- Home

- »

- Animal Health

- »

-

Veterinary Ventilators Market Size, Industry Report, 2030GVR Report cover

![Veterinary Ventilators Market Size, Share & Trends Report]()

Veterinary Ventilators Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Electronic, Mechanical), By Application (Anesthesia, Resuscitation), By Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Ventilators Market Size & Trends

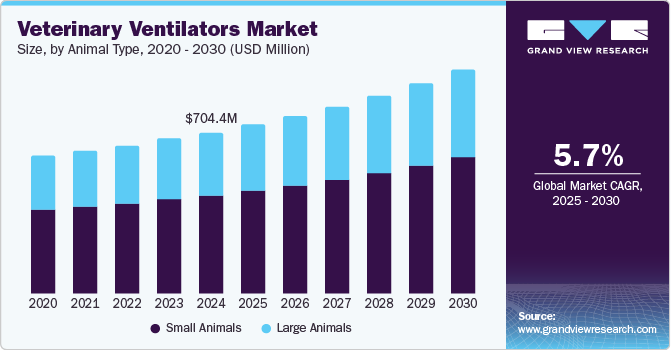

The global veterinary ventilators market size was valued at USD 704.36 million in 2024 and is expected to grow at a CAGR of 5.74% from 2025 to 2030, driven by the increasing prevalence of respiratory diseases in animals and greater adoption of these devices in clinical settings. A study published by the National Library of Medicines in February 2024 on bovine respiratory disease (BRD) highlights different strategies to diagnose the condition and its prognosis. According to the study, BRD is one of the most prominent respiratory disorders that occur in cattle. Even after substantial development in animal healthcare, the prevalence of subclinical BRD can reach as high as 67%. This study also emphasizes the correlation between different viruses and BRD, stressing the need for improved monitoring and prevention strategies. As a result, ventilators play an ever-more-important role in controlling respiratory conditions during complicated surgeries and critical care.

The rising incidence of respiratory diseases in animals is a growing concern for pet owners, farmers, and veterinarians. Factors such as infectious diseases, environmental stress, allergies, and chronic conditions contribute to these issues. A BioMed Central study published in March 2024 found that 81.2% of sheep and goats had pulmonary abnormalities, with pneumonia being the most prevalent (55.5%), followed by emphysema and atelectasis. Common parasites included Dictyocaulus filaria, and bacterial infections involved E. coli and Klebsiella pneumoniae. In companion animals, urban pollution and allergens intensify respiratory problems, while livestock faces rapid disease spread in confined spaces, leading to economic losses. The need for adequate respiratory support in these cases is critical, and veterinary ventilators provide a reliable solution, ensuring that animals receive the necessary oxygenation and ventilation support during treatment.

The rising awareness of animal health and the growing willingness of pet owners to invest in advanced care are significantly boosting the adoption of veterinary ventilators. As pet ownership increases globally and pets are increasingly viewed as family members, spending on their healthcare has risen. This trend is powerful in developed countries with widespread pet insurance and a higher demand for specialized treatments. According to the study published by MDPI in June 2024, Bovine Respiratory Disease (BRD) is estimated to cost the U.S. cattle industry between USD 800 and USD 900 million annually. Consequently, veterinary clinics are increasingly adopting advanced medical devices, including ventilators, to meet the rising demand for quality care, a trend also emerging in developing markets with rising incomes.

Furthermore, the increasing emphasis on veterinary education and training influences the prevalence and adoption rates of veterinary ventilators. Veterinary education increasingly emphasizes advanced medical technologies like ventilators, ensuring that new veterinarians are proficient in using these vital tools. In March 2024, the Food and Agriculture Organization (FAO) launched accredited online courses to enhance global animal health training, offering accessible, high-quality disease management and biosecurity education. These courses equip veterinarians and animal health professionals with crucial skills to tackle global animal care challenges. The FAO’s initiative aims to strengthen animal health systems worldwide. In addition, veterinary associations and regulatory bodies advocate for elevated care standards, including using ventilators, further driving market growth and improving veterinary practices.

Market Concentration & Characteristics

Innovation is a major growth driver in the global veterinary ventilators industry, with continuous advancements in technology enhancing device functionality, reliability, and user-friendliness. Improved software now allows for precise control of ventilation parameters, which is crucial for treating animals with diverse respiratory needs. The VentElite, a small animal ventilator designed for research, accommodates animals from mice to guinea pigs. It features pressure and volume-controlled ventilation, real-time tracheal pressure displays, adjustable inspiratory and expiratory holds, programmable sigh functions, and safety alarms. Its intuitive touchscreen interface simplifies operation, making it ideal for accurate and safe ventilation in small animal studies.

The level of mergers and acquisitions (M&A) activities in the market is a significant factor influencing market dynamics as companies seek to expand their product portfolio & enhance their technological capabilities and increase their market share. Increased M&A activities, where larger firms acquire innovative, smaller companies, are accelerating market penetration by integrating advanced technologies and leveraging established distribution networks. These acquisitions also foster competition and drive innovation, facilitating new market entrants. As demand for advanced veterinary care rises, this trend of strategic partnerships and acquisitions is expected to continue, further influencing market dynamics.

Regulations significantly influence the veterinary ventilators industry, impacting product development, market entry, and adoption. Regional regulatory frameworks, especially in North America and Europe, impose stringent standards for the safety and efficacy of veterinary medical devices. In the U.S., the FDA ensures that ventilators meet rigorous safety and efficacy criteria. Europe mandates compliance with the Medical Device Regulation (MDR) and CE marking. Similarly, Australia's Therapeutic Goods Administration (TGA) and Canada's Health Canada enforce stringent guidelines. Adherence to these regulations ensures high product standards and boosts market adoption by enhancing trust among veterinarians and pet owners.

Regional expansion is a significant factor fueling growth in the global market, as companies aim to enter emerging markets and broaden their international presence. Although North America and Europe currently lead the market due to their advanced veterinary healthcare systems and higher rates of pet ownership, regions such as Asia-Pacific, Latin America, and the Middle East offer considerable growth opportunities. For instance, in November 2021, India established BestBuds Pet Hospital, a non-profit veterinary facility featuring the country's first veterinary ventilator and fully equipped operating theaters. These regions are experiencing rising disposable incomes, increased pet ownership, and greater awareness of animal health, which are driving the demand for advanced veterinary care, including ventilators.

Product Insights

The Electronic segment held the largest revenue share of over 44% in 2024 and is also expected to grow at the highest growth rate of more than 6% over 2025-2030. This dominance can be attributed to electronic ventilators' superior functionality, precision, and versatility compared to their mechanical and pneumatic counterparts. Electronic ventilators offer advanced features such as automated settings, real-time monitoring, and the ability to tailor ventilation parameters to the specific needs of different animals, making them particularly valuable in routine and complex veterinary procedures. Their ease of use and adaptability make them highly attractive to veterinarians, leading to higher adoption rates across various clinical settings.

Innovations such as portable electronic ventilators, which can be used in mobile clinics or remote locations, have expanded the potential applications of these devices. In addition, advancements in user-friendly interfaces, integration with electronic health records (EHR), and improved battery life have enhanced the functionality and convenience of electronic ventilators. For instance, the Hallowell EMC IVS-9 Small Animal Ventilator offers versatile ventilation modes such as volume control, pressure control, and synchronized ventilation. It includes adjustable settings for inspiratory and expiratory times, tidal volume, and respiratory rates, allowing customization for various species and conditions. In addition, it features integrated monitoring with real-time displays of respiratory rate, tidal volume, and airway pressures to support precise clinical decision-making. These developments have made them more accessible to a broader range of veterinary practices, from large animal hospitals to smaller clinics, further driving market growth.

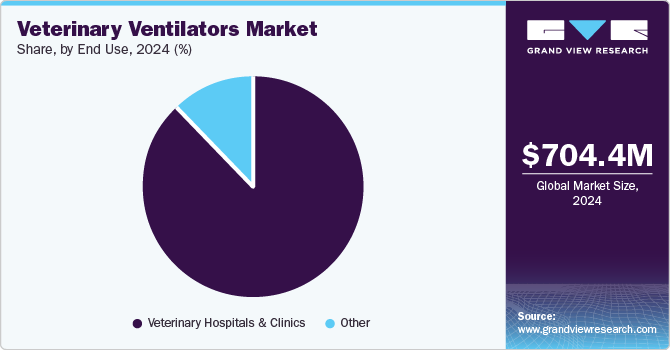

End Use Insights

Veterinary hospitals and clinics held the largest share of more than 85% in 2024. The increasing need for advanced care drives this dominance, and these institutions provide specialized care equipped with cutting-edge technologies, including ventilators, which are essential for managing critical and complex cases. The rising prevalence of respiratory and cardiovascular conditions in both small and large animals has heightened the demand for ventilators for life-saving interventions during surgeries and intensive care. Veterinary hospitals handle more severe cases and are referred centers for complicated conditions, necessitating advanced equipment. Additionally, these hospitals employ specialized staff trained in sophisticated medical devices, ensuring optimal care. As per the American Veterinary Medical Association (AVMA), as of December 2023, there were 127,131 veterinary practitioners in the U.S., with 82,704 working in clinical practice, underscoring the critical role of veterinary hospitals in providing high-quality care.

Moreover, as primary care providers, veterinary clinics invest in state-of-the-art medical equipment, including ventilators, to address the rising need for respiratory support during elective and emergency surgeries. The surge in pet adoption and increasing veterinary treatment spending further supports this trend. Moreover, the rising pet adoption, the growing number of veterinarian clinics, and the increasing owner awareness, leading to a surge in annual veterinary treatment spending, are expected to fuel market growth over the forecast period. For instance, according to Protectapet, there are 6,000+ veterinarian clinics in the country catering to nearly 17 million pets.

Animal Type Insights

The small animal segment is estimated to account for the largest market share in 2024 due to the growing adoption of companion animals. This growth is attributed to the high prevalence of respiratory and cardiovascular conditions in pets such as dogs and cats. The increasing trend of pet ownership, where pets are considered family members, has significantly boosted demand for advanced veterinary care, including ventilatory support. As pet owners spend more on veterinary services, with costs rising from USD 224 to USD 362 per year for dogs and from USD 189 to USD 321 for cats, the demand for adequate ventilatory support continues to grow. Also, it is projected that Americans would spend around USD 10.6 billion on their pets by the end of 2024, reflecting the expanding investment in high-quality animal healthcare.

The large animal segment is anticipated to experience the fastest growth with a projected CAGR of 5.83% over the forecast period. This growth is driven by the rising need for ventilatory support in large animals such as horses and livestock due to the increasing prevalence of respiratory and cardiovascular conditions like equine asthma, chronic obstructive pulmonary disease (COPD) in horses, and respiratory distress in cattle. These conditions often require advanced medical interventions, including ventilators, for effective surgical and intensive care. The increasing value of livestock and equine animals for agriculture, racing, and companionship drives the demand for high-quality veterinary care. Advanced equipment such as the Tafonius Large Animal Ventilator by Burtons Medical Equipment Ltd is specifically designed for large animals; this high-performance ventilator operates solely on oxygen, offering controlled and precise ventilation during anesthesia. It features customizable settings, an intuitive touchscreen interface, advanced monitoring capabilities, and consistent tidal volume delivery, making it essential for veterinary professionals managing large animals like horses and cattle.

Application Insights

The anesthesia segment held the largest share of the market in 2024 and is projected to grow with the fastest CAGR during the forecast period. This is primarily attributed to the increasing demand for safe and effective anesthesia management in veterinary procedures, which requires precise ventilation control to maintain appropriate animal oxygen and anesthesia levels. As veterinary surgeries become more complex and the focus on animal welfare intensifies, the need for reliable anesthesia ventilators has surged, driving the growth of this segment.

The prevalence of surgical interventions in companion animals and livestock significantly drives the anesthesia segment's growth. Procedures ranging from routine surgeries, such as spaying and neutering, to more complex operations, like orthopedic surgeries and tumor removals, often require the use of anesthesia ventilators to ensure the animal's safety and comfort. With the rise in pet ownership & the increasing willingness of pet owners to invest in advanced veterinary care, the number of surgical procedures has grown, leading to higher adoption rates of anesthesia ventilators in veterinary practices.

Regional Insights

North America Veterinary Ventilators Market Trends

North America veterinary ventilators market accounted for the largest revenue share of over 39% in 2024. This leadership is driven by the region's advanced veterinary infrastructure, high pet ownership rates, and significant spending on animal healthcare. For instance, Ontario has about 5,546 veterinarians, with 2,042 in British Columbia. Additionally, ventilators used for livestock must comply with Health Canada's stringent safety standards, ensuring high-quality care across various veterinary practices. The rise in pet diseases and growing adoption rates are expected to boost market growth further. According to the 2023 State of the Industry (SOI) report by NAPHIA, North America has 5.36 million insured pets, a 21.7% increase from 2021 number of 4.4 million.

U.S. Veterinary Ventilators Market Trends

The veterinary ventilators market in the U.S. is set to exhibit a lucrative rise driven by its advanced veterinary infrastructure, which features numerous specialized hospitals and clinics with state-of-the-art medical technology. The high prevalence of chronic and critical conditions in companion animals, such as respiratory and cardiovascular diseases, has significantly increased the need for advanced ventilatory support. According to a May 2024 report by PangoVet, there are approximately 17.6 million exotic pets across 9 million American households, with 26.0% being birds and 51% reptiles, underscoring the substantial and diverse exotic pet population in the U.S. This growing pet population further fuels the demand for sophisticated veterinary care and equipment.

Europe Veterinary Ventilators Market Trends

The European veterinary ventilators market is poised for considerable growth during the forecast period. This is driven by the region's extensive livestock sector, particularly in dairy and beef production, which necessitates rigorous health management practices to maintain productivity and product quality. According to the news published in November 2024, milk output in the Europe reached 10.8 million tonnes in 2023, which marked an increase of 0.8 million tonnes as compared to 2022, underscoring the economic significance of dairy cattle. Additionally, the widespread use of oral antimicrobial solutions in EU countries, as reported by the EMA, highlights the region's commitment to effective veterinary treatments, supporting the need for advanced ventilatory support.

UK Veterinary Ventilators Market Trends

In the UK, the veterinary ventilators market is expected to grow profitably due to increasing demand for veterinary services driven by rising rates of animal injuries and illnesses. The People’s Dispensary for Sick Animals (PDSA), a leading veterinary charity in the UK, provides low-cost and accessible treatments to needy animals. As the prevalence of injury and illnesses grows among companion animals, the need for proper treatment is expected to increase. According to PDSA’s statistics, around 800 cases a month require emergency surgery and are treated at PDSA charity animal hospital. This high demand for emergency surgeries and care translates into a greater need for advanced medical equipment, including ventilators.

Asia Pacific Veterinary Ventilators Market Trends

The Asia Pacific veterinary ventilators market is estimated to witness the notable growth over the forecast period. Rapid urbanization and increasing pet ownership across the region elevated the demand for advanced veterinary care, including ventilator support. As economies in countries like China, India, and Japan continue to expand, so does the capacity and sophistication of their veterinary infrastructure. For instance, China & India constitute approximately 30% of the cattle population globally. Furthermore, the growing prevalence of zoonotic diseases, such as the 2022 lumpy skin disease outbreak in India, which affected over 2 million animals, including 100,000 deaths across 15 states and 251 districts in three months, accelerates the need for effective management of livestock health in a country with a significant agricultural sector highlighting the importance of advanced veterinary care.

India Veterinary Ventilators Market Trends

The veterinary ventilators market in India is estimated to exhibit significant growth over the forecast period. This can be attributed to the increasing awareness of advanced animal healthcare & the rising prevalence of chronic and acute conditions in pets and livestock are major contributors. India had about 192.5 billion cattle, according to the Department of Animal Husbandry and Dairying's most recent livestock census data. Market expansion is also being fueled by the Indian government's emphasis on enhancing animal health through a number of programs and more financing for veterinary care. For example, India's USD 25 million proposal to enhance animal health security for pandemic preparedness and response was accepted by the G20 Pandemic Fund in August 2023. The Indian Ministry of Animal Husbandry and the South Asia Sub-regional Economic Cooperation are working together to improve animal health security through co-financing and investment. The funding helps India's One Health Mission initiative, which is strengthened by the country's rising rates of pet adoption, veterinary care, and pet humanization.

Latin America Veterinary Ventilators Market Trends

The veterinary ventilator market in Latin America is witnessing robust growth driven by increased investments in animal health infrastructure and a rising awareness of advanced veterinary care. The region's expanding veterinary facilities are incorporating state-of-the-art technologies to meet the growing demand for specialized animal care. This investment surge is fueled by public and private sectors recognizing the importance of high-quality veterinary services. Additionally, the escalating incidence of animal diseases and the growing pet ownership trend further propel the market.

Brazil Veterinary Ventilators Market Trends

The Brazil veterinary ventilators market is subject to lucrative growth during the forecast period. According to Agro Concept Management Ltd, Brazil, with its second-largest cattle herd of 232 million heads, is a major global player in livestock. As the world's leading beef exporter, Brazil has heightened awareness around animal health, significantly driving the demand for veterinary medicines, including antibiotics. This focus on animal health extends to advanced medical technologies, such as veterinary ventilators. This large volume export is attributed to Brazil's low illness rate among animals, robust demand from abroad, and competitive pricing.

MEA Veterinary Ventilators Market Trends

The MEA veterinary ventilators market is experiencing significant growth, driven by increasing pet ownership and the rising demand for companion animal care. As more households in the MEA embrace pets as integral family members, there is a corresponding surge in the need for advanced veterinary care. This trend is particularly evident in urban areas where higher disposable incomes and a growing middle-class lead to more significant pet health investments. As pet owners become more aware of the benefits of advanced medical treatments, including ventilatory support, the demand for sophisticated veterinary equipment has intensified.

South Africa Veterinary Ventilators Market Trends

The veterinary ventilators market in South Africa is subject to lucrative growth owing to the region’s rising focus on improving veterinary care standards and increasing investment in healthcare infrastructure. The growing awareness of advanced treatment options and the need for high-quality care in companion animals and livestock contribute to this market expansion.

Key Veterinary Ventilators Company Insights

Major players operating in the market are involved in various strategies such as distribution agreements, mergers & acquisitions, and expansions. Most crucially, they exhibit a very high degree of innovation in product research & development to improve their market penetration.

Key Veterinary Ventilators Companies:

The following are the leading companies in the veterinary ventilators market. These companies collectively hold the largest market share and dictate industry trends.

- MIDEN MEDICAL

- Midmark Corporation

- Vetronic Services Ltd.

- Hallowell EMC

- Metran Co., Ltd.

- RWD Life Science Co., LTD,

- EICKEMEYER

- VetEquip Inc.

- MINERVE Veterinary Equipment.

Recent Developments

-

In September 2024, FDA's Center for Veterinary Medicine announced a Class I recall for PneuPAC paraPAC Plus P300 and PneuPAC paraPAC Plus P310 ventilator models as there was a possibility of loosening or detachment of the patient outlet connector. The device would now be improved and can be relaunched for improving the respiratory treatments in animals.

-

In February 2024, Dispomed Ltd unveiled its turbine-driven veterinary ventilator Moduflex insPurr Ventilator that operates without a continuous oxygen supply, leading to significant cost savings. Unlike traditional ventilators, it uses 0 Liters Per Minute (LPM) of oxygen, eliminating the need for constant oxygen consumption and reducing operating costs. This efficiency does not compromise the quality of respiratory support, making the insPurr Ventilator a practical and cost-effective investment for clinics, particularly those treating small animals.

Veterinary Ventilators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 739.33 million

Revenue forecast in 2030

USD 977.36 million

Growth rate

CAGR of 5.74% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Argentina, South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MIDEN MEDICAL, Midmark Corporation, Vetronic Services Ltd., Hallowell EMC, Metran Co., Ltd., RWD Life Science Co., LTD, EICKEMEYER, VetEquip Inc., MINERVE Veterinary Equipment

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Ventilators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary ventilators market report on the basis of product, Animal type, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic

-

Mechanical

-

Pneumatic

-

Electro-pneumatic

-

Other

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia

-

Resuscitation

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary ventilators market was valued at USD 704.36 million in 2024 and is expected to reach USD 739.33 million in 2025.

b. The global veterinary ventilators market is expected to grow at a CAGR of 5.74% from 2025 to 2030 to reach USD 977.36 million by 2030.

b. In 2024, the anesthesia segment dominated the veterinary ventilators market, and is also expected to grow at the fastest CAGR during the forecast period.

b. Some of the key players operating in the veterinary ventilators market include MIDEN MEDICAL, Midmark Corporation, Vetronic Services Ltd., Hallowell EMC, Metran Co., Ltd., RWD Life Science Co., LTD, EICKEMEYER, VetEquip Inc., MINERVE Veterinary Equipment

b. Key growth drivers include the increasing prevalence of respiratory diseases in animals, advancements in veterinary medicine and greater adoption of these devices in clinical settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.