- Home

- »

- Next Generation Technologies

- »

-

Virtualized Radio Access Network Market Size Report, 2033GVR Report cover

![Virtualized Radio Access Network Market Size, Share & Trends Report]()

Virtualized Radio Access Network Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment Type, By Network Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-721-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtualized Radio Access Network (vRAN) Market Summary

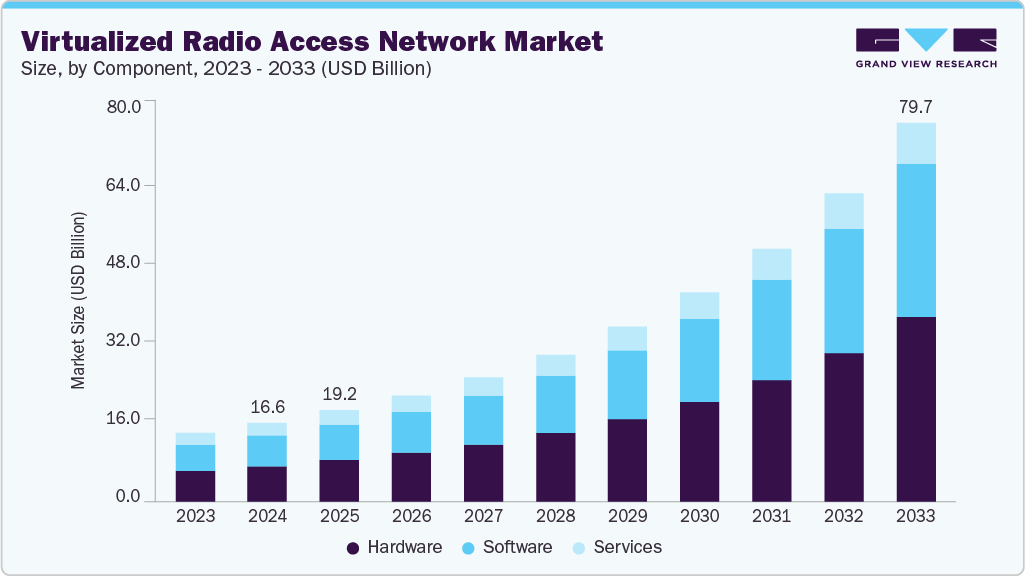

The global virtualized radio access network market size was estimated at USD 16.61 billion in 2024 and is projected to reach USD 79.71 billion by 2033, growing at a CAGR of 19.5% from 2025 to 2033. The virtualized radio access network (vRAN) market is being driven by the growing demand for flexible, scalable, and cost-efficient mobile network infrastructure.

Key Market Trends & Insights

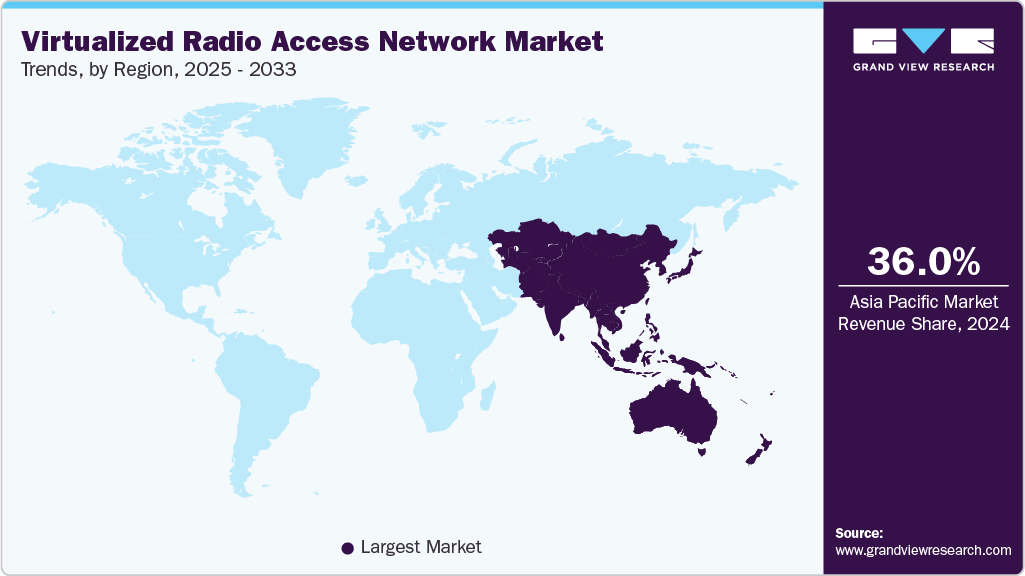

- Asia Pacific dominated the Virtualized Radio Access Network (vRAN) industry and accounted for a share of 36.0% in 2024

- The hardware segment dominated the market in 2024 and accounted for the largest share of 45.2%

- The public segment held the largest market in 2024

- The 5G segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period

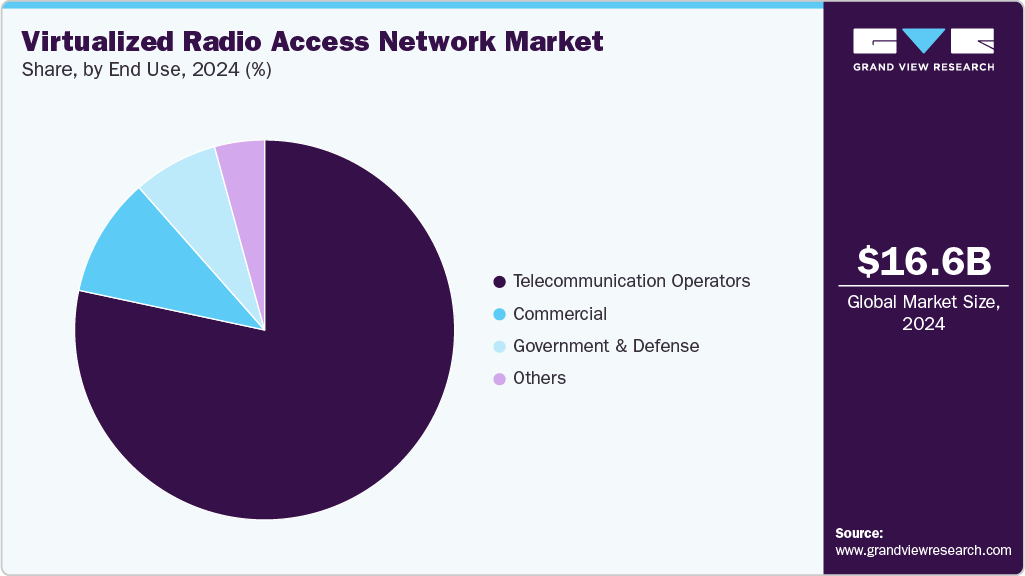

- The telecommunication operators segment dominated the market in 2024

Market Size & Forecast

- 2024 Market Size: USD 16.61 Billion

- 2033 Projected Market Size: USD 79.71 Billion

- CAGR (2025-2033): 19.5%

- Asia Pacific: Largest market in 2024

Increased data traffic, the global rollout of 5G networks, and the need for network densification have led operators to adopt virtualized architectures. The global deployment of 5G networks has become a key driver for the growth of the vRAN market. Telecom providers are upgrading their current infrastructure to enable higher bandwidth and lower latency, which increases the adoption of vRAN due to its flexible and scalable deployment options. Network densification through small cells and distributed units is also more efficiently supported by vRAN, as it separates hardware from software and allows for centralized control. This trend is especially noticeable in urban areas, where high data usage and spectrum efficiency are critical.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being integrated into vRAN systems to enable predictive analytics, real-time optimization, and automated fault detection. These technologies assist operators in managing growing data volumes, enhancing quality of service, and reducing human intervention in network operations. AI-powered RAN Intelligent Controllers (RICs) are becoming key components of the vRAN ecosystem, allowing for smarter, self-optimizing networks. This trend is especially advantageous for telecom providers aiming to improve operational efficiency and minimize downtime in high-density traffic environments.

A surge in strategic investments and public-private partnerships is speeding up the development and commercialization of vRAN solutions. Governments are increasingly supporting telecom modernization through funding programs, spectrum allocation, and pilot initiatives focused on Open RAN and vRAN technologies. Major telecom operators are forming alliances with technology vendors, chipset manufacturers, and cloud providers to create scalable and future-proof vRAN infrastructure. These collaborative efforts are growing the market and enabling large-scale deployments in both urban and rural areas.

The shift to cloud-native infrastructure is another key driver of the vRAN market. Operators are deploying vRAN functions on commercial off-the-shelf (COTS) hardware using NFV and SDN technologies, which enable centralized management, dynamic resource allocation, and lower operational costs. Combining public and private cloud with edge computing capabilities improves vRAN performance for latency-sensitive applications. Hyperscalers and telecom vendors are working together to optimize RAN workloads in the cloud, making cloud-native deployment a strategic focus for next-generation mobile networks.

Component Insights

The hardware segment led the market in 2024, capturing the largest share at 45.2%. The segment's growth is fueled by the increased adoption of Commercial Off-The-Shelf (COTS) servers and white-box hardware. Operators are shifting from proprietary, vendor-locked RAN equipment to disaggregated, open hardware platforms that enable scalability and cost savings. Demand for components such as Remote Radio Units (RRUs), network interface cards (NICs), and edge servers is rising as network densification and edge deployment strategies progress.

The software segment is expected to see a significant CAGR during the forecast period. The segment is rapidly growing as telecom operators virtualize key RAN functions using Centralized Units (CU), Distributed Units (DU), and RAN Intelligent Controllers (RIC). Software-defined architecture allows for dynamic resource allocation, network slicing, and real-time traffic management, all essential for 5G and latency-sensitive applications. The move to cloud-native and containerized software solutions further boosts operational agility, enabling quicker service deployment and lowering the total cost of ownership, which in turn drives the segment’s growth.

Deployment Type Insights

The public segment held the largest market share in 2024. Public vRAN deployments are gaining momentum as telecom operators increasingly adopt cloud-based infrastructure hosted by hyperscalers to manage network functions at scale. The shift toward the public cloud is driven by the need to lower infrastructure costs, speed up deployment, and enable centralized orchestration across vast regions. Public deployment models also support elastic scalability and global reach, making them ideal for operators looking to quickly expand 5G coverage while reducing capital investment.

The private segment is projected to grow at the fastest CAGR of 20.0% during the forecast period. Private vRAN deployments are seeing increased adoption among enterprises, government agencies, and industrial players seeking secure, low-latency, and customizable network environments. Use cases in manufacturing, logistics, defense, and smart cities are fueling demand for private 5G networks powered by vRAN, which allows organizations to deploy RAN functions on-site or at the edge. The ability to tightly control network resources, ensure data sovereignty, and customize performance to meet specific operational needs makes private deployment an attractive option.

Network Type Insights

The 5G segment led the market in 2024 and is projected to grow at the fastest CAGR during the forecast period. vRAN provides the flexibility, scalability, and automation needed to deploy 5G effectively, especially in dense urban areas and edge locations. With support for network slicing, AI-driven orchestration, and cloud-native architectures, vRAN is becoming a core element in global 5G strategies. Spectrum allocations are expanding, and private 5G networks are gaining popularity among enterprises, fueling a rapid increase in vRAN adoption in 5G deployments.

The 4G/LTE segment is expected to experience significant growth over the forecast period. The 4G LTE network segment continues to play a crucial role in the vRAN market, especially in developing regions and markets where 5G rollouts are still in early stages. Many telecom operators are using vRAN to modernize and optimize their existing LTE infrastructure before moving to full-scale 5G deployment. Virtualizing LTE networks enables operational cost savings, better energy efficiency, and improved capacity management. In rural and suburban areas, where 4G remains dominant, vRAN provides a cost-effective way to expand coverage and prepare the network for future upgrades.

End Use Insights

The telecommunication operators segment led the market in 2024. Its growth is fueled by the need to upgrade network infrastructure, cut operating costs, and speed up 5G deployment. Operators are using vRAN to separate hardware from software, simplify operations through centralized control, and enable flexible scaling across different regions. The ability to run virtualized functions on commercial off-the-shelf hardware has helped lower capital expenses and boost deployment flexibility. Additionally, the rising focus on Open RAN and multi-vendor ecosystems is pushing operators to adopt vRAN as a long-term plan to improve innovation, performance, and network agility.

The commercial segment is projected to grow at the fastest CAGR during the forecast period. Commercial enterprises are increasingly adopting vRAN to support private 5G networks across manufacturing facilities, logistics hubs, campuses, and smart infrastructure projects. Businesses are turning to vRAN for secure, low-latency, and customizable wireless connectivity that addresses the specific needs of industrial automation, real-time monitoring, and high-density device environments. The ability to deploy and manage dedicated networks on-site provides greater control over performance and data security. As enterprise digitization accelerates and demand for edge computing rises, vRAN becomes a vital enabler of tailored connectivity solutions for commercial applications.

Regional Insights

Asia Pacific led the Virtualized Radio Access Network (vRAN) industry, holding a 36.0% market share in 2024. The region’s market growth is due to early 5G adoption, supportive regulatory policies, and strong investments from both government and private sectors. Countries like Japan, South Korea, India, and China are at the forefront of vRAN trials and deployments, propelled by high mobile data usage and a focus on modernizing networks.

India Virtualized Radio Access Network (vRAN) Market Trends

India’s virtualized radio access network (vRAN) market is expected to experience the fastest growth during the forecast period. The country’s market expansion is driven by ongoing 5G deployment efforts and strong government support for telecom innovation. Major telecom operators are collaborating with global technology providers to test and implement vRAN for flexible, cost-effective network expansion, especially in rural and semi-urban areas. The country’s digital transformation goals, rising mobile internet use, and the need to serve diverse regions make vRAN an appealing solution.

The China virtualized radio access network (vRAN) market held a substantial market share in 2024, supported by aggressive 5G deployment goals and leadership in telecom manufacturing. The country’s state-supported operators and prominent vendors are investing in proprietary and open vRAN frameworks to enhance network efficiency and scalability.

Europe Virtualized Radio Access Network (vRAN) Market Trends

Europe virtualized radio access network (vRAN) market is expected to register a moderate CAGR from 2025 to 2033. The region’s market growth is supported by policy alignment, 5G innovation funding, and active participation in open networking standards. Regional operators are pursuing virtualization strategies to enhance flexibility, reduce energy consumption, and meet regulatory demands for security and interoperability. Multi-vendor deployments and trials are gaining momentum across major economies, positioning Europe as a strategic market for long-term vRAN growth.

The UK virtualized radio access network (vRAN) market is expected to grow at a significant CAGR from 2025 to 2033. The country’s market growth is driven by government initiatives to diversify telecom supply chains and promote Open RAN adoption. Telecom providers are piloting vRAN to support rural connectivity, smart city projects, and enterprise 5G applications.

The Germany virtualized radio access network (vRAN) market held a substantial market share in 2024. Germany is playing a pivotal role in Europe’s vRAN market, with strong support from government-led digital infrastructure programs and industrial demand for private 5G networks. Operators are adopting vRAN to enable flexible, software-driven networks that can meet the needs of highly automated industries. The country’s focus on digital transformation, coupled with investments in Open RAN and cloud-based telecom systems, is creating a favorable environment for vRAN deployment.

North America Virtualized Radio Access Network (vRAN) Market Trends

The North America virtualized radio access network (vRAN) market is expected to grow at a notable CAGR during the forecast period. The region’s market growth is supported by strong participation from telecom operators, hyperscale cloud providers, and enterprise customers. Early commercial deployments of 5G and active engagement in Open RAN initiatives have positioned the region at the forefront of vRAN innovation.

The U.S. virtualized radio access network (vRAN) market held a dominant position in the region in 2024.The U.S. market is characterized by large-scale operator investments in cloud-native and disaggregated network architecture. The country’s mature cloud infrastructure and emphasis on vendor diversification through Open RAN standards further reinforce its strong position in the global vRAN landscape.

Key Virtualized Radio Access Network (vRAN) Company Insights

Some of the key companies in the virtualized radio access network (vRAN) industry include Nokia Corporation, Samsung, and Ericsson, among others. These companies are leveraging their global scale, R&D capabilities, and operator relationships to drive large-scale deployments.

-

Samsung provides end-to-end vRAN solutions and is one of the early commercial deployers of fully virtualized 5G RAN. The company’s vRAN solution is cloud-native and supports disaggregation of software and hardware components, enabling high flexibility, automation, and scalability.

-

Nokia Corporation is a global telecommunications provider, offering a robust vRAN portfolio through its cloud-native vRAN 2.0 architecture. The company enables operators to virtualize both 4G and 5G radio access networks while ensuring seamless integration with existing infrastructure.

Key Virtualized Radio Access Network (vRAN) Companies:

The following are the leading companies in the virtualized radio access network (vRAN) market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung

- Mavenir

- Intel Corporation

- NEC Corporation

- Parallel Wireless

- Nokia Corporation

- Capgemini

- Ericsson

- VMware

- Cisco Systems, Inc.

Recent Developments

- In March 2025, O2 Telefónica deployed its first Cloud RAN network utilizing Ericsson technology, marking the world’s first commercial implementation of Ericsson Cloud RAN in a 5G standalone network. This Cloud RAN architecture enables telecom operators to virtualize key components of the Radio Access Network (RAN), allowing for greater flexibility, scalability, and efficiency in managing 5G infrastructure.

Virtualized Radio Access Network Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.21 billion

Revenue forecast in 2033

USD 79.71 billion

Growth rate

CAGR of 19.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, network type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Samsung; Mavenir; Intel Corporation; NEC Corporation; Parallel Wireless; Nokia Corporation; Capgemini; Ericsson; VMware; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtualized Radio Access Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global virtualized radio access network market report based on component, deployment type, network type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Public

-

Private

-

Hybrid

-

-

Network Type Outlook (Revenue, USD Million, 2021 - 2033)

-

2G/3G

-

4G/LTE

-

5G

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Telecommunication Operators

-

Government & Defense

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtualized radio access network market size was estimated at USD 16.61 billion in 2024 and is expected to reach USD 19.21 billion in 2025.

b. The global virtualized radio access network market is expected to grow at a compound annual growth rate of 19.5% from 2025 to 2033 to reach USD 79.71 million by 2030.

b. The hardware segment dominated the market in 2024 and accounted for the largest share of 45.2%. The segment growth is driven by the increasing use of Commercial Off-The-Shelf (COTS) servers and white-box hardware.

b. Some key players operating in the virtualized radio access network (vRAN) market include Samsung, Mavenir, Intel Corporation, NEC Corporation, Parallel Wireless, Nokia Corporation, Capgemini, Ericsson, VMware, Cisco Systems, Inc.

b. The virtualized radio access network (vRAN) market is being driven by the growing demand for flexible, scalable, and cost-efficient mobile network infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.