- Home

- »

- Advanced Interior Materials

- »

-

Warehouse Racking Market Size And Share Report, 2030GVR Report cover

![Warehouse Racking Market Size, Share & Trends Report]()

Warehouse Racking Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Selective Pallet, Drive-in), By Application (Automotive, Food & Beverages), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-3-68038-985-2

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Warehouse Racking Market Summary

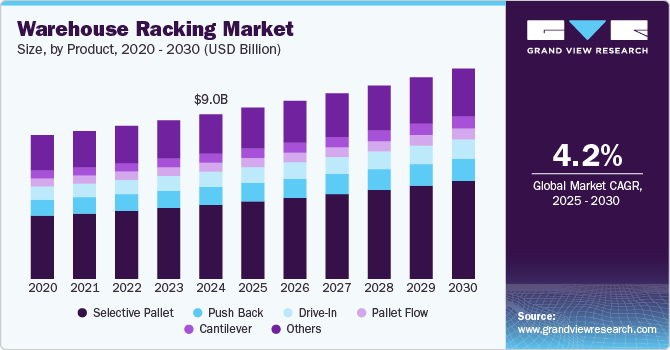

The global warehouse racking market size was estimated at USD 9.71 billion in 2024 and is projected to reach USD 12.41 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing demand for capacity expansion in warehouses coupled with the expanding online retail industry, is anticipated to benefit market growth over the forecast period.

Key Market Trends & Insights

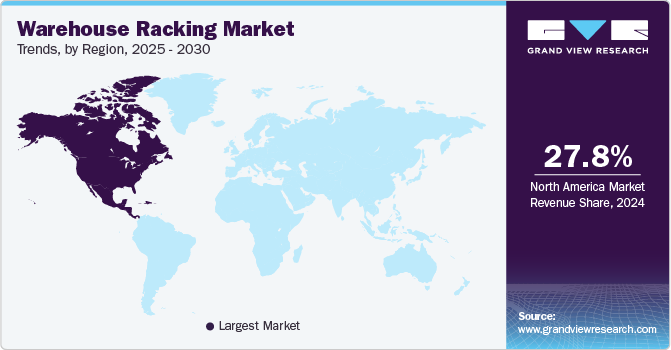

- North America led the warehouse racking market, with the largest revenue share of 27.8% in 2024.

- The U.S. dominated warehouse racking market in North America, with a revenue share of 64.6% in 2024.

- By product, the selective pallet segment led the market, with a revenue share of 45.0% in 2024.

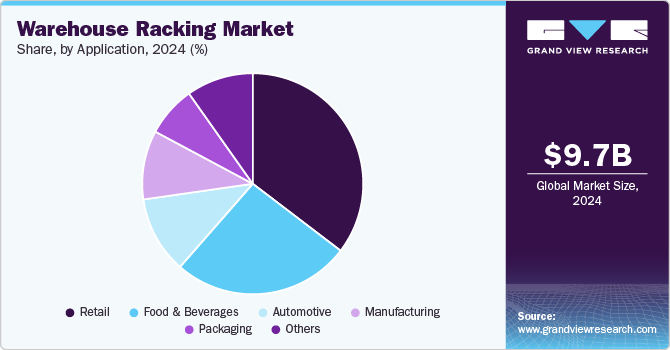

- By application, the retail segment led the market, with a revenue share of 35.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.71 Billion

- 2030 Projected Market Size: USD 12.41 Billion

- CAGR (2025-2030): 4.2%

- North America: Largest market in 2024

Warehouse racking helps in optimizing the storage spaces and increases the storage capacity. In addition, it enhances the organization of the stored products. The systematic alignment of products in the warehouse makes it easier to identify, pick, and complete the order.

In addition, it also helps in minimizing the overall time. Expansion of various application industries, such as automotive, manufacturing, retail, and food & beverage, across the globe, is projected to boost product demand. Rising demand for warehouse space to store and gain easy access to products is anticipated to propel the need for optimizing the warehouse space via racking systems. The warehouses with planned and improved racking spaces help in saving costs. The availability of large storage spaces allows for ordering more products from the vendors in a single transaction. Furthermore, on ordering products in bulk quantities, suppliers generally offer discounts.

Thus, warehouses with increased storage spaces help in saving costs. In addition, a well-organized warehouse racking makes it easier to identify and pick orders, thereby reducing the workforce requirement, which further saves costs. Moreover, with increased storage capacity, one can store more products, which helps in fulfilling orders on time without accumulating back orders. The market in the U.S. is expected to have significant growth as the economy caters to a large e-commerce market, superior infrastructure & automation facilities, and a highly skilled workforce. In addition, the presence of a significant number of manufacturers and warehouse-racking solution providers in the country leads to higher volume production and after-sales services.

The lack of knowledge among workers about the weight-bearing capacity of the warehouse rack leads to the overloading of racks beyond the engineered weight capacity. In addition, improper lift equipment training and lack of driver training results in rack damage. Irregular inspections and the use of low-quality materials are also anticipated to limit market growth. Rising demand for easy product accessibility, maximum space utilization, product & worker safety, convenient workability, and overall performance enhancement in the application industries are likely to benefit the market growth. In addition, the availability of manual and automatic rack servicing is projected to further offer growth opportunities to the market.

Product Insights

The selective pallet segment led the market with the largest revenue share of 45.0% in 2024. The system exhibits an inexpensive design having a large selection of sizes and accessories, making it excellent for standard storage and utility services. In addition, the growing product usage across the application industries is likely to fuel the segment growth. The drive-in racking system segment held the second-largest share in 2024. It is expected to be driven by the rising demand to store products with the maximum density in the warehouse facility. This type of racking system eliminates aisles in a warehouse and provides an excellent solution for storing a large number of similar products in a limited space.

The push-back racking segment is gaining popularity owing to its superior selectivity. Different racks are used for each Stock-Keeping Unit (SKU), making it easier to find, relocate, pick, or put away the required products. These types of racking systems are commonly used in cold storage and climate-controlled environments. Cantilever racking is expected to be the second-fastest-growing segment from 2025 to 2030. The segment is driven by the ease of storage and retrieval of products with varying weights, sizes, and lengths. These racking exhibit an easy installation and assembly with only a few components needed to build the product storying and holding structure.

Application Insights

Based on application, the retail segment led the market in 2024 with the largest revenue share of 35.4%, owing to the increased number of warehouses, supermarkets, hypermarkets, and others. In addition, the utilization of various types of racking systems enables retail warehouses to optimize the space and align products efficiently. Food & beverage warehouses require high-density storage structures where the materials can be stored in multiple low and high levels on a rail-based system. Increasing investments and expansion plans in food & beverage warehouses and distribution centers across the globe are further propelling the growth of the segment.

The automotive industry primarily focuses on mass production; hence bulk quantities of components, parts, and materials are needed to be stored in the inventory to carry out the assembly operations. A wide variety of racks are needed in the warehouse for specific components, including engine racks, cradle roll racks, folding shipping racks, and various others. The demand for warehouse racking systems is expected to be driven by the growing product adoption in packaging applications. Major packaging companies, such as International Paper Company, Amcor, Tetra Level, and Crown Holdings, use efficient racking to manage space and reduce the dealing of labor and inventory in terms of efficient product storage and handling.

Regional Insights

North America dominated the warehouse racking market with the largest revenue share of 27.8% in 2024, owing to the early adoption of the racking system in the region. The rising demand for fully automated warehouse facilities is expected to provide immense market potential over the forecast period. Increasing e-commerce platforms is compelling consumers to buy more products online, which caters to the development of warehouse infrastructure across the region. Rising construction activities in favor of warehouse building coupled with the replacement of obsolete technology used for storing and retrieving products in warehouses are likely to benefit market growth.

U.S. Warehouse Racking Market Trends

The U.S. Warehouse Racking market accounted for the largest share of 64.6% in North America in 2024. The market for warehouse racking in the developed economy is highly lucrative due to the presence of major manufacturers and warehouse racking solution providers such as Hannibal Industries, Georgia-Pacific, Dematic, and AK Material Handling Systems which leads to higher volume production and after-sales services. In addition, the economy caters large e-commerce market, superior infrastructure & automation facility, and a highly skilled workforce, which is further expected to make the same economy more favorable to the market growth.

The warehouse racking market in Canada is expected to grow at the fastest CAGR of 4.6% over the forecast period. The presence of a large number of food processing & cold storage plants coupled with the increasing construction activities in the country is expected to increase the demand for warehouses during the forecast period. This, in turn, is expected to add growth prospects to the overall warehouse-racking market. In addition, favorable government policies and investment coupled with the rapid expansion of e-commerce fulfillment warehouses in the country are further propelling the market growth in a positive note.

Asia Pacific Warehouse Racking Market Trends

The warehouse racking market in Asia-Pacific accounted for the revenue share of 26.33% in 2024, owing to the presence of large manufacturing, packaging, and retail application industries present in countries like China, India, Japan, and South Korea. The presence of a large number of e-commerce industry warehouses coupled with the adequate supply of the raw materials needed for racking system production is likely to add significant market growth during the forecast period.

The India warehouse racking market is expected to grow at the fastest CAGR of 6.1% over the forecast period. India has emerged as one of the leading manufacturing hubs for automobiles, retail, packaging, and other allied industries. The country is expected to witness a noteworthy growth rate in automobiles and food & beverage owing to the increasing population, rising disposable incomes, and increasing urbanization in the country. Favorable government initiatives like Make in India to increase the production in the country is expected to favor the manufacturing processes, thereby adding sufficient number of warehouses in the country.

The warehouse racking market in China is growing on account of the availability of raw materials, lower labor costs, large labor force coupled with favorable government policies. China has the largest population in the world leading to a larger consumer base. In addition, favorable government policies to launch new projects related to public health, manufacturing, packaging, and various others are expected to increase constructional activities in the country. This, in turn, is anticipated to increase the number of warehouses that cater to the storage of products to fulfill the demand of the bolstered population in the country.

Europe Warehouse Racking Market Trends

The warehouse racking market in Europe is attributed to the increased demand from the retail, automotive, food & beverage, manufacturing, and packaging application segments. In addition, the presence of large-scale warehouse-racking manufacturing companies is contributing to the region’s growth. Europe is majorly involved in the advancement of automated warehouse product distribution facilities, which, in turn, is expected to positively impact the regional market growth over the forecast period. Many retail businesses suffer in fulfilling inconsistencies in meeting consumer demands owing to the lack of an efficient warehouse racking system, this will boost product adoption.

The Germany warehouse racking market accounted for the largest revenue share of 20.3% in Europe in 2024. The rise in the development of logistics coupled with the demand of compact storage and product retrieval solutions in the country is favoring the growth of the market. The presence of the top warehouse and logistics regions such as Berlin, Frankfurt, Hamburg, Düsseldorf, and Munich deal in more than 50 percent of the country’s logistics and warehousing, offers an immense opportunity to the market over the forecast period.

The warehouse racking market in the UK is anticipated to grow at the fastest CAGR of 3.9% over the forecast period. Increasing warehouse construction and shifting consumer preferences from struggling office properties & shopping centers to online purchasing are the major factors fueling the market growth on a positive note. In addition, the rise in warehouse capacity coupled with increasing last-mile delivery facilities due to the advent of the pandemic is responsible for the growth of warehouses in the country on a large scale.

Central & South America Warehouse Racking Market Trends

The warehouse racking market in the Central & South America region is expected to witness at a significant CAGR during the forecast period. The region is one of the developing regions with high manufacturing and industrial potential. Increasing commercial activities, infrastructural development, industrialization, and urbanization are expected to have a significant impact on the market prospect. In addition, the expansive connectivity due to the internet, the presence of significant mega-cities, highlighting urbanization of the region, and favorable growth of the e-commerce sector are projected to augment the product demand.

The Brazil warehouse racking market is expected to grow at the fastest CAGR of 3.1% over the forecast period. The market is majorly driven by rising demand from the automotive, food and beverage, retail, packaging, industrial, and manufacturing applications. Brazil is a prominent contributor to the GDP and is one of the significant markets in the region. Various multinational companies across multiple industries extend their presence in the country through their supply chain network. It facilitates them to enhance their logistic services, mark presence in emerging countries like Brazil, strengthen their market position, and gain the desired customer base.

Middle East & Africa Warehouse Racking Market Trends

The warehouse racking market in the Middle East & Africa region is anticipated to grow at a significant CAGR over the forecast period. The region witnessed significant growth in the presence of multinational companies on account of its huge potential market, good customer base, and advancement in the distribution processes. The automotive logistics sector is projected to fuel the market growth over the forecast period on account of significant partnership among the logistic providers and automakers in the region.

The Saudi Arabia warehouse racking market in accounted for the largest revenue share of 34.7% in the Middle East & Africa in 2024. Saudi Arabia is projected to significantly contribute to the overall growth of the region on account of its potential manufacturing and industrial sectors. The market growth in Saudi Arabia can be attributed to the infrastructural development, industrial cities, superior quality utility supplies, and well-established logistic network. The market also witnesses a significant presence of food and beverage giants, including Ranosh, Khafif Food, Fourth Milling, etc. The presence of multinational companies such as General Electric, Goodyear Middle East, and Noon.com across varied industries, a wide potential customer base, and a well-developed logistic network in the country is projected to favor the market demand.

Key Warehouse Racking Company Insights

Some of the key players operating in the industry include Daifuku Co., Ltd., Toyota Industries Corporation, and Kardex Group.

-

Daifuku Co., Ltd. was established in 1937 and is headquartered in Osaka, Japan. The company is engaged in consulting, designing, engineering, manufacturing, installation, and after-sales services for material handling equipment and logistics systems. It offers transport systems, conveying systems, sorting/picking systems, storage systems, material handling tools, and control systems. It serves a wide range of industries, including cleanroom, automotive, airport, distribution, manufacturing, airport and public, and other sectors.

-

Kardex Group was founded in 1898 and is headquartered in Zurich, Switzerland. It is a global supplier of automated storage solutions and material handling systems. Kardex Remstar is engaged in developing, producing, and maintaining storage and retrieval systems, whereas Kardex Mlog deals with automated high bay warehouses and integrated material handling systems. The company offers its wide range of products for various applications, including storage and retrieval, buffering and sequencing, and order fulfillment to wholesale, retail, e-commerce, energy and mining, automotive, chemicals, electronics, food and beverage, consumer goods, and other industrial segments.

Emrack International and AK Material Handling Systems are some of the emerging participants in the global market.

-

Emrack International is headquartered in Victoria, Australia. It supplies a wide range of racking storage, and shelving solutions with standard and customized products. The company also offers turnkey solutions, including consultation, warehouse planning, 3D modeling, and floor plan support design, planning, engineering, supply, delivery, installation, and after-sales services.

-

AK Material Handling Systems was founded in 1988 and is headquartered in Minnesota, U.S. The company is an integrator of material handling systems specialized in offering pallet rack systems, warehouse design and layout, mezzanines, engineered sales, turnkey warehouse systems, and modular offices. The company provides drive-in, push-back, structural and double deep, selective, and pallet storage racking systems

Key Warehouse Racking Companies:

The following are the leading companies in the warehouse racking market. These companies collectively hold the largest market share and dictate industry trends.

- Daifuku Co., Ltd.

- Mecalux S.A.

- Kardex Group

- Hannibal Industries, Inc.

- Emrack International

- Jungheinrich AG

- AK Material Handling Systems

- SSI Schaefer Group

- Dematic

Recent Developments

-

In January 2023, Jungheinrich AG acquired Storage Solutions Group based in Indiana. It is a leading American supplier of racking and warehouse automation solutions. The acquisition will help Jungheinrich AG to access to the American market.

Warehouse Racking Market Report Scope

Report Attribute

Details

Market value in 2025

USD 10.10 billion

Revenue forecast in 2030

USD 12.41 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Daifuku Co., Ltd.; Mecalux S.A.; Kardex Group; Hannibal Industries; Inc.; Emrack International; Jungheinrich AG; AK Material Handling Systems; SSI Schaefer Group; Dematic; Toyota Industries Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

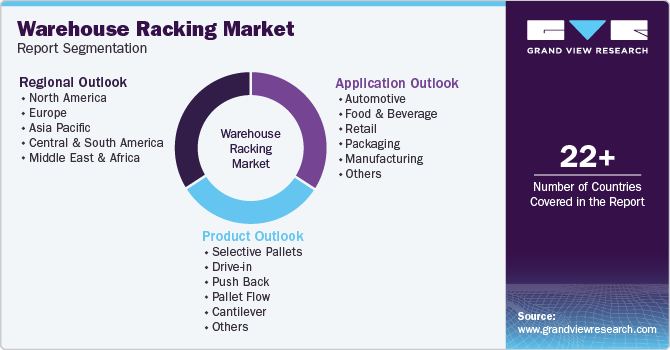

Global Warehouse Racking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global warehouse racking market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Selective Pallets

-

Drive-in

-

Push Back

-

Pallet Flow

-

Cantilever

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Food & Beverage

-

Retail

-

Packaging

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global warehouse racking market size was estimated at USD 9.71 billion in 2025 and is expected to reach USD 10.10 billion in 2025.

b. The global warehouse racking market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 12.41 billion by 2030.

b. Retail application segment dominated the warehouse racking market with a share of 36.7% in 2024, owing to the increasing number of warehouses, online retail, supermarkets, hypermarkets, food retails, and others.

b. Some of the key players operating in the warehouse racking market include Daifuku Co., Ltd., Mecalux S.A., Kardex Group, Hannibal Industries, Inc., Emrack International, Jungheinrich AG, AK Material Handling Systems, SSI SCHAEFER Group, Dematic, Toyota Industries Corporation.

b. The key factors that are driving the warehouse racking market include increasing awareness about the benefits of optimizing warehouse space and growing demand for systematic storage and easy material handling processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.