- Home

- »

- Network Security

- »

-

Web Application Firewall Market Size & Share Report, 2030GVR Report cover

![Web Application Firewall Market Size, Share & Trends Report]()

Web Application Firewall Market Size, Share & Trends Analysis Report By Component (Solutions, Services (Professionals, Managed)), By Organization Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-177-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Web Application Firewall Market Trends

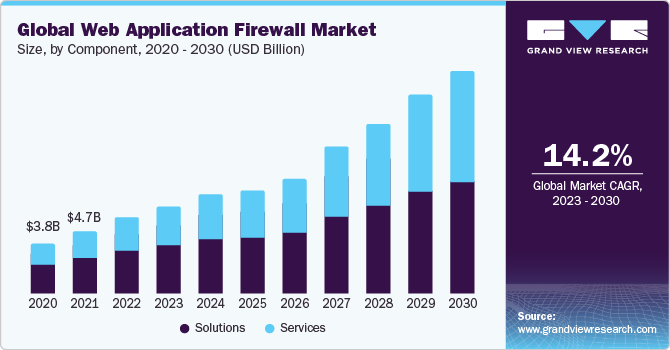

The global web application firewall market size was valued at USD 4.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. The increasing adoption of automated and AI-powered web application firewall solutions is driving market growth. Automated and AI-powered next-generation firewall solutions are gaining traction among organizations, as they are capable of responding quickly to new threats and provide intelligent decision-making capabilities.

The COVID-19 pandemic had a positive impact on the next-generation firewall market as the lockdown led to a rise in internet access and usage of IoT devices, resulting in an increased number of cyber-attacks. Work from home became mandatory for the majority of organizations during the pandemic, which further boosted the demand for robust security solutions. Therefore, to provide enhanced security to valuable data and information, enterprises adopted next-generation firewall solutions to protect their data from cyber threats and unsolicited data theft.

The web application firewall protects organizations from advanced security threats at the application level through intellectual and context-aware security structures. It combines traditional firewall capabilities such as stateful inspection and packet filtering with other technologies that empower individuals/businesses to make better decisions about what to access over the internet. Factors such as the rapid penetration of the Internet of Things (IoT) and growing internal and external threats across devices are driving the demand for web applications, firewall solutions, and services.

Component Insights

Based on the component, the web application firewall market is segmented into solutions and services. The solution segment held the largest market share in 2022. The growth of this segment is mainly attributed to the increasing demand for cutting-edge security solutions from enterprises owing to the rise in the number of cyber-attacks and the increasing need to secure crucial data. For instance, according to the 2022 Global Threat Report, published by CrowdStrike, the number of ransomware-based data leaks has increased by 82% in 2021 from 2020.

Organization Size Insights

On the basis of organization size, the market is segmented into large enterprises and small & medium enterprises. Large enterprises held the largest market share in 2022. The growth of this segment can be attributed to factors such as increasing the need to enhance productivity, increasing flexibility & agility by ensuring firewall security, and protecting organizations from cyber-attacks that can disrupt business processes. Many large enterprises have the resources and experience to operate and optimize web application firewall solutions in-house. They additionally employ security personnel to track and adjust to security events, making web application firewall implementation more convenient.

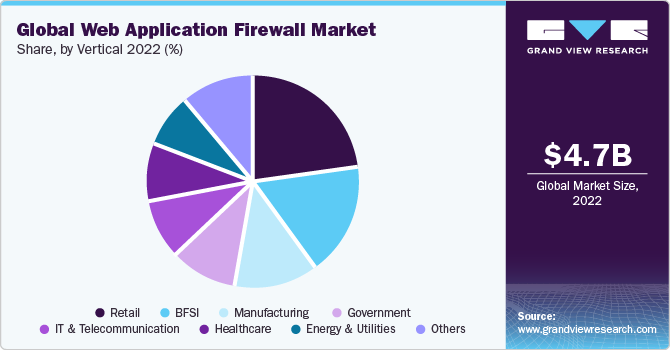

Vertical Insights

On the basis of organization size, the market is segmented into BFSI, retail, IT & telecommunication, healthcare, energy & utilities, manufacturing, and government. BFSI held the largest market share in 2022. The increasing adoption of web application firewalls to prevent cyber-attacks on financial data on hybrid or any private-cloud platform is likely to drive the demand for web application services in the banking and finance industry. The financial sector is increasing due to the advanced financial services using digital modes, which demand constant security planning. By leveraging web application firewall services, BFSI firms intend to offer seamless offerings to their worldwide.

Regional Insights

Asia Pacific held the largest market share in 2022. The growth of the region can be attributed to the presence of prominent players such as Alibaba, Citrix, Fortinet, Radware, Microsoft, Reblaze, Trustwave, and Sophos, among others. High-profile cybersecurity incidents, such as massive data breaches or attacks on APAC companies, have raised awareness about the importance of robust web application security. This increased awareness has led to an increase in demand for web application firewall solutions. The ability of web application firewall solutions to interact smoothly with additional safety devices and systems, such as intrusion prevention and detection systems, SIEM (Security Information and Event Management) solutions, and feeds of threat intelligence, often determines their level of effectiveness. WAF interoperability with different devices can have an impact on their uptake and functionality.

Key Companies & Market Share Insights

Key players operating in the market are Alibaba.com, Citrix, Fortinet, Radware, Microsoft, Reblaze, Trustwave, and Sophos, among others. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In June 2023, HCL Technologies was designated an Amazon Web Application Firewall (WAF) Delivery Partner, indicating its ability to provide AWS WAF services for protecting web-based applications on Amazon Web Services (AWS). HCL Technologies' partnership with AWS expands its footprint in the cloud computing and cybersecurity sectors, providing comprehensive solutions for protecting web-based applications deployed on Amazon Web Services.

-

In November 2022, Palo Alto Networks announced the acquisition of Cider Security, a software supply chain security and application security company. The acquisition aimed at helping Palo’s Prisma Cloud by empowering enterprises with supply chain security as part of a code-to-cloud security platform.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."