in Germany held a significant share in 2024. The country’s growth is influenced by increasing focus on livestock health, growing demand for advanced diagnostic and surgical instruments, and the expansion of veterinary services. Companies are actively innovating and forming strategic collaborations to strengthen their market presence. For example, in October 2025, Viromed Medical AG advanced its product launches, expanded partnerships, and reported promising preclinical and clinical results for veterinary applications. These trends highlight Germany’s emphasis on high-quality research equipment and precision animal healthcare solutions.

Asia Pacific Veterinary Research Equipment Market Trends

The veterinary research equipment industry in the Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to rising livestock production, increasing pet ownership, and the expansion of veterinary research infrastructure. The growing awareness of animal health, zoonotic disease prevention, and the adoption of advanced diagnostics and molecular research tools are key growth factors. For example, companies are introducing PCR systems, imaging devices, and automated laboratory instruments in countries such as China and India to support companion animal care and livestock disease monitoring. Government initiatives promoting biosecurity and animal welfare further boost market adoption across the region.

The China veterinary research equipment industry held the largest revenue share in 2024andis witnessing new growth opportunities due to growing livestock farming, rising pet ownership, and increased investment in animal health R&D. Advanced diagnostic instruments, molecular testing platforms, and automated laboratory equipment are being increasingly adopted in veterinary clinics and research institutes. For example, Chinese research centers are utilizing PCR systems and high-throughput analyzers for disease surveillance and vaccine development. Government initiatives on biosecurity, zoonotic disease control, and livestock traceability further support market growth in the country.

The veterinary research equipment industry in India is advancing due to the expansion of livestock farming, increasing pet ownership, and the rising government focus on animal health and disease control. Adoption of advanced diagnostic tools, molecular testing platforms, and automated laboratory instruments is accelerating in research institutes and veterinary clinics. For example, Indian universities and veterinary research centers are implementing PCR systems and imaging technologies for livestock disease surveillance and companion animal studies. Initiatives promoting biosecurity, animal welfare, and zoonotic disease prevention further support market expansion in India.

Latin America Veterinary Research Equipment Market Trends

The veterinary research equipment industry in Latin America is driven by expanding livestock production, rising awareness of animal health, and increased investment in veterinary research infrastructure. The adoption of advanced diagnostic instruments, molecular testing platforms, and laboratory automation is growing across Brazil and Argentina. For example, research institutes and veterinary clinics are increasingly using PCR systems and imaging technologies for disease surveillance and livestock health management. Government initiatives on biosecurity, animal welfare, and zoonotic disease control further support market expansion in the region.

The Brazil veterinary research equipment industry is growing due to the country’s large livestock sector, increasing demand for advanced animal diagnostics, and expansion of veterinary services. Investments in molecular diagnostics, imaging systems, and automated laboratory equipment are rising to support disease surveillance and productivity in cattle, poultry, and swine. For instance, Brazilian research centers are deploying PCR platforms and high-resolution imaging tools to monitor zoonotic diseases and improve livestock health. Government programs promoting biosecurity and animal welfare further drive adoption of sophisticated veterinary research solutions.

Middle East & Africa Veterinary Research Equipment Market Trends

The veterinary research equipment industry in the Middle East and Africa is driven by growing livestock production, rising demand for advanced animal healthcare, and increased focus on disease surveillance. The adoption of diagnostic instruments, molecular testing platforms, and laboratory automation is rising in research institutes and veterinary clinics across the region. For example, countries like Saudi Arabia and South Africa are investing in PCR systems and imaging technologies to enhance livestock disease monitoring and veterinary research capabilities. Government initiatives on zoonotic disease control, biosecurity, and livestock productivity further support market growth.

The South Africa veterinary research equipment industry held the largest revenue shareand is growing due to increased livestock farming, rising awareness of animal health, and investment in veterinary R&D. Advanced diagnostic tools, molecular testing platforms, and automated laboratory equipment are increasingly adopted in both research institutes and veterinary clinics. For example, South African veterinary research centers are utilizing PCR systems and imaging technologies to monitor livestock diseases and support the development of vaccines. Government programs promoting biosecurity, disease surveillance, and animal welfare further drive market adoption.

Key Veterinary Research Equipment Company Insights

The competitive landscape in the market is shaped by a mix of leading global firms and niche specialists, with a handful of major players exerting substantial influence. For instance, in March 2025, SeQuent Scientific and Viyash Lifesciences merged, due to their advanced capabilities, 16 manufacturing facilities, strong R&D, and access to over 150 international markets. This merger highlights how firms are scaling up manufacturing capacity, expanding geographic footprint, and strengthening end-to-end R&D-to-distribution pipelines, enabling them to offer a broader portfolio of diagnostics, molecularresearch instruments, and consumables.

Key Veterinary Research Equipment Companies:

The following are the leading companies in the veterinary research equipment market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories

- Bionote

- Agrivet Laboratories

- Miltenyi Biotec

- Bruker Corporation

- PerkinElmer

- Thermo Fisher Scientific

- InGeneron

- Esco Lifesciences

- MRC Group

- INFITEK INC.

Recent Developments

-

In September 2024, Esco Lifesciences Group acquired its South Korean distributor, Esco Korea Micro Ltd., to boost its reach in the region and expand its direct sales and service capabilities. This move also supports Esco's digital transformation initiatives, streamlining operations to meet the growing demands of the biopharma and research sectors.

-

In January 2024, Allentown, LLC acquired ClorDiSys Solutions, Inc., enhancing its service offerings in pre-clinical research and life sciences.

Veterinary Research Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.63 billion

Revenue forecast in 2033

USD 1.11 billion

Growth rate

CAGR of 7.34% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

IDEXX Laboratories; Bionote; Agrivet Laboratories; Miltenyi Biotec; Bruker Corporation; PerkinElmer; Thermo Fisher Scientific; InGeneron; Esco Lifesciences; MRC Group; INFITEK INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Research Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary research equipment market report based on product, animal, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

In Vivo Research Equipment

-

Molecular Biology & Genomics Equipment

-

Diagnostic Lab Instruments

-

Surgical & Preclinical Equipment

-

Histopathology & Microscopy Equipment

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animal

-

Large Animal

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Preclinical Testing

-

Vaccine Development & Immunology

-

Disease Research

-

Toxicology Studies

-

Genomics & Molecular Research

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Educational Institutions

-

Animal-Health Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Veterinary Diagnostic & Reference Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary research equipment market size was estimated at USD 0.59 billion in 2024 and is expected to reach USD 0.63 billion in 2025.

b. The global veterinary research equipment market is expected to grow at a compound annual growth rate of 7.34% from 2025 to 2033 to reach USD 1.11 billion by 2033.

b. North America dominated the veterinary research equipment market with a share of 28.9% in 2024. This is attributable to high pet ownership, advanced veterinary infrastructure, and significant R&D investment in animal health.

b. Some key players operating in the veterinary research equipment market include IDEXX Laboratories, Bionote, Agrivet Laboratories, Miltenyi Biotec, Bruker Corporation, PerkinElmer, Thermo Fisher Scientific, InGeneron, Esco Lifesciences, MRC Group, INFITEK INC.

b. Key factors that are driving the market growth include rising prevalence of animal diseases, increasing investment in animal health and diagnostics, and growing demand for advanced research tools to support companion animal care and livestock productivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.