- Home

- »

- Next Generation Technologies

- »

-

Virtual Prototype Market Size, Share & Trends Report, 2030GVR Report cover

![Virtual Prototype Market Size, Share & Trends Report]()

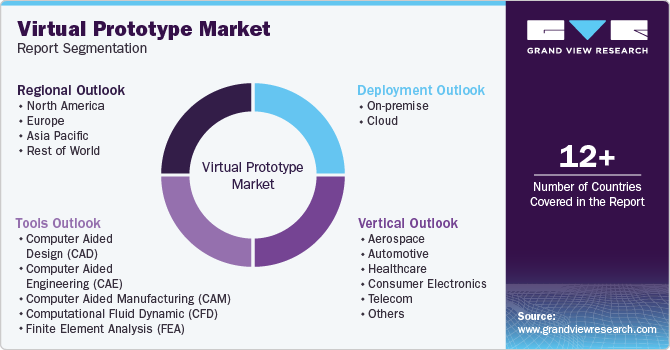

Virtual Prototype Market Size, Share & Trends Analysis Report By Tools, By Deployment, By Vertical (Aerospace, Automotive, Healthcare, Consumer Electronics, Telecom, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-482-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Virtual Prototype Market Size & Trends

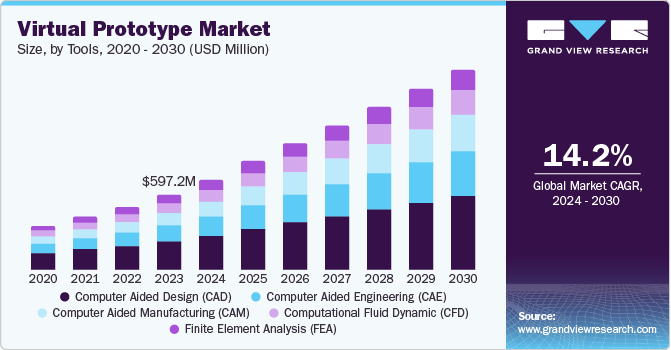

The global virtual prototype market size was valued at USD 597.2 million in 2023 and is projected to grow at a CAGR of 14.2% from 2024 to 2030. Factors such as increasing complexities of manufacturing processes, advancements in prototyping technology, increasing competition among manufacturers for the timely introduction of new products, and higher cost-efficiency offered by computer-aided prototypes are driving market growth. In addition, innovations in artificial intelligence (AI) and machine learning (ML) are expected to present new opportunities for manufacturers to develop sophisticated virtual modeling solutions, further propelling the demand from a new consumer base for virtual prototyping solutions.

Modern manufacturers are increasingly adopting virtual prototyping to aid in their cost-optimization efforts. This is owing to the sophistication of simulation software, which incorporates finite element analysis, computational fluid dynamics (CFD), and other methodologies, thus enabling the formation of highly accurate and predictive virtual prototypes. Moreover, immersive visualization technologies provide stakeholders comprehensive and intuitive insights into product performance and design intricacies. As a result, virtual prototyping significantly accelerates product development timelines by enabling iterative design refinement and early-stage validation.

Critical industries such as aerospace and healthcare depend upon high-precision and high-accuracy products, such as aircraft components and advanced diagnostics machines. Their high manufacturing costs, the requirement to follow stringent consumer safety regulations, and greater operational risks compel manufacturers to adopt the latest prototyping solutions. Organizations can reduce physical prototyping and rework costs by identifying and addressing design flaws in the virtual environment. These factors lead to a steady demand for advanced virtual modeling solutions from such industries.

Tools Insights

Computer aided design (CAD) segment led the market with a revenue share of 37.7% in 2023. CAD software is an important part of the product design process across major industries, providing essential tools for creating and modifying 3D models. Its extensive adoption has established it as a crucial component of the virtual prototyping workflow. Furthermore, CAD software offers more functionalities beyond design, such as simulation, analysis, and manufacturing process planning. It renders it a versatile and essential tool for product development. Additional characteristics such as technological maturity, interoperability, and seamless integration with other software tools have made it a highly sought-after tool for manufacturers.

The Computer Aided Manufacturing (CAM) segment is expected to register the fastest CAGR over the forecast period. CAM software facilitates the precise translation of virtual designs into physical products, enabling manufacturers to optimize production processes, reduce waste, and improve production efficiency. Moreover, the increasing adoption of additive manufacturing technologies requires sophisticated CAM solutions to manage complex part geometries and optimize build parameters. As manufacturing increasingly transforms digitally, CAM has emerged as a critical component of smart factories, enabling real-time data analysis and process automation. These factors have led to an increased adoption of CAM tools among production organizations.

Deployment Insights

Cloud deployment held the highest market revenue share in 2023. It is attributed to the scalability and flexibility of operations offered by cloud solutions, which enable organizations to adjust computational resources in real time to accommodate fluctuating project demands. This flexibility is particularly advantageous for handling complex simulations and large datasets. Additionally, by leveraging the cloud infrastructure, enterprises can eliminate the substantial capital expenditures associated with on-premises hardware and software acquisition, maintenance, and updates. These factors compel organizations with tight production budgets to adopt cloud-based solutions, leading to segment growth.

The on-premise segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This is due to increasing security and intellectual property concerns about new products in development. For instance, aerospace, defense, and automotive organizations prioritize stringent data security protocols. On-premise deployment offers greater control over data, intellectual property, and system configurations, mitigating risks generally associated with cloud-based solutions. Furthermore, several enterprises possess established IT infrastructures and legacy systems. On-premise deployment seamlessly integrates with existing environments, reducing the complexity and costs associated with system migration. As the vulnerability of cyberattacks increases, a larger industrial base is expected to shift to the on-premise deployment of prototyping solutions.

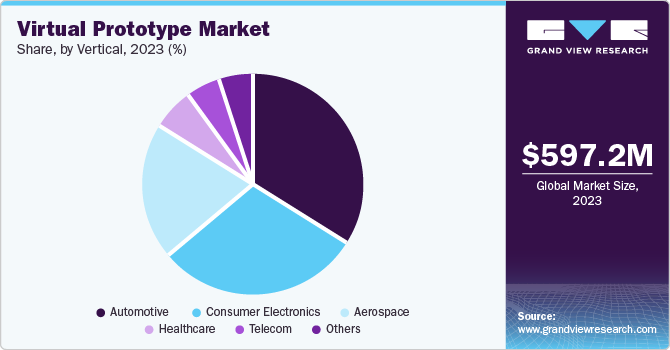

Vertical Isights

The automotive segment accounted for the highest revenue share in 2023. This is due to the high costs of new product development in this industry. The creation of physical automotive prototypes is a resource-intensive and expensive process. Virtual prototyping offers a cost-effective alternative by enabling iterative design modifications and reducing the need for multiple physical iterations. The integration of advanced technologies such as electrification, autonomous driving, and connectivity in this sector has increased the complexity of automotive design. Virtual prototyping is vital for evaluating these systems' performance and interaction, leading to high demand.

Meanwhile, the consumer electronics sector is expected to register the fastest CAGR during the forecast period. This industry is characterized by rapid product development cycles and fierce competition. Virtual prototyping offers a strategic advantage by accelerating time-to-market, enabling rapid iteration, and enhancing product differentiation. Moreover, the price-sensitive nature of the consumer electronics market makes cost reduction a paramount component for manufacturers. Virtual prototyping helps minimize physical prototyping expenses and enables early identification of design flaws, resulting in significant overall cost savings.

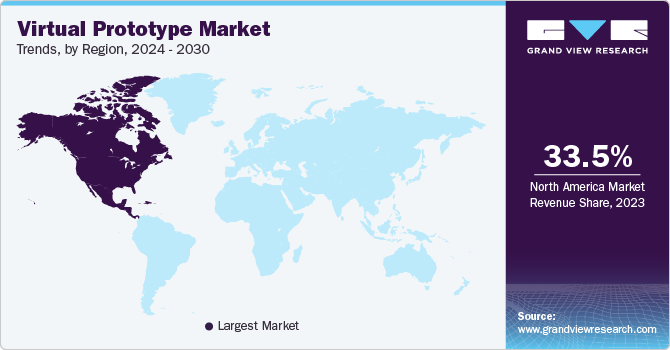

Regional Insights

North America led the virtual prototype market with a revenue share of 33.5% in 2023. This is owing to the presence of a well-developed automotive and aerospace industry in the region, which has adopted virtual prototyping technology for a long time. Significant investments in research and development activities have promoted the creation and refining of virtual prototyping tools and methodologies. Furthermore, the critical nature of products in these industries has driven the demand for rigorous testing and validation of components, which virtual prototyping effectively addresses, leading to regional dominance in this market.

U.S. Virtual Prototype Market Trends

The U.S. accounted for a substantial share of the regional market. The country has been at the forefront of adopting and implementing new-age technologies across major industries such as automotive and electronics. The presence of prominent multinational manufacturers such as General Motors, Ford, Tesla, and others has led to a high demand for virtual prototyping in the automotive sector. Additionally, significant investments to modernize the country's aerospace and defense equipment manufacturing sectors have fueled the demand for high-end modeling solutions.

Europe Virtual Prototype Market Trends

Europe virtual prototype market held a significant share of the global market in 2023. The region encompasses a wide and diverse manufacturing base across industrially developed economies such as Germany, the UK, and France. Consistent technological innovations and their early adoption by local manufacturers have created several avenues for deploying virtual prototyping solutions. Moreover, close collaborations between manufacturers and technology providers have accelerated the adoption and refinement of these technologies in the region, leading to its significant market share.

Germany is well-known globally for its engineering advancements and the historical presence of a strong automobile manufacturing industry. The economy's well-developed manufacturing ecosystem has facilitated the seamless integration of virtual prototyping into product development processes. Additionally, robust regulatory frameworks within these sectors have necessitated the adoption of advanced engineering and design practices, including virtual prototyping.

Asia Pacific Virtual Prototype Market Trends

Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. The presence of a large number of small and medium-sized enterprises (SMEs), which are increasingly adopting digitization and industry 4.0 technologies, has driven the demand for virtual prototyping solutions to enhance their product design and development capabilities. Moreover, the region's growing pool of engineers and designers, coupled with the increasing adoption of cloud-based technologies, has enabled seamless collaborations and remote work possibilities, further fueling the demand for virtual prototyping solutions.

India has witnessed substantial growth across automobile, consumer electronics, and healthcare industries, fueling the demand for virtual prototyping solutions to accelerate product development, reduce costs, and improve production efficiency. Additionally, government initiatives and investments in emerging technologies such as AI, IoT, and additive manufacturing have created a supportive ecosystem for market growth. For instance, the Production Linked Incentive (PLI) Scheme incentivizes various manufacturing sectors to upscale their production capacities. This conducive environment is expected to fuel the demand for digital technology solutions like virtual prototyping.

Key Virtual Prototype Company Insights

Some key companies involved in the virtual prototype market include PTC, ESI Group, and Synopsys, Inc., among others.

-

PTC is a U.S.-based computer software technology and services company that offers technological expertise for product lifecycle management (PLM), computer-aided design (CAD), application lifecycle management (ALM), service lifecycle management (SLM), and augmented reality (AR). PTC offers a wide range of virtual prototyping solutions under its brands, such as Creo, which offers 3D CAD, CAM, and CAE software solutions; Creo+ for integrating Creo with the cloud framework; and Onshape, among others. PTC also provides Industrial Internet of Things (IIoT) solutions, such as ThingWorx.

-

ESI Group is a France-based virtual prototype software company that specializes in providing tailored solutions for industries such as automotive, transportation, aerospace, defense, and heavy machinery. Using advanced physics modeling and virtual prototyping, the company’s software empowers engineers to digitally test and refine mechanical designs, manufacturing processes, and user interactions. Some of its most sought-after simulation software include ProCAST, PAM-COMPOSITES, PAM-STAMP, SimulationX, and VA ONE, among others.

Key Virtual Prototype Companies:

The following are the leading companies in the virtual prototype market. These companies collectively hold the largest market share and dictate industry trends.

- Synopsys, Inc.

- TWI Ltd.

- Autodesk Inc.

- Carbon Design System

- ESI Group

- Arm Limited

- Cadence Design Systems, Inc.

- Siemens

- PTC

- ENCORE

Recent Developments

-

In April 2024, ESI Group announced its strategic partnership with FAW-Volkswagen TE to advance intelligent simulation technology in the automotive sector. As part of this collaboration, an intelligent simulation and material testing laboratory has been established in China to drive innovations in this industry and ensure a safer, more productive, and cleaner future.

-

In March 2024, Arm Limited announced the release of its latest automotive software technologies and prototyping solutions. The new Armv9-based technologies, which include the Arm Neoverse V3AE, the Arm Cortex-A720AE, and the Arm Mali-C720AE, among others, will enable the automotive industry to leverage artificial intelligence for vehicle development and speed up the development cycle by up to two years.

Virtual Prototype Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 716.1 million

Revenue Forecast in 2030

USD 1,589.5 billion

Growth rate

CAGR of 14.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Tools, deployment, vertical, region

Regional scope

North America, Europe, Asia Pacific, Rest of World

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, South Korea, India, Brazil, MEA

Key companies profiled

Synopsys, Inc.; TWI Ltd.; Autodesk Inc.; Carbon Design System; ESI Group; Arm Limited; Cadence Design Systems, Inc.; Siemens; PTC; ENCORE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Prototype Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual prototype market report based on tools, deployment, vertical, and region:

-

Tools Outlook (Revenue, USD Million, 2018 - 2030)

-

Computer aided Design (CAD)

-

Computer aided Engineering (CAE)

-

Computer aided Manufacturing (CAM)

-

Computational Fluid Dynamic (CFD)

-

Finite Element Analysis (FEA)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Healthcare

-

Consumer Electronics

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

-

Rest of World

-

Brazil

-

MEA

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."