- Home

- »

- Medical Devices

- »

-

Wearable Injectors Market Size, Share & Trends Report 2030GVR Report cover

![Wearable Injectors Market Size, Share & Trends Report]()

Wearable Injectors Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (On-body, Off-body), By Technology (Spring-based, Motor-driven), By End-use (Hospitals, Clinics), By Application (Oncology), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-614-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Injectors Market Summary

The global wearable injectors market size was estimated at USD 8.80 billion in 2023 and is projected to reach USD 23.89 billion by 2030, growing at a compound annual growth rate (CAGR) of 18.11% from 2024 to 2030. The key factors driving the market include the prevalence of chronic illnesses, the rising geriatric population, and growing concern over needle stick injuries.

Key Market Trends & Insights

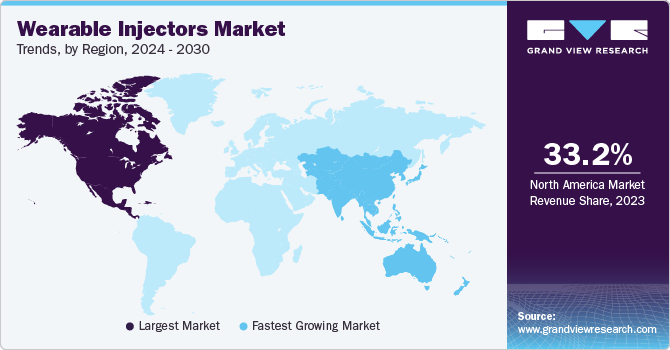

- North America dominated the market and accounted for the largest revenue share of 33.2% in 2023.

- Asia Pacific is expected to grow at a rapid CAGR of around 18.45% during the forecast period.

- Based on technology, the spring-based segment held the largest market share of 35.9% in 2023 and is expected to dominate throughout the forecast period.

- Based on application, the oncology segment held the largest market share of 29.5% in 2023.

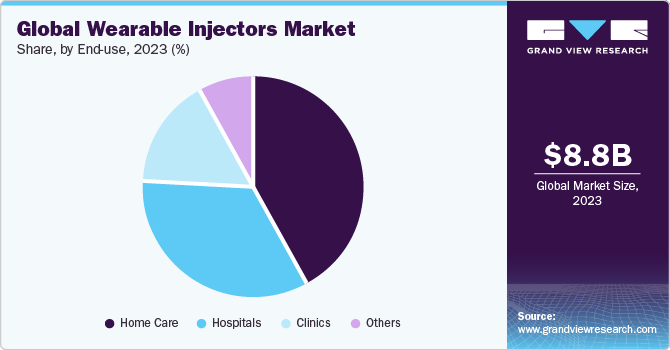

- Based on end-use, the home care segment led the market with a revenue share of almost 42.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.80 Billion

- 2030 Projected Market Size: USD 23.89 Billion

- CAGR (2024-2030): 18.11%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In comparison to other medication delivery methods, wearable injectors are less expensive. Additionally, the desire to reduce healthcare expenditures and the rising demand for continuous monitoring and home-based treatment are anticipated to boost the demand for wearable injectors.

Strong healthcare infrastructure and an increase in lifestyle disorders are some of the factors driving market expansion. However, it is projected that low demand in developing economies and expensive wearable injectors could restrain the market's expansion in the upcoming years. Needle stick injuries (NSIs) constitute the main occupational danger among healthcare workers. According to a WHO study published in 2021, nearly 2 million of the 35 million healthcare professionals worldwide are exposed to occupational injuries each year. The risk of developing infectious diseases including HIV, hepatitis B, and hepatitis C is increased by needle stick injuries.

In addition, reports from the Centers for Disease Control and Prevention (CDC) and European Agency for Safety and Health at Work (EU-OSHA) indicate that healthcare workers in the U.S. & Europe, have about 3,85,000 & 1,000,000 needle stick injuries, respectively. Moreover, according to the World Health Organization (WHO), NSIs result in 16,000, 66,000, and 1,000 instances of HCV, HBV, and HIV respectively, among Health Care Workers (HCWs) annually.

With advanced injector technology, the patient is never in contact with a needle. After attaching the injector and pressing the button, the needle is inserted. The patient is alerted with tactile, audible, and visual indications as soon as the medicine is released, and the needle automatically retracts and locks out, permitting safe and convenient disposal of the device. With the use of wearable injectors, there would be no needle stick injuries as compared to intravenous injectable and parenteral administration.

Wearable injectors increase patient and healthcare worker safety by eliminating the dangers associated with traditional infusion and injection technology, such as drug preparation, needle insertion, covering, and disposal of needles. However, one of the biggest problems emerging and developed countries face is the rise in healthcare costs. Countries strive to provide high-quality and affordable healthcare. Patients can self-administer wearable injectors subcutaneously at home with wearable injectors. It is anticipated to lower the frequency of trips to hospitals or other healthcare facilities, lowering healthcare costs.

Type Insights

The on-body wearable injectors accounted for the largest revenue share in 2023 owing to their increased demand as these patches are comfortable to wear on the skin (stomach), are water resistant, and convenient to use at home The benefits associated with on-body wearable injectors include a decrease in the number of hospital visits as it decreases healthcare costs, lifecycle management, flexible dosing, and automatic warming of refrigerated drugs. Medtronic (Ireland) introduced an infusion set in April 2021 that allows for the transport of insulin from the pump to the body for a duration of up to seven days.

The off-body wearable injectors are expected to expand at a CAGR of 18.74% during the forecast period. These devices eliminate risks, such as painful removal of devices, adhesive fitting issues to the skin, and skin sensitivity or irritation. As a result of rising investments in the development of improved off-body, injectors is anticipated to boost the growth of this segment in the future.

Technology Insights

The spring-based segment held the largest market share of 35.9% in 2023 and is expected to dominate throughout the forecast period. The market dominance is due to user-friendliness and patients’ ability to precisely distribute the medication subcutaneously by pushing one or more buttons on the device. BD Libertas Wearable Injector is a pre-fillable and innovative drug delivery system offered by BD, a U.S.-based medical device company. It is integrated with a spring-based power source that eliminates the need for batteries or disposal of heavy metals. The rotary pump wearable injectors segment is expected to grow at the fastest CAGR of 18.29% during the forecast period due to their increasing demand as they are more convenient for use.

Application Insights

The oncology segment held the largest market share of 29.5% in 2023 and is likely to dominate the market owing to the rising prevalence of cancer coupled with an increasing shift toward self-administration of medication among patients. Many drugs are available in the market today; however, to use them, a patient must visit a healthcare center frequently, which leads to increased expenditure and discomfort. The Canadian Cancer Society estimates that in 2022, approximately 13% of Canadians got lung and bronchus cancer, which caused the death of 24% of all cancer patients. Due to the rising incidence of cancer and the tendency toward patients’ self-administering medication is rising.

The infectious disease segment is anticipated to grow at the fastest CAGR of 18.35% during the forecast period. The World Health Organization (WHO) reported that approximately 20 million annual deaths are caused by infectious diseases globally. The prevalence of emerging infectious diseases, which are new or affect more people than before, such as Coronavirus, Ebola, Salmonella, Hepatitis A, and West Nile virus, increases the demand for injectors. The growing need for advanced drug delivery is one of the major factors driving the growth of the global market.

End-use Insights

The home care segment led the market with a revenue share of almost 42.0% in 2023. The market is growing due to rising demand for home-based healthcare and the requirement of advanced drug delivery devices requiring minimal expertise, and lesser hospitalization of the patients is expected to fuel the demand for wearable injectors globally. The low cost of wearable injectors and the rising demand to cut healthcare expenses is expected to drive the home care segment. According to a study, wearable injectors cost around USD 20 and USD 30, while infusion therapy ranges from USD 200 to USD 1,000 or more.

The hospital segment is expected to expand at a rapid rate owing to the rising prevalence of chronic disorders and the increased footfall of patients in hospitals for treatment.Oncology patients often require frequent administration of medications, which results in the need for regular hospital visits. Specialized clinics are also expanding. On-body injectors connected to cloud data enable physicians to track patient information and monitor drug adherence, which was previously managed during clinic visits. The integrated health model leads to an increase in the frequency of physician-patient interactions.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 33.2% in 2023. It is attributed to the rising prevalence of chronic & lifestyle-related diseases and augmented healthcare infrastructure. According to the CDC, about 37 million Americans have diabetes, 90 to 95% of whom have type 2 diabetes.

Asia Pacific is expected to grow at a rapid CAGR of around 18.45% during the forecast period as compared to other regions, which can be attributed to favorable government initiatives for the use of medical devices such as wearable injectors due to increasing geriatric population, increase in healthcare expenditure, and increase in awareness about wearable injectors in this region.

Key Companies & Market Share Insights

The market is fragmented with high competition at the global level as it has the presence of major key players. These players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and patient awareness campaigns. In March 2021 Aptar and Noble International announced their collaboration with dne pharma, a pioneer in Northern European addiction treatment, in March 2021, using the innovative Unidose Liquid System developed by Ventizolve, Aptar, and Noble. The collaboration aims to prevent the potentially fatal effects of opioid overdose in Europe as soon as feasible.

In addition, numerous biopharmaceutical companies are seeking a better method of drug delivery of their own biological drugs, for which wearable injectors are a suitable solution. For instance, in January 2023, Tandem Diabetes Care, Inc. announced the acquisition of AMF Medical SA, manufacturer of Sigi Patch Pump. In May 2023, Enable Injections, Inc. collaborated with Viridian Therapeutics, Inc., a U.S.-based biotechnology company.

Key wearable injectors Companies:

- BD

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd.

- Unilife Corporation

- Steady Med Therapeutics, Inc.

- Amgen Inc.

- Insulet Corporation

- Enable Injections

- West Pharmaceutical Services, Inc.

- CeQur Simplicity

Wearable Injectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.12 billion

Revenue forecast in 2030

USD 23.89 billion

Growth rate

CAGR of 18.11% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

BD: Johnson & Johnson Services, Inc.; F. Hoffmann-La Roche Ltd.; Unilife Corporation; Steady Med Therapeutics, Inc.; Amgen Inc.; Insulet Corporation; Enable Injections; West Pharmaceutical Services, Inc.; CeQur Simplicity

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Injectors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wearable injectors market report based on type, technology, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On-body

-

Off-body

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spring-based

-

Motor-driven

-

Rotary pump

-

Expanding battery

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious disease

-

Cardiovascular disease

-

Autoimmune disease

-

Immunodeficiency

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Home care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global wearable injectors market size was estimated at USD 8.80 billion in 2023 and is expected to reach USD 10.12 billion in 2024.

b. The global wearable injectors market is expected to grow at a compound annual growth rate of 18.11% from 2024 to 2030 to reach USD 23.89 billion by 2030.

b. North America dominated the wearable injectors market with a share of 33.2% in 2023. This is attributable to the rising prevalence of chronic & lifestyle-related diseases and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the wearable injectors market include Becton, Dickinson and Company; Johnson & Johnson Services, Inc.; F. Hoffmann-La Roche Ltd.; Unilife Corporation; SteadyMed Therapeutics, Inc.; Amgen, Inc.; Insulet Corporation; Enable Injections; West Pharmaceutical Services, Inc.; and CeQur SA.

b. Key factors that are driving the wearable injectors market growth include rising demand for round-the-clock monitoring, Increasing concern over the hazards related to needlestick injuries, and technological developments in wearable injectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.