- Home

- »

- Next Generation Technologies

- »

-

Virtual Private Network Market Size & Share Report, 2030GVR Report cover

![Virtual Private Network Market Size, Share & Trends Report]()

Virtual Private Network Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Site-To-Site, Remote Access, Extranet), By Deployment Mode, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-164-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Virtual Private Network Market Size & Trends

The global virtual private network market size was valued at USD 41.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2023 to 2030. The growing concerns over the security of the data being transferred over a public internet connection are expected to drive the growth. A virtual private network (VPN) provides an encrypted connection that allows consumers to connect to the internet over public connections. Several organizations rely on these secure connections to ensure that only designated users can access their networks remotely. However, the pandemic has changed this dynamic and has triggered a huge demand from the end-uses using VPN services. Industry experts expect this rise in demand to lead to challenges that need to be addressed by both VPN providers and enterprises.

A virtual private network ensures full-time, high-speed, and secure connectivity. Over the years, high-speed, persistent internet connections have become more expensive than those used merely for accessing emails. Hence, enterprises need more capacity to accommodate provisional spikes in usage. Using a virtual private network does not require permanent links between end nodes, which are often associated with contract negotiations and monthly fees. Another significant advantage of the VPN solution, over frame relays or leased lines, is that virtual private networks do not require any specialized equipment. In other words, a VPN can serve as an economical source of encryption, tunneling, authentication, and access control services and technologies to carry traffic over a managed IP network, internet, or a provider's backbone.

The significant upsurge in the number of cyberattacks and the rise in demand for cloud-based security solutions is expected to drive the demand for virtual private networks over the forecast period. Enterprises of all sizes operating in various industries and industry verticals are aggressively looking for effective means of data management and secured connectivity between different business units. Enterprises also require uninterrupted connectivity to maintain collaboration with partners and customers globally. At this juncture, VPNs can offer excellent service quality in terms of keeping the most crucial traffic flowing for businesses and avoiding packet loss. Particularly for IT and telecommunications companies, it is becoming necessary to minimize costs and improve the quality of business functions to survive in a competitive business environment. Hence, the demand for VPN solutions from the incumbents of the IT & telecommunications industry is expected to increase over the forecast period.

Several end-use industries have started integrating VPNs into their business processes to streamline their operations. The adoption of virtual private networks is increasing as VPNs are helping end-use organizations in becoming result-oriented and more efficient. The growing adoption of VPNs is encouraging new entrants to consider a market foray with niche application-specific solutions and services. Market incumbents are also pursuing various strategic initiatives to gain competitive advantages.

Virtual private networks are gaining prominence as they can be used to dodge censorship on the internet. Countries that presently restrict virtual private networks (such as Russia and China) haven't harmed industry growth and, in fact, have brought substantial awareness to its application. These countries have imposed laws banning virtual private network usage, which creates massive amounts of pushback from local citizens and media coverage.

Countries have obligatory censorship to block certain news portals and websites and try to monitor each click the inhabitants make. The easiest solution a lot of citizens turn to is a virtual private network. The virtual private network provides encryption of all the data so that the government is not able to censor the connection, enabling users to access the blocked websites and portals.

One of the Slate articles stated, "The companies providing virtual private networks have struggled to circumvent some of the imposed technical limitations. However, several companies reported that demand for their service offerings is increasing, and the efforts aiming to curb their practices instead of dissuading users, have developed an interest in virtual private networks. For instance, according to the head of communications, Ruby Gonzalez, NordVPN operates just under 3,000 servers and has witnessed "a lot of interest and incredibly strong growth" in China.

Regulation and compliance are strong drivers for all information security markets, including the market. Verticals and industries continue to release specific guidance and regulations for the global virtual private network market.

The European Union created the General Data Protection Regulation (GDPR) to safeguard and regulate the interests of governments and civilians. It went into effect on May 25, 2018, and covers any companies that store, log, or share the personal information of any user living in Europe. According to GDPR, every user must be able to get all of the data they've shared online from all of the websites or platforms they utilize. They would also have the ability to modify, control, and delete any data they desired.

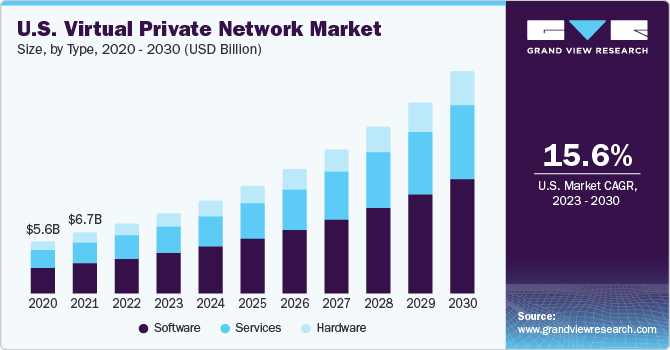

Component Insights

The software segment accounted for the largest revenue share of 49.6% in 2022. It is expected to grow at the fastest CAGR over the forecast period due to its widespread adoption and increasing demand. VPN software is easy to deploy and use, making it accessible to a wide range of users across multiple platforms, including desktop and mobile devices. Furthermore, VPN software often offers advanced features and functionalities beyond basic encryption, catering to the diverse needs of users. The subscription-based business model employed by most VPN providers ensures a steady stream of revenue as users pay recurring fees for continued access to the service. These factors collectively contribute to the software segment's dominance in revenue generation within the VPN market.

The services segment is expected to register a significant CAGR of 17.4% over the forecast period. Virtual private network solutions have been gaining high traction, particularly among commercial vendors and individual solution providers, over the past few years. The rapidly changing nature of work and the changing commercial requirements for virtual private networks will continue to drive the demand for VPN services.

A typical virtual private network solution includes control features, reporting, and management. Over the past few years, vendors have been collaborating with mobile VPN vendors and NAC solution providers as part of the efforts to drive the sales of VPN solutions. VPN services are aimed at enabling the virtual private network to secure a remote connection. Besides, vendors are allowing buyers to compare the prices online in real-time, thereby helping cost-conscious buyers assess the VPN services on offer before making a buying decision. At the same time, advances in technology coupled with economies of scale are also expected to allow providers to reduce their cost structure further and accelerate their investments in other aspects.

Connectivity Insights

The remote access segment accounted for the largest revenue share of 35.8% in 2022. This can be attributed to the increasing number of franchised dealers in the market. The proliferation of mobile VPN devices and the growing need for remote accessibility have been driving the demand for remote virtual private network solutions over the past few years. Remote access helps organizations in complying with security regulations.

The site-to-site segment is expected to grow at the fastest CAGR of 18.3% during the forecast period due to the increasing demand for secure connectivity between multiple locations, driven by factors such as the adoption of cloud services, remote work trends, interconnecting business networks, data privacy regulations, and cybersecurity concerns. The need for remote access and site-to-site connectivity has been increasing gradually to ensure seamless connectivity. Remote access and site-to-site connection ensure bandwidth and data comparison optimization.

End-use Insights

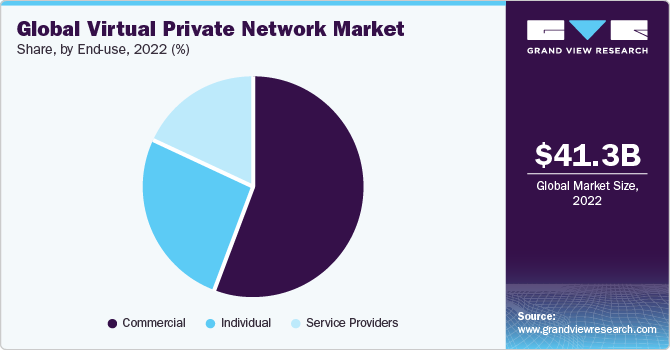

The commercial segment accounted for the largest revenue share of 55.7% in 2022. It can be attributable to the rising concerns about establishing a secure network. Moreover, virtual private networks help in reducing the risks across the entire data lifecycle. Alternatively, VPN solutions help commercial users in building trust with their customers. Cost-effectiveness and, fault-tolerant and redundant resource availability are some of the other attractive features that are expected to drive the commercial adoption of virtual private network solutions.

The individual segment is expected to grow at the fastest CAGR of 19.1% during the forecast period. Organizations have started allowing the use of remote devices in the workplace. Hence, most of the employees are now connecting to corporate networks and accessing various business applications from any location via different connected devices, including laptops, computers, netbooks, and tablets. It is particularly driving the demand for VPN solutions on an individual basis. Further, virtual private networks are used for creating hybrid network applications such as a mix of MPLS and Internet VPN solutions. Also, a virtual private network is used to extend the company data center in the cloud.

Deployment Insights

The cloud segment accounted for the largest revenue share of 73.0% in 2022 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the growing preference for cloud-based deployment to reduce maintenance and costs. Prominent market players are offering virtual private clouds to provide a secure gateway and private on-premise access to cloud resources. For instance, in December 2018, IBM Corporation announced the launch of an on-premises VPN gateway to a cloud VPN created within a VPC.

Vendors are offering virtual private cloud to help enterprises establish a private cloud computing environment on shared public cloud infrastructure. These offerings are designed to provide granulated control over granting or blocking access to particular resources for enterprise customers through specific applications or IP addresses. Cloud infrastructure resources, including storage, virtual servers, and networking, can be deployed dynamically to help VPC customers adapt to the changes according to their business needs. The subsequent reduced costs and lower maintenance can allow enterprises to focus on attaining core competencies and key business goals.

The on-premise segment is expected to register a significant CAGR of 16.3% over the forecast period. Factors such as better control over network infrastructure, along with enhanced security and predictable network performance, are driving the segment demand.

Type Insights

The IP segment accounted for the largest revenue share of 42.0% in 2022 due to its wide adoption, scalability, and cost-effectiveness. Businesses across various industries widely implement IP-based VPNs as they provide a versatile and compatible solution for secure communication over the internet. These VPNs can seamlessly integrate into existing network infrastructures, allowing organizations to establish secure connections between different locations. Additionally, IP-based VPNs offer scalability, enabling businesses to expand their network infrastructure easily without compromising security or performance.

The MPLS segment is expected to grow at the fastest CAGR of 19.6% during the forecast period. MPLS offers numerous benefits that make it appealing to enterprises and service providers. Firstly, MPLS provides efficient and reliable packet forwarding, enabling faster data transmission and reduced latency compared to other VPN technologies. It is particularly advantageous for organizations that require real-time communication or bandwidth-intensive applications. Additionally, MPLS supports secure and private communication by creating virtual private networks within the service provider's network infrastructure, providing end-to-end encryption, and protecting data from unauthorized access.

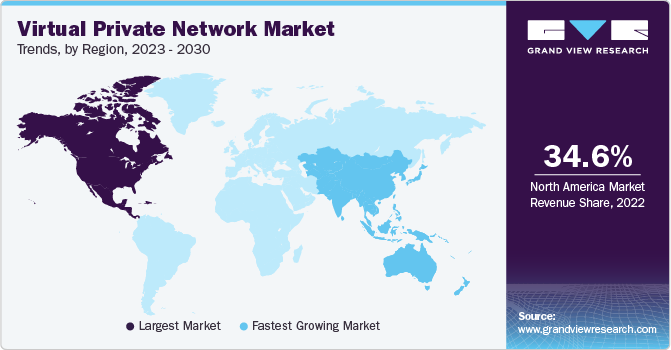

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.6% in 2022 owing to the rapid growth in the demand from telecommunications and BFSI, among other industries and industry verticals in the U.S. Additionally, the increasing concerns over personal data privacy, data security, and increase in the number of cybercrimes are the key factors fueling the market growth in the region.

Asia Pacific is expected to grow at the fastest CAGR of 19.4% during the forecast period, in line with the increasing adoption of VPN solutions and services in China, India, and other Asian countries. China is witnessing significant growth in the Asia Pacific region, with a rising number of organized players with mobile VPN services. As there are various government policies and regulations regarding popular websites, offering the virtual private network as a solution provided a number of opportunities for entrepreneurs in China, Indonesia, and other Asian countries. Additionally, using VPN services has availed easy networking and streaming in Asian countries. Using the virtual private network also ensures users ' encryption of their data and protection from hackers. These are the factors that have become significant driving factors to boost the demand for VPN solutions and services in Asian countries.

Remote working has been the new normal for almost all IT enterprises. Since the emergence of the COVID-19 pandemic, there has been a significant increase in the use of remote desktops and virtual private network (VPN) connections. The increase in remote employees and multiple devices is driving the demand for improved visibility and management. Furthermore, remote users are now able to log in to different networks, which makes central management difficult. Along with managing these devices, enterprises also want to monitor mobile workers on wireless connections.

Key Companies & Market Share Insights

All the vendors are focusing on increasing their customer base to gain a competitive edge in the market. They are pursuing several strategic initiatives, such as strategic partnerships, collaborations, acquisitions, and mergers. For instance, in January 2023, Cloudflare, Inc. announced its expanded collaboration with Microsoft, focusing on facilitating the deployment, automation, and enhancement of Zero Trust security for customers. As part of this partnership, a key objective was to ensure that VPNs are available in every region. By achieving this, whenever users connect to the secure network service, they would be directed to a local data center. Furthermore, the IP address used for browsing data will be geographically aligned with the user's actual region, resulting in improved security and a more seamless browsing experience.

Key Virtual Private Network Companies:

- Avast Software s.r.o.

- BlackBerry Limited.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- CyberGhost S.R.L.

- Google LLC

- IBM Corporation

- Absolute Software Corporation.

- Opera Holdings

- WatchGuard Technologies, Inc.

Recent Developments

-

In January 2023, Etisalat partnered with Huawei Technologies to implement and evaluate 5G portable private network multi-access edge computing (MEC) capabilities. As part of Etisalat UAE's stand-alone commercialization program, the company aimed to provide a 5G alternative to conventional VPN services, with the aim of improving remote work experiences for businesses in the UAE, leading to enhanced connectivity and increased productivity.

-

In November 2022, RadioIP announced its collaboration with NextNav, a leading provider of vertical location positioning technology. This partnership aims to enhance RadioIP's VPN solutions by incorporating mission-critical z-axis location intelligence. By leveraging NextNav's expertise, first responders and security agencies can ensure the safety and secure positioning of their personnel.

-

In February 2022, Nokia announced the world's first commercial 5G Edge Slicing deployment in collaboration with mobile operator Cellcom and Telia. Nokia's edge-slicing solution allows operators to provide enterprise customers with secure, dependable, and high-performance VPN services over other commercial 4G/5G networks.

-

In September 2021, Kape Technologies, a cybersecurity company headquartered in the UK, completed the acquisition of Express VPN service from Express VPN International Ltd for a substantial amount of USD 936 million. This strategic move by Kape Technologies expanded its presence in the commercial digital privacy sector and doubled its customer base from 3 million to 6 million.

Virtual Private Network Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 48.50 billion

Revenue forecast in 2030

USD 151.92 billion

Growth Rate

CAGR of 17.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, connectivity, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Avast Software s.r.o.; BlackBerry Limited.; Cisco Systems, Inc.; Citrix Systems, Inc.; CyberGhost S.R.L.; Google LLC; IBM Corporation; Absolute Software Corporation.; Opera Holdings; WatchGuard Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Private Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual private network market based on component, type, connectivity, deployment, end-use, and region:

- Component Outlook (Revenue in USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

- Type Outlook (Revenue in USD Billion, 2018 - 2030)

-

Hosted

-

IP

-

MPLS

-

- Connectivity Outlook (Revenue in USD Billion, 2018 - 2030)

-

Site-to-site

-

Remote access

-

Extranet

-

- Deployment Outlook (Revenue in USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

- End-use Outlook (Revenue in USD Billion, 2018 - 2030)

-

Commercial

-

Individual

-

Service providers

-

-

Regional Outlook (Revenue in USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global virtual private network market size was estimated at USD 41.33 billion in 2022 and is expected to reach USD 48.50 billion in 2023.

b. The global virtual private network market is expected to grow at a compound annual growth rate of 17.7% from 2023 to 2030 to reach USD 151.92 billion by 2030.

b. North America dominated the VPN market with a share of 34.6% in 2022. This is attributable to the presence of a large number of enterprises and an increase in the number of internet users.

b. Some key players operating in the VPN market include Cisco Systems, Inc., Cohesive Networks, IBM Corporation, Juniper Networks, Citrix Systems, Inc, NetMotion Software.

b. Key factors driving the virtual private network market growth include the increasing trend of employees working from any location and increasing cyber threats across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."