- Home

- »

- Next Generation Technologies

- »

-

Virtual Events Market Size & Share, Industry Report, 2030GVR Report cover

![Virtual Events Market Size, Share & Trends Report]()

Virtual Events Market (2025 - 2030) Size, Share & Trends Analysis Report By Event Type, By Component, By Establishment Size, By End Use, By Application, By Industry Vertical, By Use Case, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-795-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Events Market Summary

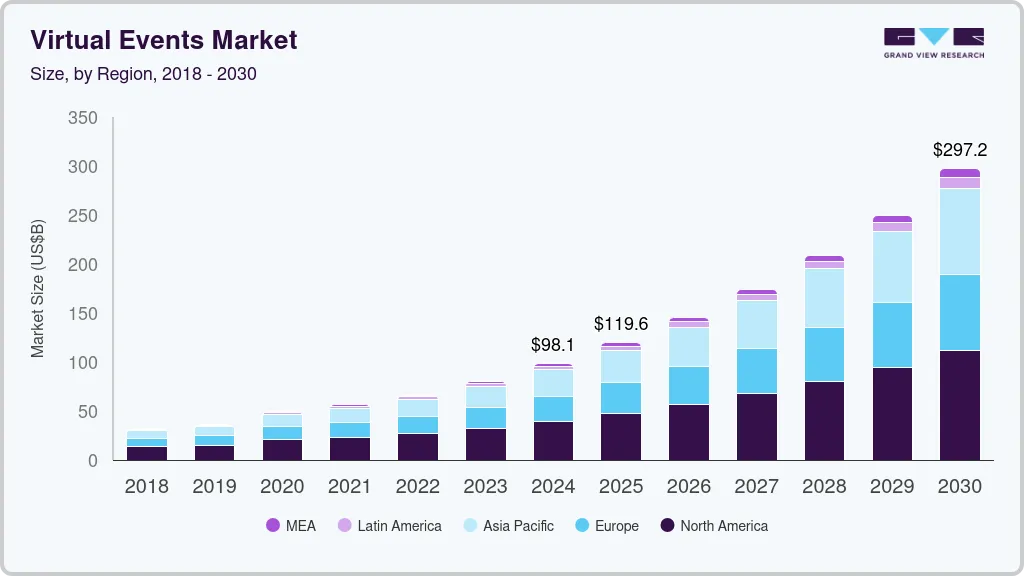

The global virtual events market size was estimated at USD 98.07 billion in 2024 and is estimated to reach USD 297.16 billion by 2030, growing at a CAGR of 20.0% from 2025 to 2030. The extensive adoption of collaboration and communication tools across diverse industries, such as retail and e-commerce, healthcare, manufacturing, construction, and education, is expected to drive market growth.

Key Market Trends & Insights

- North America virtual events market dominated the market with a revenue share of over 39% in 2024.

- The virtual events industry in the U.S. held a dominant position in 2024.

- By event type, the external event segment recorded the largest revenue share of over 40% in 2024.

- By service, the communication segment accounted for the largest market share in 2024.

- By end-use, the enterprises segment accounted for the largest revenue share 2024.

Market Size & Forecast

- 2024 Market Size: USD 98.07 Billion

- 2030 Projected Market Size: USD 297.16 Billion

- CAGR (2025-2030): 20.0%

- North America: Largest market in 2024

The increasing use of Unified Communication as a Service (UCaaS) solutions by organizations, including educational institutions, enables employees and resources to engage virtually in business activities, fostering a more efficient and effective workflow that is significantly influencing the virtual events industry. The growing acceptance of remote and hybrid work models is further fueling the market growth. The COVID-19 pandemic accelerated this shift, as organizations sought alternatives to in-person gatherings, leading to increased demand for scalable and flexible event solutions. Virtual events offer advantages such as cost savings, global reach, and enhanced accessibility, making them an attractive option for businesses and event organizers. Additionally, advancements in digital communication technologies and the integration of features like live streaming, interactive sessions, and augmented reality (AR) have further fueled the market's growth, allowing for more engaging and immersive experiences.

In addition, a rise in interactive and immersive experiences, particularly among younger demographics such as Millennials and Gen Z is impacting the virtual events industry. These groups prefer events that offer networking opportunities and engaging content delivered through advanced technologies such as virtual reality (VR) and artificial intelligence (AI). Furthermore, there is a notable shift towards hybrid event formats that blend in-person and virtual elements, catering to diverse audience preferences. The increasing focus on data-driven insights also allows organizers to tailor content effectively and demonstrate return on investment (ROI), enhancing the overall value proposition of virtual events.

The increasing focus on data-driven insights allows organizers to tailor content effectively and demonstrate return on investment (ROI). By leveraging analytics from virtual event platforms, companies can gain valuable insights into attendee behavior, engagement levels, and content preferences. This data-centric approach not only enhances the planning and execution of future events but also strengthens the overall value proposition of virtual gatherings. As organizations seek to optimize their marketing strategies through effective event management, the integration of data analytics into virtual events is becoming increasingly vital, thereby driving virtual events industry expansion.

Moreover, the rise of sustainability concerns is prompting event planners to adopt greener practices by minimizing the environmental impacts associated with traditional gatherings. Additionally, advancements in technology will continue to play a crucial role in enhancing the immersive experience of virtual events. Features such as AI-driven networking tools and personalized content delivery will become standard expectations among attendees. These factors are expected to drive the virtual events industry’s expansion.

Event Type Insights

The external event segment recorded the largest revenue share of over 40% in 2024. This growth can be attributed to the increasing use of virtual event tools by businesses to engage with external stakeholders. Many organizations are partnering with technology firms to harness technological advancements and deliver premium services to their customers. The widespread implementation of digitally simulated tools for conducting or attending tradeshows, product launches, press conferences, client meetings, and other communication events is expected to further boost segmental growth.

The extended event segment is projected to register the fastest CAGR of over 20% from 2025 to 2030. The rising utilization of virtual platforms that enable remote audiences to participate effectively in events held at different geographical locations is expected to fuel this segment's expansion. Additionally, internal events—those organized within a company—are increasingly being conducted virtually as part of the work-from-home (WFH) policies adopted by many organizations during the pandemic. Leading market players have developed various platforms to assist organizations in virtualizing their routine communications, facilitating smoother departmental operations and workflow management. This version captures the essence of your original text while enhancing clarity and readability.

Service Insights

The communication segment accounted for the largest market share in 2024. The rise of hybrid work environments has intensified the need for effective communication tools that enable collaboration among dispersed teams. This segment benefits from advancements in unified communication technologies, which integrate voice, video, and messaging services into cohesive solutions. Furthermore, as organizations prioritize real-time communication and collaboration to enhance productivity and engagement, the demand for sophisticated communication solutions is expected to remain strong, solidifying its dominance in the virtual events market.

The training segment is expected to register a considerable CAGR from 2025 to 2030, owing to the increasing demand for remote learning and skill development solutions. As organizations continue to embrace digital transformation, the need for effective training programs that can be delivered online has surged. This shift is driven by factors such as the growing adoption of e-learning technologies, the necessity for continuous employee upskilling in a rapidly changing job market, and the flexibility that virtual training offers compared to traditional methods.

Establishment Size Insights

The large institutions segment accounted for the largest revenue share in 2024, primarily driven by their extensive resources and established infrastructure that facilitate the adoption of virtual events. These institutions leverage virtual platforms for various purposes, including global outreach, internal training, and stakeholder engagement, which are essential for maintaining competitiveness in a rapidly evolving digital landscape. The integration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) into their events enhances user experience and engagement, making virtual formats an attractive option compared to traditional in-person gatherings.

The SMB’s segment is anticipated to record the fastest CAGR from 2025 to 2030, driven by the growing recognition of virtual events as cost-effective and scalable solutions for business operations. Small and medium-sized businesses (SMBs) benefit from the flexibility that virtual platforms offer, allowing them to host and participate in events without incurring the high costs associated with physical venues. This affordability is particularly appealing as SMBs seek to expand their market reach and engage with a broader audience. Additionally, the increasing adoption of cloud-based solutions among SMBs enables them to leverage advanced event technologies that enhance their operational efficiency and customer engagement.

End Use Insights

The enterprises segment accounted for the largest revenue share 2024, owing to the substantial investments made by organizations in virtual event technologies to enhance their operational efficiency and employee engagement. Enterprises leverage virtual events for various purposes, including training, product launches, and stakeholder meetings, which facilitate broader participation without the logistical challenges of in-person gatherings. The ongoing digital transformation across industries has led businesses to prioritize innovative solutions that can streamline communication and collaboration, resulting in a significant demand for virtual event platforms. This trend is expected to continue as companies recognize the value of these technologies in driving productivity and fostering connections in an increasingly remote work environment.

The educational institution segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the growing adoption of digital learning tools and online education platforms. The shift towards remote learning has accelerated due to the pandemic, leading educational institutions to invest heavily in virtual event solutions for lectures, workshops, and conferences. This segment's growth is further supported by the rising demand for flexible learning options that cater to diverse student needs and the increasing acceptance of online qualifications in the job market. Additionally, as institutions strive to enhance student engagement and provide interactive learning experiences, the integration of advanced technologies into virtual events will likely contribute to its robust growth in the coming years.

Application Insights

The exhibition & trade shows segment accounted for the largest revenue share 2024, primarily driven by the increasing need for businesses to showcase their products, assess competition, promote their offerings, and stay updated on industry trends and opportunities. Utilizing digital platforms allows exhibitors to save on travel, promotional materials, accommodations, and other costs associated with hosting traditional trade shows and exhibitions. Additionally, the high-quality leads and attendees attracted to these events enhance networking opportunities and engagement for enterprises.

The conferences segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the increasing demand for virtual platforms that facilitate knowledge sharing and professional networking. As organizations continue to embrace remote work and digital communication, virtual conferences have emerged as a cost-effective and flexible alternative to traditional in-person events. This segment's growth is further supported by advancements in technology that enhance attendee engagement, such as real-time interaction tools, live streaming, and immersive experiences. The ability to connect with a global audience without geographical constraints allows companies to maximize participation and broaden their reach, making virtual conferences an essential component of modern business strategies.

Industry Vertical Insights

The IT segment accounted for the largest revenue share in 2024. This growth can be attributed to the increasing importance of virtual events in this sector, as they enhance geographical reach and enable professionals to participate and share knowledge from any location worldwide. Additionally, these events provide greater scheduling flexibility, allowing attendees to access sessions and content at their convenience, which accommodates various time zones. Furthermore, the rising use of virtual events for continuous learning and skill development through webinars, workshops, and technical sessions is further improving the market outlook.

The BFSI segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the growing importance for effective internal communication in the banking and financial sectors as they adopt new technologies and enhance client interactions. In addition, several leading firms are developing virtual platform tools tailored for the BFSI sector to ensure secure transactions and facilitate convenient banking services, which is expected to further contribute to substantial segmental growth.

Use Case Insights

The large scale events segment accounted for the largest revenue share 2024. This growth is attributed to the significant appeal of large-scale virtual events, such as major conferences, global summits, and trade shows, which can attract thousands of participants from around the world. The ability to connect with a vast audience without geographical limitations has made these events increasingly popular among organizations looking to showcase their products, share knowledge, and foster collaboration. Moreover, advancements in virtual event technologies, including interactive features and immersive experiences, have enhanced engagement levels, further driving the segmental growth.

The everyday events segment is anticipated to record a significant CAGR from 2025 to 2030. This growth is driven by the increasing reliance on virtual platforms for routine activities such as team meetings, training sessions, webinars, and internal gatherings. As remote work and hybrid models become more prevalent, organizations are turning to everyday virtual events to maintain communication and productivity among employees. The flexibility and cost-effectiveness of these events make them an attractive option for businesses aiming to streamline operations while engaging their workforce effectively.

Regional Insights

North America virtual events market dominated the market with a revenue share of over 39% in 2024. This growth is driven by the increasing demand for remote operations, which has led businesses to adopt virtual platforms for various corporate events, including meetings, conferences, and product launches. This shift allows companies to reach wider audiences at reduced costs while facilitating effective communication across geographical boundaries.

U.S. Virtual Events Market Trends

The virtual events industry in the U.S. held a dominant position in 2024, fueled by advancements in technology that enable immersive experiences and interactive features, catering to modern audience preferences. The increasing importance of data analytics for measuring engagement and outcomes is also shaping the landscape as organizations seek to optimize their virtual event strategies, further propelling market growth in the U.S.

Europe Virtual Events Market Trends

The virtual events industry in Europe is expected to grow at a considerable CAGR of over 19% from 2025 to 2030, driven by the increasing adoption of digital communication tools and the shift towards remote and hybrid work models. The COVID-19 pandemic accelerated this transition, prompting organizations across various sectors to embrace virtual platforms for hosting events such as conferences, webinars, and trade shows. This shift not only allows companies to reach a broader audience but also reduces costs associated with traditional in-person gatherings.

The UK Virtual events market is expected to grow rapidly in the coming years, propelled by the rising demand for work-from-home policies and an increase in sponsorship for online events. As companies become more cautious about travel expenses due to the ongoing impact of the pandemic, they are turning to virtual platforms to conduct meetings and host events.

The virtual events market in Germany held a substantial market share in 2024, driven by lucrative opportunities within the event management and planning sectors. The country's strong emphasis on technological innovation facilitates the integration of advanced solutions such as artificial intelligence (AI) and virtual reality (VR) into event platforms, enhancing participant engagement and interaction.

Asia Pacific Virtual Events Market Trends

The virtual events industry in Asia Pacific is expected to grow at the significant CAGR of over 21% from 2025 to 2030, primarily driven by rapid digital transformation and increasing internet penetration across the region. The widespread adoption of high-speed internet and mobile devices has made it easier for organizations to host and participate in virtual events, such as webinars, online conferences, and trade shows. Additionally, the region's tech-savvy population is embracing these digital platforms, facilitating seamless transitions to virtual formats.

The Japan virtual events market is expected to grow rapidly in the coming years. The market is driven by advancements in technology and a cultural shift towards digital engagement. The country's robust infrastructure supports high-speed internet access, enabling organizations to conduct virtual events efficiently. Japanese businesses are increasingly adopting virtual platforms to enhance communication and collaboration, especially in light of the COVID-19 pandemic, which has accelerated the need for remote interactions. Furthermore, the rising popularity of e-learning and online training programs is driving demand for virtual events in educational institutions and corporate training settings.

The virtual events market in China held a substantial market share in 2024, owing to its large consumer base and significant investment in digital infrastructure. The country's push towards high-speed 5G networks has enhanced connectivity and enabled more immersive virtual experiences. Additionally, the increasing adoption of cloud-based solutions among businesses facilitates the hosting of large-scale virtual events, making them an attractive alternative to traditional gatherings.

Key Virtual Events Company Insights

Some of the key players operating in the market include Zoom Video Communications, Inc. and Microsoft Corporation.

-

Zoom Video Communications, Inc. is an American technology company specializing in video conferencing solutions. The company's flagship product, Zoom Meetings, allows users to host video conferences, webinars, and virtual events with high-quality audio and video capabilities. Its user-friendly interface and robust features have made it particularly popular for businesses, educational institutions, and individuals seeking reliable remote communication tools.

-

Microsoft Corporation is renowned for its software products, including the Windows operating system and Microsoft Office suite, which have become staples in both personal and professional environments. The company has diversified its portfolio to include cloud computing services through Azure, enterprise solutions, and gaming with the Xbox brand. The company has focused heavily on cloud technology and artificial intelligence, positioning itself as a leader in digital transformation. The company's commitment to innovation extends to its virtual event capabilities through Microsoft Teams and other integrated solutions that facilitate seamless online collaboration and communication for organizations worldwide.

Some of the emerging market players in the virtual events market include Vosmos Events and Hubilo

-

Vosmos Events is a tech startup specializing in creating customizable virtual event solutions, that empower users to design and host both small and large-scale virtual events with ease. The platform supports a wide range of participants, from 100 to over 100,000, and offers features such as 3D environments, live streaming, marketing analytics, and networking capabilities.

-

Hubilo is an emerging player in the virtual events industry known for its focus on enhancing attendee engagement and delivering seamless event experiences. The platform offers a highly interactive solution that includes features such as live chats, polls, Q&A sessions, and gamification elements to create dynamic virtual environments. The company also provides comprehensive analytics tools and integrates with various marketing platforms, making it easier for organizers to manage events effectively.

Key Virtual Events Companies:

The following are the leading companies in the virtual events market. These companies collectively hold the largest market share and dictate industry trends.

- Vosmos Events

- Hubilo

- 6Connex

- ALIVE

- Avaya LLC

- ALE International

- NTT Limited

- Cisco Systems Inc.

- Cvent Inc.

- EventX Limited

- George P.Johnson

- GES

- Kestone

- Martiz Holdings Inc.

- Microsoft Corporation

- Pathable

- uBivent GmbH

- Veritas Events

- vFairs

- Zoom Video Communications, Inc.

Recent Developments

-

In September 2024, Vosmos Events introduced a suite of AI-powered solutions aimed at transforming virtual events, enhancing planning, management, and audience engagement. The platform features innovative tools such as VIRSA for smart matchmaking, VosmosGPT for seamless event setup, and vClip for automated video editing.

-

In September 2024, Zoom Video Communications, Inc. and Mitel announced a strategic partnership aimed at enhancing communication solutions for businesses. This collaboration will integrate Zoom's video conferencing capabilities with Mitel's communication systems, allowing for seamless connectivity and improved user experiences in virtual meetings and events.

-

In July 2024, Martiz Holdings, Inc. acquired Convention Data Services (CDS), a registration and lead services provider, from Freeman. This acquisition aims to enhance the company’s position in the events industry by expanding its portfolio and client base, particularly in the trade show and association event sectors.

Virtual Events Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 119.62 billion

Revenue forecast in 2030

USD 297.16 billion

Growth rate

CAGR of 20.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, component, establishment size, end use, application, industry vertical, use case, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Vosmos Events; Hubilo; 6Connex; ALIVE; Avaya LLC; ALE International; NTT Limited; Cisco Systems Inc.; Cvent Inc.; EventX Limited; George P. Johnson; GES; Kestone; Martiz Holdings Inc.; Microsoft Corporation; Pathable; uBivent GmbH; Veritas Events; vFairs; Zoom Video Communications, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Events Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual events market report based on event type, component, establishment size, end use, application, industry vertical, use case, and region:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal

-

External

-

Extended

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Web-based

-

XR

-

-

Services

-

Communication

-

Recruitment

-

Sales & Marketing

-

Training

-

-

-

Establishment Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMB’s

-

Large Institutions

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Educational Institutions

-

Corporate

-

Government

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conferences and Conventions

-

Exhibitions & Trade Shows

-

Seminars and Workshops

-

Corporate Meetings and Training

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Consumer Electronics

-

Healthcare

-

IT

-

Manufacturing

-

Media & Entertainment

-

Telecom

-

Others

-

-

Use Case Outlook (Revenue, USD Billion, 2018 - 2030)

-

Everyday Events

-

Large-scale Events

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global virtual events market size was estimated at USD 98.07 billion in 2024 and is expected to reach USD 119.62 billion in 2025.

b. The global virtual events market is expected to grow at a compound annual growth rate of 20.0% from 2025 to 2030 to reach USD 297.16 billion by 2030.

b. North America dominated the virtual events market with a share of nearly 39% in 2024. This is attributable to the region being the corporate hub and also an early adopter of new technology.

b. Some key players operating in the virtual events market include Microsoft Corporation; Cisco Systems, Inc.; ALE International; Cvent Inc.; VFairs; EventX Limited; George P. Johnson; and Alive Events.

b. Key factors that are driving the virtual events market growth include its cost-effectiveness, ease of connectivity, and growing popularity of Unified Communication as a Service (UCaaS) among corporations, education institutes, and various other organizations across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.