- Home

- »

- Pharmaceuticals

- »

-

Vyvgart (Efgartigimod) Market Size, Industry Report, 2030GVR Report cover

![Vyvgart (Efgartigimod) Market Size, Share & Trends Report]()

Vyvgart (Efgartigimod) Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (Generalized Myasthenia Gravis (gMG), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)), By Route of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-618-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vyvgart (Efgartigimod) Market Summary

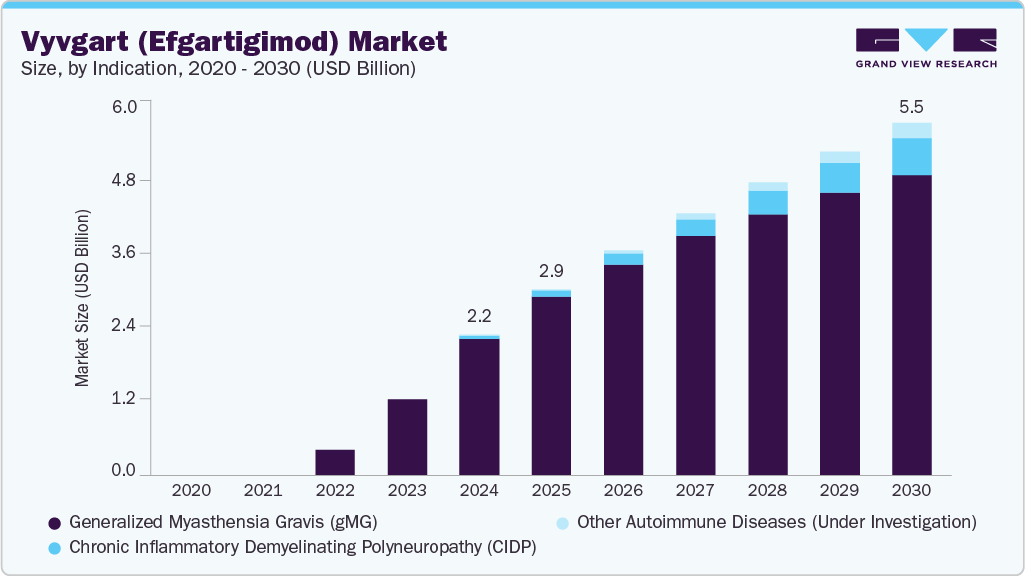

The global Vyvgart (Efgartigimod) market size was estimated at USD 2.19 billion in 2024 and is projected to reach USD 5.50 billion by 2030, growing at a CAGR of 13.6% from 2025 to 2030. The market is experiencing significant growth, driven by several key factors.

Key Market Trends & Insights

- North America Vyvgart market leads the global market and accounting for the largest share of 89.52% in 2024

- By indication, the generalized myasthenia gravis (gMG) segment dominated the vyvgart (Efgartigimod) market with the largest revenue share of 97.70% in 2024.

- By indication, the chronic inflammatory demyelinating polyneuropathy (CIDP) segment is projected to grow at a rapid pace over the forecast period

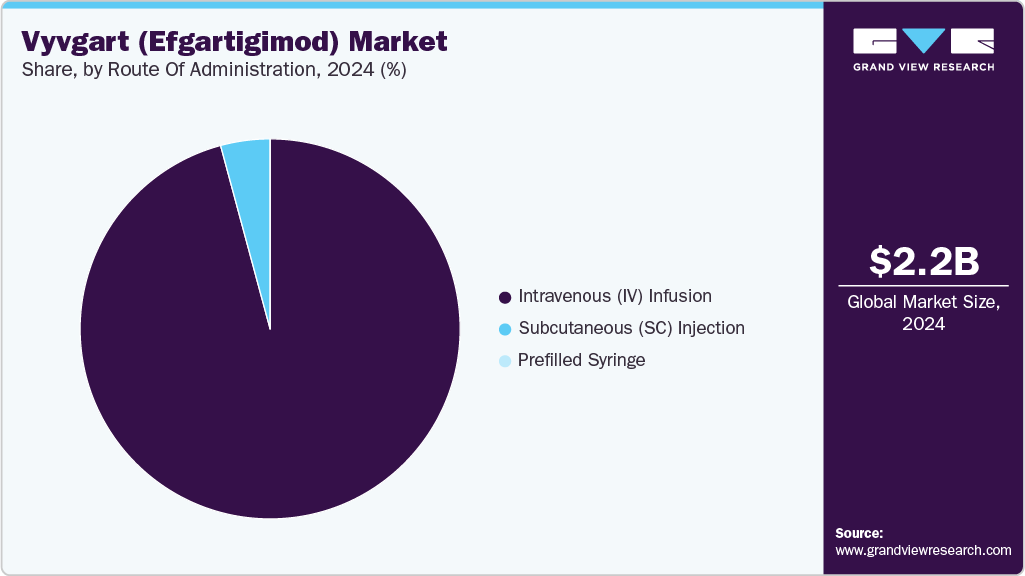

- By route of administration, the intravenous (IV) Infusion segment dominated the vyvgart (efgartigimod) market with the largest revenue share of 95.80% in 2024.

- By route of administration, the prefilled syringe segment is projected to register the fastest growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.19 Billion

- 2030 Projected Market Size: USD 5.50 Billion

- CAGR (2025-2030): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing prevalence of autoimmune diseases, such as generalized myasthenia gravis (gMG), has heightened demand for effective treatments. Vyvgart's approval in over 30 countries, including the U.S., Japan, and Europe, for multiple indications like gMG, chronic inflammatory demyelinating polyneuropathy (CIDP), and primary immune thrombocytopenia (ITP), has expanded its global reach. The introduction of a prefilled syringe formulation enhances patient convenience by enabling at-home self-administration, potentially improving adherence and broadening its patient base. These factors collectively contribute to Vyvgart's robust market performance and ongoing expansion.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) is a rare neurological disorder that can affect individuals of any age, with onset possible in any decade of life. According to the National Organization for Rare Disorders, CIDP occurs more frequently in males, with a male-to-female ratio of approximately 2:1, and the average age of onset is around 50 years. The condition has a prevalence of approximately 5-7 cases per 100,000 individuals. This consistent demographic distribution and identifiable patient population support targeted diagnosis and treatment strategies. The availability of Vyvgart (efgartigimod), with its favorable efficacy and administration options, positions it as a promising therapeutic solution. Its approval for CIDP and suitability for middle-aged and older adult populations may drive higher adoption rates, especially among neurologists seeking effective, patient-friendly autoimmune treatments.In November 2024, Zai Lab and argenx announced that China's National Medical Products Administration (NMPA) approved the supplemental Biologics License Application (sBLA) for VYVGART Hytrulo (efgartigimod alfa injection) for the treatment of adult patients with chronic inflammatory demyelinating polyneuropathy (CIDP). This approval marks the first and only NMPA-approved therapy for CIDP in China, providing a new treatment option for approximately 50,000 diagnosed patients in the country. VYVGART Hytrulo is administered as a once-weekly 30-to-90 second subcutaneous injection. The approval was supported by positive results from the ADHERE study, which demonstrated a 69% reduction in the risk of relapse and a 78% rate of clinical improvement among Chinese participants.

Moreover, technological advancements have significantly propelled the growth of the Vyvgart (efgartigimod) market, enhancing both patient experience and treatment accessibility. A notable innovation is the development of subcutaneous (SC) formulations utilizing Halozyme’s ENHANZE drug delivery technology. This technology facilitates the administration of larger biologic volumes subcutaneously, enabling rapid injections and reducing the need for intravenous (IV) infusions. In April 2025, Argenx received U.S. FDA approval for a pre-filled syringe formulation of VYVGART Hytrulo (efgartigimod alfa), enabling at-home self-administration for adults with generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP). This subcutaneous injection, deliverable in 20-30 seconds, offers patients greater flexibility and independence by reducing reliance on intravenous infusions administered in clinical settings. The approval was supported by a Phase 1 bioequivalence study demonstrating comparable safety and efficacy to existing formulations. Argenx anticipates that this innovation will enhance patient adherence, expand market reach, and position VYVGART more competitively against oral therapies. The pre-filled syringe is expected to be available within two weeks of approval at a price comparable to the existing subcutaneous version. These advancements not only improve patient adherence and quality of life but also position Vyvgart competitively against other treatments, such as Argenx SE’s Ultomiris, by offering flexible administration routes and a favorable safety profile, thereby driving market growth during the forecast period.

Pipeline Analysis for VYVGART (efgartigimod alfa-fcab)

VYVGART (efgartigimod alfa-fcab) continues to expand its therapeutic reach, with argenx advancing a robust pipeline targeting over 15 severe autoimmune diseases. Building on approvals for generalized myasthenia gravis (gMG), chronic inflammatory demyelinating polyneuropathy (CIDP), and immune thrombocytopenia (ITP), efgartigimod is undergoing registrational trials in thyroid eye disease (TED), primary Sjögren’s disease (SjD), and idiopathic inflammatory myopathies, including dermatomyositis, immune-mediated necrotizing myopathy, and anti-synthetase syndrome. Proof-of-concept studies are also underway for lupus nephritis, systemic sclerosis, and antibody-mediated rejection, with topline results anticipated between late 2025 and 2027. Additionally, externally sponsored research is exploring its potential in conditions such as Guillain-Barré syndrome and neuromyelitis optica spectrum disorder. This extensive pipeline underscores argenx's commitment to leveraging FcRn biology to address unmet needs in autoimmune diseases, positioning VYVGART as a versatile therapeutic option across multiple indications.

Indication

Development Stage

Topline Data Expected

Primary Immune Thrombocytopenia (ITP)

Approved (JP); Phase 3 Ongoing

H2 2026 (ADVANCE-NEXT)

Immune-Mediated Myopathies (IMNM, ASyS, DM)

Phase 3 (ALKIVIA)

H2 2026

Thyroid Eye Disease (TED)

Phase 3 (UplighTED)

H2 2026

Primary Sjögren’s Disease

Phase 3 (UNITY)

2027

Lupus Nephritis (LN)

Phase 2

Q4 2025

Systemic Sclerosis (SSc)

Phase 2

H2 2026

Antibody-Mediated Rejection (AMR)

Phase 2

2027

VYVGART (efgartigimod alfa-fcab) Patent & Exclusivity Summary

VYVGART and VYVGART HYTRULO are protected by regulatory exclusivity in the U.S. until December 2033, with similar protections in place in the EU and UK until August 2032 and March 2033, respectively. These exclusivity periods safeguard the products from biosimilar competition during this time. However, post-expiry, market protection will rely on the enforcement of patent rights. There remains a risk that legislative changes or regulatory interpretations could shorten these exclusivity periods or limit the FDA’s recognition of VYVGART as a reference product, potentially accelerating biosimilar entry. Additionally, once approved, interchangeable biosimilars could be automatically substituted under state laws, akin to generic drug substitution. Non-interchangeable biosimilars may also be prescribed at the provider’s discretion but cannot be auto-substituted at pharmacies. The overall impact of biosimilar substitution will depend on evolving regulatory policies and market dynamics. This adds uncertainty to VYVGART’s long-term market exclusivity and competitive positioning beyond 2033.

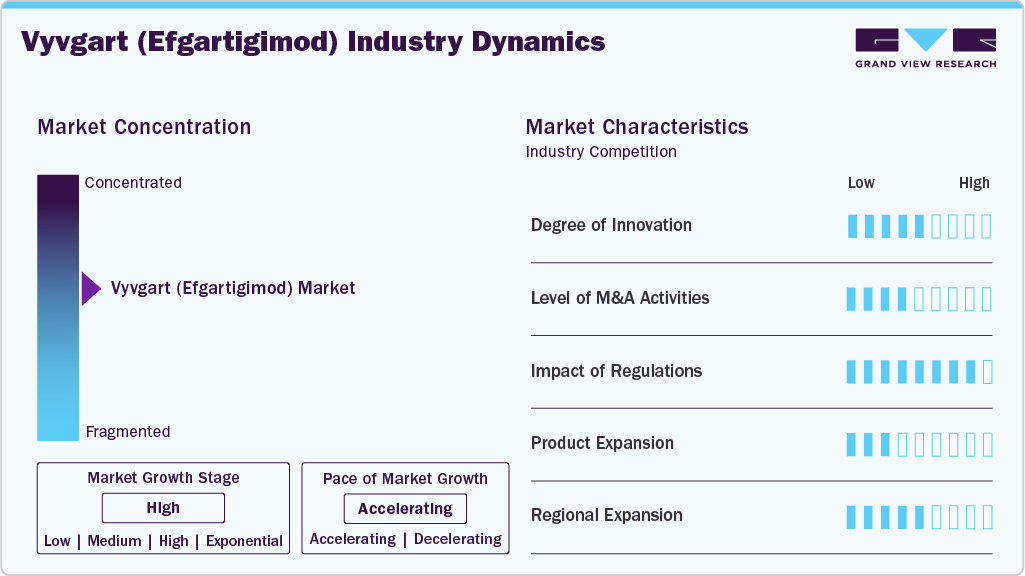

Market Concentration & Characteristics

Vyvgart introduces a novel FcRn inhibition mechanism, offering targeted IgG reduction for autoimmune conditions like gMG, CIDP, and ITP. Its ability to modulate autoantibody levels without broad immunosuppression sets it apart from conventional therapies. Subcutaneous and IV formulations enhance administration options, while pediatric trials signal commitment to younger populations. The drug's design supports individualized treatment cycles, improving tolerability and adherence.

Developing FcRn inhibitors like Vyvgart involves complex biologic engineering and long, expensive clinical trials for rare diseases. High manufacturing standards, specialized cold chain logistics, and limited patient populations add further challenges. Argenx benefits from early market entry, growing physician trust, and favorable reimbursement, making competitive entry difficult for newcomers.

Argenx is expanding Vyvgart into underserved markets across Asia, Latin America, and Eastern Europe through local partnerships and patient access programs. Emphasis is on improving diagnosis and specialist access to boost uptake. Distribution includes both hospital and specialty pharmacies, supporting infusion and self-administration in diverse healthcare settings.

Regulatory agencies demand detailed clinical outcomes, especially functional and quality-of-life improvements in chronic diseases like CIDP and gMG. Vyvgart benefits from orphan drug incentives but must meet post-market safety obligations and pediatric study requirements. HTA evaluations significantly influence access and pricing, particularly outside the U.S., where cost-effectiveness is a critical factor.

Vyvgart competes with IVIg, steroids, plasma exchange, and some monoclonal antibodies, though its mechanism and dosing flexibility provide clinical advantages. Its ability to reduce treatment burden via periodic dosing and minimal systemic effects makes it appealing in chronic care. Competitors in the FcRn space are emerging but remain in early stages.

Indication Insights

The Generalized Myasthenia Gravis (gMG) segment dominated the Vyvgart (Efgartigimod) market with the largest revenue share of 97.70% in 2024. Generalized Myasthenia Gravis (gMG) is a key growth driver for Vyvgart (efgartigimod), given its chronic, antibody-mediated pathology and need for targeted immunomodulation. Vyvgart offers a differentiated mechanism by selectively reducing pathogenic IgG through FcRn inhibition, addressing the underlying cause rather than suppressing the immune system broadly. This precision therapy aligns with growing clinical demand for safer, more effective long-term solutions in gMG. Clinical trials have demonstrated rapid and sustained improvements in muscle strength and functional outcomes, making Vyvgart a preferred option over traditional treatments such as corticosteroids or IVIg. Its individualized dosing and subcutaneous formulation enhance patient convenience and adherence, especially for those requiring lifelong management. Rising diagnosis rates, improved awareness, and updated treatment guidelines are further fueling adoption globally. As real-world data continues to validate its efficacy and safety, Vyvgart is poised to become a cornerstone therapy in the evolving gMG treatment landscape, driving significant market expansion.

The Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) segment is projected to grow at a rapid pace over the forecast period, fueled by expanding label approvals and rising clinical demand. It is a rare, chronic autoimmune disorder characterized by progressive weakness and impaired sensory function due to nerve inflammation and demyelination. The unmet need in CIDP treatment lies in effective, well-tolerated therapies that can provide sustained symptom control and reduce relapse rates. Current treatments such as corticosteroids, IVIg, and plasma exchange have limitations including side effects, frequent hospital visits, and variable patient responses. Vyvgart, with its novel FcRn inhibition mechanism, offers a targeted approach to reduce pathogenic IgG antibodies implicated in CIDP. Its potential for flexible dosing and improved safety profiles supports better patient adherence and quality of life. Increasing awareness and better diagnostic capabilities are driving more timely identification of CIDP patients, expanding the treatable population. Furthermore, regulatory encouragement for innovative therapies in rare neuromuscular diseases supports Vyvgart’s adoption as a promising alternative in the evolving CIDP treatment landscape.

Route of Administration Insights

The Intravenous (IV) Infusion segment dominated the Vyvgart (efgartigimod) market with the largest revenue share of 95.80% in 2024. IV administration served as the initial mode of delivery for Vyvgart upon its first commercial launch, providing direct and controlled dosing in clinical settings. This route became the standard among neurologists and immunologists managing moderate to severe generalized myasthenia gravis (gMG) and other autoimmune conditions. Its established safety and efficacy profile, supported by pivotal Phase 3 trial outcomes, contributed to strong uptake. Despite the emergence of alternative formulations, IV infusion remains a preferred option for newly diagnosed or high-risk patients requiring close monitoring. Additionally, hospital-administered treatments are often favored for reimbursement under institutional care protocols, especially in regions with limited access to home-based care infrastructure.

The Prefilled Syringe segment is projected to register the fastest growth over the forecast period. This shift is driven by rising demand for home-based treatment options that offer convenience and improved patient autonomy. Approved in 2025, the prefilled syringe formulation of Vyvgart enables subcutaneous self-administration in under 30 seconds, reducing the treatment burden associated with frequent hospital visits. This format supports higher adherence, especially for chronic indications like gMG and CIDP, where long-term therapy is required. As healthcare systems increasingly promote patient-centric care and cost containment, self-injectable biologics are gaining favor. The availability of prefilled syringes is expected to expand Vyvgart's market reach across both existing and newly approved indications, accelerating its adoption in outpatient and specialty pharmacy channels.

Regional Insights

North America Vyvgart market leads the global market and accounting for the largest share of 89.52% in 2024, fueled by high awareness of autoimmune neuromuscular disorders and an advanced healthcare system. The rising prevalence of Generalized Myasthenia Gravis (gMG) and Primary Immune Thrombocytopenia (ITP), coupled with increased diagnosis of Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), supports market expansion. Hospital and specialty pharmacies play a pivotal role in drug distribution, ensuring patient access across both urban and rural areas. Strong demand for therapies with improved quality-of-life outcomes, such as reduced steroid dependence, enhances Vyvgart's uptake. The U.S. remains the key growth driver, supported by recent label expansions and robust prescriber confidence.

U.S. Vyvgart (Efgartigimod) Market Trends

The U.S. constitutes the largest Vyvgart market globally, buoyed by the drug’s approval for multiple indications including gMG and CIDP. High disease awareness and diagnostic capabilities enable early patient identification, particularly among adult populations. Hospital pharmacies serve as central distribution channels, complemented by specialty pharmacies for ongoing treatment. Preference for targeted immunomodulation and therapies with fewer side effects positions Vyvgart favorably. Pediatric use is emerging as a growth area with ongoing clinical trials and increasing recognition of rare autoimmune disorders in children.

Europe Vyvgart (Efgartigimod) Market Trends

Europe holds a significant share of the Vyvgart market, driven by growing adoption in both adult and pediatric patients with autoimmune neuromuscular and hematologic diseases. Approval for use in gMG and ongoing developments in ITP and CIDP treatment fuel demand. Transition from traditional immunosuppressants to targeted therapies is evident, especially in hospital settings. However, stringent pricing regulations and access variability across countries present market challenges. Despite this, the drug’s therapeutic advantages and strong support from clinical guidelines solidify its market presence.

UK Vyvgart (Efgartigimod) Market is experiencing growth due to the NHS integration of Vyvgart for gMG and ITP has improved accessibility, particularly through hospital pharmacies. Clinicians are increasingly opting for Vyvgart due to its targeted mechanism of action and favorable safety profile. Government initiatives aimed at rare disease management and improved patient outcomes further drive adoption. Pediatric and adult patient segments both show growing acceptance. Continued updates to national guidelines and participation in clinical trials are enhancing Vyvgart’s credibility and use in the market.

Vyvgart (Efgartigimod) Market in Germanyis witnessing growth due toGermany's structured rare disease framework supports timely diagnosis and treatment initiation for conditions like CIDP and ITP. Hospital pharmacies lead distribution, with specialty pharmacies supplementing chronic care. The emphasis on minimizing corticosteroid use in gMG has driven a shift toward immunomodulatory biologics like Vyvgart. High levels of physician expertise and ongoing clinical research bolster patient and provider confidence, reinforcing Germany’s role in the European Vyvgart market.

France Vyvgart (Efgartigimod) Market is witnessing a boost due to theFrance’s centralized healthcare system and robust orphan disease programs facilitate strong uptake of Vyvgart, especially in hospital settings. Physicians are rapidly transitioning gMG and ITP patients to Vyvgart to reduce treatment burden and improve outcomes. Pediatric indications are gaining traction through early access programs. The presence of specialized clinical centers and participation in European collaborative trials accelerate integration into practice. Specialty pharmacies are also playing a growing role in long-term disease management.

Asia Pacific Vyvgart (Efgartigimod) Market Trends

Asia Pacific is witnessing the fastest growth in the Vyvgart market, driven by increased diagnosis of CIDP, ITP, and gMG in both adult and pediatric populations. Investment in healthcare infrastructure and clinical training supports wider use. Japan and China are spearheading regional adoption, supported by approvals and government backing for rare disease therapies. Hospital and specialty pharmacies collaborate to ensure distribution reach. Regional partnerships and awareness campaigns are further propelling Vyvgart’s growth trajectory.

Japan Vyvgart (Efgartigimod) Market is expanding due to theJapan’s approval of Vyvgart for gMG and expansion into CIDP treatment reflects the nation’s commitment to reducing treatment burden and steroid use. The country’s rare disease policy framework enables timely access through hospital and specialty pharmacies. Experienced clinicians and active post-marketing surveillance programs support safe integration into care. Japan’s focus on both adult and pediatric patient populations ensures sustained market development.

Vyvgart (Efgartigimod) Market in China is growing due to the shifted country’s focus on rare disease management and evolving reimbursement policies are creating a favorable environment for Vyvgart. The drug is being adopted in major urban centers through hospital pharmacies, with specialty pharmacies supporting chronic treatment needs. Increasing educational outreach and physician training on gMG and ITP contribute to greater drug uptake. Pediatric applications are gaining attention as clinical trials progress. Government support for biologic innovation further enhances market potential.

Latin America Vyvgart (Efgartigimod) Market Trends

Latin America is experiencing growing awareness of autoimmune neuromuscular and hematologic diseases. Hospital pharmacy networks and public-private partnerships are improving access to Vyvgart across adult and pediatric patient groups. Clinician preference for biologics with improved safety profiles supports a shift away from traditional immunosuppressants. Although reimbursement frameworks vary, regional harmonization efforts are accelerating drug availability. Educational initiatives continue to raise awareness among healthcare professionals.

Brazil Vyvgart market leads theLatin America, driven by increased demand for targeted therapies for gMG and ITP. Specialist networks and dedicated rare disease centers streamline diagnosis and therapy initiation. Hospital pharmacies serve as the primary distribution channel, while specialty pharmacies extend access for long-term care. Government policies aimed at improving access to high-cost biologics support broader adoption. Pediatric awareness is growing, paving the way for future expansion.

Middle East & Africa Vyvgart (Efgartigimod) Market Trends

The MEA region is gradually expanding access to Vyvgart through investments in healthcare infrastructure and rare disease initiatives. Hospital and specialty pharmacies are critical to drug distribution in urban centers. CIDP and ITP are gaining clinical attention, supported by educational campaigns and professional training. While regulatory processes vary, partnerships and market entry programs are enhancing availability. Adult and pediatric populations are both beginning to benefit from increased awareness and diagnostic capabilities.

Saudi Arabia Vyvgart (Efgartigimod) Marketis driving regional growth through strategic investments in rare disease care and advanced diagnostic services. Vyvgart adoption is rising in hospital pharmacies, particularly for adult gMG and ITP patients. Government support for biologic therapies and integration into clinical protocols facilitate market expansion. Specialty pharmacies are increasingly involved in managing long-term therapy. Ongoing physician education and patient awareness programs strengthen the market foundation for Vyvgart.

Key Vyvgart (Efgartigimod) Company Insights

A leading company in the global Vyvgart (Efgartigimod) market is argenx SE. The company is focused on expanding its commercial footprint through strategic collaborations, global expansion, and continuous innovation. With growing demand across hospital and specialty pharmacies, argenx is increasing investment in physician education and patient access programs. Strategic initiatives such as co-development partnerships and pipeline diversification position the company to maintain a strong competitive advantage in the autoimmune and rare disease therapy space.

Key Vyvgart (Efgartigimod) Companies:

The following are the leading companies in the Vyvgart (Efgartigimod) market. These companies collectively hold the largest market share and dictate industry trends.

- Argenx SE

Recent Developments

-

In April 2025, argenx SE received FDA approval for a prefilled syringe enabling self-injection of VYVGART Hytrulo (efgartigimod alfa and hyaluronidase-qvfc) for adult patients with generalized myasthenia gravis (gMG) who are anti-AChR antibody positive and those with chronic inflammatory demyelinating polyneuropathy (CIDP). This milestone is expected to significantly enhance patient convenience, reduce reliance on clinic-based infusions, and improve treatment adherence.

-

In April 2025, argenx announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) adopted a positive opinion recommending the approval of VYVGART (efgartigimod alfa) for subcutaneous injection as a monotherapy for adult patients with progressive or relapsing active chronic inflammatory demyelinating polyneuropathy (CIDP) after prior treatment with corticosteroids or immunoglobulins.

-

In November 2024, Zai Lab Limited and argenx announced that China’s NMPA approved the supplemental Biologics License Application (sBLA) for VYVGART Hytrulo (Efgartigimod Alfa Injection, Subcutaneous) for adult patients with chronic inflammatory demyelinating polyneuropathy (CIDP). As the first and only approved therapy for CIDP in China, administered via a convenient once-weekly 30-to-90 second subcutaneous injection, this approval significantly expands Vyvgart's market reach and strengthens its position in Asia’s growing rare disease segment. It marks a critical milestone for Vyvgart’s adoption in neuromuscular disorders and enhances argenx’s and Zai Lab’s competitive advantage in China.

-

In December 2021, the FDA approved Vyvgart (efgartigimod alfa-fcab) for treating generalized myasthenia gravis (gMG) in adult patients who are anti-AChR antibody positive, which accounts for ~85% of the gMG population. This approval made Vyvgart the first and only FDA-approved FcRn blocker.

Vyvgart (Efgartigimod) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.91 billion

Revenue forecast in 2030

USD 5.50 billion

Growth rate

CAGR of 13.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, Route of Administration and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Argenx SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vyvgart (Efgartigimod) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Vyvgart (Efgartigimod) market report based on indication, route of administration, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Generalized Myasthenia Gravis (gMG)

-

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous (IV) Infusion

-

Subcutaneous (SC) Injection

-

Prefilled Syringe

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Vyvgart (Efgartigimod) market size was estimated at USD 2.19 billion in 2024 and is expected to reach USD 2.91 billion in 2025.

b. The Vyvgart (Efgartigimod) market is expected to grow at a compound annual growth rate of 13.59% from 2025 to 2030 to reach USD 5.50 billion by 2030.

b. Based on indication, the Generalized Myasthenia Gravis (gMG) segment dominated the Vyvgart (Efgartigimod) market with the largest revenue share of 97.70% in 2024. Generalized Myasthenia Gravis (gMG) is a key growth driver for Vyvgart (efgartigimod), given its chronic, antibody-mediated pathology and need for targeted immunomodulation.

b. Leading player in the Vyvgart (Efgartigimod) market is Argenx SE.

b. The Vyvgart (Efgartigimod) market is primarily driven by several key factors. The increasing prevalence of autoimmune diseases, such as generalized myasthenia gravis (gMG), has heightened demand for effective treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.