Vitamin D Therapy Market Size & Trends

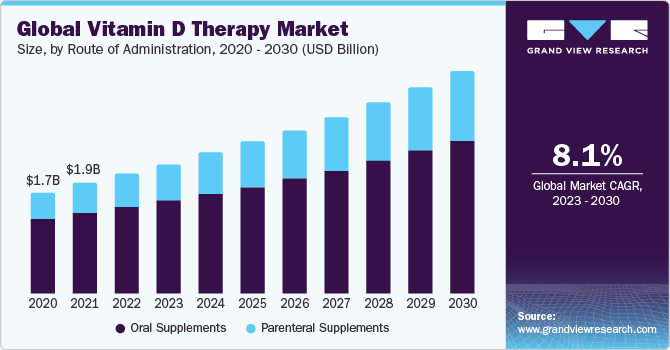

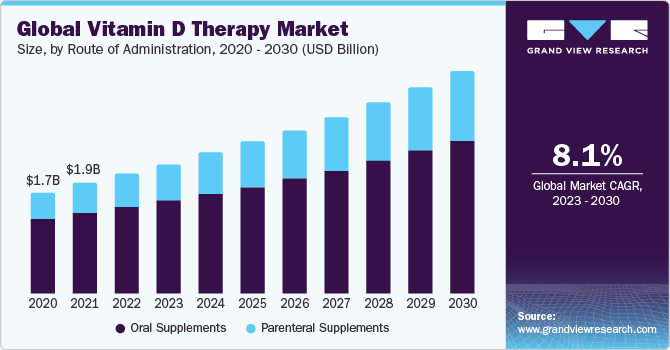

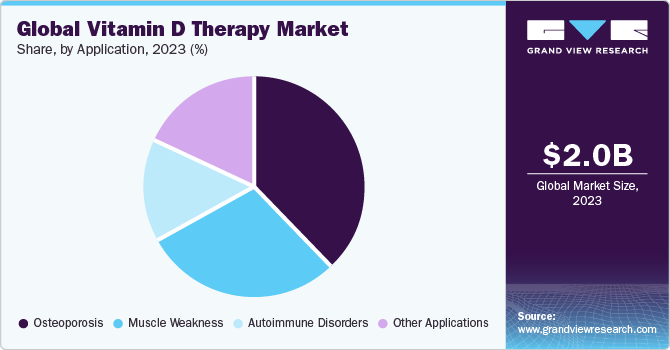

The global vitamin D therapy market size was valued at USD 2.04 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.06% from 2024 to 2030. The vitamin D therapy market is being driven by the growing awareness of the health benefits associated with vitamin D, including its crucial role in bone health, immune system function, and overall well-being. Additionally, the rising prevalence of vitamin D deficiencies and increased research highlighting its therapeutic potential in various medical conditions contribute to the market's growth.

The vitamin D therapy industry experienced accelerated growth during the COVID-19 pandemic. The relationship between vitamin D deficiency and compromised immune response, leading to susceptibility to viral infections, including COVID-19, highlighted the significance of vitamin D therapy products. Consequently, these products played a crucial role in addressing the increased demand during the pandemic. Furthermore, according to a study published in November 2022, administering vitamin D2 and D3 supplements during the pandemic demonstrated a notable reduction in the likelihood of COVID-19 infection, with a 20% and 28% decrease, respectively. Specifically, vitamin D3 supplementation was associated with a significant 33% lower incidence of COVID-19 infection, leading to a decreased risk of death within 30 days.

The demand for vitamin D supplements is notably boosted by the specific needs of children in the market. According to the StatsPearl study published in the National Library of Medicine in April 2023, 50% of children aged 1 to 5 and 70% of those aged 6 to 11 face vitamin D insufficiency. This widespread insufficiency among children has become a driving force for the vitamin D market, leading to an increased focus on products and therapies tailored to address the nutritional requirements of this demographic.

Route Of Administration Insights

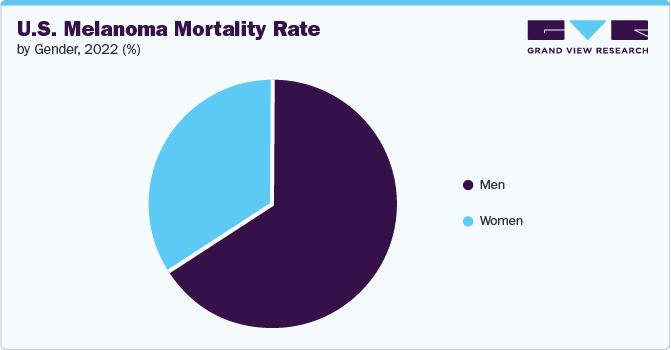

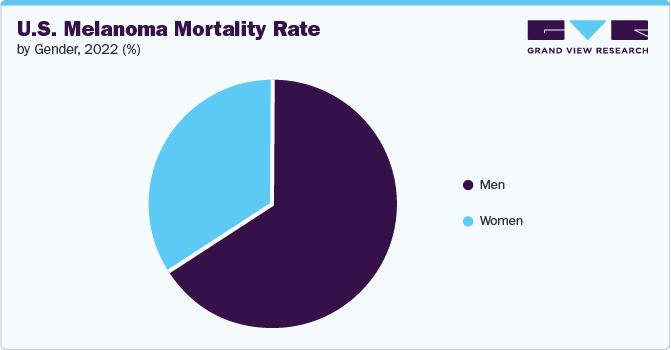

The oral vitamin D segment dominated the market in 2023. The prevalence of skin cancer is common in the U.S., acting as a significant driver for the oral vitamin D segment. According to the American Academy of Dermatology Association, one in five Americans is expected to develop skin cancer in their lifetime, and approximately 9,500 daily diagnoses. Hence, there is a substantial market demand for oral vitamin D products. This demand is particularly fueled by the research indicating that nonmelanoma skin cancer (NMSC) i.e. squamous cell carcinoma (SCC) and basal cell carcinoma (BCC), affects over 3 million Americans annually.

Type Insights

Based on type, the market is segmented into prescription and Over-the-counter (OTC). The OTC vitamin D segment dominated the market in 2023 and is driven by factors such as consumer convenience, accessibility, and the growing trend of self-care. OTC products allow consumers to purchase vitamin D supplements without a prescription, allowing for easy access in pharmacies, supermarkets, and online platforms. The increasing awareness of the importance of vitamin D for overall health and well-being has led consumers to proactively seek these supplements, contributing to the dominance of the OTC segment.

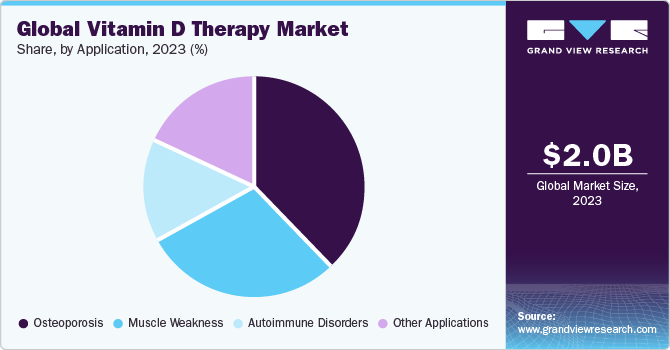

Application Insights

Based on the application, the market is segmented into autoimmune disorders, muscle weakness, osteoporosis, and other applications. The osteoporosis segment dominated the market in 2023. According to the International Osteoporosis Foundation, osteoporosis, a condition characterized by weakened bones, leads to more than 8.9 million fractures globally annually, equating to an osteoporosis-related fracture occurring approximately every 3 seconds. The high prevalence of fractures associated with osteoporosis highlights the critical need for interventions that can enhance bone health, and vitamin D therapy emerges as a key solution in addressing this widespread concern. As vitamin D plays a crucial role in bone metabolism and calcium absorption, its therapeutic applications are crucial in mitigating the risk of fractures and promoting overall bone health on a global scale.

Regional Insights

Asia Pacific dominated the market in 2023. However, North America is expected to grow at the fastest CAGR during the forecast period. Reduced physical activity, obesity, and lower social status have been linked to diminished vitamin D levels. Moreover, according to a CDC report published in January 2022, 25% of American adults do not engage in sufficient physical activity for maintaining their health. State and territory-level variations in physical inactivity rates range from 17.7% in Colorado to 49.4% in Puerto Rico. This decline in physical activity contributes to an elevated risk of vitamin D deficiency in the population, fostering increased demand for treatment and propelling market growth.

Competitive Insights

Key players operating in the market are Abbott, Pfizer, GSK plc, Biotics Research Corporation., Ortho Molecular Products, Merck KGaA, Sanofi, Bayer AG, Mitsubishi Chemical Group Corporation, Teva Pharmaceuticals Industries Ltd. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. In August 2022, Arbro Pharmaceuticals launched Vkap-D3, a plant-based capsule, in India. Vkap-D3 features Vitamin D3 at a strength of 60,000 IU within a distinctive hard vegetarian liquid-filled capsule shell crafted from HPMC with a plant-based origin. This innovative formulation is designed to address Vitamin D deficiency effectively.