- Home

- »

- Water & Sludge Treatment

- »

-

Water Testing Equipment Market Size, Industry Report, 2033GVR Report cover

![Water Testing Equipment Market Size, Share & Trends Report]()

Water Testing Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Instrument (TOC Meter, pH Meter, Dissolved Oxygen Meter, Conductivity Meter, Turbidity Meter), By Product, By End Use, By Test Type, By Technique, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-069-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Testing Equipment Market Summary

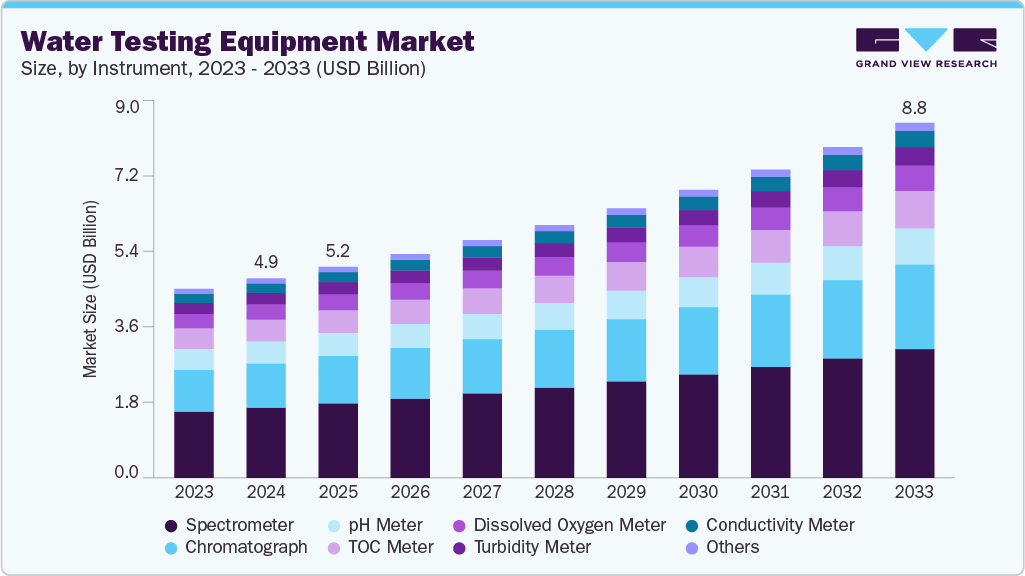

The global water testing equipment market size was estimated at USD 4,952.8 million in 2024 and is projected to reach USD 8,812.0 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The industry is driven by increasing contamination levels in municipal and industrial water sources.

Key Market Trends & Insights

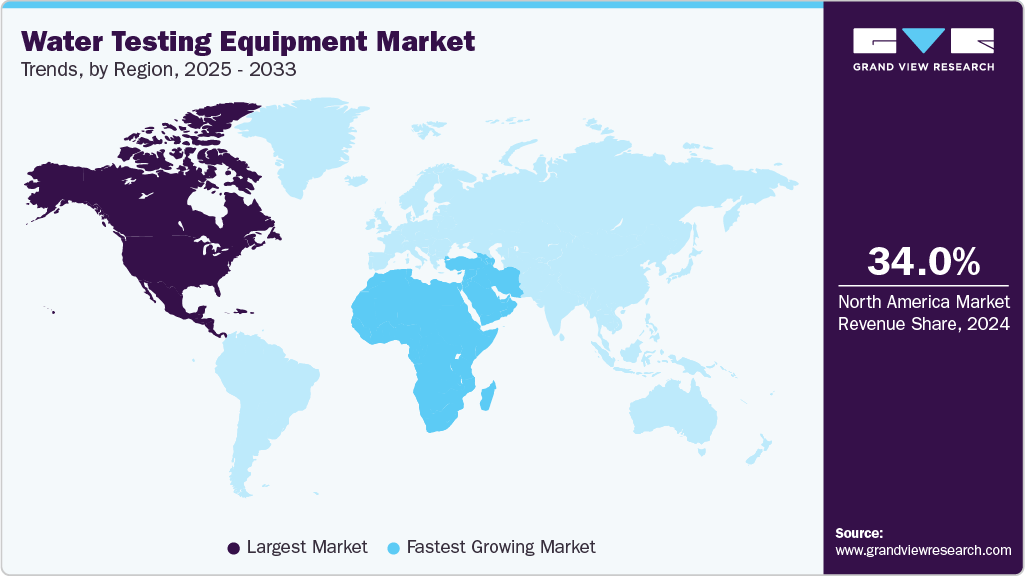

- North America dominated the water testing equipment market with the largest revenue share of 34.0% in 2024.

- The water testing equipment market in the U.S. is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By instrument, the chromatograph segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By test type, the chemical test segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

- By end use, the private laboratories segment is expected to grow at a considerable CAGR of 7.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,952.8 Million

- 2033 Projected Market Size: USD 8,812.0 Million

- CAGR (2025-2033): 6.7%

- North America: Largest market in 2024

- Middle East & Africa: Fastest growing region

Governments worldwide are enforcing stricter water quality regulations, boosting demand for advanced testing solutions. Rising public awareness about the importance of safe drinking water further accelerates the adoption of equipment.

Industrial sectors, such as pharmaceuticals, food & beverage, and chemicals, require reliable water testing systems to maintain compliance and ensure product safety. The expansion of wastewater treatment facilities is pushing investments in high-precision monitoring tools. Technological advancements, such as IoT-enabled sensors and automated analyzers, enhance testing efficiency. These innovations are prompting industries to upgrade legacy systems, driving consistent market growth.

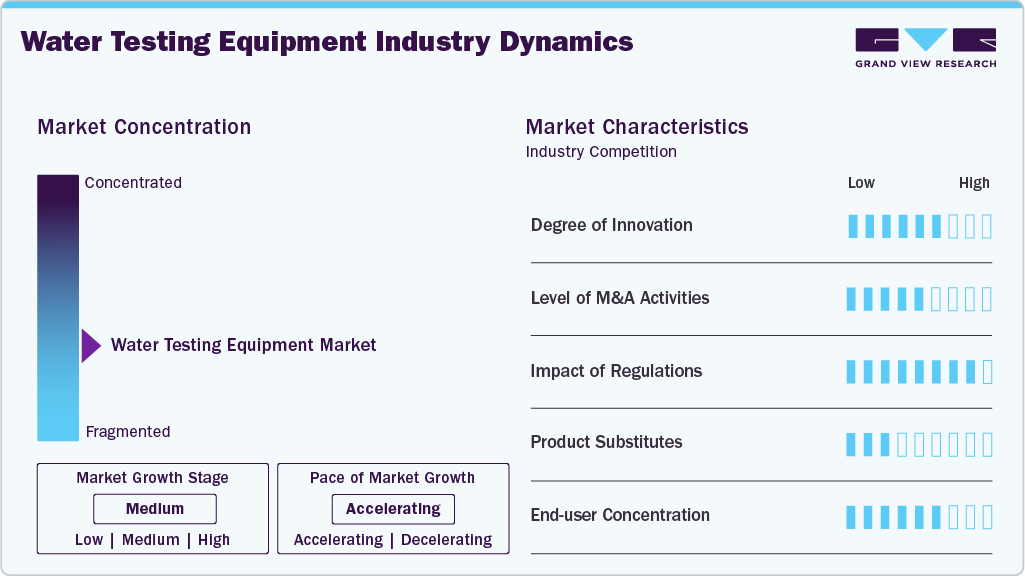

Market Concentration & Characteristics

The water testing equipment industry remains moderately fragmented, with numerous regional manufacturers competing alongside established international brands. While leading companies maintain strong positions through advanced technologies and broad distribution networks, smaller players differentiate themselves through niche solutions and localized services. Continuous innovation in portable analyzers and digital monitoring tools further encourages new entrants. As a result, competition remains robust, ensuring ongoing market dynamism and preventing high consolidation.

The market shows a high degree of innovation, driven by demand for faster, more accurate, and real-time testing solutions. Companies are integrating IoT sensors, cloud dashboards, and AI-enabled analytics to enhance data reliability. Portable, multi-parameter devices are becoming increasingly sophisticated, reducing dependency on laboratory testing. This steady technological advancement keeps the market competitive and forward-leaning.

Strict water quality laws and environmental compliance standards significantly shape market behavior. Governments mandate routine testing across municipal, industrial, and commercial facilities, boosting equipment adoption. Regulatory bodies increasingly emphasize transparency in reporting, encouraging digitalized testing solutions. These evolving rules act as a strong catalyst for continuous upgrades and new product development.

End-user concentration is diverse, covering municipal utilities, industrial processors, laboratories, and environmental agencies. No single group dominates, but industrial users generate notable demand due to continuous monitoring requirements. The rise of decentralized water treatment facilities adds new customer clusters to the landscape. This broad distribution of end users cushions the market against dependency on any one segment.

Drivers, Opportunities & Restraints

The market is driven by rising global concerns over water contamination and the increasing need for reliable, rapid-quality assessment tools. Regulatory pressure on industries and municipalities boosts the adoption of advanced testing systems. Growth in wastewater treatment infrastructure further drives demand for equipment. Technological innovations, such as smart sensors and automated analyzers, also accelerate market expansion.

There is a strong opportunity in the rapid shift toward digital and remote water monitoring solutions. Emerging economies are investing heavily in water quality infrastructure, creating new demand for affordable, portable testing devices. Industrial automation is opening space for integrated, real-time testing platforms. Additionally, rising interest in sustainable water management supports the adoption of next-generation equipment.

The high initial costs of advanced testing systems remain a significant barrier for smaller facilities and developing regions. Limited technical expertise in handling specialized instruments slows widespread adoption. Variability in water testing standards across countries adds complexity for global manufacturers. Furthermore, long replacement cycles for durable equipment can restrain recurring revenue growth.

Instrument Insights

Spectrometers dominated the market in 2024, accounting for a share of 35.2%, due to their high accuracy in detecting trace contaminants and complex chemical compositions. They are widely used in municipal laboratories and industrial facilities for comprehensive analysis. Strong demand for precise measurement of heavy metals and organic pollutants supports their widespread adoption. Continuous technological enhancements further reinforce their leading market position.

Chromatographs are the fastest-growing segment as demand rises for detailed separation and identification of emerging contaminants. Their ability to detect PFAS, pesticides, and micro-pollutants drives increased usage in advanced testing applications. Growing regulatory focus on detailed chemical profiling supports rapid adoption. Improved automation and compact designs also accelerate market penetration.

Product Insights

Portable & handheld segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue. Benchtop water testing equipment dominated the market with a 70.6% share in 2024, due to its high precision, stability, and suitability for comprehensive laboratory analysis. These systems are widely used in research centers, industrial labs, and municipal facilities for detailed testing. Their ability to handle multi-parameter analysis supports consistent demand. Advanced calibration features and long-term reliability further strengthen their leading position.

Portable and handheld equipment is the fastest-growing segment, driven by the rising demand for on-site and real-time water testing. These devices enable quick decision-making in field applications and remote locations. The increasing adoption of environmental monitoring and emergency response systems drives growth. Lightweight design and improved battery efficiency further accelerate market expansion.

Test Type Insights

Physical tests dominate the market as the segment accounted for a share of 56.2% in 2024, due to their widespread use in routine quality assessment. Parameters such as turbidity, temperature, color, and total suspended solids are essential for baseline monitoring. These tests are cost-effective and quick, making them standard across municipal and industrial facilities. Consistent regulatory requirements sustain their strong market presence.

Chemical tests are the fastest-growing segment as demand rises for precise detection of contaminants and trace compounds. Increasing focus on pesticides, heavy metals, and emerging pollutants is driving higher adoption. Advanced analytical techniques are improving accuracy and detection limits. Stricter environmental standards further accelerate growth in this segment.

Technique Insights

Separation technique segment is expected to grow at a fastest CAGR of 7.1% from 2025 to 2033 in terms of revenue. Electrochemistry technique dominated with a share of 42.7% in 2024, due to its reliability and precision in measuring key parameters such as pH, dissolved oxygen, and conductivity. It is widely used in both laboratory and field applications for continuous monitoring. The technique offers fast response time and cost-effective operation for routine analysis. Its broad applicability across municipal and industrial sectors sustains strong demand.

Separation techniques are the fastest-growing segment as advanced testing requires detailed identification of complex contaminants. These technologies are increasingly used to isolate micro-pollutants, PFAS, and organic compounds from water samples. Rising regulatory emphasis on trace-level detection boosts adoption. Improvements in efficiency and automation further accelerate market growth.

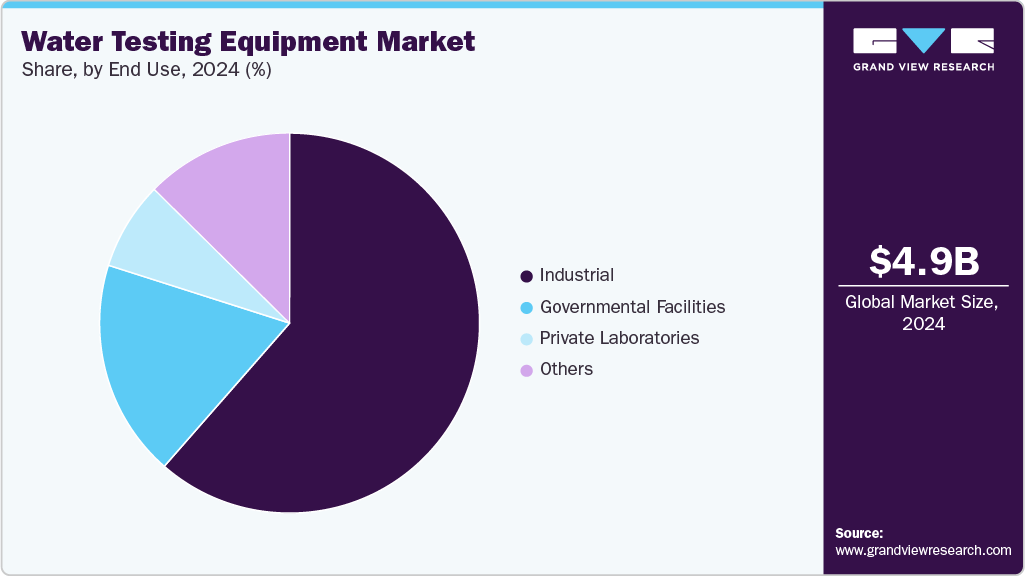

End Use Insights

The industrial segment accounted for a share of 61.5% in 2024, due to continuous monitoring requirements across manufacturing, power generation, and chemical processing facilities. Industries rely heavily on precise testing to ensure compliance with environmental and safety regulations. High water consumption and discharge volumes increase the need for advanced testing systems. Ongoing process optimization further sustains strong demand from this segment.

Private laboratories are the fastest-growing end-use segment as the outsourcing of water testing services continues to rise. Increased demand for certified and specialized analysis supports the rapid expansion of these facilities. A growing focus on quality assurance and independent testing strengthens their market position. Investment in modern equipment and automation further accelerates this segment’s growth.

Regional Insights

The North America water testing equipment industry leads the market and accounting for 34.0% share in 2024, due to its stringent water quality regulations and mature testing infrastructure. Industrial facilities and utilities invest heavily in advanced monitoring systems to meet compliance standards. Strong presence of major technique providers further boosts regional capability. Ongoing upgrades in water treatment plants also sustain steady equipment demand.

U.S. Water Testing Equipment Market Trends

The U.S. water testing equipment industry has spearheaded the North America market due to its strict federal and state-level water quality regulations. Municipal utilities and industries continuously invest in high-precision testing technologies to meet compliance requirements. Strong R&D capabilities support rapid adoption of smart digital monitoring tools. Large-scale infrastructure upgrades further reinforce the country’s leading position.

The water testing equipment industry in Canada is growing steadily as provinces enhance water safety standards and increase funding for testing infrastructure. The expansion of industrial activities, particularly in mining and energy, requires advanced monitoring solutions. Rising focus on environmental protection encourages the adoption of automated and portable testing systems. Ongoing modernization of municipal treatment facilities continues to create new market opportunities.

Europe Water Testing Equipment Market Trends

The water testing equipment industry in Europe is supported by strict environmental policies and commitments to sustainable water management. Industries across the region are modernizing laboratories with advanced digital testing solutions. The push for PFAS monitoring and the detection of emerging contaminants strengthens equipment demand. Increasing focus on circular water use further accelerates market adoption.

The Germany water testing equipment industry dominates the European market due to its strict environmental regulations and advanced industrial quality-control requirements. The country’s strong manufacturing base drives continuous demand for precise monitoring instruments. Investments in wastewater treatment upgrades further support the adoption of new equipment. Germany’s leadership in laboratory technique also strengthens its regional position.

The water testing equipment industry in the UK is growing as water utilities and industries adopt modern testing solutions to meet increasingly stringent regulatory requirements. Increased focus on detecting emerging contaminants is driving demand for digital and automated systems. Infrastructure renewal programs across water networks boost equipment procurement. Enhanced sustainability goals are also pushing organizations to upgrade to more efficient testing technologies.

Asia Pacific Water Testing Equipment Market Trends

The Asia Pacific water testing equipment industry is growing as industrial expansion and urbanization intensify pressure on water resources. Governments are increasing investments in water safety programs, driving the adoption of modern testing tools. Rising environmental awareness supports demand for portable and automated systems. Expanding wastewater treatment projects also create strong market opportunities.

The water testing equipment industry in China dominates the regional market due to its large-scale industrial base and stringent national water quality initiatives. Massive investments in wastewater treatment and river restoration drive strong demand for advanced testing tools. The country’s rapid urbanization further increases the need for municipal water monitoring. Growing adoption of digital and automated systems also strengthens China’s leading position.

The India water testing equipment industry is growing quickly as the government expands programs focused on clean drinking water and wastewater management. Rising industrial activity increases the need for reliable, on-site testing solutions. Investments in smart city projects and upgraded treatment facilities support wider equipment adoption. Rising awareness of waterborne risks is also driving demand for portable and affordable testing technologies.

Central & South America Water Testing Equipment Market Trends

The water testing equipment industry in Central & South America is experiencing growth as countries invest in improving water treatment and quality-control infrastructure. Industrial sectors, particularly mining and food processing, are increasing their testing requirements. Governments are implementing tighter safety standards, encouraging modernization of equipment. Expanding environmental monitoring initiatives also support market expansion.

The Brazil water testing equipment industry is experiencing strong growth in the market as the country expands its water treatment and pollution-control programs. Industrial sectors such as mining, food processing, and chemicals are increasing their testing requirements to meet tighter regulations. Investments in improving municipal water infrastructure are further boosting demand. Rising environmental concerns are also driving the adoption of modern, portable, and automated testing solutions.

Middle East & Africa Water Testing Equipment Market Trends

The water testing equipment industry in the Middle East & Africa is the fastest-growing region at a projected CAGR of 7.7% over the forecast period, due to rising water scarcity concerns and the need for efficient quality monitoring. Desalination plants and industrial facilities are adopting advanced testing technologies to ensure compliance. Government-led water security programs are increasing investment in analytic tools. Urban development and infrastructure upgrades further boost market demand.

The South Africa water testing equipment industry is experiencing steady growth due to rising concerns over water quality and resource management. Increased investment in wastewater treatment and monitoring infrastructure is driving higher demand for equipment. Industrial sectors such as mining and energy require continuous water quality assessment for compliance. Government-led sustainability initiatives further encourage the adoption of modern testing technologies.

Key Water Testing Equipment Company Insights

Some of the key players operating in the market include Thermo Fisher Scientific, Inc., SGS SA, and Emerson Electric Co.

-

Thermo Fisher Scientific, Inc. stands at the forefront of the global scientific instrumentation industry, particularly in water analysis and testing solutions. The company’s portfolio includes sophisticated laboratory and portable devices such as spectrophotometers, chromatographs, and digital sensors widely used in environmental, municipal, and industrial applications. Emphasizing digital innovation, Thermo Fisher incorporates IoT connectivity and advanced data analytics into its equipment, allowing users to enhance productivity and ensure regulatory compliance across diverse testing scenarios. Its solutions play a critical role in monitoring contaminants and supporting water safety in a rapidly changing regulatory and public health environment.

-

SGS SA is a global powerhouse in inspection, verification, testing, and certification services, with a robust presence in the water quality sector. Its laboratories and field teams deliver comprehensive chemical, microbiological, and physical water testing services that address the regulatory and compliance needs of governments, utilities, and industry players worldwide. SGS is renowned for its impartial analysis and the implementation of consistent, recognized testing methodologies tailored to client requirements and legal frameworks. Utilizing a vast international network, SGS ensures timely, actionable results through advanced facilities and digital tools.

Key Water Testing Equipment Companies:

The following are the leading companies in the water testing equipment market. These companies collectively hold the largest Market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- SGS SA

- Emerson Electric Co.

- Honeywell International, Inc.

- Veralto

- Veolia

- Horiba Ltd.

- 3M Company

- METTLER TOLEDO

- PerkinElmer

- Tintometer GmbH

- Eurofins Scientific

- IDEXX

- Agilent Technologies, Inc.

- Shimadzu Corporation

Recent Developments

-

In February 2025,Thermo Fisher Scientific introduced a new electrochemistry bench-meter series designed to offer more accurate pH, conductivity, and dissolved-oxygen measurements. The meters feature a touchscreen interface, simplified calibration, and built-in data recording for smoother lab workflows. They cater to applications in environmental testing, industrial labs, and quality control settings. Enhanced reporting and connectivity options also support compliance needs in regulated environments.

-

In November 2024, Veralto made a strategic minority investment in Axine Water Technologies to strengthen its position in advanced wastewater treatment. The partnership leverages Axine’s electrochemical process designed to eliminate tough contaminants, including PFAS and complex organics. Through Trojan Technologies, Veralto will help expand Axine’s reach across municipal and industrial markets. The move aligns with Veralto’s focus on scalable, next-generation water-quality solutions.

Water Testing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,239.6 million

Revenue forecast in 2033

USD 8,812.0 million

Growth Rate

CAGR of 6.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, product, test type, technique, end use, region

Regional scope

North America; Europe Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Thermo Fisher Scientific, Inc.; SGS SA; Emerson Electric Co.; Honeywell International, Inc.; Veralto; Veolia; Horiba Ltd.; 3M Company; METTLER TOLEDO; PerkinElmer; Tintometer GmbH; Eurofins Scientific; IDEXX; Agilent Technologies, Inc.; Shimadzu Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Testing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global water testing equipment market report based on instrument, product, test type, technique, end use and region.

-

Instrument Outlook (Revenue, USD Million, 2021 - 2033)

-

TOC Meter

-

pH Meter

-

Dissolved Oxygen Meter

-

Conductivity Meter

-

Turbidity Meter

-

Spectrometer

-

Chromatograph

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable & Handheld

-

Benchtop

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Physical Test

-

Chemical Test

-

Biological Test

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Electrochemistry

-

Separation Technique

-

Atomic & Molecular Spectroscopy

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Governmental Facilities

-

Private Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global water testing equipment market size was estimated at USD 4,952.8 million in 2024 and is expected to be USD 5,239.6 million in 2025.

b. The global water testing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 8,812.0 million by 2033.

b. North America leads the water testing equipment market and accounting for 34.0% share in 2024, due to its stringent water quality regulations and mature testing infrastructure. Industrial facilities and utilities invest heavily in advanced monitoring systems to meet compliance standards.

b. Some of the key players operating in the global water testing equipment market include Thermo Fisher Scientific, Inc.; SGS SA; Emerson Electric Co.; Honeywell International, Inc.; Veralto; Veolia; Horiba Ltd.; 3M Company; METTLER TOLEDO; PerkinElmer; Tintometer GmbH; Eurofins Scientific; IDEXX; Agilent Technologies, Inc.; Shimadzu Corporation.

b. The global water testing equipment market is driven by increasing water pollution levels and stricter environmental regulations worldwide. Rising demand for safe drinking water and expanding wastewater treatment infrastructure further boost equipment adoption. Technological advancements in smart, real-time testing solutions also play a key role in accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.