- Home

- »

- Next Generation Technologies

- »

-

Webcam Market Size & Trends Analysis Report, 2022 - 2030GVR Report cover

![Webcam Market Size, Share & Trends Report]()

Webcam Market Size, Share & Trends Analysis Report By Technology (Analog, Digital), By Product (USB, Wireless), By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-481-9

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global webcam market size was estimated at USD 7.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of more than 7.3% from 2022 to 2030. Increased demand for real-time monitoring devices and the adoption of UAVs for security and surveillance purpose propel the webcam market toward steady and healthy growth during the forecast period.

Increase in the usage of webcams designed for video conferencing, visual marketing, and others is augmenting the market. Webcams are the most valuable business communication tools in the corporate world. An increase in trends toward virtual workplace communication among professionals is increasing demand for webcams during the forecast period.

The rising usage of webcams in the health sector used for video conferencing and remote patient monitoring is expected to push the growth of the market worldwide. Additionally, post-COVID, with the increasing emphasis on remote working, and hybrid work models, the corporate environment is witnessing increased demand for webcams as video conferencing are becoming the new norm for conducting business and client meetings.

The changing customer demands in addition to the enhanced internet connectivity experience are the factors compelling webcam manufacturers to develop cameras with the latest technology and feature.

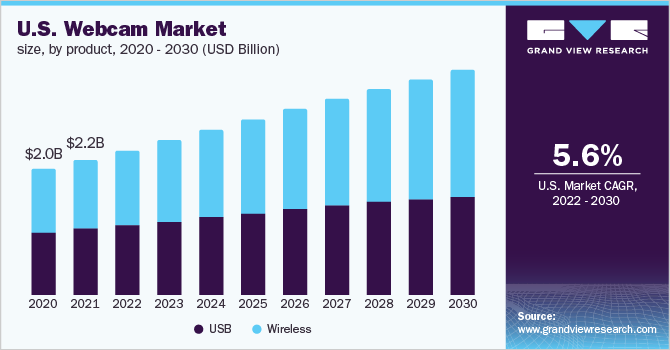

Product Insights

USB webcams are expected to dominate the market with a volume share of around 60.0%. The subsequent growth of USB webcams is attributed to the compatibility of using them on any platform, such as Mac, Linux, and Windows. These devices come with overheating prevention techniques along with larger casings which dissipate the heat rapidly as this camera can be placed anywhere, providing comfort to the user for using it. According to IEEE 802.11g specification, one can set up a Wi-Fi webcam 30.0 meters away from the computer.

The wireless segment is anticipated to register a CAGR of more than 8.0% during the forecast period, as they are versatile in application along with compatibility and provide higher resolution. Such webcams include an electric chip sensor that turns light into pixels, and the camera sends this data through Ethernet, Wi-Fi, or Bluetooth. Users can shoot high-definition photographs and films using wireless webcams as there is no interference of wired infrastructure, no wear and tear of the wire, and no purposeful wire puncture by hackers. Wireless technology is useful when it is difficult to install wires, such as when monitoring business premises.

Technology Insights

The global webcams industry has been segmented based on technology into analog and digital. The digital technology segment in the market is anticipated to hold a significant market while registering expansion at a CAGR of 9.0% during the forecast period. Digital webcams feature high-end security, providing better data encryption and protection compared to the analog model. The image capturing in digital webcams is done with the help of a Charge-Coupled Device (CCD) or Complementary Metal-Oxide-Semiconductor (CMOS) image sensors.

Distribution Channel Insights

The Brick & Mortar segment of the distribution channel in the webcam market is anticipated to dominate the market in 2021 and expand at a CAGR of more than 11.0% during the forecast period. The significant limitation of e-commerce over the Brick & Mortar stores is that it can cheat consumers by providing counterfeit products instead of the original ones, consequently, a large number of consumers prefer to purchase products from physical stores.

However, the mega-giants in the e-commerce industry are taking measures against fake and counterfeit product suppliers to instill confidence in their customers while offering discounts on products purchase. This in turn is shifting the preference of the consumer from offline purchases towards online purchases, boosting the growth of the E-Commerce segment during the forecast period. In the E-Commerce platform of the distribution channel, owing to the absence of intermediaries or distributors, consumers can avail the privilege of getting the product at a low cost.

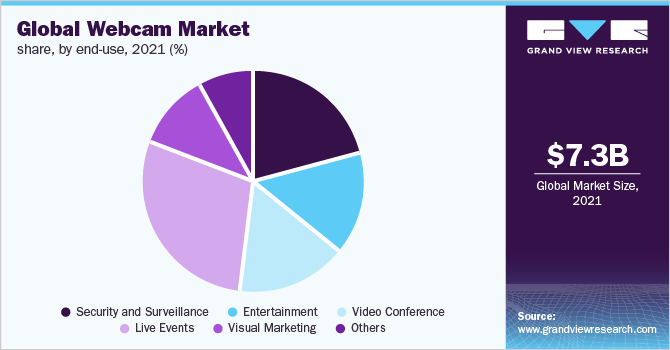

End-Use Insights

Based on end use, the global industry has been categorized into security & surveillance, video conference, entertainment, visual marketing, live events, and others. The others segment include tourism, healthcare, online education, and retail shopping centers. In terms of end-use, the live events segment is expected to lead the webcam market and hold a market share of more than of 28.0% in 2021. Growth of the live events segment is attributed to the habitude for the webcams in live events for streaming the event on every platform and for security purposes.

The security and surveillance segment is likely to register a higher CAGR of more than 9.0% during the forecast period. The growth of the segment is attributed to the rising utilization of cameras in household and commercial spaces, such as stores & malls, commercial places, and hospitality centers, owing to the rise in demand for webcams to monitor and survey in commercial areas to prevent security risks, such as theft, vandalism, and inventory loss.

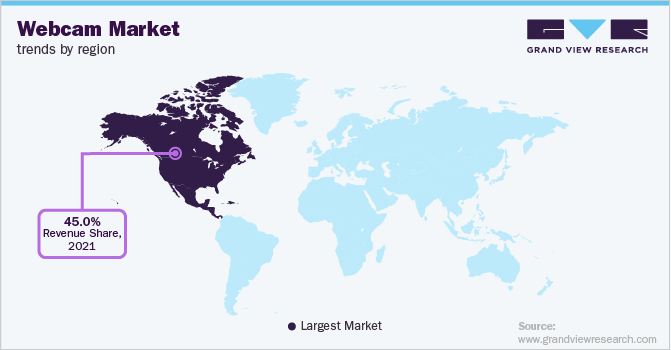

Regional Insights

North America accounted for a significant market share of more than 45.0% in terms of volume in 2021, dominating the global webcam market. Consumer preferences are shifting towards more secure and safe measures in public and private places, boosting the growth of the webcam market within the region. Enlargement of the entertainment industry around the world is augmenting demand for webcams owing to an increase in demand for the real-time monitoring and streaming of live events, boosting growth in the region.

Europe is also expected to develop at a significant CAGR of more than 6% during the forecast period. The government of the U.K. has imposed specific regulations for IoT manufacturers to embed unique passwords, which will prevent hackers from tampering and misusing the device by using the default/weak passwords.

Key Companies & Market Share Insights

Key players in the market are offering and enhancing their product portfolio by plunging into research and development of webcams and providing products at competitive pricing, increasing the competition in the market. Gaining the momentum of the highly growing market, manufacturers/companies are expanding their reach by collaborating with local players to increase their monopoly towards the customer. For instance, Cisco introduced three New WebEx Devices viz., WebEx Desk Camera, WebEx Desk Hub, and WebEx Desk to empower remote workers and allow for a safe return to work. Some of the prominent players in the global Webcam Market include:

-

Canon Inc.

-

10Moon

-

Cisco Systems Inc.

-

Koninklijke Philips N.V.

-

Lenovo

-

Microsoft

-

Logitech

-

D-Link Systems Inc.

-

Razer Inc.

-

Xiaomi

-

Sony Corporation

Webcam Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.91 billion

Revenue forecast in 2030

USD 13.93 billion

Growth rate

CAGR of 7.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in million units, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, product, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Canon Inc.; Cisco Systems Inc.; D-Link Systems Inc.; Koninklijke Philips N.V.; Lenovo; Logitech; Microsoft; Nexia; Razer Inc.; Sony Corporation; Xiaomi; 10Moons

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Webcam Market Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Webcam Market report based on technology, product, distribution channel, end-use, and region:

-

Technology Outlook (Revenue, USD Million; Revenue, Million Units, 2018 - 2030)

-

Analog

-

Digital

-

-

Product Outlook (Revenue, USD Million; Revenue, Million Units, 2018 - 2030)

-

USB

-

Wireless

-

-

Distribution Channel Outlook (Revenue, USD Million; Revenue, Million Units, 2018 - 2030)

-

Brick & Mortar

-

E-commerce

-

-

End-use Outlook (Revenue, USD Million; Revenue Million Units, 2018 - 2030)

-

Security and Surveillance

-

Entertainment

-

Video Conference

-

Live Events

-

Visual Marketing

-

Others

-

-

Regional Outlook (Revenue, USD Million; Revenue, Million Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global webcam market size was estimated at USD 7.26 billion in 2021 and is expected to reach USD 7.91 billion in 2022.

b. The global webcam market is expected to witness a compound annual growth rate of 7.3% from 2022 to 2030 to reach USD 13.93 billion by 2030.

b. The USB segment dominated the webcam market with a share of over 53% in 2021. This is attributable to its compatibility with computers using multiple platforms such as Mac, Linux, and Windows.

b. Some key players operating in the webcam market include 10Moon; Canon, Inc.; Cisco Systems, Inc.; D-Link Systems, Inc.; Koninklijke Philips N.V.; Lenovo; Logitech; Microsoft; Nexia International Limited; Razer Inc.; Sony Corporation; and Xiaomi.

b. Key factors that are driving the webcam market growth include surging demand for surveillance systems and increasing adoption of unmanned aerial vehicles (UAVs) and automated guided vehicles (AGVs) in commercial spaces.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."