- Home

- »

- Next Generation Technologies

- »

-

Virtual Shopping Assistant Market Size, Industry Report, 2033GVR Report cover

![Virtual Shopping Assistant Market Size, Share, & Trends Report]()

Virtual Shopping Assistant Market (2025 - 2033) Size, Share, & Trends Analysis Report By Revenue Type, By Age, By Income Level, By Gender, By Shopping Assistant Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-676-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Shopping Assistant Market Summary

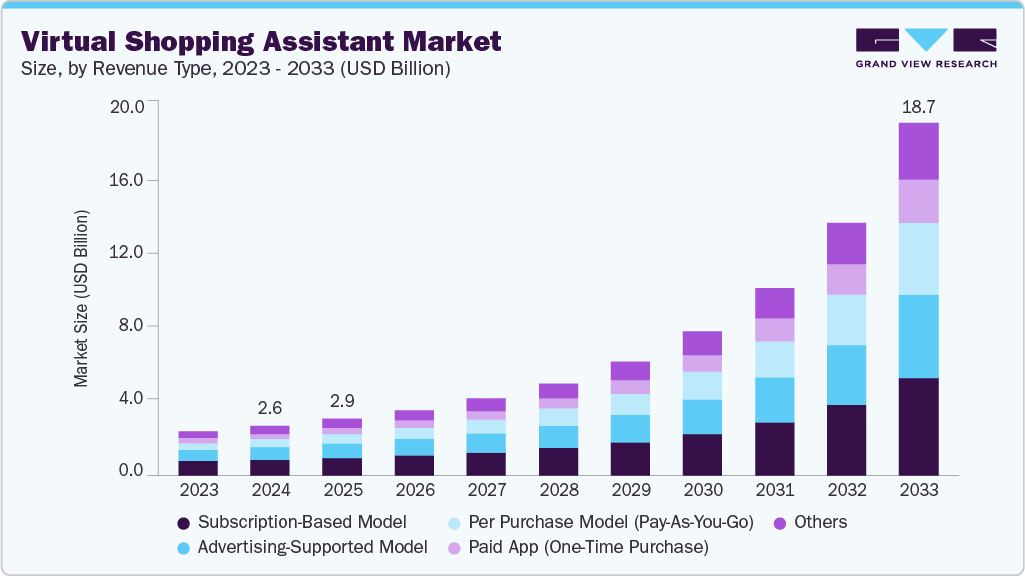

The global virtual shopping assistant market size was valued at USD 2.63 billion in 2024 and is projected to reach USD 18.77 billion by 2033, growing at a CAGR of 25.8% from 2025 to 2033. The virtual shopping assistant market is being propelled by the global shift toward mobile-first consumer behavior.

Key Market Trends & Insights

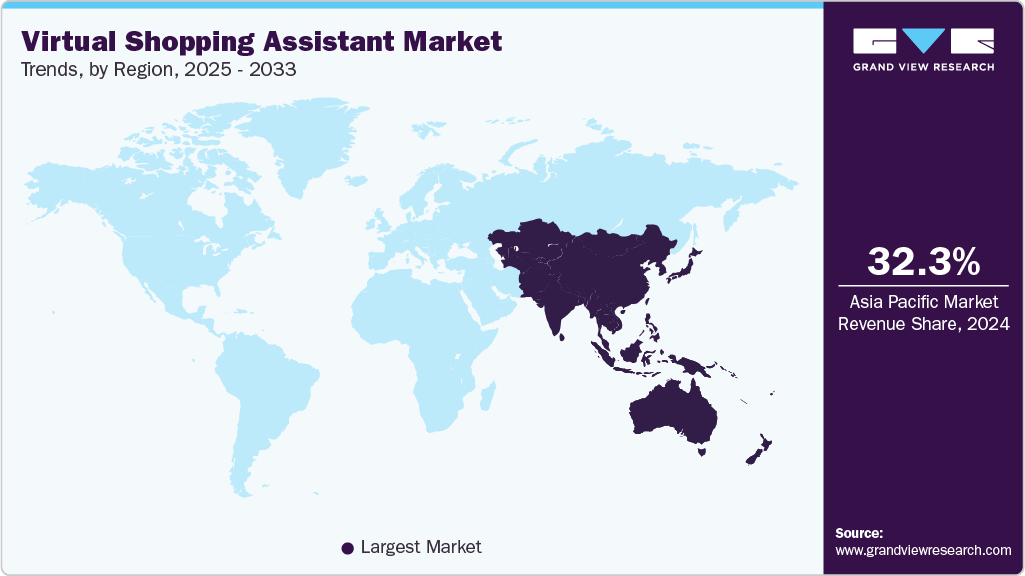

- Asia Pacific held a 32.3% revenue share of the global virtual shopping assistant market in 2024.

- In the U.S., popularity of voice commerce and AI-driven interactions are driving the market.

- By revenue type, subscription-based model segment held the largest revenue share of 31.1% in 2024.

- By age, the young adults (18-35 years) segment held the largest revenue share in 2024.

- By income level, middle-income segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.63 Billion

- 2033 Projected Market Size: USD 18.77 Billion

- CAGR (2025-2033): 25.8%

- Asia Pacific: Largest market in 2024

The growing demand for personalized shopping experiences is driving the virtual shopping assistant market growth. Consumers expect retailers to understand their preferences, anticipate their needs, and deliver tailored product recommendations. Virtual shopping assistants use artificial intelligence, natural language processing, and machine learning to analyze user behavior, purchase history, and contextual data to offer curated suggestions and relevant offers. This high level of personalization not only improves the user experience but also increases the likelihood of conversion, making these tools valuable assets for retailers aiming to boost engagement and revenue.The rise of omnichannel retail strategies is also fueling demand for virtual shopping assistants. As brands seek to provide a seamless experience across online and offline touchpoints, virtual shopping assistants serve as the bridge that connects the two. For example, customers can use their phones to scan products in-store for additional information, check inventory availability, or even complete purchases without waiting in line. This integration of digital capabilities into the physical shopping journey helps retailers streamline operations, reduce friction, and increase convenience, thereby improving customer retention and loyalty.

Advancements in voice recognition and conversational AI are further expanding the scope of virtual shopping assistants. Voice-enabled shopping assistants allow users to search for products, compare prices, and place orders through simple voice commands. This hands-free interaction is particularly appealing in scenarios such as driving, multitasking, or assisting visually impaired users. As voice technology continues to improve in accuracy and natural language understanding, it will drive broader adoption of virtual shopping assistants across different demographic groups and usage contexts.

Moreover, the growing adoption of mobile payment systems and digital wallets drives the virtual shopping assistant market growth. As payment technologies such as Apple Pay, Google Pay, and region-specific apps like Paytm or Alipay become widely accepted, virtual shopping assistants are increasingly integrated with these platforms to offer a seamless end-to-end shopping experience. This integration reduces the friction of switching between apps or entering payment information manually, which boosts user satisfaction and increases transaction completion rates. The convenience of having product discovery, decision support, and payment all within one mobile interface reinforces the value proposition of virtual shopping assistants.

Furthermore, the increasing role of data analytics and predictive intelligence in retail is also accelerating the adoption of virtual shopping assistants. These assistants are being designed not only to respond to customer queries but also to proactively suggest products based on browsing history, location, time of day, weather conditions, or seasonal demand. Retailers are leveraging these data-driven insights to anticipate customer needs and deliver highly contextual, timely interactions that can influence purchase decisions. As the volume of consumer data continues to grow, virtual shopping assistants are becoming more intelligent and intuitive, transforming from reactive tools into proactive, personalized shopping companions.

Revenue Type Insights

The subscription-based model segment dominated the virtual shopping assistant marketwith a market share of 31.1% in 2024. The subscription-based model segment in the virtual shopping assistants market is growing due to the increasing reliance of consumers on mobile platforms for personalized shopping experiences. Subscription models offer recurring revenue types that enhance user engagement and brand loyalty, particularly through personalized recommendations, exclusive deals, and curated shopping experiences. This model thrives on the convenience of automation, providing users with tailored content and shopping suggestions without the need for manual searches or filtering.

The per purchase model (pay-as-you-go) segment is projected to be the fastest-growing segment from 2025 to 2033. The growing popularity of microtransactions in mobile apps, particularly in gaming and e-commerce, drives the pay-as-you-go segment growth in the virtual shopping assistants market. Consumers are increasingly accustomed to paying small amounts for individual revenue types or features in apps, and this trend is being adopted in mobile shopping platforms as well. The convenience of making microtransactions for specific revenue types, such as personalized shopping tips or temporary access to premium search filters, fits seamlessly with modern mobile shopping behaviors.

Age Insights

The young adults (18-35 years) segment dominated the virtual shopping assistant marketin 2024. The rise of subscription revenue types and exclusive deals tailored to young adults is fueling growth in this segment. Many virtual shopping assistants offer curated deals, flash sales, and exclusive discounts that appeal to budget-conscious young adults. By providing access to limited-time offers and personalized deals, these tools create a sense of urgency and excitement around shopping, encouraging frequent use. Furthermore, many young adults are drawn to subscription-based models that simplify their shopping experience, making it easy to replenish essentials without the hassle of in-store visits. As the segment continues to seek convenience, community engagement, and ethical consumption, virtual shopping assistants effectively address sustained growth in the market.

The middle-aged adults (35-55 years) segment is projected to be the fastest-growing segment from 2025 to 2033. The demand for personalized shopping experiences is becoming increasingly significant. Middle-aged consumers appreciate tools that offer tailored recommendations based on their preferences and past purchases. Virtual shopping assistants equipped with AI and machine learning algorithms can analyze user behavior to suggest products that align with individual tastes and needs, enhancing the shopping experience. This level of personalization improves user satisfaction but also encourages repeat usage, as consumers are more likely to return to tools that understand their preferences.

Income Level Insights

The middle-income segment dominated the virtual shopping assistant market in 2024. Middle-income consumers are responsive to seasonal promotions, sales events, and holiday shopping campaigns, making these periods prime opportunities for virtual shopping assistants to engage this demographic effectively. Virtual shopping assistants that highlight upcoming sales and provide tailored notifications about exclusive deals enable middle-income users to stay informed and make timely purchasing decisions. Features, such as personalized alerts for favorite brands, curated lists of on-sale items, and easy navigation to access discounts, help these consumers maximize their savings while enjoying a seamless shopping experience.

The high-income segment is projected to be the fastest-growing segment from 2025 to 2033. The high-income segment is often more brand-conscious and values premium experiences over transactional savings. Virtual shopping assistants cater to this preference by offering brand-centric discovery experiences where the focus is less on discounts and more on finding the right product from the right brand, at the right moment. Many assistants now integrate with luxury retailers and boutique platforms to offer product updates, waitlist notifications, and early access to product drops. This exclusivity and brand alignment further drive the demand for mobile assistants for wealthier shoppers, who are looking for seamless yet elevated ways to interact with their favorite labels.

Gender Insights

The women segment dominated the virtual shopping assistant market in 2024. The adoption of augmented reality (AR) drives the segment growth. AR technology enhances the shopping experience by providing immersive, interactive features that allow users to visualize products in their real-world environments. This capability is particularly beneficial in categories like fashion, beauty, and home décor, where seeing how an item looks in context can significantly influence buying decisions. For instance, in September 2024, Google Shopping expanded its generative AI-enabled virtual try-on feature in the U.S. to include dresses. In collaboration with the ready-to-wear brand Simkhai, select dresses will be available for virtual fitting and pre-order. These AI enhancements aim to make online shopping more innovative and user-friendly.

The men segment is projected to grow significantly from 2025 to 2033. The growing interest in lifestyle and self-care among men is significantly impacting the virtual shopping assistants market. As societal norms shift, more men are prioritizing grooming, fashion, fitness, and overall wellness. Virtual shopping assistants that cater to this evolving mindset by offering curated selections of grooming products, activewear, and health supplements are seeing increased adoption. By highlighting products that align with these lifestyle trends, these assistants provide men with the resources they need to invest in their care and well-being, ultimately driving growth in the segment.

Shopping Assistant Type Insights

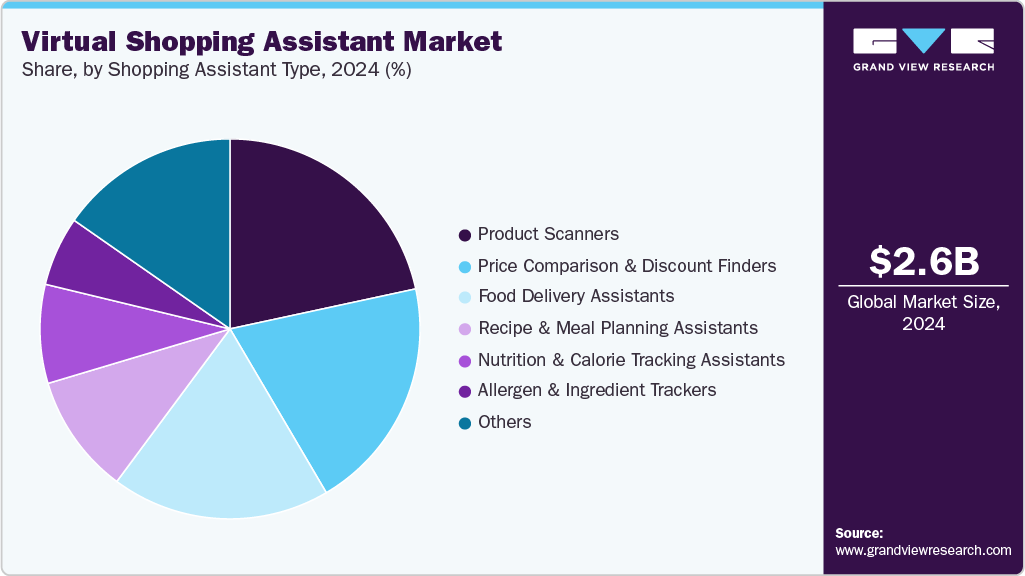

The price comparison and discount finders segment holds a significant share in 2024, the virtual shopping assistant market in 2024. The proliferation of limited-time offers, flash sales, and personalized discount campaigns is also driving demand for intelligent tools that can track and alert users to relevant savings opportunities. Virtual shopping assistants are becoming more sophisticated in this regard, using AI and machine learning to monitor price drops, apply coupon codes, and notify users when a desired item becomes more affordable. For many consumers, particularly millennials and Gen Z shoppers, the ability to secure exclusive or time-sensitive deals through automated notifications has become a significant part of their digital shopping behavior. This immediacy and personalization give shopping assistants a competitive edge over passive price comparison websites.

The allergen and ingredient trackers segment is projected to be the fastest-growing segment from 2025 to 2033. With more countries implementing stricter labeling requirements, consumers are becoming more vigilant about ingredient transparency and safety. These tools enable users to stay informed, especially in regions where labeling regulations might be inconsistent or where certain allergens are not clearly highlighted. Additionally, as people increasingly explore new diets or wellness trends, they want reliable tools to help them make informed decisions. Allergen and ingredient trackers empower users to understand their food in greater detail, adding value to the overall shopping experience and catering to a wide range of consumers, from parents managing family allergies to fitness enthusiasts improving their diets. As a result, this segment is set to expand as it addresses fundamental needs for safety, health, and convenience in food choices.

Regional Insights

Asia Pacific dominated the virtual shopping assistant market with a market share of 32.3% in 2024. The growth of the market in the region can be attributed to the rise of e-commerce and m-commerce across the region. Asia Pacific has some of the largest e-commerce markets, with players such as Alibaba, Amazon, and local competitors heavily investing in AI-driven shopping assistants to enhance customer experience. These tools help users discover products, find deals, and personalize their shopping experience, which boosts customer satisfaction and increases engagement. As e-commerce continues to grow, virtual shopping assistants are becoming integral to creating seamless, interactive, and personalized shopping experiences.

China Virtual Shopping Assistant Market Trends

The China virtual shopping assistant industry held a substantial market share in 2024. The high rate of smartphone penetration in China allows a larger segment of the population to access e-commerce platforms and mobile shopping solutions. With mobile internet connectivity improving even in rural areas, more consumers can easily utilize virtual shopping assistants for personalized recommendations, price comparisons, and real-time promotions. The tech-savvy Chinese population, especially the younger generation, is also quick to adopt these tools, integrating them seamlessly into their shopping routines for convenience and cost-effectiveness. According to GSMA Intelligence in 2024, the smartphone adoption rate was 93%.

Europe Virtual Shopping Assistant Industry Trends

The virtual shopping assistant industry in Europe is anticipated to register a considerable growth from 2025 to 2033. Enhanced internet infrastructure and the rollout of faster mobile internet speeds, particularly 5G technology, are pivotal in transforming the mobile shopping landscape. With 5G networks offering significantly higher bandwidth and lower latency compared to previous generations of mobile internet, users can enjoy seamless browsing experiences, instant page loads, and high-quality multimedia content without interruptions. This rapid connectivity enables consumers to engage with virtual shopping assistants more effectively, as they can quickly access product information, compare prices, and view high-resolution images or videos of products. According to The Mobile Economy: Europe 2024 by GSMA, 5G made up 30% of all mobile connections in Europe, representing more than 200 million connections.

The UK virtual shopping assistant market is expected to grow rapidly during the forecast period. The growing adoption of social commerce for shopping in the UK is driving the market growth. Virtual shopping assistants connect with social media platforms such as Instagram, TikTok, and Facebook. These assistants often feature options to explore trending products, share items with friends, and get instant feedback within social apps. This integration between social media and mobile shopping aligns well with younger demographics who prefer discovering and buying products within social networks. As social commerce continues to grow, virtual shopping assistants that facilitate seamless purchasing directly from social feeds are becoming more in demand.

North America Virtual Shopping Assistant Industry Trends

The North America virtual shopping assistant industry is expected to be the fastest growing segment, with a CAGR of 25.1% over the forecast period. The popularity of smart home devices, such as Amazon Alexa and Google Assistant, has led to an increase in voice-activated shopping in the region. Consumers are able to add items to their shopping lists, check prices, and reorder products through voice commands, making shopping assistants even more convenient. This voice functionality supports the growing adoption of smart home technology in North America, enhancing the appeal of virtual shopping assistants integrated with voice-activated systems.

The U.S. virtual shopping assistant industry in 2024, dominated the North America market. The popularity of voice commerce and AI-driven interactions in the U.S. market is supporting the growth of virtual shopping assistants. Tools like Amazon Alexa, Google Assistant, and Siri have made voice commands a mainstream way to interact with technology. Retailers are capitalizing on this trend by enabling shopping functions via voice interfaces, allowing users to search for items, check order status, or even complete purchases with simple spoken commands. This hands-free convenience is especially critical in multitasking scenarios and supports accessibility for a broader range of users, thereby expanding the addressable market for voice-enabled virtual shopping assistants.

Key Virtual Shopping Assistant Company Insights

Some of the key companies operating in the market include Amazon Rufus, and AliRadar among others are some of the leading players in the virtual shopping assistant market.

-

Amazon Rufus is a generative AI-powered shopping assistant embedded directly into its mobile shopping app and desktop site. Designed as a conversational interface to help customers research, compare, and discover products, Rufus is trained on Amazon’s entire product catalog, customer reviews, Q&A entries, and select public web data. Its internal language model leverages retrieval-augmented generation (RAG), reinforcement learning from user feedback, and optimizations for low-latency responses to deliver contextual and assistive answers throughout the shopper’s experience.

-

AliRadar is a consumer-focused tech company that offers a virtual shopping assistant and browser extension designed to enhance online purchasing decisions. The app offers features such as viewing a product’s price history, tracking price changes through notifications, comparing products across numerous stores, and evaluating seller trustworthiness. These tools aim to help users quickly identify real discounts and avoid unscrupulous sellers.

MyFitnessPal and Shopsavy are some of the emerging market participants in the target market.

-

MyFitnessPal is a premier health and fitness platform crowding the app stores. Its core offering centers on nutrition and activity tracking. It has an expansive database of more than 14 million foods that users can log manually or via barcode scanning and Meal Scan computer‑vision technology. With over 200 million users across 120+ countries and integration with dozens of wearable devices like Fitbit, Garmin, Apple Watch, and Samsung Health, MyFitnessPal has built its reputation as a trusted and widely adopted tool for dietary awareness and physical accountability.

-

ShopSavvy is a virtual shopping assistant that uses barcode scanning, product search, and browser integration to help users compare products across online and local retailers. When users scan an item's barcode or share a link from any app, ShopSavvy instantly searches thousands of retailers in real time online and brick-and-mortar stores for pricing, availability, delivery estimates, and seller ratings. This makes it possible to surface the best deals and avoid overpriced, low-rated sellers without opening multiple tabs or apps.

Key Virtual Shopping Assistant Companies:

The following are the leading companies in the virtual shopping assistant market. These companies collectively hold the largest market share and dictate industry trends.

- AliRadar

- Amazon Rufus

- Copilotly

- Deepgram

- Digital Reality

- HyperWrite

- i95Dev.com

- Manifest

- ModeSens

- MyFitnessPal

- Noom

- Rep AI Technologies

- ShopSavvy

- Xcelore

- Yuka

Recent Developments

-

In February 2025, MyFitnessPal’s acquisition of Intent, a personalized meal planning app, represents a major step forward in its mission to help over 270 million members make healthier food choices. By incorporating Intent’s advanced technology, MyFitnessPal will enhance its platform with personalized meal planning tools, enabling users to pursue and achieve their health and wellness goals more effectively.

-

In December 2024, Monolith Technologies, Inc. launched the ShopSavvy Shopping Assistant in 2024, a cutting-edge tool designed to enhance the shopping experience. This innovative assistant helps users effortlessly find the best deals in real time, assess their value, and receive personalized product recommendations based on individual preferences. By equipping consumers with comprehensive, tailored information, ShopSavvy empowers them to make smarter, more informed purchasing decisions.

-

In November 2024, MyFitnessPal’s acquisition of Intent, a personalized meal planning app, represents a major step forward in its mission to help over 270 million members make healthier food choices. By incorporating Intent’s advanced technology, MyFitnessPal will enhance its platform with personalized meal planning tools, enabling users to pursue and achieve their health and wellness goals more effectively.

Virtual Shopping Assistant Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 2.99 billion

Revenue Forecast in 2033

USD 18.77 billion

Growth Rate

CAGR of 25.8% from 2025 to 2033

Actual Data

2021 - 2024

Forecast Period

2025 - 2033

Quantitative Units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Revenue Type, Age, Income Level, Gender, Shopping Assistant Type, and Region

Regional Scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

AliRadar; Amazon Rufus; Copilotly; Deepgram; Digital Reality; HyperWrite; i95Dev.com; Manifest; ModeSens; MyFitnessPal; Noom; Rep AI Technologies; ShopSavvy; Xcelore; Yuka

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Shopping Assistant Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global virtual shopping assistant market based on revenue type, age, income level, gender, shopping Assistant Type, and region.

-

Revenue Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Subscription-Based Model

-

Paid App (One-Time Purchase)

-

Per Purchase Model (Pay-As-You-Go)

-

Advertising-Supported Model

-

Others

-

-

Age Outlook (Revenue, USD Billion, 2021 - 2033)

-

Less than 18 Years

-

Young Adults (18-35 Years)

-

Middle-Aged Adults (35-55 Years)

-

Older Adults (55+ Years)

-

-

Income Level Outlook (Revenue, USD Billion, 2021 - 2033)

-

High-Income

-

Middle-Income

-

Low-Income

-

-

Gender Outlook (Revenue, USD Billion, 2021 - 2033)

-

Women

-

Men

-

-

Shopping Assistant Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Product Scanners

-

Food Delivery Assistants

-

Recipe and Meal Planning Assistants

-

Nutrition and Calorie Tracking Assistants

-

Allergen and Ingredient Trackers

-

Price Comparison and Discount Finders

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual shopping assistant market size was estimated at USD 2.63 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The global virtual shopping assistant market is expected to grow at a compound annual growth rate of 25.8% from 2025 to 2033 to reach USD 18.77 billion by 2033.

b. The subscription-based model segment dominated the virtual shopping assistant market with a market share of 31.1% in 2024. The subscription-based model segment in the virtual shopping assistants market is growing due to the increasing reliance of consumers on mobile platforms for personalized shopping experiences.

b. Some key players operating in the market include ShopSavvy, AliRadar, Amazon Rufus, ModeSens, MyFitnessPal, Noom, Digital Reality, Xcelore, Yuka, i95Dev.com, Rep AI Technologies, Manifest, Deepgram, Copilotly, HyperWrite.

b. Factors such as global shift toward mobile-first consumer behavior and the rise of omnichannel retailing are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.