- Home

- »

- Medical Devices

- »

-

Vitrectomy Devices Market Size And Share Report, 2030GVR Report cover

![Vitrectomy Devices Market Size, Share & Trends Report]()

Vitrectomy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitrectomy Machines, Vitrectomy Packs, Photocoagulation Lasers), By Application (Diabetic Retinopathy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-641-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitrectomy Devices Market Summary

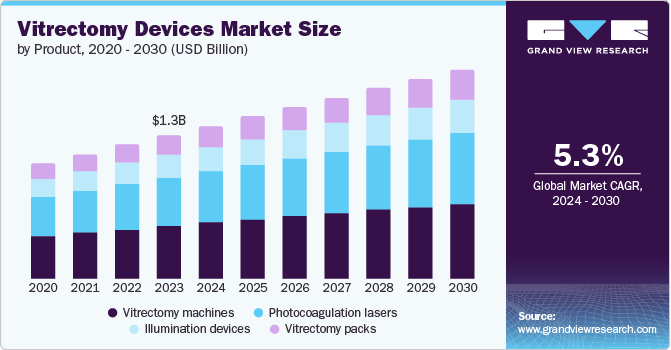

The global vitrectomy devices market size was valued at USD 1.28 billion in 2023 and is projected to reach USD 1.87 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The increasing prevalence of retinal diseases and their root causes are expected to drive growth for the market in the forecast period.

Key Market Trends & Insights

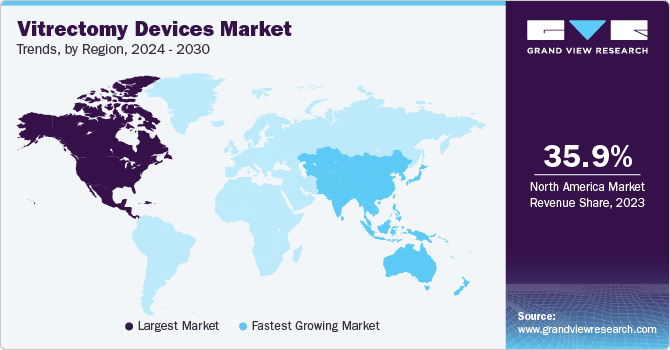

- North America vitrectomy devices market dominated the global industry in 2023 with a share of 35.9%.

- The vitrectomy devices market in the U.S. is expected to experience a significant CAGR from 2024 to 2030.

- Based on product, the vitrectomy packs segment is expected to grow at a CAGR of 6.1%.

- Based on application, the retinal detachment segment to witness a rapid growth rate of 6.0%.

- Based on end use, the ambulatory surgical centers segment to witness fastest growth of 5.8%.

Market Size & Forecast

- 2023 Market Size: USD 1.28 Billion

- 2030 Projected Market Size: USD 1.87 Billion

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Diabetes has been affecting eye health by damaging the blood vessels in the retina, resulting in vision impairment. Increasing numbers of new cases of diabetes are also anticipated to influence the market in the coming years. Vitrectomy devices are essential tools used in eye surgery to address various conditions. Surgeons use them to remove vitreous gel during vitrectomy procedures. Vitrectomy is employed for conditions like retinal detachment, macular hole, and diabetic retinopathy. The availability of more compact and portable devices, adding the ease of use factor of surgical procedures, is helping the market generate greater demand.

Advancements in vitrectomy techniques, such as smaller gauge instruments, enhanced vitrectomy machine fluidics, improved wide-angle viewing systems, and specially designed microsurgical instruments, are also expected to grow this market significantly during the forecast period. Innovation backed by intensive research and development is increasingly adopted into product development by key companies, which has also fueled the industry's growth in recent years.

Product Insights & Trends

“The vitrectomy packs segment is expected to grow at a CAGR of 6.1%”

The vitrectomy machines segment dominated the market and held the largest revenue share of 37.0% in 2023. The segment’s growth is driven by the emergence of next-generation machines equipped with enhanced features, including improved fluidics, higher cut rates, and intraocular pressure management.

The vitrectomy packs segment is expected to grow fastest from 2024 to 2030. The growing adoption of vitrectomy packs across diverse indications, including vitreous removal, epiretinal membrane removal, collective retinal surgeries, and posterior vitreous detachment, contributes to this trend. Furthermore, the added advantages of portability, optical magnification, and enhanced sensitivity associated with vitrectomy packs are anticipated to drive market growth.

Application Insights & Trends

“The retinal detachment segment to witness a rapid growth rate of 6.0%”

The macular hole segment dominated the market and is expected to maintain its dominance over the forecast period. A macular hole is an ailment that affects the retina's center, i.e., the macula. When a macular hole impacts vision, vitrectomy is one of the most common solutions, as it directly addresses the underlying issue. While some macular holes may heal spontaneously, many necessitate vitrectomy surgery to enhance vision. Factors such as high myopia, eye injuries, and retinal detachment can also contribute to macular hole formation. Consequently, the rising prevalence of these conditions is anticipated to drive growth in this segment.

The retinal detachment segment is expected to experience the fastest growth during the forecast period 2024 to 2030. Retinal detachment predominantly occurs in individuals with high myopia and can lead to permanent loss of vision. Therefore, the rising prevalence of high myopia, resulting in a greater number of vitrectomy surgeries, is projected to positively influence this segment.

End Use Insights & Trends

“The ambulatory surgical centers segment to witness fastest growth of 5.8%”

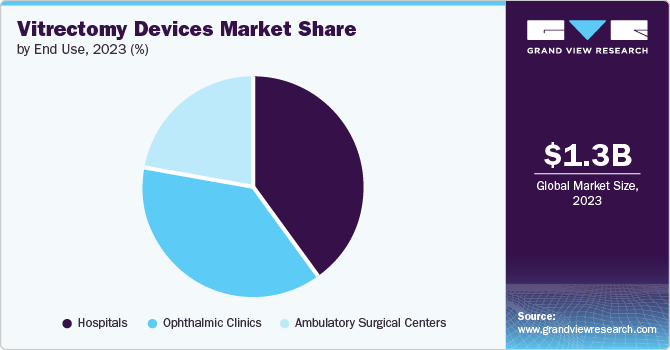

The hospital segment dominated the market and held the largest revenue share in 2023. It is attributed to the increased number of vitrectomy surgeries in these facilities. Numerous hospitals now provide ophthalmic care, including vitrectomy procedures. The presence of necessary infrastructure, trained professionals, advanced equipment empowered with uninterrupted energy supply, and availability of other practitioners in case of emergencies add benefits to the setting. This has been developing lucrative growth for this segment in recent years.

The Ambulatory surgical centers (ASCs) segment is projected to grow over the forecast period. The increasing prevalence of ocular disorders is fueling growth in this segment. Patients and professionals have preferred ambulatory surgeries over the last few years. According to The Ambulatory Surgery Center Association (ASCA), nearly 6200 Medicare-certified ambulatory surgical centers were operating across the U.S. in 2022, with 468 and 458 in Florida and Texas, respectively. Regarding a single specialty, ophthalmology had 755 ASCs operating in the country. Patients are inclined towards ASCs, as these facilities are known for providing multiple benefits, including cost savings.

Regional Insights & Trends

“Mexico to witness fastest market growth of CAGR 6.5%”

North America vitrectomy devices market dominated the global industry in 2023 with a share of 35.9%. The increasing incidence of ophthalmic ailments like diabetic retinopathy, macular holes, and retinal detachment is driving market growth in the region. Furthermore, key market players in the region fuel this trend. These companies secure U.S. FDA clearance for their products, ensuring their competitive position and compliance in the market.

U.S. Vitrectomy Devices Market Trends

The vitrectomy devices market in the U.S. is expected to experience a significant CAGR from 2024 to 2030. This market is primarily driven by the crucial increase in the country's geriatric population. According to the United States Census Bureau, 1 in 6 individuals in the U.S. were 65 and older during the 2020 census. It has a vital role in increasing demand for the vitrectomy devices market. According to the U.S. Centers for Disease Control and Prevention, the leading cause behind blindness in American adults was identified as Diabetic retinopathy (DR).

Asia Pacific Vitrectomy Devices Market Trends

The Asia Pacific vitrectomy devices market is expected to grow fastest during the forecast period. Large geriatric populations in countries such as China and India, the growing reach of enhanced healthcare infrastructure and facilities, and the substantial number of patients seeking ophthalmic care are likely to boost the demand for vitrectomy devices. An increasing number of healthcare initiatives by government and non-profit organizations in the region are also expected to contribute to the growth of this industry.

India vitrectomy devices market is a key country-based market in the regional industry. This is attributed to the country's unceasing growth in retinal detachment and diabetic retinopathy cases. According to the World Health Organization (WHO), approximately 77 million adults over the age of 18 are estimated to suffer from diabetes (type 2) in India.

Europe Vitrectomy Devices Market Trends

Europe vitrectomy devices market is poised for substantial growth during the forecast period. This can be attributed to several factors, including the high prevalence of eye diseases, surging demand for technologically advanced products, and increased research and development (R&D) investments in innovative solutions. The presence of key companies in the region also contributes to the growth. Some prominent regional organizations are Carl Zeiss, Alcon, NIDEK, Bausch Health, and Danaher.

The vitrectomy market in Germany is expected to dominate the regional industry in the upcoming years. This is primarily due to growing awareness of diseases such as diabetic retinopathy, the availability and easy accessibility of vitrectomy devices, the presence of key companies, and enhanced healthcare infrastructure coupled with expert professionals.

Key Vitrectomy Devices Company Insights

Some of the key companies in the vitrectomy devices market are Alcon Inc., Bausch + Lomb., Carl Zeiss Meditec AG, BVI and Johnson & Johnson Vision Care, Inc. Owing to the rising level of competition and increasing demand, companies in the industry are experimenting with strategies such as significant investment in research and development, forming collaborations and partnerships, fostering innovation, and introducing new products.

-

Bausch + Lomb offers a variety of eye care products, such as contact lenses, lens care products, pharmaceuticals, and intraocular lenses. The company also offers Vitesse, a hypersonic vitrectomy system equipped with advanced technology for vitreous removal.

-

Alcon is a global company in the eye care industry that engages in complementary businesses in surgical and vision care markets across several countries. The company is applauded across the industry for its CONSTELLATION vision system.

Key Vitrectomy Devices Companies:

The following are the leading companies in the vitrectomy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon Inc.

- Bausch + Lomb.

- BVI

- NIDEK CO., LTD.

- Johnson & Johnson Vision Care, Inc.

- Blink Medical

- Topcon Corporation

- Carl Zeiss Meditec AG

- HOYA Medical Singapore Pte. Ltd

Recent Developments

-

In April 2024, Carl Zeiss Meditec AG, a prominent market participant in the ophthalmic medical devices industry, acquired the Dutch Ophthalmic Research Center (D.O.R.C.). This strategic move is expected to enhance Zeiss's digital workflow solutions portfolio in the coming years.

Vitrectomy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.37 billion

Revenue forecast in 2030

USD 1.87 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2018 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Alcon Inc.; Bausch + Lomb; BVI; NIDEK CO., LTD.; Johnson & Johnson Vision Care, Inc.; Blink Medical; Topcon Corporation; Hoya Surgical Optics; Carl Zeiss Meditec AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitrectomy Devices Market Report Segmentation

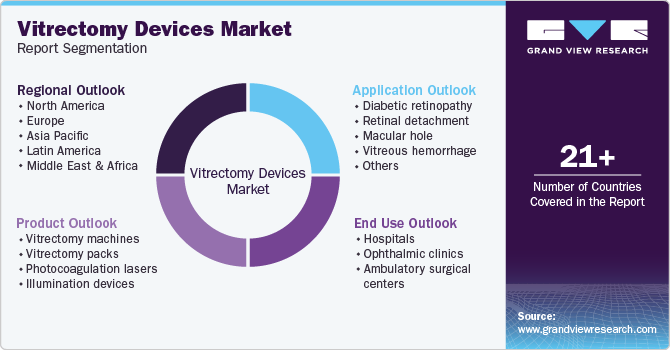

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global vitrectomy devices market based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitrectomy machines

-

Vitrectomy packs

-

Photocoagulation lasers

-

Illumination devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetic retinopathy

-

Retinal detachment

-

Macular hole

-

Vitreous hemorrhage

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic clinics

-

Ambulatory surgical centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.