- Home

- »

- Water & Sludge Treatment

- »

-

Water And Wastewater Treatment Equipment Market Report 2030GVR Report cover

![Water And Wastewater Treatment Equipment Market Size, Share & Trends Report]()

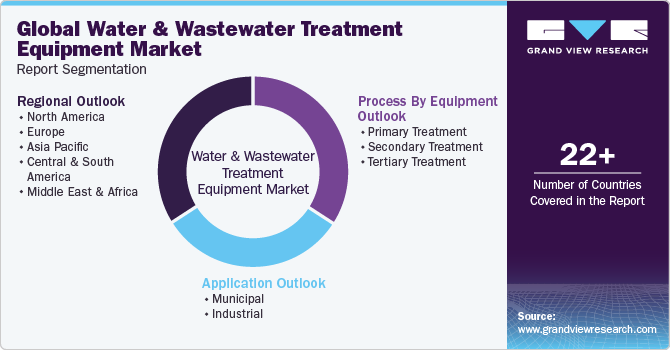

Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Application (Municipal, Industrial), By Process By Equipment (Primary Treatment, Tertiary Treatment), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-317-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

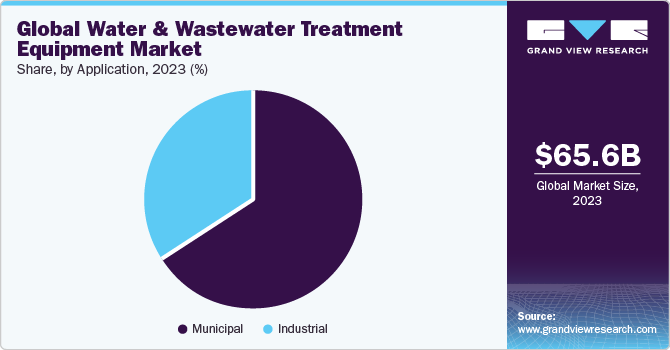

The global water and wastewater treatment equipment market size was estimated at USD 65.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. The market growth is aided mainly by factors such as the steadily rising population, industrialization, urbanization, and stringent environmental regulations. Growing awareness regarding environmental pollution, strict regulations on waste and wastewater management, as well as increasing demand for efficient and sustainable wastewater treatment solutions are expected to drive market expansion. The global market is expected to advance owing to various factors, including population growth, increasing industrialization, and strict government regulations concerning wastewater discharge.

Moreover, the deployment of advanced technologies such as activated sludge treatment, biological treatment, and membrane filtration in wastewater treatment equipment offers advantages such as reduced environmental impact, improved water quality, and enhanced public health. Companies in the market are undertaking partnerships with end-users to promote new technologies. Extensive investment in research and development activities to improve technology efficiency is also anticipated to boost market growth. Several small and medium-sized businesses are adopting new water and wastewater treatment technologies, creating strong growth opportunities.

For instance, in December 2022, LTIMindtree Limited, a consulting and information technology services company, announced a partnership with Yorkshire Water, a water treatment utility and water supply company, to transform its business operations across the latter’s asset management, wastewater, and water segments. Many opportunities prevailing in the market due to technological advancements and the introduction of innovative treatment solutions provide huge potential for market players to implement such solutions to gain a competitive advantage. The market is witnessing growth in the adoption of membrane filtration and ultraviolet disinfection technologies because of their high efficacy in treating water and wastewater.

Market Dynamics

Population growth, rapid urbanization, technological advancements, and infrastructure expansion have all increased global demand for fresh and processed water. The human population has grown and more than doubled in the last 50 years resulting in high consumption of water. The lack of freshwater sources has resulted in water scarcity. Moreover, reduced water resources and increased water pollution are also contributing to the demand for Water and Wastewater treatment equipment.

The consumption of energy fuels including petrol, natural gas, and kerosene is increasing owing to the growing population and rapid urbanization. This is expected to result in increased refinery output. Water treatment equipment is used for downstream processing in the refining sector. The prime intention of incorporating water treatment is to reduce the utility cost as well as make water available for the captive production of electricity. In addition, water treatment plants and equipment are increasingly being installed across major oil & gas refining economies, primarily in the Middle East and Asia Pacific. Hence, with the growing demand for energy fuels, the global demand for Water and Wastewater treatment equipment is anticipated to remain high over the forecast period.

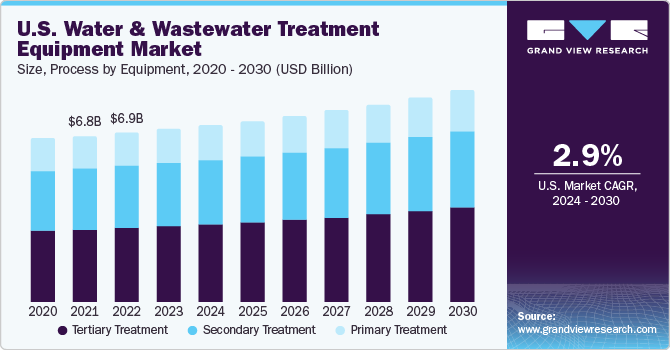

Process By Equipment Insights

The tertiary treatment segment dominated the market with a revenue share of 44.2% in 2023 and is projected to grow at the fastest CAGR of 5.0% over the forecast period. Water and wastewater treatment equipment play a crucial role in managing and treating wastewater to make it safe for discharge into the environment or for reuse. The treatment process involves several steps, each with its specific equipment and processes. During the primary treatment process, organic and inorganic solids are removed from wastewater using equipment such as primary clarifiers, oil-water separators, and dissolved air flotation systems. This step is critical to prevent clogging and damage to downstream equipment in the treatment process.

In the secondary treatment process, dissolved and suspended organic matter and nutrients are removed from wastewater using equipment such as activated sludge systems, trickling filters, and rotating biological contactors. These systems use microorganisms to break down organic matter and nutrients in wastewater, reducing its overall pollutant load. During the tertiary treatment process, remaining impurities and contaminants are removed from treated water using equipment such as membrane filtration systems and disinfection systems. This step makes certain that treated wastewater is safe for reuse in the environment or for discharge.

Application Insights

The municipal application segment dominated the market with a revenue share of 66% in 2023. The high demand for wastewater treatment systems in developing economies such as India and China is being aided by the growing regional urban population, increased investments, and favorable government policies aimed at promoting infrastructure development.

The industrial segment is projected to advance at a CAGR of 5.0% during the assessment period. This expansion is to be shaped by the high demand for fresh and processed water due to rapid urbanization, technological advancements, and a growth in the number of production units. Such factors are expected to drive the expansion of industrial applications.

In the municipal application segment, water and wastewater treatment equipment are used to purify water and make it safe for human consumption, as well as to treat wastewater prior to releasing it back into the environment. Membrane filtration systems, such as ultrafiltration and reverse osmosis, are used to remove dissolved solids, bacteria, as well as other contaminants from water. UV disinfection systems are used to kill bacteria and other microorganisms that could be present in water. Various materials and equipment, such as activated carbon, membranes, sand & gravel filters, and UV disinfection systems, are widely used in treatment processes in both municipal and industrial segments of water and wastewater treatment.

In industries, water and wastewater treatment equipment are deployed to treat the water utilized in industrial processes. These processes generally produce wastewater containing several forms of contaminants, including heavy metals, chemicals, and organic compounds. In wastewater treatment, biological treatment systems such as anaerobic digestion and activated sludge use microorganisms to decompose organic matter as well as other impurities. Meanwhile, chemical treatment processes such as flocculation and coagulation are used to remove specific forms of contaminants from wastewater.

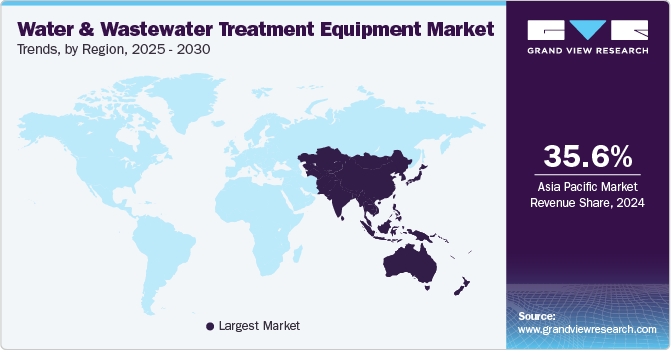

Regional Insights

Asia Pacific dominated the market with a revenue share of 35.1% in 2023 and is anticipated to grow at a CAGR of 5.9% over the forecast period. Increasing awareness among consumers and industries about the importance of water conservation and environmental protection is expected to drive the growth of the market in the region. The presence of a large number of established and emerging players in the water and wastewater treatment equipment industry such as Huber SE, SUEZ SA, Veolia Water Solutions and Technologies, Kurita Water Industries Ltd., Thermax Limited, and SWA Water Australia is expected to fuel market growth over the forecast period. All of these factors combined have contributed to the dominance of the Asia Pacific region in the market.

The Central & South America regional market is expected to advance at a CAGR of 4.8% from 2024 to 2030. Regional governments and regulatory bodies are undertaking several initiatives to improve water quality and encourage sustainable water management practices, driving regional growth. Moreover, the region is home to several major industries, including pharmaceuticals, food and beverage, and chemicals, which require effective wastewater treatment solutions to adhere to environmental regulations.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including mergers, product developments, new joint ventures, geographical expansions, and acquisitions to cater to the changing technological requirements and enhance market penetration across various applications such as municipal and industrial. For instance, in February 2023, Evoqua Water Technologies completed the acquisition of an industrial water treatment service division from Kemco Systems. This acquisition will help the company expand its aftermarket services in the North American market while strengthening the company's capability to support and serve its industrial customers.

Key Water And Wastewater Treatment Equipment Companies:

- Xylem, Inc.

- Pentair plc

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Ecolab Inc.

- DuPont

- Calgon Carbon Corporation

- Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

- Veolia Group

- Ecologix Environmental Systems, LLC

- Evonik Industries AG

- Parkson Corporation

- Lenntech B.V.

- Samco Technologies, Inc.

- Koch Membrane Systems, Inc

- General Electric

- Ovivo

Water And Wastewater Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.1 billion

Revenue forecast in 2030

USD 90.0 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, process by equipment, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Norway; Finland; China; India; Japan; Australia; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Egypt

Key companies profiled

Veolia Group; Ecolab Inc; Evoqua Water Technologies LLC; Pentair plc; Toshiba Water Solutions Private Limited; Xylem, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water and Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water and wastewater treatment equipment market report based on application, process by equipment, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Process By Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary Treatment

-

Primary Clarifier

-

Sludge Removal

-

Grit Removal

-

Pre-Treatment

-

Others

-

-

Secondary Treatment

-

Activated Sludge

-

Sludge Treatment

-

Others

-

-

Tertiary Treatment

-

Tertiary Clarifier

-

Filters

-

Chlorination Systems

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global water and wastewater treatment equipment market size was estimated at USD 65.6 billion in 2023 and is expected to reach USD 68.1 billion in 2024.

b. The water and wastewater treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 and reach USD 90.0 billion by 2030.

b. Asia Pacific dominated the Water and wastewater treatment equipment market with a revenue share of 35.1% in 2023. The region has a large population that requires access to clean and safe water, which has led to a high demand for water treatment equipment.

b. Some of the key players operating in the water and wastewater treatment equipment market include Veolia Group, Ecolab Inc., Evoqua Water Technologies LLC, Pentair plc, Toshiba Water Solutions Private Limited, Xylem, Inc.

b. The key factors that are driving the water and wastewater treatment equipment market include the growing population, increasing water scarcity, rising industrialization, and government regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."