- Home

- »

- Biotechnology

- »

-

Vitrification Market Size, Share And Growth Report, 2030GVR Report cover

![Vitrification Market Size, Share & Trends Report]()

Vitrification Market (2025 - 2030) Size, Share & Trends Analysis Report, By Specimen (Oocytes, Embryo, Sperm), By End Use (IVF Clinics, Biobanks), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-995-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitrification Market Size & Trends

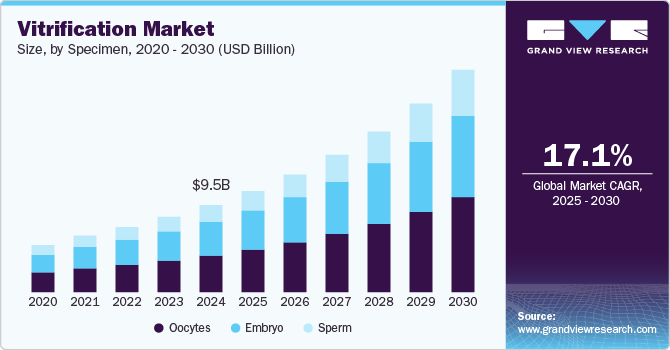

The global vitrification market size was estimated at USD 9.49 billion in 2024 and is projected to grow at a CAGR of 17.09% from 2025 to 2030. Factors such as the rising demand for Assisted Reproduction Technologies (ARTs), growing awareness about reproductive health, and an increasing number of service providers offering vitrification services are expected to fuel the global market.

Vitrification has become a more advanced cryopreservation method than traditional slow-freezing techniques due to its superior outcomes. The technique provides higher reliability and improved yield, which makes it a preferred option for most IVF clinics today. These advantages, coupled with its cost-effectiveness and efficiency in preserving reproductive cells, embryos, and tissues, drive its increased adoption in fertility clinics and reproductive health services globally.

According to the World Health Organization (WHO), infertility impacts a significant portion of the global population. Around 17.5% of adults, or approximately 1 in 6 people worldwide, experience infertility during their lifetime. This highlights the pressing need for accessible, affordable, and high-quality fertility care for those affected by this condition, as infertility can have profound social, psychological, and economic impacts on individuals and families across the world.

Infertility has become more common as cancer incidence has increased. People with a higher risk of getting cancer are encouraged to seek egg preservation treatments for future usage, taking oncological mutations into account. This is due to the fact that cancer therapy medicines might impair fertility momentarily or permanently. To maximize the odds of future fertility, cancer therapists/oncologists recommend fertility preservation before beginning treatments such as radiation therapy, chemotherapy, or surgery, encouraging the use of vitrification products and services.

As awareness about fertility issues increases, more individuals and couples are turning to Artificial Reproductive Technologies (ART) solutions. This is further supported by the normalization and reduced stigma around infertility treatments in many societies. ARTs, such as IVF, have been proven successful, boosting the confidence & number of people seeking fertility preservation. According to the CDC, approximately 1.9% of all U.S. infants are born using ART. Thus, IVF and other ARTs complement the growth of the overall fertility preservation market.

Moreover, delaying parenthood is primarily coupled with sociodemographic aspects, including career/education goals, the rising influence of women’s empowerment movements, lack of a partner, and financial barriers. Several studies have reported a lack of a suitable partner as the most common reason for not having a child till 30 to 40 years. In addition, as per a CDC report, the average age of U.S. women having their first child has increased over previous decades. Moreover, a CDC report titled National Health Statistics Report, published in January 2023, showed that the average age at first birth for women and men aged between 15 and 44 years in 2015-2019 was 23.7 & 26.4, respectively, which was higher than the average age at first birth for women and men in 2011-2015. In addition, the average age at first birth was found to be highest for non-Hispanic Asian females, which was 28.4. This has increased the demand to preserve oocytes and sperm to address infertility issues at older age.

The COVID-19 pandemic had a significant negative impact on the market in 2020. IVF and vitrification demand dropped sharply as nonessential and elective medical procedures were closed or postponed. Lockdowns, social distancing measures, and the early uncertainty around the virus forced many to delay treatments. In the UK, fertility treatments such as Donor Insemination (DI) and IVF treatments saw a 20% decline between 2019 and 2020, as reported by the Human Fertilization & Embryology Authority. In addition, on April 15, 2020, the UK suspended fertility treatments and other elective medical procedures to prioritize COVID-19 healthcare responses.

Specimen Insights

Based on specimen, the oocyte segment led the market with the largest revenue share of 42.09% in 2024. Vitrification of oocytes in egg banks is an effective technique in ART. The method's efficacy has been proven by increased oocyte survival rates and pregnancies, along with increased live births. Such advancements in oocyte vitrification techniques are anticipated to drive the market growth. Moreover, the large revenue share of the segment is owing to the rising awareness among people for oocyte preservation and supportive government legislation. In recent years, governments have made oocyte preservation a legal practice.

The sperm segment is expected to witness at the fastest CAGR from 2025 to 2030. Recent advancements in sperm vitrification devices have significantly enhanced the effectiveness, efficiency, and outcomes of fertility preservation, particularly in assisted reproductive technologies (ARTs). For instance, microfluidic devices optimize the sperm vitrification process by improving the handling and control of sperm cells, ensuring minimal exposure to cryoprotectants, and reducing the chances of cryo-injuries. Moreover, automation has allowed for more consistent and standardized sperm vitrification procedures, minimizing human error and improving the reproducibility of results. Automated devices also optimize freezing rates and reduce sperm damage during the cooling process.

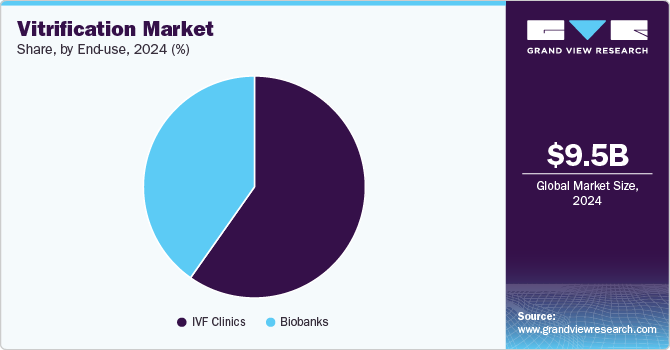

End Use Insights

Based on end use, the IVF clinicssegment led the market with the largest revenue share of 59.76% in 2024. The large share of the segment is driven by the rising number of IVF clinics offering vitrification and other ART services. In addition, clinics are offering services like sperm, egg, and oocyte storage, which is projected to propel clinic revenue share.Moreover, players are undertaking various strategies, such as acquisitions, partnerships, and expansions, to strengthen their presence in the market. For instance, in June 2023, Nova IVF acquired a Wings IVF company that offers egg freezing and IVF services. This acquisition is expected to expand Nova IVF's portfolio in egg freezing and fertility services.

The biobanks segment is expected to experience at the fastest CAGR during the forecast period, driven by advancements in vitrification techniques. This shift from traditional slow freezing to vitrification for preserving biological samples like eggs, embryos, and sperm has greatly expanded the scope of cryobanking. The growing number of biobanks has facilitated easier access to egg donation services by maintaining extensive donor databases, allowing individuals to make more informed decisions when pursuing IVF treatments with donor eggs. As a result, the share of biobanks in the market is projected to increase significantly.

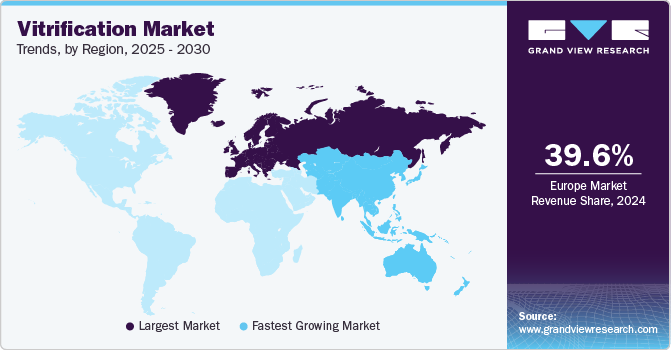

Regional Insights

The North America vitrification market held a significant share, and its growth can be attributed to factors such as increasing demand for assisted reproductive technologies, supportive government legislation for Assisted Reproductive Technology (ART) tools, and the presence of a large number of providers of vitrification products & services. Moreover, growing awareness and social acceptance of fertility treatments in this region have significantly fueled market growth in the region.

U.S. Vitrification Market Trends

The vitrification market in U.S. is anticipated to grow at the fastest CAGR during the forecast period. The number of women freezing their eggs is constantly increasing in the U.S. Moreover, there is a substantial number of fertility clinics in the country, totaling around 500 fertility clinics. These factors are anticipated to significantly boost the use of vitrification in the U.S.

Europe Vitrification Market Trends

Europe vitrification market dominated the largest revenue share of 39.63% in 2024, due to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost cryopreservation modalities in the region. Moreover, the market growth can be attributed to a growing biotechnology industry and rising investments in developing assisted reproduction technologies in countries such as the UK & Germany.

The regional market is driven by the high burden of infertility and the growing demand for egg preservation among women. Moreover, supportive government legislation for ART and various strategic initiatives undertaken by market players are further projected to drive regional market growth.

The vitrification market in the UK held a significant share in Europe in 2024. This is attributed to the increasing number of fertility treatments via fertility clinics in the country. In addition, strengthening of distribution networks of vitrification manufacturers and suppliers in the country is expected to propel the market growth

The French vitrification market is expected to grow at a significant CAGR over the forecast period. The presence of a substantial number of clinics, such as the American Hospital of Paris, which offers bio-specimen preservation services, is expected to increase the use of vitrification techniques by clinics in the country.

The vitrification market in Germany is anticipated to grow at a significant CAGR over the forecast period. Over the years, the number of IVF cycles recorded in Germany has increased significantly. This trend shows the increased use of fertility treatments in the country, which is expected to boost the use of vitrification techniques for egg, embryo, and sperm preservation in the country.

Asia Pacific Vitrification Market Trends

The vitrification market in Asia Pacific is expected to experience at the fastest CAGR of 19.86% from 2025 to 2030 The rising awareness and initiation of legal discussions on whether to legalize egg freezing for unmarried women in countries such as China are anticipated to increase the adoption of vitrification techniques in the coming few years in the Asia Pacific region. Furthermore, the growing number of companies in Asia Pacific, such as Kitazato, Shenzhen VitaVitro Biotech, Cryologic, and Cryotech Lab, which offer vitrification devices, vitrification kits, & consumables, is an indicator of market growth in this region.

The China vitrification market is expected to grow at a significant CAGR over the forecast period. The increasing focus of Chinese citizens on IVF indicates the growth of the country's market. In addition, the companies offering IVF and fertility services, including vitrification, are anticipated to grow lucratively in the region.

The vitrification market in Japan is expected to grow at a rapid CAGR over the forecast period. Japan's government is undertaking focused efforts to overcome the country's declining birth rate through initiatives such as financially helping women to freeze their eggs. For instance, in March 2023, the Tokyo Metropolitan Government announced an expected launch of a subsidy for healthy women to assist in covering the expenses of freezing their eggs. Such initiatives are anticipated to increase the competition in the market by promoting vitrification techniques to freeze their eggs.

Middle East & Africa Vitrification Market Trends

The vitrification market in Middle East & Africais expected to grow at a moderate CAGR over the forecast period. Currently, there are religious legislations such as egg preservation should only be used by married women, and only the husband’s sperm should be used for fertilization in countries such as Egypt, Jordan, & Tunisia. In countries like Jordan and Algeria, egg preservation is only allowed for married women. Only in Tunisia and Lebanon, egg freezing is allowed for all women. In the UAE, women can freeze their eggs for medical reasons only. The above factors have led to the slow adoption of vitrification techniques in the Middle East.

The Saudi Arabia vitrification market is expected to grow at the fastest CAGR over the forecast period. Infertility in Saudi Arabia has become a major concern as the condition affects around 10%-15% of couples in the country, thereby creating a high demand for ARTs in the country.

The vitrification market in Kuwait is anticipated to grow at a moderate CAGR over the forecast period. This is attributed to rising healthcare expenditure aimed at improving healthcare infrastructure services and the adoption of new technologies.

Key Vitrification Company Insights

The players operating in the global market are adopting product approval to increase the reach of their products in the market and improve their availability in diverse geographical areas, along with expansion to enhance adoption. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Vitrification Companies:

The following are the leading companies in the vitrification market. These companies collectively hold the largest market share and dictate industry trends.

- Vitrolife

- Genea Biomedx

- NidaCon International AB

- Minitube

- IMV TECHNOLOGIES GROUP (Cryo Bio System)

- The Cooper Companies, Inc. (A CooperSurgical Fertility Company)

- FUJIFILM Corporation (FUJIFILM Irvine Scientific)

- Biotech, Inc.

- Kitazato Corporation

- Shenzhen VitaVitro Biotech

Recent Development

-

In July 2024, Legacy introduced an upgraded version of its pioneering at-home sperm testing and freezing kit. This new version offers enhanced accuracy, security, and user-friendly features, further refining Legacy’s innovative service, which allows men to conveniently test and preserve their fertility from home. The updated kit takes Legacy’s fertility preservation service to a higher level by improving the overall experience, making the process even more accessible and reliable for users

-

In February 2024, Kitazato Corporation partnered strategically with IVF2.0 to integrate AI-driven solutions for improved sperm selection and embryo ranking in IVF procedures

-

In November 2023, CooperCompanies expanded its fertility and women's health product portfolio by acquiring select Cook Medical assets

-

In June 2023, Fairtility launched the new Oocyte Quality Insights capability ‘CHLOE OQ’. This launch encouraged patients and embryologists with oocyte quality insights for egg donation, egg freezing, and IVF applications

Vitrification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.02 billion

Revenue forecast in 2030

USD 24.25 billion

Growth rate

CAGR of 17.09% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specimen, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Vitrolife; Genea Biomedx; NidaCon International AB; Minitube; IMV TECHNOLOGIES GROUP (Cryo Bio System); The Cooper Companies, Inc. (A CooperSurgical Fertility Company); FUJIFILM Corporation (FUJIFILM Irvine Scientific); Biotech, Inc.; Kitazato Corporation; Shenzhen VitaVitro Biotech.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

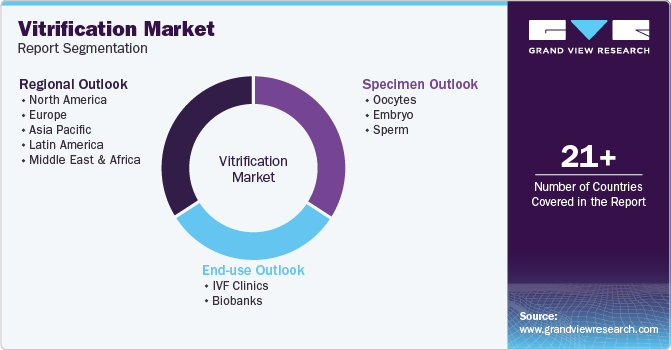

Global Vitrification Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global vitrification market report based on specimen, end use, and region:

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Oocytes

-

Kits & Consumables

-

Embryo

-

-

Devices

-

Kits & Consumables

-

Devices

-

-

Sperm

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IVF Clinics

-

Biobanks

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vitrification market size was estimated at USD 9.49 billion in 2024 and is expected to reach USD 11.02 billion in 2025.

b. The global vitrification market is expected to witness a compound annual growth rate of 17.09% from 2023 to 2030 to reach USD 24.25 billion by 2030.

b. The oocyte segment held the largest market share in 2024. Vitrification of oocytes in egg banks is an effective technique in ART. The method's efficacy has been proven by increased oocyte survival rates and pregnancies, along with increased live births. Such advancements in oocyte vitrification techniques are anticipated to drive the market.

b. Some key players in the vitrification market are Vitrolife, Genea Biomedx, NidaCon International AB, Minitube, IMV TECHNOLOGIES GROUP (Cryo Bio System), The Cooper Companies, Inc. (A CooperSurgical Fertility Company), FUJIFILM Corporation (FUJIFILM Irvine Scientific), Biotech, Inc., Kitazato Corporation, Shenzhen VitaVitro Biotech.

b. Factors such as the rising demand for Assisted Reproduction Technologies (ARTs), growing awareness about reproductive health, and an increasing number of service providers offering vitrification services are expected to fuel the global vitrification market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.