- Home

- »

- Next Generation Technologies

- »

-

Video Conferencing Market Size, Industry Report, 2033GVR Report cover

![Video Conferencing Market Size, Share & Trends Report]()

Video Conferencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, And Services), By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-081-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Conferencing Market Summary

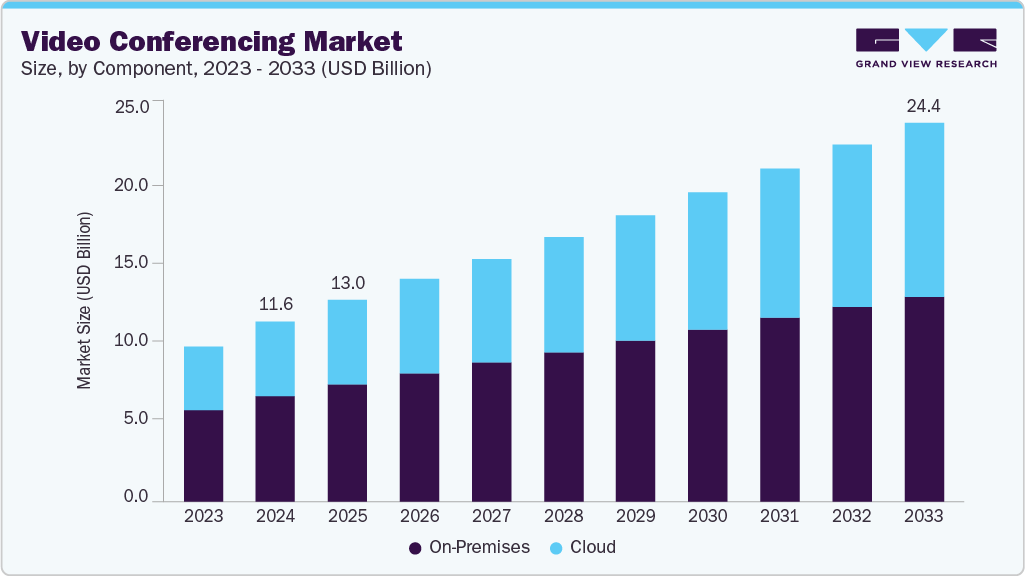

The global video conferencing market size was estimated at USD 11,653.1 million in 2024 and is projected to reach USD 24,459.2 million by 2033, growing at a CAGR of 8.2% from 2025 to 2033. This expansion is fueled by the widespread adoption of hybrid and remote work models, as organizations across sectors seek flexible, scalable communication tools to connect dispersed teams, boost productivity, and ensure business continuity in an increasingly digital work environment.

Key Market Trends & Insights

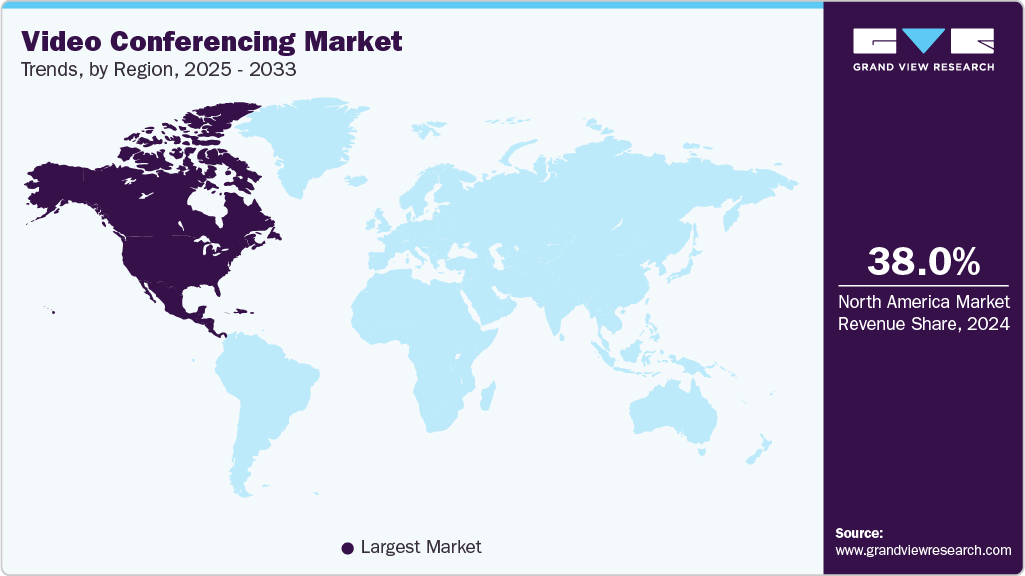

- The video conferencing market in North America accounted for the largest revenue share of over 38% in 2024.

- The U.S. video conferencing market is anticipated to grow at a CAGR of over 7% from 2025 to 2033, owing to government initiatives in the country.

- Based on deployment, the on-premises segment accounted for the largest revenue share of over 58% in 2024.

- Based on the components, the hardware segment held the highest revenue share, over 46%, in 2024.

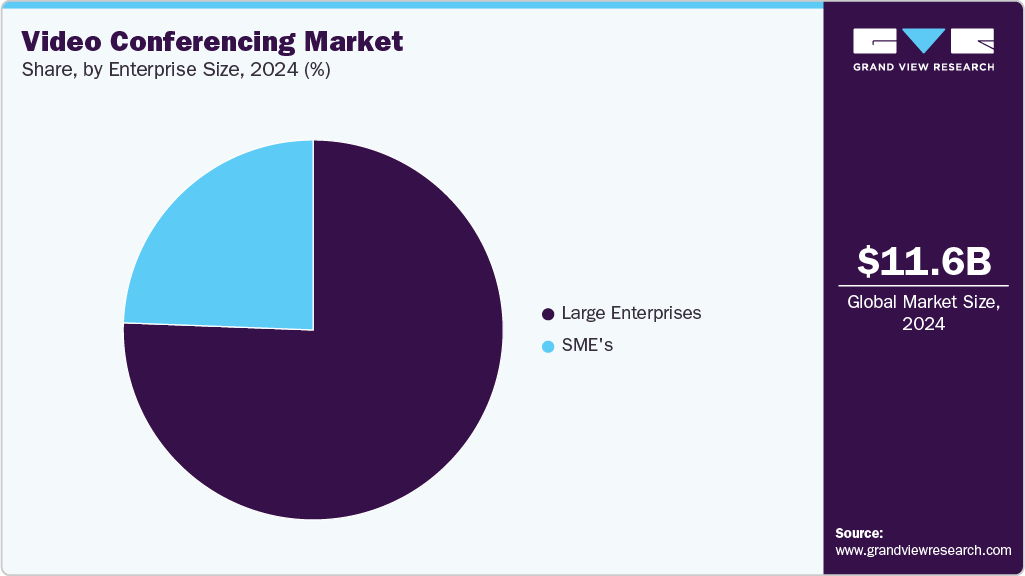

- Based on enterprise size, the large enterprises segment accounted for the highest market share of over 77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,653.1 Million

- 2033 Projected Market Size: USD 24,459.2 Million

- CAGR (2025-2033): 8.2%

- North America: Largest market in 2024

The rapid shift toward cloud-based video conferencing solutions, which offer reduced operational and capital expenditures (OPEX and CAPEX), seamless scalability, and easy integration with other enterprise tools, is expanding the video conferencing industry. Additionally, the rise of cloud-native enterprises and the growing need for virtual meeting spaces have prompted significant investments in cloud infrastructure. This enables businesses to facilitate real-time collaboration while minimizing travel costs and supporting global connectivity, further accelerating the market growth.Additionally, technological advancements, particularly the integration of artificial intelligence (AI) and machine learning, are transforming the user experience in video conferencing. AI-powered features such as automatic noise cancellation, real-time language translation, intelligent background management, and in-meeting assistants make virtual meetings more efficient, accessible, and engaging. Such innovations help enhance audio and video quality and automate scheduling, note-taking, and participant management tasks, significantly improving meeting productivity and driving the video conferencing industry expansion.

Furthermore, security and privacy have become paramount as video conferencing platforms handle sensitive business and personal information. Implementing robust encryption protocols, complying with regulations such as GDPR and HIPAA, and continuously developing advanced security features are critical trends, especially as organizations become more vigilant about data protection in virtual environments. This focus on security also drives demand for on-premises solutions in industries with strict compliance requirements.

Moreover, companies are adopting various strategies to enhance their competitive edge. Key companies are integrating advanced technologies such as artificial intelligence (AI), cloud computing, and 5G connectivity to improve user experience, scalability, and security. Additionally, companies are investing heavily in robust security protocols, including end-to-end encryption and compliance with data privacy regulations, to protect sensitive communications. Key players' strategies will drive the video conferencing industry in the coming years.

Component Insights

The hardware segment dominated the market with a share of 46% in 2024, driven by the increasing adoption of hybrid work models that require high-quality, reliable equipment such as cameras, microphones, collaboration bars, and codec systems to facilitate seamless communication across dispersed teams. Technological advancements such as AI-powered noise cancellation, intelligent framing, and 4K video resolution enhance the user experience. At the same time, the growing demand from educational institutions, corporate offices, and commercial spaces further fuels the segment's growth. Additionally, the rising popularity of all-in-one integrated devices simplifies setup and management, making hardware solutions more accessible to SMEs and large enterprises.

The software segment is expected to register the fastest CAGR of over 9% from 2025 to 2033, owing to the widespread shift to cloud-based platforms that offer scalable, flexible, and cost-effective video conferencing solutions. Increasing demand for features such as real-time collaboration, virtual backgrounds, AI-driven transcription, and meeting analytics drives software adoption. Integration capabilities with other enterprise applications, such as CRM and project management tools, enhance workflow efficiency. The growing preference for subscription-based models and the need for secure, encrypted communication further drive the segmental growth.

Deployment Insights

On-premises deployment dominated the market in 2024. By deploying on-premises solutions, companies maintain full ownership and management of their data within their infrastructure, significantly reducing dependency on external service providers and limiting exposure to extraterritorial data laws. This control allows organizations to implement customized security policies, respond swiftly to security incidents, and ensure compliance with strict regulatory requirements, which is especially important for sectors handling sensitive information such as finance, government, and healthcare.

The cloud-based deployment segment is expected to register the fastest CAGR from 2025 to 2033, owing to its flexibility, scalability, and cost-effectiveness. The ability to quickly update features, support remote workforces, and integrate with multiple devices and platforms accelerates adoption. Cloud solutions also facilitate global collaboration by enabling seamless connectivity across geographies. The rise of AI-powered enhancements and analytics within cloud platforms further improves meeting productivity and user engagement, driving growth in both enterprise and consumer segments.

Enterprise Size Insights

Large enterprises dominated the market in 2024, owing to their need for efficient global communication across multiple locations. They invest heavily in advanced conferencing solutions to support business continuity, employee training, and collaboration. The ability to reduce travel costs and improve decision-making speed are key drivers. Large enterprises also prioritize security and integration with existing IT infrastructure.

The SMEs segment is expected to register the fastest CAGR from 2025 to 2033. SMEs are increasingly adopting video conferencing to enhance flexibility and reduce operational costs. Affordable, scalable, cloud-based solutions make video conferencing accessible to SMEs. The shift toward hybrid work models and the need to remotely maintain client and team engagement are key growth factors for this segment.

Application Insights

The enterprise application dominated the market in 2024, driven by the demand for room-based hardware solutions and software platforms that enable seamless virtual meetings. Enterprises seek solutions that improve productivity, support hybrid work, and offer integration with business applications. The growth of 5G networks and enhanced internet infrastructure further facilitates enterprise adoption.

The consumer application segment is expected to register the fastest CAGR from 2025 to 2033, owing to the increased social connectivity needs, remote learning, and virtual events. The pandemic accelerated usage, and ongoing demand for high-quality, easy-to-use platforms sustains growth. Consumer-focused solutions emphasize simplicity, mobile compatibility, and affordability.

End Use Insights

The corporate segment dominated the market in 2024, driven by the growing interest in cloud-based communication and collaboration tools. The shift toward hybrid work models and global business operations increases the need for reliable, high-quality video solutions. Corporations emphasize security, ease of use, and integration with existing IT infrastructure. The growing investments in upgrading conference rooms with advanced hardware and software solutions reflect the increasing importance of video conferencing in enhancing productivity and reducing travel expenses.

The healthcare segment is expected to grow at a significant CAGR from 2025 to 2033, owing to increased telemedicine demand, cost-effective remote patient care, and regulatory support for telehealth reimbursement. The need for HIPAA-compliant, secure platforms integrated with electronic health records drives the market. Innovations such as remote monitoring and virtual consultations are transforming healthcare delivery, especially in rural and underserved areas.

Regional Insights

The North America video conferencing market dominated with a share of over 38% in 2024, driven by rapid technology adoption, widespread hybrid work models, and strong digital transformation across industries. The presence of major players is fueling innovation in cloud-based unified communication and AI-powered collaboration tools. Additionally, government initiatives promoting contactless meetings and digitalization, along with significant investments in advanced hardware and software solutions, are driving the market growth. The region also sees strong demand from educational institutions adopting video conferencing for remote learning and virtual classrooms.

U.S. Video Conferencing Market Trends

The U.S. video conferencing market dominated the market with a share of over 83% in 2024. The rapid rollout and adoption of 5G technology, which significantly enhances video call quality through faster network speeds, lower latency, and more reliable connectivity is driving the market growth in U.S. Such advancements support high-definition and even 3D video conferencing without lag or disruptions, enabling seamless remote collaboration and boosting demand for video conferencing solutions across enterprises and educational institutions.

Europe Video Conferencing Market Trends

The Europe video conferencing market accounted for a share of over 25% in 2024, owing to the widespread adoption of hybrid work models, robust digital infrastructure, and increasing reliance on virtual collaboration tools. Key drivers include rising corporate R&D investments, government initiatives such as Europe’s Digital Strategy 2050 promoting digital transformation, and integrating advanced features such as AI-powered transcription, noise suppression, and virtual backgrounds.

The Germany video conferencing market is expected to grow significantly in the coming years, driven by the increasing importance of video conferencing tools for virtual meetings, collaboration, and productivity maintenance across organizations. Germany’s strong industrial base and digital transformation initiatives encourage adoption in both private and public sectors. The country’s emphasis on technological innovation and infrastructure upgrades, including 5G deployment, supports enhanced video conferencing experiences.

The UK video conferencing market is rapidly expanding, driven by improvements in internet speed, video quality, and user-friendly software platforms. The country’s strong corporate presence and digital infrastructure facilitate widespread adoption. Hybrid and remote work trends continue to boost demand, supported by government policies and investments in digital connectivity. The UK benefits from its role as a major business hub, encouraging enterprises to adopt video conferencing for efficient communication and collaboration.

Asia Pacific Video Conferencing Market Trends

The Asia Pacific video conferencing market is expected to grow at the fastest CAGR of over 9% from 2025 to 2033, driven by a rising number of SMEs and startups, increasing penetration of high-speed internet, and growth across sectors such as IT, telecommunications, education, healthcare, and entertainment. The region’s rapid economic growth and technological adoption, including mobile broadband advancements, accelerate market expansion. The shift towards hybrid and remote work models, especially in urban centers, fuels demand for reliable and scalable video conferencing solutions.

The China video conferencing market is driven by rapid economic development, increasing digitalization, and domestic enterprises' adoption of advanced technologies. The government’s focus on digital infrastructure and smart city initiatives further propels market expansion.

The Japan video conferencing market is rapidly expanding, driven by the increasing trend toward remote and hybrid work models. As organizations prioritize flexible work arrangements, the need for dependable and high-quality video conferencing platforms is rising. Technological advancements in mobile broadband and network infrastructure also enhance the user experience. Japan’s corporate sector adoption and government support for digital transformation initiatives underpin this growth.

Key Video Conferencing Company Insights

Some of the key players operating in the market include Adobe, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., and Google LLC.

-

Adobe Inc. is a diversified multinational software solutions provider. The company’s solutions and services meet the needs of professionals, marketers, application developers, enterprises, and consumers by creating, managing, delivering, and optimizing content and experiences across multiple devices.

-

Avaya LLC. is a business communications company offering a wide range of services and software, including real-time video collaboration, unified communications, networking, contact centers, and related services, to companies of all sizes worldwide. The company operates through two business segments: products, solutions, and services.

Vidyo, Inc. (now Enghouse Video), West Corporation (Intrado Life & Safety, Inc.), and AURA Presence LLC are some of the emerging market participants in the video conferencing market.

-

Vidyo, Inc., is a global developer and provider of video conferencing solutions. It offers error-resilient, high-definition, and multi-point video conferencing to desktop and room system endpoints. The company’s video conferencing solutions include VidyoConnect, VidyoEngage, and VidyoCloud, which provide real-time, high-quality collaboration among geographically dispersed teams and offices.

-

Intrado Corporation, formerly known as West Corporation, is a network infrastructure and communication services provider. The company provides collaboration and conferencing services to various industries/sectors, such as consumer services, cable and satellite, education, financial services, healthcare, manufacturing, insurance, public safety, retail, technology, telecom, transportation and logistics, travel and hospitality, and utilities.

Key Video Conferencing Companies:

The following are the leading companies in the video conferencing market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- AURA Presence, LLC

- Avaya LLC

- Cisco Systems, Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- Logitech International S.A.

- Microsoft Corporation

- Plantronics, Inc. (acquired by HP Development Company, L.P.)

- Enghouse Video (formerly Vidyo, Inc.)

- West Corporation (Intrado Life & Safety, Inc.)

- Zoom Video Communications, Inc.

Recent Developments

-

In April 2025, Avaya LLC launched the Avaya Infinity platform, a transformative solution designed to unify fragmented customer experiences and evolve traditional contact centers into connection centers. This platform integrates AI, intelligent orchestration, and seamless channel connectivity to enhance customer and employee relationships with flexibility across cloud, on-premises, and hybrid environments.

-

In April 2024, Adobe Inc. launched the latest all-new Frame.io V4, a flexible, fast, and intuitive creative collaboration platform that streamlines and simplifies workflows across content creation and production.

-

In April 2024, Zoom Video Communications, Inc. announced the general availability of Zoom Workplace, the company’s AI-powered collaboration platform that includes new features to help users reimagine teamwork, facilitate connections, and improve productivity.

Video Conferencing Market Report Scope

Report Attribute

Details

- Market size value in 2025

USD 13,065.5 million

Revenue forecast in 2033

USD 24,459.2 million

Growth rate

CAGR of 8.2% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Billion/Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Adobe Inc.; AURA Presence, LLC; Avaya LLC; Cisco Systems, Inc.; Google LLC; Huawei Technologies Co., Ltd.; Logitech International S.A.; Microsoft Corporation; Plantronics, Inc. (acquired by HP Development Company, L.P.); Enghouse Video (formerly Vidyo, Inc.); West Corporation (Intrado Life & Safety, Inc.); Zoom Video Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Video Conferencing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global video conferencing market report based on component, deployment, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Camera

-

Microphone/Headphone

-

Others

-

-

Software

-

Service

-

Professional services

-

Managed services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud-based

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

SMEs

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer

-

Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Corporate

-

Education

-

Healthcare

-

Government & Defense

-

BFSI

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global video conferencing market size was estimated at USD 11,653.1 million in 2024 and is expected to reach USD 13,065.5 million in 2025.

b. The global video conferencing market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2033 to reach USD 24,459.2 billion by 2033.

b. North America dominated the market for video conferencing in 2024 and accounted for a revenue share of over 38%. The strong presence of various major technology companies, such as Microsoft Corporation, Google LLC, Cisco Systems, Inc., etc., providing high-end collaboration tools is contributing to the market growth.

b. Some key players operating in the video conferencing market include Adobe Inc.; Array Telepresence Inc.; Avaya Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Logitech International S.A.; Microsoft Corporation; Plantronics, Inc.; Vidyo Inc.; and West Corporation.

b. Key factors that are driving the video conferencing market growth include the rapidly growing demand for video communication on account of the globalization of businesses, geographically scattered business operations, and remote workforce management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.