- Home

- »

- Medical Devices

- »

-

Assisted Reproductive Technology Market Size Report, 2030GVR Report cover

![Assisted Reproductive Technology Market Size, Share & Trends Report]()

Assisted Reproductive Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (IVF, Artificial Insemination), By End-use (Fertility Clinics & Other Facilities, Hospitals & Other Settings), By Region, And Segment Forecasts

- Report ID: 978-1-68038-494-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Assisted Reproductive Technology Market Summary

The global assisted reproductive technology market size was estimated at USD 27.59 billion in 2023 and is projected to reach USD 41.41 billion by 2030, growing at a CAGR of 6% from 2024 to 2030. Factors, such as the rising cases of infertility, improving ART success rates, and increasing disposable income in developing countries, are expected to drive industry growth during the forecast period.

Key Market Trends & Insights

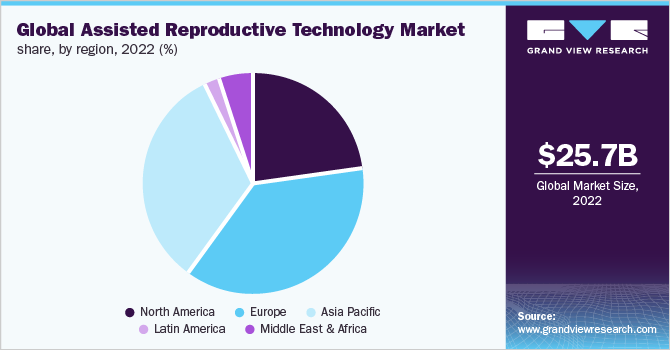

- Europe dominated the industry in 2022 and accounted for the largest revenue share of more than 36.98%.

- North America is expected to witness significant growth during the forecast period.

- By type, the IVF segment accounted for the maximum share of 91.90% of the global revenue in 2022.

- By end-use, the fertility clinics & other facilities end-use segment dominated with largest share of more than 79.93% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 27.59 Billion

- 2030 Projected Market Size: USD 41.41 Billion

- CAGR (2024-2030): 6%

- Europe: Largest market in 2022

According to the World Health Organization Statistics 2020, approximately around 186 million people face problems related to infertility globally. The increasing prevalence of infertility can be attributed to several factors including owing to Sexually Transmitted Infections (STIs), an increasing number of cigarette smokers, cases of obesity, endometriosis, Polycystic Ovary Syndrome (PCOS), Primary Ovary Insufficiency (POC), and others.

The growing acceptance of ART in society due to the adoption of more advanced technologies, such as Pre-implantation Genetic Testing (PGT), Endometrial Receptivity Analysis Testing (ERA), Magnetic Activated Cell Sorting (MACS), and time-lapse imaging of embryos, is expected to drive the demand for ART procedures. For instance, according to the Centers for Disease Control and Prevention (CDC’s) 2019 Fertility Clinic Success Rates Report, approximately 330,773 ART procedures were conducted at 448 fertility clinics in the U.S., accounting for 77,998 live births and 83,946 live-born infants. Moreover, rising awareness about the causes and treatment of infertility is expected to propel the growth of the industry.

Various organizations, such as the American Society for Reproductive Medicine and the Society for Assisted Reproductive Technology (SART), are working together to increaseawareness about infertility treatment options. Furthermore, several innovative types of research are undergoing in the field of culture media for ART. For instance, CooperSurgicals found that culture media with Granulocyte-macrophage Colony-Stimulating Factor (GM-CSF) contains essential nutrients required for embryo development and further enhance the transmission between the embryo and the endometrium, developing the essential environment for the pregnancy.

COVID-19 Assisted Reproductive Technology Market Impact: 54% Growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The pandemic negatively impacted the industry owing to the ceased operations and subsequent reduction in patient care volumes. For instance, according to the study based on assisted reproductive technology from Sympathy Health data, which includes data of 280 million U.S. individuals, a significant drop in ART procedures was reported in March-April 2020 compared to 2019 due to the fear of COVID-19 infection

The industry has quickly recovered and reclaimed the pre-pandemic numbers due to the resumption of consultation and treatment by the American Society for Reproductive Medicine, the European Society of Human Reproduction and Embryology (ESHRE), and the International Federation of Fertility Societies

The governments adopted different strategies to avoid the rapid spread of the infection. Some of the steps taken included halting fertility treatments, such as ovulation induction, artificial insemination, In Vitro Fertilization (IVF), cancellation of all embryo transfers, and non-urgent gamete cryopreservation

Technological advancement and telehealth adoption in the field of ART is expected to boost the industry growth post-pandemic. The adoption of telehealth in ART services is still in its infancy stage. Still, it has enormous potential in the future owing to advantages, such as remote monitoring and continuous management

Technological advancement, new product launches, and strategic mergers & acquisitions by key players are expected to foster industry growth during the forecast period. For instance, in December 2021, CooperCompanies completed the acquisition of Generate Life Sciences. Generate Life Sciences is the global supplier of the donor egg and sperm for fertility treatments. The transaction was worth USD 1.6 billion and is expected to aid CooperCompanies in its fertility offerings.

Type Insights

Based on the type, the industry has been segmented into IVF and artificial insemination. The IVF segment accounted for the maximum share of 91.90% of the global revenue in 2022. By IVF, the industry is further segmented into fresh donor, frozen donor, fresh non-donor, and frozen non-donor. The frozen non-donor segment held a significant revenue share in 2021. The growth can be attributed to the benefits associated with frozen non-donor over other IVF procedures. The frozen non-donor procedure is used when the woman is releasing healthy eggs and undergoing ART due to male infertility or fallopian tube malformation.

The number of IVF cycles with the aid of frozen non-donor procedures is rising as compared to the other procedures. For instance, as per the 2019 Assisted Reproductive Technology Fertility Clinic & National Summary Report, around 126,187 ART cycles were performed using frozen non-donor (frozen patient’s eggs or embryos), which is much higher than the 28,425 ART procedures using frozen non-donor in 2010. Artificial insemination is anticipated to witness highest growth with a CAGR of 8.58% during the forecast period. The segment is further divided into intrauterine insemination, intracervical insemination, intravaginal insemination, and intratubal insemination.

Artificial insemination is intended for minor fertility conditions and is usually done for same-sex couples or single women. The success rate for artificial insemination varies with the age. As per the Human Fertilization and Embryology Authority (HFEA), success rates for artificial insemination per individual cycle is around 15.8% for women aged below 35 years, 11% for females aged 35 to 39 years, and 4.7% for females aged 40 to 42 years. In addition, more than 50% of the females undergoing intrauterine insemination conceive a child over the first 6 cycles.

End-use Insights

On the basis of end-uses, the global industry has been further bifurcated into fertility clinics & other facilities and hospitals & other settings. The fertility clinics & other facilities end-use segment dominated the global industry in 2022 and accounted for the largest share of more than 79.93% of the overall revenue. The segment is projected to expand further at the fastest growth rate retaining its leading industry position throughout the forecast period. The high share and rapid growth can be attributed to a rise in the number of infertility cases and the need for a specialized place to perform ART.

For instance, in May 2021, Gulf Capitals ART Fertility Clinics, which is based in West Asia, intended to invest USD 31.3 million in building 18 clinics in major Indian cities by 2023. In addition, cost-effectiveness, specialization, expertise in the area, and customized treatment are the factors that are anticipated to propel the segment growth during the forecast period. The hospitals and other settings end-use segment is expected to witness lucrative growth in the low- and middle-income countries owing to insufficient infrastructure for setting up fertility clinics; hence, multispecialty hospitals have become the most accessible option for the treatment of infertility.

Regional Insights

Europe dominated the industry in 2022 and accounted for the largest revenue share of more than 36.98%. The high share is attributed to a rise in the infertility rate, increased awareness about fertility treatments, technological advancements, and supportive government initiatives. For instance, according to the European Society of Human Reproduction and Embryology, approximately 25 million of the European Union Population are suffering from infertility, which is the highest globally. North America is expected to witness significant growth during the forecast period. The growth is attributed to the positive outcomes seen by patients undergoing the treatment.

According to the CDC, 2.1% of infants are born in the U.S. with the aid of ART; among them, 5.5% of infants are born in Massachusetts, which is the highest, then 5.0% in the district of Columbia, and 4.4% in New Jersey. Technological advancements and increasing research for ART are expected to boost the growth of the market in Asia Pacific. As per the article published in Reproductive Medicine and Biology Journal, in 2019, around 458,101 ART cycles were performed in Japan with around 60,598 neonate births. There were around 624 registered facilities for ART in Japan and 598 facilities reported some form of ART treatment in 2019.

Key Companies & Market Share Insights

Key players are adopting various strategies, such as product launches, investment in R&D, and the expansion of product portfolios, to gain a higher industry share.For instance, in January 2021, CooperSurgical acquired Embryo Options, a prominent player in cryo-storage software solutions for fertility clinics. Embryo Options platform will aid the patients by giving access to its online resources to provide knowledge about stored specimens for future ART treatment cycles.For instance, in July 2021, Hamilton Throne Ltd., a global provider of ART research acquired IVFTECH ApS (IVFtech) and its associated firm, K4 Technology ApS. IVFtech is dedicated to providing laminar flow workstations and huge-capacity incubators for the ART with the aid of its associated firm, K4. The transaction was worth USD 8 million. Some of the prominent players in the global assisted reproductive technology market include:

-

Cosmos Biomedical Ltd.

-

Microm U.K. Ltd.

-

CooperSurgical, Inc.

-

FUJIFILM Irvine Scientific

-

Cryolab Ltd.

-

Vitrolife AB

-

European Sperm Bank

-

Bloom IVF Centre

-

Merck KGaA

-

Ferring B.V.

Assisted Reproductive Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.50 billion

Revenue forecast in 2030

USD 41.41 billion

Growth rate

CAGR of 6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; Australia, South Korea, Mexico; Brazil; Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Cosmos Biomedical; Microm U.K. Ltd.; Origio (CooperSurgical); Irvine Scientific; Cryolab Ltd.; Parallabs; European Sperm Bank; Bloom IVF Centre

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

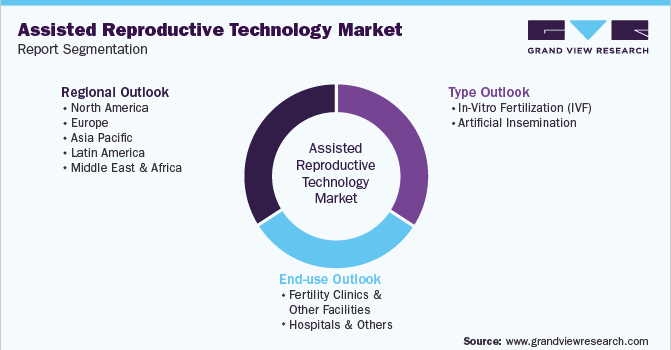

Global Assisted Reproductive Technology Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global assisted reproductive technology market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-Vitro Fertilization (IVF)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-Donor

-

Frozen Non-Donor

-

-

Artificial Insemination

-

Intrauterine Insemination

-

Intracervical Insemination

-

Intravaginal Insemination

-

Intratubal Insemination

-

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Fertility clinics & other facilities

-

Hospitals &Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global assisted reproductive technology market is expected to grow at a compound annual growth rate of 5.97% from 2023 to 2030 to reach USD 41.4 billion by 2030.

b. In-vitro fertilization dominated the assisted reproductive technology market in 2022. This is attributable to favorable reimbursement policies and the introduction of new technology.

b. Some key players operating in the assisted reproductive technology market include California Cryobank, Bloom IVF Centre, Parallabs, OvaScience, Anecova, Origio, Microm Ltd., Merck KGaA, Cooper Surgical, Inc, Ferring Pharmaceuticals, Irvine Scientific and Hamilton Throne Ltd.

b. Key factors that are driving the market growth include the increasing number of infertility cases due to obesity, growing stress, and pollution, increasing number of smokers, fertility threatening treatments such as chemotherapy, and favorable regulatory framework.

b. The global assisted reproductive technology market size was estimated at USD 25.7 billion in 2022 and is expected to reach USD 27.6 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.