- Home

- »

- Consumer F&B

- »

-

Virgin Coconut Oil Market Size, Share & Growth Report 2030GVR Report cover

![Virgin Coconut Oil Market Size, Share & Trends Report]()

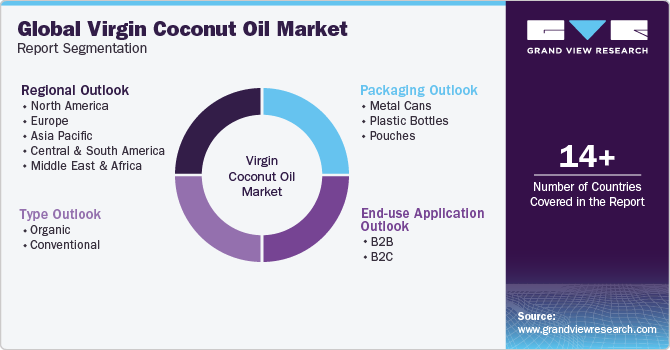

Virgin Coconut Oil Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Conventional), By Packaging (Metal Cans, Pouches), By End-use Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-153-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virgin Coconut Oil Market Summary

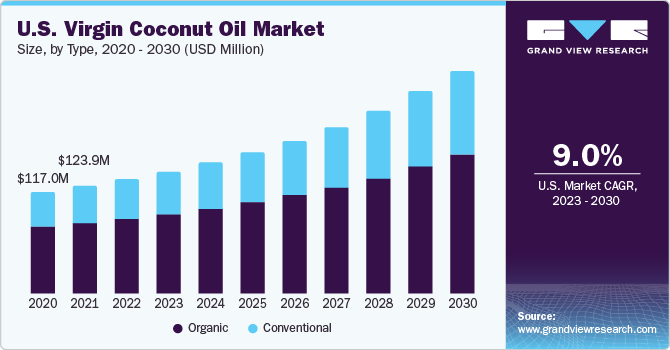

The global virgin coconut oil market size was estimated at USD 845.3 million in 2022 and is projected to reach USD 1,606.1 million by 2030, growing at a CAGR of 8.6% from 2023 to 2030. The surge in demand for virgin coconut oil can be attributed to evolving consumer preferences and prevailing societal patterns.

Key Market Trends & Insights

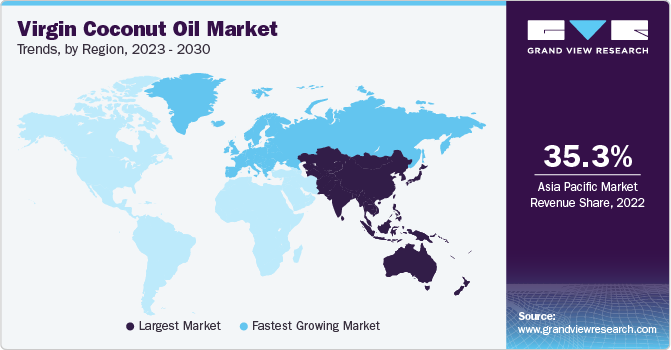

- Asia Pacific dominated the global virgin coconut oil market with the largest revenue share of 35.3% in 2022.

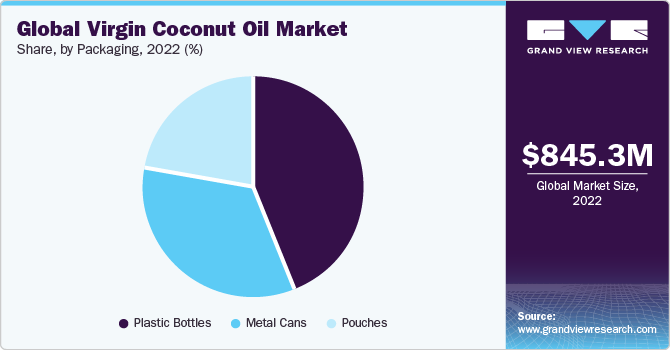

- By packaging, the plastic bottles segment led the market with the largest revenue share of 44.0% in 2022.

- By type, the organic virgin coconut oil segment led the market with the largest market share of 65.9% in 2022.

- By end use, the B2C segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 845.3 Million

- 2030 Projected Market Size: USD 1,606.1 Million

- CAGR (2023-2030): 8.6%

- Asia Pacific: Largest market in 2022

A key fuel is the increasing health awareness among consumers, which drives them to consume more healthful dietary choices. In addition, the rising consumer expenditure on functional foods and beverages has bolstered the expansion of the coconut oil food sector. As individuals emphasize their well-being and ethical considerations, the attraction of food products containing virgin coconut oil remains strong.

The market for virgin coconut oil is experiencing remarkable growth due to a confluence of factors that are both encouraging and indicative of prevailing consumer trends. Central to this expansion is the heightened consciousness surrounding health and well-being. As consumers become increasingly aware of the potential health benefits of virgin coconut oil, its reputation as a wholesome dietary choice gains prominence. Moreover, the contemporary inclination towards functional foods that offer extra health advantages beyond basic nutrition has significantly contributed to the surge. Enriched with medium-chain triglycerides (MCTs), virgin coconut oil aligns perfectly with this trend, offering potential cognitive and energy-related benefits.

The flourishing demand for vegan and plant-based diets also fuels the market's expansion. As individuals adopt these dietary preferences, virgin coconut oil's versatility as a replacement for traditional cooking oils and butter in vegan recipes makes it a sought-after ingredient. Ethical considerations further underscore this movement, as consumers increasingly opt for products that align with their eco-conscious values. Virgin coconut oil's environment-friendly production practices align with these ethical considerations, further bolstering its appeal.

The trend toward natural and organic products has also been pivotal in this expansion. Virgin coconut oil's positioning as a minimally processed and natural choice resonates with consumers seeking healthier and cleaner alternatives. Beyond its culinary applications, the incorporation of virgin coconut oil in skincare and haircare routines adds to its allure, tapping into modern consumers' multipurpose and holistic product preferences.

The COVID-19 pandemic significantly impacted the virgin coconut oil industry. The initial disruption caused by the pandemic's global supply chain disturbances and altered consumer behavior challenged the market's stability. Moreover, economic uncertainties stemming from the pandemic reduced consumer spending, particularly affecting discretionary purchases such as specialty foods like virgin coconut oil. Amid these challenges, however, several positive shifts emerged. The pandemic's spotlight on health and immunity prompted an increasing interest in wellness, with consumers exploring potential dietary additions like virgin coconut oil. As lockdowns and restaurant closures led to a surge in home cooking and self-care practices, the versatility of virgin coconut oil in both culinary and personal care applications gained traction. The shift towards online shopping further facilitated consumer access to virgin coconut oil and other specialty products. Moreover, the emphasis on local sourcing and the growing demand for functional foods that support immune health aligned favorably with the potential benefits of virgin coconut oil.

Packaging Insights

The plastic bottles segment dominated the market with a share of 44.0% in 2022. Plastic bottles offer convenience and portability, making them an ideal packaging choice for consumers who regularly use virgin coconut oil. Plastic bottles are lightweight and easy to handle, allowing consumers to easily dispense and use the oil in various applications, both in cooking and personal care.

The pouches segment is estimated to grow at the fastest CAGR of 9.7% during the forecast period. Pouches typically require less packaging material than rigid containers like bottles or jars. This can contribute to reduced packaging waste and a smaller environmental footprint, appealing to environmentally conscious consumers.

Regional Insights

Asia Pacific region dominated the market with a share of 35.3% in 2022. The rising awareness of the potential health benefits of virgin coconut oil is driving its popularity. Many consumers in the Asia Pacific region value natural remedies and traditional health practices, aligning with the perceived health advantages of virgin coconut oil. Moreover, coconut and its derivatives, including coconut oil, are deeply ingrained in the culinary and cultural traditions of many countries in the Asia Pacific region. As consumers increasingly seek to reconnect with their heritage and traditional ingredients, the demand for virgin coconut oil as a staple ingredient grows.

Europe is expected to witness the highest CAGR of 9.4% from 2023 to 2030. Europe's growing focus on health and wellness drives the demand for natural and functional ingredients. Virgin coconut oil is perceived as a healthier alternative to other cooking oils and is believed to offer potential health benefits such as supporting metabolism and immunity. As Europeans increasingly prioritize healthier lifestyles, the demand for virgin coconut oil rises.

Type Insights

The organic virgin coconut oil segment dominated the market with a share of 65.9% in 2022. As consumers become more health-conscious and seek natural and wholesome products, organic virgin coconut oil aligns with their preferences. Organic products are often perceived as being free from synthetic pesticides, chemicals, and additives, making them a choice that supports a healthier lifestyle. The potential health benefits associated with coconut oil and the organic certification make organic virgin coconut oil an appealing option for health-conscious consumers.

The conventional virgin coconut oil segment is estimated to grow at the fastest CAGR of 9.6% over the forecast period. Conventional virgin coconut oil is often more affordable to produce and purchase than its organic counterpart. This cost advantage appeals to a broad range of consumers who prioritize price when making purchasing decisions. As a result, conventional virgin coconut oil can tap into a larger consumer base, contributing to its expansion.

End-use Application Insights

The B2B segment dominated the end-use application segment, with a share of 59.1% in 2022. Countries that are major producers of virgin coconut oil often engage in B2B transactions for export purposes. These transactions can involve bulk orders for use in various products across different markets. As the global demand for virgin coconut oil continues to rise, B2B transactions play a pivotal role in facilitating international trade. The B2B segment is further divided into food & beverage, personal care & cosmetics, pharmaceuticals, institutional purchases, and others.

The B2C segment is estimated to grow at the fastest CAGR of 9.2% during the forecast period. Increasing consumer awareness of the potential health benefits of virgin coconut oil has driven its popularity. As more people seek natural and wholesome dietary choices, virgin coconut oil is perceived as healthier, leading to higher consumer demand. The B2C segment is further divided into supermarkets/hypermarkets, convenience stores, online, and others.

Key Companies & Market Share Insights

In the virgin coconut oil industry, companies are progressively launching products that seek to elevate the convenience and attractiveness of food choices. The market is fiercely competitive, featuring many competitors within the edible oil sector. These businesses are keenly attuned to consumers' preferences in local markets and are innovating an extensive array of offerings to cater to diverse consumer demands.

For instance, in February 2022, Dabur India, an Ayurvedic and Natural Health Care Company in India, introduced 'Virgin Coconut Oil.' This offering results from comprehensive research into consumer insights, demographics, and future trend projections. The oil is derived using cold press technology, which safeguards the inherent goodness, essential nutrients, fragrant aroma, and authentic taste of coconuts.

Key Virgin Coconut Oil Companies:

- Nutiva Inc.

- Forest Essentials

- MaxCare

- Barlean's Organic Oils, LLC

- Nature's Way Brands

- SPECTRUM ORGANIC PRODUCTS, LLC

- Celebes Coconut Corporation

- Universal Corporation

- Healthy Traditions

- Garden of Life

Virgin Coconut Oil Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 900.5 million

Revenue forecast in 2030

USD 1,606.1 million

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, end-use application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Indonesia; Brazil; Argentina; UAE; South Africa

Key companies profiled

Nutiva Inc.; Forest Essentials; MaxCare; Barlean's Organic Oils, LLC; Nature's Way Brands; SPECTRUM ORGANIC PRODUCTS, LLC; Celebes Coconut Corporation; Universal Corporation; Healthy Traditions; Garden of Life

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Virgin Coconut Oil Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virgin coconut oil market report based on type, packaging, end-use application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Cans

-

Plastic Bottles

-

Pouches

-

-

End-use Application Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Institutional Purchase

-

Others

-

-

B2C

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

- Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virgin coconut oil market size was estimated at USD 845.3 million in 2022 and is expected to reach USD 900.5 million in 2023

b. The global virgin coconut oil market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 1,606.1 million by 2030

b. Asia Pacific dominated the virgin coconut oil market with a market share of 35.3% in 2022. The Asia Pacific region is a major producer of coconuts, and many countries in the region have a rich history of coconut cultivation. This ready availability of coconuts provides a strong foundation for producing virgin coconut oil, contributing to the market's growth.

b. Some key players operating in the virgin coconut oil market include Nutiva Inc., Forest Essentials, MaxCare, Barlean's Organic Oils, LLC, Nature's Way Brands, SPECTRUM ORGANIC PRODUCTS, LLC, Celebes Coconut Corporation, Universal Corporation, Healthy Traditions, Garden of Life

b. Key factors driving the market growth include the rising health awareness among consumers and the increasing consumer expenditure on functional foods and beverages

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.