- Home

- »

- Water & Sludge Treatment

- »

-

Water Treatment Systems Market Size, Share Report 2030GVR Report cover

![Water Treatment Systems Market Size, Share & Trends Report]()

Water Treatment Systems Market Size, Share & Trends Analysis Report By Installation (Point-of-Use, Point-of-Entry), By Technology (RO, Distillation Systems), By Application (Residential, Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-137-5

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Water Treatment Systems Market Trends

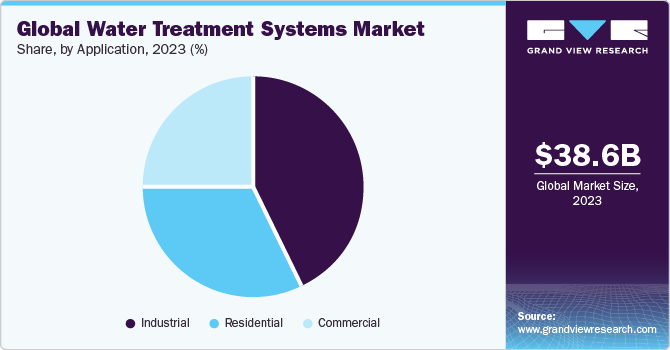

The global water treatment systems market size was estimated at USD 38.56 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The market growth is driven by an increasing need to reduce contamination and a rising demand for virus-free products. Rising freshwater scarcity, reducing groundwater levels, and various government initiatives pertaining to water quality improvements are all likely to drive industry growth. The COVID-19 pandemic had a moderate effect on the industry owing to the disruptions in the water supply network globally. As a result of the water crisis, increased water pollution, and deaths from water-borne diseases, the demand for water treatment systems has witnessed significant growth.

Growing population, strong economic growth, a rising number of construction projects, and low mortgage rates are expected to be the key factors driving market growth in the residential construction sector. Through the Safe Drinking Water Act of 1974, the Environment Protection Agency (EPA) has set standards for the quality of drinking water supply, and along with its partners, the agency implements numerous financial and technical programs to safeguard drinking water quality. The Clean Water Act establishes the fundamental framework for controlling the discharge of pollutants into waters and for regulating surface water quality standards. Thus, growing emphasis on the quality of water will drive market growth in the U.S. The increasing levels of contamination have resulted in the rising adoption of water treatment systems, thereby boosting industry growth in the country.

The EPA is still carrying out administrative orders to ensure safe drinking water through public water systems. Moreover, the announcement of the Drinking Water and Wastewater Infrastructure Act of 2021 in May 2021 by the U.S. government, with funding of USD 35.0 million, is expected to create growth opportunities for this market. Furthermore, with the growing technological advancements and increased R&D activities, there have been many new product launches. This is expected to boost market growth. For instance, in January 2024, NexTrend introduced an under-the-sink reverse osmosis (RO) water filtration system. This RO system processes the drinking water to remove impurities, such as PFAS, iron, chemicals, sediments, lead, calcium, chlorine, fluoride, etc.

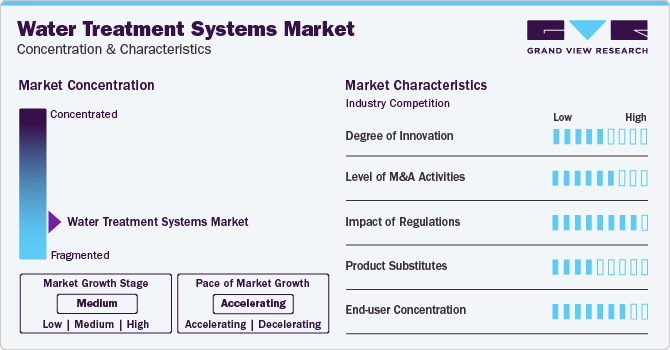

Market Concentration & Characteristics

Market growth stage is medium, and the pace of its growth is accelerating. The competitive rivalry is high in this market owing to the presence of a large number of international and regional companies. The water treatment systems market is cost-intensive and also price-sensitive as it witnesses frequent price wars among different companies striving to gain a competitive advantage in the market. Key service providers are constantly looking for new technologies to enhance their share in regional markets for water treatment systems.

The increasing implementation of various laws and legislation to ensure the supply of safe drinking water to the masses is fueling market growth. For instance, the Safe Drinking Water Act (SDWA) is responsible for protecting the quality of drinking water in the U.S. This law focuses on the water actually or potentially meant for drinking applications.

Macroeconomic factors, such as rapid urbanization, changing consumer purchasing patterns, and rising demand from emerging economies, are contributing to market growth. The advent of new water treatment technologies and the usage of their combination in different systems, such as RO+UV systems, have increased the sales of such water treatment systems across the world. The rising adoption of eco-friendly additives with low environmental impact is predicted to drive technological growth over the forecasted period.

Manufacturers adopt several strategies, including mergers, acquisitions, joint ventures, new product developments, and geographical expansions, to enhance their market penetration and cater to the changing technological demand for equipment from various end-use industries, such as residential, commercial, and industrial. For instance, in July 2022, AQUAPHOR opened its third factory in Estonia. The aim of this initiative was to annually ship their products to the global markets from new plant production lines.

Furthermore, the Internet of the Water system is in place to monitor the entire water supply and distribution infrastructure. IoT is a disruptive force for water treatment utilities because it provides an uninterrupted water supply to people living in remote and isolated areas in these water-scarce times. In the future, advanced technologies in this market are expected to augment the production rate of safe drinking water, thereby facilitating supply among the growing population.

Technology Insights

The reverse osmosis (RO) systems segment dominated the market and accounted for the largest revenue share of 28.2% in 2023. Reverse osmosis can get rid of numerous types of suspended or dissolved bacterial and amoebic particles present in the water. A reverse osmosis system includes carbon and sediment filtration. In the RO system, carbon and sediment filters remove chlorine, odor, bad taste, debris, and dirt. The distillation systems segment also accounted for a significant revenue share in 2023. Distillation units are installed as point-of-use units at the faucet rather than being used to treat all the water entering the house, as they only produce a small amount of treated water.

Point-of-use distillation systems clean water, minimize the number of toxic metals and get rid of some organic contaminants. Disinfection systems include the use of chlorine dioxide, chlorination, ozone, ultraviolet light, and chloramines. UV water disinfection technology uses ultraviolet light with a wavelength of 253.7 nanometers to disinfect bacteria, viruses, algae, and molds. This technology destroys microorganisms’ DNA, rendering them dead or unable to multiply. Filtration is the process of removing suspended solids with the help of force and moving through the pores of a filter or a membrane. The size and quantity of the contaminants affect the filtration procedure. 3M, Calgon Carbon Corp., Panasonic, and DuPont are some of the manufacturers of filtration methods.

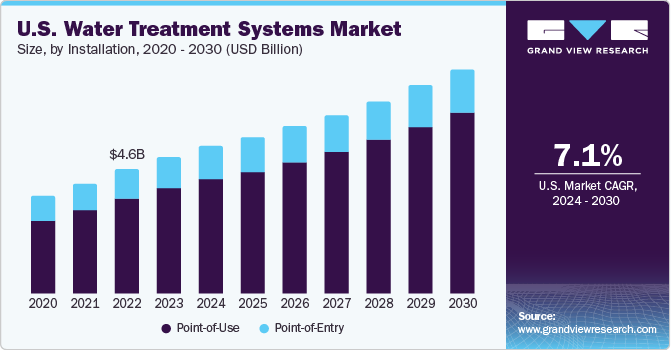

Installation Insights

The point-of-use installation segment dominated the market in 2023. PoU systems are essential for treating water in underdeveloped areas as they are simple to use, inexpensive, require minimal maintenance, and are grid-independent. These systems are extremely useful in medical settings, particularly when dealing with patients with impaired immune systems. The market for point-of-use water treatment systems is anticipated to grow substantially over the forecast period as a result of various factors, including rising water contamination, growing population, increasing awareness about the advantages of water treatment, and technological advancements in the water treatment sector.

Point-of-entry (PoE) systems are often huge and robust and can last for many years without needing any significant maintenance. These systems are affordable; however, to extend their operating life, regular cleaning or maintenance is needed. PoE water treatment method has been widely used for many years in individual commercial operations, such as lodges, hotels, restaurants, schools, and other public facilities. The key benefits of PoE for small communities include cheaper & quicker installation, easier implementation, and simpler maintenance & operation. Moreover, to guarantee clean drinking water through public water systems, the EPA is putting out administrative orders that will support segment growth.

Application Insights

The commercial application segment is projected to register the fastest CAGR from 2024 to 2030. The water treatment needs in malls, offices, retail spaces, restaurants, hotels, manufacturing plants, schools, laboratories, and other organizations with high-volume, high-quality water are primarily met by commercial water treatment systems. The probability of water-borne illnesses like cholera and cryptosporidiosis, among others, is reduced by access to clean drinking water. Consumer awareness of health issues and the benefits of a healthy lifestyle has increased noticeably with the advent of the information era. Adopting water treatment technologies to prevent the spread of water-borne diseases is a major outcome of this awareness. Thus, growing health consciousness among the young population and society’s upper classes can be linked to the rising adoption of water purification systems.

The residential application segment dominated the global market in 2023. The product demand in the residential segment is anticipated to be driven by rising concerns about new contaminants and demand for high-quality drinking water. It is also anticipated to expand due to the demand for drinking water that has been treated to remove biodegradable organics, pathogenic bacteria, unpleasant smell, taste, and discoloration. Residential applications are a large consumer group in the market. Over the past years, the drinking water quality in developing regions has witnessed high levels of contamination, primarily due to lax cleaning procedures and the percolation of unhealthy constituents into the water table.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of more than 36.2% in 2023. The growth can be attributed to the increased water pollution in the region. In addition, it is anticipated that inadequate access to clean drinking water supply in the region will also fuel the use of water treatment technologies over the forecast period. North America is characterized by the presence of major market players, such as 3M, Honeywell International Inc., DuPont, and Panasonic, with strong distribution channels. The rising spending capability of consumers and growing emphasis on water treatment in the region are expected to drive market growth over the forecast period.

Canada Water Treatment Systems Market

The water treatment systems market in Canada is anticipated to grow owing to the rise in population and subsequent growth of construction projects. Over the forecast period, it is anticipated that Canada's population growth will significantly strengthen the residential sector. Residential construction is expected to be further boosted by the Canadian government's growing investments in providing low-income families with affordable housing through the Affordable Housing Initiative (AHI) and the Canada Mortgage and Housing Corporation (CMHC) programs. In addition, the New Building Canada Plan (NBCP) by the government of Canada supports the country's building and construction projects, which, in turn, is anticipated to propel market growth in the country.

UK Water Treatment Systems Market

The water treatment systems market in the UK is expected to flourish owing to the strategies by the government to improve the country’s water quality. The Water Services Regulation Authority (Ofwat) in the UK is in charge of overseeing the financial operations of the nation’s water utilities. The agency is in charge of ecological control, and the Drinking Water Inspectorate is in charge of drinking water quality regulation. Environment Act 2021 provides legislation for strong authorities to the regulators for tackling pollution and improving water quality.

China Water Treatment Systems Market

The market growth in China is driven by the increasing adoption of water treatment systems in residential and commercial places. The rising number of industrial activities has significantly declined the water quality in many industrial areas. The rapid expansion of industrial activities and rising water pollution levels are expected to boost the demand for water treatment systems, such as reverse osmosis, disinfection, and distillation systems, in various end-use industries.

Brazil Water Treatment Systems Market

The market in Brazil is expected to witness lucrative growth due to the rising industrial activities and growth in the commercial sectors. Industrial and commercial places are required to provide safe drinking water, which requires the installation of water treatment systems on the premises. Rapid growth in the tourism sector is boosting the hospitality sector thus driving the demand for water treatment systems. By 2025, this outbound visitor spending in Brazil is expected to rise to USD 2,325, and the country is anticipated to move up to the sixth spot, behind Singapore, Australia, the U.S., Iceland, and Mauritius.

Saudi Arabia Water Treatment Systems Market

The market in Saudi Arabia is likely to register a high demand owing to the lucrative growth in the construction industry. The increasing number of residential projects in the country is likely to propel the demand for water treatment systems. To develop housing projects in the Saudi Arabian governorates of Dammam and Qatif, the state-owned National Housing Co. (NHC) signed contracts with four real estate firms. For the second stage of the residential project in the Al-Wajiha neighborhood of Dammam, contracts were signed with Maya Real Estate Development & Investment Company, Tilal Real Estate Company, Sumou Real Estate Company, and Tamkeen Real Estate Development Company. Such developments are likely to have a positive impact on the market growth.

Key Water Treatment Systems Company Insights

The industry is extremely competitive due to the presence of both international and local players. Product manufacturers use a variety of strategies to increase market penetration and meet the dynamic technological demands of end-use industries, such as residential, commercial, and industrial.

For instance, in March 2023, DuPont introduced PES ultrafiltration membranes and DuPont Multibore PRO. Customers who want to lower the distress of modules necessitated in water purification systems can utilize Multibore PRO as part of a multi-technology approach to municipal drinking water, desalination, or industrial water applications.

Key Water Treatment Systems Companies:

The following are the leading companies in the water treatment systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these water treatment systems companies are analyzed to map the supply network.

- 3M

- Honeywell International Inc.

- DuPont

- Panasonic

- Pentair plc

- BWT Aktiengesellschaft

- Culligan

- Watts Water Technologies Inc.

- Aquasana, Inc.

- Calgon Carbon Corp.

- Pure Aqua, Inc.

- EcoWater Systems LLC

- Aquaphor

- FilterSmart

- WCC (Water Control Corp.)

Recent Developments

-

In January 2024, Rainmaker Worldwide Inc. announced the acquisition of Miranda Water Treatment Systems. This acquisition is expected to lead to a horizontal integration of its resources and provide Miranda with enhanced service offerings at the global level

-

In November 2023, Saur announced the acquisition of the Natural Systems Utilities. This acquisition will expand the company's water reclamation and reuse activities in North America

Water Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.08 billion

Revenue forecast in 2030

USD 66.98 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report Updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Installation, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Russia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

3M; Honeywell International Inc.; DuPont; Panasonic; Pentair Plc; BWT Aktiengesellschaft; Culligan; Watts Water Technologies Inc.; Aquasana, Inc.; Calgon Carbon Corp.; Pure Aqua, Inc.; EcoWater Systems LLC; Aquaphor; FilterSmart; WCC (Water Control Corp.)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

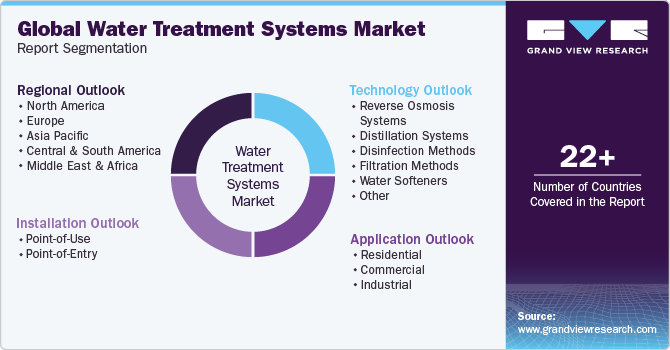

Global Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the water treatment systems market report based on installation, technology, application, and region:

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Point-of-Use (PoU)

-

Point-of-Entry (PoE)

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reverse Osmosis Systems

-

Distillation Systems

-

Disinfection Methods

-

Filtration Methods

-

Water Softeners

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Other

-

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global water treatment systems market size was estimated at USD 38.56 billion in 2023 and is expected to be USD 42.08 billion in 2024.

b. The water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 66.98 billion by 2030.

b. Asia Pacific dominated the water treatment systems market with a revenue share of 36.2% in 2023. The region has a large population that requires access to clean and safe water, which has led to a high demand for water treatment equipment

b. Some of the key players operating in the water treatment systems market include Veolia Group, Ecolab Inc., Evoqua Water Technologies LLC, Pentair plc, Toshiba Water Solutions Private Limited, Xylem, Inc.

b. The key factors that are driving the water treatment systems market include the growing population, increasing water scarcity, rising industrialization, and government regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."