- Home

- »

- Food Additives & Nutricosmetics

- »

-

Vitamin E Market Size & Share, Industry Report, 2033GVR Report cover

![Vitamin E Market Size, Share & Trends Report]()

Vitamin E Market (2025 - 2033) Size, Share & Trends Analysis Report Product (Tocopherols, Tocotrienols), By Application (Dietary Supplements, Animal Feed Nutrition, Pharmaceuticals, Cosmetics), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-836-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin E Market Summary

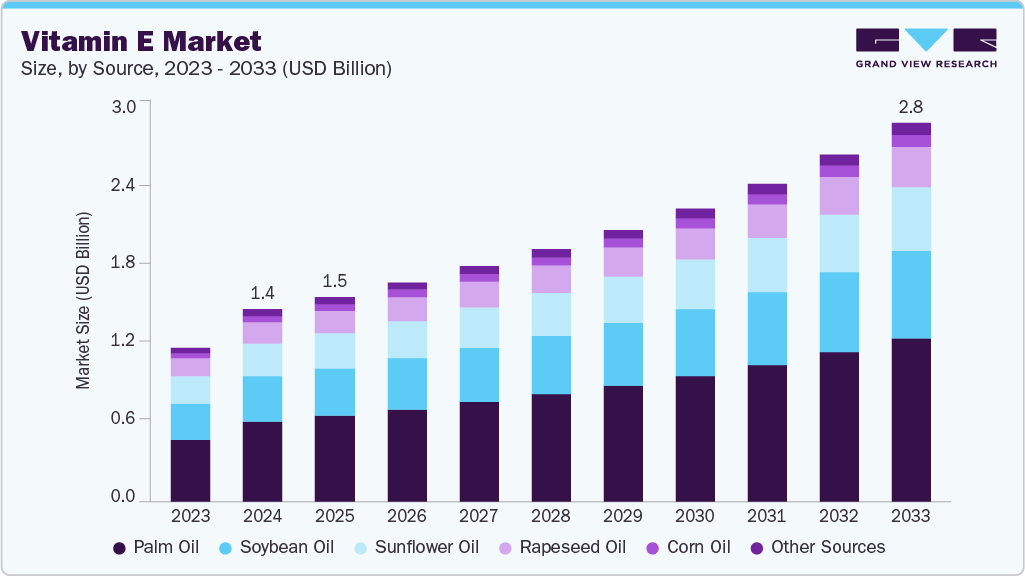

The global vitamin E market size was estimated at USD 1,428.3 million in 2024 and is projected to reach USD 2816.1 million by 2033, growing at a CAGR of 8.0% from 2025 to 2033. The market is driven by rising global adoption of preventive healthcare, which is accelerating demand for natural and high-purity tocopherols and tocotrienols in dietary supplements, pharmaceuticals, and fortified foods.

Key Market Trends & Insights

- Asia Pacific dominated the vitamin E industry with the largest revenue share of 40.9% in 2024.

- The market in Europe is expected to grow at a significant CAGR of 7.9% from 2025 to 2033.

- By product, the tocotrienols is expected to grow at the fastest CAGR of 8.7% from 2025 to 2033 in terms of revenue.

- By source, the palm oil segment held the largest revenue share of 41.8% in 2024 in terms of value.

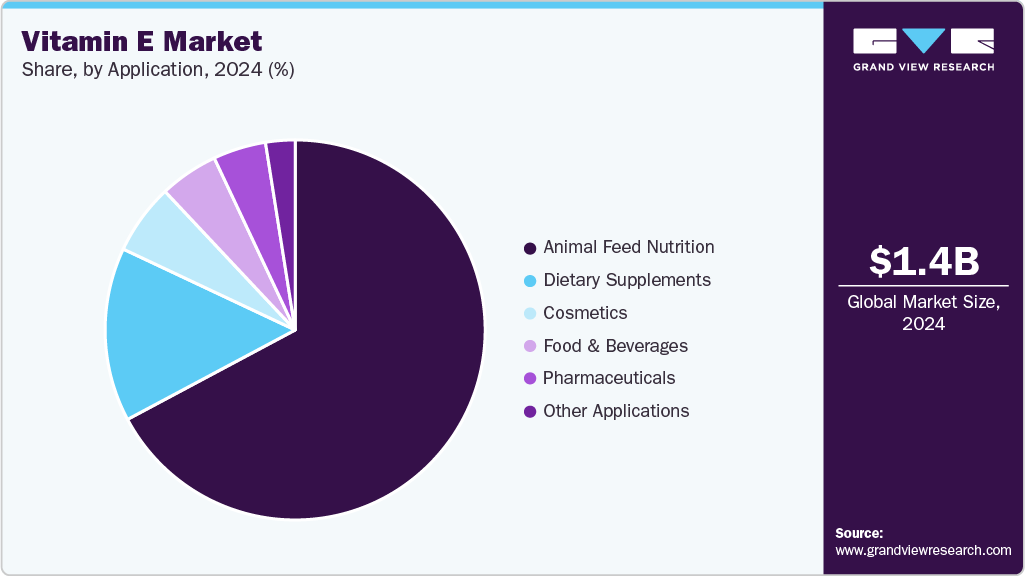

- By application, the animal feed nutrition segment held the largest revenue share of 67.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 1,428.3 Million

- 2033 Projected Market Size: USD 2,816.1 Million

- CAGR (2025-2033): 8.0%

- Asia Pacific: Largest market in 2024

Growth in commercial livestock production continues to boost consumption of feed-grade Vitamin E due to its role in animal immunity and productivity. Concurrently, clean-label and premium skincare trends are increasing the use of natural Vitamin E in cosmetics for its antioxidant and anti-aging benefits. These factors collectively strengthen demand across both high-value and high-volume application segments.Major opportunities lie in the expansion of high-grade, natural, certified Vitamin E, supported by strong consumer preference for plant-derived and sustainably sourced ingredients. Advancements in fractionation, molecular distillation, and biotech-enabled extraction can unlock higher-margin applications in pharmaceuticals and premium nutraceuticals. Increasing demand for microencapsulated and water-dispersible formats also opens new avenues in functional beverages and clinical nutrition. In addition, growth in emerging markets and rising importance of ESG compliance create strategic opportunities for suppliers offering traceability and RSPO-certified sourcing.

Key challenges include volatility in vegetable oil prices, which impacts extraction costs, and sustainability concerns surrounding palm oil, driving the need for costly certification and traceability measures. Intense competition from large integrated agribusinesses continues to pressure margins, particularly in commodity-grade segments. The regulatory variability across regions, coupled with supply chain risks linked to crop yields and logistics, increases operational complexity for manufacturers seeking consistent quality and stable sourcing.

Market Concentration & Characteristics

The global Vitamin E industry is characterized by a mix of large integrated agribusinesses and specialized nutraceutical ingredient manufacturers, creating a highly competitive environment across both commodity and value-added segments. Major players such as ADM, BASF SE, dsm-firmenich, Cargill, Wilmar International, and Louis Dreyfus Company leverage extensive control over oilseed sourcing, large-scale refining capacity, and global supply chains to maintain strong cost competitiveness and consistent product availability. These companies dominate the market for tocopherols and synthetic Vitamin E through economies of scale, diversified raw material bases, and long-term relationships with feed, food, and nutraceutical formulators. Their ability to ensure traceability, sustainability certifications, and regulatory compliance further strengthens their presence in regulated and multinational end-use categories.

Alongside these global players, the market includes a growing cohort of specialty suppliers and regional firms such as Davos Life Science, VITAE Naturals, BTSA, Vance Group, Nutralliance, SOP Nutraceuticals, and Cayman Chemical. These companies compete by offering high-purity tocopherol and tocotrienol concentrates, natural-sourced variants, niche delivery formats (e.g., microencapsulated, powder, water-dispersible), and customized formulations for nutraceuticals, cosmetics, and pharmaceutical applications. Their competitive advantage often lies in product differentiation, agility in meeting clean-label requirements, and the ability to serve emerging market customers with tailored specifications. However, rising sustainability expectations, raw material price fluctuations, and increasing consolidation among major agribusiness players continue to elevate competitive pressures, prompting smaller firms to invest in technology, partnerships, and certification programs to sustain market relevance.

Product Insights

The tocopherols segment accounted for 74.5% of the market in 2024, driven by its widespread availability, cost-effective production, and broad use across dietary supplements, animal feed, food preservation, and cosmetics. Its dominance is reinforced by large-scale extraction from commonly processed vegetable oils, enabling competitive pricing and reliable global supply. High-grade tocopherols (>70% active) lead demand in nutraceuticals, pharmaceuticals, and premium skincare due to strong antioxidant efficacy, while medium-grade (30-70%) products are extensively used in food stabilization and mid-tier supplements. Low-grade tocopherols (<30%) remain important in animal feed and industrial antioxidant applications, supporting the segment’s volume leadership.

The tocotrienols segment, though smaller, is expanding due to rising interest in their superior biological activity and emerging clinical evidence supporting cardiovascular, neuroprotective, and anti-inflammatory benefits. High-grade tocotrienols are increasingly used in premium nutraceuticals and targeted pharmaceutical formulations, while medium-grade variations serve functional foods and cosmetic blends. Low-grade tocotrienols are used primarily in mixed antioxidant systems. However, adoption is limited by restricted natural sources, higher extraction costs, and lower production volumes compared with tocopherols. While tocotrienols are poised for faster growth, tocopherols will continue to dominate mainstream applications due to scale, affordability, and regulatory acceptance.

Source Insights

Palm oil accounted for the largest revenue share of 41.8% in 2024, primarily due to its exceptionally high natural tocotrienol and tocopherol content, which makes it the most cost-efficient and scalable source for Vitamin E extraction. The extensive palm oil supply base in Malaysia, Indonesia, and parts of Southeast Asia ensures consistent raw material availability, enabling large producers to maintain competitive pricing and stable output. Its superior extraction yields, robust refining infrastructure, and strong integration of major players into RSPO-certified sustainable sourcing further support its dominance across nutritional, pharmaceutical, and cosmetic-grade Vitamin E production. As a result, palm oil continues to be the preferred choice for manufacturers seeking high-quality, high-volume, and cost-effective feedstock.

Beyond palm oil, soybean, sunflower, corn, and rapeseed oils represent important complementary sources, each serving distinct product and regional requirements. Soybean oil is widely utilized for tocopherol extraction due to its large global cultivation footprint, especially in North and South America. Sunflower and rapeseed oils are increasingly favored for natural, non-GMO, and premium-grade Vitamin E applications, particularly in Europe. Corn oil contributes to niche tocopherol production, while other sources, including wheat germ, rice bran, and olive oil, support specialty tocotrienol and high-purity formulations. Although these sources offer diversification and the potential for clean-label positioning, they generally provide lower extraction yields and higher production costs compared with palm oil, reinforcing palm’s continued leadership in the global Vitamin E value chain.

Application Insights

The animal feed nutrition segment held the largest revenue share of 67.2% in 2024, driven by the essential role of Vitamin E in enhancing immunity, reproductive performance, growth efficiency, and overall health in poultry, swine, cattle, and aquaculture. Rising global consumption of meat, dairy, and eggs, coupled with the industrialization of livestock production, continues to increase the incorporation of Vitamin E as a core nutritional additive in commercial feed formulations. Feed manufacturers predominantly use medium- and high-grade tocopherols due to their proven oxidative stability benefits in feed storage and their critical function in animal physiology. Large-volume procurement by integrated feed mills further reinforces this segment’s dominance, making it the most stable and demand-driven application area for Vitamin E globally.

Outside animal nutrition, dietary supplements represent a major value-driven segment, fueled by rising consumer focus on immunity, cardiovascular health, anti-aging benefits, and overall wellness. The cosmetics industry also drives strong demand for high-purity Vitamin E as an antioxidant and skin-conditioning agent, especially in premium skincare and haircare formulations. In pharmaceuticals, tocopherols and tocotrienols are used for niche therapeutic applications, including cardiovascular, neurological, and metabolic health products. The food & beverages sector leverages Vitamin E as a natural preservative and fortification ingredient in functional foods, beverages, and edible oils. Other applications, including plastics and polymers, fuels, and lubricants, use Vitamin E as an oxidation inhibitor to enhance stability and extend product shelf life. Although these segments collectively account for a smaller share, they represent higher value-added opportunities and support diversified market growth.

Regional Insights

Asia Pacific vitamin E industry held 40.9% share of the global market in 2024, supported by its dominant palm and soybean oil processing industries, strong animal feed consumption, and expanding nutraceutical demand across China, India, Indonesia, and Japan. High-volume commercial livestock production, rapid growth of dietary supplement usage, and the presence of major integrated producers such as Wilmar and DSM drive regional competitiveness. Rising middle-class health awareness and accelerated expansion of functional foods and cosmetics further reinforce Asia Pacific’s leadership position.

India’s Vitamin E industry is expanding rapidly due to rising consumption of dietary supplements, increasing focus on preventive healthcare, and significant growth in poultry, dairy, and aquaculture industries. The country’s strong edible oil refining sector, combined with rising demand for fortified foods and nutraceuticals, is accelerating domestic production and imports of tocopherols and tocotrienols. Rapid urbanization, higher disposable incomes, and growing penetration of premium skincare products continue to enhance market growth prospects.

Europe Vitamin E Market Trends

Europe vitamin E industry accounted for a 23.0% of the global market share in 2024, driven by strong demand for natural, non-GMO Vitamin E derived from sunflower and rapeseed oils. The region’s mature dietary supplement market, stringent clean-label regulations, and high adoption of premium skincare products support stable demand for high-purity tocopherols and tocotrienols. Europe also benefits from established specialty ingredient producers and strong R&D investments in pharmaceutical-grade and functional food formulations.

Germany vitamin E industry remains one of Europe’s most significant markets due to its robust nutraceutical sector, advanced cosmetics industry, and strong presence of pharmaceutical manufacturers. High consumer preference for natural and sustainably sourced ingredients has increased demand for sunflower- and rapeseed-based Vitamin E. Germany’s focus on product quality, regulatory compliance, and innovation in functional foods positions it as a strategic hub for premium-grade Vitamin E products.

North America Vitamin E Market Trends

North America vitamin E industry held a 20.3% of the global market share in 2024, supported by strong uptake of dietary supplements, widespread use of Vitamin E in animal feed, and growing demand for natural antioxidants in food and cosmetics. The region benefits from a large soybean oil refining base, well-established nutraceutical brands, and high consumer spending on wellness, anti-aging, and functional food products. Regulatory clarity and strong product standardization further consolidate market growth.

U.S. Vitamin E Market Trends

The U.S. vitamin E industry is the dominant market in North America, driven by high consumption of dietary supplements, strong commercial livestock production, and extensive use of natural Vitamin E in packaged foods and skincare. The country’s mature nutraceutical ecosystem, coupled with rising interest in clean-label and plant-based ingredients, accelerates demand for high-purity tocopherols. Continuous innovation in fortified foods, sports nutrition, and dermatological formulations further supports market expansion.

Middle East & Africa Vitamin E Market Trends

The Middle East & Africa vitamin E industry is growing steadily, fueled by rising demand for animal feed additives, increasing adoption of fortified foods, and expanding cosmetic and personal care industries in the GCC region. Limited local production results in high dependence on imports, especially for high-grade tocopherols used in supplements and skincare. Economic diversification efforts and dietary shifts toward functional nutrition are expected to gradually strengthen market penetration.

Latin America Vitamin E Market Trends

Latin America vitamin E industry shows stable growth led by Brazil, Argentina, and Mexico, supported by robust soybean cultivation, strong feed industry expansion, and rising awareness of nutritional supplementation. Increasing incorporation of Vitamin E in poultry and livestock feed, along with growing urban demand for fortified foods and cosmetic products, drives regional consumption. While price sensitivity persists, rising middle-class incomes and improvements in healthcare access continue to create new market opportunities.

Key Vitamin E Company Insights

Key players, such as ADM, BASF SE , dsm-firmenich, Cargill Incorporated, Wilmar International Ltd , and Davos Life Science Pte Ltd. are dominating the market.

ADM

-

ADM is one of the key players of natural vitamin E ingredients, leveraging its extensive oilseed processing capabilities and vertically integrated supply chain to serve dietary supplements, animal nutrition, food, and pharmaceutical end markets. The company benefits from strong access to key raw materials such as soybean and sunflower oils, enabling consistent production of tocopherols and mixed tocotrienols with high quality and traceability. ADM’s competitive position is reinforced by its investments in refining technologies, sustainable sourcing programs, and value-added nutritional solutions tailored to functional health applications, particularly antioxidant fortification.

Key Vitamin E Companies:

The following are the leading companies in the vitamin E market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- BASF SE

- dsm-firmenich

- Cargill Incorporated

- Wilmar International Ltd

- Davos Life Science Pte Ltd.

- Nutralliance

- Parchem

- SOP Nutraceuticals

- SD Guthrie Berhad

- Louis Dreyfus Company

- VITAE NATURALS

- Vance Group Ltd

- BTSA

- Cayman Chemical

Recent Developments

-

In March 2025, Louis Dreyfus Company introduced a new plant-based vitamin E product line at Food Ingredients China 2025, adding mixed tocopherols, acetate, and succinate grades for food, beverage, and nutrition customers. The launch strengthens LDC’s position in value-added plant-based ingredients and supports its strategy to grow beyond commodity trading into specialty health-oriented solutions.

-

In July 2024, PhytoGaia launched two branded palm-derived vitamin E ingredients, TocoGaia and STGaia, at SupplySide West 2022, positioning them as next-generation tocotrienol complexes for supplements, functional foods, and beauty-from-within products. TocoGaia delivers a full spectrum tocotrienols/tocopherol complex, while STGaia combines tocotrienols with plant squalene, targeting healthy aging, cognitive health and skin support.

Vitamin E Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,519.8 million

Revenue forecast in 2033

USD 2,816.1 million

Growth rate

CAGR of 8.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Malaysia; Indonesia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

ADM; BASF SE; dsm-firmenich; Cargill Incorporated; Wilmar International Ltd; Davos Life Science Pte Ltd.; Nutralliance; Parchem; SOP Nutraceuticals; SD Guthrie Berhad; Louis Dreyfus Company; VITAE NATURALS; Vance Group Ltd; BTSA; Cayman Chemical

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitamin E Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global vitamin E market report based on product, source, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Tocopherols

-

Low Grade/Crude Technologies

-

Medium Grade Technologies

-

High Grade Technologies

-

-

Tocotrienols

-

Low Grade/Crude Technologies

-

Medium Grade Technologies

-

High Grade Technologies

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Palm Oil

-

Sunflower Oil

-

Soybean Oil

-

Corn Oil

-

Rapeseed Oil

-

Other Sources

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Dietary Supplements

-

Animal Feed Nutrition

-

Cosmetics

-

Pharmaceuticals

-

Food & Beverages

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

US

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Indonesia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global vitamin E market size was estimated at USD 1,428.3 million in 2024 and is expected to reach USD 1,519.8 million in 2025.

b. The global vitamin E market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2033 to reach USD 2,816.1 million by 2033.

b. The tocopherols segment held the largest revenue share of 40.9% in 2024 due to its broad application across dietary supplements, food and beverages, animal nutrition, and pharmaceuticals, supported by well-established regulatory acceptance and robust commercial availability. Its cost-effective extraction from widely processed vegetable oils further strengthened its market penetration compared to the relatively premium-priced tocotrienols.

b. Some of the key players operating in the vitamin E market include ADM, BASF SE, dsm-firmenich, Cargill Incorporated, Wilmar International Ltd, Davos Life Science Pte Ltd., Nutralliance, Parchem, SOP Nutraceuticals, SD Guthrie Berhad, Louis Dreyfus Company, VITAE NATURALS, Vance Group Ltd, Btsa, and Cayman Chemical

b. The global Vitamin E market growth is primarily driven by rising demand for natural antioxidants in dietary supplements, food preservation, and animal nutrition, supported by increasing consumer preference for clean-label and plant-derived ingredients. The expanding production of vegetable oils and advancements in extraction technologies are enhancing supply efficiency and accelerating adoption across end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.