- Home

- »

- Medical Devices

- »

-

Viscosupplementation Market Size, Industry Report, 2033GVR Report cover

![Viscosupplementation Market Size, Share & Trends Report]()

Viscosupplementation Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Single, Three & Five Injections), By End Use (Hospitals & Orthopedic Clinics/ASCs), By Region (North America, Europe, APAC, LATAM & MEA), And Segment Forecasts

- Report ID: GVR-1-68038-982-1

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Viscosupplementation Market Summary

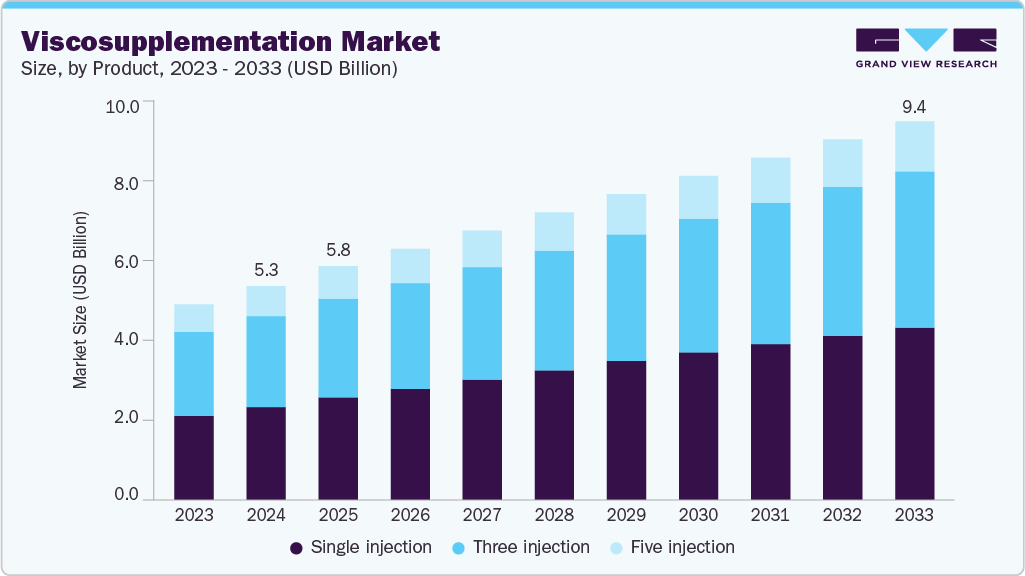

The global viscosupplementation market size was estimated at USD 5.30 billion in 2024 and is projected to reach USD 9.39 billion by 2033, growing at a CAGR of 6.21% from 2025 to 2033. Viscosupplementation aims to alleviate joint pain and enhance the functional state of the knee.

Key Market Trends & Insights

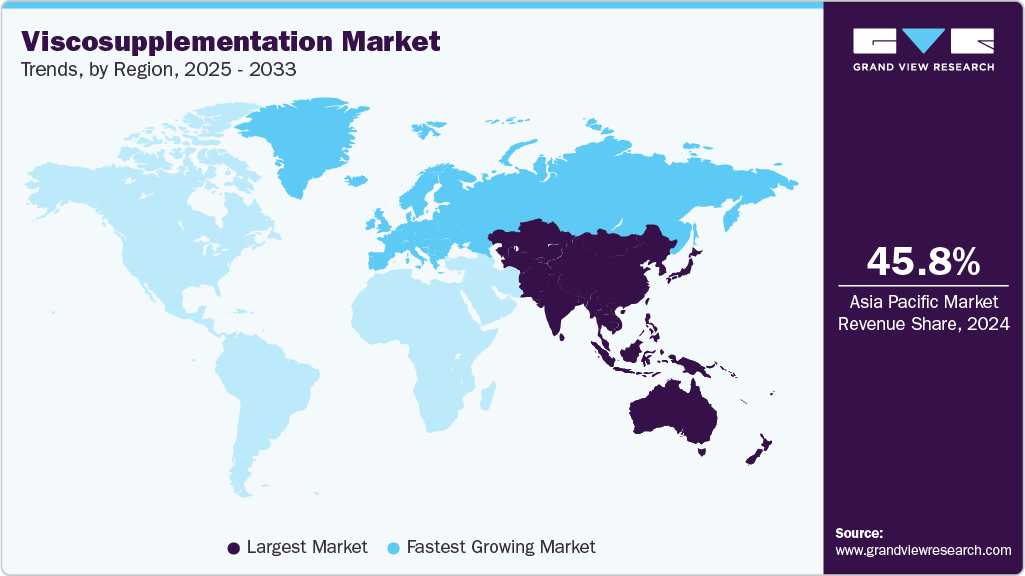

- The Asia Pacific viscosupplementation market held the largest revenue share of 45.82% of the global market in 2024.

- The viscosupplementation industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the single injection segment held the highest revenue share of 44.1% in 2024.

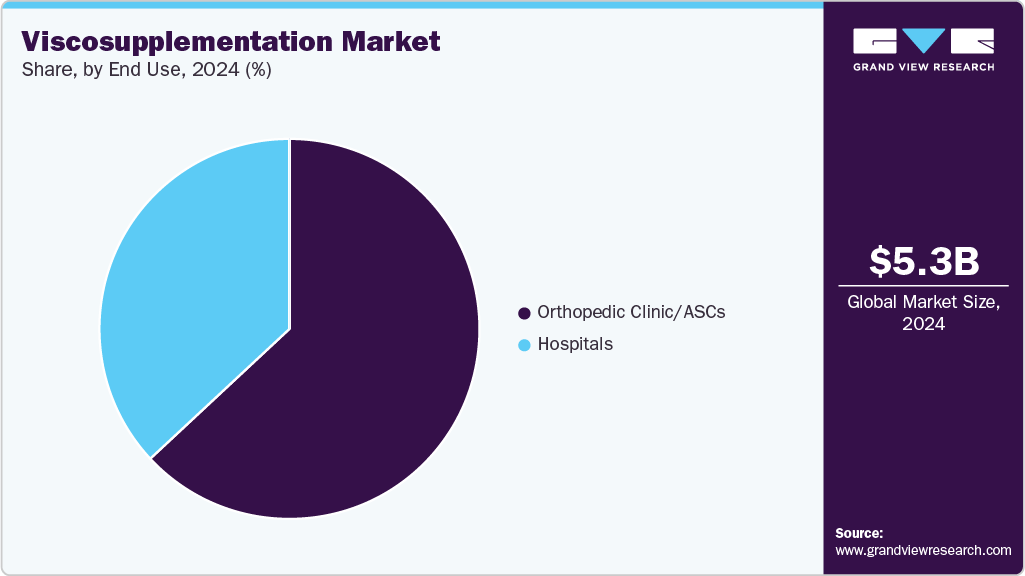

- Based on end use, the outpatient facilities/ASCs segment held the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.30 Billion

- 2033 Projected Market Size: USD 9.39 Billion

- CAGR (2025-2033): 6.21%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The growing incidence of osteoarthritis plays a significant role in driving the demand for viscosupplementation. Osteoarthritis, a chronic degenerative joint disease, is the primary cause of enduring disability. It typically emerges after the age of 30 and can progress to a disabling condition within a decade of diagnosis. In March 2025, an article published in Scientific Reports analyzed osteoarthritis data from the Global Burden of Disease Study 2021. The study reported a sharp rise in global OA incidence from 20.9 million cases in 1990 to 46.6 million in 2021, with a notable increase in years lived with disability. It also highlighted growing health inequalities, with a higher burden seen among women, in high SDI countries, and regions like Asia.

The rising incidence of joint disorders is a key driver of the viscosupplementation market. Degenerative conditions are becoming more common due to aging populations and sedentary lifestyles. This is leading to greater demand for non-surgical treatment approaches that provide symptom relief. Viscosupplementation addresses this by improving joint lubrication and mobility. Healthcare systems are recognizing the cost-effectiveness of delaying surgical intervention. In November 2024, an article in Osteoarthritis and Cartilage highlighted that osteoarthritis affected 7.6% of the global population in 2020, with prevalence increasing by 132.2% over the past 30 years. Moreover, it is noted that early-onset OA cases, occurring before age 55, accounted for over half of new diagnoses and 26.1% of total YLDs.

Preference for minimally invasive treatment options is contributing to market expansion. Patients and providers are increasingly opting for procedures that offer reduced recovery time and fewer complications. Viscosupplementation aligns with these needs, supporting its adoption in routine clinical practice. Ongoing developments in formulation are also influencing uptake. Single and multiple-injection regimens are now available to accommodate different patient profiles. In April 2024, a study published in Cureus analyzed arthritis trends among U.S. adults using BRFSS data from 2019 to 2022. The findings underscored rising prevalence and disparities by demographics and health status. These insights support growing adoption of minimally invasive surgeries (MIS) for arthritis, aimed at reducing pain, complications, and recovery time.

Growing awareness among healthcare providers and structured reimbursement policies are further supporting market growth. Continued clinical validation has led to broader acceptance of viscosupplementation in standard care protocols. This is encouraging its use at earlier stages of joint degeneration. Market players are responding with expanded product offerings to meet rising clinical demand. Regional regulatory support has facilitated product availability across key markets. In January 2024, Seikagaku Corporation announced collaborations with Anika Therapeutics and two other manufacturers to enhance multi-injection viscosupplementation products using novel cross-linked hyaluronic acid technologies.

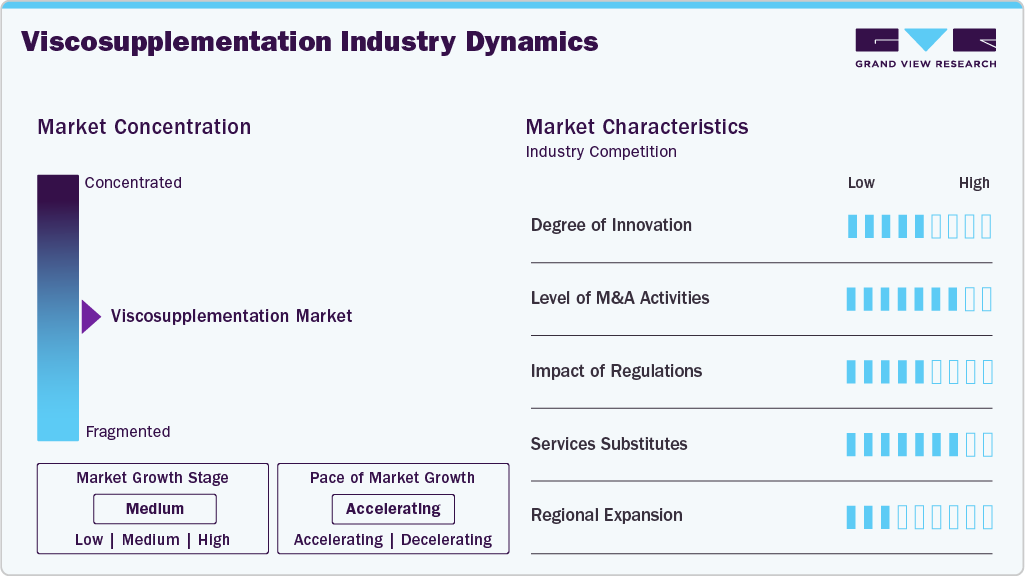

Market Concentration & Characteristics

The viscosupplementation market demonstrates a moderate level of innovation, primarily through advancements in hyaluronic acid formulations and delivery methods. Companies continue to introduce products with enhanced viscosity, improved joint retention, and fewer injections. Despite these refinements, the fundamental science behind viscosupplementation has not undergone major disruption. Most developments focus on optimizing existing therapeutic outcomes rather than introducing novel treatment paradigms.

Mergers and acquisitions are frequent in this space, reflecting a high level of strategic activity among established pharmaceutical and medtech companies. Firms aim to expand their musculoskeletal product lines, acquire proprietary formulations, or strengthen their regional presence. This consolidation helps companies achieve economies of scale and streamline regulatory pathways while staying competitive in a mature segment with limited differentiation.

The regulatory environment exerts a moderate influence on market dynamics. While approval processes differ by country, most viscosupplementation products fall under well-defined medical device or biologic classifications. Manufacturers must provide evidence of safety and effectiveness, but the process is typically less onerous than for pharmaceuticals. Variability in approval timelines and reimbursement policies across regions remains a limiting factor for rapid global expansion.

The market faces high competitive pressure from alternative therapies used to manage osteoarthritis. Non-steroidal anti-inflammatory drugs, corticosteroid injections, physical therapy, and surgical interventions offer physicians and patients a wide range of substitutes. These alternatives often have faster onset or broader clinical familiarity, challenging the long-term uptake of viscosupplementation, especially in cost-sensitive healthcare systems.

Geographic expansion in the viscosupplementation market remains low. Adoption outside North America and select European countries is limited by reimbursement uncertainties, inconsistent clinical guidelines, and a lack of physician awareness. Emerging markets offer potential, but localized regulatory barriers and low patient demand slow penetration. Most companies continue to focus efforts on established markets with proven reimbursement and clinical support.

Product Insights

By product, the single injection viscosupplementation procedure dominated with a revenue share of 43.44% in 2024, and is anticipated to grow at the fastest rate over the forecast period. These injections are relatively new in the market but show promising growth owing to a shorter regimen, reduced hospital visits, fewer adverse effects, and associated pain. Gel-One by Zimmer Biomet is the first low-volume viscosupplement available in a single injection formula. It is intended for patients who do not respond to other conservative treatments.

The three-injection segment is anticipated to grow at the significant CAGR over the forecast period. Three injections procedures are the most preferred method to treat osteoarthritis due to their effectiveness. Medical practitioners generally prefer three injections to help avoid total knee replacement surgery in case of osteoarthritis. Availability of multiple three injection in the market is contributing to the market share. Many clinical trials have been approved and shown positive results regarding their three injection procedures to treat osteoarthritis. In June 2023, Current Therapeutic Research, Clinical and Experimental published a U.S.-based trial showing that weekly injections of the viscosupplement Hylan G-F 20 provided significant pain relief in patients with chronic knee osteoarthritis flare-ups. Both single and repeat treatment cycles were effective and well tolerated. The therapy also reduced inflammation markers in the knee joint without major side effects.

End Use Insights

By end use, the orthopedic clinics/ambulatory surgical centers (ASCs) dominated the segment with a revenue share of 63.06% in 2024 due to the high demand for outpatient surgeries. Orthopedic clinics are dedicated to the care of the musculoskeletal system. This includes the treatment of surgical and nonsurgical problems involving joints, bones, ligaments, muscles, spine, and nerves. The increasing prevalence of osteoarthritis among the geriatric population is one of the major factors expected to contribute to the growth of this segment.In March 2023, The Journal of Arthroplasty published a study of 995 U.S. patients showing that hyaluronic acid injections led to modest improvements in function and symptom relief in patients with less severe knee osteoarthritis, supporting its selective clinical use.

Moreover, the orthopedic clinics/ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest rate over the forecast period as ASCs perform same-day surgeries for ACL surgery, hip, knee, & shoulder replacements, and others. These surgeries are less complicated and require little to no hospitalization. It allows orthopedic clinics to accept more patients per day. In July 2025, according to Definitive Healthcare, there are over 27,800 active orthopedic surgeons in the U.S., including specialists in spine and pediatric orthopedics.

Hospitals are forecasted to grow at a significant CAGR over the forecast period due to advancements in medical technology, causing a recent emergence in multispecialty hospitals. This growth is driving higher demand for orthopedic interventions, particularly non-surgical options such as viscosupplementation. Increased adoption of joint-preserving therapies is being fueled by the aging U.S. population and rising incidence of osteoarthritis. In February 2025, a Journal of Clinical Medicine review emphasized the clinical value of intra-articular hyaluronic acid (IAHA) in managing osteoarthritis in hospitals. The analysis found IAHA effective for early-to-moderate OA, offering pain relief and improved joint function, especially when used with hybrid formulations and in multimodal strategies.

Regional Insights

The North America viscosupplementation market is expected to grow significantly in 2024 due to the increasing prevalence of osteoarthritis and rising demand for early intervention therapies. Favorable reimbursement policies are enabling broader adoption in outpatient care settings, while advancements in hyaluronic acid formulations are enhancing treatment efficacy. The strong presence of established medical device manufacturers ensures consistent product availability across the region, supporting sustained market expansion. In July 2025, according to the CDC, osteoarthritis was identified as the most common joint disorder in the U.S., affecting over 30 million adults.

U.S. Viscosupplementation Market Trends

The viscosupplementation market in the U.S. held the largest revenue share in 2024, driven by high diagnosis rates and early clinical intervention. A robust healthcare infrastructure facilitates widespread procedural adoption, with increased physician awareness further expanding the eligible patient population. In July 2022, The BMJ published findings from a global meta-analysis indicating that viscosupplementation offers negligible pain relief and is associated with a 49% increased risk of serious adverse events in knee osteoarthritis patients. Despite this, the therapy remains widely used across the U.S., where clinical guidelines have yet to align with the growing body of evidence advising against routine use, prompting renewed debate over its continued reimbursement and practice.

Europe Viscosupplementation Market Trends

Europe viscosupplementation market is anticipated to grow at the fastest rate over the forecast period due to factors such as the growing geriatric population and increased investments by market players. Osteoporosis affects more than 2.5 million women in the UK and France every year. With the ruling by Haute Autorité de Santé (HAS), 70% of the cost of the scan is covered by the Caisse Primaire d'Assurance Maladie (CPAM). In addition, Haute Autorité de Santé (HAS), the health care body, has recommended BONVIVA, which is a medicine prescribed in the UK to increase the strength of bones, to have a reimbursement of 65% by the Caisse Primaire d'Assurance Maladie (CPAM).

Germany's viscosupplementation market is anticipated to grow steadily due to its large aging population and the increasing incidence of osteoarthritis. The country’s advanced healthcare infrastructure and high patient preference for non-surgical interventions are supporting market expansion. Growing reimbursement support for viscosupplementation also boosts adoption rates. In March 2024, Osteoarthritis and Cartilage Open reported that knee OA prevalence in Germany rose from 7.07% in 2015 to 7.39% in 2020. Around 62% of newly diagnosed patients in 2015 received pharmacological pain treatment, and 16.6% underwent knee surgery. Knee replacements increased from 7,918 in 2015 to 8,975 in 2019.

The UK viscosupplementation market is expected to register consistent growth owing to rising demand for minimally invasive pain management solutions. Increased physician awareness, coupled with national programs focused on early arthritis care, is fueling adoption. In August 2023, the British Journal of General Practice reported that osteoarthritis affected nearly 10% of UK primary care patients. People with OA had a median of 10.91 primary care visits per year compared to 9.43 in controls, and an adjusted all-cause mortality hazard ratio of 1.89. Knee and hip OA showed even higher risks, with hazard ratios of 2.09 and 2.08, respectively.

Asia Pacific Viscosupplementation Market Trends

The Asia Pacific viscosupplementation market held the largest revenue share of 45.82% in 2024. The presence of a large geriatric population, susceptible to osteoarthritis is one of the major factors driving the viscosupplementation market in the region. Also, various initiatives undertaken to strengthen the market are driving the market growth. For instance, in April 2022, Juniper Biologics and Kolon Life entered into a licensing agreement to collaborate on the development and commercialization of TissueGene-C low dose, an investigational therapy for knee osteoarthritis. It is administered as a single intra-articular injection and does not require surgery. As per the agreement, Juniper is responsible for the development and marketing of gene therapy to medical professionals and hospitals in Asia-Pacific.

China's viscosupplementation market is anticipated to register the fastest growth rate during the forecast period due to increasing osteoarthritis cases and improving healthcare access in urban and semi-urban regions. Rising awareness about non-surgical pain management and local manufacturing of hyaluronic acid products are also contributing to market momentum. In May 2024, China's National Health Commission outlined its “Healthy Aging 2030” plan, which aims to raise the use of non-pharmacological joint interventions such as viscosupplementation by 20% to address a growing elderly population.

Latin America Viscosupplementation Market Trends

Latin America viscosupplementation market is witnessing steady growth due to improving access to orthopedic care and an increase in chronic joint pain cases. Rising demand for outpatient treatments and gradual public healthcare upgrades in countries such as Brazil and Argentina are contributing factors. A June 2025 blog post on Number Analytics cited UN data projecting that the population aged 60 and older in Latin America and the Caribbean will grow from 12.4% in 2015 to 25.3% by 2050.

Brazil's viscosupplementation market is anticipated to grow at the fastest pace in the region, driven by rising healthcare investments and expanding insurance coverage for joint treatments. Growth is further supported by increasing product availability and awareness campaigns promoting early intervention in osteoarthritis. In January 2022, a study published in Clinical Rheumatology highlighted the substantial burden of osteoarthritis in Latin America. In Brazil, the prevalence of grade ≥2 radiographic knee osteoarthritis was 22% among adults aged 39 and older.

Middle East and Africa Viscosupplementation Market Trends

The Middle East and Africa region is experiencing a gradual uptake in viscosupplementation procedures, mainly due to expanding private healthcare networks and growing orthopedic awareness. While market penetration remains limited, countries such as the UAE and Saudi Arabia are leading adoption with improving diagnostic infrastructure. In March 2023, a review published in Open Access Rheumatology: Research and Reviews found a significant burden of knee osteoarthritis across 10 countries in Africa and the Middle East. Prevalence rates ranged from 9% to 34% among rheumatology outpatients, with some studies reporting over 70% prevalence among older adults.

South Africa's viscosupplementation market is anticipated to register the fastest growth rate during the forecast period. South Africa's improving orthopedic infrastructure and expanding private healthcare services are contributing to moderate growth in the viscosupplementation market. The rising prevalence of joint-related conditions and increasing awareness among healthcare providers support the use of hyaluronic acid therapies. In June 2025, an article published in Osteoarthritis and Cartilage Open highlighted the poor uptake of evidence-based rehabilitation for osteoarthritis in Africa, despite rising OA prevalence. According to the Global Burden of Disease study, Sub-Saharan Africa shows knee OA prevalence as high as 3,924.9 per 100,000 in southern regions.

Key Viscosupplementation Company Insights

Key participants in the viscosupplementation market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Viscosupplementation Companies:

The following are the leading companies in the viscosupplementation market. These companies collectively hold the largest market share and dictate industry trends.

- DePuy Synthes

- Fidia Farmaceutici S.p.A

- Sanofi

- Smith & Nephew PLC

- Anika Therapeutics, Inc.

- Seikagaku Corp.

- Zimmer Biomet

- Ferring Pharmaceuticals B.V.

- Lifecore Biomedical

- LG Life Sciences Ltd.

- F.Hoffmann-La Roche Ltd.

Recent Developments

-

In February 2024, IBSA UK, a subsidiary of the Swiss-based IBSA Group, launched its advanced SINOVIAL range in the UK for osteoarthritis treatment. The product features a proprietary formulation using NAHYCO technology, combining high and low molecular weight hyaluronic acid for optimal joint lubrication.

-

In April 2022, Juniper Biologics and Kolon Life entered into a licensing agreement to collaborate on the development and commercialization of TissueGene-C low dose, an investigational therapy for knee osteoarthritis.

-

In January 2024, Zimmer Biomet launched VISCO‑3, a three-injection high molecular weight hyaluronate treatment for moderate-stage knee osteoarthritis in select global markets. Clinical trial data showed a 52% reduction in pain at 12 weeks, extended relief up to six months, and a favorable safety profile.

Viscosupplementation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.80 billion

Revenue forecast in 2033

USD 9.39 billion

Growth rate

CAGR of 6.21% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; France; Germany; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

DePuy Synthes; Fidia Farmaceutici S.p.A; Sanofi; Smith & Nephew PLC; Anika Therapeutics, Inc.; Seikagaku Corp.; Zimmer Biomet; Ferring Pharmaceuticals B.V.; Lifecore Biomedical; LG Life Sciences Ltd.; F.Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Viscosupplementation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global viscosupplementation market report based on product, end use, and region:

-

Product Outlook (Revenue in USD Billion, 2021 - 2033)

-

Single Injection

-

Three Injection

-

Five Injection

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Orthopedic Clinics/ASCs

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global viscosupplementation market size was estimated at USD 5.30 billion in 2024 and is expected to reach USD 5.80 billion in 2025.

b. The global viscosupplementation market is expected to grow at a compound annual growth rate of 6.21% from 2025 to 2033 to reach USD 9.39 billion by 2033.

b. The Asia Pacific dominated the viscosupplementation market with a share of around 45.82% in 2024. ThPresence of large geriatric population, susceptible to osteoarthritis is one of the major factor driving the viscosupplementation market in the region.

b. Some key players operating in the viscosupplementation market include DePuy Synthes, Fidia Farmaceutici S.p.A, Sanofi, Smith & Nephew PLC, Anika Therapeutics, Inc., Seikagaku Corp., Zimmer Biomet, Ferring Pharmaceuticals B.V., Lifecore Biomedical, LG Life Sciences Ltd., and F.Hoffmann-La Roche Ltd.

b. Key factors that are driving the viscosupplementation market growth include increasing demand for non-surgical treatments for osteoarthritis, the prevalence of lifestyle-induced disorders, and advancements in the development of hyaluronic acid-based therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.